Professional Documents

Culture Documents

Understanding Monetary Policy

Understanding Monetary Policy

Uploaded by

Bernraf Orpiano0 ratings0% found this document useful (0 votes)

11 views16 pagesThe document discusses key concepts relating to monetary policy. It defines monetary policy as how a central bank like Bangko Sentral ng Pilipinas controls the money supply to influence price stability and currency value. The BSP uses tools like open market operations, reserve requirements, and interest rates to implement either contractionary or expansionary monetary policy based on economic conditions. The document also discusses monetary policy strategies and challenges like time inconsistency where policies deemed optimal today may not be in the future.

Original Description:

Original Title

UNDERSTANDING MONETARY POLICY

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses key concepts relating to monetary policy. It defines monetary policy as how a central bank like Bangko Sentral ng Pilipinas controls the money supply to influence price stability and currency value. The BSP uses tools like open market operations, reserve requirements, and interest rates to implement either contractionary or expansionary monetary policy based on economic conditions. The document also discusses monetary policy strategies and challenges like time inconsistency where policies deemed optimal today may not be in the future.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

11 views16 pagesUnderstanding Monetary Policy

Understanding Monetary Policy

Uploaded by

Bernraf OrpianoThe document discusses key concepts relating to monetary policy. It defines monetary policy as how a central bank like Bangko Sentral ng Pilipinas controls the money supply to influence price stability and currency value. The BSP uses tools like open market operations, reserve requirements, and interest rates to implement either contractionary or expansionary monetary policy based on economic conditions. The document also discusses monetary policy strategies and challenges like time inconsistency where policies deemed optimal today may not be in the future.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 16

MONETARY- RELATING TO MONEY OR

CURRENCY

POLICY- A STATEMENT OF INTENT,

AND IS IMPLEMENTED AS A

PROCEDURE OR PROTOCOL

IS THE WAY THE GOVERNMENT CONTROLS

THE SUPPLY OF MONEY AS A WAY TO

INFLUENCE PRICE STABILITY AND BRING

TRUST IN THE VALUE OF THE CURRENCY.

The Bangko Sentral ng Pilipinas or BSP is the

central monetary authority of the Republic of

the Philippines.

It provides policy directions in the areas of

money, banking and credit and exists to

supervise operations of banks and exercises

regulatory powers over non-bank financial

institutions.

TO PROMOTE PRICE STABILITY CONDUCIVE

TO BALANCED AND SUSTAINABLE GROWTH

OF THE ECONOMY.

CONTRACTIONARY- WHEN THERE IS “TOO

MUCH MONEY” IN THE ECONOMY

SUPPORTING OVERALL DEMAND FOR GOODS

AND SERVICES.

EXPANSIONARY- WHEN THERE IS “TOO LITTLE

MONEY” IN THE ECONOMY WHICH DAMPENS

OVERALL DEMAND FOR GOODS AND

SERVICES.

IN THE PHILIPPINES:

OPEN MARKET OPERATIONS

It involves the buying and selling of

government securities from banks and

financial institution of the BSP in order to

expand or contract the supply of money.

THIS REFERS TO TRANSACTIONS WHEREBY

THE BSP EXTENDS CREDIT TO A BANK

COLLATERALIZED BY ITS LOAN PAPERS TO

CUSTOMERS.

THIS IS THE MINIMUM AMOUNT OF RESERVES

THAT BANK MUST HOLD AGAINST DEPOSITS.

THE RESERVE REQUIREMENTS WHICH ARE

HELD BY BANKS AS CASH IN THEIR VAULTS

AND DEPOSITS WITH THE BSP, HELP TO

CONTROL THE MONEY AND CREDIT BY

AFFECTING THE DEMAND FOR MONEY

RESERVES AND THE MONEY MULTIPLIER

1. Monetary Targeting- is a simple rule

for monetary policy according to which the

central bank manages monetary aggregates as

operating and/or intermediate target to influence

the ultimate objective, price stability.

2. Exchange-Rate Targeting- is the process

through which a central bank intervenes in the

market mechanism to maintain the exchange

rate at a particular level that they deem as

desirable.

3. Inflation Targeting- is a central bank

strategy of specifying an inflation rate as a

goal and adjusting monetary policy to achieve

that rate. Inflation targeting primarily focuses

on maintaining price stability, but is also

believed by its proponents to support

economic growth and stability.

IT DESCRIBES SITUATIONS WHERE THE

PASSING OF TIME, POLICIES THAT WERE

DETERMINED TO BE OPTIMAL YESTERDAY ARE

NO LONGER PERCEIVED TO BE OPTIMAL

TODAY.

In 2004, Finn E. Kydland and Edward C.

Prescott were awarded the Nobel Prize in

Economics for their work on the time

inconsistency of economic policies.

They showed that time inconsistency was causing

excessive inflation. The central bank has two

core goals: trying to keep inflation close to some

target level, and keep unemployment close to the

natural rate. However, markets are not perfect,

and unemployment is usually higher than its

natural rate. The central bank’s desire to reduce

unemployment to the natural rate leads to time-

inconsistent behavior.

The central bank will announce that it will set

monetary policy such that inflation equals 2%, and

then let the labor market clear at the market-

clearing level; it means, the level at which there is

no leftover supply or demand. Nonetheless, if

workers believe inflation will effectively be 2%, they

will bargain a 2% wage increase, which will shift the

supply curve to the left. Thus, the central bank has

an incentive to create an inflation surprise and

meet its goal of reducing unemployment at a cost

of higher inflation than first announced. This

illustrates the idea of time inconsistency, since the

first announcement has changed expectations and

the central bank was better off not following what

it first proclaimed.

REFERS TO THE FREEDOM OF MONETARY

POLICY MAKERS FROM DIRECT POLITICAL OR

GOVERNMENTAL INFLUENCE IN THE

CONDUCT OF POLICY.

You might also like

- BSP and Monetary PolicyDocument49 pagesBSP and Monetary PolicySimone Reyes67% (3)

- Module 2 - Functions of BSPDocument14 pagesModule 2 - Functions of BSPQuenie De la CruzNo ratings yet

- Uk Lifestyle SurveyDocument1 pageUk Lifestyle SurveyMadhar FiazNo ratings yet

- Monetary Policy of The PhilippinesDocument6 pagesMonetary Policy of The PhilippinesRocetteAnn O'Callaghan PiconesNo ratings yet

- Monetary Policy (Group 15)Document24 pagesMonetary Policy (Group 15)Darwin SolanoyNo ratings yet

- Monetary Policy in Pakistan: BackgroundDocument6 pagesMonetary Policy in Pakistan: BackgroundChoudhery Saleh MohammadNo ratings yet

- Topic 3Document4 pagesTopic 3jay diazNo ratings yet

- MBA510 AssignmentDocument10 pagesMBA510 AssignmentNafiz Al SayemNo ratings yet

- Lecture-Chapter 5Document5 pagesLecture-Chapter 5kimdemelyn cerenoNo ratings yet

- Central Bank of The PhilippinesDocument5 pagesCentral Bank of The PhilippinesBERNALDEZ NESCEL JOYNo ratings yet

- Inflation Targeting December 2011: T BSP P S 1. What Is Inflation?Document14 pagesInflation Targeting December 2011: T BSP P S 1. What Is Inflation?Jasmine LustadoNo ratings yet

- UCP AssignmentDocument16 pagesUCP AssignmentSaniya SaddiqiNo ratings yet

- Chapter 11 Monetary Policy Lecture PresentationDocument21 pagesChapter 11 Monetary Policy Lecture PresentationalsinanhananNo ratings yet

- Q 2Document2 pagesQ 2Santhushi FernandoNo ratings yet

- Monetary PolicyDocument14 pagesMonetary Policyyea gbiNo ratings yet

- Monetary Policy & The Economy: Economics Explorer SeriesDocument22 pagesMonetary Policy & The Economy: Economics Explorer SeriesshubhraNo ratings yet

- Monetary Policy EssayDocument4 pagesMonetary Policy EssayScribdTranslationsNo ratings yet

- Inflation TargetingDocument16 pagesInflation TargetingKathryn PuyatNo ratings yet

- Project Nupur Mam KaDocument58 pagesProject Nupur Mam KaSanjog ThapaNo ratings yet

- Monetary PolicyDocument6 pagesMonetary Policypremsid28No ratings yet

- Monetary Policy of BangladeshDocument11 pagesMonetary Policy of BangladeshGobinda sahaNo ratings yet

- Monetary Policy Instruments: Description: in India, Monetary Policy of The Reserve Bank of India Is Aimed at Managing TheDocument7 pagesMonetary Policy Instruments: Description: in India, Monetary Policy of The Reserve Bank of India Is Aimed at Managing TheKikujo KikuNo ratings yet

- Monetary Policy Notes PDFDocument18 pagesMonetary Policy Notes PDFOptimistic Khan50% (2)

- The Philippine Monetary System and PolicyDocument43 pagesThe Philippine Monetary System and PolicyArrianne Zeanna77% (13)

- Monetary Policy Research Paper TopicsDocument5 pagesMonetary Policy Research Paper Topicsefeq3hd0100% (1)

- Monetary Policy and Fiscal PolicyDocument13 pagesMonetary Policy and Fiscal PolicyAAMIR IBRAHIMNo ratings yet

- MONETARY POLICY IN THE PHILIPPINES LectureDocument5 pagesMONETARY POLICY IN THE PHILIPPINES LectureMa'am Katrina Marie MirandaNo ratings yet

- Central BankingDocument24 pagesCentral BankingKARISHMAATA2No ratings yet

- What Is Monetary PolicyDocument12 pagesWhat Is Monetary PolicyNain TechnicalNo ratings yet

- Economics 101: Summary of Monetary PolicyDocument7 pagesEconomics 101: Summary of Monetary PolicySharon Ann BasulNo ratings yet

- Chapter 5 Philippine Monetary PolicyDocument74 pagesChapter 5 Philippine Monetary Policyvilladelgadojanica02No ratings yet

- Final ProjectDocument42 pagesFinal ProjectAnonymous g7uPednINo ratings yet

- BSP Central Bank Monetary PolicyDocument20 pagesBSP Central Bank Monetary PolicyJean CabigaoNo ratings yet

- Introduction To Monetary PolicyDocument6 pagesIntroduction To Monetary Policykim byunooNo ratings yet

- Monetary PolicyDocument21 pagesMonetary PolicyApple Jane Galisa SeculaNo ratings yet

- Monetary Policy of The PhilippinesDocument5 pagesMonetary Policy of The Philippinesvicenteferrer75% (4)

- Monetary Policy ToolsDocument7 pagesMonetary Policy ToolsDeepak PathakNo ratings yet

- Monetary & Fiscal PolicyDocument42 pagesMonetary & Fiscal PolicySk Imran IslamNo ratings yet

- Economic Policy - Monetary PolicyDocument17 pagesEconomic Policy - Monetary PolicyNikol Vladislavova NinkovaNo ratings yet

- Finmar Chapter 12Document30 pagesFinmar Chapter 12Lee TeukNo ratings yet

- White Down The Review On Monetary Policy As Pakistan PerspectiveDocument4 pagesWhite Down The Review On Monetary Policy As Pakistan PerspectiveAmeer hamzaNo ratings yet

- Monetary PolicyDocument2 pagesMonetary PolicyNill AkasNo ratings yet

- Assignment On Monetary Policy in BangladeshDocument6 pagesAssignment On Monetary Policy in BangladeshAhmed ImtiazNo ratings yet

- Monetary PolicyDocument18 pagesMonetary Policymodasra100% (2)

- Presentation Development 20Document8 pagesPresentation Development 20Hussain RizviNo ratings yet

- Inflation Targeting For Discussion v2.0Document18 pagesInflation Targeting For Discussion v2.0Zace RuruNo ratings yet

- All Print Macro Nad MicroDocument15 pagesAll Print Macro Nad MicrosmitaNo ratings yet

- Monetary PolicyDocument17 pagesMonetary PolicyBernard OkpeNo ratings yet

- T BSP P S 1. What Is Inflation?Document18 pagesT BSP P S 1. What Is Inflation?gladys manaliliNo ratings yet

- Inflation TargetingDocument17 pagesInflation Targetingrosalyn mauricioNo ratings yet

- Monetary Policy of BangladeshDocument26 pagesMonetary Policy of Bangladeshsuza054No ratings yet

- Monetary PolicyDocument16 pagesMonetary PolicyAdeel AhmadNo ratings yet

- Concepts of Macroeconomics Its History Objectives and InstrumentsDocument7 pagesConcepts of Macroeconomics Its History Objectives and InstrumentsDjay SlyNo ratings yet

- TargetingDocument18 pagesTargetingchingNo ratings yet

- Lectures of Monetary PolicyDocument4 pagesLectures of Monetary PolicyMughees AhmedNo ratings yet

- Monetary Policy: Aira Mae Nueva Jhessanie PinedaDocument43 pagesMonetary Policy: Aira Mae Nueva Jhessanie PinedaMAWIIINo ratings yet

- Econ (MJ)Document2 pagesEcon (MJ)sung_kei_pinNo ratings yet

- Capital MarketDocument1 pageCapital MarketFrances Bea WaguisNo ratings yet

- Preserving Wealth in Inflationary Times - Strategies for Protecting Your Financial Future: Alex on Finance, #4From EverandPreserving Wealth in Inflationary Times - Strategies for Protecting Your Financial Future: Alex on Finance, #4No ratings yet

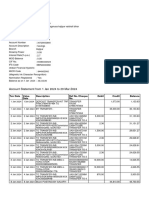

- Account Details and Transaction History: Basic Ca-IDocument10 pagesAccount Details and Transaction History: Basic Ca-IFerhan IskandarNo ratings yet

- FBGSV 003 - 2022 - Product App Form - Principal - ENGDocument5 pagesFBGSV 003 - 2022 - Product App Form - Principal - ENGalNo ratings yet

- Funds Transfers - OverviewDocument7 pagesFunds Transfers - OverviewCajita FelizNo ratings yet

- Disha RaniDocument11 pagesDisha RaniSaksham RathoreNo ratings yet

- Bombay Mercantile Co-Operative Bank LTDDocument78 pagesBombay Mercantile Co-Operative Bank LTDaadil shaikhNo ratings yet

- Raj Kumar Statement of Jan SbiDocument6 pagesRaj Kumar Statement of Jan Sbirajprince26460No ratings yet

- Jeevan Anand: G. Sudhakar Dev - OfficerDocument4 pagesJeevan Anand: G. Sudhakar Dev - OfficerYugendra Babu KNo ratings yet

- Mrs Xhilda Kapo Loan AgreementDocument5 pagesMrs Xhilda Kapo Loan Agreement8zcjft96dgNo ratings yet

- Central Luzon Telecoms ServicesDocument2 pagesCentral Luzon Telecoms ServicesGerard DGNo ratings yet

- Chapter 17 Working Capital ManagementDocument50 pagesChapter 17 Working Capital ManagementBea EuniceNo ratings yet

- 3CH6L7Document22 pages3CH6L7Melinda Escarlan JornadalNo ratings yet

- Breakfasting Mr. Ifan 31 Maret 2023Document2 pagesBreakfasting Mr. Ifan 31 Maret 2023Ifan FadilahNo ratings yet

- Compound InterestDocument12 pagesCompound InterestRannValleNo ratings yet

- Orca Share Media1540033147945Document17 pagesOrca Share Media1540033147945Melady Sison CequeñaNo ratings yet

- Loan Calculator: Enter Values Loan SummaryDocument1 pageLoan Calculator: Enter Values Loan SummaryAhsin KhanNo ratings yet

- Charles Schwab Investments Distribution Form Oct 27..2015Document10 pagesCharles Schwab Investments Distribution Form Oct 27..2015andyNo ratings yet

- Risk Management IndicatorsDocument7 pagesRisk Management Indicatorsathirah binti shazaliNo ratings yet

- Bonus Information FY 19-20 - v2 - tcm47-73104Document2 pagesBonus Information FY 19-20 - v2 - tcm47-73104KaranNo ratings yet

- PRL FORMS Bank FormDocument2 pagesPRL FORMS Bank FormDiana maria RuedaNo ratings yet

- BANK STATEMENT 07.05.2023Document4 pagesBANK STATEMENT 07.05.2023salmankuttysk1995No ratings yet

- (20-22398 37) October 27, 2015 Email From Laurence Schneider To First American Bank DE 235, Ex. ADocument8 pages(20-22398 37) October 27, 2015 Email From Laurence Schneider To First American Bank DE 235, Ex. Alarry-612445No ratings yet

- Ias 23Document19 pagesIas 23Reever RiverNo ratings yet

- Personal Finance 11Th Edition Kapoor Solutions Manual Full Chapter PDFDocument64 pagesPersonal Finance 11Th Edition Kapoor Solutions Manual Full Chapter PDFshelbyelliswimynjsrab100% (11)

- Summer Project SUSHANTA-1 (1) - 1Document26 pagesSummer Project SUSHANTA-1 (1) - 1Rony GhoshNo ratings yet

- Revolut LTD Business Terms 0.2.0 1658251077 en PDFDocument24 pagesRevolut LTD Business Terms 0.2.0 1658251077 en PDFDan CaruntuNo ratings yet

- OpTransactionHistory28 09 2021Document30 pagesOpTransactionHistory28 09 2021samboopathiNo ratings yet

- Society Noc FormatDocument1 pageSociety Noc Formatshailesh latkarNo ratings yet

- Law On Mortgage NotesDocument4 pagesLaw On Mortgage NotesRolly Pagtolon-an0% (1)

- Commercial Bank Management Sem IIIDocument11 pagesCommercial Bank Management Sem IIIJanvi MhatreNo ratings yet