Professional Documents

Culture Documents

Vat Table

Vat Table

Uploaded by

suman_civilOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Vat Table

Vat Table

Uploaded by

suman_civilCopyright:

Available Formats

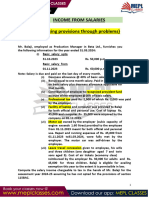

Example 03

Mr. Peiris who is a non-resident but citizen in Sri Lanka, works in DEF (Pvt) Ltd. He will get a bonus

valued Rs. 1,000,000.00 in January, 2023. His monthly gross earnings from employment (inclusive non-

cash benefits is Rs. 300,000.00.

(Hint: The amount of monthly earnings of Mr. Peiris remains unchanged for the second three month period)

Tax deductible on the bonus payable in January, 2023 should be computed as follows;

Please note that the tax deductible on monthly remunerations should be computed using Tax Table

01, separately.

Computation of tax deductible on bonus to be paid in January, 2023

Step 01 – Computation of Estimated Gross Aggregate Remunerations during the second three

month of the Year of Assessment (Y/A) 2022/2023

Gross aggregate monthly remunerations already paid during the second three months = (A): 300,000

(Monthly remuneration for the months for January 2023, i.e. 300,000 x 1)

Gross aggregate monthly remunerations payable during the second three months = (B): 600,000

(Monthly remuneration payable for February 2023 - March, 2023, i.e. 300,000 x 2)

Gross aggregate Lump-sum payments already made, being made now, & payable during the

second three months

(Amount of Bonus to be received in January 2023 i.e. 1,000,000) = (C): 1,000,000

Estimated Gross Aggregate Remunerations EGAR (paid and payable) during

the second three months = (D): 1,900,000

Step 02 – Computation of tax deductible on Lump-sum payment in January, 2023

As the EGAR or D more than 925,000, the following formula should be applied in computing the amount

of tax deductible in January, 2023 on the bonus.

(D x 36%) - [(220,500 + Aggregate of monthly tax deducted on A + Aggregate of monthly tax

deductible on B, as per Table 01) + Tax deducted previously on Lump-sum payments, if any]

= (1,900,000 x 36%) - [(220,500 + (35,000 x 1) + (35,000 x 2) + 0]

= 684,000 – [220,500 + 35,000 + 70,000 +0]

= 358,500

Therefore, tax deductible on bonus in January 2023 is Rs. 358,500

Example 04

Assuming that Mr. Peiris in the Example 03 will receive another bonus of Rs. 500,000.00 in March,

2023, tax deductible on this bonus should be computed as follows;

Please note that the tax deductible on monthly remunerations should be computed using Tax Table 01,

separately.

Computation of tax deductible on bonus payable in March, 2023

Step 01 – Computation of Estimated Gross Aggregate Remunerations during the second three

month of the Year of Assessment (Y/A) 2022/2023

Rs.

Gross aggregate monthly remunerations already paid during the second three months = (A): 900,000

You might also like

- Lesson Plan Income Taxation FINALDocument6 pagesLesson Plan Income Taxation FINALRandy Magbudhi100% (4)

- Intermediate Acctg 2 - MillanDocument6 pagesIntermediate Acctg 2 - MillanJuliana Ipo100% (1)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Questions & Answers: 2 SalariesDocument26 pagesQuestions & Answers: 2 SalariesSabyasachi Ghosh67% (3)

- EC3 - Fin Plate Connection Design ChecksDocument5 pagesEC3 - Fin Plate Connection Design Checkssuman_civilNo ratings yet

- Singapore Constr Company DetailsDocument75 pagesSingapore Constr Company Detailssuman_civil67% (6)

- Provisions On Taxation or Revenue SharingDocument2 pagesProvisions On Taxation or Revenue SharingAustin Coles33% (3)

- ExpensesDocument1 pageExpensessuman_civilNo ratings yet

- PAYE TableDocument1 pagePAYE Tablesuman_civilNo ratings yet

- Notice To Taxpayers 20 12 2022Document6 pagesNotice To Taxpayers 20 12 2022Anonymous nyOx1XmqzCNo ratings yet

- Tax TableDocument1 pageTax Tablesuman_civilNo ratings yet

- Salary TableDocument1 pageSalary Tablesuman_civilNo ratings yet

- Income Tax Divyastra CH 15 Advance Tax R 1Document7 pagesIncome Tax Divyastra CH 15 Advance Tax R 1wareva7754No ratings yet

- Recommendation:: Recommended Initial Investments To Maximize Profit To 689542.5988Document5 pagesRecommendation:: Recommended Initial Investments To Maximize Profit To 689542.5988Niña Rica PunzalanNo ratings yet

- Salary IllustrationDocument10 pagesSalary IllustrationSarvar Pathan100% (1)

- Ind AS 19 Theory & Addl. ProblemsDocument21 pagesInd AS 19 Theory & Addl. ProblemsCharu JagetiaNo ratings yet

- SW Employee BenefitsDocument3 pagesSW Employee BenefitsMikaela Joy FloraNo ratings yet

- Tax Treatement in Cash Flow StatementDocument4 pagesTax Treatement in Cash Flow StatementtilokiNo ratings yet

- Notes Loans ReceivablesDocument10 pagesNotes Loans ReceivablesIamkitten 00No ratings yet

- Advance - Tax (Inter)Document5 pagesAdvance - Tax (Inter)Shrinivas kc 12A2No ratings yet

- Income Tax 1 - 20223Document3 pagesIncome Tax 1 - 20223nimalpes21No ratings yet

- (Module 4) ExerciseDocument10 pages(Module 4) ExerciseYanie Dela CruzNo ratings yet

- Xi Acct Rev WS 1 22 23Document2 pagesXi Acct Rev WS 1 22 23RiwaanNo ratings yet

- Problems On Income From Salaries: Tax SupplementDocument20 pagesProblems On Income From Salaries: Tax SupplementJkNo ratings yet

- Work Shop On InterestDocument25 pagesWork Shop On InterestmukeshNo ratings yet

- Module 3 Class ExercisesDocument2 pagesModule 3 Class ExercisesKatie Van MeterNo ratings yet

- Mgu Questions & AnswersDocument43 pagesMgu Questions & AnswersAsher SibinNo ratings yet

- Banking Co Final AccountDocument14 pagesBanking Co Final AccountRISHAB NANGIANo ratings yet

- Tax Unit 2Document70 pagesTax Unit 2avinash.as106No ratings yet

- GKJ Taxation Final (Sums)Document7 pagesGKJ Taxation Final (Sums)ankandas3498No ratings yet

- LESSON 13 Tax PAYMENT AND PROCEDURES and ASSESSEMTDocument14 pagesLESSON 13 Tax PAYMENT AND PROCEDURES and ASSESSEMTOctavius MuyungiNo ratings yet

- Tutorial 3 (Q)Document4 pagesTutorial 3 (Q)szh saNo ratings yet

- Income From SalariesDocument6 pagesIncome From Salariesmayankking404No ratings yet

- M12 Tax ActivityDocument6 pagesM12 Tax ActivityJanna RodriguezNo ratings yet

- This Study Resource WasDocument4 pagesThis Study Resource WasMarcus MonocayNo ratings yet

- Exercise Topic 2Document4 pagesExercise Topic 2TEIK LOONG KHORNo ratings yet

- Chapter-6 (Salary)Document53 pagesChapter-6 (Salary)BoRO TriAngLENo ratings yet

- SCDL - PGDBA - Finance - Sem 4 - TaxationDocument23 pagesSCDL - PGDBA - Finance - Sem 4 - Taxationapi-3762419100% (2)

- Previous Year April To June July To March 2016-17 Nil 15000 2017-18 15000 16500 2018-19 16500 18000 2019-20 18000 19500Document4 pagesPrevious Year April To June July To March 2016-17 Nil 15000 2017-18 15000 16500 2018-19 16500 18000 2019-20 18000 19500Sumit PattanaikNo ratings yet

- Module 6 Notes ReceivableDocument5 pagesModule 6 Notes ReceivableAbegail RafolsNo ratings yet

- March (Pre), 2023Document66 pagesMarch (Pre), 2023gkhyati58No ratings yet

- Revision ch3 1thDocument18 pagesRevision ch3 1thYousefNo ratings yet

- Income Tax Divyastra CH 5 Salary R 1Document49 pagesIncome Tax Divyastra CH 5 Salary R 1sumitraarayyNo ratings yet

- Amendment To: Specification For Monthly Tax Deduction (MTD) Calculations Using Computerised Calculation FORDocument42 pagesAmendment To: Specification For Monthly Tax Deduction (MTD) Calculations Using Computerised Calculation FORKen ChiaNo ratings yet

- Problems On Business/Profession Income: SEM It AssignmentDocument9 pagesProblems On Business/Profession Income: SEM It AssignmentNikhilNo ratings yet

- NOTICE OF SALARY ADJUSTMENT SampleDocument1 pageNOTICE OF SALARY ADJUSTMENT SampleLgu San Juan AbraNo ratings yet

- Acct 212 Homework 6 Chapter 23 QDocument11 pagesAcct 212 Homework 6 Chapter 23 QLucky LyNo ratings yet

- Bba - 3a Itlp Tamanna Mini Project 1Document3 pagesBba - 3a Itlp Tamanna Mini Project 1Tamanna 2020No ratings yet

- 1686044906DTS-2 Taxation CA InteranswerDocument11 pages1686044906DTS-2 Taxation CA InteranswerViraj SharmaNo ratings yet

- Questions On IAS 19Document5 pagesQuestions On IAS 19banglauserNo ratings yet

- Template - Problem 18.1Document4 pagesTemplate - Problem 18.1dragonx0662No ratings yet

- SS Q1 Test Tax317 Dec 2021Document1 pageSS Q1 Test Tax317 Dec 2021Nik Syarizal Nik MahadhirNo ratings yet

- Batch 2 Draft Question-1Document5 pagesBatch 2 Draft Question-1Somnath BhattaraiNo ratings yet

- Non-Profit Organization (Monika)Document21 pagesNon-Profit Organization (Monika)Sumit ChaudharyNo ratings yet

- Specification For Monthly Tax Deduction (MTD) Calculations Using Computerised Calculation Method ForDocument45 pagesSpecification For Monthly Tax Deduction (MTD) Calculations Using Computerised Calculation Method ForJoseph Shabin100% (1)

- Assessment 3 SolutionsDocument3 pagesAssessment 3 SolutionsMmaleema LedwabaNo ratings yet

- Exercise Chapter 3Document7 pagesExercise Chapter 3leen attilyNo ratings yet

- Paper - 4: Taxation Section A: Income Tax Law: DebitsDocument27 pagesPaper - 4: Taxation Section A: Income Tax Law: DebitsUdit KaushikNo ratings yet

- Income Tax Salary NotesDocument48 pagesIncome Tax Salary NotesTanya AntilNo ratings yet

- AC2101 Seminar 12 Employee Benefits OutlineDocument2 pagesAC2101 Seminar 12 Employee Benefits OutlinelynnNo ratings yet

- Annexure-1 Advisory On Interest Calculator in Gstr-3B: Annexure With Illustra Ve ExampleDocument5 pagesAnnexure-1 Advisory On Interest Calculator in Gstr-3B: Annexure With Illustra Ve ExamplepapuNo ratings yet

- Parliament of The Democratic Socialist Republic of Sri LankaDocument4 pagesParliament of The Democratic Socialist Republic of Sri Lankasuman_civilNo ratings yet

- Concealed Spaces: For Buildings, Code of Practice For System Design, Installation and Servicing Is Fitted in TheDocument11 pagesConcealed Spaces: For Buildings, Code of Practice For System Design, Installation and Servicing Is Fitted in Thesuman_civilNo ratings yet

- Base Shear Resistance Calculation - R1Document8 pagesBase Shear Resistance Calculation - R1suman_civilNo ratings yet

- Tata Steel Blue BookDocument60 pagesTata Steel Blue Bookvenura100% (1)

- Vertical Escape: External Walls of Protected StairwaysDocument11 pagesVertical Escape: External Walls of Protected Stairwayssuman_civilNo ratings yet

- Tritech: Tritech Consultants Pte LTDDocument2 pagesTritech: Tritech Consultants Pte LTDsuman_civilNo ratings yet

- Earth Pressure CalcDocument3 pagesEarth Pressure Calcsuman_civilNo ratings yet

- RC Beam Design To EC2Document3 pagesRC Beam Design To EC2suman_civilNo ratings yet

- Composite Beam To EC4Document1 pageComposite Beam To EC4suman_civilNo ratings yet

- Drawing ListDocument19 pagesDrawing Listsuman_civilNo ratings yet

- Lap Length and Anchorage Length To EC2Document1 pageLap Length and Anchorage Length To EC2suman_civilNo ratings yet

- Wall - Shear Rebar Design - SumanDocument2 pagesWall - Shear Rebar Design - Sumansuman_civil100% (1)

- Examining &reporting On Tenders: Arithmetical Errors These May OccurDocument4 pagesExamining &reporting On Tenders: Arithmetical Errors These May Occursuman_civil100% (1)

- Entrance B: 1008 72 CHS 559x25 (S355) 80.64 1314 72 CHS 610x28 (S355) 105.12Document2 pagesEntrance B: 1008 72 CHS 559x25 (S355) 80.64 1314 72 CHS 610x28 (S355) 105.12suman_civilNo ratings yet

- Selvan CVDocument4 pagesSelvan CVsuman_civilNo ratings yet

- Beam - Capacity Check - SumanDocument4 pagesBeam - Capacity Check - Sumansuman_civilNo ratings yet

- Maximum Lateral Deflection of Retaining Walls at SLS (In MM)Document1 pageMaximum Lateral Deflection of Retaining Walls at SLS (In MM)suman_civilNo ratings yet

- MCA-PE3 Technical Data SheetDocument10 pagesMCA-PE3 Technical Data Sheetsuman_civilNo ratings yet

- Sap2000 17.1Document1 pageSap2000 17.1suman_civilNo ratings yet

- Sneakers SolutionDocument7 pagesSneakers SolutionRamesh Singh100% (1)

- MCQ of GSTDocument23 pagesMCQ of GSTOnline tally guide100% (2)

- How To Fill AGP SlipDocument1 pageHow To Fill AGP SlipFida DoxxNo ratings yet

- Profit and Loss Statement TemplateDocument2 pagesProfit and Loss Statement TemplateAlisa VisanNo ratings yet

- Government of West Bengal GRIPS 2.0 Acknowledgement Receipt Payment SummaryDocument2 pagesGovernment of West Bengal GRIPS 2.0 Acknowledgement Receipt Payment SummaryBidhan DuttaNo ratings yet

- A Guide To ACH Payments Federal Government: On-LineDocument109 pagesA Guide To ACH Payments Federal Government: On-LinePawPaul Mccoy100% (3)

- JioDocument2 pagesJioMadhur Raj NNo ratings yet

- Aws Romp03 1142 Aarkfab EngDocument1 pageAws Romp03 1142 Aarkfab EngNAQIB METKARNo ratings yet

- Transactions-In-The-Real-Estate-Sector 2020 - PWC ReportDocument56 pagesTransactions-In-The-Real-Estate-Sector 2020 - PWC ReportNimisha GandechaNo ratings yet

- Aussie Broadband Invoice 17023569Document2 pagesAussie Broadband Invoice 17023569mdgold1mNo ratings yet

- Beypc6802h 2024Document4 pagesBeypc6802h 2024Anilkumar ChennamsettiNo ratings yet

- Sir Lectures Final TaxDocument12 pagesSir Lectures Final TaxCrystal KateNo ratings yet

- Taxation of Passed-On' GRTDocument3 pagesTaxation of Passed-On' GRTjeorgiaNo ratings yet

- AKSINDO (Mr. Ferlian), 11 - 13 Mar 2016 (NY)Document2 pagesAKSINDO (Mr. Ferlian), 11 - 13 Mar 2016 (NY)Sunarto HadiatmajaNo ratings yet

- It SiaDocument180 pagesIt Siasupriya gupta100% (1)

- SmartOLT Invoice 2022 Sep 30 SMART700035295Document1 pageSmartOLT Invoice 2022 Sep 30 SMART700035295Luis GorozpeNo ratings yet

- List of Bir Forms: Form No. Form TitleDocument2 pagesList of Bir Forms: Form No. Form Titleabc360shelleNo ratings yet

- Deepali Chhabra Goa Package 24 NovDocument3 pagesDeepali Chhabra Goa Package 24 NovRAHUL KHOSLANo ratings yet

- Account STMT XX8258 12032024Document5 pagesAccount STMT XX8258 12032024adas27380No ratings yet

- 不好用Document2 pages不好用Waifubot 2.1No ratings yet

- Unit Test-3 (Types of Plan)Document3 pagesUnit Test-3 (Types of Plan)Gemini PatelNo ratings yet

- ReportDocument1 pageReportAnthony VinceNo ratings yet

- Offer Letter - Satyabrat PDFDocument2 pagesOffer Letter - Satyabrat PDFSatyabrata RautaNo ratings yet

- Tax Quiz ReviewDocument3 pagesTax Quiz ReviewMizelle AloNo ratings yet

- Invoice: Bill To: Sold ToDocument2 pagesInvoice: Bill To: Sold ToSethuramanNo ratings yet

- Basilan Estates Inc. v. CIR and CTADocument2 pagesBasilan Estates Inc. v. CIR and CTATon Ton CananeaNo ratings yet

- Transaction TableDocument1 pageTransaction TableASHIQ HUSSAINNo ratings yet

- Form Accepted Federal 2019 PDFDocument10 pagesForm Accepted Federal 2019 PDFRandy PettersonNo ratings yet