Professional Documents

Culture Documents

SM 11

SM 11

Uploaded by

Mai Anh ĐàoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SM 11

SM 11

Uploaded by

Mai Anh ĐàoCopyright:

Available Formats

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Eighth Canadian Edition

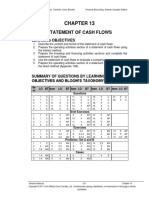

CHAPTER 11

REPORTING AND ANALYZING SHAREHOLDERS’

EQUITY

LEARNING OBJECTIVES

1. Identify and discuss the major characteristics of a corporation.

2. Record share transactions.

3. Prepare the entries for cash dividends, stock dividends, and stock splits, and

understand their financial impact.

4. Indicate how shareholders’ equity is presented in the financial

statements.

5. Evaluate dividend and earnings performance.

SUMMARY OF QUESTIONS BY LEARNING OBJECTIVES

AND BLOOM’S TAXONOMY

Item LO BT Item LO BT Item LO BT Item LO BT Item LO BT

Questions

1. 1 C 7. 2 C 13. 2 C 19. 4 K 25. 5 AN

2. 1 AP 8. 2 K 14. 3 K 20. 4 C 26. 5 C

3. 1 C 9. 2 K 15. 3 C 21. 4 C 27. 5 C

4. 1 C 10. 2 C 16. 3 C 22. 4 C 28. 5 AN

5. 1 C 11. 2 AP 17. 3 AP 23. 4 C 29 5 C

6. 2 C 12. 2 C 18. 3 K 24. 5 K

Brief Exercises

1. 1 C 5. 2 AN 9. 3 AN 13. 5 AN 17. 5 AP

2. 2 AP 6. 3 AP 10. 4 AN 14. 5 AN 18. 5 AP

3. 2 AP 7. 3 AP 11. 4 AP 15. 5 AP

4. 2 AP 8. 3 AN 12. 4 AP 16. 5 AP

Exercises

1. 1 AN 4. 2 AN 7. 2,3,4 AN 10. 4 AP 13. 5 AN

2. 2 AP 5. 2,3 AP 8. 4 C 11. 5 AN 14. 5 AN

3. 2 AN 6. 3 AP 9. 4 AP 12. 5 AP 15. 5 AN

Problems: Set A and B

1. 2,3,4 AN 4. 2,3,4 AP 7. 3,4 AP 10. 5 AN

2. 2,3,4 AN 5. 2,3,4 AP 8. 5 AP 11. 5 AN

3. 2,3,4 AN 6. 3 AN 9. 5 AN

Accounting Cycle Review

1. 2,3,4 AP

Cases

1. 2,3 C 3. 1,5 C 5. 3 C 7. 2,3,4 AP

2. 4,5 C 4. 2,3,4,5 S 6. 5 E

Solutions Manual 11-1 Chapter 11

Copyright © 2020 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Eighth Canadian Edition

Legend: The following abbreviations will appear throughout the solutions manual file.

LO Learning objective

BT Bloom's Taxonomy

K Knowledge

C Comprehension

AP Application

AN Analysis

S Synthesis

E Evaluation

Difficulty: Level of difficulty

S Simple

M Moderate

C Complex

Time: Estimated time to prepare in minutes

AACSB Association to Advance Collegiate Schools of Business

Communication Communication

Ethics Ethics

Analytic Analytic

Tech. Technology

Diversity Diversity

Reflec. Thinking Reflective Thinking

CPA CM CPA Canada Competency

cpa-e001 Ethics Professional and Ethical Behaviour

cpa-e002 PS and DM Problem-Solving and Decision-Making

cpa-e003 Comm. Communication

cpa-e004 Self-Mgt. Self-Management

cpa-e005 Team & Lead Teamwork and Leadership

cpa-t001 Reporting Financial Reporting

cpa-t002 Stat. & Gov. Strategy and Governance

cpa-t003 Mgt. Accounting Management Accounting

cpa-t004 Audit Audit and Assurance

cpa-t005 Finance Finance

cpa-t006 Tax Taxation

Solutions Manual 11-2 Chapter 11

Copyright © 2020 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Eighth Canadian Edition

ANSWERS TO QUESTIONS

1. (a) (1) Separate legal existence. A corporation is separate and distinct from its

shareholders (owners) and acts in its own name rather than in the name of

its shareholders. In addition, the acts of the shareholders do not bind the

corporation unless the shareholder is a duly appointed agent of the

corporation. This is an advantage to the corporate form of organization.

(2) Limited liability of shareholders. Because of its separate legal existence,

creditors of a corporation ordinarily have recourse only to corporate

assets to satisfy their claims. Thus, the liability of shareholders is

normally limited to their investment in the corporation. This is an

advantage to the corporate form of organization.

(3) Transferable ownership rights. Ownership of a corporation is shown in

shares, which are transferable. Shareholders may dispose of part or all of

their interest by simply selling their shares. The transfer of ownership to

another party is entirely at the discretion of the shareholder. This is an

advantage to the corporate form of organization.

(4) Ability to acquire capital. Corporations can raise capital quite easily by

issuing shares. Public corporations have an almost unlimited ability to

acquire capital. Investors find shares of corporations to be attractive since

they need not invest large sums of money to become shareholders. In

addition, shareholders benefit from limited liability. This is an advantage

to the corporate form of organization.

(5) Continuous life. Since a corporation is a separate legal entity, its

continuance as a going concern is not affected by the withdrawal, death,

or incapacity of a shareholder, employee, or officer. This is an advantage

to the corporate form of organization.

Solutions Manual 11-3 Chapter 11

Copyright © 2020 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Eighth Canadian Edition

1. (a) (continued)

(6) Separation of management and ownership. Although the shareholders of

a corporation are its owners, it is the board of directors that decides on the

operating policies of the company. The shareholders seldom get involved

in the company’s day-to-day activities. This is normally seen to be an

advantage to the corporate form of organization.

(7) Government regulations. Corporations in Canada may incorporate

federally or provincially. Government regulations usually provide

guidelines for issuing shares, distributing net income, and reacquiring

shares. Provincial securities commissions also govern the sale of share

capital to the general public. When a corporation’s shares are listed or

traded on a stock exchange, it must adhere to the reporting requirements

of that exchange. This may be a disadvantage to the corporate form of

organization because it adds extra cost and complexity to the

organization.

(8) Income tax. Corporations must pay federal and provincial income tax as

separate legal entities. However, corporations usually benefit from more

favourable tax rates than do the owners of partnerships or proprietorships.

The shareholders of the corporation do not pay tax on the corporation’s

net income unless they receive dividends from the corporation. This is

often seen to be an advantage to the corporate form of organization.

(b) While public corporations have an almost unlimited ability to acquire

capital, this is not the case for private corporations. In addition, transferring

ownership rights can be much more limited given that private corporation

shares are not publicly traded. Private companies do not have as stringent

reporting and disclosure requirements as public companies.

LO 1 BT: C Difficulty: M Time: 30 min. AACSB: None CPA: cpa-t001, cpa-t006 CM: Reporting and Tax

Solutions Manual 11-4 Chapter 11

Copyright © 2020 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Eighth Canadian Edition

2. (a) Letson has 60,000 shares issued and is eligible to issue an additional 40,000

shares (100,000 – 60,000).

(b) Only issued shares are recorded in the general journal. The number of

authorized shares is disclosed but not recorded until issued.

LO 1 BT: AP Difficulty: M Time: 5 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

3. When Richard purchased the original shares as part of

Aritzia Inc,’s initial public offering, he purchased these shares directly from the

corporation. The $1,600 (100 × $16) he spent to buy the shares went directly to

Aritzia and increased the company’s assets (Cash) and shareholders’ equity

(Common Shares). There was no impact on the company’s liabilities.

In the subsequent purchase, Richard bought shares in the secondary market from

another investor or investors. The proceeds from this sale went to the seller and

not to Aritzia. Therefore, there was no impact on Aritzia’s assets, liabilities, or

shareholders’ equity a result of the second purchase.

LO 1 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

4. Market capitalization is the measure of the fair value of a corporation’s equity. It

is calculated by multiplying the number of shares issued by the share market

price at any given date. It should not be confused with a corporation’s legal

capital which represents the amount paid to the corporation on the initial and any

subsequent issue of shares and consequently is the amount that appears on the

statement of financial position. The market price of Dollarama’s shares dropped

between 2018 and 2019 causing a corresponding drop in market capitalization.

Solutions Manual 11-5 Chapter 11

Copyright © 2020 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Eighth Canadian Edition

4. (continued)

Dollarama Inc.’s market capitalization decreased in 2019. There are two primary

reasons for a decrease in the market capitalization of a company, which may

happen separately or in combination. First, the number of shares may have

decreased because the company repurchased some of its shares. If this is the

case, assets (Cash) and shareholders’ equity (Common Shares) would decrease as

a result of the repurchase. Liabilities would be unaffected.

The second and more likely reason for the decrease in the market capitalization is

the decrease in the market price of the shares. Decreases in the market price of

the shares can result from a number of reasons but are most likely due to the

market’s perception of the future ability of the corporation to earn income. As a

result, investors bid down the price paid for the shares on the market. This

possible reason for the change in market capitalization does not affect any

element on the statement of financial position.

LO 1 BT: C Difficulty: M Time: 15 min. AACSB: None CPA: cpa-t001 CM: Reporting

5. (a) Legal capital is the portion of a company’s share capital that cannot be

distributed to shareholders. Legal capital is created largely for the

protection of creditors.

(b) The proceeds received by the company when issuing shares determine the

carrying amount of the shares recorded in the accounts. The proceeds are

considered to be legal capital that must remain invested in the company for

the protection of corporate creditors.

(c) Par value is very common in the United States and very rare in Canada.

Federally incorporated companies and most provincially incorporated

companies have no par value shares.

(d) Legal capital is kept separate from retained earnings because retained

earnings may be distributed to shareholders in the form of dividends,

whereas legal capital may not be distributed to shareholders until the

company is liquidated.

LO 1 BT: C Difficulty: M Time: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual 11-6 Chapter 11

Copyright © 2020 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Eighth Canadian Edition

6. (a) Preferred shareholders have priority over common shareholders with

respect to the distribution of dividends and, in the event of liquidation, over

the distribution of assets. Preferred shareholders do not usually have the

voting rights that the common shareholders have.

(b) Companies issue preferred shares for a permanent type of equity financing

for the company. They issue preferred shares to appeal to a larger segment

of investors. Also, issuing preferred shares (which are usually non-voting)

does not dilute ownership interest of common shareholders.

LO 2 BT: C Difficulty: M Time: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting

7. When shares are issued for a consideration other than cash, such as goods or

services, IFRS requires that the transaction be recorded at the fair value of the

consideration received. If the fair value of the consideration received cannot be

reliably determined, then the fair value of the consideration given up (for

example, shares) can be used.

When shares are issued for a noncash consideration in a private company

following ASPE, the valuation of the shares can be slightly different than that

described above for a publicly traded company following IFRS. The shares of a

private company should be recorded at the most reliable of the two values—the

fair value of the consideration (such as goods or services) received or fair value

of the consideration given up (such as shares). Quite often, the fair value of the

consideration received is the more reliable value because a private company’s

shares seldom trade and therefore do not have a ready market value.

LO 2 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual 11-7 Chapter 11

Copyright © 2020 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Eighth Canadian Edition

8. (a) A normal course issuer bid is synonymous with the repurchase of shares. In

a normal course issuer bid, a company is allowed to repurchase up to a

certain percentage of its shares subject to regulatory approval. It can

purchase the shares gradually over a period of time, such as one year. This

repurchasing strategy allows the company to buy when its shares are

favourably priced.

(b) A corporation may acquire its own shares (1) to increase trading of the

corporation's shares in the stock market, in the hopes of enhancing its

market value, (2) to reduce the number of shares issued and increase basic

earnings per share and return on equity ratios, (3) to eliminate hostile

shareholders by buying their shares, and (4) to have additional shares to

issue if required to compensate employees using stock options, or to

acquire other businesses.

LO 2 BT: K Difficulty: S Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

9. Because companies cannot realize a gain or incur a loss from share transactions

with their own shareholders, these amounts are not reported on the statement of

income. They are seen instead as an excess or deficiency that belongs to the

remaining shareholders and are recorded directly into the shareholders’ equity

accounts such as Contributed Surplus or Retained Earnings.

LO 2 BT: K Difficulty: S Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

10. When reacquiring shares, if the amount paid by the company is less than the

average cost of the shares on hand, the difference is credited to Contributed

Surplus, increasing it. If the opposite is true (i.e., the amount paid to reacquire

the shares is greater than the average cost of the shares on hand), the difference is

applied to reduce (debit) Contributed Surplus, but because that account cannot

have a negative (debit) balance, if the debit arising from the repurchase is greater

than the balance in the Contributed Surplus account, then the remainder of the

debit is applied against the Retained Earnings account, reducing it.

LO 2 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual 11-8 Chapter 11

Copyright © 2020 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Eighth Canadian Edition

11. David should expect to receive a dividend in the amount of $421.88 (1,500

shares × $1.125 ÷ 4) each quarter. When the Bank of Montreal resets the

dividend rate, it will be adjusted to more closely reflect market interest rates. If

David invested in the preferred shares because he hoped to earn a more attractive

return from dividends compared to the rate of return he could receive from

interest earned on a debt investment, he may be disappointed when the dividend

rate is reset at the lower market interest rate. On the other hand, because the

resetting of the dividend rate occurs only periodically, if David believes that

interest rates will fall, he may be very pleased to own these preferred shares (at

least until the dividend rate is reset at the same level as the lower interest rates).

Furthermore, if David believes that the interest rates will be volatile in the future,

the reset feature will make the investment in the preferred shares more appealing

because at least until the next reset, David will know what his rate of return will

be.

LO 2 BT: AP Difficulty: C Time: 5 min. AACSB: Analytic CPA: cpa-t001, cpa-t005

CM: Reporting and Finance

12. (a) Redeemable (or callable) preferred shares give the issuing corporation the

right to purchase these shares from shareholders at specified future dates

and prices. Retractable preferred shares are similar to redeemable or

callable preferred shares, except that it is at the shareholder’s option, rather

than the corporation’s option, that the shares are redeemed. This usually

occurs at an arranged price and date.

(b) Preferred shares are cumulative or noncumulative with respect to their

dividend provisions. Cumulative preferred shares entitle the shareholder to

any previous years’ dividends that have not yet been paid, as well as their

current dividend, before common shareholders can receive any dividends.

(c) Dividends in arrears can only arise from cumulative preferred shares. If a

dividend is not declared for a noncumulative preferred share, the dividend

entitlement is erased and does not carry forward into the future. On the

other hand, if a dividend is not declared for a cumulative preferred share,

the amount of the dividend shortfall becomes dividends in arrears which

must be paid first from any dividend declared in the future.

LO 2 BT: C Difficulty: M Time: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual 11-9 Chapter 11

Copyright © 2020 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Eighth Canadian Edition

13. Rate reset preferred shares allow the company the right to reset the dividend rate

periodically, usually every five years. Fixed rate preferred shares do not provide

for the option to change the dividend rate. Investors would prefer the rate reset

preferred shares on the assumption that interest rates are predicted to rise over

the long term. The reason shareholders would find rate reset preferred shares

more attractive is that they will be able to receive higher dividends in the future

when the dividend rate is adjusted to a higher rate caused by the rise in interest

rates.

LO 2 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

14. Cash dividends cannot exceed the balance of the Retained Earnings account. For

a cash dividend to be paid, a corporation must meet a solvency test to ensure that

it has sufficient cash to be able to pay its liabilities as they become due after the

dividend is declared and paid. The test essentially requires the net realizable

value of the assets of a company to exceed the total of its liabilities and share

capital. In addition, a formal dividend declaration by the board of directors is

required. Also, any required preferred dividends must be paid before common

dividends are paid.

LO 3 BT: K Difficulty: S Time: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting

15. On the declaration date, the board of directors formally authorizes the cash

dividend and announces it to shareholders. The declaration of a cash dividend

commits the corporation to a binding legal obligation. On the record date,

ownership of the shares is determined. On the payment date, dividends are paid

to the shareholders. The table below demonstrates the effect of three events on

the financial statement elements.

(a) (b) (c)

Declaration Payment

date Record date date

(1) Assets No effect No effect Decrease

(2) Liabilities Increase No effect Decrease

(3) Share capital No effect No effect No effect

(4) Retained earnings Decrease No effect No effect

(5) Total shareholders' equity Decrease No effect No effect

(6) Number of shares No effect No effect No effect

LO 3 BT: C Difficulty: M Time: 15 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual 11-10 Chapter 11

Copyright © 2020 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Eighth Canadian Edition

16.

(a) (b) (c)

Cash Stock Stock

dividend dividend split

(1) Assets Decrease No effect No effect

(2) Liabilities No effect No effect No effect

(3) Share capital No effect Increase No effect

(4) Retained earnings Decrease Decrease No effect

(5) Total shareholders' equity Decrease No effect No effect

(6) Number of shares No effect Increase Increase

LO 3 BT: C Difficulty: M Time: 15 min. AACSB: None CPA: cpa-t001 CM: Reporting

17. (a) In a stock split, the number of shares issued is increased. In the case of

Bella Corporation, the number of shares issued will increase from 10,000 to

30,000 (10,000 × 3).

(b) The effect of a split on market value is generally inversely proportional to

the size of the split. In this case, the market price would fall to

approximately $40 per share ($120 3).

LO 3 BT: AP Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

18. Cash and stock dividends are recorded in the general journal because the

financial position of the company changes. In the case of a cash dividend, the

account dividends declared is increased, which in turn decreases retained

earnings. Cash is also reduced when a cash dividend is paid. In the case of a

stock dividend, the dividends declared account is increased, which in turn

decreases retained earnings. Common Shares are increased in the case of a stock

dividend when the distribution date is reached. In the case of stock splits, there is

no change in the financial position of the company. No accounts are affected.

Only the number of shares held by shareholders will change, typically by a

multiple (for example, 2 for 1).

LO 3 BT: K Difficulty: S Time: 5 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual 11-11 Chapter 11

Copyright © 2020 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Eighth Canadian Edition

19. (a) All six accounts appear individually on the statement of changes in equity,

along with the details of the transactions that increased and decreased the

accounts during the year being reported.

(b) The first three accounts (preferred shares, common shares, and stock

dividends distributable) would be reported under the sub-heading of share

capital in the shareholders’ equity section of the statement of financial

position with balances at the reporting date. The remaining accounts would

be reported separately in the shareholders’ equity section of the statement

of financial position, after the total share capital.

LO 4 BT: K Difficulty: S Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

20. The purpose of a retained earnings restriction is to indicate that a portion of

retained earnings is currently unavailable for dividends. Restrictions may result

from the following causes: legal, contractual, or voluntary. Although not reported

separately on the statement of changes in equity or statement of financial

position, the portion of retained earnings that is restricted is disclosed in a note to

the financial statements.

LO 4 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

21. Comprehensive income is the sum of net income (loss) and other comprehensive

income and appears on the statement of comprehensive income. Other

comprehensive income (or loss) is made up of temporary accounts added to, or

deducted from, the opening balance of accumulated other comprehensive income

by closing entries at the end of the year. These changes to the accumulated other

comprehensive income account are detailed on the statement of changes in

equity. Accumulated other comprehensive income is a permanent equity account

and its ending balance appears in the shareholders’ equity section of the

statement of financial position.

LO 4 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual 11-12 Chapter 11

Copyright © 2020 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Eighth Canadian Edition

22. (a) The statement of retained earnings shows all of the changes to retained

earnings for the accounting period being reported. The statement of

retained earnings must be prepared by private companies following ASPE.

The statement of changes in equity shows the changes in retained earnings,

similar to the statement of retained earnings. However, it also shows the

changes in amounts in share capital, as well as the changes in all of the

remaining equity accounts. This is a required statement for companies

following IFRS.

(b) The statement of retained earnings shows the changes that determine the

ending balance of retained earnings, which is only one of the accounts that

appears in the shareholders’ equity section of the statement of financial

position.

The statement of changes in equity shows the changes that determine each

of the shareholders’ accounts (for example, preferred shares, common

shares, retained earnings, and accumulated other comprehensive income).

Each of these accounts appears in the shareholders’ equity section of the

statement of financial position.

LO 4 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual 11-13 Chapter 11

Copyright © 2020 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Eighth Canadian Edition

23. (a) Private companies that report using ASPE usually have a simpler capital

structure than publicly traded companies who use IFRS. Consequently, the

shareholders’ equity section of the statement of financial position has fewer

accounts with ASPE. For example, private companies are not required to

report accumulated other comprehensive income, which publicly traded

companies are required to report.

(b) Private companies using ASPE would prepare the following financial

statements: statement of financial position, statement of income, statement

of retained earnings, and statement of cash flows. For companies using

ASPE, fewer equity account transactions occur that need to be explained

and consequently there is no requirement to prepare a statement of changes

in equity. Rather, only a statement of retained earnings is required, linking

the statement of income to the retained earnings account shown in the

shareholders’ equity section of the statement of financial position.

Publicly traded companies using IFRS would prepare the following

financial statements: statement of financial position, statement of income

and/or statement of comprehensive income, statement of changes in equity,

and statement of cash flows. Under IFRS, a statement of comprehensive

income is required (in combination with, or along with the statement of

income) when there is other comprehensive income during the year.

LO 4 BT: C Difficulty: M Time: 15 min. AACSB: None CPA: cpa-t001 CM: Reporting

24. (a) Unfavourable

(b) Favourable

(c) Unfavourable

(d) Favourable

LO 5 BT: K Difficulty: S Time: 5 min. AACSB: None CPA: cpa-t001, cpa-t005

CM: Reporting and Finance

Solutions Manual 11-14 Chapter 11

Copyright © 2020 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Eighth Canadian Edition

25. Pepsi had the higher share price. The market price of the share can be determined

by dividing the dividend per share by its dividend yield.

Coca-

Ratio Cola Pepsi

Dividend per share $1.60 $3.82

Dividend yield 3.04% 2.85%

Market price per share $52.63 $134.04

LO 5 BT: AN Difficulty: M Time: 5 min. AACSB: Analytic CPA: cpa-t001, cpa-t005

CM: Reporting and Finance

26. The weighted average number of shares is a more realistic measure of the

number of shares that the corporation had throughout the year and the use of the

assets generated from these shares. The net income generated on the share issue

proceeds during the year, or reduced by the shares repurchased during the year, is

for only part of the year so the number of shares should be weighted by a partial

year factor. Given that companies routinely issue and retire shares, using the

number of shares at a specific point in time (such as year end) may not provide a

true representation of the company’s basic earnings per share.

LO 5 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001, cpa-t005 CM: Reporting and Finance

27.

Companies must use the income available to common shareholders (net

income – preferred dividends) in the calculation of their basic earnings per share

figures because preferred shareholders receive preferential treatment with respect

to the distribution of the company’s dividends. That is, common shareholders

would not receive any dividends before the preferred shareholders receive theirs.

Similarly, the preferred shareholders’ entitlement must be subtracted from both

the numerator (net income – preferred dividends) and denominator (total

shareholders’ equity – preferred shares) in the calculation of return on common

shareholders’ equity.

Consequently, both ratios use income available to common shareholders in their

numerators.

LO 5 BT: C Difficulty: M Time: 10 min. AACSB: None CPA: cpa-t001, cpa-t005

CM: Reporting and Finance

Solutions Manual 11-15 Chapter 11

Copyright © 2020 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Eighth Canadian Edition

28. (a) Company B pays out the higher proportion of its net income in dividends

and these dividends give shareholders the higher dividend yield, when

compared to Company A. Therefore, Company B is the better choice for an

investor interested in a steady dividend income.

(b) If an investor had purchased the shares for growth, Company A would have

been preferred by the investor as Company A is not using up as much cash

to pay dividends and is reinvesting more of its net income back into the

business to grow operations.

LO 5 BT: AN Difficulty: M Time: 10 min. AACSB: None CPA: cpa-t001, cpa-t005

CM: Reporting and Finance

29. Two companies can have the

same return on assets but a different return on common shareholders’ equity for a

number of reasons. Since neither company has issued preferred shares, both

ratios will have the same numerator, so any difference in these two ratio values

will arise from differences in the denominator. The difference between a

company’s assets (the denominator in the return on assets ratio) and a company’s

common shareholders’ equity (the denominator in the return on common

shareholders’ equity ratio) consists of either liabilities or preferred shares but in

this case will consist of only liabilities. Therefore, a company that has a

significant amount of liabilities will tend to have a more significant difference

between its return on assets and its return on common shareholders’ equity.

Company A likely has a higher portion of its assets financed with liabilities than

Company B has.

In taking on more liabilities, Company A can become more profitable and have a

higher return on common shareholders’ equity only if the after-tax rate of interest

paid to creditors is lower than the return on assets that were purchased with funds

borrowed from creditors. The difference between the return on these assets and

the after-tax interest paid on the funds borrowed to buy these assets will go (be

attributed to) to the common shareholders, increasing the return on common

shareholders’ equity.

LO 5 BT: C Difficulty: M Time: 10 min. AACSB: None CPA: cpa-t001, cpa-t005

CM: Reporting and Finance

Solutions Manual 11-16 Chapter 11

Copyright © 2020 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Eighth Canadian Edition

SOLUTIONS TO BRIEF EXERCISES

BRIEF EXERCISE 11.1

a. At Lightspeed POS Inc’s initial public offering, the shares issued were purchased

from the corporation. The $16.00 per share received goes directly to Lightspeed

and increases assets (cash) and shareholders’ equity (share capital).

b. At the November 15, 2019 date, the market price of $31.04 per share is a result

of the buying and selling of shares occurring in the secondary market. The

proceeds from the sale of shares go to the seller and not to Lightspeed.

Therefore, there is no impact on Lightspeed POS Inc’s financial position as a

result of the trading occurring on the stock market subsequent to the IPO.

LO 1 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual 11-17 Chapter 11

Copyright © 2020 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Eighth Canadian Edition

BRIEF EXERCISE 11.2

a.

May 2 Cash...................................................................... 30,000

Common Shares (2,000 × $15)................... 30,000

June 15 Cash ..........................................................17,000

Common Shares (1,000 × $17)................... 17,000

Nov. 1 Cash ............................................................6,000

Preferred Shares (200 × $30)...................... 6,000

Dec. 15 Cash ............................................................7,000

Preferred Shares (200 × $35)...................... 7,000

b.

Number Number

of shares of shares

authorized issued

(1) Preferred shares 200,000 400 (200+200)

(2) Common shares Unlimited 3,000 (2,000 + 1,000)

LO 2 BT: AP Difficulty: M Time: 10 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual 11-18 Chapter 11

Copyright © 2020 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Eighth Canadian Edition

BRIEF EXERCISE 11.3

a. Average cost of common shares on:

Balance

Common Number of Average

Date Shares Shares Cost

June 8 $300,000 ÷ 30,000 = $10.00

Aug. 19 $90,000 7,500

Bal. $390,000 ÷ 37,500 = $10.40

Nov. 2 $(31,200) (1) (3,000)

Bal. $358,800 ÷ 34,500 = $10.40

Dec. 7 $(41,600) (2) (4,000)

Bal. $317,200 ÷ 30,500 = $10.40

(1) 3,000 shares x average cost $10.40 = $31,200

(2) 4,000 shares x average cost $10.40 = $41,600

b.

June 8 Cash ........................................................................... 300,000

Common Shares.................................................

300,000

Aug. 19 Cash ........................................................................... 90,000

Common Shares.................................................

90,000

Nov. 2 Common Shares (1) above............................................

Contributed Surplus ($31,200 - $ 28,800).........

2,400

Cash...................................................................

28,800

Dec. 7 Common Shares (2) above............................................ 41,600

Contributed Surplus (balance)....................................... 2,400

Retained Earnings......................................................... 8,000

Cash...................................................................

52,000

LO 2 BT: AP Difficulty: C Time: 15 min. AACSB: Analytic CPA: cpa-t001, cpa-t005

CM: Reporting and Finance

Solutions Manual 11-19 Chapter 11

Copyright © 2020 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Eighth Canadian Edition

BRIEF EXERCISE 11.4

a.

Mar. 8 Cash........................................................................... 150,000

Preferred Shares (5,000 × $30)........................ 150,000

April 20.....................................................................Land 110,000

Preferred Shares (3,000 shares)....................... 110,000

b. If the fair value of the land could not be determined, the fair value of the

consideration given up ($35 per share multiplied by 3,000 shares or $105,000)

would be used. The journal entry would be as follows:

April 20.....................................................................Land 105,000

Preferred Shares (3,000 × $35)........................ 105,000

c. If Daschen Inc. was a private company using ASPE, the value of the shares

would not be as easily obtained since they do not trade on a stock exchange.

Consequently, the amount recorded on the exchange of preferred shares for land

will more likely be determined by the value of the consideration received, which

is the fair value of the land. In this case, the entry would not change since the fair

value of the land is the more clearly determinable value in the exchange.

LO 2 BT: AP Difficulty: M Time: 15 min. AACSB: Analytic CPA: cpa-t001, cpa-t005

CM: Reporting and Finance

Solutions Manual 11-20 Chapter 11

Copyright © 2020 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Eighth Canadian Edition

BRIEF EXERCISE 11.5

a. Dividends in arrears can only arise from cumulative preferred shares. If a

dividend is not declared for a noncumulative preferred share, the dividend

entitlement does not carry forward into the future.

b. Dividends in arrears at the end of the current year would be = 20,000 × $2 =

$40,000

c. Dividends in arrears are not accrued as liabilities. The amount of the dividends in

arrears is disclosed in the notes to the financial statements.

.

LO 2 BT: AN Difficulty: M Time: 10 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

BRIEF EXERCISE 11.6

May 15 Dividends Declared (110,000 × $1.50 ÷ 4).............. 41,250

Dividends Payable........................................... 41,250

June 10 No entry required

30 Dividends Payable.................................................... 41,250

Cash................................................................. 41,250

LO 3 BT: AP Difficulty: M Time: 5 min. AACSB: Analytic CPA: cpa-t001, cpa-t005

CM: Reporting and Finance

Solutions Manual 11-21 Chapter 11

Copyright © 2020 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Eighth Canadian Edition

BRIEF EXERCISE 11.7

Dec. 1 Dividends Declared (100,000 × 5% × $15)...... 75,000

Stock Dividends Distributable.................... 75,000

20 No entry required

Jan. 10 Stock Dividends Distributable............................. 75,000

Common Shares.......................................... 75,000

(Stock Dividends = Number of shares issued × Market price per share when declared)

LO 3 BT: AP Difficulty: M Time: 10 min. AACSB: Analytic CPA: cpa-t001, cpa-t005

CM: Reporting and Finance

Solutions Manual 11-22 Chapter 11

Copyright © 2020 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Eighth Canadian Edition

BRIEF EXERCISE 11.8

a. Before the stock split: 100 shares

After the stock split: 100 × 3 = 300 shares

b. Likely stock price after the stock split: $153.49 ÷ 3 = $51.16

c. There would be no journal entry recorded for the stock split. Details of the stock

split would be discussed in the notes to the financial statements.

LO 3 BT: AN Difficulty: M Time: 10 min. AACSB: Analytic CPA: cpa-t001, cpa-t005

CM: Reporting and Finance

BRIEF EXERCISE 11.9

Shareholders’ Number of

Transaction Assets Liabilities Equity Shares

(a) NE + - NE

(b) - - NE NE

(c) NE NE NE NE

(d) NE NE NE +

(e) NE NE NE +

LO 3 BT: AN Difficulty: C Time: 15 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual 11-23 Chapter 11

Copyright © 2020 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Eighth Canadian Edition

BRIEF EXERCISE 11.10

[1] $2,050,000 – $1,500,000 – $110,000 = $440,000

[2] $440,000 same as [1]

[3] $3,505,000 – $3,000,000 + $135,000 – $750,000 = $(110,000) or same as the

amount of increase in Common Shares

[4] $0

[5] $750,000 (same amount as increase in Retained Earnings)

[6] $125,000 – $100,000 = $25,000

[7] $500,000 (no change from beginning balance)

[8] $5,100,000 + $440,000 [2] – $135,000 + $750,000 [5] + $25,000 = $6,180,000

or taken from ending balances $2,050,000 + $500,000 [7] + $3,505,000 +

$125,000 = $6,180,000

LO 4 BT: AN Difficulty: M Time: 20 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

BRIEF EXERCISE 11.11

LUXAT CORPORATION

Statement of Financial Position (Partial)

December 31, 2021

Shareholders' equity

Share capital

Common shares, unlimited number of shares

authorized, 550,000 issued........................................................ $2,050,000

Contributed surplus.......................................................................... 500,000

Total share capital..................................................................... 2,550,000

Retained earnings................................................................................... 3,505,000

Accumulated other comprehensive income........................................... 125,000

Total shareholders' equity.............................................................................. $6,180,000

LO 4 BT: AP Difficulty: M Time: 10 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual 11-24 Chapter 11

Copyright © 2020 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Eighth Canadian Edition

BRIEF EXERCISE 11.12

a. STIRLING FARMS LIMITED

Statement of Retained Earnings

Year Ended December 31, 2021

Retained earnings, January 1................................................................ $510,000

Add: Net income................................................................................. 323,000

833,000

Less: Dividends declared..................................................................... 115,000

Retained earnings, December 31.......................................................... $718,000

(Ending retained earnings = Beginning retained earnings + Net income – Dividends declared)

b. If Stirling were a publicly traded corporation, a statement of changes in equity

would be required instead of a statement of retained earnings. It would report the

changes in each of the shareholders’ equity accounts, not just retained earnings.

LO 4 BT: AP Difficulty: M Time: 10 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual 11-25 Chapter 11

Copyright © 2020 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Eighth Canadian Edition

BRIEF EXERCISE 11.13

a. Payout ratio last $60,000

= 10%

year $600,000

(Payout ratio = Cash dividends declared ÷ Net income)

b. Dividends paid this year = $2,000,000 × 10% = $200,000 (assuming the same

payout ratio).

c. (Not required) Dividends paid next year = $700,000 × 10% = $70,000 (assuming

the same payout ratio).

Maintaining a constant dividend payout ratio may or may not be a sound

business practice. Many factors, including the corporation’s cash flow and the

type of investor involved would have to be taken into consideration. Because

dividend amounts are relatively fixed (or with small increases), the payout ratio

tends to fluctuate with profits. Maintaining a constant dividend payout ratio

when net income fluctuates will result in variable dividend amounts being paid to

shareholders, which may not be wise from a cash flow or growth perspective. It

is also difficult to determine in advance exactly what the net income for the year

will be. Trying to keep exactly the same payout ratio is therefore not always

possible.

LO 5 BT: AN Difficulty: C Time: 15 min. AACSB: Analytic CPA: cpa-t001, cpa-t005

CM: Reporting and Finance

Solutions Manual 11-26 Chapter 11

Copyright © 2020 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Eighth Canadian Edition

BRIEF EXERCISE 11.14

a. Canadian National Railway Canadian Pacific Railway

Dividend yield $2.15 $3.32

$123.94 $319.91

= 1.7% = 1.0%

(Dividend yield = Dividends declared per share ÷ Market price per share)

b. Investors would prefer Canadian National Railway because of its higher dividend

yield if they wished to purchase shares for the purpose of earning dividend

income.

LO 5 BT: AN Difficulty: M Time: 15 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

BRIEF EXERCISE 11.15

Weighted average number of shares:

January 1 34,000 × 12/12 = 34,000

May 1 (3,000) x 8/12 = (2,000)

August 31 9,000 × 4/12 = 3,000

November 30 6,000 × 1/12 = 500

46,000 35,500

a. The number of common shares issued at December 31, 2021 is 46,000.

b. The weighted average number of common shares for 2021 is 35,500.

LO 5 BT: AP Difficulty: M Time: 15 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual 11-27 Chapter 11

Copyright © 2020 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Eighth Canadian Edition

BRIEF EXERCISE 11.16

Basic earnings $370,000 – $20,000*

= $9.86

per share 35,500

*10,000 × $2 = $20,000

(Basic earnings per share = (Net income – preferred dividends) ÷ Weighted average number of

common shares)

LO 5 BT: AP Difficulty: M Time: 10 min. AACSB: Analytic CPA: cpa-t001, cpa-t005

CM: Reporting and Finance

BRIEF EXERCISE 11.17

a.

Basic earnings $800,000 – $100,000*

= $2.33

per share 300,000

*50,000 × $2 = $100,000

(Basic earnings per share = (Net income – preferred dividends) ÷ Weighted average

number of common shares)

b.

Basic earnings $800,000

per share = $2.67

300,000

c. Same amount as in a. $2.33

LO 5 BT: AP Difficulty: M Time: 10 min. AACSB: Analytic CPA: cpa-t001, cpa-t005

CM: Reporting and Finance

Solutions Manual 11-28 Chapter 11

Copyright © 2020 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Eighth Canadian Edition

BRIEF EXERCISE 11.18

a. Return on common shareholders’ equity:

$14,000

12.4%

($104,000 $122,000) 2

(Return on common shareholders’ equity = (Net income – preferred dividends) ÷ Average

common shareholders’ equity)

b. Had Salliq issued preferred shares and paid dividends to the preferred

shareholders, the amount of income available to common shareholders would be

reduced by the amount of the preferred dividend, reducing the return on common

shareholders’ equity ratio.

LO 5 BT: AP Difficulty: M Time: 10 min. AACSB: Analytic CPA: cpa-t001, cpa-t005

CM: Reporting and Finance

Solutions Manual 11-29 Chapter 11

Copyright © 2020 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Eighth Canadian Edition

SOLUTIONS TO EXERCISES

EXERCISE 11.1

a. High $59.03

Low $42.29

Increase $16.74 x 100 shares = $1,674.00 income

b. $0.80 per share. 1,000 shares x $0.80 = $800.00

c. 1,000 × $55.90 = $55,900

d. $55.90 - $0.44 = $55.46

e. 410,544 shares

LO 1 BT: AN Difficulty: M Time: 15 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual 11-30 Chapter 11

Copyright © 2020 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Eighth Canadian Edition

EXERCISE 11.2

a. June 12 Cash (50,000 × $6)............................................. 300,000

Common Shares........................................

300,000

July 11 Cash (1,000 × $25)............................................. 25,000

Preferred Shares........................................

25,000

Oct. 1 Land ................................................................... 75,000

Common Shares (10,000 shares)..............

75,000

Nov. 15 Cash (25,000 × $28)........................................... 700,000

Preferred Shares........................................ 700,000

b. Preferred: 2,500 + 1,000 + 25,000 = 28,500 shares

$55,000 + $25,000 + $700,000 = $780,000

Common: 140,000 + 50,000 + 10,000 = 200,000 shares

$700,000 + $300,000 + $75,000 = $1,075,000

LO 2 BT: AP Difficulty: M Time: 20 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual 11-31 Chapter 11

Copyright © 2020 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Eighth Canadian Edition

EXERCISE 11.3

a. Jan. 6 Cash ....................................................................... 300,000

Common Shares (200,000 × $1.50).............. 300,000

12 Cash ....................................................................... 87,500

Common Shares (50,000 × $1.75)................ 87,500

17 Cash ....................................................................... 250,000

Preferred Shares (10,000 × $25)................... 250,000

18 Cash ....................................................................... 1,000,000

Common Shares (500,000 × $2.00).............. 1,000,000

24 Common Shares (200,000 × $1.85) ...................... 370,000*

Retained Earnings ($380,000 - $370,000)............. 10,000

Cash (200,000 × $1.90)................................ 380,000

31 Professional Fees Expense..................................... 15,000

Common Shares (10,000 shares).................. 15,000

*Refer to part (b) $1,387,500 ÷ 750,000 = $1.85; $1.85 x 200,000 = $370,000

Solutions Manual 11-32 Chapter 11

Copyright © 2020 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Eighth Canadian Edition

EXERCISE 11.3 (CONTINUED)

b. For preferred shares, there was only the one transaction on January 17 and so the

number of shares is 10,000 and the average cost is $25.00 at January 31.

For common shares:

Number of

shares Issue Share Average

Date issued price Capital cost

January 6 200,000 $1.50 $300,000

January 12 50,000 $1.75 87,500

January 18 500,000 $2.00 1,000,000

Sub. Total 750,000 1,387,500 $1.85

January 24 (200,000) $1.85 (370,000)

January 31 10,000 15,000

Balance 560,000 $1,032,500 $1.844

c. If Moosonee were a publicly traded company, the per-share value of the shares

issued in exchange for the legal services would be easily obtained as they are

traded every business day. When shares are issued for a consideration other than

cash, such as goods or services, IFRS requires that the transaction be recorded at

the fair value of the consideration received. If the fair value of the

consideration received cannot be reliably determined, then the fair value of the

consideration given up (shares in this case) can be used. In this case, the value of

the services was given so the journal entry would not be any different under

IFRS.

LO 2 BT: AN Difficulty: C Time: 40 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual 11-33 Chapter 11

Copyright © 2020 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Eighth Canadian Edition

EXERCISE 11.4

a. Total annual preferred dividend should be 900,000 × $1.10 per share or

$990,000.

b. Dividends in arrears can only arise from cumulative preferred shares. If a

dividend is not declared for a noncumulative preferred share, the dividend

entitlement does not carry forward into the future. If the shares are cumulative,

dividends in arrears at the end of Year 1 are $340,000 ($990,000 annual dividend

less dividends declared of $650,000).

By the end of Year 2, the dividends paid of $550,000 are first allocated to the

$340,000 dividends in arrears from Year 1 and the remaining $210,000 is for

Year 2. Consequently, by the end of Year 2, dividends in arrears at that time are

$780,000. ($990,000 - $210,000)

c. Dividends in arrears are not accrued as a liability. Rather, the amount of any

dividends in arrears is disclosed in the notes to the financial statements.

d. March is required to pay annual dividends of $990,000 to its preferred

shareholders first before paying dividends to the common shareholders.

preferred shares were cumulative, dividend arrears of $780,000 and the annual

dividend of $990,000 for a total of $1,770,000 would have to be paid to the

preferred shareholders before any dividend could be paid to the common

shareholders.

LO 2 BT: AN Difficulty: C Time: 20 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual 11-34 Chapter 11

Copyright © 2020 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Eighth Canadian Edition

EXERCISE 11.5

a. Apr. 2 Cash ..........................................................100,000

Common Shares (5,000 × $20)..................... 100,000

June 15 Dividends Declared (85,000 × $0.25).................... 21,250

Dividends Payable ........................................ 21,250

July 10 Dividends Payable.................................................. 21,250

Cash............................................................... 21,250

Aug. 21 Dividends Declared................................................ 93,500

Stock Dividends Distributable...................... 93,500

(80,000 + 5,000 = 85,000 × 5% = 4,250 × $22)

(Stock Dividends = Number of shares issued × Market price per share on declaration date)

Sept. 20 Stock Dividends Distributable............................... 93,500

Common Shares........................................... 93,500

Nov. 1 Cash ............................................................75,000

Common Shares (3,000 × $25)..................... 75,000

Dec. 20 Dividends Declared................................................ 27,675

Dividends Payable......................................... 27,675

((80,000 + 5,000 + 4,250 + 3,000) x $0.30 = 92,250 × $0.30)

b. Number of common shares at the end of the year:

80,000 + 5,000 + 4,250 + 3,000 = 92,250

LO 2,3 BT: AP Difficulty: M Time: 20 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual 11-35 Chapter 11

Copyright © 2020 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Eighth Canadian Edition

EXERCISE 11.6

(1) (2) (3)

Before After Cash After Stock After Stock

Action Dividend Dividend Split

Total assets $1,250,000 $1,200,000 $1,250,000 $1,250,000

Total liabilities $ 250,000 $ 250,000 $ 250,000 $ 250,000

Common shares 600,000 600,000 670,000* 600,000

Retained earnings 400,000 350,000 330,000 400,000

Total shareholders' equity 1,000,000 950,000 1,000,000 1,000,000

Total liabilities and

shareholders’ equity $1,250,000 $1,200,000 $1,250,000 $1,250,000

Number of common shares 100,000 100,000 105,000 200,000

* $600,000 + (100,000 shares × 5% × $14) = $670,000

(Share capital is increased by the total amount of the stock dividend)

LO 3 BT: AP Difficulty: M Time: 20 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual 11-36 Chapter 11

Copyright © 2020 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Eighth Canadian Edition

EXERCISE 11.7

Shareholders’ Equity

Accumulated

Other Total

Share Retained Comprehensive Shareholders’

Assets Liabilities Capital Earnings Income Equity

1. + NE + NE NE +

2. NE + NE - NE -

3. - - NE NE NE NE

4. + NE + NE NE +

5. + NE + NE NE +

6. NE NE NE NE NE NE

7. NE NE + - NE +/-

8. NE NE +/- NE NE +/-

9. NE NE NE NE NE NE

10. + NE NE NE + +

LO 2,3,4 BT: AN Difficulty: M Time: 20 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual 11-37 Chapter 11

Copyright © 2020 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Eighth Canadian Edition

EXERCISE 11.8

Statement of Changes in Equity

Other

Share Retained Financial

Account Capital Earnings AOCI Statement Classification

1. Cash NE NE NE Statement of Current assets

financial

position

2. Common shares Common NE NE NE NE

shares

3. Other NE NE OCI: NE NE

comprehensive Revaluation

income– gain

Revaluation gain

from revaluing

property, plant,

and equipment

to fair value

4. Long-term NE NE NE Statement of Non-current

investments financial assets

position

5. Preferred shares Preferred NE NE NE NE

shares

6. Retained NE Retained NE NE NE

earnings earnings

7. Gain on disposal NE NE NE Statement of Operating

Income expenses

(reduction of)

8. Dividends NE Retained NE NE NE

declared earnings

9. Stock split NE NE NE NE NE

10. Stock dividends Common NE NE NE NE

distributable shares*

Solutions Manual 11-38 Chapter 11

Copyright © 2020 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Eighth Canadian Edition

EXERCISE 11.8 (CONTINUED)

Legend:

AOCI : Accumulated Other Comprehensive Income

OCI: Other Comprehensive Income

* Note to instructors: Preferred shares is also an acceptable answer here although

common shares are more often issued as stock dividends.

LO 4 BT: C Difficulty: M Time: 20 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual 11-39 Chapter 11

Copyright © 2020 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Eighth Canadian Edition

EXERCISE 11.9

OZABAL INC.

Statement of Financial Position (Partial)

December 31, 2021

Shareholders’ equity

Share capital

$1.40 Preferred shares, noncumulative, 100,000

authorized, 10,000 shares issued....................................... $250,000

Common shares, unlimited number of shares

authorized, 300,000 shares issued..................................... 750,000

Stock dividends distributable............................................ 90,000 $1,090,000

Contributed surplus ................................................................ 61,000

Total share capital .................................................................. 1,151,000

Retained earnings (Note R)............................................................ 1,340,000

Accumulated other comprehensive income................................... 48,500

Total shareholders’ equity....................................................................... $2,539,500

Note R: Retained earnings restricted for plant expansion, $450,000.

LO 4 BT: AP Difficulty: M Time: 20 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual 11-40 Chapter 11

Copyright © 2020 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Eighth Canadian Edition

EXERCISE 11.10

a.

THE TAKAYA CANOE LIMITED

Statement of Changes in Equity

Year Ended December 31, 2021

Accumu-

lated Other

Compre-

Common Contributed Retained hensive

Shares surplus Earnings Income Total

Balance Jan. 1 $800,000 $540,000 $1,500,000 $90,000 $2,930,000

Issued common shares 180,000 180,000

Common shares

reacquired (200,000) (40,000) (240,000)

Net income 400,000 400,000

Dividends declared (70,000) (70,000)

Other comprehensive (2

income 5,000) (25,000)

Balance Dec. 31 $780,000 $500,000 $1,830,000 $65,000 $3,175,000

b.

THE TAKAYA CANOE LIMITED

Statement of Financial Position (Partial)

December 31, 2021

Shareholders’ equity

Share capital

Common shares......................................................................... $780,000

Contributed surplus .................................................... 500,000

Total share capital .................................................................. $1,280,000

Retained earnings........................................................................... 1,830,000

Accumulated other comprehensive income................................... 65,000

Total shareholders’ equity....................................................................... $3,175,000

LO 4 BT: AP Difficulty: M Time: 20 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual 11-41 Chapter 11

Copyright © 2020 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Eighth Canadian Edition

EXERCISE 11.11

a.

Nike (in millions of Adidas (in millions of

US $) US $)

(1) Payout ratio $1,360 ÷ $4,029 = 33.8% $666 ÷ $1,706 = 39.0%

(2) Dividend yield $0.98 ÷ $93.04 = 1.1% $1.882 ÷ $147.96 = 1.3%

(Payout ratio = Cash dividends declared ÷ Net income)

(Dividend yield = Dividends declared per share ÷ Market price per share)

b. Investors would likely prefer Adidas for dividend income purposes because of its

higher dividend yield, but if the difference between these two yields is not

important to an investor, they may prefer Nike because its lower payout ratio

indicates that it retains a larger portion of its income to foster future growth.

LO 5 BT: AN Difficulty: M Time: 10 min. AACSB: Analytic CPA: cpa-t001, cpa-t005

CM: Reporting and Finance

Solutions Manual 11-42 Chapter 11

Copyright © 2020 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Eighth Canadian Edition

EXERCISE 11.12

a. Income available to common shareholders

= Net income – Preferred share dividends

= $963,750 – (60,000 × $1 × ¼)

= $948,750

b. Weighted average number of common shares

Dec. 1 180,000 × 12/12 = 180,000

Feb. 28 45,000 × 9/12 = 33,750

Nov. 1 18,000 × 1/12 = 1,500

215,250

c. Basic earnings per share

= Income available to common shareholders ÷ Weighted average number of

common shares

= $948,750 ÷ 215,250

= $4.41

LO 5 BT: AP Difficulty: M Time: 20 min. AACSB: Analytic CPA: cpa-t001, cpa-t005

CM: Reporting and Finance

Solutions Manual 11-43 Chapter 11

Copyright © 2020 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Eighth Canadian Edition

EXERCISE 11.13

a.

($ in millions) 2018 2017

$2,356 + $89 $2,121 + $52 =

= 46.4% 46.2%

(1) Payout ratio $5,267 $4,699

$5,32 $5.08

(2) Dividend yield = 4.7% = 4.5%

$113.68 $113.56

Basic earnings $5,267 - $89 $4,699 - $52

(3) = $11.69 = $11.25

per share 443 413

Return on

common

(4) $5,267 - $89 = 16.6% $4,699 - $52 = 17.8%

shareholders'

equity ($32,866 + $29,440) ÷ 2 ($29,440 + $22,673) ÷ 2

(1) (Payout ratio = Cash dividends declared ÷ Net income)

(2) (Dividend yield = Dividends declared per share ÷ Market price per share)

(3) (Basic earnings per share = (Net income – preferred dividends) ÷ Weighted average number

of common shares)

(4) (Return on common shareholders’ equity = (Net income – preferred dividends ÷ Average

common shareholders’ equity)

Solutions Manual 11-44 Chapter 11

Copyright © 2020 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Eighth Canadian Edition

EXERCISE 11.13 (CONTINUED)

b. The dividends paid by CIBC in 2018 increased in absolute amount. However,

when dividends are expressed as a percentage of the net income, the result—the

payout ratio—increased slightly from 46.2% to 46.4%.

The dividend yield increased from 4.5% in 2017 to 4.7% in 2018. The yield

increased because dividends grew by a larger percentage than did the market

price of a share. [($5.32 - $5.08) / $5.08 = 4.7% increase in dividends; ($113.68 -

$113.56) / $113.56 = 0.1% increase in share price]

CIBC’s net income improved in 2018 both in total amount and on a per-share

basis. On the other hand, its return on common shareholders’ equity decreased

from 17.8% to 16.6%. In spite of the improved profitability, the bank’s

shareholders were not willing to pay a much higher market price for the common

shares in 2018 ($113.68) compared to 2017 ($113.56).

LO 5 BT: AN Difficulty: M Time: 30 min. AACSB: Analytic CPA: cpa-t001, cpa-t005

CM: Reporting and Finance

Solutions Manual 11-45 Chapter 11

Copyright © 2020 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Eighth Canadian Edition

EXERCISE 11.14

As an investor interested in an income-oriented investment, the dividend ratios will carry

a great deal of weight when choosing between Stanley and Snap-On. The dividend

payout of Stanley is much stronger than that of Snap-On. On the other hand, Snap-On

has a slight edge over Stanley and is a better choice based on the dividend yield ratio.

The choice between the two companies should not be based on the basic earnings per

share, which are not comparable between companies. The earnings per share can only be

interpreted in conjunction with the market price of the share (for example, the price-

earnings ratio) or the dividends paid per share (for example, the dividend payout ratio).

The return on common shareholders’ equity ratio, while a profitability ratio of interest,

would not be a primary ratio relied upon to assess whether to purchase a company’s

shares for income (dividend) purposes.

For investors seeking future price appreciation in the shares of these companies, Snap-

On has a better chance for future price appreciation. It is retaining a higher percentage of

its income, and its return on common shareholders’ equity is higher.

LO 5 BT: AN Difficulty: M Time: 15 min. AACSB: Analytic CPA: cpa-t001, cpa-t005

CM: Reporting and Finance

Solutions Manual 11-46 Chapter 11

Copyright © 2020 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Eighth Canadian Edition

EXERCISE 11.15

a.

No-Debt Option Debt Option

Income from operations $80,000 $80,000

Interest expense (4%) 0 10,000 [7]

Income before income tax $80,000 [1] $70,000 [8]

Income tax expense (30%) 24,000 [2] 21,000 [9]

Net income $56,000 [3] $49,000 [10]

Average total assets $500,000 $500,000

Average common shareholders’ equity $500,000 $250,000

Number of common shares 50,000 25,000

Basic earnings per share $1.12 [4] $1.96 [11]

Dividends declared $56,000 [3] $49,000 [10]

Payout ratio 100% [5] 100% [12]

Return on common shareholders’ equity 11.2% [6] 19.6% [13]

[1] $80,000 - $0 = $80,000 [7] $250,000 x 4% = $10,000

[2] $80,000 x 30% = $24,000 [8] $80,000 - $10,000 = $70,000

[3] $80,000 - $24,000 = $56,000 [9] $70,000 x 30% = $21,000

[4] $56,000 ÷ 50,000 = $1.12 [10] $70,000 - $21,000 = $49,000

[5] Given as 100% of Net Income [3] above [11] $49,000 ÷ 25,000 = $1.96

[6] $56,000 ÷ $500,000 = 11.2% [12] Given as 100% of Net Income [10] above

[13] $49,000 ÷ $250,000 = 19.6%

Solutions Manual 11-47 Chapter 11

Copyright © 2020 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Eighth Canadian Edition

EXERCISE 11.15 (CONTINUED)

b. One main factor affecting the ratio results is the interest expense for the debt

option and the resulting tax savings from the deductible interest expense. The

other main factor affecting the ratios is the number of shares issued to obtain the

financing needed. In this scenario, a higher rate of return was earned on the

assets compared to the after-tax rate of borrowing the $250,000. Other scenarios,

with different proportions of debt and equity financing, different interest rates,

and different tax rates will provide different results. The only ratio that remains

unchanged is the payout ratio which is based on the assumptions given.

LO 5 BT: AN Difficulty: C Time: 25 min. AACSB: Analytic CPA: cpa-t001, cpa-t005

CM: Reporting and Finance

Solutions Manual 11-48 Chapter 11

Copyright © 2020 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Eighth Canadian Edition

SOLUTIONS TO PROBLEMS

PROBLEM 11.1A

Shareholders’ Equity

Accumulated

Share Capital Other

Preferred Common Contributed Retained Comprehensive

Assets Liabilities Shares Shares Surplus Earnings Income

1. +$130,000 NE NE +$130,000 NE NE NE

2. -240,0001 NE NE -162,0002 -$50,000 $28,0003 NE

3. +72,5004 NE NE +72,500 NE NE NE

4. +100,000 NE +$100,000 NE NE NE NE

5. -121,5005 NE NE NE NE -121,500 NE

1

20,000 × $12 = $240,000

2

($4,000,000 + $130,000) ÷ (500,000 + 10,000) = $8.10; $8.10 x 20,000 =

$162,000

3

$240,000 - $162,000 - $50,000 = $28,000

4

5,000 × $14.50 = $72,500

5

(50,000 + 4,000) × $2.25 = $121,500

LO 2,3,4 BT: AN Difficulty: C Time: 25 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual 11-49 Chapter 11

Copyright © 2020 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Eighth Canadian Edition

PROBLEM 11.2A

a. Transaction entries:

Jan. 10 Cash (1,000,000 × $2)................................................... 2,000,000

Common Shares.................................................. 2,000,000

Mar. 1 Cash (20,000 × $50)...................................................... 1,000,000

Preferred Shares.................................................. 1,000,000

May 1 Cash (250,000 × $3)...................................................... 750,000

Common Shares.................................................. 750,000

June 1 Common Shares (10,000 x $2.20 below)..................... 22,000

Cash (10,000 x $2.00)......................................... 20,000