Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

16 viewsBusiness Standard-The M&M-RBL Bank Saga by Tamal Bandyopadhyay

Business Standard-The M&M-RBL Bank Saga by Tamal Bandyopadhyay

Uploaded by

Garima ChaudhryM&M invested in a 3.53% stake in RBL Bank to understand the banking business over the long term. RBL Bank was not in good shape in the past due to high growth ambitions and weak risk management, but a new CEO has focused on governance, stabilized operations, and returned the bank to growth. While M&M initially said it may increase its stake up to 9.9%, it has since clarified that was not the intention unless a compelling strategic reason emerges, as this investment is meant to be long term and generate returns through the bank's performance, not control of the bank. The investment provides exposure to India's banking sector which M&M sees as important for its own financial services business

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- TUTORIAL 1 Solutions - LEAN SUPPLY CHAINSDocument16 pagesTUTORIAL 1 Solutions - LEAN SUPPLY CHAINSKhathutshelo KharivheNo ratings yet

- Regional Rural Banks of India: Evolution, Performance and ManagementFrom EverandRegional Rural Banks of India: Evolution, Performance and ManagementNo ratings yet

- Caf 1 Ia Spring 2021Document6 pagesCaf 1 Ia Spring 2021Abdul Jabbar Pechuho0% (1)

- Uber Financial StatementDocument6 pagesUber Financial StatementAdrean GonzalesNo ratings yet

- RealTime Web Appication Tech History PDFDocument45 pagesRealTime Web Appication Tech History PDFPradeep KumarNo ratings yet

- News of The Week 2Document17 pagesNews of The Week 2mehtarahul999No ratings yet

- Politics of Ethics-Poor Corporate Governance at PMC Bank: Dr. Lakshmi MohanDocument5 pagesPolitics of Ethics-Poor Corporate Governance at PMC Bank: Dr. Lakshmi MohanShruthik GuttulaNo ratings yet

- Name: Sonhera Sheikh S.id: 6606 Assignment #1 Course: Strategic Financial Analysis & DesignDocument3 pagesName: Sonhera Sheikh S.id: 6606 Assignment #1 Course: Strategic Financial Analysis & Designsonhera sheikhNo ratings yet

- Banking Finance October 17Document60 pagesBanking Finance October 17Bhaskar MohanNo ratings yet

- Financial Accounting VII Mini Project On Financial Crises of PMC Bank-1Document12 pagesFinancial Accounting VII Mini Project On Financial Crises of PMC Bank-1Shruthik GuttulaNo ratings yet

- Group8 - IndusInd BankDocument14 pagesGroup8 - IndusInd BanknidhidNo ratings yet

- Common Bases On Which The Exchange Ratio Is Determined AreDocument10 pagesCommon Bases On Which The Exchange Ratio Is Determined Aredivadivs100% (1)

- Nib Bank Merger CaseDocument12 pagesNib Bank Merger CaseRenu Esrani0% (1)

- Presentation On Impact of Merger and Acquisiton ToDocument10 pagesPresentation On Impact of Merger and Acquisiton ToMinu ChaudharyNo ratings yet

- Chapter 5 Credit Management Policy of JBLDocument20 pagesChapter 5 Credit Management Policy of JBLMd. Saiful IslamNo ratings yet

- Executive Summary: Credit Risk Management in State Bank of IndiaDocument105 pagesExecutive Summary: Credit Risk Management in State Bank of IndiamNo ratings yet

- FIM Done PDFDocument244 pagesFIM Done PDFsNo ratings yet

- Mergers: A Case Study of Forceful Merger of Global Trust Bank With Oriental Bank of CommerceDocument7 pagesMergers: A Case Study of Forceful Merger of Global Trust Bank With Oriental Bank of CommerceAkshaya SwaminathanNo ratings yet

- Corporate CreditDocument69 pagesCorporate CreditAshish chanchlani100% (1)

- Bad Bank - A Good Initiative ? Challenges and AdvantagesDocument6 pagesBad Bank - A Good Initiative ? Challenges and AdvantagesVISHWANATH SAGAR S 18CBCOM105No ratings yet

- Executive Summary: Credit Risk Management in State Bank of IndiaDocument103 pagesExecutive Summary: Credit Risk Management in State Bank of IndiaYash SoniNo ratings yet

- Fino KenDocument1 pageFino Kenhemanth pawaskarNo ratings yet

- Sme BodyDocument54 pagesSme BodySharifMahmudNo ratings yet

- SME Products of BRAC Bank LimitedDocument91 pagesSME Products of BRAC Bank LimitedAfroza KhanNo ratings yet

- Habib Metro BankDocument19 pagesHabib Metro BankIffi ButtNo ratings yet

- Research Paper On Credit Appraisal in BanksDocument7 pagesResearch Paper On Credit Appraisal in Banksh02ngq6c100% (1)

- Credit Risk Management at State Bank ofDocument106 pagesCredit Risk Management at State Bank ofmansi trivediNo ratings yet

- Did The Firm Lenders Invoke SDR Against Firm?Document3 pagesDid The Firm Lenders Invoke SDR Against Firm?Rajnish TrivediNo ratings yet

- PresentationDocument16 pagesPresentationShilpa SabbarwalNo ratings yet

- Canara Bank To Expand OverseasDocument4 pagesCanara Bank To Expand OverseasShruti TalikotiNo ratings yet

- NBFCs in India: Challenges and ConcernsDocument8 pagesNBFCs in India: Challenges and Concernsanjali mishraNo ratings yet

- Orner Ffice: Business Outlook Steady Internal Accruals To Support Growth MomentumDocument8 pagesOrner Ffice: Business Outlook Steady Internal Accruals To Support Growth Momentum0003tzNo ratings yet

- Case Study GroupDocument9 pagesCase Study GroupPrabhujot SinghNo ratings yet

- RBL 20181127 Mosl CF PDFDocument8 pagesRBL 20181127 Mosl CF PDFmilandeepNo ratings yet

- Agrani 1Document1 pageAgrani 1Mohsinat NasrinNo ratings yet

- Report On Loan Disbursement and Recovery Status of Krishi BankDocument66 pagesReport On Loan Disbursement and Recovery Status of Krishi BankAnendya Chakma100% (1)

- Final GK POWER CAPSULE FOR UIIC AO SBI CLERK MAINS 2016 PDFDocument70 pagesFinal GK POWER CAPSULE FOR UIIC AO SBI CLERK MAINS 2016 PDFKeerthipriya MuthyalaNo ratings yet

- Final GK Power Capsule 2016Document70 pagesFinal GK Power Capsule 2016Vishnu KumarNo ratings yet

- Non - Performing Assets - PublicationDocument12 pagesNon - Performing Assets - PublicationChandra SekarNo ratings yet

- Banking Project GokulDocument63 pagesBanking Project GokulShyam KrishNo ratings yet

- Group 2 - Brac BankDocument28 pagesGroup 2 - Brac BankRagib HossainNo ratings yet

- GMIT JJ21 Jitendra SinghalDocument5 pagesGMIT JJ21 Jitendra SinghalShruthik GuttulaNo ratings yet

- An Assignment On "Case Study of Merger of Bank of Baroda With Vijaya Bank and Dena Bank"Document15 pagesAn Assignment On "Case Study of Merger of Bank of Baroda With Vijaya Bank and Dena Bank"Shubham DeshmukhNo ratings yet

- L1 BankingDocument38 pagesL1 BankingdjroytatanNo ratings yet

- Lending Principles and Loan ClassificationDocument3 pagesLending Principles and Loan ClassificationCAKrishnaNiraula100% (1)

- BanksDocument2 pagesBanksShubham NarayanNo ratings yet

- AU SMALL FINANCE Bank LTD PDFDocument7 pagesAU SMALL FINANCE Bank LTD PDFqvdghqhjbdcNo ratings yet

- The KASB BANK Scandal SynopsisDocument6 pagesThe KASB BANK Scandal Synopsisnaeem_309759385No ratings yet

- Microfinancial Analysis of J&K Grameen Bank2Document99 pagesMicrofinancial Analysis of J&K Grameen Bank2Ayan NazirNo ratings yet

- Term Paper FIN 101 FinalDocument25 pagesTerm Paper FIN 101 FinalOnnesha Sadia HossainNo ratings yet

- Discuss The Recent Regulatory Changes Adopted For The Better Governance of Nbfcs in India. (Pradeeba C 215119061)Document5 pagesDiscuss The Recent Regulatory Changes Adopted For The Better Governance of Nbfcs in India. (Pradeeba C 215119061)Pradeeba ChinnaduraiNo ratings yet

- BRAC Bank PDFDocument11 pagesBRAC Bank PDFFuadNo ratings yet

- Non Performing Assets - IdbiDocument7 pagesNon Performing Assets - IdbiKitten KittyNo ratings yet

- INDEX1Document64 pagesINDEX1Rameez BhatNo ratings yet

- Ibps Po Mains GK Capsule 2019 21Document170 pagesIbps Po Mains GK Capsule 2019 21AssNo ratings yet

- Yes Bank-Case Study AnalysisDocument9 pagesYes Bank-Case Study AnalysisANUSHKA SHARMA 20111307No ratings yet

- Case Study On The Reserve Bank of IndiaDocument3 pagesCase Study On The Reserve Bank of IndiaParth GoelNo ratings yet

- Banking Industry in India: Presented By: Samrat BanerjeeDocument23 pagesBanking Industry in India: Presented By: Samrat BanerjeeSohini KarNo ratings yet

- Institute of Management Studies Davv Indore Mba (Financial Administration) Iiird Semester - Fa 303C Insurance and Bank ManagementDocument4 pagesInstitute of Management Studies Davv Indore Mba (Financial Administration) Iiird Semester - Fa 303C Insurance and Bank ManagementjaiNo ratings yet

- Credit Appraisal of Project Financing and Working CapitalDocument70 pagesCredit Appraisal of Project Financing and Working CapitalSami ZamaNo ratings yet

- DCB Bank ReportDocument80 pagesDCB Bank Reportbarmanroshan580No ratings yet

- Post Merger Analysis of Sbi and It'S Associate Banks On Customer'S PerceptionDocument4 pagesPost Merger Analysis of Sbi and It'S Associate Banks On Customer'S PerceptionLucky khandelwalNo ratings yet

- Approved: How to Get Your Business Loan Funded Faster, Cheaper, & with Less StressFrom EverandApproved: How to Get Your Business Loan Funded Faster, Cheaper, & with Less StressRating: 5 out of 5 stars5/5 (1)

- P 13-9A - SolutionDocument1 pageP 13-9A - SolutionMichelle GraciaNo ratings yet

- MRK - Fall 2023 - HRM619 - 4 - MC220205002Document7 pagesMRK - Fall 2023 - HRM619 - 4 - MC220205002hssdj2hfdmNo ratings yet

- JLL Italian Logistics Snapshot q2 2023Document18 pagesJLL Italian Logistics Snapshot q2 2023abdalrahmananas45No ratings yet

- Biturox® Bitumen Processing Units: Selected ReferencesDocument6 pagesBiturox® Bitumen Processing Units: Selected ReferencesLAYTHNo ratings yet

- 04 LCI Design Forum TVD Slide DeckDocument78 pages04 LCI Design Forum TVD Slide DeckAndrew NgNo ratings yet

- Distribution Products - Pricelist (September) .2022)Document64 pagesDistribution Products - Pricelist (September) .2022)Gokul MenonNo ratings yet

- THC001 - Chapter 4Document3 pagesTHC001 - Chapter 4Allyn BalabatNo ratings yet

- Ig1-Obe-Qp - 5Document5 pagesIg1-Obe-Qp - 5Okay GoogleNo ratings yet

- OD427980832162006100Document1 pageOD427980832162006100nikhbiradarNo ratings yet

- Stages of Digital Transformation in Competency Management - TejaDocument6 pagesStages of Digital Transformation in Competency Management - TejaImmanuel Teja HarjayaNo ratings yet

- Do More With Microsoft Teams: Download The Teams App HereDocument1 pageDo More With Microsoft Teams: Download The Teams App HerejcherrandNo ratings yet

- Attachment 1632620829Document4 pagesAttachment 1632620829sadiaNo ratings yet

- Surya Pricelist Compressed 1Document92 pagesSurya Pricelist Compressed 1Raj Kumar VermaNo ratings yet

- Heat Exchanger Options: Confidential Marketing GuideDocument12 pagesHeat Exchanger Options: Confidential Marketing GuideEmerson PenaforteNo ratings yet

- Neja 1Document8 pagesNeja 1Fathan NugrahaNo ratings yet

- EarningsperShare Finacc5Document3 pagesEarningsperShare Finacc5Miladanica Barcelona BarracaNo ratings yet

- Installation Guide: Space Manager With Livereorg 8.6Document45 pagesInstallation Guide: Space Manager With Livereorg 8.6Enrike AlonsoNo ratings yet

- Why Renting Is Better Than BuyingDocument4 pagesWhy Renting Is Better Than BuyingMonali MathurNo ratings yet

- THEVIDEOGAMINGINDUSTRYDocument10 pagesTHEVIDEOGAMINGINDUSTRYlacrosivanNo ratings yet

- Technical Integration Guide For Entrust® Identityguard 9.3 and Microsoft Forefront Unified Access Gateway (Uag) 2010Document39 pagesTechnical Integration Guide For Entrust® Identityguard 9.3 and Microsoft Forefront Unified Access Gateway (Uag) 2010mostafaNo ratings yet

- CHP 4 Job-AnalysisDocument17 pagesCHP 4 Job-AnalysisIftekhar MahmudNo ratings yet

- Management of Financial ServicesDocument7 pagesManagement of Financial ServicesKajal BhammarNo ratings yet

- Reference List Sample For ResumeDocument7 pagesReference List Sample For Resumec2yyr2c3100% (1)

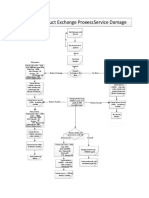

- Product Exchange Process - Service Damage: Old Product Old ProductDocument2 pagesProduct Exchange Process - Service Damage: Old Product Old ProductsameerjaleesNo ratings yet

- Pragya ResumeDocument2 pagesPragya Resumepeople.barodaNo ratings yet

- Job Sheet KosongDocument33 pagesJob Sheet KosongHatta Rasyida SulaimanNo ratings yet

Business Standard-The M&M-RBL Bank Saga by Tamal Bandyopadhyay

Business Standard-The M&M-RBL Bank Saga by Tamal Bandyopadhyay

Uploaded by

Garima Chaudhry0 ratings0% found this document useful (0 votes)

16 views1 pageM&M invested in a 3.53% stake in RBL Bank to understand the banking business over the long term. RBL Bank was not in good shape in the past due to high growth ambitions and weak risk management, but a new CEO has focused on governance, stabilized operations, and returned the bank to growth. While M&M initially said it may increase its stake up to 9.9%, it has since clarified that was not the intention unless a compelling strategic reason emerges, as this investment is meant to be long term and generate returns through the bank's performance, not control of the bank. The investment provides exposure to India's banking sector which M&M sees as important for its own financial services business

Original Description:

Original Title

Business Standard-The M&M-RBL Bank saga by Tamal Bandyopadhyay

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentM&M invested in a 3.53% stake in RBL Bank to understand the banking business over the long term. RBL Bank was not in good shape in the past due to high growth ambitions and weak risk management, but a new CEO has focused on governance, stabilized operations, and returned the bank to growth. While M&M initially said it may increase its stake up to 9.9%, it has since clarified that was not the intention unless a compelling strategic reason emerges, as this investment is meant to be long term and generate returns through the bank's performance, not control of the bank. The investment provides exposure to India's banking sector which M&M sees as important for its own financial services business

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

16 views1 pageBusiness Standard-The M&M-RBL Bank Saga by Tamal Bandyopadhyay

Business Standard-The M&M-RBL Bank Saga by Tamal Bandyopadhyay

Uploaded by

Garima ChaudhryM&M invested in a 3.53% stake in RBL Bank to understand the banking business over the long term. RBL Bank was not in good shape in the past due to high growth ambitions and weak risk management, but a new CEO has focused on governance, stabilized operations, and returned the bank to growth. While M&M initially said it may increase its stake up to 9.9%, it has since clarified that was not the intention unless a compelling strategic reason emerges, as this investment is meant to be long term and generate returns through the bank's performance, not control of the bank. The investment provides exposure to India's banking sector which M&M sees as important for its own financial services business

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

<

The M&M-RBL Bank saga

Why M&M has invested in RBL and what does the bank look like

A little over a decade ago, on June 24, 2013, Mahindra & handsome returns over time. (Price-to-book value or

Mahindra Financial Services Ltd had an extremely vol- P/BV is the ratio of the market value of a company’s

atile day on the bourses after it announced its board’s share price over its book value of equity — the value of

decision of not applying for a banking licence. The a company’s assets).

announcement was made during trading hours. The At the current level of equity ownership, M&M is the

stock fell as much as 15.91 per cent to hit the day’s low third-largest shareholder in RBL Bank, behind Baring

of ~216.25, soon after the announcement. However, as Private Equity Asia (9.9 per cent) and British

bargain hunting emerged at lower levels, the stock pared International Investment (a little over 6 per cent).

some of its losses. While the M&M investors heaved a sigh of relief, one

M&M Financial Services decided not to proceed with gentleman must have been all smiles after this, RBL

the application for a banking licence after reviewing Bank MD and CEO R Subramaniakumar.

the guidelines issued by the Reserve Bank of India (RBI) In the not-so-distant past, the bank was not in the

for such an application, along with the clarifications best of shape. On December 27, 2021, the RBI had issued

issued by the central bank earlier that month. The com- a release after some depositors started withdrawing

pany said its board expressed full confidence in M&M money from the bank. It said: “There has been specu-

Financial Services’ plans and prospects for growth as lation relating to the RBL Bank in certain quarters which

an independent non-banking financial company appears to be arising from recent events surrounding

(NBFC). the bank… There is no need for depositors and other

The RBI guidelines provided for the conversion of stakeholders to react to the speculative reports. The

an NBFC into a bank but did not offer any flexibility in bank’s financial health remains stable.”

terms of meeting the reserve requirements — cash Subramaniakumar, former MD and CEO of Indian

reserve ratio and statutory liquidity ratio were applica- Overseas Bank, took over the reins at RBL Bank on June

ble from the inception of the bank. That was the stum- 22, 2022. He has addressed the trust deficit among the

bling block. regulator, employees and customers by clinically focus-

Fast forward to July 27, 2023. Parent Mahindra & sing on governance issues. A string of committees have

Mahindra’s (M&M) shares dropped 6.9 per cent in intra- been set up at different levels, bridging the gap between

day trading after the company said it had acquired a the board and employees. He has managed to arrest

3.53 per cent stake in RBL Bank Ltd and indicated that high attrition of staff; stabilised the bank; and, most

it might increase the stake up to 9.9 importantly, brought it back to the

per cent in the future. growth path.

M&M did not spell out the He is also exploiting the strength

rationale behind the share pur- of the bank’s banking correspondent

chase. “We have acquired a 3.53 per subsidiary, RBL Finserve Ltd. Earlier,

cent stake in RBL Bank as an invest- the two worked in silos — bank

ment at a cost of ~417 crore,” the branches focusing on raising deposits

company said in an exchange filing. and the subsidiary sourcing small

“We may consider further invest- loans. Now, they collaborate for every

ment, subject to pricing, regulatory business and, as this opens new pos-

approvals and required procedures. sibilities, RBL Bank adds to its pro-

However, in no circumstance will duct kitty.

it exceed 9.9 per cent,” it said. To be sure, RBL Bank was not a

Flashback to April 2021. M&M BANKER’S TRUST stretcher case. Even when the regu-

Managing Director (MD) Anish lator intervened, it was well capita-

TAMAL BANDYOPADHYAY

Shah, in his first interview as the lised and its financial position was

chief executive of the group, said satisfactory. It came under the RBI

the conglomerate could apply for a banking licence. glare years ago because of its insatiable lust for growth

“We feel that from a governance standpoint we will before putting in place the right risk-management and

meet all the criteria,” he told the Economic Times. credit-appraisal practices. A few corporate loans turned

However, the group was yet to decide whether its bad and the expansion in unsecured loan books made

foray into formal banking would be through acquisition the regulator wary.

of a private bank or by acquiring a public-sector bank. In FY20 and FY21, its growth was muted. Before that,

“The Mahindra group does not borrow from Mahindra microfinance loans were 12 per cent of its loan book.

Finance today. If anything, we actually lend to Mahindra The contribution of the unsecured credit card business

Finance sometimes, when required, and we put in the to its overall loan portfolio was around 20 per cent, the

capital earlier this year as well,” Shah said. highest in the industry.

Against this backdrop, the July 27 exchange filing As I write this column, credit cards continue to be

by the company made many of us believe that Shah around 24 per cent of its assets but the share of micro-

was walking the talk. As we were eagerly waiting for the finance loans has come down to around 8 per cent.

drama to unfold, the denouement happened too fast. Overall, the wholesale loans are 46 per cent of the total

On August 4, at an analysts’ call after announcing the book. While the average low-cost current and savings

June quarter earnings of M&M, Shah made it clear that accounts, or Casa, was around 37.3 per cent of the total

the company would not increase its capital allocation deposits in June, the portion of retail deposits had risen

in RBL Bank, unless it found a compelling strategic to close to 44 per cent. In the past one year, its gross

value in the bank. This was contrary to the earlier bad loans have come down to 3.22 per cent from 4.08

announcement of increasing the stake in the bank to per cent and, after provisioning, net bad loans have

9.9 per cent. dropped from 2.35 per cent to 1 per cent.

“This is an investment of ~417 crore today. It’s an By FY26, the bank plans to have three lines of busi-

investment in a sector that is the core sector for us, ness in equal proportion — wholesale, credit card and

financial services, a sector that we want to grow a lot microfinance — and new products such as education

more… This investment is in a sector in which we have loans, gold loans, small business loans, car and tractor

almost ~40,000 crore market cap... And this investment loans and personal loans. The worst seems to be behind

is really for us to understand banking in a lot more detail RBL Bank.

with a very long-term view — seven- to 10-year view. In his immediate past assignment, as an adminis-

There are no assumptions on our part today whether trator, Subramaniakumar oversaw the insolvency pro-

we want to get into banking or not. In fact, at this point cess of Dewan Housing Finance Corporation Ltd. In a

of time, we cannot and don’t want to….,” Shah had said, little over a year at RBL Bank, he has convinced the

adding: “At this stage, we don’t expect to go higher… At investors that his expertise goes beyond stress man-

some point in the future, if there is a compelling strate- agement.

gic reason, we need to evaluate in line with our capital

allocation policy….” The writer is an author and senior advisor to

Why did the company zero in on RBL Bank to under- Jana Small Finance Bank Ltd

stand the business of banking? Well, according to Shah, His latest book is Roller Coaster: An Affair with Banking

it’s a great investment opportunity with a one-time To read his previous columns, please log on to

price-to-book value, a very well-run bank with a good www.bankerstrust.in

management. He expects this investment to generate X: @TamalBandyo

You might also like

- TUTORIAL 1 Solutions - LEAN SUPPLY CHAINSDocument16 pagesTUTORIAL 1 Solutions - LEAN SUPPLY CHAINSKhathutshelo KharivheNo ratings yet

- Regional Rural Banks of India: Evolution, Performance and ManagementFrom EverandRegional Rural Banks of India: Evolution, Performance and ManagementNo ratings yet

- Caf 1 Ia Spring 2021Document6 pagesCaf 1 Ia Spring 2021Abdul Jabbar Pechuho0% (1)

- Uber Financial StatementDocument6 pagesUber Financial StatementAdrean GonzalesNo ratings yet

- RealTime Web Appication Tech History PDFDocument45 pagesRealTime Web Appication Tech History PDFPradeep KumarNo ratings yet

- News of The Week 2Document17 pagesNews of The Week 2mehtarahul999No ratings yet

- Politics of Ethics-Poor Corporate Governance at PMC Bank: Dr. Lakshmi MohanDocument5 pagesPolitics of Ethics-Poor Corporate Governance at PMC Bank: Dr. Lakshmi MohanShruthik GuttulaNo ratings yet

- Name: Sonhera Sheikh S.id: 6606 Assignment #1 Course: Strategic Financial Analysis & DesignDocument3 pagesName: Sonhera Sheikh S.id: 6606 Assignment #1 Course: Strategic Financial Analysis & Designsonhera sheikhNo ratings yet

- Banking Finance October 17Document60 pagesBanking Finance October 17Bhaskar MohanNo ratings yet

- Financial Accounting VII Mini Project On Financial Crises of PMC Bank-1Document12 pagesFinancial Accounting VII Mini Project On Financial Crises of PMC Bank-1Shruthik GuttulaNo ratings yet

- Group8 - IndusInd BankDocument14 pagesGroup8 - IndusInd BanknidhidNo ratings yet

- Common Bases On Which The Exchange Ratio Is Determined AreDocument10 pagesCommon Bases On Which The Exchange Ratio Is Determined Aredivadivs100% (1)

- Nib Bank Merger CaseDocument12 pagesNib Bank Merger CaseRenu Esrani0% (1)

- Presentation On Impact of Merger and Acquisiton ToDocument10 pagesPresentation On Impact of Merger and Acquisiton ToMinu ChaudharyNo ratings yet

- Chapter 5 Credit Management Policy of JBLDocument20 pagesChapter 5 Credit Management Policy of JBLMd. Saiful IslamNo ratings yet

- Executive Summary: Credit Risk Management in State Bank of IndiaDocument105 pagesExecutive Summary: Credit Risk Management in State Bank of IndiamNo ratings yet

- FIM Done PDFDocument244 pagesFIM Done PDFsNo ratings yet

- Mergers: A Case Study of Forceful Merger of Global Trust Bank With Oriental Bank of CommerceDocument7 pagesMergers: A Case Study of Forceful Merger of Global Trust Bank With Oriental Bank of CommerceAkshaya SwaminathanNo ratings yet

- Corporate CreditDocument69 pagesCorporate CreditAshish chanchlani100% (1)

- Bad Bank - A Good Initiative ? Challenges and AdvantagesDocument6 pagesBad Bank - A Good Initiative ? Challenges and AdvantagesVISHWANATH SAGAR S 18CBCOM105No ratings yet

- Executive Summary: Credit Risk Management in State Bank of IndiaDocument103 pagesExecutive Summary: Credit Risk Management in State Bank of IndiaYash SoniNo ratings yet

- Fino KenDocument1 pageFino Kenhemanth pawaskarNo ratings yet

- Sme BodyDocument54 pagesSme BodySharifMahmudNo ratings yet

- SME Products of BRAC Bank LimitedDocument91 pagesSME Products of BRAC Bank LimitedAfroza KhanNo ratings yet

- Habib Metro BankDocument19 pagesHabib Metro BankIffi ButtNo ratings yet

- Research Paper On Credit Appraisal in BanksDocument7 pagesResearch Paper On Credit Appraisal in Banksh02ngq6c100% (1)

- Credit Risk Management at State Bank ofDocument106 pagesCredit Risk Management at State Bank ofmansi trivediNo ratings yet

- Did The Firm Lenders Invoke SDR Against Firm?Document3 pagesDid The Firm Lenders Invoke SDR Against Firm?Rajnish TrivediNo ratings yet

- PresentationDocument16 pagesPresentationShilpa SabbarwalNo ratings yet

- Canara Bank To Expand OverseasDocument4 pagesCanara Bank To Expand OverseasShruti TalikotiNo ratings yet

- NBFCs in India: Challenges and ConcernsDocument8 pagesNBFCs in India: Challenges and Concernsanjali mishraNo ratings yet

- Orner Ffice: Business Outlook Steady Internal Accruals To Support Growth MomentumDocument8 pagesOrner Ffice: Business Outlook Steady Internal Accruals To Support Growth Momentum0003tzNo ratings yet

- Case Study GroupDocument9 pagesCase Study GroupPrabhujot SinghNo ratings yet

- RBL 20181127 Mosl CF PDFDocument8 pagesRBL 20181127 Mosl CF PDFmilandeepNo ratings yet

- Agrani 1Document1 pageAgrani 1Mohsinat NasrinNo ratings yet

- Report On Loan Disbursement and Recovery Status of Krishi BankDocument66 pagesReport On Loan Disbursement and Recovery Status of Krishi BankAnendya Chakma100% (1)

- Final GK POWER CAPSULE FOR UIIC AO SBI CLERK MAINS 2016 PDFDocument70 pagesFinal GK POWER CAPSULE FOR UIIC AO SBI CLERK MAINS 2016 PDFKeerthipriya MuthyalaNo ratings yet

- Final GK Power Capsule 2016Document70 pagesFinal GK Power Capsule 2016Vishnu KumarNo ratings yet

- Non - Performing Assets - PublicationDocument12 pagesNon - Performing Assets - PublicationChandra SekarNo ratings yet

- Banking Project GokulDocument63 pagesBanking Project GokulShyam KrishNo ratings yet

- Group 2 - Brac BankDocument28 pagesGroup 2 - Brac BankRagib HossainNo ratings yet

- GMIT JJ21 Jitendra SinghalDocument5 pagesGMIT JJ21 Jitendra SinghalShruthik GuttulaNo ratings yet

- An Assignment On "Case Study of Merger of Bank of Baroda With Vijaya Bank and Dena Bank"Document15 pagesAn Assignment On "Case Study of Merger of Bank of Baroda With Vijaya Bank and Dena Bank"Shubham DeshmukhNo ratings yet

- L1 BankingDocument38 pagesL1 BankingdjroytatanNo ratings yet

- Lending Principles and Loan ClassificationDocument3 pagesLending Principles and Loan ClassificationCAKrishnaNiraula100% (1)

- BanksDocument2 pagesBanksShubham NarayanNo ratings yet

- AU SMALL FINANCE Bank LTD PDFDocument7 pagesAU SMALL FINANCE Bank LTD PDFqvdghqhjbdcNo ratings yet

- The KASB BANK Scandal SynopsisDocument6 pagesThe KASB BANK Scandal Synopsisnaeem_309759385No ratings yet

- Microfinancial Analysis of J&K Grameen Bank2Document99 pagesMicrofinancial Analysis of J&K Grameen Bank2Ayan NazirNo ratings yet

- Term Paper FIN 101 FinalDocument25 pagesTerm Paper FIN 101 FinalOnnesha Sadia HossainNo ratings yet

- Discuss The Recent Regulatory Changes Adopted For The Better Governance of Nbfcs in India. (Pradeeba C 215119061)Document5 pagesDiscuss The Recent Regulatory Changes Adopted For The Better Governance of Nbfcs in India. (Pradeeba C 215119061)Pradeeba ChinnaduraiNo ratings yet

- BRAC Bank PDFDocument11 pagesBRAC Bank PDFFuadNo ratings yet

- Non Performing Assets - IdbiDocument7 pagesNon Performing Assets - IdbiKitten KittyNo ratings yet

- INDEX1Document64 pagesINDEX1Rameez BhatNo ratings yet

- Ibps Po Mains GK Capsule 2019 21Document170 pagesIbps Po Mains GK Capsule 2019 21AssNo ratings yet

- Yes Bank-Case Study AnalysisDocument9 pagesYes Bank-Case Study AnalysisANUSHKA SHARMA 20111307No ratings yet

- Case Study On The Reserve Bank of IndiaDocument3 pagesCase Study On The Reserve Bank of IndiaParth GoelNo ratings yet

- Banking Industry in India: Presented By: Samrat BanerjeeDocument23 pagesBanking Industry in India: Presented By: Samrat BanerjeeSohini KarNo ratings yet

- Institute of Management Studies Davv Indore Mba (Financial Administration) Iiird Semester - Fa 303C Insurance and Bank ManagementDocument4 pagesInstitute of Management Studies Davv Indore Mba (Financial Administration) Iiird Semester - Fa 303C Insurance and Bank ManagementjaiNo ratings yet

- Credit Appraisal of Project Financing and Working CapitalDocument70 pagesCredit Appraisal of Project Financing and Working CapitalSami ZamaNo ratings yet

- DCB Bank ReportDocument80 pagesDCB Bank Reportbarmanroshan580No ratings yet

- Post Merger Analysis of Sbi and It'S Associate Banks On Customer'S PerceptionDocument4 pagesPost Merger Analysis of Sbi and It'S Associate Banks On Customer'S PerceptionLucky khandelwalNo ratings yet

- Approved: How to Get Your Business Loan Funded Faster, Cheaper, & with Less StressFrom EverandApproved: How to Get Your Business Loan Funded Faster, Cheaper, & with Less StressRating: 5 out of 5 stars5/5 (1)

- P 13-9A - SolutionDocument1 pageP 13-9A - SolutionMichelle GraciaNo ratings yet

- MRK - Fall 2023 - HRM619 - 4 - MC220205002Document7 pagesMRK - Fall 2023 - HRM619 - 4 - MC220205002hssdj2hfdmNo ratings yet

- JLL Italian Logistics Snapshot q2 2023Document18 pagesJLL Italian Logistics Snapshot q2 2023abdalrahmananas45No ratings yet

- Biturox® Bitumen Processing Units: Selected ReferencesDocument6 pagesBiturox® Bitumen Processing Units: Selected ReferencesLAYTHNo ratings yet

- 04 LCI Design Forum TVD Slide DeckDocument78 pages04 LCI Design Forum TVD Slide DeckAndrew NgNo ratings yet

- Distribution Products - Pricelist (September) .2022)Document64 pagesDistribution Products - Pricelist (September) .2022)Gokul MenonNo ratings yet

- THC001 - Chapter 4Document3 pagesTHC001 - Chapter 4Allyn BalabatNo ratings yet

- Ig1-Obe-Qp - 5Document5 pagesIg1-Obe-Qp - 5Okay GoogleNo ratings yet

- OD427980832162006100Document1 pageOD427980832162006100nikhbiradarNo ratings yet

- Stages of Digital Transformation in Competency Management - TejaDocument6 pagesStages of Digital Transformation in Competency Management - TejaImmanuel Teja HarjayaNo ratings yet

- Do More With Microsoft Teams: Download The Teams App HereDocument1 pageDo More With Microsoft Teams: Download The Teams App HerejcherrandNo ratings yet

- Attachment 1632620829Document4 pagesAttachment 1632620829sadiaNo ratings yet

- Surya Pricelist Compressed 1Document92 pagesSurya Pricelist Compressed 1Raj Kumar VermaNo ratings yet

- Heat Exchanger Options: Confidential Marketing GuideDocument12 pagesHeat Exchanger Options: Confidential Marketing GuideEmerson PenaforteNo ratings yet

- Neja 1Document8 pagesNeja 1Fathan NugrahaNo ratings yet

- EarningsperShare Finacc5Document3 pagesEarningsperShare Finacc5Miladanica Barcelona BarracaNo ratings yet

- Installation Guide: Space Manager With Livereorg 8.6Document45 pagesInstallation Guide: Space Manager With Livereorg 8.6Enrike AlonsoNo ratings yet

- Why Renting Is Better Than BuyingDocument4 pagesWhy Renting Is Better Than BuyingMonali MathurNo ratings yet

- THEVIDEOGAMINGINDUSTRYDocument10 pagesTHEVIDEOGAMINGINDUSTRYlacrosivanNo ratings yet

- Technical Integration Guide For Entrust® Identityguard 9.3 and Microsoft Forefront Unified Access Gateway (Uag) 2010Document39 pagesTechnical Integration Guide For Entrust® Identityguard 9.3 and Microsoft Forefront Unified Access Gateway (Uag) 2010mostafaNo ratings yet

- CHP 4 Job-AnalysisDocument17 pagesCHP 4 Job-AnalysisIftekhar MahmudNo ratings yet

- Management of Financial ServicesDocument7 pagesManagement of Financial ServicesKajal BhammarNo ratings yet

- Reference List Sample For ResumeDocument7 pagesReference List Sample For Resumec2yyr2c3100% (1)

- Product Exchange Process - Service Damage: Old Product Old ProductDocument2 pagesProduct Exchange Process - Service Damage: Old Product Old ProductsameerjaleesNo ratings yet

- Pragya ResumeDocument2 pagesPragya Resumepeople.barodaNo ratings yet

- Job Sheet KosongDocument33 pagesJob Sheet KosongHatta Rasyida SulaimanNo ratings yet