Professional Documents

Culture Documents

Expenses

Expenses

Uploaded by

suman_civilCopyright:

Available Formats

You might also like

- 2023-Quiz (Income From Salary)Document7 pages2023-Quiz (Income From Salary)SunnyNo ratings yet

- Intermediate Acctg 2 - MillanDocument6 pagesIntermediate Acctg 2 - MillanJuliana Ipo100% (1)

- Questions & Answers: 2 SalariesDocument26 pagesQuestions & Answers: 2 SalariesSabyasachi Ghosh67% (3)

- EC3 - Fin Plate Connection Design ChecksDocument5 pagesEC3 - Fin Plate Connection Design Checkssuman_civilNo ratings yet

- Singapore Constr Company DetailsDocument75 pagesSingapore Constr Company Detailssuman_civil67% (6)

- One Retail Group v. Ideal Time Consultants - ComplaintDocument83 pagesOne Retail Group v. Ideal Time Consultants - ComplaintSarah BursteinNo ratings yet

- Trial Transcript FullDocument38 pagesTrial Transcript FullForeclosure Fraud100% (1)

- La Acusación en EE - UU. Contra Lennys Rangel, Gerente de PetrocedeñoDocument10 pagesLa Acusación en EE - UU. Contra Lennys Rangel, Gerente de Petrocedeñodocs_archiverNo ratings yet

- Vat TableDocument1 pageVat Tablesuman_civilNo ratings yet

- PAYE TableDocument1 pagePAYE Tablesuman_civilNo ratings yet

- Notice To Taxpayers 20 12 2022Document6 pagesNotice To Taxpayers 20 12 2022Anonymous nyOx1XmqzCNo ratings yet

- Salary TableDocument1 pageSalary Tablesuman_civilNo ratings yet

- Tax TableDocument1 pageTax Tablesuman_civilNo ratings yet

- Income Tax Divyastra CH 15 Advance Tax R 1Document7 pagesIncome Tax Divyastra CH 15 Advance Tax R 1wareva7754No ratings yet

- Recommendation:: Recommended Initial Investments To Maximize Profit To 689542.5988Document5 pagesRecommendation:: Recommended Initial Investments To Maximize Profit To 689542.5988Niña Rica PunzalanNo ratings yet

- Work Shop On InterestDocument25 pagesWork Shop On InterestmukeshNo ratings yet

- Pay FixationDocument8 pagesPay Fixationjaideep sainiNo ratings yet

- Ind AS 19 Theory & Addl. ProblemsDocument21 pagesInd AS 19 Theory & Addl. ProblemsCharu JagetiaNo ratings yet

- Salary IllustrationDocument10 pagesSalary IllustrationSarvar Pathan100% (1)

- Problems On Business/Profession Income: SEM It AssignmentDocument9 pagesProblems On Business/Profession Income: SEM It AssignmentNikhilNo ratings yet

- Lecture 13 PensionDocument11 pagesLecture 13 PensionVikas WadmareNo ratings yet

- Previous Year April To June July To March 2016-17 Nil 15000 2017-18 15000 16500 2018-19 16500 18000 2019-20 18000 19500Document4 pagesPrevious Year April To June July To March 2016-17 Nil 15000 2017-18 15000 16500 2018-19 16500 18000 2019-20 18000 19500Sumit PattanaikNo ratings yet

- Questions & Answers - Salary IncomeDocument14 pagesQuestions & Answers - Salary IncomeKiran BendeNo ratings yet

- Advance - Tax (Inter)Document5 pagesAdvance - Tax (Inter)Shrinivas kc 12A2No ratings yet

- Annual Compensation and Business TaxesDocument21 pagesAnnual Compensation and Business TaxesRyDNo ratings yet

- SW Employee BenefitsDocument3 pagesSW Employee BenefitsMikaela Joy FloraNo ratings yet

- Chapter-6 (Salary)Document53 pagesChapter-6 (Salary)BoRO TriAngLENo ratings yet

- Exercise Topic 2Document4 pagesExercise Topic 2TEIK LOONG KHORNo ratings yet

- SS Q1 Test Tax317 Dec 2021Document1 pageSS Q1 Test Tax317 Dec 2021Nik Syarizal Nik MahadhirNo ratings yet

- Batch 2 Draft Question-1Document5 pagesBatch 2 Draft Question-1Somnath BhattaraiNo ratings yet

- LESSON 13 Tax PAYMENT AND PROCEDURES and ASSESSEMTDocument14 pagesLESSON 13 Tax PAYMENT AND PROCEDURES and ASSESSEMTOctavius MuyungiNo ratings yet

- Intacc 3. Ans. To MC 17, 28Document1 pageIntacc 3. Ans. To MC 17, 28Mhico MateoNo ratings yet

- Problems On Income From Salaries: Tax SupplementDocument20 pagesProblems On Income From Salaries: Tax SupplementJkNo ratings yet

- March (Pre), 2023Document66 pagesMarch (Pre), 2023gkhyati58No ratings yet

- GKJ Taxation Final (Sums)Document7 pagesGKJ Taxation Final (Sums)ankandas3498No ratings yet

- M12 Tax ActivityDocument6 pagesM12 Tax ActivityJanna RodriguezNo ratings yet

- Tax Treatement in Cash Flow StatementDocument4 pagesTax Treatement in Cash Flow StatementtilokiNo ratings yet

- This Study Resource WasDocument4 pagesThis Study Resource WasMarcus MonocayNo ratings yet

- Amendment To: Specification For Monthly Tax Deduction (MTD) Calculations Using Computerised Calculation FORDocument42 pagesAmendment To: Specification For Monthly Tax Deduction (MTD) Calculations Using Computerised Calculation FORKen ChiaNo ratings yet

- Questions On IAS 19Document5 pagesQuestions On IAS 19banglauserNo ratings yet

- Accounts 2024 12@Document17 pagesAccounts 2024 12@simarpreetsingh368No ratings yet

- Specification For Monthly Tax Deduction (MTD) Calculations Using Computerised Calculation Method ForDocument45 pagesSpecification For Monthly Tax Deduction (MTD) Calculations Using Computerised Calculation Method ForJoseph Shabin100% (1)

- Tutorial Bkat2013 (288748)Document3 pagesTutorial Bkat2013 (288748)Hafizzudin ZolkifelyNo ratings yet

- Cost and Management Accounting (1) .PDFDocument4 pagesCost and Management Accounting (1) .PDFtejasvgahlot05No ratings yet

- Annexure-1 Advisory On Interest Calculator in Gstr-3B: Annexure With Illustra Ve ExampleDocument5 pagesAnnexure-1 Advisory On Interest Calculator in Gstr-3B: Annexure With Illustra Ve ExamplepapuNo ratings yet

- Taxation of SalaryDocument27 pagesTaxation of SalaryAshish RanjanNo ratings yet

- Bba - 3a Itlp Tamanna Mini Project 1Document3 pagesBba - 3a Itlp Tamanna Mini Project 1Tamanna 2020No ratings yet

- Template - Problem 18.1Document4 pagesTemplate - Problem 18.1dragonx0662No ratings yet

- Practical Application of Taxation On CorporationsDocument5 pagesPractical Application of Taxation On CorporationsClaire BarbaNo ratings yet

- Notes Loans ReceivablesDocument10 pagesNotes Loans ReceivablesIamkitten 00No ratings yet

- RR 2-95Document7 pagesRR 2-95matinikkiNo ratings yet

- 06 Withholding Tax On Compensation IncomeDocument13 pages06 Withholding Tax On Compensation IncomeZatsumono YamamotoNo ratings yet

- L4 Part 3 - IND AS 19 - Questions - by CA Aakash KandoiDocument8 pagesL4 Part 3 - IND AS 19 - Questions - by CA Aakash Kandoipratikdubey9586No ratings yet

- Income From SalariesDocument6 pagesIncome From Salariesmayankking404No ratings yet

- Revision ch3 1thDocument18 pagesRevision ch3 1thYousefNo ratings yet

- SALARYDocument19 pagesSALARYHrishit Raj SardaNo ratings yet

- Assingment 3Document4 pagesAssingment 3Shershah JalalzaiNo ratings yet

- QUESTION 3 (B) - TAXATION OF INCOME - November 30, 2022Document4 pagesQUESTION 3 (B) - TAXATION OF INCOME - November 30, 2022Nathan NakibingeNo ratings yet

- SCDL - PGDBA - Finance - Sem 4 - TaxationDocument23 pagesSCDL - PGDBA - Finance - Sem 4 - Taxationapi-3762419100% (2)

- INP - 2211 - Account - SUGGESTED ANSWERSDocument15 pagesINP - 2211 - Account - SUGGESTED ANSWERSSachin ChourasiyaNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Parliament of The Democratic Socialist Republic of Sri LankaDocument4 pagesParliament of The Democratic Socialist Republic of Sri Lankasuman_civilNo ratings yet

- Concealed Spaces: For Buildings, Code of Practice For System Design, Installation and Servicing Is Fitted in TheDocument11 pagesConcealed Spaces: For Buildings, Code of Practice For System Design, Installation and Servicing Is Fitted in Thesuman_civilNo ratings yet

- Base Shear Resistance Calculation - R1Document8 pagesBase Shear Resistance Calculation - R1suman_civilNo ratings yet

- Tata Steel Blue BookDocument60 pagesTata Steel Blue Bookvenura100% (1)

- Vertical Escape: External Walls of Protected StairwaysDocument11 pagesVertical Escape: External Walls of Protected Stairwayssuman_civilNo ratings yet

- Tritech: Tritech Consultants Pte LTDDocument2 pagesTritech: Tritech Consultants Pte LTDsuman_civilNo ratings yet

- Earth Pressure CalcDocument3 pagesEarth Pressure Calcsuman_civilNo ratings yet

- RC Beam Design To EC2Document3 pagesRC Beam Design To EC2suman_civilNo ratings yet

- Composite Beam To EC4Document1 pageComposite Beam To EC4suman_civilNo ratings yet

- Drawing ListDocument19 pagesDrawing Listsuman_civilNo ratings yet

- Lap Length and Anchorage Length To EC2Document1 pageLap Length and Anchorage Length To EC2suman_civilNo ratings yet

- Wall - Shear Rebar Design - SumanDocument2 pagesWall - Shear Rebar Design - Sumansuman_civil100% (1)

- Examining &reporting On Tenders: Arithmetical Errors These May OccurDocument4 pagesExamining &reporting On Tenders: Arithmetical Errors These May Occursuman_civil100% (1)

- Entrance B: 1008 72 CHS 559x25 (S355) 80.64 1314 72 CHS 610x28 (S355) 105.12Document2 pagesEntrance B: 1008 72 CHS 559x25 (S355) 80.64 1314 72 CHS 610x28 (S355) 105.12suman_civilNo ratings yet

- Selvan CVDocument4 pagesSelvan CVsuman_civilNo ratings yet

- Beam - Capacity Check - SumanDocument4 pagesBeam - Capacity Check - Sumansuman_civilNo ratings yet

- Maximum Lateral Deflection of Retaining Walls at SLS (In MM)Document1 pageMaximum Lateral Deflection of Retaining Walls at SLS (In MM)suman_civilNo ratings yet

- MCA-PE3 Technical Data SheetDocument10 pagesMCA-PE3 Technical Data Sheetsuman_civilNo ratings yet

- Sap2000 17.1Document1 pageSap2000 17.1suman_civilNo ratings yet

- Statutory Books Records Annual ReturnsDocument12 pagesStatutory Books Records Annual ReturnsEl GwekwerereNo ratings yet

- RGS Leave Application Form - Rodel DerlaDocument1 pageRGS Leave Application Form - Rodel DerlaRodel DerlaNo ratings yet

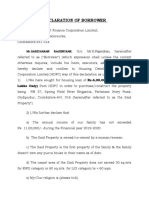

- Declaration of Borrower: S/o. Mr.K.Rajendran, HereinafterDocument4 pagesDeclaration of Borrower: S/o. Mr.K.Rajendran, HereinafterSasidharan RajendranNo ratings yet

- 1 SMDocument28 pages1 SMine ylsNo ratings yet

- Consignment Security Declaration: ICAO-WCO Joint Workshop Air Cargo Security and Facilitation H 4.8 Page 1 of 3Document3 pagesConsignment Security Declaration: ICAO-WCO Joint Workshop Air Cargo Security and Facilitation H 4.8 Page 1 of 3Rayan SaidaneNo ratings yet

- Cap - Instruction To Students - MBA FIRST - YRDocument2 pagesCap - Instruction To Students - MBA FIRST - YRshamikh khanNo ratings yet

- Carrier: Delhivery: Deliver To FromDocument1 pageCarrier: Delhivery: Deliver To FromnayeemNo ratings yet

- SME Loan by IIFL Finance - Updated June 2023Document5 pagesSME Loan by IIFL Finance - Updated June 2023Anuj AnujNo ratings yet

- Notes On Application For Authority To Print ReceiptsDocument3 pagesNotes On Application For Authority To Print ReceiptsDenzel Edward CariagaNo ratings yet

- Auditing Theory Answer Key 6Document3 pagesAuditing Theory Answer Key 6Jasper GicaNo ratings yet

- MES Challan FoamDocument1 pageMES Challan FoamTaiMurTXaibNo ratings yet

- Bid FormDocument2 pagesBid FormDianara De GuzmanNo ratings yet

- Torfaen Citizens Advice BureauDocument2 pagesTorfaen Citizens Advice Bureauapi-179765145No ratings yet

- E-Newsletter - July-September 2022 IssueDocument44 pagesE-Newsletter - July-September 2022 IssueVIJAY CHANDNo ratings yet

- IRP-1 Form First Time RegistrationDocument2 pagesIRP-1 Form First Time Registrationbella FlorNo ratings yet

- Personal Bond of IndemnityDocument4 pagesPersonal Bond of IndemnityAmit Kumar100% (1)

- En 10288Document52 pagesEn 10288Danilo FornaroNo ratings yet

- GovernanceDocument35 pagesGovernanceStudent Use100% (1)

- Process Flow Bids and Awards Committee For Public BiddingDocument2 pagesProcess Flow Bids and Awards Committee For Public BiddingLoyd Carlo IbarraNo ratings yet

- VIT Chennai Men's Hostel AffidavitDocument1 pageVIT Chennai Men's Hostel AffidavitChandra MohanNo ratings yet

- Final FNFDocument3 pagesFinal FNFbhagender singhNo ratings yet

- FSI TDR Concepts in RedevelopmentDocument32 pagesFSI TDR Concepts in RedevelopmentkunalkadamNo ratings yet

- Merit List BTech-MTech Computer Science and Engineering (Cyber Security) NFAT2023 V8.0 Digitally SignedDocument73 pagesMerit List BTech-MTech Computer Science and Engineering (Cyber Security) NFAT2023 V8.0 Digitally SignedNo ratings yet

- Atmanirbhar BharatDocument5 pagesAtmanirbhar BharatTopper's Coaching CentreNo ratings yet

- PCIT v. M Sons Gems N Jewellery-Delhi HCDocument3 pagesPCIT v. M Sons Gems N Jewellery-Delhi HCSaksham ShrivastavNo ratings yet

- ICAP ATR 14 Minimum Fee Revised 2008Document4 pagesICAP ATR 14 Minimum Fee Revised 2008Zeeshan Shahid100% (3)

- EPaycard - Customer Account Opening Form - 2015Document1 pageEPaycard - Customer Account Opening Form - 2015Drw ArcyNo ratings yet

Expenses

Expenses

Uploaded by

suman_civilOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Expenses

Expenses

Uploaded by

suman_civilCopyright:

Available Formats

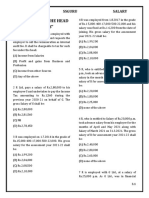

(Amount of incentive to be received in January 2023, i.e. Rs.

300,000)

Estimated Gross Aggregate Remunerations EGAR (paid and payable) during the second

Three-month period of the Y/A 2022/2023 = (D): 630,000

Step 02 – Computation of tax deductible on Lump-sum payment in January, 2023

As the EGAR or D falls in between Rs. 550,001 and Rs. 675,000, the following formula should be

applied in computing the amount of tax deductible in January, 2023 on the incentive;

(D x 18%) - [(76,500 + Aggregate of monthly tax deducted on A + Aggregate of monthly tax

deductible on B, as per Table 01) + Tax deducted previously on Lump-sum payments, if any]

= (630,000 x 18%) - [(76,500 + (600x 1) + (600 x 2) + 0]

= 113,400 – [76,500+600 +1200]

= 35,100

Therefore, tax deductible on the incentive in January, 2023 is Rs. 35,100

Example 02

Assuming that Mrs. Fernando in the Example 01 will receive an incentive arrears (incentive) of Rs.

100,000.00 in March, 2023, tax deductible on this incentive should be computed as follows;

Please note that the tax deductible on monthly remunerations should be computed using Tax Table 01,

separately.

Computation of tax deductible on the incentive payable in March, 2023

Step 01 – Computation of Estimated Gross Aggregate Remunerations during the second three

months of the Year of Assessment (Y/A) 2022/2023

Rs.

Gross aggregate monthly remunerations already paid during the second three-month period of = (A): 330,000

the Y/A 2022/2023 (Monthly remuneration for the months for January –March, 2023, i.e. 110,000 x 3)

Gross aggregate monthly remunerations payable during the second-three month period of the = (B): 0

Y/A 2022/2023 (Monthly remuneration payable for January - March, 2023, i.e. 110,000 x 0)

Gross aggregate Lump-sum payments already made, being made now, & payable during the

second three-month period of the Y/A 2022/2023

(Amount of incentive received in January, 2023 and to be received in March, 2023,

i.e. 300,000+ 100,000) = (C): 400,000

Estimated Gross Aggregate Remunerations EGAR (paid and payable) during the second

three-month period of the Y/A 2022/2023 = (D): 730,000

Step 02 – Computation of tax deductible on Lump-sum payment in March, 2023

As the EGAR or D falls in between Rs. 675,001 and 800,000, the following formula should be applied in

computing the amount of tax deductible in March 2023 on the incentive.

(D x 24%) - [(117,000 + Aggregate of monthly tax deducted on A + Aggregate of monthly tax

deductible on B, as per Table 01) + Tax deducted previously on Lump-sum payments, if any]

= (730,000 x 24%) - [(117,000 + (600 x 3) + (0 x 0) + 35,100]

= 175,200 – [117,000 + 1800+ 0 +35,100]

= 21,300

Therefore, tax deductible on the incentive in March, 2023 is Rs. 21,300

You might also like

- 2023-Quiz (Income From Salary)Document7 pages2023-Quiz (Income From Salary)SunnyNo ratings yet

- Intermediate Acctg 2 - MillanDocument6 pagesIntermediate Acctg 2 - MillanJuliana Ipo100% (1)

- Questions & Answers: 2 SalariesDocument26 pagesQuestions & Answers: 2 SalariesSabyasachi Ghosh67% (3)

- EC3 - Fin Plate Connection Design ChecksDocument5 pagesEC3 - Fin Plate Connection Design Checkssuman_civilNo ratings yet

- Singapore Constr Company DetailsDocument75 pagesSingapore Constr Company Detailssuman_civil67% (6)

- One Retail Group v. Ideal Time Consultants - ComplaintDocument83 pagesOne Retail Group v. Ideal Time Consultants - ComplaintSarah BursteinNo ratings yet

- Trial Transcript FullDocument38 pagesTrial Transcript FullForeclosure Fraud100% (1)

- La Acusación en EE - UU. Contra Lennys Rangel, Gerente de PetrocedeñoDocument10 pagesLa Acusación en EE - UU. Contra Lennys Rangel, Gerente de Petrocedeñodocs_archiverNo ratings yet

- Vat TableDocument1 pageVat Tablesuman_civilNo ratings yet

- PAYE TableDocument1 pagePAYE Tablesuman_civilNo ratings yet

- Notice To Taxpayers 20 12 2022Document6 pagesNotice To Taxpayers 20 12 2022Anonymous nyOx1XmqzCNo ratings yet

- Salary TableDocument1 pageSalary Tablesuman_civilNo ratings yet

- Tax TableDocument1 pageTax Tablesuman_civilNo ratings yet

- Income Tax Divyastra CH 15 Advance Tax R 1Document7 pagesIncome Tax Divyastra CH 15 Advance Tax R 1wareva7754No ratings yet

- Recommendation:: Recommended Initial Investments To Maximize Profit To 689542.5988Document5 pagesRecommendation:: Recommended Initial Investments To Maximize Profit To 689542.5988Niña Rica PunzalanNo ratings yet

- Work Shop On InterestDocument25 pagesWork Shop On InterestmukeshNo ratings yet

- Pay FixationDocument8 pagesPay Fixationjaideep sainiNo ratings yet

- Ind AS 19 Theory & Addl. ProblemsDocument21 pagesInd AS 19 Theory & Addl. ProblemsCharu JagetiaNo ratings yet

- Salary IllustrationDocument10 pagesSalary IllustrationSarvar Pathan100% (1)

- Problems On Business/Profession Income: SEM It AssignmentDocument9 pagesProblems On Business/Profession Income: SEM It AssignmentNikhilNo ratings yet

- Lecture 13 PensionDocument11 pagesLecture 13 PensionVikas WadmareNo ratings yet

- Previous Year April To June July To March 2016-17 Nil 15000 2017-18 15000 16500 2018-19 16500 18000 2019-20 18000 19500Document4 pagesPrevious Year April To June July To March 2016-17 Nil 15000 2017-18 15000 16500 2018-19 16500 18000 2019-20 18000 19500Sumit PattanaikNo ratings yet

- Questions & Answers - Salary IncomeDocument14 pagesQuestions & Answers - Salary IncomeKiran BendeNo ratings yet

- Advance - Tax (Inter)Document5 pagesAdvance - Tax (Inter)Shrinivas kc 12A2No ratings yet

- Annual Compensation and Business TaxesDocument21 pagesAnnual Compensation and Business TaxesRyDNo ratings yet

- SW Employee BenefitsDocument3 pagesSW Employee BenefitsMikaela Joy FloraNo ratings yet

- Chapter-6 (Salary)Document53 pagesChapter-6 (Salary)BoRO TriAngLENo ratings yet

- Exercise Topic 2Document4 pagesExercise Topic 2TEIK LOONG KHORNo ratings yet

- SS Q1 Test Tax317 Dec 2021Document1 pageSS Q1 Test Tax317 Dec 2021Nik Syarizal Nik MahadhirNo ratings yet

- Batch 2 Draft Question-1Document5 pagesBatch 2 Draft Question-1Somnath BhattaraiNo ratings yet

- LESSON 13 Tax PAYMENT AND PROCEDURES and ASSESSEMTDocument14 pagesLESSON 13 Tax PAYMENT AND PROCEDURES and ASSESSEMTOctavius MuyungiNo ratings yet

- Intacc 3. Ans. To MC 17, 28Document1 pageIntacc 3. Ans. To MC 17, 28Mhico MateoNo ratings yet

- Problems On Income From Salaries: Tax SupplementDocument20 pagesProblems On Income From Salaries: Tax SupplementJkNo ratings yet

- March (Pre), 2023Document66 pagesMarch (Pre), 2023gkhyati58No ratings yet

- GKJ Taxation Final (Sums)Document7 pagesGKJ Taxation Final (Sums)ankandas3498No ratings yet

- M12 Tax ActivityDocument6 pagesM12 Tax ActivityJanna RodriguezNo ratings yet

- Tax Treatement in Cash Flow StatementDocument4 pagesTax Treatement in Cash Flow StatementtilokiNo ratings yet

- This Study Resource WasDocument4 pagesThis Study Resource WasMarcus MonocayNo ratings yet

- Amendment To: Specification For Monthly Tax Deduction (MTD) Calculations Using Computerised Calculation FORDocument42 pagesAmendment To: Specification For Monthly Tax Deduction (MTD) Calculations Using Computerised Calculation FORKen ChiaNo ratings yet

- Questions On IAS 19Document5 pagesQuestions On IAS 19banglauserNo ratings yet

- Accounts 2024 12@Document17 pagesAccounts 2024 12@simarpreetsingh368No ratings yet

- Specification For Monthly Tax Deduction (MTD) Calculations Using Computerised Calculation Method ForDocument45 pagesSpecification For Monthly Tax Deduction (MTD) Calculations Using Computerised Calculation Method ForJoseph Shabin100% (1)

- Tutorial Bkat2013 (288748)Document3 pagesTutorial Bkat2013 (288748)Hafizzudin ZolkifelyNo ratings yet

- Cost and Management Accounting (1) .PDFDocument4 pagesCost and Management Accounting (1) .PDFtejasvgahlot05No ratings yet

- Annexure-1 Advisory On Interest Calculator in Gstr-3B: Annexure With Illustra Ve ExampleDocument5 pagesAnnexure-1 Advisory On Interest Calculator in Gstr-3B: Annexure With Illustra Ve ExamplepapuNo ratings yet

- Taxation of SalaryDocument27 pagesTaxation of SalaryAshish RanjanNo ratings yet

- Bba - 3a Itlp Tamanna Mini Project 1Document3 pagesBba - 3a Itlp Tamanna Mini Project 1Tamanna 2020No ratings yet

- Template - Problem 18.1Document4 pagesTemplate - Problem 18.1dragonx0662No ratings yet

- Practical Application of Taxation On CorporationsDocument5 pagesPractical Application of Taxation On CorporationsClaire BarbaNo ratings yet

- Notes Loans ReceivablesDocument10 pagesNotes Loans ReceivablesIamkitten 00No ratings yet

- RR 2-95Document7 pagesRR 2-95matinikkiNo ratings yet

- 06 Withholding Tax On Compensation IncomeDocument13 pages06 Withholding Tax On Compensation IncomeZatsumono YamamotoNo ratings yet

- L4 Part 3 - IND AS 19 - Questions - by CA Aakash KandoiDocument8 pagesL4 Part 3 - IND AS 19 - Questions - by CA Aakash Kandoipratikdubey9586No ratings yet

- Income From SalariesDocument6 pagesIncome From Salariesmayankking404No ratings yet

- Revision ch3 1thDocument18 pagesRevision ch3 1thYousefNo ratings yet

- SALARYDocument19 pagesSALARYHrishit Raj SardaNo ratings yet

- Assingment 3Document4 pagesAssingment 3Shershah JalalzaiNo ratings yet

- QUESTION 3 (B) - TAXATION OF INCOME - November 30, 2022Document4 pagesQUESTION 3 (B) - TAXATION OF INCOME - November 30, 2022Nathan NakibingeNo ratings yet

- SCDL - PGDBA - Finance - Sem 4 - TaxationDocument23 pagesSCDL - PGDBA - Finance - Sem 4 - Taxationapi-3762419100% (2)

- INP - 2211 - Account - SUGGESTED ANSWERSDocument15 pagesINP - 2211 - Account - SUGGESTED ANSWERSSachin ChourasiyaNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Parliament of The Democratic Socialist Republic of Sri LankaDocument4 pagesParliament of The Democratic Socialist Republic of Sri Lankasuman_civilNo ratings yet

- Concealed Spaces: For Buildings, Code of Practice For System Design, Installation and Servicing Is Fitted in TheDocument11 pagesConcealed Spaces: For Buildings, Code of Practice For System Design, Installation and Servicing Is Fitted in Thesuman_civilNo ratings yet

- Base Shear Resistance Calculation - R1Document8 pagesBase Shear Resistance Calculation - R1suman_civilNo ratings yet

- Tata Steel Blue BookDocument60 pagesTata Steel Blue Bookvenura100% (1)

- Vertical Escape: External Walls of Protected StairwaysDocument11 pagesVertical Escape: External Walls of Protected Stairwayssuman_civilNo ratings yet

- Tritech: Tritech Consultants Pte LTDDocument2 pagesTritech: Tritech Consultants Pte LTDsuman_civilNo ratings yet

- Earth Pressure CalcDocument3 pagesEarth Pressure Calcsuman_civilNo ratings yet

- RC Beam Design To EC2Document3 pagesRC Beam Design To EC2suman_civilNo ratings yet

- Composite Beam To EC4Document1 pageComposite Beam To EC4suman_civilNo ratings yet

- Drawing ListDocument19 pagesDrawing Listsuman_civilNo ratings yet

- Lap Length and Anchorage Length To EC2Document1 pageLap Length and Anchorage Length To EC2suman_civilNo ratings yet

- Wall - Shear Rebar Design - SumanDocument2 pagesWall - Shear Rebar Design - Sumansuman_civil100% (1)

- Examining &reporting On Tenders: Arithmetical Errors These May OccurDocument4 pagesExamining &reporting On Tenders: Arithmetical Errors These May Occursuman_civil100% (1)

- Entrance B: 1008 72 CHS 559x25 (S355) 80.64 1314 72 CHS 610x28 (S355) 105.12Document2 pagesEntrance B: 1008 72 CHS 559x25 (S355) 80.64 1314 72 CHS 610x28 (S355) 105.12suman_civilNo ratings yet

- Selvan CVDocument4 pagesSelvan CVsuman_civilNo ratings yet

- Beam - Capacity Check - SumanDocument4 pagesBeam - Capacity Check - Sumansuman_civilNo ratings yet

- Maximum Lateral Deflection of Retaining Walls at SLS (In MM)Document1 pageMaximum Lateral Deflection of Retaining Walls at SLS (In MM)suman_civilNo ratings yet

- MCA-PE3 Technical Data SheetDocument10 pagesMCA-PE3 Technical Data Sheetsuman_civilNo ratings yet

- Sap2000 17.1Document1 pageSap2000 17.1suman_civilNo ratings yet

- Statutory Books Records Annual ReturnsDocument12 pagesStatutory Books Records Annual ReturnsEl GwekwerereNo ratings yet

- RGS Leave Application Form - Rodel DerlaDocument1 pageRGS Leave Application Form - Rodel DerlaRodel DerlaNo ratings yet

- Declaration of Borrower: S/o. Mr.K.Rajendran, HereinafterDocument4 pagesDeclaration of Borrower: S/o. Mr.K.Rajendran, HereinafterSasidharan RajendranNo ratings yet

- 1 SMDocument28 pages1 SMine ylsNo ratings yet

- Consignment Security Declaration: ICAO-WCO Joint Workshop Air Cargo Security and Facilitation H 4.8 Page 1 of 3Document3 pagesConsignment Security Declaration: ICAO-WCO Joint Workshop Air Cargo Security and Facilitation H 4.8 Page 1 of 3Rayan SaidaneNo ratings yet

- Cap - Instruction To Students - MBA FIRST - YRDocument2 pagesCap - Instruction To Students - MBA FIRST - YRshamikh khanNo ratings yet

- Carrier: Delhivery: Deliver To FromDocument1 pageCarrier: Delhivery: Deliver To FromnayeemNo ratings yet

- SME Loan by IIFL Finance - Updated June 2023Document5 pagesSME Loan by IIFL Finance - Updated June 2023Anuj AnujNo ratings yet

- Notes On Application For Authority To Print ReceiptsDocument3 pagesNotes On Application For Authority To Print ReceiptsDenzel Edward CariagaNo ratings yet

- Auditing Theory Answer Key 6Document3 pagesAuditing Theory Answer Key 6Jasper GicaNo ratings yet

- MES Challan FoamDocument1 pageMES Challan FoamTaiMurTXaibNo ratings yet

- Bid FormDocument2 pagesBid FormDianara De GuzmanNo ratings yet

- Torfaen Citizens Advice BureauDocument2 pagesTorfaen Citizens Advice Bureauapi-179765145No ratings yet

- E-Newsletter - July-September 2022 IssueDocument44 pagesE-Newsletter - July-September 2022 IssueVIJAY CHANDNo ratings yet

- IRP-1 Form First Time RegistrationDocument2 pagesIRP-1 Form First Time Registrationbella FlorNo ratings yet

- Personal Bond of IndemnityDocument4 pagesPersonal Bond of IndemnityAmit Kumar100% (1)

- En 10288Document52 pagesEn 10288Danilo FornaroNo ratings yet

- GovernanceDocument35 pagesGovernanceStudent Use100% (1)

- Process Flow Bids and Awards Committee For Public BiddingDocument2 pagesProcess Flow Bids and Awards Committee For Public BiddingLoyd Carlo IbarraNo ratings yet

- VIT Chennai Men's Hostel AffidavitDocument1 pageVIT Chennai Men's Hostel AffidavitChandra MohanNo ratings yet

- Final FNFDocument3 pagesFinal FNFbhagender singhNo ratings yet

- FSI TDR Concepts in RedevelopmentDocument32 pagesFSI TDR Concepts in RedevelopmentkunalkadamNo ratings yet

- Merit List BTech-MTech Computer Science and Engineering (Cyber Security) NFAT2023 V8.0 Digitally SignedDocument73 pagesMerit List BTech-MTech Computer Science and Engineering (Cyber Security) NFAT2023 V8.0 Digitally SignedNo ratings yet

- Atmanirbhar BharatDocument5 pagesAtmanirbhar BharatTopper's Coaching CentreNo ratings yet

- PCIT v. M Sons Gems N Jewellery-Delhi HCDocument3 pagesPCIT v. M Sons Gems N Jewellery-Delhi HCSaksham ShrivastavNo ratings yet

- ICAP ATR 14 Minimum Fee Revised 2008Document4 pagesICAP ATR 14 Minimum Fee Revised 2008Zeeshan Shahid100% (3)

- EPaycard - Customer Account Opening Form - 2015Document1 pageEPaycard - Customer Account Opening Form - 2015Drw ArcyNo ratings yet