Professional Documents

Culture Documents

2022full Year Audited Group Results

2022full Year Audited Group Results

Uploaded by

Githui KiunaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2022full Year Audited Group Results

2022full Year Audited Group Results

Uploaded by

Githui KiunaCopyright:

Available Formats

BRITAM HOLDINGS PLC

AUDITED SUMMARY CONSOLIDATED RESULTS FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2022

The Board of Directors is pleased to announce the Group’s audited results for the financial year ended 31 December 2022

2022 Performance Highlights

Audited Audited

2022 2021 Gross Earned Premium and Fund Total Assets

Management Fees

Shs‘000 Shs‘000 1.2%

CAGR +1

.5%

33,402,890 32,523,890 CAGR +7

(7,077,697) (6,823,395)

26,325,193 25,700,495

Interest and dividend income 13,007,944 10,872,447

103,656

125,244

136,962

153,427

158,422

24,986

27,667

28,821

32,524

33,403

Net gain from investment property 643,237 (206,410)

(3,913,086) 1,799,672

2018 2019 2020 2021 2022 2018 2019 2020 2021 2022

1,603,056 1,459,547

540,086 602,224

38,206,430 40,227,975 Commentary on the Group 2022 Financial Results

The Group has reported a profit before tax of Shs 2.95 billion for the financial year ended 31 December 2022. This

Net insurance claims, increase in policyholder's benefits and loss is a significant improvement compared to a profit before tax of Shs 1.01 billion reported in the financial year ended

adjustment expenses 31 December 2021.

17,860,203 17,840,426

4,922,686 5,230,998 The improved performance is attributable to a growth in top line revenue as well as operating efficiency and cost

8,365,770 11,327,916 management initiatives. This together with improved dividend and interest income helped cushion the significant fair

272,917 413,989 value losses to register improved profitability.

3,830,040 4,117,100

Overall, the Group's gross earned premiums and fund management fees grew by 2.7 percent to Shs 33.4 billion with

35,251,616 38,930,429 the regional units continuing to significantly contribute to the Group's revenue and profitability. The international

Profit before share of loss of associate 2,954,814 1,297,546 general insurance businesses contributed 23 percent of the Group’s gross earned premiums.

Share of results of associates (2,760) (286,085)

Profit before tax 2,952,054 1,011,461 The Group remains focused on the improvement of operating efficiency. Total operating costs were down 26.1

percent to Shs 8.4 billion from Shs 11.3 billion reported in 2021. Reduction in costs is due to efficiencies derived

Income tax expense (1,260,755) (939,337) from cost containment measures under the new strategy's operating model.

Profit for the year 1,691,299 72,124

Gains on revaluation of financial assets at fair value through other The total shareholders equity as at 31 December 2022 stood at Shs 20.8 billion. This is a 9.2 percent increase from

comprehensive income 31 December 2021 reflecting the improved financial results.

86,374 1,992,717

Others adjustments (19,596) (48,156) The ongoing execution of the Group's EPIC2 #OneBritam Transformational Strategy is expected to continue creating

Total other comprehensive income 66,778 1,944,561 value by growing the business and its profitability.

Comprehensive income for the year 1,758,077 2,016,685

Other Matters

Basic and diluted earnings per share (Shs) 0.63 0.02

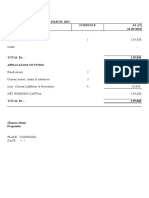

SUMMARY CONSOLIDATED STATEMENT OF FINANCIAL POSITION Dividends

The Board of Directors do not recommend the payment of a dividend for the year ended 31 December 2022. The

Audited Audited

Annual General Meeting is scheduled to be held on or about 9 June 2023.

31-Dec-22 31-Dec-21

Shs‘000 Shs‘000 The above summary Consolidated Statement of Profit or Loss and Other Comprehensive Income, Summary

252,344 Consolidated Statement of Financial Position, Summary Consolidated Statement of Cash Flows, and other

disclosures are extracted from the 2022 Audited Consolidated Financial Statements which were approved by the

13,237,451

Board of Directors on 28 March 2023 and signed on its behalf by:

13,583,135 16,394,912

Accumulated losses (6,468,770) (10,943,574) By Order of the Board

20,604,160 18,941,133 Mr. Kuria Muchiru Mrs. Caroline Kigen

237,434 142,384 Chairman Director

20,841,594 19,083,517 Independent Auditor's Report on the Summary Financial

Statements to the Shareholders of Britam Holdings Plc

2,226,371 2,672,572

134,914,548 130,376,533 Opinion

We have audited the summary financial statements of Britam Holdings Plc, which comprise the summary

14,415,781 13,396,109

consolidated statement of financial position at 31 December 2022 and the summary consolidated statements of

Cash and cash equivalents 1,798,708 1,862,538 profit or loss and other comprehensive income, changes in equity and cash flows for the year then ended which are

5,066,371 5,119,584 derived from the audited financial statements of Britam Holdings Plc and its subsidiaries (together, the "Group") for

158,421,779 153,427,336 the year ended 31 December 2022. The Group's financial statements are prepared in accordance with International

Financial Reporting Standards and the Companies Act, 2015.

125,457,686 114,676,009

In our opinion the accompanying summary financial statements are consistent, in all material respects, with the

2,540,223 4,227,825 audited financial statements of the Group which are prepared in accordance with International Financial Reporting

Provisions and other payables 9,582,276 15,439,985 Standards (IFRS) and the Companies Act, 2015.

137,580,185 134,343,819

Summary financial statements

20,841,594 19,083,517 The summary financial statements do not contain all the disclosures required by International Financial Reporting

Standards and in the manner required by the Companies Act, 2015.

SUMMARY CONSOLIDATED STATEMENT OF CASHFLOWS

Audited Audited Reading the summary financial statements and the auditor's report thereon, therefore, is not a substitute for reading

2022 2021 the audited financial statements. The summary financial statements and the audited financial statements do not

reflect the effects of events that occurred subsequent to the date of our report on the audited financial statements.

Shs‘000 Shs‘000

Cash generated from operations 3,028,503 1,510,052 The audited financial statements and our report thereon

We expressed an unmodified audit opinion on the audited financial statements in our audit report dated 28 March

(231,073) (246,521)

2023. That audit report also includes the communication of key audit matters. Key audit matters are those matters

Net cash generated from operating activities 2,797,430 1,263,531 that, in our professional judgement, were of most significance in our audit of the financial statements of the current

Net cash used in investing activities (125,567) (230,102) period.

Net cash used in financing activities (2,179,494) (1,031,944)

492,369 1,485 Directors' responsibility for the summary financial statements

The directors are responsible for the preparation of the summary financial statements in accordance with

the International Financial Reporting Standards and Companies Act, 2015.

7,499,485 7,498,000

492,369 1,485 Auditor's Responsibility

7,991,854 7,499,485 Our responsibility is to express an opinion on whether the summary financial statements are consistent, in all

At the end of the year

material respects, with the audited financial statements based on our procedures, which were conducted in

SUMMARY CONSOLIDATED STATEMENT OF CHANGES IN EQUITY accordance with International Standard on Auditing (ISA) 810 (Revised), Engagements to report on summary

financial statements.

Reserves

and non- FCPA Richard Njoroge, Practising certificate No. 1244

controlling

Engagement partner responsible for the audit

interest

For and behalf of PricewaterhouseCoopers LLP

5,593,722 19,083,517

Profit for the year 1,691,299 1,691,299 Certified Public Accountants

Nairobi

Other comprehensive income 66,778 66,778 28 March 2023

At 31 December 2022 7,351,799 20,841,594

KENYA UGANDA TANZANIA RWANDA SOUTH SUDAN MOZAMBIQUE MALAWI Head Office: Britam Tower, Hospital Road, Upper Hill

www.britam.com BritamEA BritamEA Tel: 0705 100 100 Email: customerservice@britam.com

You might also like

- Global Internal Audit StandardsDocument120 pagesGlobal Internal Audit StandardsMarcos Wilker100% (3)

- Chapter 4 Solutions Horngren Cost AccountingDocument50 pagesChapter 4 Solutions Horngren Cost AccountingAnik Kumar MallickNo ratings yet

- Auditing Problems Roque 2023-2024Document385 pagesAuditing Problems Roque 2023-2024Roisu De KuriNo ratings yet

- Ecobank FinancialsDocument2 pagesEcobank FinancialsFuaad Dodoo0% (1)

- 2019-12 - EIC Accelerator Pilot - Annex - 4 - Financial Information - Proposal Template Part BDocument3 pages2019-12 - EIC Accelerator Pilot - Annex - 4 - Financial Information - Proposal Template Part BminossotaNo ratings yet

- BLF BEO Constituting The BACDocument2 pagesBLF BEO Constituting The BACfcgomezjrNo ratings yet

- Financial Report ExampleDocument18 pagesFinancial Report ExampleelizaroyNo ratings yet

- SunPharmaAR2019 20 PDFDocument288 pagesSunPharmaAR2019 20 PDFAvishkar AvishkarNo ratings yet

- Unaudited Financial Statements For The Period Ended 31 March, 2022Document2 pagesUnaudited Financial Statements For The Period Ended 31 March, 2022Fuaad DodooNo ratings yet

- DSCR CalculationDocument2 pagesDSCR CalculationusmanthesaviorNo ratings yet

- Swipate Gate 3Document10 pagesSwipate Gate 3Kipsxz LeopNo ratings yet

- Accounts Fy 22 23 BaluchistanDocument104 pagesAccounts Fy 22 23 BaluchistanFarooq MaqboolNo ratings yet

- Balance Sheet As at 31 March 2022 Profit and Loss Account For The Year Ended 31 March 2022Document1 pageBalance Sheet As at 31 March 2022 Profit and Loss Account For The Year Ended 31 March 2022burhan mattooNo ratings yet

- Year 2 Loan WorkingsDocument1 pageYear 2 Loan WorkingsTully HamutenyaNo ratings yet

- Year 1 Loan WorkingsDocument1 pageYear 1 Loan WorkingsTully HamutenyaNo ratings yet

- Unaudited Financial Statements For The Period Ended 30 September, 2021Document2 pagesUnaudited Financial Statements For The Period Ended 30 September, 2021Fuaad DodooNo ratings yet

- TASCODocument13 pagesTASCOsozodaaaNo ratings yet

- Audited Fin Results Mar 2021 (ESFBS 0458 24 05 21)Document1 pageAudited Fin Results Mar 2021 (ESFBS 0458 24 05 21)Deepak KanojiaNo ratings yet

- Quarterly Report Q2 FY2023Document27 pagesQuarterly Report Q2 FY2023Hang LekiuNo ratings yet

- Dashen Bank 2023 Report 4 Website 2 1Document63 pagesDashen Bank 2023 Report 4 Website 2 1yemaneatakNo ratings yet

- Complete Annual ReportDocument325 pagesComplete Annual Reportrahul vNo ratings yet

- SOIC-Consitent CompoundersDocument28 pagesSOIC-Consitent CompoundersPrateekNo ratings yet

- Open Bionics LTD Open Bionics Financial Outlook 2023 To 2026Document2 pagesOpen Bionics LTD Open Bionics Financial Outlook 2023 To 2026Dragan SaldzievNo ratings yet

- Quarterly Report 20221231Document21 pagesQuarterly Report 20221231Ang SHNo ratings yet

- MB Annual FS 2019 (May 12, 2020) - Final DraftDocument164 pagesMB Annual FS 2019 (May 12, 2020) - Final DraftDilip Devidas JoshiNo ratings yet

- AMAR CFmaruhDocument6 pagesAMAR CFmaruhratuhsNo ratings yet

- 1QFY2022 FinancialResultsDocument17 pages1QFY2022 FinancialResultsCheah ChenNo ratings yet

- CAL BankDocument2 pagesCAL BankFuaad DodooNo ratings yet

- WABCO INDIA Annual Report 2023Document199 pagesWABCO INDIA Annual Report 2023WendyNo ratings yet

- Htpadu bs2022Document2 pagesHtpadu bs2022shuhada shuhaimiNo ratings yet

- How To Budget - AnuDocument7 pagesHow To Budget - AnuSreekanth NairNo ratings yet

- 2021 2020 Bank Group Bank Group: in Thousands of Ghana Cedis in Thousands of Ghana CedisDocument2 pages2021 2020 Bank Group Bank Group: in Thousands of Ghana Cedis in Thousands of Ghana CedisFuaad DodooNo ratings yet

- Financial Model Asian PaintsDocument19 pagesFinancial Model Asian Paintssantoshj423No ratings yet

- Financial Statement: Bajaj Auto LTDDocument20 pagesFinancial Statement: Bajaj Auto LTDrohanNo ratings yet

- Masteel 4Q 2023Document12 pagesMasteel 4Q 2023GZHNo ratings yet

- Bursa Malaysia Derivatives Monthly Newsletter-1Document2 pagesBursa Malaysia Derivatives Monthly Newsletter-1SamyakNo ratings yet

- Sun Pharma AR FY19Document264 pagesSun Pharma AR FY19Dhagash VoraNo ratings yet

- Fy2023 Analysis of Revenue and ExpenditureDocument24 pagesFy2023 Analysis of Revenue and ExpenditurePutri AgustinNo ratings yet

- Aisha Steel Mills LTDDocument19 pagesAisha Steel Mills LTDEdnan HanNo ratings yet

- Majeed Traders Projections 2024 To 2025Document12 pagesMajeed Traders Projections 2024 To 2025vayave5454No ratings yet

- Mega Budgeting Budnle of MaterialsDocument6 pagesMega Budgeting Budnle of MaterialsMukti TawakalNo ratings yet

- a237f07e-0946-42cc-93d1-998fc61372d7Document20 pagesa237f07e-0946-42cc-93d1-998fc61372d7sonu.k.gupta9No ratings yet

- SPIL-Annual Report 2015 Upload PDFDocument195 pagesSPIL-Annual Report 2015 Upload PDFVarun BansalNo ratings yet

- ResultsDocument12 pagesResultsmyra.khiwaniNo ratings yet

- Ques 3:: Less: Management Cost Add: Capital ExpenditureDocument2 pagesQues 3:: Less: Management Cost Add: Capital ExpenditurearunNo ratings yet

- Q4 2022 Bursa Announcement - 2Document13 pagesQ4 2022 Bursa Announcement - 2Quint WongNo ratings yet

- Unaudited Condensed Consolidated Financial Statement For The Financial Year 2021 Fourth Quarter Ended 31 March 2021Document21 pagesUnaudited Condensed Consolidated Financial Statement For The Financial Year 2021 Fourth Quarter Ended 31 March 2021Iqbal YusufNo ratings yet

- + UpdatedDocument22 pages+ UpdatedRobert ManjoNo ratings yet

- VIL Reg 33 Results Q4FY24Document10 pagesVIL Reg 33 Results Q4FY24Samim Al RashidNo ratings yet

- Kamre Aalam Balance Sheet - March-2022Document4 pagesKamre Aalam Balance Sheet - March-2022Parth KachhiyaNo ratings yet

- GC Export ChartDocument1 pageGC Export ChartAgatha PrintingNo ratings yet

- Wasay Laboratories Projections 2024 To 2026 - Revised April 2024Document13 pagesWasay Laboratories Projections 2024 To 2026 - Revised April 2024vayave5454No ratings yet

- Financials VTL FinalDocument19 pagesFinancials VTL Finalmuhammadasif961No ratings yet

- Steady-: We Are What Our Bikes Are..Document140 pagesSteady-: We Are What Our Bikes Are..Suraj GameingNo ratings yet

- Unaudited Consolidated Financial Statements: For The Quarter Ended 31 March 2022Document7 pagesUnaudited Consolidated Financial Statements: For The Quarter Ended 31 March 2022Fuaad DodooNo ratings yet

- Annual Report 202021Document128 pagesAnnual Report 202021fddNo ratings yet

- Salon de Elegance FinalDocument35 pagesSalon de Elegance FinalRon Benlheo OpolintoNo ratings yet

- 1 - Laporan Tahunan 2022 12Document1 page1 - Laporan Tahunan 2022 12Lowongan PekerjaanNo ratings yet

- Interim Financial Statements For The Period Ended 30 September 2022Document10 pagesInterim Financial Statements For The Period Ended 30 September 2022kasun witharanaNo ratings yet

- 195879Document69 pages195879Irfan MasoodNo ratings yet

- Societe Generale Ghana PLC Unaudited Financial Statements For The Half Year Ended 30 June 2021Document2 pagesSociete Generale Ghana PLC Unaudited Financial Statements For The Half Year Ended 30 June 2021Fuaad DodooNo ratings yet

- The Ultimate Guide To Auto Cad 2022 3D Modeling For 3d Drawing And ModelingFrom EverandThe Ultimate Guide To Auto Cad 2022 3D Modeling For 3d Drawing And ModelingNo ratings yet

- Transforming Bangladesh’s Participation in Trade and Global Value ChainFrom EverandTransforming Bangladesh’s Participation in Trade and Global Value ChainNo ratings yet

- LA Fitness PLC: Annual Report and Accounts 2004Document48 pagesLA Fitness PLC: Annual Report and Accounts 20044coolkidNo ratings yet

- Oil Record Book Guidelines PDFDocument4 pagesOil Record Book Guidelines PDFBaderN100% (3)

- Adani Power LimitedDocument23 pagesAdani Power LimitedRakesh KNo ratings yet

- The Chief Audit Executive-Understanding The Role and Professional Obligations of A CAEDocument18 pagesThe Chief Audit Executive-Understanding The Role and Professional Obligations of A CAESophia De GuzmanNo ratings yet

- Chapter 12Document12 pagesChapter 12Arslan Saleem0% (1)

- Sub Rma 503Document10 pagesSub Rma 503Areeb BaqaiNo ratings yet

- FPOE-Tentative Schedule PDFDocument1 pageFPOE-Tentative Schedule PDFWajahat GhafoorNo ratings yet

- 14TH - Year - End - Awards - Nfjpia - NCR Irr PDFDocument46 pages14TH - Year - End - Awards - Nfjpia - NCR Irr PDFJulius Lester AbieraNo ratings yet

- Stat Chapter 1 Stat RefresherDocument28 pagesStat Chapter 1 Stat RefresherWonde Biru100% (2)

- Human Resources Accounting and Shareholders' Wealth of Deposit Money Banks in NigeriaDocument8 pagesHuman Resources Accounting and Shareholders' Wealth of Deposit Money Banks in NigeriaEditor IJTSRDNo ratings yet

- Bur Ling Ham BeesDocument2 pagesBur Ling Ham BeesmildredNo ratings yet

- Effectiveness of Forensic AuditingDocument21 pagesEffectiveness of Forensic AuditingManjula Nadeeth De Silva0% (1)

- Current Developments in Accounting TheoryDocument8 pagesCurrent Developments in Accounting TheorySheirgene NgNo ratings yet

- PDFDocument6 pagesPDFtal polano100% (1)

- Assurance and Audit Procedures: WWW - Defencegateway.mod - UkDocument13 pagesAssurance and Audit Procedures: WWW - Defencegateway.mod - UkaiNo ratings yet

- Chapter 1Document29 pagesChapter 1MadCube gamingNo ratings yet

- Aud589 (Pya 2019 Dec)Document7 pagesAud589 (Pya 2019 Dec)amirah zahidahNo ratings yet

- Purchasing Audit Work ProgramDocument10 pagesPurchasing Audit Work Programmr auditorNo ratings yet

- Bardege Layibi Division LLG Performance Assessment Full AssessmentDocument12 pagesBardege Layibi Division LLG Performance Assessment Full Assessmentnoreply.otimsNo ratings yet

- BSBFIM501 AAP v2.0Document135 pagesBSBFIM501 AAP v2.0Alicia AlmeidaNo ratings yet

- Contract Agreement NCRMP TPQA Part I of IIIDocument55 pagesContract Agreement NCRMP TPQA Part I of IIIHenRique Xavi InestaNo ratings yet

- Figures and Tables Daily Word RoutineDocument115 pagesFigures and Tables Daily Word RoutineSailesh VenkatramanNo ratings yet

- MSA 1 Question Wise Paper Analysis S17 To S22 by ST AcademyDocument5 pagesMSA 1 Question Wise Paper Analysis S17 To S22 by ST AcademyRafayAliNo ratings yet

- Resume Ankur BanerjeeDocument2 pagesResume Ankur BanerjeesanchitNo ratings yet

- The Revenue CycleDocument3 pagesThe Revenue CycleConner BeckerNo ratings yet

- Excipact StandardsDocument96 pagesExcipact Standardselighi100% (1)