Professional Documents

Culture Documents

Financial Due Diligence

Financial Due Diligence

Uploaded by

Nehal Mehta0 ratings0% found this document useful (0 votes)

54 views9 pagesThe document discusses key analyses for financial due diligence, including quality of earnings, net working capital, proof of cash, and net financial position. Quality of earnings analysis identifies a company's normal earnings level and adjustments like excluding one-time costs/revenues. Net working capital looks at components like receivables, inventory, and payables. Proof of cash verifies cash transactions and assesses internal controls and cash flow. Net financial position is important for valuation and determining how much debt a company can take on.

Original Description:

Fdd

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses key analyses for financial due diligence, including quality of earnings, net working capital, proof of cash, and net financial position. Quality of earnings analysis identifies a company's normal earnings level and adjustments like excluding one-time costs/revenues. Net working capital looks at components like receivables, inventory, and payables. Proof of cash verifies cash transactions and assesses internal controls and cash flow. Net financial position is important for valuation and determining how much debt a company can take on.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

54 views9 pagesFinancial Due Diligence

Financial Due Diligence

Uploaded by

Nehal MehtaThe document discusses key analyses for financial due diligence, including quality of earnings, net working capital, proof of cash, and net financial position. Quality of earnings analysis identifies a company's normal earnings level and adjustments like excluding one-time costs/revenues. Net working capital looks at components like receivables, inventory, and payables. Proof of cash verifies cash transactions and assesses internal controls and cash flow. Net financial position is important for valuation and determining how much debt a company can take on.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 9

By Bojan Radojicic

FINANCIAL

DUE

DILIGENCE

4 MUST HAVE

ANALYSIS

Bojan Radojicic robojan.gumroad.com Repost

1 Quality of Earnings

Identify normal and sustainable level of operational

earning

This help to make sure that multiple-based price we

pay for transaction is fair

Usual subjects of adjustments : Revenues, Costs, Net

Working capital

Sources of data for review: Management and public

reports, auditor reports, disclosures, post-year

events, seasonality analysis,

Bojan Radojicic robojan.gumroad.com Repost

1 Quality of Earnings

Some of key procedures to idenfity anomalies

Analyze of periodical changes in costs and revenues

(monthly, annually)

Analyze variances: actual vs. budgets

Compare official accounts with management reports

and business plan

Review of key ratio numbers and changes in ratio

numbers

Review monthly movement in sold quantities,

purchased units etc.

Test of accrued expenses and cut offs.

Bojan Radojicic robojan.gumroad.com Repost

1 Quality of Earnings

Examples of earning adjustments done in QoE:

Excluding one – off revenue and costs (non –

recurring and discontinued operations)

Adjusting transactions with related parties to market

level (arm’s length principle)

Excluding start – up costs (costs made for

expansion)

Including annualized income for new business units

(from previous bullet point)

Reviewing end – of – year provisions and accruals

Bojan Radojicic robojan.gumroad.com Repost

2 Net Working Capital

My favourite checks:

Movement in NWC and its main components,

review of DSO, DIO and DPO.

Fair value of receivables: overdue, bad debt,

payment terms, litigation, balance structure, after

balance sheet date collection

Compare NWC/Revenue ration with industry

benchmark and peers.

Quality of inventories: potential obsolescence,

historical write offs, general conditions, DIO

movement

Check trade payable overdue if any (this is sign to

increase NWC, compare payment terms with

industry benchmark)

Bojan Radojicic robojan.gumroad.com Repost

3 Proof of Cash

Importance of PofC

Detection of fraudulent activities

One of the primary reasons for performing a proof

of cash is to identify any discrepancies or unusual

transactions that might indicate fraud.

Evaluation of internal controls

A proof of cash can also shed light on the

effectiveness of a company's internal controls

related to cash transactions. If there are numerous

reconciling items or discrepancies, it might indicate

weak internal controls.

Assessment of cash flow

For a potential buyer or investor, understanding the

cash flow is crucial. The proof of cash provides a

detailed view of cash receipts and disbursements,

helping assess the company's liquidity and

operational efficiency.

Bojan Radojicic robojan.gumroad.com Repost

3 Proof of Cash

How to conduct

Make PofC Model

Gather necessary documents: Obtain bank

statements and the company's cash ledger for the

period under review.

Break down the period: Divide the period into

smaller segments, such as monthly, to make the

analysis more manageable.

Verification of cash transactions: It ensures that all

transactions affecting cash are recorded correctly in

the company's books.

Match company data outputs with your model:

Check if your test given in form of model shows the

same results as real cash in company and analyze

differences.

Bojan Radojicic robojan.gumroad.com Repost

4 Net financial position

Importance of NFP

Measure of NFP is importance for valuation, as

NFP is to be deducted from enterprise value to get

equity value.

Acquirers often leverage debt to finance

acquisitions. A clear understanding of the target's

NFP is crucial to determine how much additional

debt both companies can bear

A healthy NFP might indicate that the target

company has been generating enough cash and

has the capacity to invest in future growth

opportunities

High liabilities or a negative NFP can signify

potential liquidity problems, impacting the overall

risk profile of the acquisition

Bojan Radojicic robojan.gumroad.com Repost

Like this

content?

Let’s connect.

Bojan Radojicic robojan.gumroad.com Repost

You might also like

- Assignment 1 - 2021 - 2022Document4 pagesAssignment 1 - 2021 - 2022Assya El MoukademNo ratings yet

- Sealed Air Corporation's Leveraged Recapitalization (A)Document10 pagesSealed Air Corporation's Leveraged Recapitalization (A)Ramji100% (1)

- Module 6 - Asset-Based ValuationDocument42 pagesModule 6 - Asset-Based Valuationnatalie clyde matesNo ratings yet

- Tire City AssignmentDocument7 pagesTire City AssignmentShivam Kanojia100% (1)

- Fin & Acc For MGT - Interpretation of Accounts HandoutDocument16 pagesFin & Acc For MGT - Interpretation of Accounts HandoutSvosvetNo ratings yet

- 2a - 16-21feb - Discounted Cash Flow - Pts1-2Document11 pages2a - 16-21feb - Discounted Cash Flow - Pts1-2Udit DhawanNo ratings yet

- Financial Strategy Formulation Feb 2024Document28 pagesFinancial Strategy Formulation Feb 2024Alkhair SangcopanNo ratings yet

- Chapter 11 Valuation MethodDocument34 pagesChapter 11 Valuation Methodmansisharma8301No ratings yet

- 46 Interpretation of AccountsDocument32 pages46 Interpretation of Accountstuga100% (1)

- Accounting For Finance 1716483898Document142 pagesAccounting For Finance 1716483898christien1tshikaNo ratings yet

- TRIAL Financial Dashboard Template v.1.0Document8 pagesTRIAL Financial Dashboard Template v.1.0zaynab ELFATIMINo ratings yet

- CHUONG 3 - Financial Ratio StudentDocument34 pagesCHUONG 3 - Financial Ratio StudentnguyenbachptpNo ratings yet

- Chap 2Document51 pagesChap 2k60.2113150049No ratings yet

- Credit Analysis and Distress PredictionDocument57 pagesCredit Analysis and Distress Predictionrizki nurNo ratings yet

- Business ValuationDocument82 pagesBusiness Valuationaccpco.100No ratings yet

- 1-5 To Do An Audit, There Must Be Information in A Verifiable Form and SomeDocument18 pages1-5 To Do An Audit, There Must Be Information in A Verifiable Form and Somejulivio mewohNo ratings yet

- Write Up m201802 SinghalDocument14 pagesWrite Up m201802 Singhalshalini singhalNo ratings yet

- Interviews Financial ModelingDocument7 pagesInterviews Financial ModelingsavuthuNo ratings yet

- Chapter TWO FM I1Document65 pagesChapter TWO FM I1Embassy and NGO jobsNo ratings yet

- Working Capital Determinants, Operating Cycle of WorkingDocument8 pagesWorking Capital Determinants, Operating Cycle of WorkingGLORYNo ratings yet

- Adventity Valuation DCF AnalysisDocument22 pagesAdventity Valuation DCF Analysisw_fibNo ratings yet

- Discussion Forum Unit 8Document34 pagesDiscussion Forum Unit 8Eyad AbdullahNo ratings yet

- Summarizing Chapter 2Document10 pagesSummarizing Chapter 2Walaa Ragab100% (1)

- Financial Statement Analysis: Financial Management-Tenth EditionDocument4 pagesFinancial Statement Analysis: Financial Management-Tenth Editionanon_427723504No ratings yet

- Group 9 - BBB Audit Plan - V2-NCDocument21 pagesGroup 9 - BBB Audit Plan - V2-NCNicholas CoxNo ratings yet

- Financial Statement AnalysisDocument40 pagesFinancial Statement AnalysisLu CasNo ratings yet

- Unit 3 Assignment Brief 2 New 2022Document3 pagesUnit 3 Assignment Brief 2 New 2022neerajgup_No ratings yet

- Accounting Ratios 1. What Does An Accounting Ratio Mean?Document28 pagesAccounting Ratios 1. What Does An Accounting Ratio Mean?mmujeebsNo ratings yet

- Chapter 3 NotesDocument3 pagesChapter 3 NotesLeonardo WenceslaoNo ratings yet

- Financial Ratios and Analysis of Tata Motors: Research PaperDocument15 pagesFinancial Ratios and Analysis of Tata Motors: Research PaperMCOM 2050 MAMGAIN RAHUL PRASADNo ratings yet

- Finance: Analysis of Financial Statements RatiosDocument18 pagesFinance: Analysis of Financial Statements RatiosJohn Verlie EMpsNo ratings yet

- About Financial RatiosDocument6 pagesAbout Financial RatiosAmit JindalNo ratings yet

- Analysis of Balance SheetDocument5 pagesAnalysis of Balance Sheetprashant pawarNo ratings yet

- Financial Evaluation Report With SampleDocument12 pagesFinancial Evaluation Report With SamplemaidangphapNo ratings yet

- Fundamental Analysis Chaper 1Document19 pagesFundamental Analysis Chaper 1Mukesh YadavNo ratings yet

- IFRS 9 Financial InstrumentsDocument38 pagesIFRS 9 Financial InstrumentsohonestNo ratings yet

- Valuation For Investment BankingDocument27 pagesValuation For Investment BankingK RameshNo ratings yet

- Noer Rachmadhani H - 1810523011 - Week 10 AssignmentDocument9 pagesNoer Rachmadhani H - 1810523011 - Week 10 AssignmentSajakul SornNo ratings yet

- Lesson 1. Financial Statements (Cabrera & Cabrera, 2017)Document10 pagesLesson 1. Financial Statements (Cabrera & Cabrera, 2017)Axel MendozaNo ratings yet

- Chap 15Document7 pagesChap 15Huang Wei (Jane)No ratings yet

- Solutions - Chapter 5Document21 pagesSolutions - Chapter 5Dre ThathipNo ratings yet

- Difference Between Accounts & FinanceDocument4 pagesDifference Between Accounts & Financesameer amjadNo ratings yet

- Unit 5. Financial Statement Analysis IIDocument32 pagesUnit 5. Financial Statement Analysis IIsikute kamongwaNo ratings yet

- Unit 2 MADocument28 pagesUnit 2 MATheresa BrownNo ratings yet

- Chapter 8 Financial StatementDocument34 pagesChapter 8 Financial StatementMuhammad AfzalNo ratings yet

- Importance of Financial StatementDocument11 pagesImportance of Financial StatementJAY SHUKLANo ratings yet

- GoodwillDocument1 pageGoodwillarmor.coverNo ratings yet

- Financial Management (1 Day, P.M.)Document12 pagesFinancial Management (1 Day, P.M.)simon berksNo ratings yet

- EFim 05 Ed 3Document23 pagesEFim 05 Ed 3mahnoor javaidNo ratings yet

- Financial Ratios OBLIGATORY Test ExamDocument88 pagesFinancial Ratios OBLIGATORY Test Exambuenop373No ratings yet

- Financial Performance Measurement: 0reviewing The ChapterDocument5 pagesFinancial Performance Measurement: 0reviewing The Chapterkent232323No ratings yet

- Credit Week 5 - Financial Statement AnalysisDocument7 pagesCredit Week 5 - Financial Statement AnalysisShailesh NathanNo ratings yet

- Financial Ratios Topic (MFP 1) PDFDocument9 pagesFinancial Ratios Topic (MFP 1) PDFsrinivasa annamayyaNo ratings yet

- Ac 1Document39 pagesAc 1taajNo ratings yet

- Venture Capital: Noel J. Maquiling, Mba Car, Micb, CFMP, MosDocument18 pagesVenture Capital: Noel J. Maquiling, Mba Car, Micb, CFMP, MosKrisha Pioco0% (1)

- The DCF Model ArticlesDocument8 pagesThe DCF Model ArticlesJames H SingletaryNo ratings yet

- Audithow Com Auditing Cash and Cash EquivalentsDocument7 pagesAudithow Com Auditing Cash and Cash EquivalentsMunyaradzi Onismas ChinyukwiNo ratings yet

- Petroleum Economics Part 1 Oct 2009Document3 pagesPetroleum Economics Part 1 Oct 2009boisvertljNo ratings yet

- Chapter 3 Managerial-Finance Solutions PDFDocument24 pagesChapter 3 Managerial-Finance Solutions PDFMohammad Mamun UddinNo ratings yet

- MBA711 - Answers To Book - Chapter 3Document17 pagesMBA711 - Answers To Book - Chapter 3anonymathieu50% (2)

- Financial Statements and Analysis: ̈ Instructor's ResourcesDocument24 pagesFinancial Statements and Analysis: ̈ Instructor's ResourcesMohammad Mamun UddinNo ratings yet

- Rates 104 - Debt Instruments 1Document42 pagesRates 104 - Debt Instruments 1ssj7cjqq2dNo ratings yet

- Analysis of Capital Budgeting Practices in Textile Industry in IndiaDocument26 pagesAnalysis of Capital Budgeting Practices in Textile Industry in IndiaAnonymous 3iFhGK5No ratings yet

- Whina1512m000 888 20231002-085023Document11 pagesWhina1512m000 888 20231002-085023Panca PrasastiNo ratings yet

- Solutions To Chapter 8 Net Present Value and Other Investment CriteriaDocument21 pagesSolutions To Chapter 8 Net Present Value and Other Investment CriteriaChaituNo ratings yet

- Working Capital ManagementDocument5 pagesWorking Capital ManagementDr. Ehsan ul HassanNo ratings yet

- CH 12Document48 pagesCH 12Nguyen Ngoc Minh Chau (K15 HL)No ratings yet

- Newzen Mba Finance 2022Document12 pagesNewzen Mba Finance 2022New Zen InfotechNo ratings yet

- Module Far1 Unit-1 Part-1bDocument5 pagesModule Far1 Unit-1 Part-1bHazel Jane EsclamadaNo ratings yet

- Navneet Model Practice-2Document7 pagesNavneet Model Practice-2Rudra ShahNo ratings yet

- Assignment 9 - QuestionsDocument3 pagesAssignment 9 - QuestionstasleemfcaNo ratings yet

- PAS 36 Impairment of AssetsDocument8 pagesPAS 36 Impairment of AssetswalsondevNo ratings yet

- Accountancy Class 11 Most Important Sample Paper 2023-2024Document12 pagesAccountancy Class 11 Most Important Sample Paper 2023-2024Hardik ChhabraNo ratings yet

- ARK Autonomous Tech. & Robotics ETF: Holdings Data - ARKQDocument2 pagesARK Autonomous Tech. & Robotics ETF: Holdings Data - ARKQSpiker ValorantNo ratings yet

- Annexure To Trading & Demat Account Opening Form: Power of Attorney (This Document Is Voluntary)Document3 pagesAnnexure To Trading & Demat Account Opening Form: Power of Attorney (This Document Is Voluntary)Consultant NowFoundationNo ratings yet

- Accounting 315 - Quiz Business CombinationDocument3 pagesAccounting 315 - Quiz Business CombinationJoshua HongNo ratings yet

- Afrah Azzahira Wismono - 008202000053 - Assignment Week 14Document6 pagesAfrah Azzahira Wismono - 008202000053 - Assignment Week 14Afrah AzzahiraNo ratings yet

- Sapura Energy: Company ReportDocument4 pagesSapura Energy: Company ReportBrian StanleyNo ratings yet

- Partnership FormationDocument4 pagesPartnership FormationDesiree Dawn GabalesNo ratings yet

- FIN201 Assignment Cisco Ratio AnalysisDocument23 pagesFIN201 Assignment Cisco Ratio AnalysisDark RushNo ratings yet

- Maple Leafs Financial RatiosDocument8 pagesMaple Leafs Financial RatiosjeffreygodlyNo ratings yet

- Chapter Eight: Stock ValuationDocument29 pagesChapter Eight: Stock ValuationRehman LaljiNo ratings yet

- ACCT Exam 2 Study GuideDocument12 pagesACCT Exam 2 Study GuideNhan TranNo ratings yet

- Private Equity Fund Business Plan+SampleDocument6 pagesPrivate Equity Fund Business Plan+SampleprenqyaqNo ratings yet

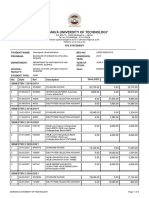

- FeeStatement-AS203 - 0008 - 2018-18 Feb 2023Document2 pagesFeeStatement-AS203 - 0008 - 2018-18 Feb 2023JaykeNo ratings yet

- Embrace Your Stereotype - Definitive Growth Equity Guide For The Rest of 2020Document16 pagesEmbrace Your Stereotype - Definitive Growth Equity Guide For The Rest of 2020OliverNo ratings yet

- Mida InfoDocument12 pagesMida InfoMuhammad AdnanNo ratings yet

- Multiple Choice Questions: Arts, Commerce and Science College, Bodwad. Question Bank Subject: - Corporate AccountingDocument12 pagesMultiple Choice Questions: Arts, Commerce and Science College, Bodwad. Question Bank Subject: - Corporate AccountingAshutosh shahNo ratings yet