Professional Documents

Culture Documents

TRACES Annual Tax Statement

TRACES Annual Tax Statement

Uploaded by

Raviteja SiramsettiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TRACES Annual Tax Statement

TRACES Annual Tax Statement

Uploaded by

Raviteja SiramsettiCopyright:

Available Formats

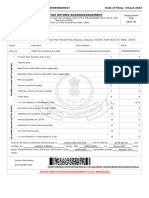

Home Logout A A A English

View/ Verify Tax Credit Register on TRACES E-Verified Services

Form 26AS/Annual Tax Statement

Assessment Year* 2023-24

View As HTML

View / Download Export as PDF

From AY 2023-24 onwards, Annual Tax Statement available on TRACES portal will display

only TDS/TCS related data. Other details would be available in the AIS (Annual

Information Statement) at e-filing portal (https://www.incometax.gov.in/iec/foportal). For

data prior to AY 2023-24, there would be no change in display.

In order to Download PDF, please view HTML then click on Export as PDF button

Form 26AS/Annual Tax Statement in Excel Format is available through TRACES Account.

Password for Form 26AS/Annual Tax Statement Text file is Date of Birth / Date of

Incorporation as printed on PAN card. Enter date in ddmmyyyy format to open file (e.g.,

for 10-Oct-2012, enter as 10102012)

Current Status Assessment

Permanent Account Number (PAN) FDTPD5350P Active Financial Year

of PAN Year

Name of Assessee KUSUM SAI DAMULURI

1-19, ARIGIPALEM, VEPADA, SRUNGAVARAPUKOTA,

Address of Assessee

VIZIANAGARAM, ANDHRA PRADESH, 535161

Click here to 'Verify TDS Certificate'

Above data / Status of PAN is as per PAN details. For any changes in data as mentioned

above, you may submit request for corrections.

Refer www.tin-nsdl.com / www.utiitsl.com for more details. In case of discrepancy in

status of PAN please contact your Assessing Officer

Communication details for TRACES can be updated in 'Profile' section. However, these

changes will not be updated in PAN database as mentioned above

** Total TDS Deposited will not include the amount deposited as Fees and Interest

** Total Amount Deposited other than TDS includes the Fees , Interest and Other etc.

Copyright © 2012 Income Tax Department

Site best viewed on latest version of Microsoft Edge, Mozilla Firefox and Google Chrome

You might also like

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCFrom EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCRating: 4 out of 5 stars4/5 (5)

- The Counting Crows Song Book 1.0Document73 pagesThe Counting Crows Song Book 1.0Frederic Paleizy100% (1)

- MA250 - Intro To PDEsDocument16 pagesMA250 - Intro To PDEsRebecca RumseyNo ratings yet

- Identification of Account Holder: PARTDocument2 pagesIdentification of Account Holder: PARTMuhammad HarisNo ratings yet

- DTL Training Report Avnish KatiyarDocument71 pagesDTL Training Report Avnish KatiyarKuldip Singh75% (4)

- TRACES Annual Tax StatementDocument1 pageTRACES Annual Tax StatementabhitesplNo ratings yet

- TDS CalculatorDocument3 pagesTDS CalculatorFinance SoftSolvers SolutionsNo ratings yet

- 14 Tax Saving OptionsDocument4 pages14 Tax Saving OptionsleninbapujiNo ratings yet

- Hillside Children's Center, New York 2014 IRS ReportDocument76 pagesHillside Children's Center, New York 2014 IRS ReportBeverly TranNo ratings yet

- Intertech Fluid Power 2019Document38 pagesIntertech Fluid Power 2019Sue StevenNo ratings yet

- rc145 Fill 19eDocument3 pagesrc145 Fill 19ejalaj nakraNo ratings yet

- Directorate of Income Tax 20 SepDocument4 pagesDirectorate of Income Tax 20 SepOmkar KhanapureNo ratings yet

- 2013 - Form 990Document30 pages2013 - Form 990Fred MednickNo ratings yet

- Draft Confirmation - VendorDocument1 pageDraft Confirmation - VendorMahesh VarmaNo ratings yet

- Etds Software EasyofficeDocument63 pagesEtds Software EasyofficeetilahdNo ratings yet

- Checklist For Enrolment With GST Portal 09012017Document8 pagesChecklist For Enrolment With GST Portal 09012017Mahaveer P UpadhyeNo ratings yet

- E-Filing Home Page, Income Tax Department, Government of IndiaDocument2 pagesE-Filing Home Page, Income Tax Department, Government of IndiassNo ratings yet

- User Manual For E-RegistrationDocument22 pagesUser Manual For E-RegistrationRakesh SharmaNo ratings yet

- One and Done 2307Document2 pagesOne and Done 2307Maricris LegaspiNo ratings yet

- 2013 Tax OrgDocument18 pages2013 Tax OrgShashikant TripathiNo ratings yet

- 6 Month JST Programme VmeDocument8 pages6 Month JST Programme VmeHemanth Krishna RavipatiNo ratings yet

- 2019 CorporateDocument32 pages2019 Corporateapi-167637329No ratings yet

- 3in1tax Calculator With Form 16 V 14.2 FY 2019-20Document18 pages3in1tax Calculator With Form 16 V 14.2 FY 2019-20Nihit SandNo ratings yet

- 4.Web-e-TDS Compliance Solution ProposalDocument9 pages4.Web-e-TDS Compliance Solution ProposalkarthikeyanwebtelNo ratings yet

- 80C CalculationDocument2 pages80C CalculationanandpurushothamanNo ratings yet

- 2014 Alabama Possible 990Document39 pages2014 Alabama Possible 990Alabama PossibleNo ratings yet

- Declaration 4005106Document2 pagesDeclaration 4005106Muhammad AbdullahNo ratings yet

- 398 2019 ArchiveTaxReturnDocument10 pages398 2019 ArchiveTaxReturnjimmy naranjoNo ratings yet

- Form 12Document16 pagesForm 12Diego RozulNo ratings yet

- Income Tax Department: Computerized Payment Receipt (CPR - It)Document1 pageIncome Tax Department: Computerized Payment Receipt (CPR - It)Mian EnterprisesNo ratings yet

- TdsDocument22 pagesTdsFRANCIS JOSEPHNo ratings yet

- Process Document For Download TDS/26 AS FormDocument1 pageProcess Document For Download TDS/26 AS FormKanaga VaratharajanNo ratings yet

- How To Register For GST OnlineDocument11 pagesHow To Register For GST Onlinerishank52No ratings yet

- NCPL TanDocument1 pageNCPL TanCA Alpesh TatedNo ratings yet

- Declaration 4005106Document2 pagesDeclaration 4005106Muhammad AbdullahNo ratings yet

- 10 17 22 NPJJ LLC 8879 E-File Authorization 2021-Signed-CertificateDocument2 pages10 17 22 NPJJ LLC 8879 E-File Authorization 2021-Signed-CertificatejimNo ratings yet

- Online Tax Filing Single User Olbb eDocument17 pagesOnline Tax Filing Single User Olbb eGary TattersallNo ratings yet

- APP Form - Travel and Tour Agencies Page 1 To 3Document3 pagesAPP Form - Travel and Tour Agencies Page 1 To 3Edwin Rueras Sibugal100% (1)

- lsm19 5bDocument22 pageslsm19 5bSri VenkateshNo ratings yet

- Auto Tax Calculator Version 15.0 (Blank) FY 2020-21Document18 pagesAuto Tax Calculator Version 15.0 (Blank) FY 2020-21Deepak DasNo ratings yet

- CRS 421019577252Document5 pagesCRS 421019577252Saad KhanNo ratings yet

- Form12 PDFDocument20 pagesForm12 PDFwattersed1711No ratings yet

- 1099k Document ExampleDocument65 pages1099k Document ExamplemuchromadhooniNo ratings yet

- Free Income Tax Efiling in India For For FY 2020-21 On ClearTax - Upload Your Form-16 To E-File Income Tax ReturnsDocument21 pagesFree Income Tax Efiling in India For For FY 2020-21 On ClearTax - Upload Your Form-16 To E-File Income Tax ReturnsAnurag KumarNo ratings yet

- SodapdfDocument1 pageSodapdfsukantabera215No ratings yet

- Declaration 4005106Document2 pagesDeclaration 4005106Muhammad AbdullahNo ratings yet

- Tax Collector Correspondence4005106Document2 pagesTax Collector Correspondence4005106Mohammed AbdullahNo ratings yet

- Computation of Adjusted Profit For Self EmployedDocument8 pagesComputation of Adjusted Profit For Self EmployedCindyNo ratings yet

- Bank AL Habib Limited: CRS Individual / Proprietorship Tax ResidencyDocument2 pagesBank AL Habib Limited: CRS Individual / Proprietorship Tax ResidencyMitti da PalwaanNo ratings yet

- Declaration 206AB and 206CCA For Vendor & CustomerDocument2 pagesDeclaration 206AB and 206CCA For Vendor & CustomerAbhimanyu100% (1)

- Income Tax On FD Interest IncomeDocument5 pagesIncome Tax On FD Interest IncomeAnirudh KumarNo ratings yet

- Form 16: Ibm Daksh Business Process Services Pvt. LTDDocument5 pagesForm 16: Ibm Daksh Business Process Services Pvt. LTDmadan mehtaNo ratings yet

- Comprehensive Guide For Income Tax Returns FY 20-21Document34 pagesComprehensive Guide For Income Tax Returns FY 20-21mayuresh pingale100% (1)

- Aakash 2023-24Document5 pagesAakash 2023-24suneetbansalNo ratings yet

- Soudamini Resume 1Document2 pagesSoudamini Resume 1Soudamini MohapatraNo ratings yet

- How To Pay Income Tax-RSFDCLDocument9 pagesHow To Pay Income Tax-RSFDCLaccounts sarafNo ratings yet

- GHR JobsDocument1 pageGHR JobsaliNo ratings yet

- Prerequisites in E-Filing Income Tax Returns: Dr. Kailash KalyaniDocument62 pagesPrerequisites in E-Filing Income Tax Returns: Dr. Kailash KalyaniRicha KalyaniNo ratings yet

- Aakash Rana: Professional ExperienceDocument1 pageAakash Rana: Professional ExperienceCHANDRAKANT RANANo ratings yet

- Taxation Laws - Ms. de CastroDocument54 pagesTaxation Laws - Ms. de CastroCC100% (1)

- FBR FerozabadDocument1 pageFBR Ferozabadferozabad schoolNo ratings yet

- SDFDocument3 pagesSDFShantsmackayNo ratings yet

- Provincial Facilitation for Investment and Trade Index: Measuring Economic Governance for Business Development in the Lao People’s Democratic Republic-Second EditionFrom EverandProvincial Facilitation for Investment and Trade Index: Measuring Economic Governance for Business Development in the Lao People’s Democratic Republic-Second EditionNo ratings yet

- SlurryFlo PresentationDocument30 pagesSlurryFlo PresentationGabrielNo ratings yet

- Secret of Richard HadleeDocument3 pagesSecret of Richard HadleeucallmeshwetaNo ratings yet

- Fin358 Individual Assignment Nur Hazani 2020818012Document12 pagesFin358 Individual Assignment Nur Hazani 2020818012nur hazaniNo ratings yet

- Learning Guide 14: Animal Health Care Service NTQF Level-IVDocument41 pagesLearning Guide 14: Animal Health Care Service NTQF Level-IVRafez JoneNo ratings yet

- MATOUWANG-Publication and Routing ChartDocument6 pagesMATOUWANG-Publication and Routing Charttharindu hasarangaNo ratings yet

- HP Man DP9.00 Device Support Matrix PDFDocument65 pagesHP Man DP9.00 Device Support Matrix PDFHanh TranNo ratings yet

- Red OxDocument2 pagesRed Oxsun_rise_14No ratings yet

- Leaning Tower of PisaDocument21 pagesLeaning Tower of PisaTAJAMULNo ratings yet

- Fourier Series LessonDocument41 pagesFourier Series Lessonjackson246No ratings yet

- Water Managment PlanDocument31 pagesWater Managment Planmehmal malikNo ratings yet

- Pe BLSDocument4 pagesPe BLSchn pastranaNo ratings yet

- CB Insights - Most Promising StartupsDocument122 pagesCB Insights - Most Promising StartupsRazvan CosmaNo ratings yet

- DuwarDocument2 pagesDuwarMy ChannelNo ratings yet

- Boletin ToyotaDocument2 pagesBoletin ToyotaLalo Barajas Garcia75% (4)

- Capacitor - Wikipedia, The ...Document17 pagesCapacitor - Wikipedia, The ...srikanthjenaNo ratings yet

- Carta Organisasi PibgDocument1 pageCarta Organisasi PibgNasha FatehaNo ratings yet

- CVS-128 128B OME Rev06Document84 pagesCVS-128 128B OME Rev06Ahamed Shiraz ARNo ratings yet

- PRAKTEK ANALYTICAL TEXT - Alya Tsany mukhbita.01.XI MIPA 4Document3 pagesPRAKTEK ANALYTICAL TEXT - Alya Tsany mukhbita.01.XI MIPA 4Alya tsany mukhbitaNo ratings yet

- Introduction To Quantitative Research 1-3Document9 pagesIntroduction To Quantitative Research 1-3Almonte MateoNo ratings yet

- SHRMPMCasestudy PDFDocument36 pagesSHRMPMCasestudy PDFParth PatelNo ratings yet

- Getachew AlemuDocument4 pagesGetachew AlemuGetachew AlemuNo ratings yet

- Ship Power PlantDocument141 pagesShip Power Plantnguyentrunghieu51dltt100% (2)

- Warhammer 40k - Codex - Errata - Dark Angels Q&A v2.0Document2 pagesWarhammer 40k - Codex - Errata - Dark Angels Q&A v2.0Jakub KalembaNo ratings yet

- 10 MeasuringDevicesPowerMonitoring LV10 042020 EN 202006081510359865Document36 pages10 MeasuringDevicesPowerMonitoring LV10 042020 EN 202006081510359865hamed hamamNo ratings yet

- Caltech - PG Program in Cloud ComputingDocument22 pagesCaltech - PG Program in Cloud ComputingkaperumaNo ratings yet

- Wind Load CalculationDocument13 pagesWind Load CalculationPre SheetNo ratings yet

- Math 6 - Q4 - Mod1 - DeterminingTheRelationshipOfVolumeBetweenARectangularPrismAndAPyramidACylinderAndAConeACylinderAndSphere - V3Document21 pagesMath 6 - Q4 - Mod1 - DeterminingTheRelationshipOfVolumeBetweenARectangularPrismAndAPyramidACylinderAndAConeACylinderAndSphere - V3Kathlyn PerezNo ratings yet