Professional Documents

Culture Documents

Presentation To Petromindo

Presentation To Petromindo

Uploaded by

Buls projectOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Presentation To Petromindo

Presentation To Petromindo

Uploaded by

Buls projectCopyright:

Available Formats

Coal, Metals & Mining

Power sector coal demand in APAC to 2030

13 August 2020

James Stevenson, Senior Director, Coal Metals & Mining, +61 447 622 258, james.stevenson@ihsmarkit.com

Confidential. © 2020 IHS Markit®. All rights reserved.

IHS Markit presentation to Petromindo - August 2020

Key implications

• 2020 is clearly a very grim year for coal demand globally. APAC is impacted, but the negatives are

at least partially offset by some positives.

• Thermal coal import demand in the region will grow to 2020:

• Import demand will decline in the traditional markets of Japan, South Korea and Mainland China

• These declines are more than offset by growth, especially in India and Vietnam

• APAC suppliers are able to meet this demand growth, but will face some more competition from

Atlantic suppliers

Confidential. © 2020 IHS Markit®. All rights reserved. 2

IHS Markit presentation to Petromindo - August 2020

Thermal coal import demand to decline around 91 MMt this year

Changes in thermal coal imports, 2019 to 2020 Changes in thermal coal supply expectations

10.0

0.0

Year-on-year change 2019 to 2020 (MMt)

-10.0

-20.0

Required cuts: 91 MMt+

Cuts YTD + announced: ~70 MMt

-30.0

-40.0

-50.0

Mongolia

Mozambique

Colombia

South Africa

Indonesia

Russia

Canada

Australia

United States

Pre-COVID-19 forecast* Current forecast

Source: IHS Markit © 2020 IHS Markit Source: IHS Markit © 2020 IHS Markit

Confidential. © 2020 IHS Markit®. All rights reserved. 3

IHS Markit presentation to Petromindo - August 2020

Japan, South Korea, Taiwan

Japan imports, annual South Korea imports, annual

140 120

<4 ,20 0 kcal/kg, NA R <4 ,20 0 kcal/kg, NA R

120 100

Million metric tons

Million metric tons

4,200-5 ,00 0 kcal/kg, NA R 4,200-5 ,00 0 kcal/kg, NA R

100

80

5,000-5 ,60 0 kcal/kg, NA R 5,000-5 ,60 0 kcal/kg, NA R

80

60

60 5,600-6 ,20 0 kcal/kg, NA R 5,600-6 ,20 0 kcal/kg, NA R

40

40 >6 ,20 0 kcal/kg, NA R >6 ,20 0 kcal/kg, NA R

20 20

0 0

201 3 201 5 201 7 201 9 202 1 202 3 202 5 202 7 202 9 201 3 201 5 201 7 201 9 202 1 202 3 202 5 202 7 202 9

Source: IHS Markit © 2017 IHS Markit Source: IHS Markit © 2017 IHS Markit

Taiwan imports, annual • Modest coal demand decline expected over the coming

70

<4 ,20 0 kcal/kg, NA R decade

60

Million metric tons

4,200-5 ,00 0 kcal/kg, NA R

50 • Nuclear supportive for near term coal demand in Japan

5,000-5 ,60 0 kcal/kg, NA R

40

30 5,600-6 ,20 0 kcal/kg, NA R • Environmental policies increasingly encroaching on coal

20 >6 ,20 0 kcal/kg, NA R demand

10

0 • Coal-gas competition a developing theme

201 3 201 5 201 7 201 9 202 1 202 3 202 5 202 7 202 9

Source: IHS Markit © 2017 IHS Markit

Confidential. © 2020 IHS Markit®. All rights reserved. 4

IHS Markit presentation to Petromindo - August 2020

Mainland China

China imports, annual • Import restrictions are a key driver not just for 2020 but for

at least a few years to come. If imports are left

250 unconstrained, economics will drive them higher. But IHS

<4,200 kcal/kg, NAR Markit expects that import restrictions will curtail imports

on an ongoing basis.

200 4,200-5,000 kcal/kg,

NAR • Ultimately imports will decline, driven by:

Million metric tons

150 5,000-5,600 kcal/kg, • Growth of coastal nuclear

NAR

• Impact of hydro

5,600-6,200 kcal/kg,

100 NAR • Growth of LNG regasification and gas capacity

>6,200 kcal/kg, NAR • Growth of coal-by-wire

50

• Better domestic coal transportation

• Move of ‘center of gravity’ of coal generation inland

0

2013 2015 2017 2019 2021 2023 2025 2027 2029

Source: IHS Markit © 2017 IHS Markit

Confidential. © 2020 IHS Markit®. All rights reserved. 5

IHS Markit presentation to Petromindo - August 2020

India

• After the sizeable 2020 downturn, Indian import demand growth will

India imports, annual

resume, and will continue to 2050.

250 • However, 2020 is giving domestic Indian suppliers (primarily CIL) a

<4,200 kcal/kg, NAR chance to catch up with domestic demand. Coming out of COVID-

19, domestic supply will take some market share from imports. This

200

4,200-5,000 kcal/kg, will be an ongoing phenomenon – caused by COVID-19 but not

NAR constrained to 2020. Additionally, changes in ash blending rules

further favor domestic coal over imports.

Million metric tons

150 5,000-5,600 kcal/kg,

NAR

• This is bad news for Indonesian suppliers, who will likely see some

lost exports to India.

5,600-6,200 kcal/kg,

100 NAR

• Ultimately demand growth will still be massive, with a staggering 92

>6,200 kcal/kg, NAR GW of new capacity coming online by 2030.

50

0

2013 2015 2017 2019 2021 2023 2025 2027 2029

Source: IHS Markit © 2017 IHS Markit

Confidential. © 2020 IHS Markit®. All rights reserved. 6

IHS Markit presentation to Petromindo - August 2020

Vietnam

Vietnam imports, annual • GDP growth expectations remain positive this year (1.1%)

• Weak hydro year is stimulating record imports in 2020—

90

<4,200 kcal/kg, NAR despite global pandemic

80

• However, IHS Markit expects import strength to wane in

70 4,200-5,000 kcal/kg, the second half:

NAR

60 • Wet season enabling hydro generation

Million metric tons

5,000-5,600 kcal/kg,

50 NAR

• Recent rise in COVID-19 cases

40 5,600-6,200 kcal/kg,

NAR • Longer term, Vietnam is still in the midst of a massive

30 coal-fired capacity build:

>6,200 kcal/kg, NAR

20 • More than 10 GW of coal-fired capacity is under construction and

will come online by 2025

10

• Another 10 GW is planned (and likely) and will come online

0 between 2025 and 2030.

2013 2015 2017 2019 2021 2023 2025 2027 2029

• Capacity build beyond 2030 will likely slow dramatically

Source: IHS Markit © 2017 IHS Markit

Confidential. © 2020 IHS Markit®. All rights reserved. 7

IHS Markit presentation to Petromindo - August 2020

Elsewhere in Asia

Philippines imports, annual Cambodia imports, annual

40 14

<4 ,20 0 kcal/kg, NA R <4 ,20 0 kcal/kg, NA R

35 12

Million metric tons

Million metric tons

30 4,200-5 ,00 0 kcal/kg, NA R 4,200-5 ,00 0 kcal/kg, NA R

10

25 5,000-5 ,60 0 kcal/kg, NA R 5,000-5 ,60 0 kcal/kg, NA R

8

20

5,600-6 ,20 0 kcal/kg, NA R 6 5,600-6 ,20 0 kcal/kg, NA R

15

10 >6 ,20 0 kcal/kg, NA R 4 >6 ,20 0 kcal/kg, NA R

5 2

0 0

201 3 201 5 201 7 201 9 202 1 202 3 202 5 202 7 202 9 201 3 201 5 201 7 201 9 202 1 202 3 202 5 202 7 202 9

Source: IHS Markit © 2017 IHS Markit Source: IHS Markit © 2017 IHS Markit

Thailand imports, annual Malaysia imports, annual

30 45

<4 ,20 0 kcal/kg, NA R

40

25 4,200-5 ,00 0 kcal/kg, NA R <4 ,20 0 kcal/kg, NA R

Million metric tons

Million metric tons

35

5,000-5 ,60 0 kcal/kg, NA R 4,200-5 ,00 0 kcal/kg, NA R

20 30

5,600-6 ,20 0 kcal/kg, NA R 5,000-5 ,60 0 kcal/kg, NA R

25

15 >6 ,20 0 kcal/kg, NA R 5,600-6 ,20 0 kcal/kg, NA R

20

SSCC + PCI >6 ,20 0 kcal/kg, NA R

10 15

HCC SSCC + PCI

10

5 HCC

5

0 0

201 3 201 5 201 7 201 9 202 1 202 3 202 5 202 7 202 9 201 3 201 5 201 7 201 9 202 1 202 3 202 5 202 7 202 9

Source: IHS Markit © 2017 IHS Markit Source: IHS Markit © 2017 IHS Markit

Confidential. © 2020 IHS Markit®. All rights reserved. 8

IHS Markit presentation to Petromindo - August 2020

Global demand grows slowly over the next ten years, as growth in APAC

slightly outweighs declines elsewhere

Thermal demand Thermal supply

1,200 1200.0

1,000 1000.0

800 800.0

Million metric tons

Million metric tons

600 600.0

400 400.0

200 200.0

0 0.0

2015 2020 2025 2030 2015 2020 2025 2030

Europe Mediterranean

Americas Indian Ocean Australia Indonesia South Africa Colombia Russia

Southeast Asia East Asia (China, Hong Kong, JKT) United States Canada Mozambique Others

Other

Source: IHS Markit © 2020 IHS Markit Source: IHS Markit © 2020 IHS Markit

Confidential. © 2020 IHS Markit®. All rights reserved. 9

IHS Markit Customer Care

CustomerCare@ihsmarkit.com

Americas: +1 800 IHS CARE (+1 800 447 2273)

Europe, Middle East, and Africa: +44 (0) 1344 328 300

Asia and the Pacific Rim: +604 291 3600

Disclaimer

The information contained in this presentation is confidential. Any unauthorized use, disclosure, reproduction, or disseminat ion, in full or in part, in any media or by any means, without the prior written permission of IHS Markit or any of its affiliates ("IHS Markit") is strictly

prohibited. IHS Markit owns all IHS Markit logos and trade names contained in this presentation that are subject to license. Opinions, statements, estimates, and projections in this presentation (including other media) are solely those of the individualauthor(s) at the time of

writing and do not necessarily reflect the opinions of IHS Markit. Neither IHS Markit nor the author(s) has any obligation to update this presentation in the event that any content, opinion, statement, estimate, or projection (collectively, "information ") changes or subsequently

becomes inaccurate. IHS Markit makes no warranty, expressed or implied, as to the accuracy, completeness, or timeliness of any information in this presentation, and shall not in any way be liable to any recipient for any inaccuracies or omissions. Without limiting the

foregoing, IHS Markit shall have no liability whatsoever to any recipient, whether in contract, in tort (including negligence ), under warranty, under statute or otherwise, in respect of any loss or damage suffered by any recipient as a result of or in connection with any

information provided, or any course of action determined, by it or any third party, whether or not based on any information p rovided. The inclusion of a link to an external website by IHS Markit should not be understood to be an endorsement of that website or the site's

owners (or their products/services). IHS Markit is not responsible for either the content or output of external websites. Cop yright © 2020, IHS Markit®. All rights reserved and all intellectual property rights are retained by IHS Markit.

You might also like

- Test Bank For Berne and Levy Physiology 6th Edition KoeppenDocument24 pagesTest Bank For Berne and Levy Physiology 6th Edition KoeppenChristopherWrightgipe100% (46)

- Roller DooyaDocument147 pagesRoller DooyaNachoNo ratings yet

- Iso 21905-HRSGDocument106 pagesIso 21905-HRSGadepp8642100% (1)

- Aspect® Unified IP® 7.4 SP1 Aspect® Unified IP® - Advanced List Management 7.4 ™ SP1 Product Release NotesDocument29 pagesAspect® Unified IP® 7.4 SP1 Aspect® Unified IP® - Advanced List Management 7.4 ™ SP1 Product Release NotesAbNo ratings yet

- WTO - International Arrivals To Venezuela (2012-2016)Document2 pagesWTO - International Arrivals To Venezuela (2012-2016)Anonymous mF1cc3NNo ratings yet

- Country Profile: ColombiaDocument10 pagesCountry Profile: ColombiaPaula Andrea RodríguezNo ratings yet

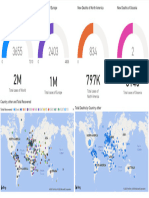

- PowerBI Dashboard ExampleDocument1 pagePowerBI Dashboard ExampleCharielle Esthelin BacuganNo ratings yet

- PowerBI Dashboard ExampleDocument1 pagePowerBI Dashboard ExampleKolade OrimoladeNo ratings yet

- Shell Immersion Cooling Fluid Marketing Brochure Updated Oct 23Document12 pagesShell Immersion Cooling Fluid Marketing Brochure Updated Oct 23Optus 583No ratings yet

- TopGlove - Integrated - Annual - Report - 2022 - Part 1Document25 pagesTopGlove - Integrated - Annual - Report - 2022 - Part 1Dharesini ChandranNo ratings yet

- Vietnam and The Global Value Chain: FIGURE 2.1. Export-Led Growth and Poverty Reduction, 1992-2017Document1 pageVietnam and The Global Value Chain: FIGURE 2.1. Export-Led Growth and Poverty Reduction, 1992-2017hnmjzhviNo ratings yet

- Study - Id67394 - Foreign Direct Investments in IndiaDocument26 pagesStudy - Id67394 - Foreign Direct Investments in IndiavishnuNo ratings yet

- 21-4-6 IDFC MF Equity Market Outlook FY 22Document42 pages21-4-6 IDFC MF Equity Market Outlook FY 22reddyramireddy2022No ratings yet

- Valuation Report of BPCLDocument35 pagesValuation Report of BPCLJobin JohnNo ratings yet

- Urban: Pay Date Cac No. Amount Paid Punch DateDocument1 pageUrban: Pay Date Cac No. Amount Paid Punch DateDivyansh JohriNo ratings yet

- Madhya Pradesh Road Development Corporation: Last 11 Yrs. Completed Road Length (In KM)Document15 pagesMadhya Pradesh Road Development Corporation: Last 11 Yrs. Completed Road Length (In KM)Rajveer Singh YadavNo ratings yet

- Standards - Report - e by WTODocument6 pagesStandards - Report - e by WTOVivek BadkurNo ratings yet

- Menap PPT 042020Document25 pagesMenap PPT 042020AbhinavSinghNo ratings yet

- Q3 2022 ID ColliersQuarterly JakartaDocument27 pagesQ3 2022 ID ColliersQuarterly JakartaGeraldy Dearma PradhanaNo ratings yet

- FRB 8 Acctg For FWL Waiver Rebate (Final)Document19 pagesFRB 8 Acctg For FWL Waiver Rebate (Final)cheezhen5047No ratings yet

- Malaysian House Price Index (MHPI)Document2 pagesMalaysian House Price Index (MHPI)Afiq KhidhirNo ratings yet

- ReviewDocument7 pagesReviewAbdullah CheemaNo ratings yet

- Group 2Document1 pageGroup 2HamzaMehmoodBhattiNo ratings yet

- Oil Companies TransitoinDocument1 pageOil Companies TransitoinandresNo ratings yet

- Madhya Pradesh Road Development Corporation: Last 11 Yrs. Completed Road Length (In KM)Document16 pagesMadhya Pradesh Road Development Corporation: Last 11 Yrs. Completed Road Length (In KM)Vivek VermaNo ratings yet

- Nazara IM - Spark CapitalDocument27 pagesNazara IM - Spark CapitalBBNo ratings yet

- Etude Avolta-VC-MA-Tech-Trends-France-2022Document26 pagesEtude Avolta-VC-MA-Tech-Trends-France-2022Thibaud CombeNo ratings yet

- Madan Bohara Marketing PRESENTATION R I1Document22 pagesMadan Bohara Marketing PRESENTATION R I1Navin AcharyaNo ratings yet

- 溫室氣體盤查3日種子班-第一天-講義 1121130Document82 pages溫室氣體盤查3日種子班-第一天-講義 1121130MillerNo ratings yet

- Covid 19Document1 pageCovid 19oyuka oyukaNo ratings yet

- 2 - Avendano - Digital Regulation Framework For ASEANDocument15 pages2 - Avendano - Digital Regulation Framework For ASEANAom SakornNo ratings yet

- Chart PackDocument35 pagesChart Packxyan.zohar7No ratings yet

- Energy September 2023Document41 pagesEnergy September 2023Dalina Maria AndreiNo ratings yet

- 3.4 Financial Analysis Kena Buat Huraikan SikitDocument7 pages3.4 Financial Analysis Kena Buat Huraikan SikitSolehah OmarNo ratings yet

- ERTMSETCS in Numbers 1Document2 pagesERTMSETCS in Numbers 1Donato ToccoNo ratings yet

- Surabaya Property Market Report: Colliers Half Year Report H1 2018 20 September 2018Document22 pagesSurabaya Property Market Report: Colliers Half Year Report H1 2018 20 September 2018anthony csNo ratings yet

- 09.EK September 2022Document6 pages09.EK September 2022kleber VergaraNo ratings yet

- Guide To: ExcellenceDocument12 pagesGuide To: ExcellenceSuri SANo ratings yet

- SHS WFP PPMP App Sob MDP Fy2020Document114 pagesSHS WFP PPMP App Sob MDP Fy2020Haydee YuriNo ratings yet

- Digitalization in Mining IndustryDocument49 pagesDigitalization in Mining IndustryOskr FdzNo ratings yet

- Chart PackDocument34 pagesChart Packmodeste29001No ratings yet

- GEM - Structure - Vietnam - AB 2021 10 19Document34 pagesGEM - Structure - Vietnam - AB 2021 10 19Trần Thái Đình KhươngNo ratings yet

- Indonesia IEP June 2021 SlidesDocument17 pagesIndonesia IEP June 2021 Slidesfrisdian97No ratings yet

- MOSL New Year Top Picks 2023Document19 pagesMOSL New Year Top Picks 2023dcpjimmy100% (1)

- The New Global Competence in Hot Rolling 2019Document15 pagesThe New Global Competence in Hot Rolling 2019belkacemNo ratings yet

- 乐鑫科技2021年企业社会责任报告Document48 pages乐鑫科技2021年企业社会责任报告王烁然No ratings yet

- Telematics Product Catalog 2021 FebruaryDocument38 pagesTelematics Product Catalog 2021 FebruaryAli AnbaaNo ratings yet

- The President's Eskom Sustainability Task Team - Anton EberhardDocument20 pagesThe President's Eskom Sustainability Task Team - Anton EberhardChristo88No ratings yet

- Service Sector in IndiaDocument15 pagesService Sector in IndiaNick NickyNo ratings yet

- Telematics Product Catalog 2021 AugustDocument39 pagesTelematics Product Catalog 2021 AugustFiros KNo ratings yet

- KPO IndustryDocument33 pagesKPO IndustryManish Saran100% (6)

- PROJ02 - Bao-idangC & JimenezJDocument6 pagesPROJ02 - Bao-idangC & JimenezJChaermalyn Bao-idangNo ratings yet

- Najeeb Gas BillDocument1 pageNajeeb Gas BillAbdul ghaffarNo ratings yet

- Global Economic Prospects Jun2020 PressHighlights Chp4Document3 pagesGlobal Economic Prospects Jun2020 PressHighlights Chp4CristianMilciadesNo ratings yet

- Valuation Report of BPCLDocument24 pagesValuation Report of BPCLJobin JohnNo ratings yet

- World Trade Statical Review in 2021Document136 pagesWorld Trade Statical Review in 2021Lê Thị TìnhNo ratings yet

- Full Glossary of Statistics TermsDocument150 pagesFull Glossary of Statistics Termsshahid 1shahNo ratings yet

- The Australian EconomyDocument35 pagesThe Australian Economybiangbiang bangNo ratings yet

- PT Bekasi Fajar Industrial Estate TBK: Investors Highlight - 3M 2021Document6 pagesPT Bekasi Fajar Industrial Estate TBK: Investors Highlight - 3M 2021ninja vibelNo ratings yet

- Employment Insurance Sytem (Eis) : VOLUME 4/2020 The Impact of Covid-19 On LoeDocument26 pagesEmployment Insurance Sytem (Eis) : VOLUME 4/2020 The Impact of Covid-19 On LoeunicornmfkNo ratings yet

- BV Cia 3Document27 pagesBV Cia 3Jobin JohnNo ratings yet

- ObliconDocument111 pagesObliconBroy D BriumNo ratings yet

- FINAL - Commercial Law (From Divina Rev)Document22 pagesFINAL - Commercial Law (From Divina Rev)Lynnette ChungNo ratings yet

- The Scope of Corporate FinanceDocument11 pagesThe Scope of Corporate Financelinda zyongweNo ratings yet

- COMPANY LAW LECTURE NOTES - Tracked - Nov15.2020Document59 pagesCOMPANY LAW LECTURE NOTES - Tracked - Nov15.2020John Quachie100% (1)

- Definition, Concept and Purpose of Taxation: Taxation 1 Case Digest Atty. Marvin CaneroDocument13 pagesDefinition, Concept and Purpose of Taxation: Taxation 1 Case Digest Atty. Marvin CaneroStela PantaleonNo ratings yet

- Obligations and Contracts (Dean Ulan)Document26 pagesObligations and Contracts (Dean Ulan)Priscilla DawnNo ratings yet

- Business Basics Handout Types of Business OwnershipDocument5 pagesBusiness Basics Handout Types of Business OwnershipToniann LawrenceNo ratings yet

- Labor BarQsDocument10 pagesLabor BarQsAtheena Marie PalomariaNo ratings yet

- CM-f3e Module: Technical DescriptionDocument34 pagesCM-f3e Module: Technical DescriptionLejlaNo ratings yet

- G.R. No. 185522Document6 pagesG.R. No. 185522Kyla AbadNo ratings yet

- Case Labor Law Alilin VS PetronDocument9 pagesCase Labor Law Alilin VS Petronedawrd aroncianoNo ratings yet

- Transcultural Health Care A Culturally Competent Approach 4th Edition Purnell Test BankDocument18 pagesTranscultural Health Care A Culturally Competent Approach 4th Edition Purnell Test Bankjadialuwaehs100% (20)

- MC14027B Dual J-K Flip-Flop: FeaturesDocument6 pagesMC14027B Dual J-K Flip-Flop: Featuresmarcos cordovaNo ratings yet

- Ez-Light SP Series Signal Light: DatasheetDocument8 pagesEz-Light SP Series Signal Light: DatasheetJosé Antonio Solorzano cruzNo ratings yet

- Abandoned Property (Disposal) Act, 1974Document5 pagesAbandoned Property (Disposal) Act, 1974Maame Ekua Yaakwae AsaamNo ratings yet

- Occupiers Liability Act 1957Document4 pagesOccupiers Liability Act 1957Abdullah SaeedNo ratings yet

- Iphone Software License4Document11 pagesIphone Software License4raghuNo ratings yet

- A Comparitive Study On Inevitable Accident and Act of GodDocument9 pagesA Comparitive Study On Inevitable Accident and Act of GodAkash JNo ratings yet

- Corporation Code (De Leon, 2010) PDFDocument1,114 pagesCorporation Code (De Leon, 2010) PDFJayson De LemonNo ratings yet

- 3 TNV 88 FDocument266 pages3 TNV 88 FKhaled Naseem Abu-Sabha100% (1)

- Mercantile Law Q and A Set 1Document5 pagesMercantile Law Q and A Set 1Enzo OfilanNo ratings yet

- Corporation Law Digested CasesDocument11 pagesCorporation Law Digested CasesKarl Jason JosolNo ratings yet

- License SASDocument3 pagesLicense SASjharmifer stiven heredia duranNo ratings yet

- ReadmeDocument3 pagesReadmeTemelkoski DarkoNo ratings yet

- Loans and Credit Corporation." The Assailed Rulings Reversed and Set Aside The DecisionDocument12 pagesLoans and Credit Corporation." The Assailed Rulings Reversed and Set Aside The DecisionJulian DubaNo ratings yet

- The Workmen Compensation Act 1923Document12 pagesThe Workmen Compensation Act 1923Vishnu BalajiNo ratings yet

- Yes HospitalDocument4 pagesYes Hospitalhare_07No ratings yet

- Torts and Damages Notes FinalllyDocument192 pagesTorts and Damages Notes FinalllyVanessa VelascoNo ratings yet