Professional Documents

Culture Documents

Kerala +1 Accountancy Focus Area Question Bank - Introduction To Accounting

Kerala +1 Accountancy Focus Area Question Bank - Introduction To Accounting

Uploaded by

hadiyxxOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Kerala +1 Accountancy Focus Area Question Bank - Introduction To Accounting

Kerala +1 Accountancy Focus Area Question Bank - Introduction To Accounting

Uploaded by

hadiyxxCopyright:

Available Formats

FOCUS AREA BASED ON PREVIOUS AND EXPECTED QUESTIONS ,

ANSWERS OF PLUS ONE ACCOUNTANCY 2020-2021

Prepared by:

PRAKASH.P.N

9447226258,7012881563

GOVT.HSS NEDUMGOLAM

KOLLAM

Chapter 1

Introduction to Accounting

1. Explain the term accounting ? (2 scores)

Ans: Accounting is the art of recording, classifying, and summarising in a significant manner

and in terms of money, transactions and events which are, in part at least, of financial

character, and interpreting the results thereof.

2. What are the qualitative characteristics of accounting information ? (4 scores)

Ans:1.Reliability : Reliability means the users must be able to depend on the information.

Accounting information is considered to be reliable if it is free from bias and faithfully represents

the facts.

2.Relevance : The information to be relevant, it must be available in time.

3.Understandability: Understandability means decision-makers must interpret accounting

information in the same sense as it is prepared and conveyed to them.

4.Comparability: It means that the accounting reports should be comparable with other firms

to identify similarities or differences.

3. Discuss the objectives of accounting ? (4 scores)

1.Maintenance of Records of Business Transactions:

Accounting is used for the maintenance of a systematic record of all financial transactions in book

of accounts. Moreover, the recorded information enables verifiability and acts as an evidence.

2 Calculation of Profit and Loss:

The most important objective of every business is to earn profit. Accounting helps in ascertaining

profit or loss to the enterprise by preparing a profit and loss account.

3 Depiction of Financial Position

Accounting aims at ascertaining the financial position of the business concern in the form of its

assets and liabilities at the end of every accounting period.

4 Providing Accounting Information to its Users:

The accounting information generated by the accounting process is communicated in the form of

reports, statements, graphs and charts to the users who need it in different decision situations.

1 score each.

4.Find the odd one out.

a. Debtors b. Stock c. Cash d. Furniture.

Ans: d. Furniture.

5.A person who owes money to the business . Identify the person.

A. Debtor b. Creditor c. Customer d. None of these.

Ans: A. Debtor

6.Identify the intangible assets from the following.

a. Patent b. Copyright c. Goodwill d. All of them.

Ans:d. All of them

7. Which one of the following is a wasting assets ?

a. Copyright b. Goodwill c. Mines d. Preliminary expenses.

Ans: c. Mines

Prepared by PRAKASH.P.N,, Govt.HSS Nedumgolam, Kollam,9447226258,7012881563

downloaded from HSS REPORTER

8. The owner who invest money into his business.

a. Drawings b. Capital c. Profit d. Gain.

Ans: b. Capital

9. The owner who withdraw money from his business for his personal purpose. It is called..

a. Capital b. Drawings c. Profit d. None of these.

Ans:b. Drawings

10. Choose the correct one from the following.

a. Reliability b. Relevance c. Understandability d. All of them.

Ans:d. All of them.

11.Excess of income over expenses is known as....

a. Profit b. Loss c. Expenditure. d. Payments.

Ans: a. Profit

12.An obligation of business is.....

a. Assets b. Liabilities c. Expenses d. Incomes.

Ans: b. Liabilities

13. Which is the excess of expenses over revenues...

a. Profit b. Loss. c. Gain d. None of these.

Ans: b. Loss.

14. a. Tangible assets. b. Intangible assets c. Wasting Assets d. Fixed assets.

Find the odd one.

Ans: d. Fixed assets.

15. Who first published the ‘ book on Double Entry System of Accounting’?

a. Peter. F. Drucker b. Mary Parker c. Luca Pacioli d. None of these.

Ans: c. Luca Pacioli

16. Discount on issue of shares and debentures is an example of ....

a. Fictitious assets b. Wasting Assets c. Tangible Assets. d. Intangible Assets.

Ans: a. Fictitious assets

17. Purchase of machinery is an example of....

a. Capital expenditure b. Revenue expenditure c. Expenses d. None of these.

Ans:a. Capital expenditure

18. ........ is something on hand goods.

a. Debtors b. Stock c. Creditors d. None of these.

Ans: b. Stock

19. In every business transactions at least ..................parties are involved.

a. 2. b.3.c 4. d.5

Ans: a. 2

20. Which is the correct one.

a. Assets = Capital + Liabilities b. Assets= Capital -Liabilities

c. Capital = Assets+ Liabilities d. Liabilities= Assets+ capital.

Ans:a. Assets = Capital + Liabilities

21. Which is the language of business transaction.

a. Communication b. Accounting c. Management d. Society.

Ans:b. Accounting

22. Business sold goods to Kasi on credit. Kasi is the ........ of the business.

Ans: Debtor

23. Pick out the wrong pair.

a. Land, Building b. Cash, Stock c. Debtors, machinery d. Copyright, Patent.

Ans: c. Debtors, machinery

24. Note books purchased by a stationery shop comes under

a. Assets b,. Income c. Purchase d. Liabilities.

Ans: c. Purchase

Prepared by PRAKASH.P.N,, Govt.HSS Nedumgolam, Kollam,9447226258,7012881563

downloaded from HSS REPORTER

25.Choose the correct sequences

1. Identifying, Recording, Classifying, Summarising

2. Identifying, Recording, Summarising, Classifying

3. Recording, Summarising, Classifying, Identifying

4. Identifying, Classifying, Recording, Summarising

Ans:1. Identifying, Recording, Classifying, Summarising

26.Which one of the following is NOT a fixed asset?

a) Goodwill . b) Stock of goods . c) Furniture. d) Land.

Ans: b) Stock of goods

27...........is an example of current asset.

(a) Furniture (b) Building (c) Debtors (d) Land.

Ans:(c) Debtors

28.” Accounting is the post mortem survey”. Do you agree? Justify your answer ?

Ans: Yes. It is basically financial post mortem analysis of past events.

29.Mention the name of the value of goods remaining unsold at the end of an accounting

period ?

Ans: Closing Stock

30.Assets-Liabilities=...........

Ans: Capital

31.Identify the type of expenditure for paying salary.

Ans: Revenue Expenditure

32.Quarries is the examples of...... .....asset.

a)Tangible Assets(b)Intangible Assets(c) Wasting Assets(d) Fictitious assets.

Ans: (c) Wasting Assets

33.Identity the asset held for long term use in the business.

Ans: Fixed Asset

34.Find the odd one out and state reason.

(a) Sundry Creditors (b) Bills Payable (c) Overdraft (d) Debentures.

Ans:(d) Debentures.

35. .........is an example of fixed Asset.

(a) Sundry debtors (b) Machinery (c) Bills Receivable(d) Cash at Bank

Ans:(b) Machinery

36. Income received in advance is .......

a) Income (b)Expense (c) Asset (d)Liability.

Ans:(d)Liability.

37.Classify the following Assets under appropriate heads.

(a) Cash (b) Debtors (c) Machinery (d) Land.

Ans: cash- Current Asset.

Debtors- current Asset.

Machinery- Fixed Asset.

Land- Fixed Asset.

38.Complete the series based on the hint given.

Tangible asset. ..... Building

a) Intangible asset ....... ?

ans. Goodwill/ Trade mark/ copyright

b) Fictitious asset ....... ?

ans. Preliminary Expenses, /Discount issue of shares or debentures

39,Find the odd one out and state.

(a) Goodwill (b) Copyright (c) Machinery (d) Trade Mark.

Ans: (c) Machinery

Prepared by PRAKASH.P.N,, Govt.HSS Nedumgolam, Kollam,9447226258,7012881563

downloaded from HSS REPORTER

40.Classify the following into Capital expenditure and Revenue expenditure.

a) Salary paid b) Machinery purchased c) Wages paid c) Computer purchased.

a) Salary paid -- Revenue Expenditure

b) Machinery purchased – Capital expenditure.

c. Wages paid -Revenue Expenditure.

c) Computer purchased.-Capital expenditure.

41 Match the following

Goodwill Wasting assets

Debtors Intangible asset

Oil fields Tangible asset

Building Current assets

Ans: Goodwill- Intangible asset

Debtors- Current assets

Oil fields- Wasting assets

Building - Tangible asset

42.Which one of the following is not a business transaction?

a) Bought motorcar for business ₹ 100000

b) Paid employee's salary ₹ 1000

c) Paid son's fees from his personal account ₹ 2000.

d) Paid son's fees from business ₹ 2000.

Ans: c) Paid son's fees from his personal account ₹ 2000.

43. Find the odd one among the given users of accounting information.

a. Managers b. Creditors c. Tax Authorities d. Labour Unions.

Ans:a. Managers

44. Suresh advanced 3 months salary to an employee of his firm. This advance salary is

a. Revenue expenses b. Capital expenses c. Current Asset d. Current Liabilities.

Ans: c. Current Asset.

45. Goods or cash withdraw by the proprietor is debited to ..........account.

a. Cash b. Cash or Goods c. Drawings d. Purchase.

Ans: c. Drawings

46. The amount earned by a business concern through sale of its products or providing

services to customers is called...

a. Revenue b. Expenses c. Capital d. Interest.

Ans:a. Revenue

47. ...... reduces the capital of owners.

a. Asset purchased b. Goods purchased c. Drawings d. Expenses.

Ans: c. Drawings

48. The proprietor of a furniture shop took a dinning table from his shop for homely use. In

which this transaction is recorded.

a. Drawings b. Purchase c. Sales d. Expenses.

Ans:a. Drawings

Prepared by PRAKASH.P.N,, Govt.HSS Nedumgolam, Kollam,9447226258,7012881563

downloaded from HSS REPORTER

49 Explain the term current asset and current liabilities. ?

Ans:a) Current assets:

Current assets are those assets which can be converted in to cash within a short period. ie.

within one year.

Ans:a)Current Liabilities: These are liabilities which become due and payable within a short

time (within one year).

50.The assets which can be converted into cash within a period of one year. What are they?

Ans: Current Asset.

51.Complete the diagram from the hint given below:

?

Stock in trade

Current Assets

?

?

?

Ans: Current Assets. , Debtors, Cash in hand,Cash at bank, Bills receivable , etc.

52.Classify the following assets under appropriate heads.

a. cash -?

Ans. Current Asset

b. Machinery -?

Ans. Fixed Asset

c. Land -?

Ans. Fixed Asset

d. Stock -?

Ans. Current Asset.

53. The person to whom the business owes money . Who is this ?

Ans: Creditor.

54. Complete the series based on the hint below.

Hint: Good will-- Intangible Asset.

a. Underwriting commission --?

Ans: Fictitious Assets.

b. Cash in hand--?

Ans:Current assets.

55. Classify the assets into current assets and non-current assets.

Current investment, Fixed Assets, Non-current investment, Inventories, Deferred Tax Assets,

Long term loans and advances, short term loans and advances, Trade Receivable , Prepaid

Income, Debtors.

Current Assets:

Current investment, Inventories, short term loans and advances,Trade Receivable , Prepaid

Income, Debtors.

Non-current assets.

Fixed Assets,Non-current investment, Deferred Tax Assets, Long term loans and advances,

56. Goods returned by the buyer due to breakage in transits...

Ans: Sales Return / Return inward.

57. Goods sold for cash and credit.........

Ans: Sales.

Prepared by PRAKASH.P.N,, Govt.HSS Nedumgolam, Kollam,9447226258,7012881563

downloaded from HSS REPORTER

downloaded from HSS REPORTER

You might also like

- Business Plan For Juan A Drink PDFDocument17 pagesBusiness Plan For Juan A Drink PDFMaria Jane MoyanoNo ratings yet

- Accounting 1101 Midterm Examination 100 PointsDocument7 pagesAccounting 1101 Midterm Examination 100 PointsRhaizel HernandezNo ratings yet

- REVIEWERDocument9 pagesREVIEWERHanns Lexter PadillaNo ratings yet

- FABM 1-Exam Fourth QuarterDocument3 pagesFABM 1-Exam Fourth QuarterRaul Cabanting100% (1)

- Lyconet Compensation Plan UsDocument21 pagesLyconet Compensation Plan UsAlexLogothetis80% (5)

- BP Plastic, AnalysisDocument5 pagesBP Plastic, AnalysisChiaki HidayahNo ratings yet

- Strategic Management of Southeast Bank LimitedDocument32 pagesStrategic Management of Southeast Bank LimitediqbalNo ratings yet

- 14UCO130201Document29 pages14UCO130201Fawaz FazilNo ratings yet

- Kerala +1 Accountancy Focus Area Question Bank - Theory Base of AccountingDocument7 pagesKerala +1 Accountancy Focus Area Question Bank - Theory Base of AccountinghadiyxxNo ratings yet

- Class 11 Chapter Wise Questions AccountancyDocument41 pagesClass 11 Chapter Wise Questions AccountancyAkhilesh MaheshwariNo ratings yet

- Midterms Q3 FABM1Document10 pagesMidterms Q3 FABM1Emerita MercadoNo ratings yet

- Plus One Question BankDocument38 pagesPlus One Question Bankstuntallen21No ratings yet

- Financial Accounting - MCQ'S For PracticeDocument8 pagesFinancial Accounting - MCQ'S For Practiceprathampawar5912No ratings yet

- AccountingDocument290 pagesAccountingNibash KumuraNo ratings yet

- Accounting Equation MCQDocument8 pagesAccounting Equation MCQKulNo ratings yet

- Financial and Management AccountingDocument27 pagesFinancial and Management AccountingSoumendra Roy100% (1)

- Fabm 1 Test QDocument7 pagesFabm 1 Test QJemimah CorporalNo ratings yet

- Accounting1s IstqtrexamDocument3 pagesAccounting1s IstqtrexamJessa BeloyNo ratings yet

- Ex-08 - Comprehensive Review 2.0Document14 pagesEx-08 - Comprehensive Review 2.0Jedidiah Smith0% (1)

- Accounting Equation - ADFMADocument6 pagesAccounting Equation - ADFMAMahima SheromiNo ratings yet

- Accounting MCQsDocument12 pagesAccounting MCQsLaraib AliNo ratings yet

- 1 Pu Accountancy Theory Notes-2Document48 pages1 Pu Accountancy Theory Notes-2yashwanthnyashu00No ratings yet

- Eco MCQDocument9 pagesEco MCQthis.is.goldensnowflakesNo ratings yet

- Sample Quiz Question 3Document7 pagesSample Quiz Question 3Sonam Dema DorjiNo ratings yet

- AC 501 (Pre-Mid)Document3 pagesAC 501 (Pre-Mid)RodNo ratings yet

- Basic Accounting ReviewerDocument4 pagesBasic Accounting ReviewerColeen Del RosarioNo ratings yet

- Fundamentals of Accountancy, Business & Management 1 Second Grading ExaminationDocument6 pagesFundamentals of Accountancy, Business & Management 1 Second Grading ExaminationMc Clent CervantesNo ratings yet

- Diagnostic Test FABM 1Document2 pagesDiagnostic Test FABM 1Marjorie BadiolaNo ratings yet

- At 7Document9 pagesAt 7Leah Jane Tablante Esguerra100% (1)

- Mid Term Break HomeworkDocument10 pagesMid Term Break Homeworknurfa061No ratings yet

- Examination Paper: Instruction To CandidatesDocument11 pagesExamination Paper: Instruction To CandidatesNikesh MunankarmiNo ratings yet

- Test Bank For CH1 - CH2Document15 pagesTest Bank For CH1 - CH2passemmoresNo ratings yet

- Mcqs 103 Business AccountingDocument8 pagesMcqs 103 Business AccountingMOLALIGNNo ratings yet

- Quiz On RizalDocument14 pagesQuiz On RizalYorinNo ratings yet

- Tutorial - Introduction To Financial AccountingDocument10 pagesTutorial - Introduction To Financial Accountingnurfa061No ratings yet

- 101 MA (Account) Heavy Merge 3032 Pages (Sppu - Mba)Document3,032 pages101 MA (Account) Heavy Merge 3032 Pages (Sppu - Mba)Adwait BowlekarNo ratings yet

- Exam Fabm1Document3 pagesExam Fabm1Mark Gil GuillermoNo ratings yet

- AC503 - Finals Reviewer 2Document10 pagesAC503 - Finals Reviewer 2Ashley Levy San PedroNo ratings yet

- 1Document42 pages1Magdy KamelNo ratings yet

- Cfas Mock Test PDFDocument71 pagesCfas Mock Test PDFRose Dumadaug50% (2)

- Basic Accounting: Multiple ChoiceDocument38 pagesBasic Accounting: Multiple ChoiceErika GambolNo ratings yet

- Question Bank - Multiple Choice Questions (MCQS) : Unit 1: Financial AccountingDocument34 pagesQuestion Bank - Multiple Choice Questions (MCQS) : Unit 1: Financial AccountingMonojit kunduNo ratings yet

- Class 11 BSTDocument4 pagesClass 11 BSTnizamkhan9616No ratings yet

- Accounting ReviewerDocument6 pagesAccounting ReviewerHarry EvangelistaNo ratings yet

- 11th - ACCOUNTANCY - PUBLIC EXAM MARCH-2023 ANSWER KEY (EM)Document17 pages11th - ACCOUNTANCY - PUBLIC EXAM MARCH-2023 ANSWER KEY (EM)nishvanprabhuNo ratings yet

- Foundation May 2018Document140 pagesFoundation May 2018multenplanintegratedltdNo ratings yet

- Accountancy Extra PointsDocument14 pagesAccountancy Extra PointsRishav KuriNo ratings yet

- Comprehensive 1Document44 pagesComprehensive 1Alan RajNo ratings yet

- Acct 3351Document10 pagesAcct 3351RedWolf PopeNo ratings yet

- First Quarter Assessment in FABM2Document4 pagesFirst Quarter Assessment in FABM2Nhelben ManuelNo ratings yet

- 1ST Exam Fabm1Document3 pages1ST Exam Fabm1rose gabonNo ratings yet

- Exam 1 PDFDocument4 pagesExam 1 PDFFiraa'ool YusufNo ratings yet

- Exam 1 PDFDocument4 pagesExam 1 PDFFiraa'ool YusufNo ratings yet

- Amoni Edome Coc Sample Exam-Level LLLDocument13 pagesAmoni Edome Coc Sample Exam-Level LLLAmoni EdomeNo ratings yet

- 26u9ofk7l - FAR - FINAL EXAMDocument18 pages26u9ofk7l - FAR - FINAL EXAMLyra Mae De BotonNo ratings yet

- ACCOUNTING REVIEW PrelimDocument32 pagesACCOUNTING REVIEW PrelimMaria Isabel FermocilNo ratings yet

- Activity No. 1 CA 2022 Financial Accounting and Reepeorting Far PCVDocument8 pagesActivity No. 1 CA 2022 Financial Accounting and Reepeorting Far PCVPrecious mae BarrientosNo ratings yet

- Jawaban Answer Question Buku Akuntansi KiesoDocument3 pagesJawaban Answer Question Buku Akuntansi Kiesodutaardian100% (1)

- TQ-FABM1 2nd Q 2023Document4 pagesTQ-FABM1 2nd Q 2023Evelyn Dionisio MabutiNo ratings yet

- One and Two Marks Answers PDFDocument48 pagesOne and Two Marks Answers PDFsharkulNo ratings yet

- MCQ 101 MaDocument37 pagesMCQ 101 MaRishabh TiwariNo ratings yet

- A152 Bkal 1013 Midsem Exam QDocument10 pagesA152 Bkal 1013 Midsem Exam QHeap Ke XinNo ratings yet

- MCQs Financial AccountingDocument30 pagesMCQs Financial AccountingMehboob Ul-haq100% (1)

- Cambridge Made a Cake Walk: IGCSE Accounting theory- exam style questions and answersFrom EverandCambridge Made a Cake Walk: IGCSE Accounting theory- exam style questions and answersRating: 2 out of 5 stars2/5 (4)

- Accountancy Chapter 1 Introduction To Accounting Aesthetic NotesDocument12 pagesAccountancy Chapter 1 Introduction To Accounting Aesthetic NoteshadiyxxNo ratings yet

- Plus One Accountancy With CA Focus Area-2021 Notes & Expected Q&AsDocument140 pagesPlus One Accountancy With CA Focus Area-2021 Notes & Expected Q&Ashadiyxx100% (1)

- Biology Answer Key EM SSLC Exam 2020 by RIYAS Sir PPMHSS KOTTUKKARADocument3 pagesBiology Answer Key EM SSLC Exam 2020 by RIYAS Sir PPMHSS KOTTUKKARAhadiyxxNo ratings yet

- BIOLOGY Answer Key English Medium SSLC March 2019 by A+ EducareDocument5 pagesBIOLOGY Answer Key English Medium SSLC March 2019 by A+ EducarehadiyxxNo ratings yet

- Kerala Plus One Accountancy Chapter Wise Previous Questions and Answers Chapter 1 Introduction To AccountingDocument10 pagesKerala Plus One Accountancy Chapter Wise Previous Questions and Answers Chapter 1 Introduction To AccountinghadiyxxNo ratings yet

- Kerala SSLC March 2015 Previous Year Question Paper - Social Science - English MediumDocument4 pagesKerala SSLC March 2015 Previous Year Question Paper - Social Science - English MediumhadiyxxNo ratings yet

- BIOLOGY Answer Key (EM) Kerala SSLC Second Term Christmas Exam Dec 2019Document4 pagesBIOLOGY Answer Key (EM) Kerala SSLC Second Term Christmas Exam Dec 2019hadiyxxNo ratings yet

- Sheniblog-10 Biology (Eng Med) Revision Notes by Rasheed OdakkalDocument14 pagesSheniblog-10 Biology (Eng Med) Revision Notes by Rasheed OdakkalhadiyxxNo ratings yet

- A+ Blog - SSLC - Model Theory Questions - 2023 - emDocument37 pagesA+ Blog - SSLC - Model Theory Questions - 2023 - emhadiyxxNo ratings yet

- Sheniblog-Eqip-Question Pool 2023-Biology-EmDocument58 pagesSheniblog-Eqip-Question Pool 2023-Biology-EmhadiyxxNo ratings yet

- UntitledDocument4 pagesUntitledhadiyxxNo ratings yet

- First Terminal Examination 2019-20: PhysicsDocument3 pagesFirst Terminal Examination 2019-20: PhysicshadiyxxNo ratings yet

- The Model School AbudhabiDocument5 pagesThe Model School AbudhabihadiyxxNo ratings yet

- UntitledDocument8 pagesUntitledhadiyxxNo ratings yet

- SSLC Model Examination, February-2020: PhysicsDocument3 pagesSSLC Model Examination, February-2020: PhysicshadiyxxNo ratings yet

- SSLC Pre Model Examination - 2023: ChemistryDocument2 pagesSSLC Pre Model Examination - 2023: ChemistryhadiyxxNo ratings yet

- Purisima v. Philippine Tobacco Institute, Inc.Document2 pagesPurisima v. Philippine Tobacco Institute, Inc.Charmila Siplon50% (2)

- Letter Backing Jere HochmanDocument1 pageLetter Backing Jere HochmantauchterlonieDVNo ratings yet

- Excise Tax On CosmeticsDocument8 pagesExcise Tax On CosmeticsCaroline Claire BaricNo ratings yet

- JD & MainDocument2 pagesJD & MainSourabh Sharma100% (1)

- SAMPLE HOURLY: Personnel Activity Report (Time & Effort Report)Document1 pageSAMPLE HOURLY: Personnel Activity Report (Time & Effort Report)phaser2k10No ratings yet

- Mayor & SB Members: Powers, Duties &functionsDocument44 pagesMayor & SB Members: Powers, Duties &functionsJuan Paolo S. Brosas100% (1)

- Individual TaxationDocument38 pagesIndividual TaxationannyeongchinguNo ratings yet

- Course Outline FINA0601Document4 pagesCourse Outline FINA0601Kevin YauNo ratings yet

- BNM Takaful Operational Framework 2019Document29 pagesBNM Takaful Operational Framework 2019YEW OI THIMNo ratings yet

- W-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageW-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)nhat duy leNo ratings yet

- Engineering EconomicsDocument12 pagesEngineering EconomicsAngel SakuraNo ratings yet

- Should Darden Invest With UVUMCO Case StudyDocument2 pagesShould Darden Invest With UVUMCO Case StudysufyanNo ratings yet

- SEC V Chris Faulkner Aka Frack MasterDocument63 pagesSEC V Chris Faulkner Aka Frack MasterSharon WilsonNo ratings yet

- Result FileDocument42 pagesResult Fileclaudio pizziniNo ratings yet

- Company Valuation MethodsDocument20 pagesCompany Valuation MethodsKlaus LaurNo ratings yet

- Makati Leasing V WeareverDocument1 pageMakati Leasing V WeareverNaomi Quimpo100% (1)

- CUNY Standard Verification WorksheetDocument3 pagesCUNY Standard Verification Worksheethicu0No ratings yet

- Usury and Unconscionable Interest RatesDocument6 pagesUsury and Unconscionable Interest RatesClauds GadzzNo ratings yet

- The Timing of Asset Sales and Earnings MDocument8 pagesThe Timing of Asset Sales and Earnings MRizqullazid MufiddinNo ratings yet

- Assessor Ref ManualDocument133 pagesAssessor Ref ManualchidseymattNo ratings yet

- Troika Moot Court PetitionerDocument16 pagesTroika Moot Court PetitionerVishal MandalNo ratings yet

- Nyse Aan 2005Document48 pagesNyse Aan 2005gaja babaNo ratings yet

- Sublease FormatDocument6 pagesSublease FormatNan MallNo ratings yet

- Examination-Ttedin Idl AlpDocument16 pagesExamination-Ttedin Idl AlpZaher SharafNo ratings yet

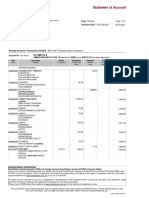

- Statement of Account: No 48L Lorong 5 Jalan Nong Chik Nong Chik Heights Johor Bahru 80100 JOHOR, JOHORDocument2 pagesStatement of Account: No 48L Lorong 5 Jalan Nong Chik Nong Chik Heights Johor Bahru 80100 JOHOR, JOHORFake PopcornNo ratings yet

- Invitation To Bid: General GuidelinesDocument25 pagesInvitation To Bid: General GuidelinesHerbert HernandezNo ratings yet