Professional Documents

Culture Documents

PwC-IFRS-FS-2020-IFRS - VN - Part 3

PwC-IFRS-FS-2020-IFRS - VN - Part 3

Uploaded by

Hung LeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PwC-IFRS-FS-2020-IFRS - VN - Part 3

PwC-IFRS-FS-2020-IFRS - VN - Part 3

Uploaded by

Hung LeCopyright:

Available Formats

4 Material profit or loss items 1,2

IAS1(119),(97) The group has identified a number of items which are material due to the significance of their nature

and/or amount. These are listed separately here to provide a better understanding of the financial

performance of the group.

2020 2019

Notes CU’000 CU’000

IAS1(97),(98)(c) Gain on sale of freehold land (a) 1,270 -

IAS1(97),(98)(b) Restructuring costs 8(i) (1,377) -

IAS1(97) Impairment of goodwill 8(d) (2,410) -

IAS36(126)(a) Impairment of other assets (b)

IAS36(130)(b) Office and warehouse building (465) -

Plant and equipment (210) -

Inventories (535) -

IAS1(97) Total impairment losses – other assets (1,210) -

Insurance recovery (b) 300 -

IAS1(97),(98)(c) Loss on disposal of plant and equipment (c) - (230)

IAS1(97),(98)(f) Litigation settlement relating to claim against the land

development division (d) - (370)

Recognition of tax losses (e) - 945

IAS1(97) Total material items from continuing operations (3,427) 345

Gain on sale of discontinued operation 15 481 -

4(a) Sale of freehold land

Following the re-zoning of land held by VALUE IFRS Consulting Inc, the entity sold a large parcel of

freehold land at a significant profit and realised a gain of CU1,270,000 (included in the IT consulting –

US segment).

4(b) Impairment of other assets

IAS36(129)(a), A fire in Springfield in March 2020 damaged a major office and warehouse building owned by a

(130)(a),(c)

subsidiary that is part of the Oneland furniture manufacturing and wholesale segment. The fire also

destroyed equipment and inventories stored in the warehouse.

IAS36(130)(e),(f) The office and warehouse building was written down to its recoverable amount of CU1,220,000, which

was determined by reference to the building’s fair value less costs of disposal. The main valuation

inputs used were a market value of CU105 per square metre (determined by an independent valuer)

and costs of repair, estimated by management to be approximately CU430,000. Since the estimated

costs of repair are a significant unobservable input, the fair value of the office and warehouse building is

classified as a level 3 fair value.

As the inventory and equipment were destroyed beyond repair, their fair value less cost of disposal was

nil.

IAS36(126)(a) The impairment loss is included in administrative expenses in the statement of profit or loss.

IAS16(74)(d) An insurance recovery of CU300,000 has been received and recognised as other income.

4(c) Disposal of plant and equipment

VALUE IFRS Manufacturing upgraded its plant and equipment by installing a large new production line

in its Springfield factory in the previous financial year. There were several items of old equipment that

had to be removed to make place for the new plant. Since the items were using superseded

technology, the entity was not able to sell them at their carrying amounts but incurred a loss of

CU230,000 on disposal (included in the Furniture manufacture – Oneland segment).

4(d) Litigation settlement

In January 2019, VALUE IFRS Development Limited paid CU370,000 as settlement for a claim lodged

against the company following the termination of the Pinetree development in Alpville (included in ‘all

other segments’ in the segment note).

PwC VALUE IFRS Plc 44

31 December 2020

Material profit or loss items

4(e) Recognition of tax losses

Following a significant improvement in trading conditions in the Oneland furniture manufacturing and

wholesale segment in 2019, the group reviewed previously unrecognised tax losses and determined

that it was now probable that taxable profits will be available against which the tax losses can be

utilised. As a consequence, a deferred tax asset of CU945,000 was recognised for these losses in

2019.

Material profit or loss items

IAS1(97),(98) Where items of income and expense are material, their nature and amount shall be disclosed

separately either in the statement of comprehensive income, the statement of profit or loss

(where applicable) or in the notes. Circumstances that would give rise to the separate

disclosure of items of income and expense include:

(a) write-downs of inventories to net realisable value or of property, plant and equipment to

recoverable amount, as well as reversals of such write-downs

(b) restructurings of the activities of an entity and reversals of any provisions for the costs of

restructuring

(c) disposals of items of property, plant and equipment

(d) disposals of investments

(e) discontinued operations (refer to note 15)

(f) litigation settlements

(g) other reversals of provisions, and

(h) gains or losses recognised in relation to a business combination.

Material items do not need to be presented in a separate note. However, in our view it will be

easier for users to assess the impact of such items on the entity’s performance if this

information is presented together.

5 Other income and expense items 1,9

This note provides a breakdown of the items included in other income, other gains/(losses), finance

income and costs and an analysis of expenses by nature. Information about specific profit and loss

items (such as gains and losses in relation to financial instruments) is disclosed in the related balance

sheet notes.

IAS1(112)(c)

5(a) Other income

2020 2019

Notes CU’000 CU’000

Rental income and sub-lease rental income 8(c) 7,240 7,240

Dividends (i) 3,300 4,300

IAS1(82)(a) Interest income on financial assets held as investments (ii) 258 249

Not mandatory Other items (iii) 550 244

11,348 12,033

(i) Dividends

IAS1(117) Dividends are received from financial assets measured at fair value through profit or loss (FVPL) and at

IFRS9(5.7.1A),(B5.7.1)

fair value through other comprehensive income (FVOCI). Dividends are recognised as other income in

profit or loss when the right to receive payment is established. This applies even if they are paid out of

pre-acquisition profits, unless the dividend clearly represents a recovery of part of the cost of an

investment. In this case, the dividend is recognised in OCI if it relates to an investment measured at

FVOCI.

(ii) Interest income 6

IAS1(117) Interest income from financial assets at FVPL is included in the net fair value gains/(losses) on these

assets, see note 5(b) below. Interest income on financial assets at amortised cost and financial assets

at FVOCI calculated using the effective interest method is recognised in profit or loss as part of other

income.

PwC VALUE IFRS Plc 45

31 December 2020

Other income and expense items

5(a) Other income

IFRS9(5.4.1) Interest income is calculated by applying the effective interest rate to the gross carrying amount of a

financial asset except for financial assets that subsequently become credit-impaired. For credit-

impaired financial assets, the effective interest rate is applied to the net carrying amount of the financial

asset (after deduction of the loss allowance).

Interest income is presented as finance income where it is earned from financial assets that are held for

cash management purposes, see note 5(d) below. Any other interest income is included in other

income.

IFRS7(20)(b) Total interest income on financial assets that are measured at amortised cost for the year was

CU1,670,000 and interest income from debt investments that are measured at FVOCI was CU200,000

(2019 – CU1,154,000 interest income from financial assets not measured at FVPL).

(iii) Government grants

IAS20(39)(b),(c) Export market development grants of CU250,000 (2019 – CU244,000) are included in the ‘other items’

line item. There are no unfulfilled conditions or other contingencies attaching to these grants. The group

did not benefit directly from any other forms of government assistance.

IAS1(117)

Deferral and presentation of government grants

IAS20(12),(29) Government grants relating to costs are deferred and recognised in profit or loss over the period

necessary to match them with the costs that they are intended to compensate.

IAS20(24),(26) Government grants relating to the purchase of property, plant and equipment are included in non-

current liabilities as deferred income and they are credited to profit or loss on a straight-line basis over

the expected lives of the related assets.

5(b) Other gains/(losses)

2020 2019

Notes CU’000 CU’000

Net gain/(loss) on disposal of property, plant and equipment

(excluding property, plant and equipment sold as part of the

engineering division) 8(a) 1,620 (530)

IAS40(76)(d) Fair value adjustment to investment property 8(c) 1,350 1,397

IFRS7(20)(a)(i) Net fair value gains/(losses) on financial assets at fair value

through profit or loss 7(d) 955 (620)

IAS21(52) Net foreign exchange gains/(losses) 12(b) 518 (259)

IFRS7(20)(a)(i) Net fair value gains on derivatives held for trading 12(a) 11 (621)

Not mandatory Other items 139 (38)

4,593 (671)

5(c) Breakdown of expenses by nature

2019

2020 Restated

Notes CU’000 CU’000

Not mandatory Changes in inventories of finished goods and work in progress 8(f) (6,681) (5,255)

Not mandatory Raw materials and consumables used 8(f) 62,218 54,108

IAS1(104),(105) Employee benefits expenses 2 56,594 52,075

IAS1(104),(105) Depreciation 8(a),8(b) 10,374 9,350

IAS1(104),(105) Amortisation 8(d),3(b) 2,166 730

IAS1(97) Impairment of goodwill 8(d) 2,410 -

IAS1(97) Impairment of assets damaged by fire 4(b) 1,210 -

Not mandatory Other expenses 27,839 16,270

Not mandatory Total cost of sales, distribution cost and administrative

expenses 156,130 127,278

PwC VALUE IFRS Plc 46

31 December 2020

Other income and expense items

5(d) Finance income and costs 3-7

2019

2020 Restated

Notes CU’000 CU’000

Finance income 7,8

Interest income from financial assets held for cash management

purposes (a)(ii) 1,261 905

IFRS9(3.3.3) Net gain on settlement of debt 7(g) 355 -

IFRS7(20)(a)(v)

Finance income 1,616 905

Finance costs 3-6

IFRS7(20)(b) Interest and finance charges paid/payable for lease liabilities and

financial liabilities not at fair value through profit or loss 8(b) (6,956) (6,367)

IAS37(60) Provisions: unwinding of discount 8(i) (93) (78)

IFRS7(24C)(b)(iv) Fair value gain on interest rate swaps designated as cash flow

hedges – transfer from OCI 12(b) 155 195

IAS21(52)(a) Net exchange losses on foreign currency borrowings 12(b) (1,122) (810)

(8,016) (7,060)

IAS23(26)(a) Amount capitalised (i) 525 325

Finance costs expensed (7,491) (6,735)

Net finance costs (5,875) (5,830)

(i) Capitalised borrowing costs

IAS23(26)(b) The capitalisation rate used to determine the amount of borrowing costs to be capitalised is the

weighted average interest rate applicable to the entity’s general borrowings during the year, in this case

7.02% (2019 – 7.45%).

Other income and expense items

This note provides a breakdown of other income, other gains/losses and an analysis of

expenses by nature, but it does not show all of the profit and loss amounts that must be

disclosed under various accounting standards. Instead, individual profit and loss items are now

disclosed together with the relevant information to which they belong. For example, gains or

losses related to various financial instruments held by the group are disclosed together with the

balance sheet amounts. We believe that this presentation is more useful for users of the

financial statements.

Employee benefits expenses

IAS19(25),(158),(171) Although IAS 19 Employee Benefits does not require specific disclosures about employee

benefits other than post-employment benefits, other standards may require disclosures, for

example, where the expense resulting from such benefits is material and so would require

disclosure under paragraph 97 of IAS 1 Presentation of Financial Statements. Similarly,

termination benefits may result in an expense needing disclosure in order to comply with

paragraph 97 of IAS 1.

Finance costs

Finance costs will normally include:

IAS23(5),(6) (a) costs that are borrowing costs for the purposes of IAS 23 Borrowing Costs:

IFRS7(IG13) (i) interest expense calculated using the effective interest rate method as described in

IFRS 9 Financial Instruments

(ii) interest in respect of lease liabilities (refer to note 8(b)), and

(iii) exchange differences arising from foreign currency borrowings to the extent that they

are regarded as an adjustment to interest costs

PwC VALUE IFRS Plc 47

31 December 2020

Other income and expense items

Other income and expense items

IAS37(60) (b) the unwinding of the effect of discounting provisions

IAS32(35),(40) (c) dividends on preference shares that are classified as debt

IFRS9(B5.4.4) (d) the amortisation of discounts and premiums on debt instruments that are liabilities

(e) interest on tax payable where the interest element can be identified separately

IFRS5(17) (f) the increase in the present value of the costs to sell in relation to assets that are held for

sale, where the sale is expected to occur beyond one year.

IFRS16(49) Interest expense on lease liabilities must also be presented as a component of finance cost in

the statement of profit or loss and other comprehensive income.

IAS21(52)(a) Amounts disclosed under paragraph 3(a)(iii) above shall also be included in the net foreign

exchange gain or loss disclosed under paragraph 52(a) of IAS 21 The Effects of Changes in

Foreign Exchange Rates. VALUE IFRS Plc discloses this amount in note 12(b).

Costs which may also be classified as finance cost include other costs associated with the

entity’s management of cash, cash equivalents and debt; for example, fair value changes on

interest rate hedges, the ineffective portion of cash flow interest rate hedges or a loss on the

extinguishment of a liability.

Finance income

IFRS15(Appendix A) The classification of finance income depends on the entity’s accounting policy for such items.

IAS1(82)(a)

Where earning interest income is part of the entity’s ordinary activities rather than an incidental

benefit, the interest income should be included within the main ‘revenue’ heading and

separately disclosed in the statement of profit or loss, if material. In other cases, entities may

take the view that finance income is most appropriately included as ‘other operating income’ or

as a separate line item in arriving at operating profit (if disclosed). VALUE IFRS Plc includes

finance income that arises from treasury activity (for example, income on surplus funds

invested for the short term) outside operating profit whilst including other types of finance

income as operating items. Although entities have some discretion in the way in which finance

income is included in the statement of comprehensive income, the presentation policy adopted

should be applied consistently and disclosed if material.

IFRS7(20)(b) In addition, entities must disclose the total interest revenue (calculated using the effective

interest rate method) for financial assets that are measured at amortised cost and those that

are measured at fair value through other comprehensive income. This applies regardless of the

presentation chosen in the primary financial statements. This requirement is illustrated in note

5(a)(i).

Disclosures not illustrated: not applicable to VALUE IFRS Plc

The following requirements are not illustrated in this publication as they are not applicable to

VALUE IFRS Plc:

IFRS7(20)(c) (a) Where material, entities must separately disclose any fee income arising from financial

assets not at fair value through profit or loss and from trust and other fiduciary activities.

PwC VALUE IFRS Plc 48

31 December 2020

6 Income tax expense 8,9

This note provides an analysis of the group’s income tax expense, and shows what amounts are

recognised directly in equity and how the tax expense is affected by non-assessable and non-

deductible items. It also explains significant estimates made in relation to the group’s tax position.

2019

2020 Restated *

CU’000 CU’000

IAS12(79),(81)(g)(ii)

6(a) Income tax expense

Current tax

IAS12(80)(a) Current tax on profits for the year 17,116 11,899

IAS12(80)(b) Adjustments for current tax of prior periods (369) 135

Total current tax expense 16,747 12,034

IAS12(80)(c) Deferred income tax

Decrease/(increase) in deferred tax assets (note 8(e)) (4) (1,687)

(Decrease)/increase in deferred tax liabilities (note 8(e)) (177) 1,399

Total deferred tax expense/(benefit) (181) (288)

Income tax expense 16,566 11,746

Income tax expense is attributable to:

Profit from continuing operations 16,182 11,575

Profit from discontinued operation 384 171

16,566 11,746

* See note 11(b) for details regarding the restatement as a result of an error.

6(b) Significant estimates – uncertain tax position and tax-related contingency

IAS1(122),(125) The tax legislation in relation to expenditures incurred in association with the establishment of the

IFRIC23(A5)

retail division is unclear. The group considers it probable that a tax deduction of CU1,933,000 will be

available and has calculated the current tax expense on this basis. However, the group has applied for

IAS37(86),(88) a private ruling to confirm its interpretation. If the ruling is not favourable, this would increase the

group’s current tax payable and current tax expense by CU580,000 respectively. The group expects to

get a response, and therefore certainty about the tax position, before the next interim reporting date.

IAS12(81)(c)(i),

(84),(85) 6(c) Numerical reconciliation of income tax expense to prima

facie tax payable 1,2

2019

2020 Restated *

CU’000 CU’000

Profit from continuing operations before income tax expense 51,086 39,617

Profit from discontinued operation before income tax expense 1,111 570

52,197 40,187

IAS12(81)(d),(85) Tax at the Oneland tax rate of 30% (2019 – 30%) 15,659 12,056

Tax effect of amounts which are not deductible (taxable) in calculating

taxable income:

Goodwill impairment 723 -

Amortisation of intangibles 3 92 158

Entertainment 82 79

Employee option plan 4 277 99

Dividends paid to preference shareholders 378 378

Recycling of foreign currency translation reserve on sale of subsidiary,

see note 15 (51) -

Sundry items 189 14

Subtotal 17,349 12,784

PwC VALUE IFRS Plc 49

31 December 2020

Income tax expenses

IAS12(81)(c)(i),

(84),(85) 6(c) Numerical reconciliation of income tax expense to prima

facie tax payable

2019

2020 Restated *

CU’000 CU’000

Subtotal 17,349 12,784

IAS12(85) Difference in overseas tax rates (248) (127)

IAS12(80)(b) Adjustments for current tax of prior periods (369) 135

Research and development tax credit (121) (101)

IAS12(80)(f) Previously unrecognised tax losses used to reduce deferred tax expense

(refer to note 4(e)) - (945)

IAS12(80)(e) Previously unrecognised tax losses now recouped to reduce current tax

(45) -

expense

Income tax expense 16,566 11,746

* See note 11(b) for details regarding the restatement as a result of an error.

2020 2019

Notes CU’000 CU’000

6(d) Amounts recognised directly in equity 5,6

IAS12(81)(a),(62A) Aggregate current and deferred tax arising in the reporting

period and not recognised in net profit or loss or other

comprehensive income but directly debited or credited to equity:

Current tax: share buy-back transaction costs 9(a) (15) -

Deferred tax: Convertible note and share issue costs 8(e) 990 -

975 -

In addition, the group recognised deferred tax amounts directly in retained earnings as a result of the

restatement of an error (see note 11(b)).

6(e) Tax losses

IAS12(81)(e) Unused tax losses for which no deferred tax asset has been

recognised 1,740 2,796

Potential tax benefit @ 30% 522 839

The unused tax losses were incurred by a dormant subsidiary that is not likely to generate taxable

income in the foreseeable future. They can be carried forward indefinitely. See note 8(e) for information

about recognised tax losses and significant judgements made in relation to them.

6(f) Unrecognised temporary differences

IAS12(81)(f) Temporary differences relating to investments in subsidiaries for

which deferred tax liabilities have not been recognised:

Foreign currency translation 2,190 1,980

Undistributed earnings 1,350 -

3,540 1,980

IAS12(87) Unrecognised deferred tax liabilities relating to the above

Not mandatory 1,062 594

temporary differences

Temporary differences of CU2,190,000 (2019 – CU1,980,000) have arisen as a result of the translation

of the financial statements of the group’s subsidiary in China. However, a deferred tax liability has not

been recognised as the liability will only crystallise in the event of disposal of the subsidiary, and no

such disposal is expected in the foreseeable future. 7

VALUE IFRS Retail Limited has undistributed earnings of CU1,350,000 (2019 – nil) which, if paid out

as dividends, would be subject to tax in the hands of the recipient. An assessable temporary difference

exists, but no deferred tax liability has been recognised as VALUE IFRS Plc is able to control the timing

of distributions from this subsidiary and is not expected to distribute these profits in the foreseeable

future.

PwC VALUE IFRS Plc 50

31 December 2020

You might also like

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Types of Contracts Contracts Under Seal TraditionallyDocument12 pagesTypes of Contracts Contracts Under Seal TraditionallyAndrew_Magraci_2381100% (3)

- CallRecord LogDocument17 pagesCallRecord LogLela SokhateriNo ratings yet

- Bilant Traducere Versiune PrescurtataDocument9 pagesBilant Traducere Versiune PrescurtataAlinafuleaNo ratings yet

- Accounting Research Proposal (Otw To Final)Document31 pagesAccounting Research Proposal (Otw To Final)Astrid99100% (4)

- MCQ 4 GroundwaterDocument6 pagesMCQ 4 GroundwaterAnonymous EvbW4o1U7100% (5)

- Technical Specification: For NPT40R Rescue BoatDocument3 pagesTechnical Specification: For NPT40R Rescue BoatThomas SellersNo ratings yet

- PwC-IFRS-FS-2020-IFRS - VN - Part 8Document6 pagesPwC-IFRS-FS-2020-IFRS - VN - Part 8Hung LeNo ratings yet

- Movement Schedule of Non-Current AssetsDocument6 pagesMovement Schedule of Non-Current AssetsMichael BwireNo ratings yet

- PwC-IFRS-FS-2020-IFRS - VN - Part 7Document17 pagesPwC-IFRS-FS-2020-IFRS - VN - Part 7Hung LeNo ratings yet

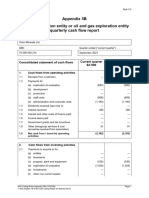

- September 2023 Quarterly Cash Flow ReportDocument6 pagesSeptember 2023 Quarterly Cash Flow ReportPhilip KennyNo ratings yet

- Profit&Loss 09 10Document1 pageProfit&Loss 09 10Rashmin TomarNo ratings yet

- PwC-IFRS-FS-2020-IFRS - VN - Part 9Document15 pagesPwC-IFRS-FS-2020-IFRS - VN - Part 9Hung LeNo ratings yet

- Statement Profit Loss ConsolidatedDocument1 pageStatement Profit Loss Consolidatedshubham kumarNo ratings yet

- Disposal of Asset-Th & ExerciseDocument2 pagesDisposal of Asset-Th & ExerciseProficient CyberNo ratings yet

- TATA MOTORS Profit and Loss SheetDocument1 pageTATA MOTORS Profit and Loss SheetKaushal RautNo ratings yet

- Lecture 11-11Document2 pagesLecture 11-11Nouman ShamasNo ratings yet

- NESTLEDocument141 pagesNESTLENataly Abanto VasquezNo ratings yet

- Directors' Report: 1. Company PerformanceDocument57 pagesDirectors' Report: 1. Company PerformanceMUHAMMEDNo ratings yet

- ATU Quarterly Appendix 5B Cash Flow Report-1Document5 pagesATU Quarterly Appendix 5B Cash Flow Report-1jmrivascidNo ratings yet

- Annual Report 2020 21 261 PDFDocument1 pageAnnual Report 2020 21 261 PDFAnand GovindanNo ratings yet

- Case Study 10 - 1Document5 pagesCase Study 10 - 1Michelle Angelina BudimanNo ratings yet

- Disclosure IAS 38Document8 pagesDisclosure IAS 38Lavanya JalakamNo ratings yet

- In Millions of Euros, Except For Per Share DataDocument33 pagesIn Millions of Euros, Except For Per Share DataGrace StylesNo ratings yet

- Appendix 4C Quarterly Report For Entities Subject To Listing Rule 4.7BDocument5 pagesAppendix 4C Quarterly Report For Entities Subject To Listing Rule 4.7BAsoka P JayasingheNo ratings yet

- 10.multiple Choices Question - Manufacture AccountsDocument3 pages10.multiple Choices Question - Manufacture Accountsactsectfcd1No ratings yet

- Ac1104 Week1illDocument12 pagesAc1104 Week1illmjxncwk7nbNo ratings yet

- Financial Accounting and Reporting-I: Page 1 of 7Document7 pagesFinancial Accounting and Reporting-I: Page 1 of 7Hareem AbbasiNo ratings yet

- PwC-IFRS-FS-2020-IFRS - VN - Part 6Document22 pagesPwC-IFRS-FS-2020-IFRS - VN - Part 6Hung LeNo ratings yet

- CAF 1 Spring 2024Document6 pagesCAF 1 Spring 2024saadiimalik08No ratings yet

- Consolidated Statement of Cash Flows: PWC Holdings LTD and Its SubsidiariesDocument3 pagesConsolidated Statement of Cash Flows: PWC Holdings LTD and Its SubsidiariesEmmanuel C. DumayasNo ratings yet

- Pages From PayPal Holdings Inc Combined 2023 Proxy Statement and 2022 Annual ReportDocument2 pagesPages From PayPal Holdings Inc Combined 2023 Proxy Statement and 2022 Annual ReportkartiksharmainspireNo ratings yet

- Financials Fy 2022-23Document39 pagesFinancials Fy 2022-23syedfareed596No ratings yet

- 72 XTO O&G SupplementDocument4 pages72 XTO O&G SupplementAndriamihajaHermannNo ratings yet

- Periodic Disclosures Form Nl-2-B-PlDocument1 pagePeriodic Disclosures Form Nl-2-B-PlNilesh DawandeNo ratings yet

- Q Bank AS 10Document15 pagesQ Bank AS 10Rakesh mehto tutorialNo ratings yet

- Consolidated Balance Sheet For Hindustan Unilever LTDDocument11 pagesConsolidated Balance Sheet For Hindustan Unilever LTDMohit ChughNo ratings yet

- SA Syl08 Dec2014 P17Document14 pagesSA Syl08 Dec2014 P17Ranadeep ReddyNo ratings yet

- 2018-19 Statement of Profit and LossDocument1 page2018-19 Statement of Profit and LosscapraisyjanetteNo ratings yet

- In Millions of Euros, Except For Per Share DataDocument24 pagesIn Millions of Euros, Except For Per Share DataGrace StylesNo ratings yet

- DCF Model: Consolidated Balance Sheet Consolidated Statement of Profit & Loss Consolidated Statement of Cash FlowsDocument1 pageDCF Model: Consolidated Balance Sheet Consolidated Statement of Profit & Loss Consolidated Statement of Cash FlowsGolamMostafaNo ratings yet

- DownloadDocument21 pagesDownloadVai MallyaNo ratings yet

- Quarterly Cashflow ReportDocument6 pagesQuarterly Cashflow ReportLian Taing CoffeeNo ratings yet

- 9706 Accounting: MARK SCHEME For The October/November 2014 SeriesDocument7 pages9706 Accounting: MARK SCHEME For The October/November 2014 SeriesAsad Aasim AliNo ratings yet

- 9706 Accounting: MARK SCHEME For The October/November 2014 SeriesDocument7 pages9706 Accounting: MARK SCHEME For The October/November 2014 SeriesHashir BijaraniNo ratings yet

- 2023-02-09 TVK - Press Release Q1 2023Document5 pages2023-02-09 TVK - Press Release Q1 2023DavidNo ratings yet

- Aud Application 2 - Handout 1 PPE Acquisition (UST)Document3 pagesAud Application 2 - Handout 1 PPE Acquisition (UST)RNo ratings yet

- FFR 2Document9 pagesFFR 2Jai KishanNo ratings yet

- 2102AFE Topic 2 - Assets I - LecturerDocument54 pages2102AFE Topic 2 - Assets I - LecturerMelvina GodivaNo ratings yet

- Global kons-COns ContractDocument2 pagesGlobal kons-COns ContractSandeep GyawaliNo ratings yet

- Examination, 2015 Commerce Specialized Accounting: (Printed Pages 7) Roll. No.Document4 pagesExamination, 2015 Commerce Specialized Accounting: (Printed Pages 7) Roll. No.AbhishekNo ratings yet

- Nexans 2022 Consolidated Financial StatementsDocument76 pagesNexans 2022 Consolidated Financial StatementsvolgatangaNo ratings yet

- AAFR R.Test 2 Solution FinalDocument8 pagesAAFR R.Test 2 Solution FinalShahzaib VirkNo ratings yet

- Annual Report of Reliance General Insurance On 10-11Document49 pagesAnnual Report of Reliance General Insurance On 10-11bhagathnagarNo ratings yet

- Statement of Profit and LossDocument1 pageStatement of Profit and LossrytryrtyrtNo ratings yet

- Hong Fok Corporation Limited: Revenue (Note 1)Document8 pagesHong Fok Corporation Limited: Revenue (Note 1)Theng RogerNo ratings yet

- 2017 Revenues 41,381 40,859: (In Millions of Euros, Except For Per Share Data)Document37 pages2017 Revenues 41,381 40,859: (In Millions of Euros, Except For Per Share Data)Cristina PascariNo ratings yet

- FR Income Statement HGB Adidas Ar21Document1 pageFR Income Statement HGB Adidas Ar21yukkiyukki171No ratings yet

- E2 Statement Cognate Group INDAS1718Document6 pagesE2 Statement Cognate Group INDAS1718hrishikesh gaikwadNo ratings yet

- FR222.(IL-I) Solution CMA January-2023 Exam.Document9 pagesFR222.(IL-I) Solution CMA January-2023 Exam.Shawn MehdiNo ratings yet

- Cipla FRA Assignment 2 Group 3Document7 pagesCipla FRA Assignment 2 Group 3xzeekNo ratings yet

- ASX Release: 23 August 2021Document40 pagesASX Release: 23 August 2021Peper12345No ratings yet

- PublicDisclosure 1660281762Document48 pagesPublicDisclosure 1660281762mantoo kumarNo ratings yet

- Allocation and Apportionment and Job and Batch Costing Worked Example Question 20Document2 pagesAllocation and Apportionment and Job and Batch Costing Worked Example Question 20Roshan RamkhalawonNo ratings yet

- Rustler - Volume 3 Number 11Document8 pagesRustler - Volume 3 Number 11Hung LeNo ratings yet

- Sextra 1999 02 MagazineDocument52 pagesSextra 1999 02 MagazineHung LeNo ratings yet

- Sexteen 2 VebukaDocument11 pagesSexteen 2 VebukaHung LeNo ratings yet

- BITE LIPS MAGAZINE No 3 - 03 - 30 - 2019Document97 pagesBITE LIPS MAGAZINE No 3 - 03 - 30 - 2019Hung Le100% (1)

- Adult Quest May 2012Document72 pagesAdult Quest May 2012Hung LeNo ratings yet

- BITE LIPS MAGAZINE No 1 - March 10 2019Document99 pagesBITE LIPS MAGAZINE No 1 - March 10 2019Hung LeNo ratings yet

- Adult Quest March 2014Document64 pagesAdult Quest March 2014Hung LeNo ratings yet

- Adult Quest January 2012Document72 pagesAdult Quest January 2012Hung LeNo ratings yet

- Adult Quest March 2012Document72 pagesAdult Quest March 2012Hung LeNo ratings yet

- Adult Quest June 2012Document72 pagesAdult Quest June 2012Hung LeNo ratings yet

- Erotica Vol. 2 No.3 Enero 2014Document24 pagesErotica Vol. 2 No.3 Enero 2014Hung LeNo ratings yet

- Adult Quest August 2012Document72 pagesAdult Quest August 2012Hung LeNo ratings yet

- PwC-IFRS-FS-2020-IFRS - VN - Part 5Document11 pagesPwC-IFRS-FS-2020-IFRS - VN - Part 5Hung LeNo ratings yet

- Adult Quest July 2012Document72 pagesAdult Quest July 2012Hung LeNo ratings yet

- Orgasm Answer GuideDocument171 pagesOrgasm Answer GuideHung LeNo ratings yet

- PwC-IFRS-FS-2020-IFRS - VN - Part 9Document15 pagesPwC-IFRS-FS-2020-IFRS - VN - Part 9Hung LeNo ratings yet

- EY-IFRS-FS-20 - Part 5Document8 pagesEY-IFRS-FS-20 - Part 5Hung LeNo ratings yet

- Camshaft Opel Zafira-BDocument3 pagesCamshaft Opel Zafira-Bmr & mrsNo ratings yet

- Chapter FourDocument101 pagesChapter FourBEZU A.GERESUNo ratings yet

- Jurassic Park Research Paper TopicsDocument5 pagesJurassic Park Research Paper Topicsafeawckew100% (1)

- PR Expressanker en ReinzeichnungDocument2 pagesPR Expressanker en ReinzeichnungAlexander PaxiNo ratings yet

- Modomo v. Sps. Layug - Partial NovationDocument2 pagesModomo v. Sps. Layug - Partial NovationJcNo ratings yet

- Problem StatementDocument6 pagesProblem StatementSyed Bilal AliNo ratings yet

- Manual de Servicio AudiómetroDocument57 pagesManual de Servicio AudiómetroLoree RojasNo ratings yet

- Day Bang by Roosh V by Gene - PDF ArchiveDocument8 pagesDay Bang by Roosh V by Gene - PDF ArchivemohammaderfandardashtiNo ratings yet

- Overhead Crane Operator Candidate Handbook - 120122aDocument21 pagesOverhead Crane Operator Candidate Handbook - 120122a전우영No ratings yet

- RDO No. 36 - Puerto Princesa City, PalawanDocument491 pagesRDO No. 36 - Puerto Princesa City, PalawanDiana Lyn Bello CastilloNo ratings yet

- Norman Bel Geddes - HorizonsDocument324 pagesNorman Bel Geddes - HorizonsjoedoedoedoeNo ratings yet

- KPA500 Datasheet 2011 V1bDocument1 pageKPA500 Datasheet 2011 V1bzascribdotNo ratings yet

- Infrared Portable Space Heater: Model No.: DR-968Document16 pagesInfrared Portable Space Heater: Model No.: DR-968sigilum_deiNo ratings yet

- BalucanDocument4 pagesBalucanBryantNo ratings yet

- Verfication Performa PDFDocument1 pageVerfication Performa PDFAhmad JamalNo ratings yet

- History of Planning in IndiaDocument18 pagesHistory of Planning in IndiaSaloni AnandNo ratings yet

- MT6781 Android ScatterDocument34 pagesMT6781 Android ScatterOliver FischerNo ratings yet

- Changing HRM Practices With Firm Growth: Bernice Kotey and Alison SheridanDocument12 pagesChanging HRM Practices With Firm Growth: Bernice Kotey and Alison SheridanAhmed KhanNo ratings yet

- Room Confirmation: Dear Mr. BalceDocument1 pageRoom Confirmation: Dear Mr. BalceHarvey BalceNo ratings yet

- Funny Short StoriesDocument43 pagesFunny Short StorieschicankzNo ratings yet

- Chapter 01 (Introduction To Marketing Part II)Document54 pagesChapter 01 (Introduction To Marketing Part II)Dilshan KularathneNo ratings yet

- CONTRACT TO SELL (Sample)Document3 pagesCONTRACT TO SELL (Sample)arne navarra100% (1)

- Subway Malaysia Write UpDocument2 pagesSubway Malaysia Write UpKavita SubramaniamNo ratings yet

- Sample Student ResumeDocument1 pageSample Student ResumeSouvik Roy ChowdhuryNo ratings yet

- Lecture No. 9 Basic Principles of CT ScanDocument24 pagesLecture No. 9 Basic Principles of CT ScanMohammed Khalil SaeedNo ratings yet