Professional Documents

Culture Documents

Employee Name - (EE & ER) - PDOC-Date Paid-2023-02-26

Employee Name - (EE & ER) - PDOC-Date Paid-2023-02-26

Uploaded by

William Joe0 ratings0% found this document useful (0 votes)

21 views1 pagepdoc

Original Title

Employee name-(EE & ER)-PDOC-Date paid-2023-02-26

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentpdoc

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

21 views1 pageEmployee Name - (EE & ER) - PDOC-Date Paid-2023-02-26

Employee Name - (EE & ER) - PDOC-Date Paid-2023-02-26

Uploaded by

William Joepdoc

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

Employee name-(EE & ER)-PDOC-Date paid-2023-02-26.

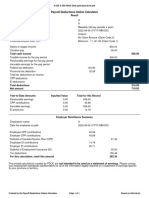

Payroll Deductions Online Calculator

Result

Employee's name:

Employer's name:

Pay period frequency: Biweekly (26 pay periods a year)

Date the employee is paid: 2023-02-26 (YYYY-MM-DD)

Province of employment: British Columbia

Federal amount from TD1: 15,000.00

Provincial amount from TD1: 11,981.00

Salary or wages income 2,500.00

Total cash income 2,500.00

Pensionable earnings for the pay period 2,575.00

Insurable earnings for the pay period 2,500.00

Federal tax deduction 189.36

Provincial tax deduction 80.20

Total tax deductions on income 269.56

CPP deductions 145.20

EI deductions 40.75

Amounts deducted at source 425.00

Total deductions 880.51

Net amount 1,619.49

Taxable benefits (non-cash)

Employer's Contribution to Employee's RRSP 75.00

Amounts deducted at source

Employee contribution to RRSP 125.00

Alimony or Maintenance Payments 300.00

Year-to-Date Amounts Inputted Value Total for this Record

Pensionable earnings 7,725.00 10,300.00

CPP contributions 417.30 562.50

Insurable earnings 7,725.00 10,225.00

EI premiums 122.05 162.80

Employer Remittance Summary

Employee's name:

Date the employee is paid: 2023-02-26 (YYYY-MM-DD)

Employee CPP contributions 145.20

Employer CPP contributions 145.20

Subtotal of Canada Pension Plan (CPP) 290.40

Employee EI contributions 40.75

Employer EI contributions 57.05

Subtotal of Employment Insurance (EI) 97.80

Tax deductions 269.56

For this calculation, remit this amount 657.76

Based on pensionable months entered, the employee and employer Canada Pension Plan contribution maximum for the

year is $3,754.45.

The printed calculations created by PDOC are not intended to be used as a statement of earnings. Please contact

your employment standards representative for all of the information legally required on a statement of earnings specific

to your province or territory.

Created by the Payroll Deductions Online Calculator Page 1 of 1 Saved on 2023-02-08

You might also like

- Plain Paper PayslipDocument4 pagesPlain Paper PayslipmisprumbokodoNo ratings yet

- JollibeeDocument12 pagesJollibeePankaj Sahu67% (3)

- MR Sharanabasappa Hosamani 01386452: Sap Labs India Pvt. LTDDocument1 pageMR Sharanabasappa Hosamani 01386452: Sap Labs India Pvt. LTDSharanu HosamaniNo ratings yet

- Payslip Aug 2019 PDFDocument1 pagePayslip Aug 2019 PDFAbhishek MitraNo ratings yet

- Pay Slip July 2020...Document2 pagesPay Slip July 2020...laxman lucky100% (2)

- Rangkuman OB Chapter 3 by MSSDocument4 pagesRangkuman OB Chapter 3 by MSSCahyaning SatykaNo ratings yet

- Age Diversity Related To Hospitality and TourismDocument6 pagesAge Diversity Related To Hospitality and TourismAakashNo ratings yet

- Employee Name - (EE & ER) - PDOC-Date Paid-2024-03-28Document2 pagesEmployee Name - (EE & ER) - PDOC-Date Paid-2024-03-28RileyNo ratings yet

- Mary Doe - (EE & ER) - PDOC-Date Paid-2022-02-25Document1 pageMary Doe - (EE & ER) - PDOC-Date Paid-2022-02-25rahul_ransureNo ratings yet

- A - (EE & ER) - PDOC-Date Paid-2022-08-05Document1 pageA - (EE & ER) - PDOC-Date Paid-2022-08-05armanf2020zNo ratings yet

- Candy Simpson - (EE & ER) - PDOC-Date Paid-2020-12-12 (WEEK 2)Document1 pageCandy Simpson - (EE & ER) - PDOC-Date Paid-2020-12-12 (WEEK 2)mcocampo2No ratings yet

- Mirjana Myra Ribich (EE) PDOC Date Paid 2023-08-11Document1 pageMirjana Myra Ribich (EE) PDOC Date Paid 2023-08-11mirjana ribichNo ratings yet

- Heads of Income Monthly Actual YTD Projected TotalDocument2 pagesHeads of Income Monthly Actual YTD Projected Totalprakriti sankhlaNo ratings yet

- Heads of Income Monthly Actual YTD Projected Total: EIT Services India PVT LTD Income Tax Computation StatementDocument2 pagesHeads of Income Monthly Actual YTD Projected Total: EIT Services India PVT LTD Income Tax Computation Statementsunit pattanayakNo ratings yet

- Heads of Income Monthly Actual YTD Projected TotalDocument2 pagesHeads of Income Monthly Actual YTD Projected TotalDsr Santhosh KumarNo ratings yet

- EMPH2800 TAXSHEET March 2021Document1 pageEMPH2800 TAXSHEET March 2021the anonymousNo ratings yet

- CTC BreakupDocument2 pagesCTC BreakupbaluNo ratings yet

- Provisional Taxsheet Mar 2020Document1 pageProvisional Taxsheet Mar 2020vivianNo ratings yet

- Capgemini Technology Services India LimitedDocument2 pagesCapgemini Technology Services India LimitedFlawsome FoodsNo ratings yet

- XXXXXDocument2 pagesXXXXXvivek tiwariNo ratings yet

- 31 Jan 2024Document2 pages31 Jan 2024vikzNo ratings yet

- DownloadDocument2 pagesDownloadSowbhagya VaderaNo ratings yet

- Total Earnings Total Deductions: Net Pay (RS.) 41,000.00Document1 pageTotal Earnings Total Deductions: Net Pay (RS.) 41,000.00Diwakar ChaturvediNo ratings yet

- FormDocument1 pageFormRahul GaurNo ratings yet

- Payslip Tax 1 2024Document2 pagesPayslip Tax 1 2024n17mahey09No ratings yet

- Payslip Tax 12 2023-1Document2 pagesPayslip Tax 12 2023-1n17mahey09No ratings yet

- CTC 02000663Document1 pageCTC 02000663saravanaNo ratings yet

- Payslip India June - 2023Document2 pagesPayslip India June - 2023RAJESH DNo ratings yet

- Pay Slip: Payroll Basic DataDocument2 pagesPay Slip: Payroll Basic DataAdarsha ChandelNo ratings yet

- INT085 Payslip To Print Report Design 03-12-2024Document1 pageINT085 Payslip To Print Report Design 03-12-2024lesliedariqusNo ratings yet

- INT085 Payslip To Print Report Design 03-12-2024Document1 pageINT085 Payslip To Print Report Design 03-12-2024lesliedariqusNo ratings yet

- March Pay SlipDocument1 pageMarch Pay SlipBale MishraNo ratings yet

- CTC Breakup 12 2023Document2 pagesCTC Breakup 12 2023n17mahey09No ratings yet

- PayslipsDocument6 pagesPayslipsbskapoor68No ratings yet

- JuneDocument1 pageJuneRmillionsque FinserveNo ratings yet

- UnknownDocument1 pageUnknownrahulagarwal33No ratings yet

- Invitation LetterDocument32 pagesInvitation LetterPRASENJIT DENo ratings yet

- Payslip IndiaApproved On30 Nov 2023 - UnlockedDocument3 pagesPayslip IndiaApproved On30 Nov 2023 - UnlockedrithulblockchainNo ratings yet

- AccountingDocument4 pagesAccountingSum WhosinNo ratings yet

- Servlet ControllerDocument2 pagesServlet ControllerRJNo ratings yet

- PayslipDocument1 pagePayslipSuyash RaulNo ratings yet

- Payslip Nov 2023Document1 pagePayslip Nov 2023VarshaNo ratings yet

- Rajiv Verma - Income Tax Computation StatementDocument2 pagesRajiv Verma - Income Tax Computation StatementRajiv VermaNo ratings yet

- Bedaprabhash Mishra - 1075 2017 Annual AprisalDocument2 pagesBedaprabhash Mishra - 1075 2017 Annual AprisalBedaprabhashNo ratings yet

- Income Computation DetailsDocument4 pagesIncome Computation DetailssachinNo ratings yet

- Pricewaterhousecoopers Service Delivery Center (Bangalore) PVT LTD Income Tax Computation StatementDocument15 pagesPricewaterhousecoopers Service Delivery Center (Bangalore) PVT LTD Income Tax Computation StatementRajat SinghNo ratings yet

- ReportDocument1 pageReportsumayaNo ratings yet

- 2022-Mar Payslip - Purewealth Ebc Corporation: Payroll Break Down Year - To - DateDocument2 pages2022-Mar Payslip - Purewealth Ebc Corporation: Payroll Break Down Year - To - DateLance PazNo ratings yet

- Elijah Jayie: Rate Hours Amount Amount YTD Hours YTD Amount YTD AmountDocument1 pageElijah Jayie: Rate Hours Amount Amount YTD Hours YTD Amount YTD Amountmdyafi8084No ratings yet

- Payslip India May - 2023Document2 pagesPayslip India May - 2023RAJESH DNo ratings yet

- Balance Sheet and Profit & Loss JuneDocument2 pagesBalance Sheet and Profit & Loss JuneQasim RazaNo ratings yet

- Salary Slip 1700531238397241Document1 pageSalary Slip 1700531238397241nirasahu7894No ratings yet

- MAY - 23 - Pay SlipDocument2 pagesMAY - 23 - Pay Slipphaninv1294No ratings yet

- S K Tiwari 24-25Document1 pageS K Tiwari 24-25pnmbbsrz1.acilNo ratings yet

- Slip 2Document1 pageSlip 2Tariq MehmoodNo ratings yet

- Com 23Document3 pagesCom 23TAX INDIANo ratings yet

- Jul 2023Document2 pagesJul 2023NilanjanNo ratings yet

- Chapter 19 in Class ExercisesDocument14 pagesChapter 19 in Class ExercisesByul ProductionsNo ratings yet

- Employee Details Payment & Leave Details: Arrears Current AmountDocument1 pageEmployee Details Payment & Leave Details: Arrears Current Amountabhilash eNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsKlevin LloydNo ratings yet

- MboDocument4 pagesMboSum WhosinNo ratings yet

- MPDCDocument4 pagesMPDCSum WhosinNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- EPMS Sample FormDocument3 pagesEPMS Sample FormKdan ChanNo ratings yet

- Curriculum Vitae K.A.M. Rifat Hasan: Areer BjectiveDocument4 pagesCurriculum Vitae K.A.M. Rifat Hasan: Areer BjectiveMd Shawfiqul IslamNo ratings yet

- Topic 1 (Management)Document42 pagesTopic 1 (Management)Nur Adnin KhairaniNo ratings yet

- Qualifications of Board of NursingDocument11 pagesQualifications of Board of NursingKram PerezNo ratings yet

- 2021 March Prosper Survey ResultsDocument13 pages2021 March Prosper Survey ResultsStuff NewsroomNo ratings yet

- Frequently Asked Questions: Step IncrementDocument6 pagesFrequently Asked Questions: Step Incrementsharoncerro81No ratings yet

- Hots Business StudiesDocument37 pagesHots Business StudiesDaniel RobertNo ratings yet

- Group Project by Group No. 06Document18 pagesGroup Project by Group No. 06Abhishek PatilNo ratings yet

- Seminar ReportDocument60 pagesSeminar ReportReet DhaliwalNo ratings yet

- Final COP-Section 1Document86 pagesFinal COP-Section 1Arbaz KhanNo ratings yet

- Mathis JacksonDocument36 pagesMathis Jacksonandutzzzu100% (1)

- Performance Management at Network Solutions, Inc.Document19 pagesPerformance Management at Network Solutions, Inc.Ishu Singla83% (6)

- Apprentices Contract Registration CardDocument2 pagesApprentices Contract Registration CardabhijeettembhurneNo ratings yet

- 8-Stop Work Authority - PPSXDocument8 pages8-Stop Work Authority - PPSXMohamed Mahmoud0% (1)

- An Analysis On The Determinants of Quality of Work Life and Employee Turnover Among The Nurses of Private Hospitals in CoimbatoreDocument13 pagesAn Analysis On The Determinants of Quality of Work Life and Employee Turnover Among The Nurses of Private Hospitals in CoimbatoreIAEME PublicationNo ratings yet

- Study On Effectiveness of RecruitmentDocument46 pagesStudy On Effectiveness of RecruitmentManasa m100% (1)

- Public Service Vacancy Circular 05 of 2019Document186 pagesPublic Service Vacancy Circular 05 of 2019jonnydeep1970virgilio.itNo ratings yet

- Jamia Millia Islamia New Delhi: Subject - Labour Law - I Topic - Strike and Lock-OutDocument14 pagesJamia Millia Islamia New Delhi: Subject - Labour Law - I Topic - Strike and Lock-OutPrashant KumarNo ratings yet

- Chapter 1 Cybersecurity and The Security Operations CenterDocument9 pagesChapter 1 Cybersecurity and The Security Operations Centeradin siregarNo ratings yet

- 175 PacDocument7 pages175 PacRACHMAD ARIFUDDINNo ratings yet

- Case Study10Document5 pagesCase Study10KanakaMaha LakshmiNo ratings yet

- Business Essentials Canadian 7th Edition Ebert Solutions ManualDocument42 pagesBusiness Essentials Canadian 7th Edition Ebert Solutions ManualkaylintocwcNo ratings yet

- Strategic Pay PlanDocument20 pagesStrategic Pay PlanArifuzzaman khan75% (4)

- Session 17 Heizer Ch15 F JIT & Lean OperationsDocument52 pagesSession 17 Heizer Ch15 F JIT & Lean OperationsBhanu PratapNo ratings yet

- 09 Bernardo v. NLRCDocument4 pages09 Bernardo v. NLRCJoshua Ejeil PascualNo ratings yet

- Apple Case Write-Up FinalDocument13 pagesApple Case Write-Up FinalNgọc Anh VõNo ratings yet

- Recruitment PT. J Resources NusantaraDocument1 pageRecruitment PT. J Resources NusantaraNunung TajebNo ratings yet