Professional Documents

Culture Documents

PL FM M22 Student Marks Plan

PL FM M22 Student Marks Plan

Uploaded by

lavanya vsCopyright:

Available Formats

You might also like

- Anwal Gas-TnDocument35 pagesAnwal Gas-TnMaysam Kh67% (3)

- Model Assignment Aug-23Document3 pagesModel Assignment Aug-23Abner ogegaNo ratings yet

- SaaS Financial Model Template by ChargebeeDocument15 pagesSaaS Financial Model Template by ChargebeeNikunj Borad0% (1)

- Aurora Textile CompanyDocument16 pagesAurora Textile CompanyJesslin Ruslim0% (1)

- New Heritage Doll Company Case SolutionDocument31 pagesNew Heritage Doll Company Case SolutionSoundarya AbiramiNo ratings yet

- Acquisition of Consolidated Rail CorporationDocument12 pagesAcquisition of Consolidated Rail CorporationEdithNo ratings yet

- Coffee CubeDocument5 pagesCoffee Cubes3976142No ratings yet

- Calpine SolutionDocument5 pagesCalpine SolutionDarshan GosaliaNo ratings yet

- Monthly Average Services Production - Ton (Sillicon A1+A2) : 2020 P 2021 P 2022 P 2023 P 2018 Actual 2019 BudgetDocument12 pagesMonthly Average Services Production - Ton (Sillicon A1+A2) : 2020 P 2021 P 2022 P 2023 P 2018 Actual 2019 Budgetlidia_396516605No ratings yet

- Sabit FSDocument8 pagesSabit FSMilagrosa VillasNo ratings yet

- Economics Module - Vusal Iskandarov .XLSBDocument414 pagesEconomics Module - Vusal Iskandarov .XLSBTural ƏliyevNo ratings yet

- XLS915-XLS-ENG DesarrolladoDocument10 pagesXLS915-XLS-ENG DesarrolladoYessu Amhed Condori RavichaguaNo ratings yet

- 1233 NeheteKushal BAV Assignment1Document12 pages1233 NeheteKushal BAV Assignment1Anjali BhatiaNo ratings yet

- Material Complementario - Cafes Monte BiancoDocument7 pagesMaterial Complementario - Cafes Monte BiancoDavid ReyesNo ratings yet

- Analisa KepekaanDocument72 pagesAnalisa KepekaanHilda SusantiNo ratings yet

- Group D Uralita Furnaces CalculationsDocument36 pagesGroup D Uralita Furnaces Calculationsgugal KumarNo ratings yet

- Powerol - Monthly MIS FormatDocument34 pagesPowerol - Monthly MIS Formatdharmender singhNo ratings yet

- Valuation Final ExamDocument4 pagesValuation Final ExamJeane Mae Boo100% (1)

- Dreamy Destination Travel and Tours Start Up CapitalDocument21 pagesDreamy Destination Travel and Tours Start Up CapitalValentina Daluran AtentaNo ratings yet

- Student Version Work MACC Unit 6 - Theatre Calgary ExcelDocument6 pagesStudent Version Work MACC Unit 6 - Theatre Calgary ExcelVesela MihaylovaNo ratings yet

- America Movil Historical Income Statements (In 000,000s) : AssetsDocument19 pagesAmerica Movil Historical Income Statements (In 000,000s) : AssetsAna AsatianiNo ratings yet

- Material Complementario - Cafes Monte BiancoDocument20 pagesMaterial Complementario - Cafes Monte BiancoGlenda ChiquilloNo ratings yet

- Business Finance Decision Suggested Solution Test # 2: Answer - 1Document4 pagesBusiness Finance Decision Suggested Solution Test # 2: Answer - 1Syed Muhammad Kazim RazaNo ratings yet

- Winners' Financial ModelDocument5 pagesWinners' Financial ModelARCHIT KUMARNo ratings yet

- Capital Investment Break-Up: Marketing and PromotionDocument7 pagesCapital Investment Break-Up: Marketing and PromotionDeepak RamamoorthyNo ratings yet

- Perhitungan NPV Dan Hubungan Dengan Discount RateDocument5 pagesPerhitungan NPV Dan Hubungan Dengan Discount RateChristopher D NaraNo ratings yet

- Kourba Costing Sheet - Q4 - 301119Document15 pagesKourba Costing Sheet - Q4 - 301119Haneen JosephNo ratings yet

- ZafaDocument3 pagesZafaDayavantiNo ratings yet

- Financial Slide For ReportDocument6 pagesFinancial Slide For ReportTuan Noridham Tuan LahNo ratings yet

- Motives For Merger: 1. Horizontal 2. Vertical 3. Conglomerate 4. ConcentricDocument41 pagesMotives For Merger: 1. Horizontal 2. Vertical 3. Conglomerate 4. ConcentricWasif HossainNo ratings yet

- Chapter 5Document7 pagesChapter 5Bea Dela PeniaNo ratings yet

- CG Fs OLDDocument49 pagesCG Fs OLDDine CapuaNo ratings yet

- MA FX Q Solution 1 2 3Document4 pagesMA FX Q Solution 1 2 3thalnay zarsoeNo ratings yet

- Manage FinanceDocument11 pagesManage FinanceGurjinder Hanjra100% (2)

- Assumptions - Assumptions - Financing: Year - 0 Year - 1 Year - 2 Year - 3 Year - 4Document2 pagesAssumptions - Assumptions - Financing: Year - 0 Year - 1 Year - 2 Year - 3 Year - 4PranshuNo ratings yet

- DHL ExhibitsDocument7 pagesDHL ExhibitsAlan SamNo ratings yet

- Yolanda Resort FSDocument17 pagesYolanda Resort FSnyx100% (1)

- IAS 36 CA Final Solution Class WorkDocument14 pagesIAS 36 CA Final Solution Class WorkUmmar FarooqNo ratings yet

- Fit Deli TODAY Version 1.xlsb 1Document17 pagesFit Deli TODAY Version 1.xlsb 1Micah Valerie SaradNo ratings yet

- Solucion Caso PacificDocument7 pagesSolucion Caso PacificPaulina EsparzaNo ratings yet

- Strategic Finance All Question-13Document1 pageStrategic Finance All Question-13TheNOOR129No ratings yet

- Lecture 2.6 - SlidesDocument19 pagesLecture 2.6 - Slidessfalcao91No ratings yet

- Year 1979 1980 1981 1982 1983 1984 Period 0 1 2 3 4 5Document30 pagesYear 1979 1980 1981 1982 1983 1984 Period 0 1 2 3 4 5shardullavande33% (3)

- Final Project EconomicsDocument5 pagesFinal Project EconomicsAayan AhmedNo ratings yet

- Tesla FinModelDocument58 pagesTesla FinModelPrabhdeep DadyalNo ratings yet

- Financial ModelDocument10 pagesFinancial ModelAbdul RehmanNo ratings yet

- DCF Model - Blank: Strictly ConfidentialDocument5 pagesDCF Model - Blank: Strictly ConfidentialaeqlehczeNo ratings yet

- Chap 14 Case Study Q2Document3 pagesChap 14 Case Study Q2vecasussince2023No ratings yet

- BSBFIM601 Appendix E Budget TemplateDocument5 pagesBSBFIM601 Appendix E Budget TemplatekanejNo ratings yet

- Instructor: Assumptions / InputsDocument17 pagesInstructor: Assumptions / InputsJoAnna MonfilsNo ratings yet

- EXAM SOLUTIONS May - June 2020 Suggested SolutionsDocument6 pagesEXAM SOLUTIONS May - June 2020 Suggested SolutionsphumeleleNo ratings yet

- FM Study HubDocument71 pagesFM Study HubchimbanguraNo ratings yet

- Spinning Project FeasibilityDocument19 pagesSpinning Project FeasibilityMaira ShahidNo ratings yet

- Dietrich Farms - Worksheet 2Document39 pagesDietrich Farms - Worksheet 2spam.ml2023No ratings yet

- EPCL Financial Model CY22Document87 pagesEPCL Financial Model CY22Umer FarooqNo ratings yet

- Financial AnalysisDocument12 pagesFinancial AnalysisAlaa AlsultanNo ratings yet

- IS, SOFP, SCE My WorkDocument6 pagesIS, SOFP, SCE My WorkoluwapelumiotunNo ratings yet

- Power Markets and Economics: Energy Costs, Trading, EmissionsFrom EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNo ratings yet

- Headlines Publishing Company HPC Specializes in InternationalDocument1 pageHeadlines Publishing Company HPC Specializes in InternationalAmit PandeyNo ratings yet

- HyperinflationDocument16 pagesHyperinflationJhonalyn Montimor Galdones100% (1)

- International Economics Theory and Policy 10th Edition Krugman Solutions ManualDocument7 pagesInternational Economics Theory and Policy 10th Edition Krugman Solutions Manualkhucly5cst100% (19)

- Insurance QuestionnaireDocument4 pagesInsurance QuestionnaireDavid WrightNo ratings yet

- Test Bank For MKTG 7th Edition LambDocument3 pagesTest Bank For MKTG 7th Edition LambEdwin Palmer100% (4)

- Registration of CooperativesDocument5 pagesRegistration of CooperativesRheneir Mora100% (1)

- Kunci Jawaban ElisaDocument52 pagesKunci Jawaban ElisaElisa EndrianiiNo ratings yet

- UKFSN SocialfranchisingguideDocument34 pagesUKFSN SocialfranchisingguideZak1717No ratings yet

- 3 Module 1 - QM - in - Con - V18June20 - 4Document170 pages3 Module 1 - QM - in - Con - V18June20 - 4nghiahnNo ratings yet

- Jurnal Umkm UnpadDocument10 pagesJurnal Umkm Unpadkunto ajiNo ratings yet

- ICMM. Ps - Tailings-Governance PDFDocument6 pagesICMM. Ps - Tailings-Governance PDFFelipe Ignacio Campos RodriguezNo ratings yet

- BCC 2021 Prospectus v4 DigitalDocument116 pagesBCC 2021 Prospectus v4 DigitalRifki JuliNo ratings yet

- Nestle CaseDocument14 pagesNestle CasePranav NyatiNo ratings yet

- Ninjacart - Depth and Diversity - The Two-Pronged Strategy That Helped WayCool Make A Mark in B2B Food Supply - The Economic TimesDocument12 pagesNinjacart - Depth and Diversity - The Two-Pronged Strategy That Helped WayCool Make A Mark in B2B Food Supply - The Economic TimesChirag Arora100% (1)

- MCA RegistrantsDocument408 pagesMCA RegistrantsanjumNo ratings yet

- Catalogo HL20 Máquina de Circulación ExtracorporeaDocument2 pagesCatalogo HL20 Máquina de Circulación Extracorporealoze13No ratings yet

- Arcelor MittalDocument4 pagesArcelor Mittalnispo100% (1)

- Solution DWDMDocument44 pagesSolution DWDMAli SaleemNo ratings yet

- Cost Control and Cost ReductionDocument34 pagesCost Control and Cost Reductionshreepal19No ratings yet

- BE Guidelines For Ethical LeadershipDocument2 pagesBE Guidelines For Ethical Leadershipits4krishna3776No ratings yet

- Feasibility Analysis of Business Case Study in Indonesia MinimarketDocument16 pagesFeasibility Analysis of Business Case Study in Indonesia Minimarketfabia afaniNo ratings yet

- DAV Question BankDocument79 pagesDAV Question BankSantosh SrivastavaNo ratings yet

- IBIG 03 03 Your Own DealsDocument17 pagesIBIG 03 03 Your Own DealsіфвпаіNo ratings yet

- E-MARKETING Digital EthicDocument10 pagesE-MARKETING Digital EthicAlif NajmiNo ratings yet

- Jornal Prblems 1Document6 pagesJornal Prblems 1Pooja PhatnaniNo ratings yet

- Multiplos 3 e Commerce DiscrecionalDocument3 pagesMultiplos 3 e Commerce DiscrecionalCesarNo ratings yet

- Commission On Audit Circular No. 92-125A March 4, 1992 TO: All Heads of Departments, Bureaus and Offices of The National GovernmentDocument6 pagesCommission On Audit Circular No. 92-125A March 4, 1992 TO: All Heads of Departments, Bureaus and Offices of The National GovernmentJade Darping KarimNo ratings yet

- Creative Accounting and Financial Reporting: Model Development and Empirical TestingDocument11 pagesCreative Accounting and Financial Reporting: Model Development and Empirical TestingPutri ElisaNo ratings yet

- Bba Iii CfaDocument3 pagesBba Iii Cfasaksham sikhwalNo ratings yet

- PM Unit 1 (Bba)Document55 pagesPM Unit 1 (Bba)Shankar SainiNo ratings yet

PL FM M22 Student Marks Plan

PL FM M22 Student Marks Plan

Uploaded by

lavanya vsCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PL FM M22 Student Marks Plan

PL FM M22 Student Marks Plan

Uploaded by

lavanya vsCopyright:

Available Formats

Professional Level – Financial Management - March 2022

MARK PLAN AND EXAMINER’S COMMENTARY

The marking plan set out below was that used to mark this question. Markers were encouraged to use

discretion and to award partial marks where a point was either not explained fully or made by implication.

More marks were available than could be awarded for each requirement. This allowed credit to be given for a

variety of valid points which were made by candidates.

Question 1

Total Marks: 35

General comments

The scenario of the question is that a company is launching a new product onto the market.

Part 1.1 of the question covers NPV analysis.

Part 1.2 of the question requires a sensitivity calculation.

Part 1.3 of the question requires discussion of an ethical issue.

Part 1.4 of the question discusses the impact of increasing the life of the project.

Part 1.5 of the question discusses predictive and prescriptive analytics.

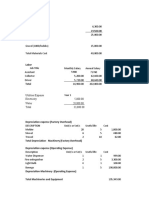

1.1

Option 1

0 1 2 3 4 5

£’000 £’000 £’000 £’000 £’000 £’000

Wristband sales 2,500 3,000 3,025 2,475 1,650

Wristband costs (1,000) (1,272) (1,236) (1,072) (758)

Subscription fees 250 550 825 1,050 1,200

Fixed costs (+3%) (1,300) (1,339) (1,379) (1,421) (1,463)

Operating c/fs 450 939 1,235 1,032 629

Tax @ 25% (113) (235) (309) (258) (157)

IT equipment (2,500) 200

Capital allowances 113 92 76 62 51 181

Net cash flows (2,387) 429 780 988 825 853

PV of T1-T5 cash flows @ 11% £2,792k

Less: initial outlay in T0 (£2,387k)

NPV £405k

Wristband sales and costs

1 2 3 4 5

Wristbands sold 50,000 60,000 55,000 45,000 30,000

Selling price £50.00 £50.00 £55.00 £55.00 £55.00

Total sales £2,500k £3,000k £3,025k £2,475k £1,650k

Cost per band (+6% pa) £20.00 £21.20 £22.47 £23.82 £25.25

Total costs £1,000k £1,272k £1,236k £1,072k £758k

Subscription fees

1 2 3 4 5

App users 50,000 110,000 165,000 210,000 240,000

Fee per user £5.00 £5.00 £5.00 £5.00 £5.00

Total sales £250k £550k £825k £1,050k £1,200k

Copyright © ICAEW 2022. All rights reserved Page 1 of 11

Professional Level – Financial Management - March 2022

Capital allowances

Cost/WDV 18% CA 25% Tax

£’000 £’000 £’000

Year 0 2,500 450 113

Year 1 2,050 369 92

Year 2 1,681 303 76

Year 3 1,378 248 62

Year 4 1,130 203 51

Year 5 927

Disposal -200 727 181

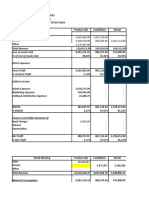

Option 2

0 1 2 3 4 5

£’000 £’000 £’000 £’000 £’000 £’000

Wristband sales 2,625 1,625 1,250 1,000 625

Wristband costs (2,100) (1,378) (1,124) (953) (631)

Subscription fees 1,050 1,700 2,200 2,600 2,850

Fixed costs (+3%) (1,300) (1,339) (1,379) (1,421) (1,463)

Operating c/fs 275 608 947 1,226 1,381

Tax @ 25% (69) (152) (237) (307) (345)

IT equipment (2,500) 200

Capital allowances 113 92 76 62 51 181

Net cash flows (2,387) 298 532 772 970 1,417

PV of T1-T5 cash flows @ 11% £2,745k

Less: initial outlay in T0 (£2,387k)

NPV £358k

Wristband sales and costs

1 2 3 4 5

Wristbands sold 105,000 65,000 50,000 40,000 25,000

Selling price £25.00 £25.00 £25.00 £25.00 £25.00

Total sales £2,625k £1,625k £1,250k £1,000k £625k

Cost per band (+6% pa) £20.00 £21.20 £22.47 £23.82 £25.25

Total costs £2,100k £1,378k £1,124k £953k £631k

Subscription fees

1 2 3 4 5

App users 105,000 170,000 220,000 260,000 285,000

Fee per user £10.00 £10.00 £10.00 £10.00 £10.00

Total sales £1,050k £1,700k £2,200k £2,600k £2,850k

Conclusion

NPV Option 1 = £405k

NPV Option 2 = £358k

Oceania should invest. Both options give a positive NPV and would increase shareholder wealth.

They should choose pricing Option 1 because this has the highest NPV.

Copyright © ICAEW 2022. All rights reserved Page 2 of 11

Professional Level – Financial Management - March 2022

Most candidates performed well on this requirement, with many of them scoring full marks or only making

minor mistakes. The most common mistakes related to the timing of the first capital allowance or

calculating the final balancing allowance. Some candidates also mixed up some of the figures between

Option 1 and Option 2. But overall, this was a well answered requirement.

Total possible marks 17

Maximum full marks 17

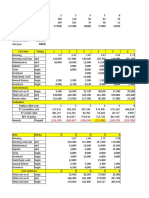

1.2

Option 1

0 1 2 3 4 5

£’000 £’000 £’000 £’000 £’000 £’000

Subscription fees 250 550 825 1,050 1,200

Tax @ 25% (63) (138) (206) (263) (300)

After tax 187 412 619 787 900

PV of T1-T5 cash flows @ 11% £2,008k

Sensitivity = £405k / £2,008k = 20.1%

Option 2

0 1 2 3 4 5

£’000 £’000 £’000 £’000 £’000 £’000

Subscription fees 1,050 1,700 2,200 2,600 2,850

Tax @ 25% (263) (425) (550) (650) (713)

After tax 787 1,275 1,650 1,950 2,137

PV of T1-T5 cash flows @ 11% £5,503k

Sensitivity = £358k / £5,503k = 6.5%

Comments

Option 1 is not very sensitive to changes in subscription fees but Option 2 is much more sensitive to any

change.

This makes Option 1 a more favourable choice than Option 2 (less risky).

Many candidates successfully completed the sensitivity calculations and made appropriate comments.

However, there was a notable number of candidates who didn’t know how to approach this requirement at

all. This was a surprise, as sensitivity analysis is examined frequently. It is possible that some candidates

may have tried to rote learn specific sensitivity analysis calculations based on changes in sales volume

and sales price, but subsequently had difficulty reapplying their knowledge to a different form of revenue.

Either way, many candidates may find the answer is much more straight forward than they initially thought.

Many candidates misinterpreted their results stating that the option with the highest % was the most

sensitive, rather than the least.

Total possible marks 6

Maximum full marks 6

1.3

Not telling employers that the subscription fees will automatically update would be dishonest and shows a

lack of integrity or transparency.

Taking money automatically from the employers without making them aware of the automatic renewal

could be fraud which would be illegal.

Copyright © ICAEW 2022. All rights reserved Page 3 of 11

Professional Level – Financial Management - March 2022

The answers provided to this requirement, were generally very good. However, a small number of weaker

candidates failed to see the main issue relating to the transparency of the fee renewals and resorted to

suggesting any ethical term that they could think of in the hope of obtaining marks.

Total possible marks 3

Maximum full marks 3

1.4

Potential impact

The impact would be much greater for Option 2 which has a higher number of app users at 31 March 2027

and a higher subscription fee per user.

Option 1 may even lose money from this decision as the annual subscription fees are less than the

running cost of the data warehouse in each year.

The decision could make Option 2 a better choice than Option 1.

Factors to consider

• Impact on the fixed running costs.

• Number of app users who are a likely to remain (legally) subscribed.

• Number of additional years the app will be provided for.

• Technological obsolescence.

• Impact on the scrap value of the IT equipment.

• Impact on capital allowances.

• Impact on management time.

This requirement provided an opportunity for candidates to use their analytical skills to look back at the

two net present value calculations and consider what would happen if the subscription fees continued for

another few years. Candidates who did this successfully spotted that this would have a bigger impact on

Option 2 because the number of subscribers and subscription fee was higher than Option 1. Unfortunately,

there were many candidates who must not have looked back at their NPV calculations and struggled to

answer the first part of this requirement.

However almost all candidates provided sensible suggestions for other factors that the company should

consider before extending the app subscriptions.

Total possible marks 6

Maximum full marks 5

1.5

Predictive analytics

Predictive analytics uses historical and current data to create predictions about the future.

Predictive analytics could be used to forecast the impact of each alternative.

Prescriptive analytics

Prescriptive analytics combines statistical tools utilised in predictive analytics with Artificial Intelligence and

algorithms to calculate the optimum outcome from a variety of business decisions.

Predictive analytics could be used to identify the optimum pricing policy.

This requirement tested a topic that was added to the syllabus over 12 months ago. However, there were

a notable number of candidates who struggled to describe these two forms of analytics which suggested

that they may not have been familiar with this section of the learning materials.

Total possible marks 4

Maximum full marks 4

Copyright © ICAEW 2022. All rights reserved Page 4 of 11

Professional Level – Financial Management - March 2022

Question 2

Total Marks: 35

General comments

The scenario of the question is a company that is calculating a cost of capital.

Part 2.1 of the question discusses dividend policy.

Part 2.2 of the question discusses the use of special dividends and share repurchases.

Part 2.3 of the question requires a calculation of dividend growth rates and a discussion of the most

appropriate rate to apply.

Part 2.4 of the question requires a WACC calculation using the dividend valuation model.

Part 2.5 of the question requires a WACC calculation using the CAPM.

Part 2.6 of the questions discusses the challenges of valuing a digital technology company.

2.1

Appropriateness of the dividend policy from 2016 to 2019

Reasons why Just Breathe’s dividend policy may be considered to be appropriate are as follows:

• Shareholders’ wealth will not be increased by paying dividends. Their wealth will be increased by

investing in projects with a positive NPV (M&M theory).

• During this period, Just Breathe were able to achieve significant growth, as a result of reinvesting

profits.

• Some shareholders may prefer to receive capital gains rather than dividends for tax purposes (tax

effect).

• If shareholders need cash now then they can raise this by selling some of their shares (DIY dividends)

• Using retained earnings before a rights issue or new issue of shares is consistent with the pecking

order theory.

Reasons why Just Breathe’s dividend policy may be considered to not be appropriate are as follows:

• Shareholders’ may prefer to receive money today rather than dividends or capital gains in the future

(traditional theory / bird in the hand theory).

• The shareholders may not want the company to make this investment but they are not being given a

choice (agency problem).

Reaction to the increase in dividend

• Shareholders are expecting 14.5% pa growth based on 2016-2019.

• Changing the dividend policy may have sent out a worrying or confusing signal to the market

(signalling)

• Some shareholders will have invested in the company based on the policy of paying low dividends and

reinvesting profits (clientele effect/tax).

• The share price may have fallen / fluctuated as a result of the uncertainty caused by the change in the

dividend policy.

Most candidates showed a reasonable level of knowledge of the different views on dividend policy.

However, often the answers provided to this requirement lacked structure and application.

Weaker candidates sporadically listed all of the different viewpoints without specifically relating them to the

scenario. Whilst stronger candidates started by discussing the pros and/or cons of paying a lower dividend

and then discussed the potential impact of the change in policy.

Copyright © ICAEW 2022. All rights reserved Page 5 of 11

Professional Level – Financial Management - March 2022

Total possible marks 11

Maximum full marks 8

2.2

(a) Special dividend

A special dividend is a “one-off” dividend in addition to the ordinary dividend.

Special dividends can be used to pay extra dividends to shareholders without disrupting the normal

dividend pattern.

This would only be appropriate if the directors believed that the increase in dividend was temporary and

would eventually return to a lower dividend per share. Market circumstances suggest otherwise so not

appropriate.

(b) Share repurchase

A repurchase of shares may be achieved by buying shares in the stock market, inviting shareholders to

tender their shares or by arrangement with particular shareholders.

This is method would also only be appropriate if the directors wanted to release cash to shareholders on a

“one-off” basis. Market circumstances suggest otherwise so not appropriate.

This would reduce equity, which would have an impact on the dividends per share in future years (and

would increase gearing).

There appeared to be many students who were unfamiliar with the concept of a special dividend, despite

this topic being tested in many previous sittings. Many candidates are still confusing special dividends with

scrip dividends. Additionally, there were many candidates who also had difficulty describing a share

repurchase. As a result of these issues, many students struggled to provide meaningful answers to this

requirement.

Total possible marks 4

Maximum full marks 4

2.3

March 2016 to March 2022: g = (35.0 ÷ 5.0)(1/6) - 1 = 38.31%

March 2020 to March 2022: g = (35.0 ÷ 33.0) 1/2) - 1 = 2.99%

The dividend policy has changed in March 2020, which makes it less appropriate to consider the dividends

paid before then.

It seems unlikely that 38.3% growth would be sustainable in the future.

The problem with only considering the dividend from March 2020 is that it is difficult to predict future

growth based on three years.

However, overall it would be most appropriate to use the growth from March 2020 to March 2022.

Some candidates had difficulty calculating the growth rates, with the most common mistake being using

the wrong number of years. Curiously, some candidates would get one of the calculations correct but the

other one wrong. Generally, the discursive part of this requirement was answer well and most candidates

identified that it would be more appropriate to use the average growth rate from the 2020 to 2022.

Total possible marks 6

Maximum full marks 5

Copyright © ICAEW 2022. All rights reserved Page 6 of 11

Professional Level – Financial Management - March 2022

2.4

Cost of equity

Ke = (35.0p x 1.0299 / 560.0p) + 0.0299 = 9.43%

MVe = £120m ÷£0.50 = 240 million x £5.60 = £1,344m

3% redeemable debentures

Using the rate function the inputs are:

Number of payments 5

Annual coupon £3.00

Ex-interest market value -£94.00

Redemption £100.00

Annual YTM using the rate function 4.36%

Less: tax @ 25% = 4.36% x (1 – 0.25) = 3.27%

MVd = £400m x £94 / £100 = £376m

WACC calculation

Cost % Market value (£m) Cost (£)

Ordinary shares 9.43 1,344 126.7

3% debentures 3.27 376 12.3

1,720 139.0

WACC = 139 / 1720 = 8.1%

This was a well answered requirement overall. However, there were still some careless mistakes which

usually related to calculating the market value of the ordinary shares or an inability to calculate the cost of

equity formula correctly, even with all the correct figures.

Total possible marks 6

Maximum full marks 6

2.5

NutriFit plc should be used to find an appropriate asset beta as this is the only company which has an app

covering both nutrition and fitness.

NutriFit’s asset beta:

βa = 1.65 ÷ (1 + ((50 x 0.75)/75)) = 1.10

Re-gear with Just Breathe’s gearing:

βe = 1.10 x (1 + ((376 x 0.75)/1344)) = 1.33

Calculate ke using the CAPM:

Ke = 2 + 1.33 (8 - 2) = 10.0%

WACC calculation

Cost % Market value (£m) Cost (£)

Ordinary shares 10.00 1,344 134.4

3% debentures 3.27 376 12.3

1,720 146.7

WACC = 146.7 / 1720 = 8.5%

Copyright © ICAEW 2022. All rights reserved Page 7 of 11

Professional Level – Financial Management - March 2022

The cost of equity will have to reflect the systematic business risk of the diversification and the

(systematic) financial risk of Just Breathe.

The calculation shows that the systematic business risk of the diversification is higher than sportswear

manufacturing as the cost of equity (or WACC) is higher than Just Breathe’s current cost of equity (or

WACC).

Many candidates made this requirement much more difficult that it needed to be by choosing to calculate

an average equity beta from the beta of the three companies that had been provided, along with average

values of debt and equity. If those candidates had taken careful notice of the information provided, they

should have spotted that this was unnecessary because the description of the activities carried out by

NutriFit perfectly matched the activities of the target company.

Total possible marks 8

Maximum full marks 8

2.6

It is difficult use an asset based valuation because most of Biddle’s assets are digital assets which are

difficult to value.

They cannot apply an earnings (or dividends) based valuation as this is a newly formed company with no

previous earnings (or dividends).

It will be difficult to predict future earnings because Biddle have an inexperienced management team.

Additionally, the future performance of technology companies can be difficult to predict as they are likely to

have:

• Unpredictable market acceptance of the products

• Unknown competition.

Without previous experience, it would be difficult to value the potential synergies that could be achieved by

the two companies working together.

Most candidates correctly identified the challenges of using an asset-based valuation on a company like

this. However, many answers only considered this form of valuation and did not consider any other

valuation methods such earnings based approaches.

Total possible marks 5

Maximum full marks 4

Copyright © ICAEW 2022. All rights reserved Page 8 of 11

Professional Level – Financial Management - March 2022

Question 3

Total Marks: 30

General comments

The scenario of the question is a company that receives money from overseas investors.

Part 3.1(a) of the question requires computations using various forex hedging instruments.

Part 3.1(b) of the question discusses the use of the hedging instruments used in the first part of the

question.

Part 3.2(a) of the question requires computations using various Bitcoin hedging instruments.

Part 3.2(b) of the question discusses the difference between the calculations from the third part of the

question.

Part 3.3 of the question requires a computation to demonstrate how traded options can be used to protect

the company against a fall in the value of a portfolio of investments.

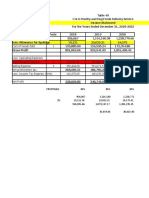

3.1(a)

Forward contract

Forward rate: HK$ 10.70 + HK$0.04 = HK$ 10.74

Sterling receipt: HK$ 15,000,000 ÷ HK$ 10.74/£ = £1,396,648

Money market hedge

Borrow HK$: HK$ 15,000,0000 ÷ (1 + (0.024 x 6/12)) = HK$ 14,822,134

Sell HK$ at spot rate: HK$14,882,134 ÷ HK$ 10.70/£ = £1,385,246

Deposit in £ to give a total receipt: £1,385,246 x (1 + (0.016 x 6/12) = £1,396,328

OTC currency option

Use put options to sell HK$ with an exercise price of HK$ 10.75

The premium will be HK$ 15,000,000 x £0.002/HK$ = £30,000

The premium with interest = £30,000 x (1 + (0.016 x 6/12)) = £30,240

If the spot is HK$ 11.22 on 30 September they would exercise the option.

Sterling payment will be HK$ 15,000,000 ÷ HK$ 10.75 /£ = £1,395,349

Total receipt will be £1,395,349- £30,240 = £1,365,109

Generally this requirement was very well answered. However, a small number of candidates still made

mistakes on the OTC option such as choosing a call option instead of a put. Other candidates made more

careless mistakes such as correctly identifying that this company should use a put option but then

calculating the premium for a call option.

Total possible marks 8

Maximum full marks 8

3.1(b)

Expected cost

Forward contract = £1,396,648

Money market hedge = £1,396,328

Copyright © ICAEW 2022. All rights reserved Page 9 of 11

Professional Level – Financial Management - March 2022

OTC option = £1,365,109

Without hedging = £1,336,898

Forward contract is the higher receipt.

MMH is only marginally lower.

The receipt from the OTC option is significantly lower. This is due to the premium.

Forward contract

Tailored specifically for Peregrine

However, there is no secondary market

Money market hedge

More difficult to set up than a forward contract

Might use up credit lines

OTC currency option

Allows Peregrine to exploit upside risk potential

There is no secondary market

Conclusion

The forward contract would be recommended if the intention is to maximise the receipt.

However, the OTC currency option may be preferred if the directors wish to retain the upside risk potential.

This requirement was answered very well by the majority of candidates. However, considering the number

of marks available for this requirement, some weaker responses contained a relatively small range of

comments.

Total possible marks 8

Maximum full marks 10

3.2(a)

Forward contract

Peregrine will receive 26 bitcoin x £40,780 = £1,060,280

Bitcoin futures

Peregrine will sell May futures at £40,820

Number of contracts = 26 Bitcoin ÷5 Bitcoin per contract = 5.2 = 5 contracts

At 31 May 2022:

Sell 26 Bitcoin @ £36,480 = £948,480

Gain on futures (£40,820 - £36,500) x 5 contracts x 5 Bitcoin = £108,000

Net receipt = £948,480 + £108,000 = £1,056,480

This was the second time that crypto-currency hedging had been tested in this paper and it was pleasing

to see that many candidates were familiar with Bitcoin forward contracts. The calculating relating to Bitcoin

futures proved to be a bit trickier with errors often occurring when calculating the gain on the futures.

Total possible marks 5

Maximum full marks 5

3.2 (b)

One reason why there is a difference between the net sterling receipts is because the two contracts were

offered at different rates (£40,780 vs £40,820).

Based on these rates the net receipt from the futures contracts should have been higher. But instead, the

forward contract provides the highest net receipt.

Copyright © ICAEW 2022. All rights reserved Page 10 of 11

Professional Level – Financial Management - March 2022

This is because five futures contracts did not cover the full transaction and Peregrine could not recover the

fall in value of the unhedged Bitcoin.

Most answers correctly identified that the rounding of the contacts would be one factor that would cause a

difference in the two calculations. However, many failed to spot what should have been a more obvious

difference which was that the futures and forward contracts were being offered at different rates. Answers

tended to focus on basis risk instead, which would have been more appropriate if the final transaction had

taken place before the 31 May.

Total possible marks 3

Maximum full marks 2

3.3

Peregrine should use June put options at a price of 7150.

The number of contracts = £2,781,350 ÷ (7,150 x £10) = 38.9 = 39 contracts

The premium will cost = 39 contracts x 60 pts x £10 = £23,400

FTSE index rises

Peregrine should let the options lapse

Net receipt = £2,878,600 - £23,400 = £2,855,200

FTSE index falls

Peregrine should exercise the options

Gain on options (7150 - 6800) x 39 contracts x £10 = £136,500

Net receipt = £2,645,200 + £136,500 - £23,400 = £2,758,300

There were a lot of very good answers provided for this requirement, with many candidates obtaining full

marks. Common mistakes included choosing July contracts instead of June or forgetting to adjust for the

£10 per point contract size when calculating the number of contracts or the gain on the options.

Total possible marks 7

Maximum full marks 7

Copyright © ICAEW 2022. All rights reserved Page 11 of 11

You might also like

- Anwal Gas-TnDocument35 pagesAnwal Gas-TnMaysam Kh67% (3)

- Model Assignment Aug-23Document3 pagesModel Assignment Aug-23Abner ogegaNo ratings yet

- SaaS Financial Model Template by ChargebeeDocument15 pagesSaaS Financial Model Template by ChargebeeNikunj Borad0% (1)

- Aurora Textile CompanyDocument16 pagesAurora Textile CompanyJesslin Ruslim0% (1)

- New Heritage Doll Company Case SolutionDocument31 pagesNew Heritage Doll Company Case SolutionSoundarya AbiramiNo ratings yet

- Acquisition of Consolidated Rail CorporationDocument12 pagesAcquisition of Consolidated Rail CorporationEdithNo ratings yet

- Coffee CubeDocument5 pagesCoffee Cubes3976142No ratings yet

- Calpine SolutionDocument5 pagesCalpine SolutionDarshan GosaliaNo ratings yet

- Monthly Average Services Production - Ton (Sillicon A1+A2) : 2020 P 2021 P 2022 P 2023 P 2018 Actual 2019 BudgetDocument12 pagesMonthly Average Services Production - Ton (Sillicon A1+A2) : 2020 P 2021 P 2022 P 2023 P 2018 Actual 2019 Budgetlidia_396516605No ratings yet

- Sabit FSDocument8 pagesSabit FSMilagrosa VillasNo ratings yet

- Economics Module - Vusal Iskandarov .XLSBDocument414 pagesEconomics Module - Vusal Iskandarov .XLSBTural ƏliyevNo ratings yet

- XLS915-XLS-ENG DesarrolladoDocument10 pagesXLS915-XLS-ENG DesarrolladoYessu Amhed Condori RavichaguaNo ratings yet

- 1233 NeheteKushal BAV Assignment1Document12 pages1233 NeheteKushal BAV Assignment1Anjali BhatiaNo ratings yet

- Material Complementario - Cafes Monte BiancoDocument7 pagesMaterial Complementario - Cafes Monte BiancoDavid ReyesNo ratings yet

- Analisa KepekaanDocument72 pagesAnalisa KepekaanHilda SusantiNo ratings yet

- Group D Uralita Furnaces CalculationsDocument36 pagesGroup D Uralita Furnaces Calculationsgugal KumarNo ratings yet

- Powerol - Monthly MIS FormatDocument34 pagesPowerol - Monthly MIS Formatdharmender singhNo ratings yet

- Valuation Final ExamDocument4 pagesValuation Final ExamJeane Mae Boo100% (1)

- Dreamy Destination Travel and Tours Start Up CapitalDocument21 pagesDreamy Destination Travel and Tours Start Up CapitalValentina Daluran AtentaNo ratings yet

- Student Version Work MACC Unit 6 - Theatre Calgary ExcelDocument6 pagesStudent Version Work MACC Unit 6 - Theatre Calgary ExcelVesela MihaylovaNo ratings yet

- America Movil Historical Income Statements (In 000,000s) : AssetsDocument19 pagesAmerica Movil Historical Income Statements (In 000,000s) : AssetsAna AsatianiNo ratings yet

- Material Complementario - Cafes Monte BiancoDocument20 pagesMaterial Complementario - Cafes Monte BiancoGlenda ChiquilloNo ratings yet

- Business Finance Decision Suggested Solution Test # 2: Answer - 1Document4 pagesBusiness Finance Decision Suggested Solution Test # 2: Answer - 1Syed Muhammad Kazim RazaNo ratings yet

- Winners' Financial ModelDocument5 pagesWinners' Financial ModelARCHIT KUMARNo ratings yet

- Capital Investment Break-Up: Marketing and PromotionDocument7 pagesCapital Investment Break-Up: Marketing and PromotionDeepak RamamoorthyNo ratings yet

- Perhitungan NPV Dan Hubungan Dengan Discount RateDocument5 pagesPerhitungan NPV Dan Hubungan Dengan Discount RateChristopher D NaraNo ratings yet

- Kourba Costing Sheet - Q4 - 301119Document15 pagesKourba Costing Sheet - Q4 - 301119Haneen JosephNo ratings yet

- ZafaDocument3 pagesZafaDayavantiNo ratings yet

- Financial Slide For ReportDocument6 pagesFinancial Slide For ReportTuan Noridham Tuan LahNo ratings yet

- Motives For Merger: 1. Horizontal 2. Vertical 3. Conglomerate 4. ConcentricDocument41 pagesMotives For Merger: 1. Horizontal 2. Vertical 3. Conglomerate 4. ConcentricWasif HossainNo ratings yet

- Chapter 5Document7 pagesChapter 5Bea Dela PeniaNo ratings yet

- CG Fs OLDDocument49 pagesCG Fs OLDDine CapuaNo ratings yet

- MA FX Q Solution 1 2 3Document4 pagesMA FX Q Solution 1 2 3thalnay zarsoeNo ratings yet

- Manage FinanceDocument11 pagesManage FinanceGurjinder Hanjra100% (2)

- Assumptions - Assumptions - Financing: Year - 0 Year - 1 Year - 2 Year - 3 Year - 4Document2 pagesAssumptions - Assumptions - Financing: Year - 0 Year - 1 Year - 2 Year - 3 Year - 4PranshuNo ratings yet

- DHL ExhibitsDocument7 pagesDHL ExhibitsAlan SamNo ratings yet

- Yolanda Resort FSDocument17 pagesYolanda Resort FSnyx100% (1)

- IAS 36 CA Final Solution Class WorkDocument14 pagesIAS 36 CA Final Solution Class WorkUmmar FarooqNo ratings yet

- Fit Deli TODAY Version 1.xlsb 1Document17 pagesFit Deli TODAY Version 1.xlsb 1Micah Valerie SaradNo ratings yet

- Solucion Caso PacificDocument7 pagesSolucion Caso PacificPaulina EsparzaNo ratings yet

- Strategic Finance All Question-13Document1 pageStrategic Finance All Question-13TheNOOR129No ratings yet

- Lecture 2.6 - SlidesDocument19 pagesLecture 2.6 - Slidessfalcao91No ratings yet

- Year 1979 1980 1981 1982 1983 1984 Period 0 1 2 3 4 5Document30 pagesYear 1979 1980 1981 1982 1983 1984 Period 0 1 2 3 4 5shardullavande33% (3)

- Final Project EconomicsDocument5 pagesFinal Project EconomicsAayan AhmedNo ratings yet

- Tesla FinModelDocument58 pagesTesla FinModelPrabhdeep DadyalNo ratings yet

- Financial ModelDocument10 pagesFinancial ModelAbdul RehmanNo ratings yet

- DCF Model - Blank: Strictly ConfidentialDocument5 pagesDCF Model - Blank: Strictly ConfidentialaeqlehczeNo ratings yet

- Chap 14 Case Study Q2Document3 pagesChap 14 Case Study Q2vecasussince2023No ratings yet

- BSBFIM601 Appendix E Budget TemplateDocument5 pagesBSBFIM601 Appendix E Budget TemplatekanejNo ratings yet

- Instructor: Assumptions / InputsDocument17 pagesInstructor: Assumptions / InputsJoAnna MonfilsNo ratings yet

- EXAM SOLUTIONS May - June 2020 Suggested SolutionsDocument6 pagesEXAM SOLUTIONS May - June 2020 Suggested SolutionsphumeleleNo ratings yet

- FM Study HubDocument71 pagesFM Study HubchimbanguraNo ratings yet

- Spinning Project FeasibilityDocument19 pagesSpinning Project FeasibilityMaira ShahidNo ratings yet

- Dietrich Farms - Worksheet 2Document39 pagesDietrich Farms - Worksheet 2spam.ml2023No ratings yet

- EPCL Financial Model CY22Document87 pagesEPCL Financial Model CY22Umer FarooqNo ratings yet

- Financial AnalysisDocument12 pagesFinancial AnalysisAlaa AlsultanNo ratings yet

- IS, SOFP, SCE My WorkDocument6 pagesIS, SOFP, SCE My WorkoluwapelumiotunNo ratings yet

- Power Markets and Economics: Energy Costs, Trading, EmissionsFrom EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNo ratings yet

- Headlines Publishing Company HPC Specializes in InternationalDocument1 pageHeadlines Publishing Company HPC Specializes in InternationalAmit PandeyNo ratings yet

- HyperinflationDocument16 pagesHyperinflationJhonalyn Montimor Galdones100% (1)

- International Economics Theory and Policy 10th Edition Krugman Solutions ManualDocument7 pagesInternational Economics Theory and Policy 10th Edition Krugman Solutions Manualkhucly5cst100% (19)

- Insurance QuestionnaireDocument4 pagesInsurance QuestionnaireDavid WrightNo ratings yet

- Test Bank For MKTG 7th Edition LambDocument3 pagesTest Bank For MKTG 7th Edition LambEdwin Palmer100% (4)

- Registration of CooperativesDocument5 pagesRegistration of CooperativesRheneir Mora100% (1)

- Kunci Jawaban ElisaDocument52 pagesKunci Jawaban ElisaElisa EndrianiiNo ratings yet

- UKFSN SocialfranchisingguideDocument34 pagesUKFSN SocialfranchisingguideZak1717No ratings yet

- 3 Module 1 - QM - in - Con - V18June20 - 4Document170 pages3 Module 1 - QM - in - Con - V18June20 - 4nghiahnNo ratings yet

- Jurnal Umkm UnpadDocument10 pagesJurnal Umkm Unpadkunto ajiNo ratings yet

- ICMM. Ps - Tailings-Governance PDFDocument6 pagesICMM. Ps - Tailings-Governance PDFFelipe Ignacio Campos RodriguezNo ratings yet

- BCC 2021 Prospectus v4 DigitalDocument116 pagesBCC 2021 Prospectus v4 DigitalRifki JuliNo ratings yet

- Nestle CaseDocument14 pagesNestle CasePranav NyatiNo ratings yet

- Ninjacart - Depth and Diversity - The Two-Pronged Strategy That Helped WayCool Make A Mark in B2B Food Supply - The Economic TimesDocument12 pagesNinjacart - Depth and Diversity - The Two-Pronged Strategy That Helped WayCool Make A Mark in B2B Food Supply - The Economic TimesChirag Arora100% (1)

- MCA RegistrantsDocument408 pagesMCA RegistrantsanjumNo ratings yet

- Catalogo HL20 Máquina de Circulación ExtracorporeaDocument2 pagesCatalogo HL20 Máquina de Circulación Extracorporealoze13No ratings yet

- Arcelor MittalDocument4 pagesArcelor Mittalnispo100% (1)

- Solution DWDMDocument44 pagesSolution DWDMAli SaleemNo ratings yet

- Cost Control and Cost ReductionDocument34 pagesCost Control and Cost Reductionshreepal19No ratings yet

- BE Guidelines For Ethical LeadershipDocument2 pagesBE Guidelines For Ethical Leadershipits4krishna3776No ratings yet

- Feasibility Analysis of Business Case Study in Indonesia MinimarketDocument16 pagesFeasibility Analysis of Business Case Study in Indonesia Minimarketfabia afaniNo ratings yet

- DAV Question BankDocument79 pagesDAV Question BankSantosh SrivastavaNo ratings yet

- IBIG 03 03 Your Own DealsDocument17 pagesIBIG 03 03 Your Own DealsіфвпаіNo ratings yet

- E-MARKETING Digital EthicDocument10 pagesE-MARKETING Digital EthicAlif NajmiNo ratings yet

- Jornal Prblems 1Document6 pagesJornal Prblems 1Pooja PhatnaniNo ratings yet

- Multiplos 3 e Commerce DiscrecionalDocument3 pagesMultiplos 3 e Commerce DiscrecionalCesarNo ratings yet

- Commission On Audit Circular No. 92-125A March 4, 1992 TO: All Heads of Departments, Bureaus and Offices of The National GovernmentDocument6 pagesCommission On Audit Circular No. 92-125A March 4, 1992 TO: All Heads of Departments, Bureaus and Offices of The National GovernmentJade Darping KarimNo ratings yet

- Creative Accounting and Financial Reporting: Model Development and Empirical TestingDocument11 pagesCreative Accounting and Financial Reporting: Model Development and Empirical TestingPutri ElisaNo ratings yet

- Bba Iii CfaDocument3 pagesBba Iii Cfasaksham sikhwalNo ratings yet

- PM Unit 1 (Bba)Document55 pagesPM Unit 1 (Bba)Shankar SainiNo ratings yet