Professional Documents

Culture Documents

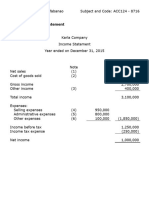

Karla Company

Karla Company

Uploaded by

Celine Therese BuOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Karla Company

Karla Company

Uploaded by

Celine Therese BuCopyright:

Available Formats

Karla Company Karla Company

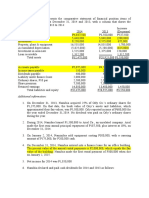

Income Statement - FUNCTIONAL Income Statement - NATURAL

Year ended December 31, 2023 Year ended December 31, 2023

Net Sales Revenue 7,700,000 Net Sales Revenue 7,700,000

Cost of Sales -5,000,000 Other Income 400,000

Gross Income 2,700,000 Total 8,100,000

Other Income 400,000 Expenses:

Total Income 3,100,000 Increases in Inventory -500,000

Expenses: Net Purchases 5,500,000

Distribution Costs 950,000 Freight-out 175,000

Administrative Expenses 800,000 Salesmen's commission 650,000

Other Expenses 100,000 1,850,000 Depreciation 425,000

Income before Tax 1,250,000 Officer's Salaries 500,000

Income Tax -250,000 Other Expenses 100,000 6,850,000

Net Income 1,000,000 Income before Tax 1,250,000

Income Tax -250,000

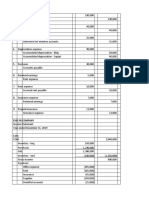

Note 1 - Net Sales Revenue Note 4 - Distribution Costs Net Income 1,000,000

Gross Sales 7,850,000 Freight out 175,000

Sales returns and allowances -140,000 Salesmen's commission 650,000 Note 1 - Net Sales Revenue Note 4 - Net Purchases

Sales Discounts -10,000 Depreciation - Store Equipment 125,000 Gross Sales 7,850,000 Purchases 5,250,000

Net Sales Revenue 7,700,000 Total Distribution Costs 950,000 Sales returns and allowances -140,000 Freight in 500,000

Sales Discounts -10,000 Purchase returns and allowances -150,000

Note 2 - Cost of Sales Note 5 - Administrative Expenses Net Sales Revenue 7,700,000 Purchase Discounts -100,000

Inventory, Jan. 1 1,000,000 Officer's Salaries 500,000 Total 5,500,000

Purchases 5,250,000 Depreciation - Office Equipment 300,000 Note 2 - Other income

Freight in 500,000 Total Administrative Expenses 800,000 Rental Income 250,000 Note 5 - Depreciation

Purchase returns and allowances -150,000 Dividend Income 150,000 Depreciation - Store Equipment 125,000

Purchase Discounts -100,000 Note 6 - Other Expenses Total Other Income 400,000 Depreciation - Office Equipment 300,000

Net Purchases 5,500,000 Loss on Sale of Equipment 50,000 Total 425,000

Goods Available for Sale 6,500,000 Loss on Sale of Investment 50,000 Note 3 - Increases in Inventory

Inventory, Dec. 31 1,500,000 Total Other Expenses 100,000 Inventory, Dec. 31 1,500,000 Note 6 - Other Expenses

Cost of Sales 5,000,000 Inventory, Jan. 1 -1,000,000 Loss on Sale of Equipment 50,000

Increases in Inventory 500,000 Loss on Sale of Investment 50,000

Note 3 - Other income Total Other Expenses 100,000

Rental Income 250,000

Dividend Income 150,000

Total Other Income 400,000

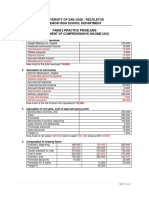

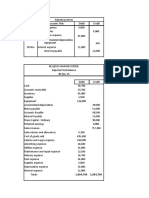

Exemplar Company

Statement of Financial Position

December 31, 2019

ASSETS

Current Assets

Cash and Cash Equivalents 500,000

Trading Securities 280,000

Trade and Other Receivables 640,000

Inventories 1,300,000

Prepaid Expenses 70,000

Total Current Assets 2,790,000

Noncurrent Assets

Property, Plant and Equipment 5,300,000

Long-term Investments 1,310,000

Intangible Assets 3,350,000

Other Noncurrent Assets 150,000

Total Noncurrent Assets 10,110,000

Total Assets 12,900,000

LIABILITIES AND SHAREHOLDERS' EQUITY

Current Liabilities

Trade and Other Payables 1,000,000

Noncurrent Liabilities

Bonds Payable 5,000,000

Premium on Bonds Payable 1,000,000

Total Noncurrent Liabilities 6,000,000

Total Liabilities 7,000,000

Shareholders' Equity

Share Capital 7,000,000

Reserves 700,000

Retained Earnings (Deficit) -1,800,000

Total Shareholders' Equity 5,900,000

Total Liabilities and Shareholders' Equity 12,900,000

You might also like

- Managing The Family Business - Theory and Practice - Zellweger, Thomas M (2017)Document545 pagesManaging The Family Business - Theory and Practice - Zellweger, Thomas M (2017)Raoul Estipona100% (3)

- Accounting For Lawyers OutlineDocument14 pagesAccounting For Lawyers OutlineKatie F.100% (1)

- Bharat Chemicals Ltd. SolnDocument4 pagesBharat Chemicals Ltd. SolnJayash KaushalNo ratings yet

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- 4-2 Endless CompanyDocument3 pages4-2 Endless CompanyyayayaNo ratings yet

- Bharat Chemical CaseDocument5 pagesBharat Chemical CaseambitiousfirkinNo ratings yet

- The Garden Place - SemifinalDocument4 pagesThe Garden Place - SemifinalKrish Hegde0% (1)

- ACC124, AssignmentDocument4 pagesACC124, AssignmentValerie SandicoNo ratings yet

- Brown CompanyDocument4 pagesBrown CompanyAdam CuencaNo ratings yet

- ACC124 Part2Document6 pagesACC124 Part2Christine LigutomNo ratings yet

- UntitledDocument6 pagesUntitledMarian grace DivinoNo ratings yet

- Karla Company Income Statement Year Ended December 31, 2008 NoteDocument8 pagesKarla Company Income Statement Year Ended December 31, 2008 NoteROCHELLE ANNE VICTORIANo ratings yet

- 9825Document7 pages9825Adam CuencaNo ratings yet

- ACC124 - Assignment On Income StatementDocument6 pagesACC124 - Assignment On Income StatementRuzuiNo ratings yet

- Presentation of Financial Statement Income StatementDocument5 pagesPresentation of Financial Statement Income Statementgerald almencionNo ratings yet

- Comprehensive Income ModuleDocument5 pagesComprehensive Income ModuleMich Jerald MendiolaNo ratings yet

- Cost of Goods ManufacturedDocument3 pagesCost of Goods ManufacturedLorie RoncalNo ratings yet

- Comprehensive IncomeDocument9 pagesComprehensive IncomeJesiah PascualNo ratings yet

- Synthesis ReportingDocument3 pagesSynthesis ReportingJason Dwight CamartinNo ratings yet

- Statement of Financial Position/Retained EarningsDocument5 pagesStatement of Financial Position/Retained EarningsShane TabunggaoNo ratings yet

- Problem 9-1: Net IncomeDocument16 pagesProblem 9-1: Net IncomeHerlyn Juvelle SevillaNo ratings yet

- AnsweredASS17 AccountingDocument2 pagesAnsweredASS17 Accountingvomawew647No ratings yet

- 4 2 Endless Company PDFDocument3 pages4 2 Endless Company PDFJulius Mark Carinhay TolitolNo ratings yet

- PAS 1 Application - SCIDocument43 pagesPAS 1 Application - SCICzanelle Nicole EnriquezNo ratings yet

- Comprehensive AccountingDocument5 pagesComprehensive AccountingAnn Kea GuillepaNo ratings yet

- Comprehensive IncomeDocument2 pagesComprehensive IncomeLeomar CabandayNo ratings yet

- Weekly Asigment 1Document1 pageWeekly Asigment 1Inge setiawanNo ratings yet

- Cash and Accrual BasisDocument10 pagesCash and Accrual BasisNoeme LansangNo ratings yet

- Conceptual Framework Valix 2019 8-1, 9-1 PDFDocument6 pagesConceptual Framework Valix 2019 8-1, 9-1 PDFTenshi Aina SantosNo ratings yet

- Net Cash Flows From Operating ActivitiesDocument7 pagesNet Cash Flows From Operating ActivitiesShaneNiñaQuiñonezNo ratings yet

- Fabm2 - Statement of Comprehensive Income (Practice Problems) - Answer KeyDocument3 pagesFabm2 - Statement of Comprehensive Income (Practice Problems) - Answer KeyMounicha Ambayec100% (4)

- Fabm2 Statement of Comprehensive Income Practice Problems Answer KeyDocument3 pagesFabm2 Statement of Comprehensive Income Practice Problems Answer KeyMounicha Ambayec0% (1)

- Sample Functional Form of Statement of Comprehensive IncomeDocument2 pagesSample Functional Form of Statement of Comprehensive IncomeHazel Joy DemaganteNo ratings yet

- Lesson 2 The Statement of Comprehensive Income (Part 2 of 2)Document4 pagesLesson 2 The Statement of Comprehensive Income (Part 2 of 2)Franchesca CalmaNo ratings yet

- Asdos Pert 2Document2 pagesAsdos Pert 2mutiaoooNo ratings yet

- A. Adjusting Entries Description Debit CreditDocument4 pagesA. Adjusting Entries Description Debit CreditRocel Avery SacroNo ratings yet

- Class Project - Expenses and Payables - Closing Entries - UnsolvedDocument6 pagesClass Project - Expenses and Payables - Closing Entries - UnsolvedMarcoNo ratings yet

- Cash FlowsDocument16 pagesCash FlowsArly Claire CepadaNo ratings yet

- Group Quiz InstructionsDocument9 pagesGroup Quiz InstructionsRaidenhile mae VicenteNo ratings yet

- Chapter 9 - Presentation of Fs (Statement of Comprehensive Income)Document2 pagesChapter 9 - Presentation of Fs (Statement of Comprehensive Income)Mark IlanoNo ratings yet

- Statement of Comprehensive IncomeDocument4 pagesStatement of Comprehensive Incomebobo tangaNo ratings yet

- Week 11 Sole Trader AccountsDocument24 pagesWeek 11 Sole Trader AccountsGaba RieleNo ratings yet

- Simple Company-WPS OfficeDocument3 pagesSimple Company-WPS OfficeAngeline BautistaNo ratings yet

- Draft SciDocument5 pagesDraft SciMariella Antonio-NarsicoNo ratings yet

- Financial StatementDocument18 pagesFinancial StatementhamdanNo ratings yet

- Govacc Finals DrillsDocument8 pagesGovacc Finals DrillsVon Andrei Medina100% (1)

- Mary Joy Asis QUIZ 1Document6 pagesMary Joy Asis QUIZ 1Joseph AsisNo ratings yet

- Laporan Laba RugiDocument1 pageLaporan Laba RugiRictu SempakNo ratings yet

- 4-6 Dahlia CompanyDocument1 page4-6 Dahlia CompanyyayayaNo ratings yet

- Ia3 Quiz 3Document5 pagesIa3 Quiz 3Magdaraog LutzNo ratings yet

- Note 4 Indirect MethodDocument2 pagesNote 4 Indirect Methodنور عفيفهNo ratings yet

- Cost of Gooods Manufactured 5,060,000Document5 pagesCost of Gooods Manufactured 5,060,000yayayaNo ratings yet

- P3 4Document3 pagesP3 4Nam Nguyen100% (1)

- Confra Financial StatementsDocument3 pagesConfra Financial StatementsPia ChanNo ratings yet

- Chapter 4 - Ia3Document10 pagesChapter 4 - Ia3Xynith Nicole RamosNo ratings yet

- Additional InformationDocument6 pagesAdditional InformationBabylyn NavarroNo ratings yet

- TEMPLATE Business BudgetDocument5 pagesTEMPLATE Business BudgetNabil IzhamNo ratings yet

- Jessbel G. Mahilum - IA3-CD1 - Assignment4Document6 pagesJessbel G. Mahilum - IA3-CD1 - Assignment4Jessbel MahilumNo ratings yet

- Comprehensive SOCF ProblemDocument1 pageComprehensive SOCF ProblemAbdullah alhamaadNo ratings yet

- E2 Comprehensive IncomeDocument3 pagesE2 Comprehensive IncomeSean H2ONo ratings yet

- Corp AccountsDocument8 pagesCorp AccountsShreyNo ratings yet

- Statement of Profit or Loss and Other Comprehensive Income Trial Balance For The Year Ended 31 December 20X1. Item Debit ( ) Credit ( )Document3 pagesStatement of Profit or Loss and Other Comprehensive Income Trial Balance For The Year Ended 31 December 20X1. Item Debit ( ) Credit ( )Ezra Mikah CaalimNo ratings yet

- 03 - HO - Statement of Comprehensive IncomeDocument3 pages03 - HO - Statement of Comprehensive IncomeYoung MetroNo ratings yet

- FinMar PrelimDocument6 pagesFinMar PrelimCeline Therese BuNo ratings yet

- Planning The Audit - BankDocument15 pagesPlanning The Audit - BankCeline Therese BuNo ratings yet

- Practice 1 ReceivablesDocument7 pagesPractice 1 ReceivablesCeline Therese BuNo ratings yet

- General ProvisionsDocument12 pagesGeneral ProvisionsCeline Therese BuNo ratings yet

- Constitution and by LawsDocument8 pagesConstitution and by LawsCeline Therese BuNo ratings yet

- IA For Prelims FinalDocument438 pagesIA For Prelims FinalCeline Therese BuNo ratings yet

- SocPhi Reviewer (Prelim)Document4 pagesSocPhi Reviewer (Prelim)Celine Therese BuNo ratings yet

- SW PhilHi (Questions Only)Document3 pagesSW PhilHi (Questions Only)Celine Therese BuNo ratings yet

- AmalagamationDocument3 pagesAmalagamationPavan ReddyNo ratings yet

- IC Pro Forma Balance Sheets Template 10510Document4 pagesIC Pro Forma Balance Sheets Template 10510Royd BeñasNo ratings yet

- Balance Sheet and Profit & Loss SeptemberDocument2 pagesBalance Sheet and Profit & Loss SeptemberQasim RazaNo ratings yet

- Krishna G. Palepu, Paul M. Healy, Erik Peek - Business Analysis and Valuation - IFRS Edition-Cengage Learning (2013) - Chapter 5 PDFDocument58 pagesKrishna G. Palepu, Paul M. Healy, Erik Peek - Business Analysis and Valuation - IFRS Edition-Cengage Learning (2013) - Chapter 5 PDFTrần BetaNo ratings yet

- KPI - by Duncan WilliamsonDocument6 pagesKPI - by Duncan WilliamsonSuta VijayaNo ratings yet

- Revenue: MaicsaDocument13 pagesRevenue: MaicsaJamilah EdwardNo ratings yet

- ACC301 Seminar 5 Slides 30 03 2018Document84 pagesACC301 Seminar 5 Slides 30 03 2018MinBu MinRuNo ratings yet

- A Study On Capital Management of Rathna Bio Teck PVT LimitedDocument11 pagesA Study On Capital Management of Rathna Bio Teck PVT LimitedeshwarNo ratings yet

- Finance OverviewDocument19 pagesFinance OverviewyomoNo ratings yet

- Executive Summary A. Introduction: Governmen T Equity 42%Document5 pagesExecutive Summary A. Introduction: Governmen T Equity 42%sandra bolokNo ratings yet

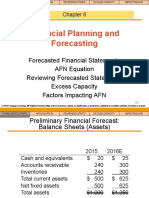

- Financial Planning and ForecastingDocument15 pagesFinancial Planning and ForecastingNicolaus BagaskaraNo ratings yet

- Mbto LK Q1 2019Document86 pagesMbto LK Q1 2019Ridwan PutraNo ratings yet

- Sears Vs Walmart - ExcelDocument11 pagesSears Vs Walmart - ExcelTamas OberoiNo ratings yet

- Acotel 2008 Annual ReportDocument157 pagesAcotel 2008 Annual Reportg00031065No ratings yet

- Strategic Plan of Indian Tobacco Company (ItcDocument27 pagesStrategic Plan of Indian Tobacco Company (ItcJennifer Smith100% (1)

- Majid Al Futtaim Hypermarkets GeorgiaDocument12 pagesMajid Al Futtaim Hypermarkets GeorgiaGiga KutkhashviliNo ratings yet

- Maple Leaf Cement Factory Limited.Document17 pagesMaple Leaf Cement Factory Limited.MubasharNo ratings yet

- Financial Statements For A Sole Proprietorship: Accounting Chapter 7Document22 pagesFinancial Statements For A Sole Proprietorship: Accounting Chapter 7Nur SiaNo ratings yet

- Case - Rayovac Corporation - 23-12-2022Document16 pagesCase - Rayovac Corporation - 23-12-2022harsh agarwalNo ratings yet

- Financial Analysis ReportDocument26 pagesFinancial Analysis ReportMustafa MahmoodNo ratings yet

- Annual Report 1314 Carl ZeissDocument136 pagesAnnual Report 1314 Carl Zeissalkanm750No ratings yet

- Chap 1-4Document20 pagesChap 1-4Rose Ann Robante TubioNo ratings yet

- Analysis and Interpretation of Financial StatementsDocument24 pagesAnalysis and Interpretation of Financial StatementsMariel NatullaNo ratings yet

- Answers To True or False, Relating To SFP, With ExplanationsDocument3 pagesAnswers To True or False, Relating To SFP, With ExplanationsPATRICIA SANTOS100% (1)

- Air Asia CompleteDocument18 pagesAir Asia CompleteAmy CharmaineNo ratings yet

- Capital-Structure at HDFC BankDocument81 pagesCapital-Structure at HDFC Bankvickram jainNo ratings yet

- Liquidation AccountingDocument5 pagesLiquidation AccountingTomy Mathew100% (1)