Professional Documents

Culture Documents

Big Aa Corporation V Bir Digest

Big Aa Corporation V Bir Digest

Uploaded by

Christian RodriguezCopyright:

Available Formats

You might also like

- Reply On PANDocument6 pagesReply On PANPaul Casaje89% (18)

- Chap011 Exam3Document78 pagesChap011 Exam3Huyen Vo100% (2)

- 1 Syllabus - NIRC Remedies (1st Sem 18-19)Document13 pages1 Syllabus - NIRC Remedies (1st Sem 18-19)Zyki Zamora Lacdao100% (3)

- WAY4 Overview SmallDocument8 pagesWAY4 Overview SmallDipanwita BhuyanNo ratings yet

- Cir Vs CaDocument5 pagesCir Vs CaArthur John GarratonNo ratings yet

- Cir V CaDocument8 pagesCir V CaVan CazNo ratings yet

- CIR v. Fitness by DesignDocument4 pagesCIR v. Fitness by DesignJesi CarlosNo ratings yet

- CIR V Fitness by DesignDocument3 pagesCIR V Fitness by Designsmtm06100% (4)

- Remedies of The TaxpayerDocument4 pagesRemedies of The TaxpayerAngelyn Sanjorjo50% (2)

- Assessment DueprocessDocument2 pagesAssessment DueprocessRester NonatoNo ratings yet

- EASTERN TELECOMMUNICATIONS PHILIPPINES INC. vs. COMMISSIONER OF INTERNAL REVENUEDocument3 pagesEASTERN TELECOMMUNICATIONS PHILIPPINES INC. vs. COMMISSIONER OF INTERNAL REVENUEJASON BRIAN AVELINONo ratings yet

- Part C 1 - CIR Vs Avon Products ManufacturingDocument4 pagesPart C 1 - CIR Vs Avon Products ManufacturingCyruz TuppalNo ratings yet

- Part C 1 - CIR Vs Avon Products ManufacturingDocument4 pagesPart C 1 - CIR Vs Avon Products ManufacturingCyruz Tuppal75% (4)

- TaxDocument21 pagesTaxAnna Dela VegaNo ratings yet

- CIR V SonyDocument2 pagesCIR V Sonycary_puyatNo ratings yet

- Eastern Telecommunications Vs CIRDocument6 pagesEastern Telecommunications Vs CIRHarold B. LacabaNo ratings yet

- En Banc G.R. No. 166387 January 19, 2009 Commissioner OF Internal REVENUE, Petitioners, Enron Subic Powercorporation, Respondents. Resolution Corona, J.Document4 pagesEn Banc G.R. No. 166387 January 19, 2009 Commissioner OF Internal REVENUE, Petitioners, Enron Subic Powercorporation, Respondents. Resolution Corona, J.Eunice NavarroNo ratings yet

- Tax ReviewerDocument68 pagesTax Reviewerviva_33No ratings yet

- VAT CLAIM FOR REFUND - Northern Mini Hydro Vs CIRDocument2 pagesVAT CLAIM FOR REFUND - Northern Mini Hydro Vs CIRChristine Gel MadrilejoNo ratings yet

- Tax CasesDocument87 pagesTax CasesSachieCasimiroNo ratings yet

- Protesting A Tax AssessmentDocument3 pagesProtesting A Tax AssessmenterinemilyNo ratings yet

- TX102 Topic 1 Module 3Document21 pagesTX102 Topic 1 Module 3Richard Rhamil Carganillo Garcia Jr.No ratings yet

- Who Is An EmployeeDocument14 pagesWho Is An EmployeeJevi RuiizNo ratings yet

- CIR V MarubeniDocument3 pagesCIR V MarubenichrissamagatNo ratings yet

- Tax RemediesDocument16 pagesTax RemediesNeil ArmstrongNo ratings yet

- Pbcom V CirDocument9 pagesPbcom V CirAbby ParwaniNo ratings yet

- Cir Vs Fitness by DesignDocument2 pagesCir Vs Fitness by DesignAnonymous 5MiN6I78I0No ratings yet

- Denial of Due Process TaxDocument10 pagesDenial of Due Process TaxramilflecoNo ratings yet

- PH Tax News July2017Document12 pagesPH Tax News July2017yest23No ratings yet

- Pan FanDocument2 pagesPan FanAnonymous BvmMuBSwNo ratings yet

- TAXATION II REMEDIES CasesDocument26 pagesTAXATION II REMEDIES CasesJayzel LaureanoNo ratings yet

- Tax Rev Notes RemediesDocument179 pagesTax Rev Notes RemediesJake MacTavishNo ratings yet

- Defend RMC 12-2018Document4 pagesDefend RMC 12-2018John Evan Raymund BesidNo ratings yet

- Cta 8149Document46 pagesCta 8149Edrian ApayaNo ratings yet

- Second DivisionDocument13 pagesSecond DivisionRam Migue SaintNo ratings yet

- Tax Case SummaryDocument10 pagesTax Case SummaryYomari ObiasNo ratings yet

- Abci V Cir DigestDocument9 pagesAbci V Cir DigestSheilaNo ratings yet

- CIR v. ENRON SUBIC POWER CORPORATION, GR No. 166387, 2009-01-19 FactsDocument5 pagesCIR v. ENRON SUBIC POWER CORPORATION, GR No. 166387, 2009-01-19 FactsluckyNo ratings yet

- CIR Vs Ariete - TaxationDocument2 pagesCIR Vs Ariete - TaxationCarl MontemayorNo ratings yet

- PBCOM vs. CIRDocument19 pagesPBCOM vs. CIRColeen Navarro-RasmussenNo ratings yet

- Tax Remedies - Part IDocument11 pagesTax Remedies - Part IRamon AngelesNo ratings yet

- Eastern Telecommunications Philippines Inc Vs CirDocument4 pagesEastern Telecommunications Philippines Inc Vs CirAerwin AbesamisNo ratings yet

- Case Digest IIDocument9 pagesCase Digest IISansui Jusan Rochel100% (1)

- LG-Electronics-vs.-CIR-digestDocument21 pagesLG-Electronics-vs.-CIR-digestDarrel John SombilonNo ratings yet

- Gulf Air Co-Phil Branch v. CIRDocument3 pagesGulf Air Co-Phil Branch v. CIRJustine GaverzaNo ratings yet

- CIR Vs Enron Subic Power G.R. No. 166387Document6 pagesCIR Vs Enron Subic Power G.R. No. 166387Ahmad Israfil PiliNo ratings yet

- 1maple v. CIRDocument26 pages1maple v. CIRaudreydql5No ratings yet

- Rationale For The Imposition of TaxesDocument5 pagesRationale For The Imposition of TaxesBurnok SupolNo ratings yet

- Northern Mini Hydro Corporation Vs CIRDocument2 pagesNorthern Mini Hydro Corporation Vs CIRJolina SuwalawanNo ratings yet

- Bir Regulations No. 14-2003Document12 pagesBir Regulations No. 14-2003Haryeth CamsolNo ratings yet

- CIR vs. The Stanley Work SalesDocument3 pagesCIR vs. The Stanley Work SalesKate DomingoNo ratings yet

- Tax CasesDocument16 pagesTax Casesnicole5anne5ddddddNo ratings yet

- Tax Remedies Digest 62 70Document12 pagesTax Remedies Digest 62 70Christine Angelus MosquedaNo ratings yet

- Surigao Cons. Minining v. Collector FactsDocument2 pagesSurigao Cons. Minining v. Collector Factsmondragon4No ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- 1040 Exam Prep Module XI: Circular 230 and AMTFrom Everand1040 Exam Prep Module XI: Circular 230 and AMTRating: 1 out of 5 stars1/5 (1)

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Contract To SellDocument2 pagesContract To SellAnn Camille JoaquinNo ratings yet

- Basic Essentials For AMZ WS UKDocument3 pagesBasic Essentials For AMZ WS UKOsama ArshadNo ratings yet

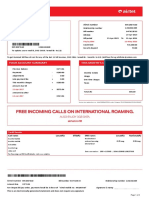

- Airtel BillDocument2 pagesAirtel Billbharathkumar jNo ratings yet

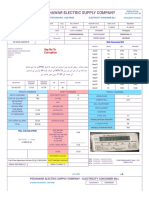

- PESCO ONLINE BILL Jan2023Document2 pagesPESCO ONLINE BILL Jan2023amjadali482No ratings yet

- P6UK 2014 Dec ADocument12 pagesP6UK 2014 Dec APOUNo ratings yet

- DuplicateDocument4 pagesDuplicateAdinarayana RaoNo ratings yet

- E. Chapter 4.NVLDocument12 pagesE. Chapter 4.NVLnguyenduckiena55No ratings yet

- IndividualsDocument63 pagesIndividualsWilliam HarrisNo ratings yet

- FBO InvoiceDocument2 pagesFBO InvoiceThe smocking tyresNo ratings yet

- Employees Vs Ind ContractorDocument5 pagesEmployees Vs Ind ContractorGetto VocabNo ratings yet

- Paytm 6 Months StatementDocument27 pagesPaytm 6 Months StatementRaghav SharmaNo ratings yet

- Tax Statement As On Dec 2021: Employee DetailsDocument1 pageTax Statement As On Dec 2021: Employee DetailsElakkiyaNo ratings yet

- Tax Invoice Service Charge: 0223070005016818 05 Jul 2023 01 Jul 2023 To 30 Sep 2023 Quarterly 04 Aug 2023Document2 pagesTax Invoice Service Charge: 0223070005016818 05 Jul 2023 01 Jul 2023 To 30 Sep 2023 Quarterly 04 Aug 2023Katherine TaguinesNo ratings yet

- It MCQDocument31 pagesIt MCQbigbulleye6078No ratings yet

- Gold Mastercard Titanium Mastercard Platinum MastercardDocument3 pagesGold Mastercard Titanium Mastercard Platinum MastercardRoseyy GalitNo ratings yet

- Online Tax Payment PortalDocument1 pageOnline Tax Payment PortalRahul ShawNo ratings yet

- Deutsche Bank AG Manila Branch v. CIRDocument3 pagesDeutsche Bank AG Manila Branch v. CIRDonna DumaliangNo ratings yet

- Deck Merchant MSF 4274Document9 pagesDeck Merchant MSF 4274Syed MujtabaNo ratings yet

- Tax AvoidanceDocument38 pagesTax AvoidancerampayareNo ratings yet

- Negotiable Instruments Act 1881Document11 pagesNegotiable Instruments Act 1881kallasanjay100% (1)

- Study of Digital Wallet Adoption Among Students ReportDocument108 pagesStudy of Digital Wallet Adoption Among Students ReportKARTIK SINGH100% (1)

- Navitar-Immersive World-RFQ For 2 HM4K 178 HL Lenses For Christie Griffyn 4K32 Dual Cove-2020!09!09 - V1Document3 pagesNavitar-Immersive World-RFQ For 2 HM4K 178 HL Lenses For Christie Griffyn 4K32 Dual Cove-2020!09!09 - V1BoanergeNo ratings yet

- GST BillDocument1 pageGST BillTIPS ON TECHNOLOGYNo ratings yet

- In Case of Errors or Questions About Your Electronic Funds TransfersDocument2 pagesIn Case of Errors or Questions About Your Electronic Funds TransfersMuhammad AdeelNo ratings yet

- Commissioner of Internal Revenue vs. Philippine Daily Inquirer, IncDocument2 pagesCommissioner of Internal Revenue vs. Philippine Daily Inquirer, IncJoseph SalidoNo ratings yet

- Tax 1 PDFDocument17 pagesTax 1 PDFLeah MoscareNo ratings yet

- Preliminary Considerations: Negotiable Instruments Outline IDocument9 pagesPreliminary Considerations: Negotiable Instruments Outline IKrishielle AnneNo ratings yet

- CIR Vs Inter PublicDocument3 pagesCIR Vs Inter PublicArrianne ObiasNo ratings yet

Big Aa Corporation V Bir Digest

Big Aa Corporation V Bir Digest

Uploaded by

Christian RodriguezOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Big Aa Corporation V Bir Digest

Big Aa Corporation V Bir Digest

Uploaded by

Christian RodriguezCopyright:

Available Formats

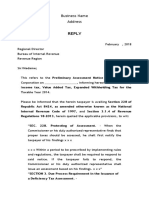

BIG AA CORPORATION, represented By Erlinda L.

Stohner,

petitioner, vs. BUREAU OF INTERNAL REVENUE, respondent.

C.T.A. CASE NO. 7093. February 22, 2006

FACTS:

Petitioner is a domestic corporation duly created and registered under the

law. It is engaged mainly in the distributorship of San Miguel beer and

soft drinks products.

For the taxable year 2001, petitioner filed its original Quarterly Value-

Added Tax (VAT) Returns on April 25, 2001, July 24, 2001, October 9,

2001 and January 10, 2002, showing the total purchases for the period in

the amount of P12,338,206.40.

In March, 2004, petitioner, relying on the provisions of Section 6(A) of

the National Internal Revenue Code of 1997, filed its 2001 Amended

Annual Income Tax Return and Amended Quarterly Value-Added Tax

Returns to reflect the correct total purchases in the amount of

P235,579,870.00 and paid the corresponding additional income tax and

VAT, including interests and compromise penalties before the authorized

bank of the respondent

Respondent, through the Bureau's Third Party Information Program,

found that there was a discrepancy in the amount of total purchases made

by petitioner based on the List of Sales and Purchases of San Miguel

Corporation and the original returns filed by petitioner in the amount of

P211,467,735.02 or 94.49% of the total and actual purchases.

Respondent caused the issuance of a Letter of Notice requiring petitioner

to avail of the Voluntary Assessment and Abatement Program (VAAP).

Having received no reply from the petitioner, respondent then issued the

2nd Notice dated January 15, 2003.

Due to petitioner's disregard of respondent's notices and orders, a

criminal complaint against petitioner's General Manager, Erlinda I.

Stohner, was then filed on August 31, 2004 before the City Prosecutor's

Office of the City of Manila for violations of the National Internal

Revenue Code of 1997. The aforesaid criminal case was subsequently

dismissed.

While the abovementioned criminal complaint was still pending further

investigation, petitioner filed this instant Petition for Review questioning

the validity of Revenue Memorandum Circular No. 40-2003 which

clarified that a Letter Notice is considered as a Notice of Audit or

Investigation for purposes of barring petitioner in amending its income

and value-added tax returns for the taxable year 2001.

(Note: Pertinent part of Revenue Memorandum Circ. No. 40-2003 reads;

“LN being served by the Bureau upon the taxpayers who were found to

have under-declared their sales or purchases through the Third Party

Information Program can be considered a notice of audit or

investigation which would in effect disqualify the taxpayers concerned

Sultan Sarabutnik Notes

from amending any return which is the subject of such audit or

investigation”.)

Petitioner argues that the letter notice issued by respondent is not the

same as a "notice of audit or investigation" contemplated under the

provisions of Section 6(A) of the NIRC of 1997. It contends that if the

law had intended to mean that a notice of audit or investigation is similar

to a letter notice, then the same should have been included in the

provisions of Section 6(A) of the same Code. Petitioner further submits

that administrative circulars cannot supersede, abrogate, modify or

nullify a statute, as where conflict exists, the substantive Tax Law

prevails.

Respondent maintains that the Commissioner of Internal Revenue has

the power to interpret the provisions of the NIRC of 1997 pursuant to

Section 4 thereof. And that revenue issuances promulgated by the

respondent clarifying or interpreting the provisions of the NIRC of 1997

have the force and effect of law unless otherwise declared by the court.

ISSUE:

Whether or not Revenue Memorandum Circular No. 40-2003 issued on July

3, 2003 is valid or constitutional.

RULING:

CTA agrees with the respondent

In the present case, it is unarguable that the power of the Commissioner of

Internal Revenue to interpret the provisions of the National Internal Revenue

Code of 1997 is provided under Section 4 of the said Code, thus:

"Section 4. Power of the Commissioner to Interpret Tax laws and

to Decide Tax Cases. — The power to interpret the provisions of this code

and other tax laws shall be under the exclusive and original jurisdiction of

the Commissioner, subject to review by the Secretary of Finance.

The power to decide disputed assessments, refunds of internal

revenue taxes, fees or other charges, penalties imposed in relation thereto,

or other matters arising under this Code or other laws or portions thereof

administered by the Bureau of Internal Revenue is vested in the

Commissioner, subject to the exclusive appellate jurisdiction of the Court

of Tax Appeals."

Based on the above provision of law, the Commissioner has the power to

issue rules and regulations to interpret the provisions of the law, subject to

the review by the Secretary of Finance. And it is pursuant to this power that

respondent issued RMC No. 40-2003 clarifying that a "letter notice" issued

by the respondent to taxpayers pursuant to the Third Party Information

Sultan Sarabutnik Notes

Program is considered as a "notice of audit or investigation", contemplated

under paragraph 3, Section 6(A) of the National Internal Revenue Code of

1997 which, in effect, bars a taxpayer from amending its returns once the

said letter notice has already been issued against it.

The general rule is that the construction of a statute by an administrative

agency charged with the task of interpreting or applying the same is entitled

to great weight and respect unless such interpretations are against the law it

seeks to interpret, evidently erroneous, or when there is a clear abuse of

discretion. In the case at bar, this Court gives great weight to the

determination of the Commissioner of Internal Revenue that "letter notices"

issued against a taxpayer in connection with the information of under

declarations of sales and purchases gathered through the Third Party

Information Program may be considered as a "notice of audit or

investigation" in the absence of evident error or clear abuse of discretion.

In the case herein, The CTA gave great weight to the determination of the

Commissioner of Internal Revenue that "letter notices" issued against a

taxpayer in connection with the information of under declarations of sales

and purchases gathered through the Third Party Information Program may

be considered as a "notice of audit or investigation" in the absence of evident

error or clear abuse of discretion.

Sultan Sarabutnik Notes

You might also like

- Reply On PANDocument6 pagesReply On PANPaul Casaje89% (18)

- Chap011 Exam3Document78 pagesChap011 Exam3Huyen Vo100% (2)

- 1 Syllabus - NIRC Remedies (1st Sem 18-19)Document13 pages1 Syllabus - NIRC Remedies (1st Sem 18-19)Zyki Zamora Lacdao100% (3)

- WAY4 Overview SmallDocument8 pagesWAY4 Overview SmallDipanwita BhuyanNo ratings yet

- Cir Vs CaDocument5 pagesCir Vs CaArthur John GarratonNo ratings yet

- Cir V CaDocument8 pagesCir V CaVan CazNo ratings yet

- CIR v. Fitness by DesignDocument4 pagesCIR v. Fitness by DesignJesi CarlosNo ratings yet

- CIR V Fitness by DesignDocument3 pagesCIR V Fitness by Designsmtm06100% (4)

- Remedies of The TaxpayerDocument4 pagesRemedies of The TaxpayerAngelyn Sanjorjo50% (2)

- Assessment DueprocessDocument2 pagesAssessment DueprocessRester NonatoNo ratings yet

- EASTERN TELECOMMUNICATIONS PHILIPPINES INC. vs. COMMISSIONER OF INTERNAL REVENUEDocument3 pagesEASTERN TELECOMMUNICATIONS PHILIPPINES INC. vs. COMMISSIONER OF INTERNAL REVENUEJASON BRIAN AVELINONo ratings yet

- Part C 1 - CIR Vs Avon Products ManufacturingDocument4 pagesPart C 1 - CIR Vs Avon Products ManufacturingCyruz TuppalNo ratings yet

- Part C 1 - CIR Vs Avon Products ManufacturingDocument4 pagesPart C 1 - CIR Vs Avon Products ManufacturingCyruz Tuppal75% (4)

- TaxDocument21 pagesTaxAnna Dela VegaNo ratings yet

- CIR V SonyDocument2 pagesCIR V Sonycary_puyatNo ratings yet

- Eastern Telecommunications Vs CIRDocument6 pagesEastern Telecommunications Vs CIRHarold B. LacabaNo ratings yet

- En Banc G.R. No. 166387 January 19, 2009 Commissioner OF Internal REVENUE, Petitioners, Enron Subic Powercorporation, Respondents. Resolution Corona, J.Document4 pagesEn Banc G.R. No. 166387 January 19, 2009 Commissioner OF Internal REVENUE, Petitioners, Enron Subic Powercorporation, Respondents. Resolution Corona, J.Eunice NavarroNo ratings yet

- Tax ReviewerDocument68 pagesTax Reviewerviva_33No ratings yet

- VAT CLAIM FOR REFUND - Northern Mini Hydro Vs CIRDocument2 pagesVAT CLAIM FOR REFUND - Northern Mini Hydro Vs CIRChristine Gel MadrilejoNo ratings yet

- Tax CasesDocument87 pagesTax CasesSachieCasimiroNo ratings yet

- Protesting A Tax AssessmentDocument3 pagesProtesting A Tax AssessmenterinemilyNo ratings yet

- TX102 Topic 1 Module 3Document21 pagesTX102 Topic 1 Module 3Richard Rhamil Carganillo Garcia Jr.No ratings yet

- Who Is An EmployeeDocument14 pagesWho Is An EmployeeJevi RuiizNo ratings yet

- CIR V MarubeniDocument3 pagesCIR V MarubenichrissamagatNo ratings yet

- Tax RemediesDocument16 pagesTax RemediesNeil ArmstrongNo ratings yet

- Pbcom V CirDocument9 pagesPbcom V CirAbby ParwaniNo ratings yet

- Cir Vs Fitness by DesignDocument2 pagesCir Vs Fitness by DesignAnonymous 5MiN6I78I0No ratings yet

- Denial of Due Process TaxDocument10 pagesDenial of Due Process TaxramilflecoNo ratings yet

- PH Tax News July2017Document12 pagesPH Tax News July2017yest23No ratings yet

- Pan FanDocument2 pagesPan FanAnonymous BvmMuBSwNo ratings yet

- TAXATION II REMEDIES CasesDocument26 pagesTAXATION II REMEDIES CasesJayzel LaureanoNo ratings yet

- Tax Rev Notes RemediesDocument179 pagesTax Rev Notes RemediesJake MacTavishNo ratings yet

- Defend RMC 12-2018Document4 pagesDefend RMC 12-2018John Evan Raymund BesidNo ratings yet

- Cta 8149Document46 pagesCta 8149Edrian ApayaNo ratings yet

- Second DivisionDocument13 pagesSecond DivisionRam Migue SaintNo ratings yet

- Tax Case SummaryDocument10 pagesTax Case SummaryYomari ObiasNo ratings yet

- Abci V Cir DigestDocument9 pagesAbci V Cir DigestSheilaNo ratings yet

- CIR v. ENRON SUBIC POWER CORPORATION, GR No. 166387, 2009-01-19 FactsDocument5 pagesCIR v. ENRON SUBIC POWER CORPORATION, GR No. 166387, 2009-01-19 FactsluckyNo ratings yet

- CIR Vs Ariete - TaxationDocument2 pagesCIR Vs Ariete - TaxationCarl MontemayorNo ratings yet

- PBCOM vs. CIRDocument19 pagesPBCOM vs. CIRColeen Navarro-RasmussenNo ratings yet

- Tax Remedies - Part IDocument11 pagesTax Remedies - Part IRamon AngelesNo ratings yet

- Eastern Telecommunications Philippines Inc Vs CirDocument4 pagesEastern Telecommunications Philippines Inc Vs CirAerwin AbesamisNo ratings yet

- Case Digest IIDocument9 pagesCase Digest IISansui Jusan Rochel100% (1)

- LG-Electronics-vs.-CIR-digestDocument21 pagesLG-Electronics-vs.-CIR-digestDarrel John SombilonNo ratings yet

- Gulf Air Co-Phil Branch v. CIRDocument3 pagesGulf Air Co-Phil Branch v. CIRJustine GaverzaNo ratings yet

- CIR Vs Enron Subic Power G.R. No. 166387Document6 pagesCIR Vs Enron Subic Power G.R. No. 166387Ahmad Israfil PiliNo ratings yet

- 1maple v. CIRDocument26 pages1maple v. CIRaudreydql5No ratings yet

- Rationale For The Imposition of TaxesDocument5 pagesRationale For The Imposition of TaxesBurnok SupolNo ratings yet

- Northern Mini Hydro Corporation Vs CIRDocument2 pagesNorthern Mini Hydro Corporation Vs CIRJolina SuwalawanNo ratings yet

- Bir Regulations No. 14-2003Document12 pagesBir Regulations No. 14-2003Haryeth CamsolNo ratings yet

- CIR vs. The Stanley Work SalesDocument3 pagesCIR vs. The Stanley Work SalesKate DomingoNo ratings yet

- Tax CasesDocument16 pagesTax Casesnicole5anne5ddddddNo ratings yet

- Tax Remedies Digest 62 70Document12 pagesTax Remedies Digest 62 70Christine Angelus MosquedaNo ratings yet

- Surigao Cons. Minining v. Collector FactsDocument2 pagesSurigao Cons. Minining v. Collector Factsmondragon4No ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- 1040 Exam Prep Module XI: Circular 230 and AMTFrom Everand1040 Exam Prep Module XI: Circular 230 and AMTRating: 1 out of 5 stars1/5 (1)

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Contract To SellDocument2 pagesContract To SellAnn Camille JoaquinNo ratings yet

- Basic Essentials For AMZ WS UKDocument3 pagesBasic Essentials For AMZ WS UKOsama ArshadNo ratings yet

- Airtel BillDocument2 pagesAirtel Billbharathkumar jNo ratings yet

- PESCO ONLINE BILL Jan2023Document2 pagesPESCO ONLINE BILL Jan2023amjadali482No ratings yet

- P6UK 2014 Dec ADocument12 pagesP6UK 2014 Dec APOUNo ratings yet

- DuplicateDocument4 pagesDuplicateAdinarayana RaoNo ratings yet

- E. Chapter 4.NVLDocument12 pagesE. Chapter 4.NVLnguyenduckiena55No ratings yet

- IndividualsDocument63 pagesIndividualsWilliam HarrisNo ratings yet

- FBO InvoiceDocument2 pagesFBO InvoiceThe smocking tyresNo ratings yet

- Employees Vs Ind ContractorDocument5 pagesEmployees Vs Ind ContractorGetto VocabNo ratings yet

- Paytm 6 Months StatementDocument27 pagesPaytm 6 Months StatementRaghav SharmaNo ratings yet

- Tax Statement As On Dec 2021: Employee DetailsDocument1 pageTax Statement As On Dec 2021: Employee DetailsElakkiyaNo ratings yet

- Tax Invoice Service Charge: 0223070005016818 05 Jul 2023 01 Jul 2023 To 30 Sep 2023 Quarterly 04 Aug 2023Document2 pagesTax Invoice Service Charge: 0223070005016818 05 Jul 2023 01 Jul 2023 To 30 Sep 2023 Quarterly 04 Aug 2023Katherine TaguinesNo ratings yet

- It MCQDocument31 pagesIt MCQbigbulleye6078No ratings yet

- Gold Mastercard Titanium Mastercard Platinum MastercardDocument3 pagesGold Mastercard Titanium Mastercard Platinum MastercardRoseyy GalitNo ratings yet

- Online Tax Payment PortalDocument1 pageOnline Tax Payment PortalRahul ShawNo ratings yet

- Deutsche Bank AG Manila Branch v. CIRDocument3 pagesDeutsche Bank AG Manila Branch v. CIRDonna DumaliangNo ratings yet

- Deck Merchant MSF 4274Document9 pagesDeck Merchant MSF 4274Syed MujtabaNo ratings yet

- Tax AvoidanceDocument38 pagesTax AvoidancerampayareNo ratings yet

- Negotiable Instruments Act 1881Document11 pagesNegotiable Instruments Act 1881kallasanjay100% (1)

- Study of Digital Wallet Adoption Among Students ReportDocument108 pagesStudy of Digital Wallet Adoption Among Students ReportKARTIK SINGH100% (1)

- Navitar-Immersive World-RFQ For 2 HM4K 178 HL Lenses For Christie Griffyn 4K32 Dual Cove-2020!09!09 - V1Document3 pagesNavitar-Immersive World-RFQ For 2 HM4K 178 HL Lenses For Christie Griffyn 4K32 Dual Cove-2020!09!09 - V1BoanergeNo ratings yet

- GST BillDocument1 pageGST BillTIPS ON TECHNOLOGYNo ratings yet

- In Case of Errors or Questions About Your Electronic Funds TransfersDocument2 pagesIn Case of Errors or Questions About Your Electronic Funds TransfersMuhammad AdeelNo ratings yet

- Commissioner of Internal Revenue vs. Philippine Daily Inquirer, IncDocument2 pagesCommissioner of Internal Revenue vs. Philippine Daily Inquirer, IncJoseph SalidoNo ratings yet

- Tax 1 PDFDocument17 pagesTax 1 PDFLeah MoscareNo ratings yet

- Preliminary Considerations: Negotiable Instruments Outline IDocument9 pagesPreliminary Considerations: Negotiable Instruments Outline IKrishielle AnneNo ratings yet

- CIR Vs Inter PublicDocument3 pagesCIR Vs Inter PublicArrianne ObiasNo ratings yet