Professional Documents

Culture Documents

Broad Strategy For Investing in Stocks

Broad Strategy For Investing in Stocks

Uploaded by

deepanshu12Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Broad Strategy For Investing in Stocks

Broad Strategy For Investing in Stocks

Uploaded by

deepanshu12Copyright:

Available Formats

Broad Strategy for Investing in stocks

Post retirement financial plan must be to have enough stable income from pension, rent,

and interest on fixed deposits. Investment in the stock market should not be with money

that you may need in an emergency. It should be with money that you can safely set aside

for the long term. A part of this investible amount should also be in cash/FD. What

proportion depends on the state of the market.

The Current PE of the Nifty50 index is 21.98. See https://nifty-pe-ratio.com/

The following numbers are for the SENSEX PE from the beginning.

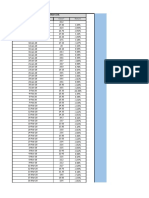

Cum

Cum Max Cum Min Cum Avg

Median

19.7 35.13 10.27 20.1959

The variation for the minimum from the average is 96% and for the maximum, it is 74%. Such drastic

swings from the average or median are rare but can happen once in 10 years.

Making money on stocks is easy only if you have enough holding capacity, discipline and conviction

to survive a black swan event such as the market correcting by 74%.

It is a law of nature that everything regresses to the mean. This means that everything reverts to the

mean eventually. Your investment strategy must therefore be tailored accordingly.

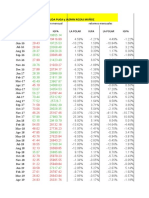

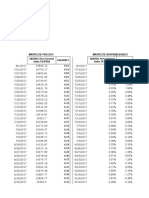

The Current PE of Nifty50 is 21.98 which is marginally above the mean. Let us say you can spare Rs 10

lacs for investment in stocks, then keep 5 lacs in reserve and do not invest beyond 5 lacs in the

current situation. Choose good stocks with good performance and trading below their median PE for

investment. Book profits when stocks make big moves that take them beyond their median PE. Avoid

risky stocks. When the market corrects and the PE goes below 18, invest another Rs 1 lacs from your

reserve of Rs 5 lacs, and if it goes below PE of 15, invest another 2 lacs. If the PE goes below 12, sell

your property and invest in stocks for 100% gains in about a year’s time (I am joking but you get the

point).

The stock market can be extremely volatile and without a sound strategy and staying power, you can

lose a lot of money. The rich with discipline and a sound approach will always make a lot of money in

the market. Look at the following table that has destroyed many and made many leave the stock

market:

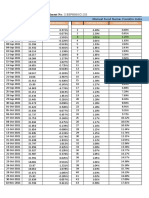

Nifty Nifty Period

Date 1 Date 2 Growth/decline

PE PE (months)

Jan-99 12.54 Feb-00 27.32 13.0 117.86%

Feb-00 27.32 May-00 20.24 3.0 -25.92%

May-00 20.24 Jun-00 23.72 1.0 17.19%

Jun-00 23.72 Aug-00 20.6 2.0 -13.15%

Aug-00 20.6 Sep-00 21.06 1.0 2.23%

Sep-00 21.06 Oct-00 17.9 1.0 -15.00%

Oct-00 17.9 Feb-01 21.07 4.0 17.71%

Feb-01 21.07 Sep-01 13.2 7.0 -37.35%

Sep-01 13.2 Mar-02 18.58 6.0 40.76%

Mar-02 18.58 May-03 11.15 14.0 -39.99%

May-03 11.15 Jan-04 21.14 8.1 89.60%

Jan-04 21.14 Jun-04 12.14 5.0 -42.57%

Jun-04 12.14 Dec-04 16.54 6.0 36.24%

Dec-04 16.54 Jun-05 13.99 6.0 -15.42%

Jun-05 13.99 Apr-06 20.7 10.0 47.96%

Apr-06 20.7 Jun-06 16.64 2.0 -19.61%

Jun-06 16.64 Jan-07 21.37 7.0 28.43%

Jan-07 21.37 Mar-07 17.96 1.9 -15.96%

Mar-07 17.96 Jan-08 26.67 10.1 48.50%

Jan-08 26.67 Nov-08 12.29 10.0 -53.92%

Nov-08 12.29 Jan-11 22.63 26.0 84.13%

Jan-11 22.63 Dec-11 17.2 11.0 -23.99%

Dec-11 17.2 Feb-12 19.07 2.0 10.87%

Feb-12 19.07 May-12 16.89 3.0 -11.43%

May-12 16.89 Oct-12 19 5.0 12.49%

Oct-12 19 Aug-13 16.08 10.0 -15.37%

Aug-13 16.08 Aug-14 20.45 12.0 27.18%

Aug-14 20.45 Aug-15 23.38 12.0 14.33%

Aug-15 23.38 Aug-16 23.63 12.0 1.07%

Aug-16 23.63 Aug-17 25.45 12.0 7.70%

Aug-17 25.45 Aug-18 28.23 12.0 10.92%

Aug-18 28.23 Aug-19 27.15 12.0 -3.83%

Aug-19 27.15 Aug-20 31.64 12.0 16.54%

Aug-20 31.64 Aug-21 26.25 12.0 -17.04%

Aug-21 26.25 Aug-22 21 12.0 -20.00%

Aug-22 21 Aug-23 22.63 12.0 7.76%

What you see is that you could lose 26% in 3 months, 54% in 10 months and if you enough fund in

reserve to invest after every big correction, you can also make a lot of money in a short period.

You might also like

- George Michael - Theology of Hate (2009)Document302 pagesGeorge Michael - Theology of Hate (2009)branx100% (2)

- The British Student's Guide To Obtaining Your Visa To Study at The Islamic University of Madinah v.2Document76 pagesThe British Student's Guide To Obtaining Your Visa To Study at The Islamic University of Madinah v.2Nouridine El KhalawiNo ratings yet

- Physical Education Lesson Plan-2Document3 pagesPhysical Education Lesson Plan-2api-459799295No ratings yet

- Computer Siwes Web DesignDocument16 pagesComputer Siwes Web DesignKareemSeyeGanzboy0% (1)

- XIAOMIDocument10 pagesXIAOMISrinath Saravanan75% (4)

- Corporate Finance ProjectDocument12 pagesCorporate Finance ProjectKanishk SinghNo ratings yet

- dữ liệu c2Document10 pagesdữ liệu c2Dương Thị Thúy HuỳnhNo ratings yet

- Treasury Bonds OutstandingDocument6 pagesTreasury Bonds OutstandingNiloy MallickNo ratings yet

- Regression Beta of TeslaDocument5 pagesRegression Beta of TeslaNikhil AnantNo ratings yet

- HistoryDocument6 pagesHistorymichael.zisisNo ratings yet

- Attock Cement Company ProfileDocument47 pagesAttock Cement Company ProfileAhmed ShazadNo ratings yet

- % Var - Mastercard: Gráfico de BetaDocument16 pages% Var - Mastercard: Gráfico de BetaMario RefNo ratings yet

- History Favours The BraveDocument4 pagesHistory Favours The BraveNaresh KumarNo ratings yet

- Forex-Usd and GBPDocument13 pagesForex-Usd and GBPSana ShaikhNo ratings yet

- Trabajo Listo Carteras ListasDocument49 pagesTrabajo Listo Carteras ListasSantiago SanchezNo ratings yet

- Nume Clasă Statistică: ROBID - ROBOR - Serii Zilnice Observaţii: Nota: Serii Disponibile Începând Din August 1995 MetodologieDocument133 pagesNume Clasă Statistică: ROBID - ROBOR - Serii Zilnice Observaţii: Nota: Serii Disponibile Începând Din August 1995 MetodologieslisNo ratings yet

- Beta Gpo ArgosDocument56 pagesBeta Gpo Argoscamilo godoyNo ratings yet

- Ghana Guinea Base Currency: GHS Base Currency: GNF: SourcesDocument5 pagesGhana Guinea Base Currency: GHS Base Currency: GNF: SourcesgeotrophNo ratings yet

- FM Report. Syed Aman, Syed Ali, Ali.Document49 pagesFM Report. Syed Aman, Syed Ali, Ali.Zaima YaseenNo ratings yet

- Erp by MonthDocument22 pagesErp by MonthKhánh Vy VũNo ratings yet

- Graficos TP EconomiaDocument8 pagesGraficos TP EconomiaHernan CruzNo ratings yet

- Financial Modeling Project 4 - Qasim Chaudhary - 17542Document108 pagesFinancial Modeling Project 4 - Qasim Chaudhary - 17542Shumail AkhundNo ratings yet

- Casos Excel - EncajeDocument24 pagesCasos Excel - EncajeSebastian Ramirez MoranNo ratings yet

- Fase Planeado Actual Ingenieria de Detalle Suministro de Equipos Y Materiales Construccion Progreso de ProyectoDocument15 pagesFase Planeado Actual Ingenieria de Detalle Suministro de Equipos Y Materiales Construccion Progreso de ProyectoArturo Saenz ArteagaNo ratings yet

- Bank Nifty Weekly Options StrategyDocument48 pagesBank Nifty Weekly Options StrategyAllur Sai Vijay KumarNo ratings yet

- KZ FileDocument16 pagesKZ FileimtiazNo ratings yet

- Date Close Return: National Fertilizers LTDDocument49 pagesDate Close Return: National Fertilizers LTDARUN KUMARNo ratings yet

- OBJECTIVE: To Find The Valuation of ALLCARGO LOGISTICSDocument26 pagesOBJECTIVE: To Find The Valuation of ALLCARGO LOGISTICSDeepak KshirsagarNo ratings yet

- Key Tenets To Reduce Risks While Investing in EquitDocument8 pagesKey Tenets To Reduce Risks While Investing in EquitdigthreeNo ratings yet

- WIDYAWATIDocument38 pagesWIDYAWATIAinul YaqinNo ratings yet

- QuanticoDocument7 pagesQuanticoAbdelrahman AkeedNo ratings yet

- Date S&P500 Aapl MSFT BAC XOM PFE Correlation MatrixDocument14 pagesDate S&P500 Aapl MSFT BAC XOM PFE Correlation MatrixZeynep DerinözNo ratings yet

- Scheme Name Aum (CR) Nav Nav DateDocument2 pagesScheme Name Aum (CR) Nav Nav DateAditya bansalNo ratings yet

- Gini Index: WEF, Inclusive Development IndexDocument10 pagesGini Index: WEF, Inclusive Development IndexAkshay GargNo ratings yet

- Fase Planeado Actual Ingenieria de Detalle Suministro de Equipos Y Materiales Construccion Progreso de ProyectoDocument26 pagesFase Planeado Actual Ingenieria de Detalle Suministro de Equipos Y Materiales Construccion Progreso de ProyectoArturo Saenz ArteagaNo ratings yet

- Historical PLF DetailsDocument6 pagesHistorical PLF Detailseurostarimpex1No ratings yet

- Estimacion Del Precio de Los Metales: ORO (Au) Plata (Ag)Document11 pagesEstimacion Del Precio de Los Metales: ORO (Au) Plata (Ag)malenaNo ratings yet

- Fecha IPC Inflación Anual Inflación Mensual Inflación Año CorridoDocument6 pagesFecha IPC Inflación Anual Inflación Mensual Inflación Año CorridoHugo FriesNo ratings yet

- Sapm ProjectDocument24 pagesSapm ProjectPratiksha GhosalNo ratings yet

- Monthly Macro-Economic Dashboard: Sep-20 Oct-20 10-Year Govt Bond YieldDocument22 pagesMonthly Macro-Economic Dashboard: Sep-20 Oct-20 10-Year Govt Bond YieldVsn 99No ratings yet

- Macro Economic Dashboard Task - Ayush SrivastavaDocument12 pagesMacro Economic Dashboard Task - Ayush SrivastavaAyush SrivastavaNo ratings yet

- Alex Sharpe - S PortfolioDocument7 pagesAlex Sharpe - S PortfolioPedro José ZapataNo ratings yet

- Company AnalysisDocument10 pagesCompany AnalysisPoorvi VermaNo ratings yet

- Portafolio de InversiónDocument27 pagesPortafolio de InversiónKaren Sofía MurNo ratings yet

- EJERICICIO 3 - Valor en Riesgo (VAR) - SEMANA 12Document299 pagesEJERICICIO 3 - Valor en Riesgo (VAR) - SEMANA 12aidaNo ratings yet

- Historic Returns - Mid Cap Fund, Mid Cap Fund Performance Tracker Mutual FundsDocument2 pagesHistoric Returns - Mid Cap Fund, Mid Cap Fund Performance Tracker Mutual FundsAditya bansalNo ratings yet

- CFDocument21 pagesCFaditya chandNo ratings yet

- Fmue 16 2021 ProblemDocument164 pagesFmue 16 2021 Problemyash jhunjhunuwalaNo ratings yet

- Mutual Fund Scheme To Invest in 2021Document18 pagesMutual Fund Scheme To Invest in 2021NikhilNo ratings yet

- CRONOLOGIA8Document1 pageCRONOLOGIA83C ARQUITECTOS DISEÑO Y CONSTRUCCIONNo ratings yet

- FDRM A Final Report GroupDocument84 pagesFDRM A Final Report GroupMilan MeherNo ratings yet

- Olah Data FarahDocument13 pagesOlah Data Farahnabilafarah442No ratings yet

- IBF PROJECT Perfect OneDocument96 pagesIBF PROJECT Perfect OneNaveed AbbasNo ratings yet

- Close Price 7,736.07 High Price Low Price A 7,776.22: All Are in Current DayDocument285 pagesClose Price 7,736.07 High Price Low Price A 7,776.22: All Are in Current DayJinn KyoNo ratings yet

- FM ProjectDocument10 pagesFM ProjectZain SardarNo ratings yet

- Exchang, Inflation & Interest Rate-Ali RazaDocument7 pagesExchang, Inflation & Interest Rate-Ali RazahamzafarooqNo ratings yet

- Data DSS Asignment 2Document53 pagesData DSS Asignment 2rodrigobuck1111No ratings yet

- CPI Monthly Review December 2022Document1 pageCPI Monthly Review December 2022Waqar HassanNo ratings yet

- Sumativa 1 Exp 2 FinDocument14 pagesSumativa 1 Exp 2 FinRoger Danilo Lujan ArmasNo ratings yet

- Solved Problems 14 AprilDocument8 pagesSolved Problems 14 Aprilvishal.khalane9No ratings yet

- Casagrc1 Casagrc1 S&P/BVL Peru General Index TR (PEN) S&P/BVL Peru General Index TR (PEN)Document5 pagesCasagrc1 Casagrc1 S&P/BVL Peru General Index TR (PEN) S&P/BVL Peru General Index TR (PEN)DannyNo ratings yet

- Simulación BirdstakingDocument10 pagesSimulación Birdstakingjeanpitt24No ratings yet

- Britannia Industries Historical Closing Price Data-FinalDocument48 pagesBritannia Industries Historical Closing Price Data-FinalSourabh ChiprikarNo ratings yet

- Nifty 50 DataDocument17 pagesNifty 50 DataABHIJEET GAJRENo ratings yet

- United States Census Figures Back to 1630From EverandUnited States Census Figures Back to 1630No ratings yet

- Engage One ProDocument40 pagesEngage One Procadrian842No ratings yet

- Navigate A1 WB Answer KeyDocument12 pagesNavigate A1 WB Answer KeyFirenze CalzadosymasNo ratings yet

- NABH Series5 HIC - 0Document57 pagesNABH Series5 HIC - 0Shejil BalakrishnanNo ratings yet

- Dieci Pegasus 40 25 Spare Parts Catalog Axl0057Document22 pagesDieci Pegasus 40 25 Spare Parts Catalog Axl0057guqupil100% (55)

- 2.2 - Concrete Cracked Elastic Stresses StageDocument12 pages2.2 - Concrete Cracked Elastic Stresses StageMarcelo AbreraNo ratings yet

- Rickett'S: Visual Treatment Objective (V.T.O)Document4 pagesRickett'S: Visual Treatment Objective (V.T.O)MariyamNo ratings yet

- Rules For Subject - Verb Agreement Are As Follows:: Boy BoyDocument37 pagesRules For Subject - Verb Agreement Are As Follows:: Boy BoyKumaresan RamalingamNo ratings yet

- Ricky Gervais' Opening Monologue at The Golden Globe AwardsDocument12 pagesRicky Gervais' Opening Monologue at The Golden Globe AwardsElle_Mikala_La_2191No ratings yet

- Lgu Night 2024 ScriptDocument13 pagesLgu Night 2024 Scriptmedy drizaNo ratings yet

- Tekken Corporation: Company GuideDocument9 pagesTekken Corporation: Company Guidehout rothanaNo ratings yet

- Malunggay Oleifera As Cleaning AgentDocument2 pagesMalunggay Oleifera As Cleaning AgentMackieNo ratings yet

- Module 2 TheoDocument6 pagesModule 2 TheoMichlee Joy Paguila LagocNo ratings yet

- 080930-Antarctica TourismDocument15 pages080930-Antarctica TourismVân PhươngNo ratings yet

- Proba Orala1Document5 pagesProba Orala1andreiNo ratings yet

- Sample .Doc and .Docx Download - File Examples DownloadDocument2 pagesSample .Doc and .Docx Download - File Examples DownloadgjgdfbngfnfgnNo ratings yet

- Blue Printing Pharmacology AssessmentDocument6 pagesBlue Printing Pharmacology Assessmentprasan bhandariNo ratings yet

- PKM Full C.V. Sept 2021Document11 pagesPKM Full C.V. Sept 2021aopera87No ratings yet

- ENVIDIP Module 1. IntroductionDocument31 pagesENVIDIP Module 1. IntroductionLilia GC CasanovaNo ratings yet

- HealthcareStudentWorkbook XIIDocument130 pagesHealthcareStudentWorkbook XIIRobin McLarenNo ratings yet

- Brazil - S Sustainable Infrastructure Market Assessment - Sept 2020Document74 pagesBrazil - S Sustainable Infrastructure Market Assessment - Sept 2020Rafa BorgesNo ratings yet

- General Knowlege QuestionsDocument36 pagesGeneral Knowlege QuestionsSarahNo ratings yet

- Sociology Exploring The Architecture of Everyday Life Readings 10th Edition Newman Test BankDocument11 pagesSociology Exploring The Architecture of Everyday Life Readings 10th Edition Newman Test Bankdoctorsantalumu9coab100% (27)

- III Year A EEEDocument2 pagesIII Year A EEEshenbagaraman cseNo ratings yet

- Operational AmplifiersDocument27 pagesOperational AmplifiersDark PhenixNo ratings yet

- Catheterisation Standard Operating ProcedureDocument27 pagesCatheterisation Standard Operating ProcedureSherly RositaNo ratings yet