Professional Documents

Culture Documents

Chapter Ten: Short-Term Finance - Working Capital: Questions

Chapter Ten: Short-Term Finance - Working Capital: Questions

Uploaded by

R and R wweCopyright:

Available Formats

You might also like

- CB Chapter 16Document4 pagesCB Chapter 16Sim Pei YingNo ratings yet

- AC1025 Mock Exam Comm 2017Document17 pagesAC1025 Mock Exam Comm 2017Nghia Tuan NghiaNo ratings yet

- 1 Problem Set 1Document6 pages1 Problem Set 1Kazi MohasinNo ratings yet

- Cash and ReceivablesDocument30 pagesCash and ReceivablesAira Mae Hernandez CabaNo ratings yet

- Financial MGMT CH 8Document23 pagesFinancial MGMT CH 8ChrisNo ratings yet

- Solutions Manual: Introducing Corporate Finance 2eDocument9 pagesSolutions Manual: Introducing Corporate Finance 2eMane Scal JayNo ratings yet

- Receivables - Addtl ConceptsDocument6 pagesReceivables - Addtl ConceptsXiena100% (4)

- Jones Electrical DistributionDocument6 pagesJones Electrical DistributionChris Mlincsek67% (3)

- Practice Final 2 FinanceDocument13 pagesPractice Final 2 Financedscgool1232No ratings yet

- COMM 229 Notes Chapter 4Document4 pagesCOMM 229 Notes Chapter 4Cody ClinkardNo ratings yet

- Debt Practice ProblemsDocument11 pagesDebt Practice ProblemsmikeNo ratings yet

- Final Exam Preparation Results: Answer All Questions in Part 1 and One of The Two Problems inDocument8 pagesFinal Exam Preparation Results: Answer All Questions in Part 1 and One of The Two Problems insafiqulislamNo ratings yet

- Final Exam Preparation Results: Answer All Questions in Part 1 and One of The Two Problems inDocument8 pagesFinal Exam Preparation Results: Answer All Questions in Part 1 and One of The Two Problems insafiqulislamNo ratings yet

- 2022 ND - FM Suggested AnswerDocument10 pages2022 ND - FM Suggested Answermiradvance studyNo ratings yet

- Assignment1 SolutionDocument6 pagesAssignment1 SolutionAnonymous dpWU6H5Lx2No ratings yet

- Fin Exam ADocument14 pagesFin Exam AtahaalkibsiNo ratings yet

- 21 Problems For CB NewDocument31 pages21 Problems For CB NewNguyễn Thảo MyNo ratings yet

- Week 7 Home Work ProblemDocument3 pagesWeek 7 Home Work ProblemSandip AgarwalNo ratings yet

- CH17Document7 pagesCH17mnbzxcpoiqweNo ratings yet

- Accounts Receivables and Payables A&BDocument9 pagesAccounts Receivables and Payables A&BAb PiousNo ratings yet

- 2019 Exam - Moed A - Computer Science - (Solution)Document11 pages2019 Exam - Moed A - Computer Science - (Solution)adoNo ratings yet

- Particulars Amount Amount Rs. (DR.) Rs. (DR.)Document14 pagesParticulars Amount Amount Rs. (DR.) Rs. (DR.)Alka DwivediNo ratings yet

- MVJUSTINIANI - BAFACR16 - INTERIM ASSESSMENT 1 - 3T - AY2022 23 With Answer KeysDocument4 pagesMVJUSTINIANI - BAFACR16 - INTERIM ASSESSMENT 1 - 3T - AY2022 23 With Answer KeysDe Gala ShailynNo ratings yet

- Exercises of Cash Liquidity ManagementDocument8 pagesExercises of Cash Liquidity ManagementTâm ThuNo ratings yet

- Financial Analyst G&M - Real Estate Test & Case Study (SUMAN SAURABH)Document24 pagesFinancial Analyst G&M - Real Estate Test & Case Study (SUMAN SAURABH)sourabh sinhaNo ratings yet

- Acctg 115 - CH 10 SolutionsDocument22 pagesAcctg 115 - CH 10 SolutionschinmusicianNo ratings yet

- CB Chapter 13 AnswerDocument2 pagesCB Chapter 13 AnswerSim Pei YingNo ratings yet

- Required: Using These Data, Construct The December 31, Year 5 Balance Sheet For Your AnalysisDocument3 pagesRequired: Using These Data, Construct The December 31, Year 5 Balance Sheet For Your AnalysisJARED DARREN ONGNo ratings yet

- PV ProblemsDocument3 pagesPV ProblemsStephen VolkertNo ratings yet

- Long-Term Debt FinancingDocument53 pagesLong-Term Debt FinancingGaluh Boga KuswaraNo ratings yet

- Review Questions - 1Document3 pagesReview Questions - 1nlNo ratings yet

- Exercise Week 2 - Cash and ReceivablesDocument4 pagesExercise Week 2 - Cash and Receivablesnatasha karyadiNo ratings yet

- CH 10Document3 pagesCH 10pablozhang1226No ratings yet

- Assignment Chap17 - WINDOWDocument6 pagesAssignment Chap17 - WINDOWAimee EemiaNo ratings yet

- Receivables ExercisesDocument5 pagesReceivables ExercisesChrystelle Gail LiNo ratings yet

- Accounting Chapter 10Document11 pagesAccounting Chapter 10Andrew ChouNo ratings yet

- Fin Exam 1Document14 pagesFin Exam 1tahaalkibsiNo ratings yet

- Financial Management: Section 1Document10 pagesFinancial Management: Section 1Hibernation PetersonNo ratings yet

- A'lla Zahwa Andewi Nugraheni - 464977 - Tugas FM CH 16 & 19Document7 pagesA'lla Zahwa Andewi Nugraheni - 464977 - Tugas FM CH 16 & 19PRA MBANo ratings yet

- DD The Superior College Lahore: InstructionsDocument3 pagesDD The Superior College Lahore: Instructionsmehzil haseebNo ratings yet

- Accounting For Liabilities: Learning ObjectivesDocument39 pagesAccounting For Liabilities: Learning ObjectivesJune KooNo ratings yet

- 21 Problems For CBDocument10 pages21 Problems For CBNguyễn QuỳnhNo ratings yet

- 21 Problems For CBDocument10 pages21 Problems For CBThu HòaiNo ratings yet

- Chapter 2: Current Liabilities, Provisions, and ContingenciesDocument14 pagesChapter 2: Current Liabilities, Provisions, and ContingenciesGirma NegashNo ratings yet

- On June 1 AcctDocument5 pagesOn June 1 AcctMelody Bautista100% (1)

- 3311 Class 11 GSDocument19 pages3311 Class 11 GSkatharine1981100% (2)

- Chapter1 Current Liab, Prov & ContengeciesDocument51 pagesChapter1 Current Liab, Prov & Contengeciessamuel hailuNo ratings yet

- Chapter 14Document4 pagesChapter 14ks1043210No ratings yet

- Financial Analyst G&M - Real Estate Test & Case StudyDocument19 pagesFinancial Analyst G&M - Real Estate Test & Case StudyDhruv ShahNo ratings yet

- Solution: Mcgriff Dog Food CompanyDocument6 pagesSolution: Mcgriff Dog Food CompanyAnna CharlotteNo ratings yet

- 12Document8 pages12Ishaq EssaNo ratings yet

- 13lecture13workingcapitalmanagement PDFDocument10 pages13lecture13workingcapitalmanagement PDFMurali VadiveluNo ratings yet

- Quiz 2 AuditingDocument18 pagesQuiz 2 Auditingaldrin elsisuraNo ratings yet

- CMA B4.7 Bank LoansDocument13 pagesCMA B4.7 Bank LoansZeinabNo ratings yet

- Finance SolutionsDocument16 pagesFinance SolutionsmhussainNo ratings yet

- Building Wealth on a Dime: Finding your Financial FreedomFrom EverandBuilding Wealth on a Dime: Finding your Financial FreedomNo ratings yet

- ch15 Non-Current LiabilitiesDocument66 pagesch15 Non-Current LiabilitiesDesain KPPN KPHNo ratings yet

- Amer Shareef ResumeDocument2 pagesAmer Shareef Resumeamershareef337No ratings yet

- A Comparative Analysis of Financial Performance of Nepal SBI Bank Limited, Himalayan Bank Limited and Kumari Bank LimitedDocument131 pagesA Comparative Analysis of Financial Performance of Nepal SBI Bank Limited, Himalayan Bank Limited and Kumari Bank LimitedBijaya DhakalNo ratings yet

- Philippine Commercial International Bank v. Court of Appeals, G.R. No. 121413 January 29, 2001Document23 pagesPhilippine Commercial International Bank v. Court of Appeals, G.R. No. 121413 January 29, 2001Krister VallenteNo ratings yet

- Motorola Premium Model Store ListDocument17 pagesMotorola Premium Model Store ListSandeep SharmaNo ratings yet

- NHTM Ch3Document19 pagesNHTM Ch3jnaxx27No ratings yet

- Design AP Process Definition Document 1.2Document93 pagesDesign AP Process Definition Document 1.2Saq IbNo ratings yet

- BSP Functions, Roles and Sources of Funds BSP FunctionsDocument2 pagesBSP Functions, Roles and Sources of Funds BSP FunctionsAlice StarNo ratings yet

- Table of Content: Schedule of Bank Charges (Exclusive of FED)Document30 pagesTable of Content: Schedule of Bank Charges (Exclusive of FED)ahsanNo ratings yet

- Jefferson Parish Legals: Parish & City Officials Directory of Parish & City OfficialsDocument5 pagesJefferson Parish Legals: Parish & City Officials Directory of Parish & City Officialstheadvocate.comNo ratings yet

- Financial ServicesDocument23 pagesFinancial ServicesFarah Ain Sidi Hamat100% (1)

- Non Performing Assets A Study of Shree Warana Co Operative Bank Ltd. WarananagarDocument4 pagesNon Performing Assets A Study of Shree Warana Co Operative Bank Ltd. WarananagarEditor IJTSRDNo ratings yet

- The Comparative Study of Credit Policy and Its Implementation of Nabil Bank, Everest Bank and Nic Bank"Document124 pagesThe Comparative Study of Credit Policy and Its Implementation of Nabil Bank, Everest Bank and Nic Bank"Bijaya DhakalNo ratings yet

- AccntsDocument24 pagesAccntsAngel SweetNo ratings yet

- Pauline 1. Application FormDocument3 pagesPauline 1. Application FormMaria Reylan GarciaNo ratings yet

- Fdi Notes 3Document121 pagesFdi Notes 3Nikki KumariNo ratings yet

- Ursa Minor-Course CurriculumDocument14 pagesUrsa Minor-Course CurriculumArvi SunNo ratings yet

- Dubai Islamic Bank Pakistan Internal Auditing DepartmentDocument18 pagesDubai Islamic Bank Pakistan Internal Auditing DepartmentMuqadam Ali100% (1)

- Cipla-I 4/4/2018 13:45 565.55 NEUTRAL 567.34 Cnxit-I 4/4/2018 12:30 12620 SELL MODE 12634.93Document8 pagesCipla-I 4/4/2018 13:45 565.55 NEUTRAL 567.34 Cnxit-I 4/4/2018 12:30 12620 SELL MODE 12634.93dewanibipinNo ratings yet

- Financial Market PDFDocument64 pagesFinancial Market PDFsnehachandan91No ratings yet

- Format For Financial StatementDocument3 pagesFormat For Financial StatementmmasalekNo ratings yet

- Resume of - MD Raziul Haque 09-05-2016Document2 pagesResume of - MD Raziul Haque 09-05-2016Siddique SiddNo ratings yet

- Baft Cdcs Flyer Final 10 13 16 PDFDocument2 pagesBaft Cdcs Flyer Final 10 13 16 PDFDileep310No ratings yet

- A Saint in The Board Room Book Cover (Hardbound)Document1 pageA Saint in The Board Room Book Cover (Hardbound)vijay999No ratings yet

- Sir Syed Institute of Sciences and CommerceDocument3 pagesSir Syed Institute of Sciences and CommerceMian Hidayat ShahNo ratings yet

- Fintech and The Banking Sector in Sub Saharan Africa Case of CameroonDocument119 pagesFintech and The Banking Sector in Sub Saharan Africa Case of CameroonalexiaNo ratings yet

- NBFC Module 2 CompletedDocument27 pagesNBFC Module 2 CompletedAneesha AkhilNo ratings yet

- IL&FSDocument14 pagesIL&FSKavita BagewadiNo ratings yet

- Estatement-202304 20230504055631Document4 pagesEstatement-202304 20230504055631Abu SaiNo ratings yet

Chapter Ten: Short-Term Finance - Working Capital: Questions

Chapter Ten: Short-Term Finance - Working Capital: Questions

Uploaded by

R and R wweOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter Ten: Short-Term Finance - Working Capital: Questions

Chapter Ten: Short-Term Finance - Working Capital: Questions

Uploaded by

R and R wweCopyright:

Available Formats

Chapter Ten: Short-term finance — working capital

Questions

10.2 What is the trade-off that a financial manager must juggle in deciding on

the most appropriate level of working capital?

Having sufficient working capital but minimising the cost. Having more may be easily

arranged, but almost certainly will reduce the return on investors’ funds.

10.3 How can having excessive working capital reduce the profitability of the

firm?

Cash and inventory are essential to many firms and debtors allow increases in sales

that otherwise would not be made. However, excess cash has an opportunity cost,

excess stock increases costs and too high a debtor level can mean the firm is pushing

for sales to potentially risky clients. Hence all areas of working capital is allowed to

become excessive can increase costs and reduce profits.

10.4 Explain the apparent paradox that the excessive use of short-term funds

could increase the risk of illiquidity for a firm.

Short-term debt must be repaid more often, so funds must be available at those times

to repay the debt easily. If it is not available, the firm faces illiquidity and may have to

try to raise funds quickly and expensively.

10.11 Temporary assets should be funded with temporary sources of funding.

Why?

To match repayment needs with the liquidation of the assets

10.20 Explain the differences between factoring and discounting invoices.

Factoring means the debts are sold to another party which takes over the collection

role; discounting means the debts are used as security for a loan and the issuer of the

invoices continues to collect the proceeds.

Financial Problems

10.1 David Pride Fashions has an overdraft account at its bank with a limit of

$100 000. Interest is charged at the rate of 11.25% p.a. on daily balance,

debited monthly. The balance remains at $26 833.25 O/D for 7 days and

© John Wiley and Sons Australia, Ltd 2008 10.1

Introducing Corporate Finance 2e Solutions Manual

then falls to $55 800.02 O/D for the remaining 23 days in the month. What

is the monthly interest expense?

$26 833.25 × .000308219 × 7 = $57.89

$55 800.02 × .000308219 × 23 = $395.57

Total = $453.46

10.2 Georg Zeller is a conservative chief financial officer. He often over-

estimates the need for cash in his firm. The internal auditor has just

reported to the board that Georg kept $250 000 more in the current

account than was necessary for a particular 6 months period. Funds in

the current account earned 0.25% while funds in the almost risk-free

short-term money market earned 5.25%. The internal audit reported a

cost to the firm post-tax through this action. What amount would you

report to the board as the cost? Would it be pre- or post-tax?

Opportunity interest cost = 5%. Interest lost = $6250 pre-tax or $4375 after-tax.

10.9 Bill Smith Sportstore has funds to invest for a short period. Bill, the

owner, approaches his bank and finds he can lend funds to other

businesses for short periods via the bank-accepted bill medium. Bill is

happy that there is little risk with the bank acceptance of the security. Bill

pays over the funds to finance a $100 000 commercial bills for 180 days at

6.3% yield. How much does Bill pay to the bank? How much will Bill be

repaid at the end of the period?

100 000

P=

(1+0. 063×180 ) 100 000

365 = 1 .0311 = $96 983.80

Repayment = $100 000

10.15 Ace Discounters buy $600 000 of invoices for a 4.3% fee. Ace collects 90%

of the debts in 30 days and 10% in 61 days. If funds cost Ace 6.0% p.a.

and assuming the costs of collecting the debts amount to 2% of face value

per month for debts collected within 30 days and 3% of face value per

month for debts collected within 2 months. Was this deal worth doing for

Ace? Why? How could Ace manage a better outcome?

Revenue: .043 × 600 000 = $25 800

Costs: interest: $2700 + $600 = $3300. Collection: $10 800 + $3600 = $14 400. Total

cost = $17 700. Yes, an $8100 surplus. Faster collection would reduce interest costs

and probably collection costs.

© John Wiley and Sons Australia, Ltd 2008 10.2

Chapter Ten: Short-term finance — working capital

10.18 A floor-plan financier agrees to lend a car dealer funds to buy stock up to

a limit of $1 million. The first order under this scheme is for 25 sedans

and wagons which average $23 000 each with all ordered optional extras

included. The cars are delivered and the invoice paid by the financier on

Monday, 1 October. The interest charge is 6.5% p.a., charged monthly on

balance at 5.00 pm each day. Five vehicles are sold in the first week, and

6 in the second week, at an average price of $30 000 each. The dealer pays

the financier electronically, at cost price, late on Friday at the end of each

week for the vehicles sold during that week. The dealer re-orders vehicles

at the end of the second week, and 10 new vehicles are delivered and paid

for by the financier on the Monday of the fourth week at the same

average price as the original lot. Sales comprise 5 vehicles in each of

weeks 3 and 4, and 2 in the last few days of the month. How much does

the dealer owe the financier on the first day of the new month?

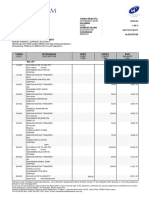

This problem is best tackled by means of a time line on which are marked the days

each amount is outstanding. For example, in the first period of 4 days, the outstanding

amount is $575 000, then it drops to $460 000 for 7 days, then $322 000 for 7 days,

$207 000 for 3 days, $437 000 for 4 days and $322 000 for 6 days. Ignore the last two

cars sold as they are not brought to account until the first Friday of the new month.

Check that you have 31 days for the month. You can also check that each addition and

subtraction of total outstanding funds does indeed equal a multiple of $23 000. The

interest rate is 0.178 per $1000 per day. On 1 November, the dealer owes $2149.35

interest and $322 000 principal. A table also helps as an analytical tool.

Date 1 5 12 19 22 26 31

Day Mon Fri Fri Fri Mon Fri Wed

Days to date 0 4 7 7 3 4 6

Balance owing

before payment 207

($000) 575 575 460 322 437 437 322

Balance owing after

payment ($000) n.a. 460 322 207 n.a. 322 n.a.

No. cars in stock 25 20 14 9 19 14 n.a.

Interest for period n.a. 409.4 573.16 401.21 110.54 311.14 343.90

© John Wiley and Sons Australia, Ltd 2008 10.3

You might also like

- CB Chapter 16Document4 pagesCB Chapter 16Sim Pei YingNo ratings yet

- AC1025 Mock Exam Comm 2017Document17 pagesAC1025 Mock Exam Comm 2017Nghia Tuan NghiaNo ratings yet

- 1 Problem Set 1Document6 pages1 Problem Set 1Kazi MohasinNo ratings yet

- Cash and ReceivablesDocument30 pagesCash and ReceivablesAira Mae Hernandez CabaNo ratings yet

- Financial MGMT CH 8Document23 pagesFinancial MGMT CH 8ChrisNo ratings yet

- Solutions Manual: Introducing Corporate Finance 2eDocument9 pagesSolutions Manual: Introducing Corporate Finance 2eMane Scal JayNo ratings yet

- Receivables - Addtl ConceptsDocument6 pagesReceivables - Addtl ConceptsXiena100% (4)

- Jones Electrical DistributionDocument6 pagesJones Electrical DistributionChris Mlincsek67% (3)

- Practice Final 2 FinanceDocument13 pagesPractice Final 2 Financedscgool1232No ratings yet

- COMM 229 Notes Chapter 4Document4 pagesCOMM 229 Notes Chapter 4Cody ClinkardNo ratings yet

- Debt Practice ProblemsDocument11 pagesDebt Practice ProblemsmikeNo ratings yet

- Final Exam Preparation Results: Answer All Questions in Part 1 and One of The Two Problems inDocument8 pagesFinal Exam Preparation Results: Answer All Questions in Part 1 and One of The Two Problems insafiqulislamNo ratings yet

- Final Exam Preparation Results: Answer All Questions in Part 1 and One of The Two Problems inDocument8 pagesFinal Exam Preparation Results: Answer All Questions in Part 1 and One of The Two Problems insafiqulislamNo ratings yet

- 2022 ND - FM Suggested AnswerDocument10 pages2022 ND - FM Suggested Answermiradvance studyNo ratings yet

- Assignment1 SolutionDocument6 pagesAssignment1 SolutionAnonymous dpWU6H5Lx2No ratings yet

- Fin Exam ADocument14 pagesFin Exam AtahaalkibsiNo ratings yet

- 21 Problems For CB NewDocument31 pages21 Problems For CB NewNguyễn Thảo MyNo ratings yet

- Week 7 Home Work ProblemDocument3 pagesWeek 7 Home Work ProblemSandip AgarwalNo ratings yet

- CH17Document7 pagesCH17mnbzxcpoiqweNo ratings yet

- Accounts Receivables and Payables A&BDocument9 pagesAccounts Receivables and Payables A&BAb PiousNo ratings yet

- 2019 Exam - Moed A - Computer Science - (Solution)Document11 pages2019 Exam - Moed A - Computer Science - (Solution)adoNo ratings yet

- Particulars Amount Amount Rs. (DR.) Rs. (DR.)Document14 pagesParticulars Amount Amount Rs. (DR.) Rs. (DR.)Alka DwivediNo ratings yet

- MVJUSTINIANI - BAFACR16 - INTERIM ASSESSMENT 1 - 3T - AY2022 23 With Answer KeysDocument4 pagesMVJUSTINIANI - BAFACR16 - INTERIM ASSESSMENT 1 - 3T - AY2022 23 With Answer KeysDe Gala ShailynNo ratings yet

- Exercises of Cash Liquidity ManagementDocument8 pagesExercises of Cash Liquidity ManagementTâm ThuNo ratings yet

- Financial Analyst G&M - Real Estate Test & Case Study (SUMAN SAURABH)Document24 pagesFinancial Analyst G&M - Real Estate Test & Case Study (SUMAN SAURABH)sourabh sinhaNo ratings yet

- Acctg 115 - CH 10 SolutionsDocument22 pagesAcctg 115 - CH 10 SolutionschinmusicianNo ratings yet

- CB Chapter 13 AnswerDocument2 pagesCB Chapter 13 AnswerSim Pei YingNo ratings yet

- Required: Using These Data, Construct The December 31, Year 5 Balance Sheet For Your AnalysisDocument3 pagesRequired: Using These Data, Construct The December 31, Year 5 Balance Sheet For Your AnalysisJARED DARREN ONGNo ratings yet

- PV ProblemsDocument3 pagesPV ProblemsStephen VolkertNo ratings yet

- Long-Term Debt FinancingDocument53 pagesLong-Term Debt FinancingGaluh Boga KuswaraNo ratings yet

- Review Questions - 1Document3 pagesReview Questions - 1nlNo ratings yet

- Exercise Week 2 - Cash and ReceivablesDocument4 pagesExercise Week 2 - Cash and Receivablesnatasha karyadiNo ratings yet

- CH 10Document3 pagesCH 10pablozhang1226No ratings yet

- Assignment Chap17 - WINDOWDocument6 pagesAssignment Chap17 - WINDOWAimee EemiaNo ratings yet

- Receivables ExercisesDocument5 pagesReceivables ExercisesChrystelle Gail LiNo ratings yet

- Accounting Chapter 10Document11 pagesAccounting Chapter 10Andrew ChouNo ratings yet

- Fin Exam 1Document14 pagesFin Exam 1tahaalkibsiNo ratings yet

- Financial Management: Section 1Document10 pagesFinancial Management: Section 1Hibernation PetersonNo ratings yet

- A'lla Zahwa Andewi Nugraheni - 464977 - Tugas FM CH 16 & 19Document7 pagesA'lla Zahwa Andewi Nugraheni - 464977 - Tugas FM CH 16 & 19PRA MBANo ratings yet

- DD The Superior College Lahore: InstructionsDocument3 pagesDD The Superior College Lahore: Instructionsmehzil haseebNo ratings yet

- Accounting For Liabilities: Learning ObjectivesDocument39 pagesAccounting For Liabilities: Learning ObjectivesJune KooNo ratings yet

- 21 Problems For CBDocument10 pages21 Problems For CBNguyễn QuỳnhNo ratings yet

- 21 Problems For CBDocument10 pages21 Problems For CBThu HòaiNo ratings yet

- Chapter 2: Current Liabilities, Provisions, and ContingenciesDocument14 pagesChapter 2: Current Liabilities, Provisions, and ContingenciesGirma NegashNo ratings yet

- On June 1 AcctDocument5 pagesOn June 1 AcctMelody Bautista100% (1)

- 3311 Class 11 GSDocument19 pages3311 Class 11 GSkatharine1981100% (2)

- Chapter1 Current Liab, Prov & ContengeciesDocument51 pagesChapter1 Current Liab, Prov & Contengeciessamuel hailuNo ratings yet

- Chapter 14Document4 pagesChapter 14ks1043210No ratings yet

- Financial Analyst G&M - Real Estate Test & Case StudyDocument19 pagesFinancial Analyst G&M - Real Estate Test & Case StudyDhruv ShahNo ratings yet

- Solution: Mcgriff Dog Food CompanyDocument6 pagesSolution: Mcgriff Dog Food CompanyAnna CharlotteNo ratings yet

- 12Document8 pages12Ishaq EssaNo ratings yet

- 13lecture13workingcapitalmanagement PDFDocument10 pages13lecture13workingcapitalmanagement PDFMurali VadiveluNo ratings yet

- Quiz 2 AuditingDocument18 pagesQuiz 2 Auditingaldrin elsisuraNo ratings yet

- CMA B4.7 Bank LoansDocument13 pagesCMA B4.7 Bank LoansZeinabNo ratings yet

- Finance SolutionsDocument16 pagesFinance SolutionsmhussainNo ratings yet

- Building Wealth on a Dime: Finding your Financial FreedomFrom EverandBuilding Wealth on a Dime: Finding your Financial FreedomNo ratings yet

- ch15 Non-Current LiabilitiesDocument66 pagesch15 Non-Current LiabilitiesDesain KPPN KPHNo ratings yet

- Amer Shareef ResumeDocument2 pagesAmer Shareef Resumeamershareef337No ratings yet

- A Comparative Analysis of Financial Performance of Nepal SBI Bank Limited, Himalayan Bank Limited and Kumari Bank LimitedDocument131 pagesA Comparative Analysis of Financial Performance of Nepal SBI Bank Limited, Himalayan Bank Limited and Kumari Bank LimitedBijaya DhakalNo ratings yet

- Philippine Commercial International Bank v. Court of Appeals, G.R. No. 121413 January 29, 2001Document23 pagesPhilippine Commercial International Bank v. Court of Appeals, G.R. No. 121413 January 29, 2001Krister VallenteNo ratings yet

- Motorola Premium Model Store ListDocument17 pagesMotorola Premium Model Store ListSandeep SharmaNo ratings yet

- NHTM Ch3Document19 pagesNHTM Ch3jnaxx27No ratings yet

- Design AP Process Definition Document 1.2Document93 pagesDesign AP Process Definition Document 1.2Saq IbNo ratings yet

- BSP Functions, Roles and Sources of Funds BSP FunctionsDocument2 pagesBSP Functions, Roles and Sources of Funds BSP FunctionsAlice StarNo ratings yet

- Table of Content: Schedule of Bank Charges (Exclusive of FED)Document30 pagesTable of Content: Schedule of Bank Charges (Exclusive of FED)ahsanNo ratings yet

- Jefferson Parish Legals: Parish & City Officials Directory of Parish & City OfficialsDocument5 pagesJefferson Parish Legals: Parish & City Officials Directory of Parish & City Officialstheadvocate.comNo ratings yet

- Financial ServicesDocument23 pagesFinancial ServicesFarah Ain Sidi Hamat100% (1)

- Non Performing Assets A Study of Shree Warana Co Operative Bank Ltd. WarananagarDocument4 pagesNon Performing Assets A Study of Shree Warana Co Operative Bank Ltd. WarananagarEditor IJTSRDNo ratings yet

- The Comparative Study of Credit Policy and Its Implementation of Nabil Bank, Everest Bank and Nic Bank"Document124 pagesThe Comparative Study of Credit Policy and Its Implementation of Nabil Bank, Everest Bank and Nic Bank"Bijaya DhakalNo ratings yet

- AccntsDocument24 pagesAccntsAngel SweetNo ratings yet

- Pauline 1. Application FormDocument3 pagesPauline 1. Application FormMaria Reylan GarciaNo ratings yet

- Fdi Notes 3Document121 pagesFdi Notes 3Nikki KumariNo ratings yet

- Ursa Minor-Course CurriculumDocument14 pagesUrsa Minor-Course CurriculumArvi SunNo ratings yet

- Dubai Islamic Bank Pakistan Internal Auditing DepartmentDocument18 pagesDubai Islamic Bank Pakistan Internal Auditing DepartmentMuqadam Ali100% (1)

- Cipla-I 4/4/2018 13:45 565.55 NEUTRAL 567.34 Cnxit-I 4/4/2018 12:30 12620 SELL MODE 12634.93Document8 pagesCipla-I 4/4/2018 13:45 565.55 NEUTRAL 567.34 Cnxit-I 4/4/2018 12:30 12620 SELL MODE 12634.93dewanibipinNo ratings yet

- Financial Market PDFDocument64 pagesFinancial Market PDFsnehachandan91No ratings yet

- Format For Financial StatementDocument3 pagesFormat For Financial StatementmmasalekNo ratings yet

- Resume of - MD Raziul Haque 09-05-2016Document2 pagesResume of - MD Raziul Haque 09-05-2016Siddique SiddNo ratings yet

- Baft Cdcs Flyer Final 10 13 16 PDFDocument2 pagesBaft Cdcs Flyer Final 10 13 16 PDFDileep310No ratings yet

- A Saint in The Board Room Book Cover (Hardbound)Document1 pageA Saint in The Board Room Book Cover (Hardbound)vijay999No ratings yet

- Sir Syed Institute of Sciences and CommerceDocument3 pagesSir Syed Institute of Sciences and CommerceMian Hidayat ShahNo ratings yet

- Fintech and The Banking Sector in Sub Saharan Africa Case of CameroonDocument119 pagesFintech and The Banking Sector in Sub Saharan Africa Case of CameroonalexiaNo ratings yet

- NBFC Module 2 CompletedDocument27 pagesNBFC Module 2 CompletedAneesha AkhilNo ratings yet

- IL&FSDocument14 pagesIL&FSKavita BagewadiNo ratings yet

- Estatement-202304 20230504055631Document4 pagesEstatement-202304 20230504055631Abu SaiNo ratings yet