Professional Documents

Culture Documents

Liability Sheet

Liability Sheet

Uploaded by

aakashgupta viaanshOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Liability Sheet

Liability Sheet

Uploaded by

aakashgupta viaanshCopyright:

Available Formats

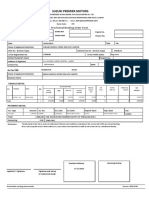

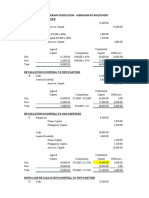

Assessment Print Page 1 of 1

AsessmentSheet Print

Claim Details

Claim No : Insured Name :

Assessment Filled By : CSM/Surveyor Name :

Vehicle Details

Vehicle Type : Depreciation Applicable From : 02-APR-2021

Vehicle Make : Date of Registration of Vehicle : 02-APR-2021

Registration No. Garage Name local garage

Date of Loss 01-MAY-2023 Assessment Date

Manufacturer TATA MOTORS Model 1616

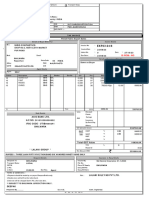

Statewise Paint Bifurcation 25-75

GST From State Rajasthan GST To State Rajasthan

GSTIN Number Nearest State

GST Registration Status No Invoice To IL

Part

Tax Labour Labour No. Of

Name Sub Part Part Part Part Depr Disc Tax Tax Tax Taxable Gross Net Part O/F DT Pt Total

Part Name QTY Depr Salvage Disc% post Invoice Invoice Panels Net Amt

as per Name Type Rate Amt Rate AMT Type Rate Amt amount Amt Amt Est. Est. Est. Lab.

rate No Date Painted

Invoice

SUSPENSION LEAF 30-JUL-

Metal 1 14382 14382 0 0 1150.56 0 0 0 0 0 12940 0 14090.56 13231.44 InitialOEM 3200 0 0 0 3200 16431.44

& BRAKES SPRINGS 2023

FASTENING &

30-JUL-

CONSUMABLE CLIPS Metal 1 332 332 0 0 0 0 0 0 0 0 324.69 0 324.69 332 InitialOEM 0 0 0 0 0 332

2023

ITEMS

FASTENING &

30-JUL-

CONSUMABLE BOLT Metal 1 266 266 0 0 0 0 0 0 0 0 260.14 0 260.14 266 InitialOEM 0 0 0 0 0 266

2023

ITEMS

LOAD

30-JUL-

LOAD BODY BODY Metal 1 15600 15600 0 0 1248 0 0 0 0 0 14035.88 0 15283.88 14352 InitialOEM 3000 17600 3000 0 23600 37952

2023

MATERIAL

FENDER 30-JUL-

FENDER Metal 1 500 500 0 0 40 0 0 0 0 0 449.87 0 489.87 460 InitialOEM 250 0 0 0 250 710

FRONT LH 2023

SUSPENSION 30-JUL-

U CLAMP Metal 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 InitialOEM 750 0 0 0 750 750

& BRAKES 2023

ANGLES 30-JUL-

LOAD BODY Metal 1 2000 2000 0 0 160 0 0 0 0 0 1799.47 0 1959.47 1840 InitialOEM 250 750 0 0 1000 2840

& FLATS 2023

BUMPER 30-JUL-

BUMPER Metal 1 5500 5500 0 0 440 0 0 0 0 0 4948.55 0 5388.55 5060 InitialOEM 500 0 0 0 500 5560

REAR 2023

BUMPER

30-JUL-

BUMPER REAR Metal 1 3000 3000 0 0 240 0 0 0 0 0 2699.21 0 2939.21 2760 InitialOEM 500 0 0 0 500 3260

2023

LOWER

Taxable

Deductible Pre- Taxable Post- Gross SGST SGST UGST UGST CGST CGST IGST IGST

Part/Labour SAC Code. Amt. before

Component TAX value TAX labour % Amt. % Amt. % Amt. % Amt.

dedc

Opening &

Fitting

998729 8450 186.12 0 8263.88 0 8263.88 0 0 0 0 0 0 0 0

Painting 998729 3000 66.08 0 2933.92 0 2933.92 0 0 0 0 0 0 0 0

Denting 998729 18350 404.18 0 17945.82 0 17945.82 0 0 0 0 0 0 0 0

Total Part Amt : 41580 Total O/F Labour : 8450 Total Net Amt 68101.43

Total Depreciation : 0 Total DT Labour : 18350

Assessment type Main Ancillary

Total Salvage : 3278.56 Total PT Labour : 3000

Compulsory Excess (Single) 1500

Deductible Component Part : 843.63 Total Labour Amt : 29800

Voluntary Excess

Taxable amount of parts : 37457.81 Depreciation on Painting : 0

Additional Deductible

Total Tax Amt : 0 Deductible Component Labor : 656.38

Imposed Excess/Paint

Total Part GST Tax: 0 Taxable amount of Labor : 29143.62 Depreciation

Total Gross Amt : 40736.37 Total Labour GST Tax: 0 Non Standard Settlement (0%) 0

Total Net Part Amt: 37457.81 Net Painting Amount: 2933.92 Total Payable 66601

Garage Type: Non-Corporate Grand Net Lab. Amt: 29143.62 Invoice Amt 91480

Education Cess (0%) Difference 24879

Service Tax No. WCT: (%) 0 Base Claim Amount. 66601

PAN No. : WCTP : (%) 0

TIN Number Depreciation on painting:

ILA Remark

Cashless Status

Payment to

Export To Excel Exit

http://fasttrack.prodicicilombard.com/cmssiteroot/common/frmasessmentprintv2.aspx?enc... 7/31/2023

You might also like

- Z Henn 3504342774 2019/02/13 75: Copy of Tax InvoiceDocument3 pagesZ Henn 3504342774 2019/02/13 75: Copy of Tax InvoiceZian Henn0% (2)

- Bajaj Allianz General Insurance CompanyDocument3 pagesBajaj Allianz General Insurance Companysarath potnuri0% (1)

- Cornerstones of Financial Accounting 4th Edition Rich Test BankDocument34 pagesCornerstones of Financial Accounting 4th Edition Rich Test Bankalanholt09011983rta100% (37)

- Consociational - Democracy - KaricDocument340 pagesConsociational - Democracy - KaricSahra ManNo ratings yet

- Annexure C ReportDocument1 pageAnnexure C Reportrohail ashrafNo ratings yet

- Annexure C Report (12) ICTDocument2 pagesAnnexure C Report (12) ICTSaqib XamNo ratings yet

- EWR-10Document1 pageEWR-10platinum motocorpNo ratings yet

- Ertiga EstimateDocument1 pageErtiga EstimateRohit BhatnagarNo ratings yet

- Up14ht0049 PDFDocument2 pagesUp14ht0049 PDFRaghav GuptaNo ratings yet

- HR98J5334 With All Cover BajajDocument2 pagesHR98J5334 With All Cover Bajajpankaj_97No ratings yet

- HR98J5334 Icici With All CoverDocument2 pagesHR98J5334 Icici With All Coverpankaj_97No ratings yet

- Bajaj Allianz General Insurance CompanyDocument2 pagesBajaj Allianz General Insurance Companysarath potnuriNo ratings yet

- The Resource of This Report Item Is Not ReachableDocument2 pagesThe Resource of This Report Item Is Not Reachableparentsareworld7No ratings yet

- HR 38 S 8272 PDFDocument2 pagesHR 38 S 8272 PDFiamalokkumar2002No ratings yet

- Annexure C ReportDocument1 pageAnnexure C ReportMuhammad AslamNo ratings yet

- D025859451 1090420548299394 SchedulescDocument2 pagesD025859451 1090420548299394 Schedulescramrit994No ratings yet

- Ap02y4777 Ar Ic BajajDocument1 pageAp02y4777 Ar Ic BajajPrince AnjiNo ratings yet

- Sourajit Dutta SbiDocument2 pagesSourajit Dutta SbiDev JyotiNo ratings yet

- STMT 153263690-4Document2 pagesSTMT 153263690-4anveshdudhat9No ratings yet

- Sample Policy Copy: Digit Two-Wheeler Package Policy UIN No.: IRDAN158RP0006V01201718Document2 pagesSample Policy Copy: Digit Two-Wheeler Package Policy UIN No.: IRDAN158RP0006V01201718AMIT RAJNo ratings yet

- ECS 792 (Aurangzeb) DLDocument1 pageECS 792 (Aurangzeb) DLاورنگزیب ملکNo ratings yet

- Adobe Scan Aug 26Document1 pageAdobe Scan Aug 26sushantnairNo ratings yet

- Siris Synthetics BhilDocument1 pageSiris Synthetics Bhilprakashsynthetics009No ratings yet

- Anita Devi InsuranceDocument1 pageAnita Devi InsurancePRAKASH SINGHNo ratings yet

- ICICI Lombard General Insurance Company LimitedDocument1 pageICICI Lombard General Insurance Company LimitedanirudhNo ratings yet

- Gasbill 1096652525 202304 20230527201157Document1 pageGasbill 1096652525 202304 20230527201157Faraz EssaniNo ratings yet

- Mteza A Abutment 12 - 033546Document2 pagesMteza A Abutment 12 - 033546Citymap Geospatial LtdNo ratings yet

- Adobe Scan Jun 04, 2023Document7 pagesAdobe Scan Jun 04, 2023atul.kapse3214No ratings yet

- Lifting Equipment Thorough Examination Register: Almansoori Inspection ServicesDocument5 pagesLifting Equipment Thorough Examination Register: Almansoori Inspection ServicesRanjithNo ratings yet

- Electric Bill RamudayanpattiDocument1 pageElectric Bill RamudayanpattiDanial ChakkaravarthyNo ratings yet

- PolicyDocument3 pagesPolicyAJITH JNo ratings yet

- Tax Invoice For LT Current Consumption Charges For The Month of January 2024Document1 pageTax Invoice For LT Current Consumption Charges For The Month of January 2024astortech360No ratings yet

- RTO Records Service SampleDocument1 pageRTO Records Service SampleSam KoshyNo ratings yet

- 131 - DeemaDocument1 page131 - DeemaAzhar MonNo ratings yet

- Adjustorsubmissionid Number - 3122982 07 - 05 - 2024Document2 pagesAdjustorsubmissionid Number - 3122982 07 - 05 - 2024kunal chandeNo ratings yet

- Tax Invoice For LT Current Consumption Charges For The Month of November 2023Document1 pageTax Invoice For LT Current Consumption Charges For The Month of November 2023airtelnet58No ratings yet

- Page From OG-24-1701-1802-00492400Document1 pagePage From OG-24-1701-1802-00492400sanjeevmurmu81No ratings yet

- Policy Type-Product Name-: Policy & Owner Details Renew Auto Secure - Standalone Own Damage Two Wheeler PolicyDocument1 pagePolicy Type-Product Name-: Policy & Owner Details Renew Auto Secure - Standalone Own Damage Two Wheeler PolicyApurba MandalNo ratings yet

- Estimate of Vehicle 22BH9228DDocument1 pageEstimate of Vehicle 22BH9228DBhagawant KamatNo ratings yet

- LARAN Sales Invoice - TT Steel 79Document3 pagesLARAN Sales Invoice - TT Steel 79likith.mallesh.14No ratings yet

- 26as 22.9.2023Document4 pages26as 22.9.2023prakashnaik998No ratings yet

- HR38U5752Document3 pagesHR38U5752amiraamirkhanaamirkhanNo ratings yet

- Gas Bill (July)Document1 pageGas Bill (July)Khyber AutosNo ratings yet

- DAFinalReport DA2708236140Document2 pagesDAFinalReport DA2708236140osama10qawsNo ratings yet

- Quotation Signage: Supplier InformationDocument2 pagesQuotation Signage: Supplier InformationD Anil KumarNo ratings yet

- BilldetailDocument1 pageBilldetailRam PriyanNo ratings yet

- Bill DetailDocument1 pageBill DetailAlavutieen 5roseNo ratings yet

- Rahul Mohan Tiwari PolicyDocument3 pagesRahul Mohan Tiwari PolicyManish TiwariNo ratings yet

- STMT 150092305Document2 pagesSTMT 150092305blinkfinance7No ratings yet

- Https Vahan - Parivahan.gov - in Vahanservice Vahan Ui Onlineservice Form Print RC SmartCard Report - XHTMLDocument1 pageHttps Vahan - Parivahan.gov - in Vahanservice Vahan Ui Onlineservice Form Print RC SmartCard Report - XHTMLJagannatha BeheraNo ratings yet

- KA14ER2268.PDF-Shkti PRVSNDocument2 pagesKA14ER2268.PDF-Shkti PRVSNImran KhanNo ratings yet

- Adobe Scan Aug 28, 2021Document1 pageAdobe Scan Aug 28, 2021sushantnairNo ratings yet

- HDB InsuranceDocument4 pagesHDB InsuranceabttatatirupurNo ratings yet

- Sel Bmpmisor1-2023-03-001Document1 pageSel Bmpmisor1-2023-03-001FrancisCarloTadenaNo ratings yet

- SCS BNG02 23-24 000040 10088Document1 pageSCS BNG02 23-24 000040 10088Jaya PrasoonNo ratings yet

- D014321128 4331850639678608 SchedulescDocument2 pagesD014321128 4331850639678608 SchedulescSairakeshNo ratings yet

- The New India Assurance Co. LTDDocument2 pagesThe New India Assurance Co. LTDsapputiroleNo ratings yet

- Accounting VoucherDocument1 pageAccounting Vouchersaigalavn5No ratings yet

- Pending Surveillance CasesDocument1 pagePending Surveillance Casessdo sNo ratings yet

- Sudip DasDocument1 pageSudip DasSurajit SarkarNo ratings yet

- Prakash S YadavDocument2 pagesPrakash S YadavAnil kadamNo ratings yet

- Innova 4755Document1 pageInnova 4755aakashgupta viaanshNo ratings yet

- RJ14HU2073 NYSA - ICICI LombardDocument1 pageRJ14HU2073 NYSA - ICICI Lombardaakashgupta viaanshNo ratings yet

- RJ14EA4072 NYSA - ICICI LombardDocument3 pagesRJ14EA4072 NYSA - ICICI Lombardaakashgupta viaanshNo ratings yet

- Amazing Goa Flight Inclusive Deal 4N (23-01-2024T18 - 08) - QuoteId-29870777Document13 pagesAmazing Goa Flight Inclusive Deal 4N (23-01-2024T18 - 08) - QuoteId-29870777aakashgupta viaanshNo ratings yet

- Car ProspectusDocument5 pagesCar Prospectusaakashgupta viaanshNo ratings yet

- Technical NoteDocument1 pageTechnical Noteaakashgupta viaanshNo ratings yet

- Prospectus Corporate CoverDocument42 pagesProspectus Corporate Coveraakashgupta viaanshNo ratings yet

- Assessment SheetDocument2 pagesAssessment Sheetaakashgupta viaanshNo ratings yet

- Technical ScheduleDocument138 pagesTechnical Scheduleaakashgupta viaanshNo ratings yet

- CENTRAL KYC REGISTRY Know Your Customer (KYC) Application Form IndividualDocument2 pagesCENTRAL KYC REGISTRY Know Your Customer (KYC) Application Form Individualaakashgupta viaanshNo ratings yet

- Burglary Insurance - GEN415Document13 pagesBurglary Insurance - GEN415aakashgupta viaanshNo ratings yet

- India Non JudicialDocument2 pagesIndia Non Judicialaakashgupta viaanshNo ratings yet

- 58 Gen891Document9 pages58 Gen891aakashgupta viaanshNo ratings yet

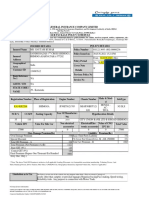

- Claim Form-2Document3 pagesClaim Form-2aakashgupta viaanshNo ratings yet

- 80 HP Kishore Pump Estimate, 88345Document1 page80 HP Kishore Pump Estimate, 88345aakashgupta viaanshNo ratings yet

- 1st Reminder Letter - SandeepDocument1 page1st Reminder Letter - Sandeepaakashgupta viaanshNo ratings yet

- 7402 AssessmentDocument1 page7402 Assessmentaakashgupta viaanshNo ratings yet

- Brochure - United Value Udyam SurakhaDocument2 pagesBrochure - United Value Udyam Surakhaaakashgupta viaanshNo ratings yet

- Policy DetailsDocument20 pagesPolicy Detailsaakashgupta viaanshNo ratings yet

- Final Tax Invoice MH48CB3080Document2 pagesFinal Tax Invoice MH48CB3080aakashgupta viaanshNo ratings yet

- Part 6Document4 pagesPart 6aakashgupta viaanshNo ratings yet

- Barnala Machinery Break Down ListDocument7 pagesBarnala Machinery Break Down Listaakashgupta viaanshNo ratings yet

- LOA - Manipur PKG-VDocument4 pagesLOA - Manipur PKG-Vaakashgupta viaanshNo ratings yet

- Part 3Document2 pagesPart 3aakashgupta viaanshNo ratings yet

- CAR POLICY LOR Due To FloodDocument2 pagesCAR POLICY LOR Due To Floodaakashgupta viaanshNo ratings yet

- Project BOQ - Maintenance BOQ Annxure-4 PDFDocument14 pagesProject BOQ - Maintenance BOQ Annxure-4 PDFaakashgupta viaanshNo ratings yet

- Project Damaged Report Aug.22 Annxure-1 PDFDocument1 pageProject Damaged Report Aug.22 Annxure-1 PDFaakashgupta viaanshNo ratings yet

- Digit Contractor's All Risks Insurance Policy (Commercial) PDFDocument14 pagesDigit Contractor's All Risks Insurance Policy (Commercial) PDFaakashgupta viaanshNo ratings yet

- Below 1800 Shri Dhanpat Rai Sachdeva Memorial ProspectusDocument15 pagesBelow 1800 Shri Dhanpat Rai Sachdeva Memorial ProspectusArjun Narayanan SatchidanandamNo ratings yet

- Oracle Inventory Management Integrations To Warehouse Execution Systems v7Document26 pagesOracle Inventory Management Integrations To Warehouse Execution Systems v7Srinivasa Rao AsuruNo ratings yet

- UBL Business PartnerDocument3 pagesUBL Business PartnerwaqasCOMSATSNo ratings yet

- BarrientosDocument3 pagesBarrientosJulieta Aragos PingcaNo ratings yet

- Supreme Court Administrative Order No. 26-19Document17 pagesSupreme Court Administrative Order No. 26-19adonis lorilloNo ratings yet

- ACI Syslog ReferenceDocument516 pagesACI Syslog ReferenceBobNo ratings yet

- Summative Assessment-Partnership Dissolution - Admission by InvestmentDocument10 pagesSummative Assessment-Partnership Dissolution - Admission by InvestmentAllondra DapengNo ratings yet

- CRIMINAL - Posadas Vs Sandiganbayan - Anti Graft and Corrupt Practices Act PDFDocument27 pagesCRIMINAL - Posadas Vs Sandiganbayan - Anti Graft and Corrupt Practices Act PDFKin Pearly FloresNo ratings yet

- Final Question Paper Business LawDocument12 pagesFinal Question Paper Business Lawmoiz aliNo ratings yet

- Torio vs. Fontanilla 85 SCRA 599Document12 pagesTorio vs. Fontanilla 85 SCRA 599Bong Bong SkiNo ratings yet

- The Christian Church - Distorted and DeformedDocument60 pagesThe Christian Church - Distorted and DeformedcincationalNo ratings yet

- Active MoneyWorks BrochureDocument7 pagesActive MoneyWorks BrochureSteve LocsinNo ratings yet

- Public Service Commission, West Bengal: Advertisement No. 22 / 2018Document2 pagesPublic Service Commission, West Bengal: Advertisement No. 22 / 2018sougata janaNo ratings yet

- Judaism's View of Jesus - Wikipedia, The Free EncyclopediaDocument14 pagesJudaism's View of Jesus - Wikipedia, The Free EncyclopediaNiclas PascalNo ratings yet

- Reimbursement Claim FormDocument1 pageReimbursement Claim FormmoinuNo ratings yet

- Auditing and Assurance Services 15Th Edition Arens Solutions Manual Full Chapter PDFDocument44 pagesAuditing and Assurance Services 15Th Edition Arens Solutions Manual Full Chapter PDFstephenthanh1huo100% (15)

- Rlta AppeaalDocument15 pagesRlta AppeaalshahithNo ratings yet

- Legaspi Oil Co., Inc. vs. Court of Appeals Legaspi Oil Co., Inc. vs. Court of AppealsDocument3 pagesLegaspi Oil Co., Inc. vs. Court of Appeals Legaspi Oil Co., Inc. vs. Court of AppealsJoshua CuentoNo ratings yet

- Proses Penyesuaian Dalam AkuntansiDocument31 pagesProses Penyesuaian Dalam AkuntansiHahaha HihihiNo ratings yet

- Observer Application: General Personal InformationDocument3 pagesObserver Application: General Personal InformationDragomir IsabellaNo ratings yet

- Chapter 12 Accounting For Foreign Currency Transactions and Hedging Foreign Exchange RiskDocument31 pagesChapter 12 Accounting For Foreign Currency Transactions and Hedging Foreign Exchange RiskMuhammad Za'far SiddiqNo ratings yet

- Rechnung200012888 PDFDocument1 pageRechnung200012888 PDFMirco PiccoloNo ratings yet

- Martin Luther King British English Pre Intermediate GroupDocument2 pagesMartin Luther King British English Pre Intermediate GroupPopovici AdrianaNo ratings yet

- Research - Mail MatterDocument2 pagesResearch - Mail MatterBon HartNo ratings yet

- Lying For GodDocument518 pagesLying For GodRaul E. Bizarro Huaycho100% (1)

- 1 - Tempo de AmarDocument7 pages1 - Tempo de AmarAnderson TorresNo ratings yet

- Circular MotionDocument10 pagesCircular MotionEdgardo Leysa100% (1)

- Dog Mauling Case: Downes Case: Evans: Waker's CaseDocument15 pagesDog Mauling Case: Downes Case: Evans: Waker's CaseAnjali YadavNo ratings yet