Professional Documents

Culture Documents

Fig 31 PDF

Fig 31 PDF

Uploaded by

Edrian SantosOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fig 31 PDF

Fig 31 PDF

Uploaded by

Edrian SantosCopyright:

Available Formats

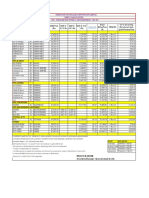

Figure 3.

1

Quasi-Correlations by Region1,2

Median Quasi-Correlations by Region1

(Excluding crisis periods)

Intra-Asia China supply-chain economies Full sample Intra-ASEAN-5 (RHS) 1990s 2000s

4.0 9 0.8

3.5 8 0.7

3.0 7 0.6

6 0.5

2.5

5 0.4

2.0

4

0.3

1.5

3

0.2

1.0

2

0.1

0.5 1

0.0

0.0 0

-0.1

-0.5 -1 Intra-Asia ASEAN-5 China supply- Intra-euro Intra-emerging Intra-Latin Full sample

chain area 11 Europe America

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

Bilateral Pearson Growth Correlations by Region1,2 Average Bilateral Pearson Growth Correlations

(Excluding crisis periods) (Excluding crisis periods)

1990s 2000s 1990-99 2000-12

0.70

0.8

0.7 0.50

0.6

0.5 0.30

0.4 0.10

0.3

0.2 -0.10

0.1

-0.30

0.0

ASEAN-5

ASEAN-5

ASEAN-5

ASEAN-5

Full sample

Full sample

Full sample

Full sample

Rest of Asia

Rest of Asia

Rest of Asia

Rest of Asia

-0.1

-0.2

Intra-Asia ASEAN-5 China supply- Intra-euro Intra-emerging Intra-Latin Full sample

chain area 11 Europe America China Japan United States Euro Area

Sources: IMF, World Economic Outlook database; and IMF staff calculations.

1

China supply-chain economies include China, Korea, Malaysia, the Philippines, Taiwan Province of China, and Thailand. They are identified based on the intensity of their trade linkages (in

value-added terms). Unlike the usual (Pearson) correlation coefficient, which has to be computed over a time interval, the quasi-correlation can be calculated at any point in time. For a given

pair of countries i and j, it is equal to the product of deviations of growth rates in i and j from their sample averages, divided by the product of standard deviations of growth rates in i and j

over the sample. For details, see Duval and others, 2014. Crisis periods are years 1998 and 2009.

2

Euro area includes the 11 countries that adopted the euro in 1999.

You might also like

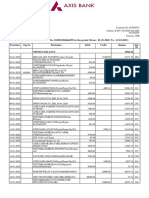

- Acct Statement - XX0310 - 30012023Document13 pagesAcct Statement - XX0310 - 30012023IRSHAD SHAN KNo ratings yet

- Free Trade AgreementDocument26 pagesFree Trade AgreementRohitnanda Sharma ThongratabamNo ratings yet

- UofT BetaDistributionDocument1 pageUofT BetaDistributionlainNo ratings yet

- FDI & Economics Growth of PakistanDocument15 pagesFDI & Economics Growth of PakistanMuhammad Usman AkramNo ratings yet

- Ci Latam q4 2018 ReportDocument8 pagesCi Latam q4 2018 ReportHarold Zuñiga NatividadNo ratings yet

- Sheet No.15 Autocad ExercisesDocument1 pageSheet No.15 Autocad ExercisesHaitham YoussefNo ratings yet

- Brosur Takagi CP-40Document4 pagesBrosur Takagi CP-40reagan setiawanNo ratings yet

- LNG Spot Prices and Long-Term Contracts: Peter R HartleyDocument41 pagesLNG Spot Prices and Long-Term Contracts: Peter R HartleyAhmad NawwarNo ratings yet

- Reflection FactorDocument3 pagesReflection FactorMUHAMMAD SADIQ SYAMIR BIN HASNAN MoeNo ratings yet

- Plano Juntas FinalDocument1 pagePlano Juntas FinalJhon GomezNo ratings yet

- Reinforcement Detail: Section A-ADocument1 pageReinforcement Detail: Section A-AAnup KhoslaNo ratings yet

- Week 10 L1Document9 pagesWeek 10 L1Venkat ReddiNo ratings yet

- Carta Smith GraficoDocument1 pageCarta Smith GraficoEmma mendoza quispeNo ratings yet

- Ejemplo 8.15 Seader: Edward Alejandro TorresDocument5 pagesEjemplo 8.15 Seader: Edward Alejandro TorresPaulina Velandia LopezNo ratings yet

- Sub:-Working Drawing: Title:-Column Layout PlanDocument1 pageSub:-Working Drawing: Title:-Column Layout PlanFasi Rahman AbrarNo ratings yet

- Sub:-Working Drawing: Title:-Column Layout PlanDocument1 pageSub:-Working Drawing: Title:-Column Layout PlanFasi Rahman AbrarNo ratings yet

- Sub:-Working Drawing: Title:-Column Layout PlanDocument1 pageSub:-Working Drawing: Title:-Column Layout Planfasi rahmanNo ratings yet

- Sub:-Working Drawing: Title:-Column Layout PlanDocument1 pageSub:-Working Drawing: Title:-Column Layout Planfasi rahmanNo ratings yet

- East ElevationDocument1 pageEast ElevationFejer TiborNo ratings yet

- Resort Site B&WDocument1 pageResort Site B&WAkshay NandhuNo ratings yet

- Smitch ChartDocument3 pagesSmitch ChartBharat ChNo ratings yet

- The Complete Smith Chart: Black Magic DesignDocument1 pageThe Complete Smith Chart: Black Magic DesignNguyễn Tần TiếnNo ratings yet

- IlmuDocument1 pageIlmuMUHAMMAD RIFKI IKHWALNo ratings yet

- FLOOR PLAN A PDFDocument1 pageFLOOR PLAN A PDFYohannes HabeshawiNo ratings yet

- AN010 - CT's Specification Guidelines For Pro-N, Xmore & Smart - 11 - 2022 PDFDocument12 pagesAN010 - CT's Specification Guidelines For Pro-N, Xmore & Smart - 11 - 2022 PDFPrje AccNo ratings yet

- The Complete Smith Chart: Black Magic DesignDocument1 pageThe Complete Smith Chart: Black Magic DesignHagoro kaguNo ratings yet

- Reinforcement Detail: Section AaDocument1 pageReinforcement Detail: Section AaAnup KhoslaNo ratings yet

- Smith ChartDocument2 pagesSmith ChartsureshsullanNo ratings yet

- Diagramme Généralisé de Compressibilité PDFDocument1 pageDiagramme Généralisé de Compressibilité PDFDz AchrefNo ratings yet

- Jamil Saadeh 21800709 Wooden PlanDocument1 pageJamil Saadeh 21800709 Wooden PlanJamil SaadehNo ratings yet

- Tablas CeneguelDocument1 pageTablas CeneguelMargarito Robles KingNo ratings yet

- Food Analysis - Complete LectureDocument63 pagesFood Analysis - Complete LectureKelvin Khoa100% (3)

- Design Spectra Philippines Seismic Part 4Document144 pagesDesign Spectra Philippines Seismic Part 4Mike2322No ratings yet

- A15 Cengel - Gráfica de TermodinámicaDocument1 pageA15 Cengel - Gráfica de Termodinámicalolololprogamer0263No ratings yet

- Normalized Impedance and Admittance CoordinatesDocument2 pagesNormalized Impedance and Admittance CoordinatesGina CalderonNo ratings yet

- 2009-03-31 Function Transformation, Part 3.5Document2 pages2009-03-31 Function Transformation, Part 3.5samjshahNo ratings yet

- 1 Piso YeseniaDocument1 page1 Piso YeseniaRichard Alexander Tovar PonceNo ratings yet

- Civ-01-022-Sludge Dewatering BuildingDocument4 pagesCiv-01-022-Sludge Dewatering BuildingOmar ATENo ratings yet

- Terreno MartinDocument1 pageTerreno MartinRaúl VargasNo ratings yet

- AN010 CTs Specification Guidelines For Pro N Pro NX Smart 10 2016Document12 pagesAN010 CTs Specification Guidelines For Pro N Pro NX Smart 10 2016Petre GabrielNo ratings yet

- ECE333 Renewable Energy Systems 2015 Lect10Document30 pagesECE333 Renewable Energy Systems 2015 Lect10rdelgranadoNo ratings yet

- Machine Learning-ClusteringDocument3 pagesMachine Learning-Clusteringaviral1987No ratings yet

- Lampiran THT AsrDocument2 pagesLampiran THT AsrHafizh Renanto A.No ratings yet

- Planta Primer Piso W.RDocument1 pagePlanta Primer Piso W.RMauricio MeloNo ratings yet

- CASA RE-ModeloDocument1 pageCASA RE-ModeloMADELAINE BETHSABE TAYUPANDA MAZANo ratings yet

- The Tolerance Unless Classified 0.3mm: Outline Dimension & Block DiagramDocument1 pageThe Tolerance Unless Classified 0.3mm: Outline Dimension & Block DiagramadilNo ratings yet

- Saul DefinidoDocument1 pageSaul DefinidoSaulo Palomino MuñozNo ratings yet

- Smith Chart in Color - 2Document1 pageSmith Chart in Color - 2Andro Elnatan HarianjaNo ratings yet

- Smith Chart in Color - 2Document1 pageSmith Chart in Color - 2Andro Elnatan HarianjaNo ratings yet

- Plano ESCALERA 8-3-23Document1 pagePlano ESCALERA 8-3-23Josias M.R.No ratings yet

- CPT Static Liquefaction Analysis PlotsDocument1 pageCPT Static Liquefaction Analysis PlotsmyplaxisNo ratings yet

- William T - Cabecera-ModeloDocument1 pageWilliam T - Cabecera-Modelówef wfwefNo ratings yet

- Barda - FinalDocument1 pageBarda - FinalJose alfredo Heredia moroNo ratings yet

- 1 PDFDocument1 page1 PDFYohannes HabeshawiNo ratings yet

- Diagrama de CompresibilidadDocument1 pageDiagrama de CompresibilidadJuan Pablo Vela MartinezNo ratings yet

- Diagrama de CompresibilidadDocument1 pageDiagrama de CompresibilidadcarlosNo ratings yet

- Column LayoutDocument1 pageColumn LayoutAlhanNo ratings yet

- MycompressibilityDocument1 pageMycompressibilityodunolaakimuNo ratings yet

- Ultrahigh-Speed Switching Applications: Package Dimensions FeaturesDocument4 pagesUltrahigh-Speed Switching Applications: Package Dimensions FeaturesJosephSyNo ratings yet

- Armatura Grede PDFDocument6 pagesArmatura Grede PDFMiljan TrivicNo ratings yet

- Result INTER-RAT MLBDocument1 pageResult INTER-RAT MLBangga measNo ratings yet

- Applied Time Series Econometrics: A Practical Guide for Macroeconomic Researchers with a Focus on AfricaFrom EverandApplied Time Series Econometrics: A Practical Guide for Macroeconomic Researchers with a Focus on AfricaRating: 3 out of 5 stars3/5 (1)

- Solved A Draw The Wage Schooling Locus For Someone For Whom TheDocument1 pageSolved A Draw The Wage Schooling Locus For Someone For Whom TheM Bilal SaleemNo ratings yet

- Portugal Economy ReportDocument17 pagesPortugal Economy Reportsouravsingh1987No ratings yet

- Learning Activity 1. GlobalizationDocument8 pagesLearning Activity 1. GlobalizationFanni BenítezNo ratings yet

- Budget at A GlanceDocument5 pagesBudget at A GlanceHarshal AjmeraNo ratings yet

- ECONOMICS RiyaDocument17 pagesECONOMICS RiyaNikita TyagiNo ratings yet

- Lancer Inc A U S Based Company Establishes A Subsidiary in ADocument2 pagesLancer Inc A U S Based Company Establishes A Subsidiary in AAmit Pandey0% (1)

- تمويل الاقتصاد الأخضر ومتطلبات التنمية المستدامةDocument19 pagesتمويل الاقتصاد الأخضر ومتطلبات التنمية المستدامةZuhair Abdullah FadhelNo ratings yet

- Fixed Income Report: Global Market UpdateDocument4 pagesFixed Income Report: Global Market UpdateWinston FieroNo ratings yet

- Ôn Thi KTQTDocument24 pagesÔn Thi KTQTKim Ngân Nguyễn DươngNo ratings yet

- HZ Yu O4 GVBHQzoti LDocument12 pagesHZ Yu O4 GVBHQzoti LVishal BawaneNo ratings yet

- Chapter Two: - Tax Type and Tax SystemsDocument30 pagesChapter Two: - Tax Type and Tax Systemsembiale ayaluNo ratings yet

- Bùi Thị Thu Hường - HS170959 - MKT1813 - ECO121 - Test-01 - Individual Assignment 01Document4 pagesBùi Thị Thu Hường - HS170959 - MKT1813 - ECO121 - Test-01 - Individual Assignment 01Bui Thi Thu Huong K17 HLNo ratings yet

- Fractional Reserve BankingDocument1 pageFractional Reserve BankingNat YelvertonNo ratings yet

- TAX - CIR Vs Aichi ForgingDocument1 pageTAX - CIR Vs Aichi ForgingChynah Marie MonzonNo ratings yet

- Prashant Enterprises: Near Parihar Dhaba, Karhal Chauraha, Agra Bye Pass Road Mainpuri-205001 (UP)Document4 pagesPrashant Enterprises: Near Parihar Dhaba, Karhal Chauraha, Agra Bye Pass Road Mainpuri-205001 (UP)Prashant EnterprisesNo ratings yet

- Credit Management in The Banking Industry, A Case Study of Nigerian Agricultural and Cooperative Bank and First Bank of Nigeria PLC PDFDocument96 pagesCredit Management in The Banking Industry, A Case Study of Nigerian Agricultural and Cooperative Bank and First Bank of Nigeria PLC PDFjoseph maseleNo ratings yet

- Tax Invoice: Gift From: Gift To: Customer CommentsDocument1 pageTax Invoice: Gift From: Gift To: Customer CommentsCA Shrikant VaranasiNo ratings yet

- Rooms PaderesDocument18 pagesRooms Paderesapi-273920612No ratings yet

- Bolivia - Proxy GDPDocument1 pageBolivia - Proxy GDPEduardo PetazzeNo ratings yet

- TariffDocument8 pagesTariffprobuddhaNo ratings yet

- HPCL Price List Eff-01st March 2021Document1 pageHPCL Price List Eff-01st March 2021aee lwe0% (1)

- International Investment in Bangladesh: Griffin & PustayDocument14 pagesInternational Investment in Bangladesh: Griffin & PustayGendhlf TornNo ratings yet

- Unit 17 PDFDocument9 pagesUnit 17 PDFnitikanehiNo ratings yet

- Global Business Today: by Charles W.L. HillDocument10 pagesGlobal Business Today: by Charles W.L. HillshamzanNo ratings yet

- From 01-01-2020 To 12-03-2021Document31 pagesFrom 01-01-2020 To 12-03-2021parvesh kumarNo ratings yet

- International Business: SwedenDocument45 pagesInternational Business: SwedenNazish SohailNo ratings yet

- Form GSTR-3B System Generated Summary: Section I: Auto-Populated Details of Table 3.1, 3.2, 4 and 5.1 of FORM GSTR-3BDocument7 pagesForm GSTR-3B System Generated Summary: Section I: Auto-Populated Details of Table 3.1, 3.2, 4 and 5.1 of FORM GSTR-3BArun SasidharanNo ratings yet

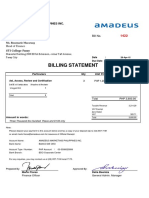

- Bill No. 1422 STI College - PasayDocument1 pageBill No. 1422 STI College - PasayKristel BelenNo ratings yet