Professional Documents

Culture Documents

Technical Analysis For Beginners (The Ultimate Guide) - New Trader U

Technical Analysis For Beginners (The Ultimate Guide) - New Trader U

Uploaded by

Puneet RajCopyright:

Available Formats

You might also like

- Free Chart Patterns BookDocument8 pagesFree Chart Patterns BookKikogamerz 2021100% (1)

- Ultimate Guide To Institutional Candlestick Patterns PDFDocument36 pagesUltimate Guide To Institutional Candlestick Patterns PDFofficialbasseyjohnNo ratings yet

- The Power of Japanese Candlestick ChartsDocument5 pagesThe Power of Japanese Candlestick ChartsSyahirN50% (2)

- Price Action CheatsheetDocument22 pagesPrice Action CheatsheetCapitanu Iulian100% (2)

- Trend Lines and PatternsDocument6 pagesTrend Lines and PatternsUpasara WulungNo ratings yet

- Report Big Three Strategy PDFDocument18 pagesReport Big Three Strategy PDFCHARMINo ratings yet

- Harmonic Forex Patterns Cheat SheetDocument2 pagesHarmonic Forex Patterns Cheat SheetAklchanNo ratings yet

- Average True RangeDocument2 pagesAverage True Rangesanny2005100% (1)

- M1 M5 Forex Scalping Trading Strategy PDFDocument9 pagesM1 M5 Forex Scalping Trading Strategy PDFzooor100% (1)

- Candlestick Chart PatternsDocument9 pagesCandlestick Chart Patternssmitha100% (1)

- 58-The DMI Stochastic PDFDocument7 pages58-The DMI Stochastic PDFlondonmorganNo ratings yet

- Trading Support and Resistance Levels v.3Document14 pagesTrading Support and Resistance Levels v.3amedkillpic100% (2)

- Price Action CourseDocument3 pagesPrice Action CourseNjine PatrickNo ratings yet

- Professional Day Trading & Technical Analysis Strategic System For Intraday Trading Stocks, Forex & Financial Trading.From EverandProfessional Day Trading & Technical Analysis Strategic System For Intraday Trading Stocks, Forex & Financial Trading.No ratings yet

- Trading with the Trendlines: Harmonic Patterns Strategy Trading Strategy. Forex, Stocks, FuturesFrom EverandTrading with the Trendlines: Harmonic Patterns Strategy Trading Strategy. Forex, Stocks, FuturesNo ratings yet

- Day Trading Strategies For Beginners: Day Trading Strategies, #2From EverandDay Trading Strategies For Beginners: Day Trading Strategies, #2No ratings yet

- Become A Successful Trader Using Smart Money Concept: The Complete Guide to Forex Trading, Stock Trading, and Crypto Currency Trading for BeginnersFrom EverandBecome A Successful Trader Using Smart Money Concept: The Complete Guide to Forex Trading, Stock Trading, and Crypto Currency Trading for BeginnersNo ratings yet

- Mean Reversion Day Trading Strategies: Profitable Trading StrategiesFrom EverandMean Reversion Day Trading Strategies: Profitable Trading StrategiesRating: 5 out of 5 stars5/5 (1)

- SWING TRADING: Maximizing Returns and Minimizing Risk through Time-Tested Techniques and Tactics (2023 Guide for Beginners)From EverandSWING TRADING: Maximizing Returns and Minimizing Risk through Time-Tested Techniques and Tactics (2023 Guide for Beginners)No ratings yet

- Micro Patterns 2Document18 pagesMicro Patterns 2Aris ResurreccionNo ratings yet

- Technical AnalysisDocument32 pagesTechnical AnalysisDhikshit ShettyNo ratings yet

- Full Guide On Support and Resistance: by Crypto VIP SignalDocument11 pagesFull Guide On Support and Resistance: by Crypto VIP SignalBen AdamteyNo ratings yet

- Accumulation/Distribution Line: Divergence AnalysisDocument44 pagesAccumulation/Distribution Line: Divergence AnalysismpdharmadhikariNo ratings yet

- Log Com - Miniclip.cricketleague 1690042258Document35 pagesLog Com - Miniclip.cricketleague 1690042258250 RaiderNo ratings yet

- Free Price Action Trading PDF GuideDocument20 pagesFree Price Action Trading PDF Guidemohamed hamdallah100% (2)

- TechAnalysis InvestopediaDocument14 pagesTechAnalysis InvestopediaCristian FilipNo ratings yet

- Accumulation Manipulation Distribtuion: RefinedDocument4 pagesAccumulation Manipulation Distribtuion: RefinedHODAALE MEDIANo ratings yet

- Supportand Resistance Trading StrategyDocument10 pagesSupportand Resistance Trading StrategyEng Abdikariim AbdillahiNo ratings yet

- HHLL Trading System (PRINT) PDFDocument15 pagesHHLL Trading System (PRINT) PDFWilliam ZhuangNo ratings yet

- Price Action Chart PatternsDocument13 pagesPrice Action Chart Patternsmatas matas0% (1)

- An Intraday Trading MethodologyDocument249 pagesAn Intraday Trading Methodologysuraj100% (1)

- Simple Trading Techniques, Powerful Results-1Document103 pagesSimple Trading Techniques, Powerful Results-1Fernando Magalhães100% (2)

- Binary Option Trading: Introduction to Binary Option TradingFrom EverandBinary Option Trading: Introduction to Binary Option TradingNo ratings yet

- Beginner's Guide To Become A Professional TraderDocument9 pagesBeginner's Guide To Become A Professional TraderBir Bahadur MishraNo ratings yet

- TA Secrets #4 - Basic Chart PatternsDocument7 pagesTA Secrets #4 - Basic Chart PatternsBlueNo ratings yet

- Trend Is Your FriendDocument3 pagesTrend Is Your Frienddyadav00No ratings yet

- 10 Price Action Bar Patterns You Must KnowDocument22 pages10 Price Action Bar Patterns You Must KnowSudipto PaulNo ratings yet

- False Breakout - How To Avoid and Even Trade It?Document14 pagesFalse Breakout - How To Avoid and Even Trade It?vic beckham100% (1)

- Captains Posts With Attachments 1 PDFDocument211 pagesCaptains Posts With Attachments 1 PDFMushfiq FaysalNo ratings yet

- Forex Candlestick Ambush Trade .Document31 pagesForex Candlestick Ambush Trade .Malik SaraikiNo ratings yet

- 10 Price Action SecretsDocument6 pages10 Price Action SecretsElap Elap100% (2)

- Forex Hedging Strategy PDF Download For BeginnersDocument19 pagesForex Hedging Strategy PDF Download For BeginnersAbdiaziz MohamedNo ratings yet

- Options Introduction - TsugiTradesDocument5 pagesOptions Introduction - TsugiTradeshassanomer2122No ratings yet

- TA Chapter 3Document56 pagesTA Chapter 3Phúc Thiên NguyễnNo ratings yet

- Candlestick Flashcards 101Document10 pagesCandlestick Flashcards 101Viet Nguyen DuyNo ratings yet

- Forex Price Action Strategy: The Ultimate Guide (2018 Update)Document39 pagesForex Price Action Strategy: The Ultimate Guide (2018 Update)Tanyaradzwa100% (3)

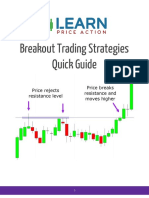

- Breakout Trading Strategies Quick GuideDocument10 pagesBreakout Trading Strategies Quick GuideSMadhusuthanaPerumal100% (1)

- The Candlestick Training GuideDocument21 pagesThe Candlestick Training GuideYureAndradeNo ratings yet

- Wedge Pattern Workbook - UnlockedDocument24 pagesWedge Pattern Workbook - Unlockedshah farizNo ratings yet

- MYTS Candlestick PatternsDocument14 pagesMYTS Candlestick Patternsoneuptrade teste100% (1)

- Price ActionDocument100 pagesPrice Actionchelle100% (3)

- Technical IndicatorsDocument37 pagesTechnical Indicatorskrishna4340No ratings yet

- Swap Zones-1 PDFDocument5 pagesSwap Zones-1 PDFNakata YTNo ratings yet

- FMC Derive Price Action GuideDocument50 pagesFMC Derive Price Action GuideTafara MichaelNo ratings yet

- Thousand Baby Boy Names Starting With V (Hindu)Document24 pagesThousand Baby Boy Names Starting With V (Hindu)Sai RamNo ratings yet

- 10 Chart Pattan Traders Should KnowDocument24 pages10 Chart Pattan Traders Should Knowstephen briggsNo ratings yet

- Ascending & Descending BroadingDocument9 pagesAscending & Descending BroadingvvpvarunNo ratings yet

- Technical AnalysisDocument43 pagesTechnical AnalysisAhsan Iqbal100% (1)

- Forexbee Co Order Blocks ForexDocument11 pagesForexbee Co Order Blocks ForexMr WatcherNo ratings yet

- 02 - Breakout - How To Trade With Momentum The Correct WayDocument10 pages02 - Breakout - How To Trade With Momentum The Correct Waysidd100% (1)

- Technical Analysis WordDocument16 pagesTechnical Analysis WordSwapnil G MankarNo ratings yet

- An Introduction To Price Action Trading StrategiesDocument5 pagesAn Introduction To Price Action Trading StrategiesPrem KarthikNo ratings yet

- Efficient Capital MarketsDocument25 pagesEfficient Capital MarketsAshik Ahmed NahidNo ratings yet

- 3 Best Chart Patterns For Intraday Trading in ForexDocument15 pages3 Best Chart Patterns For Intraday Trading in ForexCheng80% (5)

- #45 PDFDocument76 pages#45 PDFjivaneto100% (1)

- 44 - 1994 WinterDocument74 pages44 - 1994 WinterLinda ZwaneNo ratings yet

- Study of Fluctuations in Stock MarketDocument34 pagesStudy of Fluctuations in Stock MarketHeena GuptaNo ratings yet

- Auto Trend Line Support and ResistenceDocument10 pagesAuto Trend Line Support and Resistenceraj06740No ratings yet

- Chapter-1 Techinical AnalysisDocument90 pagesChapter-1 Techinical AnalysisRajesh Insb100% (1)

- Pizzottaite Journal Technical Analysis Article-297-315Document19 pagesPizzottaite Journal Technical Analysis Article-297-315Financial Management by Dr MujahedNo ratings yet

- 2023 Symposium Final AgendaDocument38 pages2023 Symposium Final AgendaNishan LeemaNo ratings yet

- Elite PDFDocument29 pagesElite PDFRaja RajNo ratings yet

- Stephen Poser - Elliott Wave Theory For Short Term and Intraday TradingDocument16 pagesStephen Poser - Elliott Wave Theory For Short Term and Intraday Tradingchetuzz2100% (1)

- Influence of Social Media Over Stock MarketDocument9 pagesInfluence of Social Media Over Stock MarketHaaturaNo ratings yet

- Forex - The Foreign Exchange Market - : L - D - R V DDocument8 pagesForex - The Foreign Exchange Market - : L - D - R V DLaura SoneaNo ratings yet

- FB 210903174753Document51 pagesFB 210903174753phoyesorasNo ratings yet

- Penny StockDocument57 pagesPenny StockPete CNo ratings yet

- "Equity Research On Cement Sector": Master of Business AdministrationDocument62 pages"Equity Research On Cement Sector": Master of Business AdministrationVishwas ChaturvediNo ratings yet

- Topic 2-Dow TheoryDocument11 pagesTopic 2-Dow TheoryZatch Series UnlimitedNo ratings yet

- 2022 Personal Finance - Investments CP 6 & 7Document22 pages2022 Personal Finance - Investments CP 6 & 7Ariella SalvacionNo ratings yet

- Traders WorldDocument60 pagesTraders WorldSushant KanadeNo ratings yet

- Gold's Super Cycle: Decades in The Making?Document5 pagesGold's Super Cycle: Decades in The Making?Robert HaryantoNo ratings yet

- Automatic Trendline Detection With Hough TransformDocument11 pagesAutomatic Trendline Detection With Hough TransformlluuukNo ratings yet

- MBA 3rd Semester Curriculum in Session 2020-21Document18 pagesMBA 3rd Semester Curriculum in Session 2020-21Uma KhamhariNo ratings yet

- Candlestick Patterns (Ahmer Waqas)Document25 pagesCandlestick Patterns (Ahmer Waqas)ayubzulqarnain492No ratings yet

- Roman UrduDocument27 pagesRoman Urduhashmiaqeedat5No ratings yet

- Brochure Foundation of Stock Market InvestingDocument10 pagesBrochure Foundation of Stock Market InvestingRahul SharmaNo ratings yet

- Project Report 2 PDFDocument8 pagesProject Report 2 PDFAkash SinghNo ratings yet

- DT Time BandDocument4 pagesDT Time BandanudoraNo ratings yet

Technical Analysis For Beginners (The Ultimate Guide) - New Trader U

Technical Analysis For Beginners (The Ultimate Guide) - New Trader U

Uploaded by

Puneet RajOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Technical Analysis For Beginners (The Ultimate Guide) - New Trader U

Technical Analysis For Beginners (The Ultimate Guide) - New Trader U

Uploaded by

Puneet RajCopyright:

Available Formats

New Trader U

Empowering Your Financial Journey

Elegance that lasts lifetime

Ad

Jaquar World

VISIT SITE

Elegance that lasts lifetime

Technical Analysis For Beginners (The

Ultimate Guide)

By Steve Burns

Technical analysis is the art and science of reading charts to quantify the trend or trading

range price is in, the path of least resistance for the next directional move, the area of value

on the chart, and create good risk/reward ratios by defining key technical levels.

There are two major schools of thought within technical analysis: predictive technical

analysis and reactive technical analysis.

Shopee No.1 Marketplace

Shopee

Predictive technical analysis is practiced when traders project what will happen next in price

movement based on a current chart pattern. They look for the clues of volume, trendlines,

and the levels of support and resistance to project the probabilities of the future price

movement. It’s an attempt to predict the future price action based on the current and past

price action.

Reactive technical analysis is practiced when a trader’s entries and exits are based on

current price signals that backtest as profitable by creating good risk/reward ratios. Their

quantified price signals tell them when to get in for a good probability of success and where

to get out with a small loss or to lock in a profit. Reactive traders rely on trade management

as the price action plays out to minimize losses and maximize gains for profitability. They

rely on quantified systems to make money in the markets, not knowing the future.

There are four primary trading tools used in technical analysis for identifying entry and exit

signals.

Drawing Tools

Candlestick patterns

Chart Patterns

Technical Indicators

A trader must understand the purpose each tool is used for so they are implemented

correctly.

NEW

Shopee Coins Cashback…

Shopee

How Are Drawing Tools Used In Trading?

Most charting platforms have drawing tools that allow a trader to draw their own trendlines

directly on a chart and create trend channels to track the momentum of a trend, with peaks

(or highs) frequently respecting the upper trend channel; and troughs (or lows) respecting

the lower channel.

A trader can project Fibonacci extension levels from a present trend and also project

Fibonacci retracement levels from an existing trend.

Technical Analysis For Beginners (The Ultimate Guide)

Image Courtesy of TrendSpider.com

Technical Analysis Methods

Drawing tools also allow the creation of captions to highlight buy and sell signals and record

your observations on the chart.

Trendlines are the identifiers and connectors of resistance and support in chart patterns.

Trendlines are ways to measure and quantify the path of least resistance for a chart in your

time frame.

Trendlines are identifiers of the trend in your trading time frame.

Vertical trend lines must be drawn from left to right to identify one of the following:

A trend of higher highs signaling an uptrend.

A trend of higher lows for support in an uptrend.

A trend of lower lows signaling a downtrend.

A trend of lower highs for resistance in a downtrend.

Horizontal trend lines must be drawn straight from left to right to identify price levels of

resistance based on repeating high prices that can’t be broken or levels of support based

on repeating lows that hold.

Trend lines can connect end of day prices or the full daily range of prices. For candlestick

charts the wicks represent intra-day prices that were outside the open or the close. Both

are viable options for trend lines.

Trend lines should connect at least two price levels in a direct path to be considered viable.

The more connections that a trend line makes the more meaningful it is.

Trend lines must be updated daily to ensure a trend is still in place. You want to see a

connection and trend of prices in your timeframe.

A break out of price through your connecting trend line can indicate the beginning of a

change in trend or market environment. A market could be going from an uptrend or

downtrend to a sideways range as your trend line breaks or reversing in trend completely.

The vertical red lines on this chart represents the two downtrends that $XLE went through

for weeks making lower highs day after day for much of the downtrend.

The green lines on the $XLE chart represent vertical support of higher lows as $XLE trends

up twice on this chart. Notice that the red downtrend line was broken both times before the

next uptrend began.

Technical Analysis For Beginners (The Ultimate Guide)

Chart courtesy of StockCharts.com

Chart Summary: Trendlines are visual ways to measure, identify, and track the trends on a

chart by connecting vertical or horizontal support and resistance on a chart.

Price channels can be: up, down, or sideways.

There are uptrend, downtrend, and range bound price channels.

Here is an example of an up trending price channel:

Technical Analysis For Beginners (The Ultimate Guide)

Chart Courtesy of TrendSpider.com.

Here is what a range bound trading channel looks like:

Technical Analysis For Beginners (The Ultimate Guide)

Many times after a break out of resistance, old resistance can become new support: (Or

vice versa).

Technical Analysis For Beginners (The Ultimate Guide)

Image via ColibriTrader.com

Chart Facts:

A trading channel can be vertical or horizontal and is defined by trendlines.

Vertical ascending up trend channels is defined by parallel higher highs and higher

lows.

Vertical down trend channels are defined by parallel lower highs and lower lows.

Horizontal descending trendlines are defined by parallel lines that have price

resistance around the same area of a high price level and price support around a

similar lower area of price.

Resistance lines in a chart pattern is where buyers are absent at higher prices and

selling pressure at those prices set in.

Support lines in a chart pattern are where buyers step in to buy at a price level to

prevent prices from going lower overcoming the selling pressure.

Buyers and sellers are always equal in any trade the variance is in what price that the

trade will take place.

Many times when a horizontal price channel is broken higher the old resistance

becomes the new support.

Many times when a horizontal price channel is broken lower the old support becomes

the new resistance.

Channels are for identifying where buyers and sellers are located.

Momentum and trend signals are given when a well defined price channel is broken.

Another name for a horizontal price chart pattern is a rectangle. The break out of the

range in either direction is the signal to enter a trade in the direction of the break.

This $SMH chart shows examples of three ascending channels during the uptrend in this

chart. The lower trend lines held up well in real time tracking and connecting on this chart.

The upper trend line continued to set higher highs which was bullish. You also want to see

the lower ascending support line continue to set higher lows by the close each day to keep

reconnecting your lower trend line for ascending support.

Technical Analysis For Beginners (The Ultimate Guide)

Chart Courtesy of StockCharts.com

This $PSX chart is an example of a reoccurring horizontal price channel for months. This is

an example of a range bound market. The resistance is near $78.50 and support is near

$74.50 to create a trading range. Notice that breakouts above and below these levels failed

over and over. Returning to the previous price range after a failed break out is a sign of a

range bound market. Trending market should have continuation after a break out is

attempted several times. The best way to look for patterns of support and resistance is to

look at where highs and lows of prices went to the last few times it made short term lows

and highs in price.

Technical Analysis For Beginners (The Ultimate Guide)

You might also like

- Free Chart Patterns BookDocument8 pagesFree Chart Patterns BookKikogamerz 2021100% (1)

- Ultimate Guide To Institutional Candlestick Patterns PDFDocument36 pagesUltimate Guide To Institutional Candlestick Patterns PDFofficialbasseyjohnNo ratings yet

- The Power of Japanese Candlestick ChartsDocument5 pagesThe Power of Japanese Candlestick ChartsSyahirN50% (2)

- Price Action CheatsheetDocument22 pagesPrice Action CheatsheetCapitanu Iulian100% (2)

- Trend Lines and PatternsDocument6 pagesTrend Lines and PatternsUpasara WulungNo ratings yet

- Report Big Three Strategy PDFDocument18 pagesReport Big Three Strategy PDFCHARMINo ratings yet

- Harmonic Forex Patterns Cheat SheetDocument2 pagesHarmonic Forex Patterns Cheat SheetAklchanNo ratings yet

- Average True RangeDocument2 pagesAverage True Rangesanny2005100% (1)

- M1 M5 Forex Scalping Trading Strategy PDFDocument9 pagesM1 M5 Forex Scalping Trading Strategy PDFzooor100% (1)

- Candlestick Chart PatternsDocument9 pagesCandlestick Chart Patternssmitha100% (1)

- 58-The DMI Stochastic PDFDocument7 pages58-The DMI Stochastic PDFlondonmorganNo ratings yet

- Trading Support and Resistance Levels v.3Document14 pagesTrading Support and Resistance Levels v.3amedkillpic100% (2)

- Price Action CourseDocument3 pagesPrice Action CourseNjine PatrickNo ratings yet

- Professional Day Trading & Technical Analysis Strategic System For Intraday Trading Stocks, Forex & Financial Trading.From EverandProfessional Day Trading & Technical Analysis Strategic System For Intraday Trading Stocks, Forex & Financial Trading.No ratings yet

- Trading with the Trendlines: Harmonic Patterns Strategy Trading Strategy. Forex, Stocks, FuturesFrom EverandTrading with the Trendlines: Harmonic Patterns Strategy Trading Strategy. Forex, Stocks, FuturesNo ratings yet

- Day Trading Strategies For Beginners: Day Trading Strategies, #2From EverandDay Trading Strategies For Beginners: Day Trading Strategies, #2No ratings yet

- Become A Successful Trader Using Smart Money Concept: The Complete Guide to Forex Trading, Stock Trading, and Crypto Currency Trading for BeginnersFrom EverandBecome A Successful Trader Using Smart Money Concept: The Complete Guide to Forex Trading, Stock Trading, and Crypto Currency Trading for BeginnersNo ratings yet

- Mean Reversion Day Trading Strategies: Profitable Trading StrategiesFrom EverandMean Reversion Day Trading Strategies: Profitable Trading StrategiesRating: 5 out of 5 stars5/5 (1)

- SWING TRADING: Maximizing Returns and Minimizing Risk through Time-Tested Techniques and Tactics (2023 Guide for Beginners)From EverandSWING TRADING: Maximizing Returns and Minimizing Risk through Time-Tested Techniques and Tactics (2023 Guide for Beginners)No ratings yet

- Micro Patterns 2Document18 pagesMicro Patterns 2Aris ResurreccionNo ratings yet

- Technical AnalysisDocument32 pagesTechnical AnalysisDhikshit ShettyNo ratings yet

- Full Guide On Support and Resistance: by Crypto VIP SignalDocument11 pagesFull Guide On Support and Resistance: by Crypto VIP SignalBen AdamteyNo ratings yet

- Accumulation/Distribution Line: Divergence AnalysisDocument44 pagesAccumulation/Distribution Line: Divergence AnalysismpdharmadhikariNo ratings yet

- Log Com - Miniclip.cricketleague 1690042258Document35 pagesLog Com - Miniclip.cricketleague 1690042258250 RaiderNo ratings yet

- Free Price Action Trading PDF GuideDocument20 pagesFree Price Action Trading PDF Guidemohamed hamdallah100% (2)

- TechAnalysis InvestopediaDocument14 pagesTechAnalysis InvestopediaCristian FilipNo ratings yet

- Accumulation Manipulation Distribtuion: RefinedDocument4 pagesAccumulation Manipulation Distribtuion: RefinedHODAALE MEDIANo ratings yet

- Supportand Resistance Trading StrategyDocument10 pagesSupportand Resistance Trading StrategyEng Abdikariim AbdillahiNo ratings yet

- HHLL Trading System (PRINT) PDFDocument15 pagesHHLL Trading System (PRINT) PDFWilliam ZhuangNo ratings yet

- Price Action Chart PatternsDocument13 pagesPrice Action Chart Patternsmatas matas0% (1)

- An Intraday Trading MethodologyDocument249 pagesAn Intraday Trading Methodologysuraj100% (1)

- Simple Trading Techniques, Powerful Results-1Document103 pagesSimple Trading Techniques, Powerful Results-1Fernando Magalhães100% (2)

- Binary Option Trading: Introduction to Binary Option TradingFrom EverandBinary Option Trading: Introduction to Binary Option TradingNo ratings yet

- Beginner's Guide To Become A Professional TraderDocument9 pagesBeginner's Guide To Become A Professional TraderBir Bahadur MishraNo ratings yet

- TA Secrets #4 - Basic Chart PatternsDocument7 pagesTA Secrets #4 - Basic Chart PatternsBlueNo ratings yet

- Trend Is Your FriendDocument3 pagesTrend Is Your Frienddyadav00No ratings yet

- 10 Price Action Bar Patterns You Must KnowDocument22 pages10 Price Action Bar Patterns You Must KnowSudipto PaulNo ratings yet

- False Breakout - How To Avoid and Even Trade It?Document14 pagesFalse Breakout - How To Avoid and Even Trade It?vic beckham100% (1)

- Captains Posts With Attachments 1 PDFDocument211 pagesCaptains Posts With Attachments 1 PDFMushfiq FaysalNo ratings yet

- Forex Candlestick Ambush Trade .Document31 pagesForex Candlestick Ambush Trade .Malik SaraikiNo ratings yet

- 10 Price Action SecretsDocument6 pages10 Price Action SecretsElap Elap100% (2)

- Forex Hedging Strategy PDF Download For BeginnersDocument19 pagesForex Hedging Strategy PDF Download For BeginnersAbdiaziz MohamedNo ratings yet

- Options Introduction - TsugiTradesDocument5 pagesOptions Introduction - TsugiTradeshassanomer2122No ratings yet

- TA Chapter 3Document56 pagesTA Chapter 3Phúc Thiên NguyễnNo ratings yet

- Candlestick Flashcards 101Document10 pagesCandlestick Flashcards 101Viet Nguyen DuyNo ratings yet

- Forex Price Action Strategy: The Ultimate Guide (2018 Update)Document39 pagesForex Price Action Strategy: The Ultimate Guide (2018 Update)Tanyaradzwa100% (3)

- Breakout Trading Strategies Quick GuideDocument10 pagesBreakout Trading Strategies Quick GuideSMadhusuthanaPerumal100% (1)

- The Candlestick Training GuideDocument21 pagesThe Candlestick Training GuideYureAndradeNo ratings yet

- Wedge Pattern Workbook - UnlockedDocument24 pagesWedge Pattern Workbook - Unlockedshah farizNo ratings yet

- MYTS Candlestick PatternsDocument14 pagesMYTS Candlestick Patternsoneuptrade teste100% (1)

- Price ActionDocument100 pagesPrice Actionchelle100% (3)

- Technical IndicatorsDocument37 pagesTechnical Indicatorskrishna4340No ratings yet

- Swap Zones-1 PDFDocument5 pagesSwap Zones-1 PDFNakata YTNo ratings yet

- FMC Derive Price Action GuideDocument50 pagesFMC Derive Price Action GuideTafara MichaelNo ratings yet

- Thousand Baby Boy Names Starting With V (Hindu)Document24 pagesThousand Baby Boy Names Starting With V (Hindu)Sai RamNo ratings yet

- 10 Chart Pattan Traders Should KnowDocument24 pages10 Chart Pattan Traders Should Knowstephen briggsNo ratings yet

- Ascending & Descending BroadingDocument9 pagesAscending & Descending BroadingvvpvarunNo ratings yet

- Technical AnalysisDocument43 pagesTechnical AnalysisAhsan Iqbal100% (1)

- Forexbee Co Order Blocks ForexDocument11 pagesForexbee Co Order Blocks ForexMr WatcherNo ratings yet

- 02 - Breakout - How To Trade With Momentum The Correct WayDocument10 pages02 - Breakout - How To Trade With Momentum The Correct Waysidd100% (1)

- Technical Analysis WordDocument16 pagesTechnical Analysis WordSwapnil G MankarNo ratings yet

- An Introduction To Price Action Trading StrategiesDocument5 pagesAn Introduction To Price Action Trading StrategiesPrem KarthikNo ratings yet

- Efficient Capital MarketsDocument25 pagesEfficient Capital MarketsAshik Ahmed NahidNo ratings yet

- 3 Best Chart Patterns For Intraday Trading in ForexDocument15 pages3 Best Chart Patterns For Intraday Trading in ForexCheng80% (5)

- #45 PDFDocument76 pages#45 PDFjivaneto100% (1)

- 44 - 1994 WinterDocument74 pages44 - 1994 WinterLinda ZwaneNo ratings yet

- Study of Fluctuations in Stock MarketDocument34 pagesStudy of Fluctuations in Stock MarketHeena GuptaNo ratings yet

- Auto Trend Line Support and ResistenceDocument10 pagesAuto Trend Line Support and Resistenceraj06740No ratings yet

- Chapter-1 Techinical AnalysisDocument90 pagesChapter-1 Techinical AnalysisRajesh Insb100% (1)

- Pizzottaite Journal Technical Analysis Article-297-315Document19 pagesPizzottaite Journal Technical Analysis Article-297-315Financial Management by Dr MujahedNo ratings yet

- 2023 Symposium Final AgendaDocument38 pages2023 Symposium Final AgendaNishan LeemaNo ratings yet

- Elite PDFDocument29 pagesElite PDFRaja RajNo ratings yet

- Stephen Poser - Elliott Wave Theory For Short Term and Intraday TradingDocument16 pagesStephen Poser - Elliott Wave Theory For Short Term and Intraday Tradingchetuzz2100% (1)

- Influence of Social Media Over Stock MarketDocument9 pagesInfluence of Social Media Over Stock MarketHaaturaNo ratings yet

- Forex - The Foreign Exchange Market - : L - D - R V DDocument8 pagesForex - The Foreign Exchange Market - : L - D - R V DLaura SoneaNo ratings yet

- FB 210903174753Document51 pagesFB 210903174753phoyesorasNo ratings yet

- Penny StockDocument57 pagesPenny StockPete CNo ratings yet

- "Equity Research On Cement Sector": Master of Business AdministrationDocument62 pages"Equity Research On Cement Sector": Master of Business AdministrationVishwas ChaturvediNo ratings yet

- Topic 2-Dow TheoryDocument11 pagesTopic 2-Dow TheoryZatch Series UnlimitedNo ratings yet

- 2022 Personal Finance - Investments CP 6 & 7Document22 pages2022 Personal Finance - Investments CP 6 & 7Ariella SalvacionNo ratings yet

- Traders WorldDocument60 pagesTraders WorldSushant KanadeNo ratings yet

- Gold's Super Cycle: Decades in The Making?Document5 pagesGold's Super Cycle: Decades in The Making?Robert HaryantoNo ratings yet

- Automatic Trendline Detection With Hough TransformDocument11 pagesAutomatic Trendline Detection With Hough TransformlluuukNo ratings yet

- MBA 3rd Semester Curriculum in Session 2020-21Document18 pagesMBA 3rd Semester Curriculum in Session 2020-21Uma KhamhariNo ratings yet

- Candlestick Patterns (Ahmer Waqas)Document25 pagesCandlestick Patterns (Ahmer Waqas)ayubzulqarnain492No ratings yet

- Roman UrduDocument27 pagesRoman Urduhashmiaqeedat5No ratings yet

- Brochure Foundation of Stock Market InvestingDocument10 pagesBrochure Foundation of Stock Market InvestingRahul SharmaNo ratings yet

- Project Report 2 PDFDocument8 pagesProject Report 2 PDFAkash SinghNo ratings yet

- DT Time BandDocument4 pagesDT Time BandanudoraNo ratings yet