Professional Documents

Culture Documents

Government Grants

Government Grants

Uploaded by

Aristeia Notes0 ratings0% found this document useful (0 votes)

25 views8 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

25 views8 pagesGovernment Grants

Government Grants

Uploaded by

Aristeia NotesCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 8

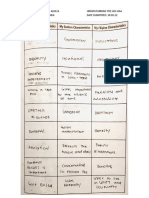

CHAPTER 15:

GOVERNMENT GRANTS

Nature of Government Grants

2. Recognition Principles for Governmént Grants

3. Accounting for Government Grants

4. Classification of Government Grants

5. Repayment of Government Grants

6. Grant of Interest-Free Loan

7. Government Assistance

8._Disclosures on Government Grants

Nature of Government Grants

» Government grants are assistance by the government in the form of transfers of

resources to an entity in return for past or future compliance with certain

conditions relating to the operating activities of the entity.

ition Principles for Gc iment Grant

>. Government grants, including non-monetary grants at fair value, shall not be

recognized until there is reasonable assurance that:

The entity will comply with the conditions attached to them; and

Y The grants will be received.

> Government grants shall be recognized-on an accrual basis when received or

receivable. Nn

Nofe: IAS 20 disallows-the recognition of government grants.on.a.cash basis as this is.|._

‘accordance with generally accepted accounting principles.

for rant z

> Government grants shall be recognized in profit or loss on a systematic basis over

the periods in which the entity recognizes as expenses the related costs for which

the grants are intended to compensate.

> Rules:

° ir nition of specifi S

‘© Recognized in profit or loss in the same period as the related expenses.

able

Grants 1

‘9 Recognized in profit or loss over the periods and in the proportions in

which depreciation expense on those assets is recognized:

Scanned with CamScanner

obligations (or conditions),

© Recognized in profit or loss over the periods that bear the cost of meeting

the obligations (or conditions).

Note: A government grant that becomesireceivable as compensation for expenses or

losses already incurred or for the purpose of giving Immediate financial support to the

entity with no future felated costs shall be)fecognized in profit or loss of the period in

which it becomes receivable,

Tlustration 4: (Grant in recognition of specific expenses)...

Atthe SOS reson Wain Conreny received'a grant of P45,000,000 from

the U.S. government to defray safety and environmental costs within the area where the

entity is located.

‘The safety and environmental costs are expected to be incurred over four years as

follows:

Year Amount ‘ ;

2023. 3,600,000 —~ i 2

2024 7,200,000 4 he ide

2025 10,800,000 : # ?

2026 14,400,000 sei Ngee

© Q; Determine the grant income to be recognized for the years angs-edeugh

2026. Ht Riss

eA “ay

Safety and Fraction Grant income

environmental costs

2023 3,600,000 -3.6/36 ' 4,500,000

2024 7,200,000, 7.2/36 9,000,000

2025 10,800,000’ 10.8/36 13,500,000

2026 14,400,000’ | 14.4/36 __" 18,000,000

Total 36,000,000" 45,000,000

ntries

Cash 45,000,000

fred grant income 45,000,000

Deferred grant income * ~ 4,500,000

Grant income 4,500,000

Safety and environmental expense, 3,600,000 x

Cash ‘ 3,600,000 2OL-Z

Comment:

> Grant in recognition of specific expenses shall be recognized as income in the

same period as the related expense.

© AS a result, the granbof P45,000,000 Is distributed as income over four

years in proportion to the éxpenses incurred.

748

Scanned with CamScanner

Ghappten 15: Government Grants

Tilustration 2: (Grants related to day

preciable assets)

At the beginning of the current year, XYZ Company received a grant of P5,000,000 from |.

the African government for the acquisition of ility_ wit i

P7,500,000 and useful life ofS years, eee

@Q; Prepare the journal entries during the current year.

eA:

Cash 5,000,000

Deferred grant income i 5,000,000

Building 7,500,000

Cash a 7,500,000

Depreci we coprinn (P7.5M/5) 1,500,000

AceGmulated depreciation 1,500,000

ferred grant income 1,000,000

Grant income (P5M/5) 1,000,000

Comment: Grants related to depreciable assets shall be recognized in profit or loss over

the periods and in the proportions in which depreciation expense on those assets is

recognized.

Illustration 3: (Grants related to non-depreciable assets requiring fulfillment

of certain conditions)

At the beginning of the current year, Kram Company is granted a large tract of land in

the Tlocos region by the Philippine government. The fair value of the land is P48,000,000.

The entity is required by the grant to construct a research facility and employ only

Personnel residing in the Tlocos region.

The estimated cost of the facility is P54,000,000 which has a useful life of 10 years. The

research facility was completed and ready for the intended use at the end of the current

year.

@Q: Prepare the journal entries during the current year.

& PAV

ee 48,000,000

Land 000,

Deferred grant income 48,000,000 +

8 54,000,000

‘Cah 54,000,000

4,800,000 PRY

Deferred grant income asboaen ie

Grant income (48M/10)

Comment: Grants related to non-depreciable assets requiring fulfillment of certain

conditions shell be recognized in profit or oss over the periods that bear the cost of

Meeting the conditions. ls Pay

i onl j Gs

Her, Dees Ea Je a

749 Woow

Scanned with CamScanner

Comprehensive Aecountiag Restewer Sores

Volume ti Financial Acaanting end Reporteg

Tllustration 4: (Grant as immediate financial support)

Atthe beginning of the current yet, Sam Company received a grant of P7,000,000 from

the British government to compensate for massive losses incurred because of a'recent

tsunami. The grant was made for the purpose of giving immediate financial support to

the entity. It will take the entity two years to reconstruct the assets destroyed by the

‘tsunami. 4

@Q: Prepare the journal entries during the current year.

GA:

Cash 7,000,000

Grant income 7,000,000

y Comment: A government grant that becbmes receivable as compensation for expenses

or losses already incurred or for the purpose of giving immediate financial support to the

entity with no future related costs shall be recoghized in profit or loss of the period in

which it becomes receivable.

Classification of Government Grants

1. Grants related to assets

2. Grants related to income =|

Grants related to assets

> Grants whose primary condition is that an entity qualifying for the grant shall

purchase, construct, or acquire fixed assets.

(2) Setting up the grant as deferred income, or

(b) Deducting the grant in ariving at the carrying amount of the asset.

Note:

oye > If the grant is recognized as deferred income, it will be recognized in profit or

loss on @ systematic basis over the useful life of the asset.

If the grant is deducted in arriving at the carrying amount of the asset, the

grant is recognized in profit or loss over the life of a depreciable asset as a

reduced depreciation expense.

> Journal entries:

(a) Cash x

Deferred grant income x

(b) Cash x

Property, plant, and equipment xx

Grants related to income

> Grants other than those related to assets.

750

=

Scanned with CamScanner

Chapter 15: Govcrament Grants

> Presentation:

© Either by:

(@) Using a separate income account or under other (or miscellaneous)

income”, or

(b). Deducting from the related expense.

> Journal entries:

(a) Cash xx

Income (or other/miscellaneous income) XX

(b) Cash Xx

Expense mt

ent of Govern

> A government grant that becomes repayable due to non-compliance with

conditions shall be accounted for as a change in accountin

° ant

((?) Repayment of a. grant related to an asset shall be recognized by

increasing the carrying amount of the asset or reducing the deferred

grant income balance by the amount repayable.

oe

i) The cumulative additional depreciation that would have been recognized

in profit or loss to date in the absence of the grant shall be recognized

immediately in profit or loss.

+ ts related to incor

¥ \ Repayment of a grant related to income shall be applied first against any

unamortized deferred income in respect of the grant.

© If the repayment exceeds any existing deferred grant income, or

when no deferred grant income exists, ‘the repayment shall be

recognized immediately in profit or loss.

¥ ) Journal entry:

Deferred grant income xx

Loss on repayment of grant XX

Cash xx

Tilustration 5:

White Company purchased a machine for P5,250,000 on January 1, 2023, and received

2 government grant of P750,000 toward the capital cost. The machine is to be

depreciated on a straight-line basis over 5 years and estimated to have a residual value

of P375,000 at the end of its useful life.

On January 1, 2025, the entity violated certain conditions attached to the grant and

therefore had to repay fully such grant to the government.

Case 1: The accounting policy is to treat the grant a deferred income,

@Q-1: Prepare the journal entries for the year 2023,

@Q-2: Prepare the journal entries for the year 2025,

751

Scanned with CamScanner

Comprehensive Accounting Reviewer Series

Motu ts Flaancial Acounting aad Reporting

en ee

Case 2: The accounting policy is to treat the grant as a reduction in the cost of the

asset.

(@ Q-1: Prepare the journal entries for the year 2023.

© Q-2: Prepare the journal entries for the year 2025.

Case 1

Ont ‘

Machine 5,250,000

Cash 5,250,000

Cash 750,000

Deferred grant income 750,000

Depreciation expense [(5.25M - 375T)/5] 975,000

‘Accumulated depreciation 975,000

Deferred grant income 150,000

Grant income (7507/5) ‘ 150,000

@A-2:

\ Deferred grant income 450,000

Loss on repayment of grant 300,000

Cash 750,000

Deferred grant income, 1/1/2023 750,000

Less: Grant income, 2023 — 2024 (150,000 x 2) _(300,000)

Deferred grant income, 12/31/2024 450,000,

Depreciation expense 975,000

‘Accumulated depreciation + 975,000

Case 2

Gat: s

Machine 5,250,000

Cash 5,250,000

Cash 750,000 :

Machine 750,000

Depreciation expense {(5,25M - 750T) ~375T/5) 825,000

Accumulated depreciation ee 825,000

@A-2:

Machine

4 750,000

Cash 750,000

Depreciation expense

000

‘Accumulated depreciation 1,275,

1,275,000

752

Scanned with CamScanner

Chapter 15: Government Grants

‘Original depreciation

Add: Depreciation expense that would have aoe

there been no grant [(750T/5}x 3 years ne erence had 450,000

Depreciation expense — 2025 1,275,000

int of Interest-Fres

> _A forgivable loan from the government is treated as a government grant when

there is reasonable assurance that ity wil

fences the entity will meet the terms for the

> The benefit of a government loan with no interest or below-1 it

treated as a government grant. Ee

©The benefit is measured as the difference between the face amount and the

present value of the loan.

* The benefit is recognized as the discount on the:note payable to be

amortized over the term of the loan using the éffective interest method.

Note: The grant income per year is equal to the per year amortization of the discount

on note payable.

Government Assistance :

> An action by the government designed to provide an’ economic benefit specific to

an entity or range of entities qualifying under certain criteria,

> No value can be placed upon government assistance,

> £xampl :

(7) Free technical or marketing advice,

Provision of guarantees.

Government procurement policy that is responsible for a portion of the entity's

\U sales.

> Does not include indirect benefits or those benefits not specific to an entity such

ast

¥ Infrastructure in development areas such as improvements to the general

transport and communication network.

Imposition of trading constraints on competitors.

Improved facilities such as irrigation for the benefit of an entire local

community.

res on Government Grat

> ) The accounting policy adopted for government grants, including the method of

presentation adopted In the financial statements. eM

SUE irene c : > :

he nature and extent of goverrimient:grants fecoghized in the financial statements )

1d an indication of other forms of government assistance from which the entity

has directly benefited.

Oyo conditions and other contingencies attached to government assistance

~—Anat has been recognized. i

a) :

Scanned with CamScanner

Aeceanting Reotewer Seves

Untume 1: Financial Hecounting and Reportiog

Noter IAS 20 does not require the disclosure of the name of the government agenc

that gave the grant along with the date ‘of sanction of the grant by such governmert

agency and the date when cash was recelved In case of monetary grant.

-000-

74

Scanned with CamScanner

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Business Tax - October 17Document15 pagesBusiness Tax - October 17Aristeia NotesNo ratings yet

- 23.+Other+Percentage+Tax-REVISED+2023-classroom+discussion - Students 2Document55 pages23.+Other+Percentage+Tax-REVISED+2023-classroom+discussion - Students 2Aristeia NotesNo ratings yet

- 10 - Donor's TaxDocument38 pages10 - Donor's TaxAristeia NotesNo ratings yet

- Lecture 06 Lump Sum LiquidationDocument2 pagesLecture 06 Lump Sum LiquidationAristeia NotesNo ratings yet

- Inventories Theory and FormulaDocument29 pagesInventories Theory and FormulaAristeia NotesNo ratings yet

- Obli - Con Prelims ReviewerDocument33 pagesObli - Con Prelims ReviewerAristeia NotesNo ratings yet

- MANALO - M5-My Introspective SelfDocument3 pagesMANALO - M5-My Introspective SelfAristeia NotesNo ratings yet

- RPH ManaloDocument4 pagesRPH ManaloAristeia NotesNo ratings yet

- Manalo Module 3 ActivityDocument4 pagesManalo Module 3 ActivityAristeia NotesNo ratings yet

- MANALO - M5-My Introspective SelfDocument3 pagesMANALO - M5-My Introspective SelfAristeia NotesNo ratings yet

- RPH ManaloDocument3 pagesRPH ManaloAristeia NotesNo ratings yet