Professional Documents

Culture Documents

A FABM 2 Guide Week 1 To 10

A FABM 2 Guide Week 1 To 10

Uploaded by

Efren Grenias Jr0 ratings0% found this document useful (0 votes)

15 views11 pagesThe document discusses key financial statements and accounting concepts. It defines a statement of financial position (balance sheet) as showing a company's total assets, liabilities, and equity on a specific date. It describes permanent accounts that remain on the balance sheet from period to period, like cash, versus temporary accounts that reset each period on the income statement, like expenses. It also defines contra assets that reduce asset balances, like accumulated depreciation. The document contrasts single-step and multi-step income statement formats and how the statements differ between service and merchandising companies.

Original Description:

fabm 2

Original Title

a-FABM-2-Guide-Week-1-to-10

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses key financial statements and accounting concepts. It defines a statement of financial position (balance sheet) as showing a company's total assets, liabilities, and equity on a specific date. It describes permanent accounts that remain on the balance sheet from period to period, like cash, versus temporary accounts that reset each period on the income statement, like expenses. It also defines contra assets that reduce asset balances, like accumulated depreciation. The document contrasts single-step and multi-step income statement formats and how the statements differ between service and merchandising companies.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

15 views11 pagesA FABM 2 Guide Week 1 To 10

A FABM 2 Guide Week 1 To 10

Uploaded by

Efren Grenias JrThe document discusses key financial statements and accounting concepts. It defines a statement of financial position (balance sheet) as showing a company's total assets, liabilities, and equity on a specific date. It describes permanent accounts that remain on the balance sheet from period to period, like cash, versus temporary accounts that reset each period on the income statement, like expenses. It also defines contra assets that reduce asset balances, like accumulated depreciation. The document contrasts single-step and multi-step income statement formats and how the statements differ between service and merchandising companies.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 11

STATEMENT OF FINANCIAL POSITION – Also Account Form – A form of the SFP that shows

known as the balance sheet. This statement assets on the left side and liabilities and

includes the amounts of the company’s total owner’s equity on the right side just like the

assets, liabilities, and owner’s equity which in debit and credit balances of an account.

totality provides the condition of the company (Haddock, Price, & Farina, 2012)

on a specific date. (Haddock, Price, & Farina,

Report Form

2012)

PERMANENT ACCOUNTS – As the name

suggests, these accounts are permanent in a

sense that their balances remain intact from

one accounting period to another. (Haddock,

Price, & Farina, 2012) Examples of permanent

account include Cash, Accounts Receivable,

Accounts Payable, Loans Payable and Capital

among others. Basically, assets, liabilities and

equity accounts are permanent accounts.

They are called permanent accounts because

the accounts are retained permanently in the

SFP until their balances become zero. This is in

contrast with temporary accounts which are

found in the Statement of Comprehensive

Income (SCI). Temporary accounts unlike

permanent accounts will have zero balances

at the end of the accounting period.

CONTRA ASSETS – Contra assets are those

accounts that are presented under the assets

portion of the SFP but are reductions to the

company’s assets. These include Allowance for

Doubtful Accounts and Accumulated

Depreciation. Allowance for Doubtful

Accounts is a contra asset to Accounts

Receivable. This represents the estimated

amount that the company may not be able to

collect from delinquent customers.

Accumulated Depreciation is a contra asset to

the company’s Property, Plant and Equipment.

This account represents the total amount of Account Form

depreciation booked against the fixed assets

of the company.

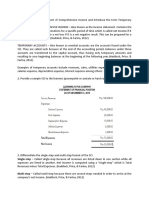

Report Form – A form of the SFP that shows

asset accounts first and then liabilities and

owner’s equity accounts after. (Haddock,

Price, & Farina, 2012)The balance sheet

shown earlier is in report form.

Parts of the Statement of Financial Position

Current Assets – Assets that can be realized

(collected, sold, used up) one year after year-

end date. Examples include Cash, Accounts

Receivable, Merchandise Inventory, Prepaid

Expense, etc.

Current Liabilities – Liabilities that fall due

(paid, recognized as revenue) within one year

after yearend date. Examples include Notes

Payable, Accounts Payable, Accrued Expenses

(example: Utilities Payable), Unearned

Income, etc.

Current Assets are arranged based on which

asset can be realized first (liquidity) . Current

assets and current liabilities are also called

short term assets and shot term liabilities.

Noncurrent Assets – Assets that cannot be

realized (collected, sold, used up) one year

after yearend date. Examples include

Property, Plant and Equipment (equipment,

furniture, building, land), Long Term

investments, Intangible Assets etc.

______________________________________

Noncurrent Liabilities – Liabilities that do not

_________

fall due (paid, recognized as revenue) within

one year after year-end date. Examples STATEMENT OF COMPREHENSIVE INCOME –

include Loans Payable, Mortgage Payable, etc. Also known as the income statement.

Contains the results of the company’s

Noncurrent assets and noncurrent liabilities

operations for a specific period of time which

are also called long term assets and long term

is called net income if it is a net positive result

liabilities.

while a net loss if it is a net negative result.

This can be prepared for a month, a quarter or

a year. (Haddock, Price, & Farina, 2012)

Difference of the Statement of Financial

Position of a Service Company and of a TEMPORARY ACCOUNTS – Also known as

Merchandising Company. nominal accounts are the accounts found

under the SCI. They are called such because at

The main difference of the Statements of the

the end of the accounting period, balances

two types of business lies on the inventory

under these accounts are transferred to the

account. A service company has supplies

capital account, thus having only temporary

inventory classified under the current assets

amounts and resulting to zero beginning

of the company. While a merchandising

balances at the beginning of the following

company also has supplies inventory classified

year.(Haddock, Price, & Farina, 2012)Examples

under the current assets of the company, the

of temporary accounts include revenues,

business has another inventory account under

sales, utilities expense, supplies expense,

its current assets which is the Merchandise

Inventory, Ending.

salaries expense, depreciation expense, merchandise which is presented under the

interest expense among others. line item Cost of Goods Sold. In presenting

these items on the Statement of

Sample of Statement of Comprehensive

Comprehensive Income, a service company

Income

will separate all revenues and expenses (as

seen in the single-step format) while a

merchandising company will present total

sales and cost of goods sold on the first part of

the statement which will net to the company’s

gross profit before presenting the other

expenses which are classified as either

administrative expenses or selling expenses

(as seen in the multi-step format)

Sample of SCI (Service Type of Business)

Differentiate the single-step and multi-step

format of the SCI

Single-step – Called single-step because all

revenues are listed down in one section while

all expenses are listed in another. Net income

is computed using a “single-step” which is

Total Revenues minus Total Expenses.

(Haddock, Price, & Farina, 2012)

Multi-step – Called multi-step because there

are several steps needed in order to arrive at

the company’s net income. (Haddock, Price, & a. Heading

Farina, 2012) i. Name of the Company

a. The two formats will yield the same ii. Name of the Statement

amount of net income/loss iii. Date of preparation (emphasis on the

b. SCI is more commonly used by service wording – “for the”)

companies while multi-step format is more b. Sample of a Report Form SFP – Refer to the

commonly used by merchandising companies one above

i. First part is revenues This is the total

amount of revenue that the company was

Difference of the Statement of Comprehensive

able to generate from providing services to

Income of a Service Company and of a

customers

Merchandising Company.

ii. Second part is expenses (can be broken

The main difference of the Statements of the down into General and Administrative and

two types of business lies on how they Selling Expenses) Please see the discussion

generate their revenue. A service company in multi-step for general and administrative

provides services in order to generate revenue and selling expenses.

and the main cost associated with their iii. Revenues less Expenses. Net income for

service is the cost of labor which is presented a positive result and net loss for a negative

under the account Salaries Expense. On the result

other hand, a merchandising company sells

goods to customers and the main cost Sample of SCI (Merchandising Type of

associated with the activity is the cost of the Business)

iii. Sales less Sales returns and Sales discount

is Net Sales

iv. Third part is Cost of Goods Sold – This

account represents the actual cost of

merchandise that the company was able to

sell during the year. (Haddock, Price, & Farina,

2012)

iv.i. Beginning inventory – This is the

amount of inventory at the beginning of

the accounting period. This is also the

amount of ending inventory from the

previous period.

iv.ii. Net Cost of Purchases = Purchases +

Freight In

iv.ii.i. Net Purchases = Purchases –

(Purchase discount and purchase returns)

iv.ii.i.i. Purchases – amount of goods

bought during the current accounting

period.

iv.ii.i.ii. Contra Purchases –An account

c. Sample of a multi-step SCI that is credited being “contrary” to the

i. First part is sales This is the total amount of normal balance of Purchases account.

revenue that the company was able to iv.ii.i.ii.i.Purchase discount –

generate from selling products Account used to record early

ii. Second part compose of contra revenue – payments by the company to the

called contra because it is on the opposite side suppliers of merchandise. (Haddock,

of the sales account. The sales account is on Price, & Farina, 2012) This is how

the credit side while the reductions to sales buyers see a sales discount given to

accounts are on the debit side. This is them by a supplier.

“contrary” to the normal balance of the sales iv.ii.i.ii.ii. Purchase returns –

or revenue accounts. (Haddock, Price, & Account used to record

Farina, 2012) merchandise returned by the

ii.i. Sales returns – This account is debited company to their suppliers.

in order to record returns of customers or (Haddock, Price, & Farina,2012) This

allowances for such returns.(Haddock, is how buyers see a sales return

Price, & Farina, 2012) Sales returns occur recorded by their supplier

when customers return their products for iv.ii.ii. Freight In – This account is used to

reasons such as but not limited to defects record transportation costs of merchandise

or change of preference. purchased by the company. (Haddock,

ii.ii.Sales discount – This is where discounts Price, & Farina, 2012) Called freight in

given to customers who pay early are because this is recorded when goods are

recorded. (Haddock, Price, & Farina, 2012) transported into the company.

Also known as cash discount. This is iv.iii. Add Beginning inventory and Net cost

different from trade discounts which are of Purchases to get Cost of Goods Available

given when customers buy in bulk. Sales for Sale iv. Ending inventory – amount if

discount is awarded to customers who pay inventory presented in the Statement of

earlier or before the deadline

Financial Position. Total cost of inventory SINGLE/SOLE PROPRIETORSHIP –An entity

unsold at the end of the accounting cycle. whose assets, liabilities, income and expenses

v. Sales less Cost of Goods Sold is Gross Profit are centered or owned by only one person

vi. Fourth Part is General and Administrative

PARTNERSHIP – An entity whose assets,

Expenses –These expenses are not directly

liabilities, income and expenses are centered

related to the merchandising function of the

or owned by two or more persons

company but are necessary for the business to

operate effectively. (Haddock, Price, & Farina, CORPORATION – An entity whose assets,

2012) liabilities, income and expenses are centered

vii. Fifth Part is Selling Expenses – These or owned by itself being a legally separate

expenses are those that are directly related to entity from its owners. Owners are called

the main purpose of a merchandising shareholders or stockholders of the company.

business: the sale and delivery of

merchandise. This does not include cost of

goods sold and contra revenue accounts.

(Haddock, Price, & Farina, 2012)

viii.Gross Profit less General and

Administrative Expenses less Selling Expenses

is Net Income for a positive result while Net

Loss for a negative result.

Initial Investment – The very first investment

of the owner to the company.

Sample of SCI (Merchandising Type of

Business)- Simple Additional Investment – Increases to owner’s

equity by adding investments by the owner.

Withdrawals –Decreases to owner’s equity by

withdrawing assets by the owner

Distribution of Income – When a company is

organized as a corporation, owners (called

shareholders) do not decrease equity by way

of withdrawal. Instead, the corporation

distributes the income to the shareholders

based on the shares that they have

(percentage of ownership of the company)

WEEK 3

Statement of Changes in Equity

STATEMENT OF CHANGES IN EQUITY – All

changes, whether increases or decreases to

the owner’s interest on the company during

the period are reported here. This statement

is prepared prior to preparation of the

Statement of Financial Position to be able to

obtain the ending balance of the equity to be

used in the SFP

Note: “Fort the Year Ended”- amounts in the e. Instead of withdrawals, distribution of net

SCE are changes during the period. This means income to shareholders decreases the Capital

that what happened in the previous years are of the corporation

not included in the Statement.

______________________________________

_________________________________

Cash Flow Statement

CASH FLOW STATEMENT – Provides an

The Statement of Changes in Partners’ Equity analysis of inflows and/or outflows of cash

is used by a partnerships instead of the from/to operating, investing and financing

Statement of Changes in Owner’s Equity. The activities (Deloitte Global Services Limited,

differences between the two are as follows: 2015). This statement shows cash transactions

a. Title – The word “partners’” is used to only compared to the SCI which follows the

denote that this is a partnership accrual principle.

b. There are two or more owners in a

partnership thus, the changes in the capital Importance: The CFS provides the net change

account of each partner is presented in the cash balance of a company for a period.

c. The net income is divided between partners This helps owners see if their revenues are

(not always equal. Based on the agreement. actually translated to cash collections or if

Example: 60:40, 40:60, etc.) they have enough cash inflows in order to pay

any maturing liabilities.

The Statement of Changes in Shareholders’

Equity is used by a corporation instead of the

Statement of Changes in Owner’s Equity. The

differences between the two are as follows:

a. Title – instead of owner’s, shareholders’ is

used to denote that this is a corporation

b. There are an unlimited number of

shareholders but unlike the partnership, the

names of the shareholders are not indicated

here. Instead, the corporation keeps an official

list with the corporate secretary a. Receipts from customers - derived from the

c. The capital account is called share capital following formula:

(just like owner’s being shareholders) Ending Accounts Receivable = Beginning

d. Instead of additional investment, share Accounts Receivable + Net Sales – Collections

issuances (happens when shares are sold to Therefore: Collections (receipts from

shareholders) increases the share capital of a customers) = Beginning Accounts Receivable +

corporation Net Sales or Net Revenue –Ending Accounts

Receivable

b. Payments to Suppliers and Employees –

derived from the following formula:

Ending Accounts Payable and Ending Accrued

Salaries Expense = Beginning Accounts

Payable + Beginning Accrued Salaries Expense

+ Net Purchases + Salaries Expense - Payments

Therefore: Payments = Beginning Accounts

Payable + Beginning Accrued Salaries Expense

+ Net Purchases + Salaries Expense –

Payments WEEK 4

Financial statement (FS) analysis is the

process of evaluating risks, performance,

Parts of the Cash Flow Statement

financial health, and future prospects of a

Operating Activities – Activities that are

business by subjecting financial statement

directly related to the main revenue-

data to computational and analytical

producing activities of the company such as

techniques with the objective of making

cash from customers and cash paid to

economic decisions (White et.al 1998).

suppliers/employees (Deloitte Global Services

There are three kinds of FS analysis

Limited, 2015).

techniques:

Investing Activities – Cash transactions

- Horizontal analysis

related to purchase or sale of non-current

- Vertical analysis

assets (Deloitte Global Services Limited, 2015).

- Financial ratios

Financing Activities – Cash transactions

related to changes in equity and borrowings.

Horizontal analysis, also called trend analysis,

Net change in cash or net cash flow

is a technique for evaluating a series of

(increase/decrease) – The net amount of

financial statement data over a period of time

change in cash whether it is an increase or

with the purpose of determining the increase

decrease for the current period. The total

or decrease that has taken place

change brought by operating, investing and

(Weygandtet.al 2013). This will reveal the

financing activities.

behavior of the account over time. Is it

Beginning Cash Balance – The balance of the

increasing, decreasing or not moving? What is

cash account at the beginning of the

the magnitude of the change? Also, what is

accounting period.

the relative change in the balances of the

Ending Cash Balance – The balance of the

account over time?

cash account at the end of the accounting

- Horizontal analysis uses financial statements

period computed using the beginning balance

of two or more periods.

plus the net change in cash for the current

- All line items on the FS may be subjected to

period.

horizontal analysis.

- Only the simple year-on-year (Y-o-Y)grow

this covered in this lesson.

- Changes can be expressed in monetary value

(peso) and percentages computed by using

the following formulas:

• Peso change=Balance of Current Year-

Balance of Prior Year

• Percentage change= (Balance of Current • This will reveal how “Net Sales” is used up

Year-Balance of Prior Year)/(Balance of Prior by the various expenses.

Year) • Net income as a percentage of sales is also

Example known as the net profit margin.

2013 2014 • Example:

175,000. 250,000.

Sales 00 00

✓Peso change = P250,000 - P175,000 =

P75,000

✓Percentage change = (P250,000 -

P175,000) / P175,000 = 42.86%

✓This is evaluated as follows: Sales increased

by P75,000. This represents growth of 42.86%

from 2013 levels.

______________________________________

____________________________________

Ratio analysis expresses the relationship

among selected items of financial statement

data. The relationship is expressed in terms of

a percentage, a rate, or a simple proportion

To compute the percentage of (Weygandtet.al. 2013). A financial ratio is

Increase/Decrease = Amount of composed of a numerator and a denominator.

Increase/Decrease ÷ Previous Year For example, a ratio that divides sales by

Example: Net Sales (2014) = 100,000/500,000 assets will find the peso amount of sales

= 20% generated by every peso of asset invested.

This is also known as the “Year over Year This is an important ratio because it tells us

(YoY) growth” the efficiency of invested asset to create

revenue. This ratio is called asset turnover.

• Vertical analysis, also called common-size There are many ratios used in business. These

analysis, is a technique that expresses each ratios are generally grouped into three

financial statement item as a percentage of a categories: (a) profitability, (b) efficiency, and

base amount (Weygandt et.al. 2013). (c) financial health.

- For the SFP, the base amount is Total Assets.

• Balance of Account / Total Assets. Profitability ratiosmeasure the ability of the

• From the common-size SFP, the analyst company to generate income from the use of

can infer the composition of assets and the its assets and invested capital as well as

company’s financing mix. control its cost. The following are the

commonly used profitability ratios:

- Gross profit ratio reports the peso value of

the gross profit earned for every peso of sales.

We can infer the average pricing policy from

the gross profit margin.

- Operating income ratio expresses operating

income as a percentage of sales. It measures

- For the SCI, the base amount is Net Sales.

the percentage of profit earned from each

• Balance of Account / Total Sales.

peso of sales in the company’s core business

operations (Horngren et.al. 2013). A company individually. The turnover ratios are primarily

with a high operating income ratio may imply used to measure operational efficiency.

a lean operation and have low operating - Asset turnover measures the peso value of

expenses. Maximizing operating income sales generated for every peso of the

depends on keeping operating costs as low as company’s assets. The higher the turnover

possible (Horngren et.al. 2013). rate, the more efficient the company is in

- Net profit ratio relates the peso value of the using its assets.

net income earned to every peso of sales. This - Fixed asset turnover is indicator of the

shows how much profit will go to the owner efficiency of fixed assets in generating sales.

for every peso of sales made. - Inventory turnover is measured based on

- Return on asset(ROA) measures the peso cost of goods sold and not sales. As such both

value of income generated by employing the the numerator and denominator of this ratio

company’s assets. It is viewed as an interest are measured at cost. It is an indicator of how

rate or a form of yield on asset investment. fast the company can sell inventory.An

The numerator of ROA is net income. alternative to inventory turnover is “days in

However, net income is profit for the inventory”. This measures the number of days

shareholders. On the other hand, asset is from acquisition to sale.

allocated to both creditors and shareholders. - Accounts receivables turnover the

Some analyst prefers to use earnings before measures the number of times the company

interest and taxes instead of net income. was able to collect on its average accounts

There are also two acceptable denominators receivable during the year. An alternative to

for ROA – ending balance of total assets or accounts receivable turnover is “days in

average of total assets. Average assets is accounts receivable”. This measures the

computed as beginning balance + ending company’s collection period which is the

balance divided by 2. number of days from sale to collection.

- Return on equity(ROE) measures the return

(net income) generated by the owner’s capital

invested in the business. Similar to ROA, the

denominator of ROE may also be total equity

or average equity.

Financial Health Ratios look into the

company’s solvency and liquidity ratios.

Solvency refers to the company’s capacity to

pay their long term liabilities. On the other

hand, liquidity ratio intends to measure the

Operational efficiency ratio measures the

company’s ability to pay debts that are

ability of the company to utilize its assets.

coming due (short term debt).

Operational efficiency is measured based on

- Debt ratio indicates the percentage of the

the company’s ability to generate sales from

company’s assets that are financed by debt. A

the utilization of its assets, as a whole or

high debt to asset ratio implies a high level of

debt.

- Equity ratio indicates the percentage of the

company’s assets that are financed by capital.

A high equity to asset ratio implies a high level

of capital.

- Debt to equity ratio indicates the company’s

reliance to debt or liability as a source of

financing relative to equity. A high ratio

suggests a high level of debt that may result in

high interest expense.

- Interest coverage ratio measures the

company’s ability to cover the interest

expense on its liability with its operating

income. Creditors prefer a high coverage ratio

to give them protection that interest due to

them can be paid.

- Current ratio is used to evaluate the

company’s liquidity. It seeks to measure

whether there are sufficient current assets to

pay for current liabilities. Creditors normally

prefer a current ratio of 2.

- Quick ratio is a stricter measure of liquidity.

It does not consider all the current assets, only

those that are easier to liquidate such as cash

and accounts receivable that are referred to

as quick assets.

FABM 2

Week 1

You might also like

- Understanding Financial Statements (Review and Analysis of Straub's Book)From EverandUnderstanding Financial Statements (Review and Analysis of Straub's Book)Rating: 5 out of 5 stars5/5 (5)

- C CCDebitEasyAccess SampleReport PDFDocument2 pagesC CCDebitEasyAccess SampleReport PDFsaeed50% (2)

- FABM2 Module 02 (Q1-W2-3)Document9 pagesFABM2 Module 02 (Q1-W2-3)Christian Zebua100% (1)

- Cinnamon Peelers in Sri Lanka: Shifting Labour Process and Reformation of Identity Post-1977Document8 pagesCinnamon Peelers in Sri Lanka: Shifting Labour Process and Reformation of Identity Post-1977Social Scientists' AssociationNo ratings yet

- Aluminum SectorDocument16 pagesAluminum Sectortomahawk1212No ratings yet

- FABM 2 Guide Mid Term ALL LearnersDocument8 pagesFABM 2 Guide Mid Term ALL LearnersYnahNo ratings yet

- FABM 2 QuizDocument2 pagesFABM 2 QuizShann 2No ratings yet

- Comprehensive Income StatementDocument5 pagesComprehensive Income StatementEmarilyn BayotNo ratings yet

- LEARNERS COPY FABM2 CHAPTER 2 Statement of Comprehensive IncomeDocument10 pagesLEARNERS COPY FABM2 CHAPTER 2 Statement of Comprehensive IncomeAliyha MendozaNo ratings yet

- Abm 2 Topic 1: Statement of Comprehensive Income Learning ObjectivesDocument8 pagesAbm 2 Topic 1: Statement of Comprehensive Income Learning ObjectivesJUDITH PIANONo ratings yet

- PDF 1 FABM 2 SCI Week 2 PDFDocument45 pagesPDF 1 FABM 2 SCI Week 2 PDFShann 2No ratings yet

- Gross Profit Net Sales - Cost of Goods Sold Operating Income Gross Profit - Operating Expense Net Income Operating Income + Non Operating ItemsDocument8 pagesGross Profit Net Sales - Cost of Goods Sold Operating Income Gross Profit - Operating Expense Net Income Operating Income + Non Operating ItemsIan VinoyaNo ratings yet

- Statement of Comprehensive Income (SCI) : Lesson 2Document20 pagesStatement of Comprehensive Income (SCI) : Lesson 2Rojane L. AlcantaraNo ratings yet

- FINDEFA4Document7 pagesFINDEFA4Shahnawaz ChunawalaNo ratings yet

- FABM2Document6 pagesFABM2JOCELLE CRUTANo ratings yet

- A Primer On Financial StatementsDocument9 pagesA Primer On Financial StatementsKarol WeberNo ratings yet

- Statement of Comprehensive IncomeDocument26 pagesStatement of Comprehensive IncomerachelNo ratings yet

- Elt122 1Document73 pagesElt122 1JsmnvllaNo ratings yet

- Final AccountsDocument40 pagesFinal AccountsCA Deepak Ehn100% (1)

- Fabm 2 NotesDocument3 pagesFabm 2 NotesJewel ClairNo ratings yet

- FABM 2 Lecture NotesDocument4 pagesFABM 2 Lecture NotesLucky MimNo ratings yet

- Entrepreneur Chapter 18Document6 pagesEntrepreneur Chapter 18CaladhielNo ratings yet

- Inbound 99353899863108459Document17 pagesInbound 99353899863108459Rh EaNo ratings yet

- G12 Fabm2 Week2Document16 pagesG12 Fabm2 Week2Whyljyne Glasanay100% (1)

- Statement of Comprehensive IncomeDocument38 pagesStatement of Comprehensive IncomeDaphne Gesto SiaresNo ratings yet

- Topic II - Statement of Comprehensive IncomeDocument8 pagesTopic II - Statement of Comprehensive IncomeJianne Ricci GalitNo ratings yet

- Fabm SciDocument5 pagesFabm SciDionne Sebastian DoromalNo ratings yet

- m2 Statement of Comprehensive Income For StudentsDocument3 pagesm2 Statement of Comprehensive Income For StudentsJolhania BlahblehblahNo ratings yet

- Q1 LAS 3 FABM2 12 Week 2 3Document7 pagesQ1 LAS 3 FABM2 12 Week 2 3Flare ColterizoNo ratings yet

- Statement of Comprehensive Income (SCI) : Fabm IiDocument17 pagesStatement of Comprehensive Income (SCI) : Fabm IiAlyssa Nikki VersozaNo ratings yet

- Accounting Terminologies - Feb 2022Document7 pagesAccounting Terminologies - Feb 202210Mansi ManekNo ratings yet

- Fundamentals of Accountancy, Business and Management 2Document6 pagesFundamentals of Accountancy, Business and Management 2DYLANNo ratings yet

- Accounting Notes (Week 1)Document9 pagesAccounting Notes (Week 1)junkmail4akhNo ratings yet

- BusfinanzDocument4 pagesBusfinanzfrancine ًNo ratings yet

- Student's Learning Activity in FUNDAMENTALS OF ACCOUNTANCY Business and Management 2Document7 pagesStudent's Learning Activity in FUNDAMENTALS OF ACCOUNTANCY Business and Management 2Shelly RhychaelleNo ratings yet

- Chap 2 (PT 2)Document2 pagesChap 2 (PT 2)Allen Jierqs SanchezNo ratings yet

- Fabm 2 Module2Document10 pagesFabm 2 Module2Veinraxzia LlamarNo ratings yet

- FABM 2 - Lesson1Document19 pagesFABM 2 - Lesson1---100% (1)

- FABM 2 Module 3 Statement of Comprehensive IncomeDocument10 pagesFABM 2 Module 3 Statement of Comprehensive IncomebabyjamskieNo ratings yet

- CH2 Fabm2Document27 pagesCH2 Fabm2Crisson FermalinoNo ratings yet

- Financial StatementsDocument30 pagesFinancial StatementsMarcel VelascoNo ratings yet

- About Financial RatiosDocument6 pagesAbout Financial RatiosAmit JindalNo ratings yet

- LAS ABM - FABM12 Ic D 5 6 Week 2Document7 pagesLAS ABM - FABM12 Ic D 5 6 Week 2ROMMEL RABONo ratings yet

- Cfa3 1Document2 pagesCfa3 1Trinh NguyễnNo ratings yet

- 2 Statement of Comprehensive IncomeDocument27 pages2 Statement of Comprehensive IncomeMichael Lalim Jr.No ratings yet

- Financial Analysiss IiDocument40 pagesFinancial Analysiss IiChe Omar100% (3)

- SAP Financial Planning v1.0Document42 pagesSAP Financial Planning v1.0edoardo.dellaferreraNo ratings yet

- Bookkeeping Concepts NotesDocument10 pagesBookkeeping Concepts Notesnkosii.mthekuuuNo ratings yet

- FABM2Document50 pagesFABM2Anne LayuganNo ratings yet

- Fae3e SM ch02Document42 pagesFae3e SM ch02JarkeeNo ratings yet

- FAE4e - SM - Ch02 120216 - Excluding Assignment QuestionsDocument37 pagesFAE4e - SM - Ch02 120216 - Excluding Assignment QuestionsKathy Thanh PKNo ratings yet

- Mid Term Assignment: Submitted BY Mohammad Adil CHDocument10 pagesMid Term Assignment: Submitted BY Mohammad Adil CHMohammad Adil ChoudharyNo ratings yet

- Commonly Used Financial TermsDocument2 pagesCommonly Used Financial TermsMihai GeambasuNo ratings yet

- FM CHAPTER 3 Definition of Terms and SummaryDocument4 pagesFM CHAPTER 3 Definition of Terms and SummaryJoyceNo ratings yet

- Partial - Solution - Module 2 - 6theditionDocument16 pagesPartial - Solution - Module 2 - 6theditionJenn AmaroNo ratings yet

- Income STDocument23 pagesIncome STKholoud LabadyNo ratings yet

- Course+Notes FP&ADocument20 pagesCourse+Notes FP&AHương ĐỗNo ratings yet

- Fundamentals of Accounting and Business Management 2: Statement of Financial Position Account FormDocument6 pagesFundamentals of Accounting and Business Management 2: Statement of Financial Position Account Formmarcjann dialinoNo ratings yet

- Glossary Accounts A To ZDocument8 pagesGlossary Accounts A To Zritvikjindal100% (1)

- Statement of Financial Position: Group 1Document11 pagesStatement of Financial Position: Group 1Jazzlyn BorlonganNo ratings yet

- LeaP FABM2 Q3 Week1 Day 2Document8 pagesLeaP FABM2 Q3 Week1 Day 2Danna Marie EscalaNo ratings yet

- Financial Analysis 101: An Introduction to Analyzing Financial Statements for beginnersFrom EverandFinancial Analysis 101: An Introduction to Analyzing Financial Statements for beginnersNo ratings yet

- Developing The Whole Person 2Document24 pagesDeveloping The Whole Person 2Efren Grenias JrNo ratings yet

- Q1 2 Social Political and Cultural ChangeDocument25 pagesQ1 2 Social Political and Cultural ChangeEfren Grenias JrNo ratings yet

- Q1 1 Nature Goals and Perspectives in of Anthropology Sociology and Political ScienceDocument44 pagesQ1 1 Nature Goals and Perspectives in of Anthropology Sociology and Political ScienceEfren Grenias JrNo ratings yet

- The Impact of Mental Health Awareness Among Grade11 Students in Alitagtag Senior High SchoolDocument26 pagesThe Impact of Mental Health Awareness Among Grade11 Students in Alitagtag Senior High SchoolEfren Grenias JrNo ratings yet

- BUS6110 Module 4 Executive Summary Worksheet - EditedDocument2 pagesBUS6110 Module 4 Executive Summary Worksheet - EditedEbelechukwu NwinyiNo ratings yet

- FN9021402922Document1 pageFN9021402922Varu NayanNo ratings yet

- Note Discounting LMS QuizDocument6 pagesNote Discounting LMS QuizJuan Miguel Suerte FelipeNo ratings yet

- Kasus KasDocument4 pagesKasus Kasslrt mataramNo ratings yet

- Savings Account Statement: Capitec B AnkDocument8 pagesSavings Account Statement: Capitec B AnkLonwaboNo ratings yet

- New Microsoft Word DocumentDocument16 pagesNew Microsoft Word DocumentMelak tarkoNo ratings yet

- Sem - Output.cad 313Document7 pagesSem - Output.cad 313ladynian115No ratings yet

- Chapter 1 - International Financial Markets & MNCsDocument97 pagesChapter 1 - International Financial Markets & MNCsDung VươngNo ratings yet

- Incoterms2020 OverviewDocument1 pageIncoterms2020 Overviewsunil_chorodiyaNo ratings yet

- Chapter 1Document5 pagesChapter 1Jimmy LojaNo ratings yet

- Future of Money, Banking and Payments 2022Document24 pagesFuture of Money, Banking and Payments 2022Yosi YonahNo ratings yet

- Nigerian Breweries PLC Rating Report GCR April 2022 ExpiryDocument9 pagesNigerian Breweries PLC Rating Report GCR April 2022 ExpiryOlawale John AdeotiNo ratings yet

- Sanchay Plus - v09 BrochureDocument30 pagesSanchay Plus - v09 BrochureshwetaNo ratings yet

- Grade 9 History UNIT FOUR Note.pDocument10 pagesGrade 9 History UNIT FOUR Note.pAkinahom Taye100% (1)

- Working Capital Policy Example Problem MDocument23 pagesWorking Capital Policy Example Problem MPeter PiperNo ratings yet

- GSTR3B 10DJKPP0543R1ZW 082020Document3 pagesGSTR3B 10DJKPP0543R1ZW 082020siwantaxsolution1No ratings yet

- Trade Profiles19 e PDFDocument404 pagesTrade Profiles19 e PDFArshad Bin EkramNo ratings yet

- Ind AS-40Document29 pagesInd AS-40rajantiwari1604No ratings yet

- Trade & Commodity Finance Experience BrochureDocument28 pagesTrade & Commodity Finance Experience BrochureRongye Daniel Lai0% (1)

- SSDTDocument1 pageSSDTCeejay RosalesNo ratings yet

- Agrarian Origins of CapitalismDocument56 pagesAgrarian Origins of CapitalismCHAKMA LYRICS VIDEONo ratings yet

- Economic ImpactDocument4 pagesEconomic ImpactnyandeniunhlakaNo ratings yet

- Receiving and Storage of Goods: NtroductionDocument25 pagesReceiving and Storage of Goods: NtroductionSakshi SuranaNo ratings yet

- Mobile Money Transaction History: Msisdn: Account Holder Name: From: ToDocument9 pagesMobile Money Transaction History: Msisdn: Account Holder Name: From: ToFarid QuayeNo ratings yet

- Chapter 8 Managing Transaction RisksDocument22 pagesChapter 8 Managing Transaction Risksmatthew kobulnickNo ratings yet

- Gen Math Module 2Document19 pagesGen Math Module 2Bernard Dale B. RocientoNo ratings yet

- 1 Daftar AkunDocument2 pages1 Daftar Akunnazwa utami27No ratings yet