Professional Documents

Culture Documents

Double Entry: What It Means in Accounting and How It's Used: 80% Touchless AP Processing

Double Entry: What It Means in Accounting and How It's Used: 80% Touchless AP Processing

Uploaded by

ThuraCopyright:

Available Formats

You might also like

- Double Entry BookkeepingDocument2 pagesDouble Entry BookkeepingGauravNo ratings yet

- What A Journal Is in Accounting, Investing, and TradingDocument1 pageWhat A Journal Is in Accounting, Investing, and TradingThuraNo ratings yet

- Module 4 - Double Entry Bookkeeping System and The Accounting EquationDocument9 pagesModule 4 - Double Entry Bookkeeping System and The Accounting EquationMark Christian BrlNo ratings yet

- Acc 7Document1 pageAcc 7Maxine FalcoNo ratings yet

- Unit 1 MADocument23 pagesUnit 1 MATheresa BrownNo ratings yet

- Module 2 - Double Entry Bookkeeping System and The Accounting EquationDocument9 pagesModule 2 - Double Entry Bookkeeping System and The Accounting EquationPrincess Joy CabreraNo ratings yet

- Basic Accounting Module 3Document72 pagesBasic Accounting Module 3Prince Varry LaureanoNo ratings yet

- 2double EntryDocument22 pages2double EntryJhoanNo ratings yet

- Module 2 - Double Entry Bookkeeping System and The Accounting EquationDocument9 pagesModule 2 - Double Entry Bookkeeping System and The Accounting EquationPrincess Joy CabreraNo ratings yet

- CHAPTER 3 Accounting Cycle (I)Document33 pagesCHAPTER 3 Accounting Cycle (I)Zemene HailuNo ratings yet

- ACFAR ReviewDocument39 pagesACFAR ReviewYza IgartaNo ratings yet

- Vaibhaw Iom AssingnDocument7 pagesVaibhaw Iom Assingnapi-3696990No ratings yet

- Reading Material AccountantDocument123 pagesReading Material Accountantsatyanweshi truthseeker100% (1)

- Basic Accounting For IT Part IIDocument4 pagesBasic Accounting For IT Part IImailbag6No ratings yet

- The Definitive and Comparative of Fundamentals of Accountancy, Business and ManagementDocument2 pagesThe Definitive and Comparative of Fundamentals of Accountancy, Business and ManagementEdlene Marielle ToribioNo ratings yet

- Debit and Credit RulesDocument4 pagesDebit and Credit RulesDanica VetuzNo ratings yet

- Ccounting Principles: Prepared by Christina SososutiksnoDocument47 pagesCcounting Principles: Prepared by Christina SososutiksnohattumercyNo ratings yet

- Acount BitDocument1 pageAcount BitOrbin SunnyNo ratings yet

- Q1 Week 3Document23 pagesQ1 Week 3Theresa Louiza PascualNo ratings yet

- Double Entry Book Keeping System Class 12 AccountDocument11 pagesDouble Entry Book Keeping System Class 12 AccountDixit PhuyalNo ratings yet

- Chapter 2 The Accounting CycleDocument63 pagesChapter 2 The Accounting CycleMULATNo ratings yet

- Basic Accounting ConceptsDocument2 pagesBasic Accounting ConceptsKhurram BaigNo ratings yet

- Accounting System (Compatibility Mode) PDFDocument10 pagesAccounting System (Compatibility Mode) PDFAftab AlamNo ratings yet

- Unit 1 PoaDocument12 pagesUnit 1 Poajigyasa.pNo ratings yet

- Simplified Notes Unit 1 and 2Document4 pagesSimplified Notes Unit 1 and 2John Paul Gaylan100% (1)

- Ita L3Document44 pagesIta L3kuloskiNo ratings yet

- Basic Accounting Concepts, Conventions, Bases & Policies, Concept of Balance SheetDocument44 pagesBasic Accounting Concepts, Conventions, Bases & Policies, Concept of Balance SheetVivan Menezes86% (7)

- Definition of AccountingDocument9 pagesDefinition of AccountingarvinapriskaNo ratings yet

- Accountacy Trial BalanceDocument5 pagesAccountacy Trial BalanceNihar patraNo ratings yet

- ACCTG 1 Week 4 - Recording Business TransactionsDocument17 pagesACCTG 1 Week 4 - Recording Business TransactionsReygie FabrigaNo ratings yet

- Double-Entry Book-KeepingDocument6 pagesDouble-Entry Book-KeepingFarman AfzalNo ratings yet

- Accounting ProcessDocument36 pagesAccounting ProcessYnnej GemNo ratings yet

- Basic AccountingDocument40 pagesBasic Accountingwajeeh100% (1)

- Accounting Essay - What Is Double Entry BookkkeepingDocument1 pageAccounting Essay - What Is Double Entry BookkkeepingyannaNo ratings yet

- Title /course Code Principles of AccountingDocument6 pagesTitle /course Code Principles of AccountingM Noaman AkbarNo ratings yet

- Introduction To Accounting and FinanceDocument39 pagesIntroduction To Accounting and FinanceEngr Muhammad RohanNo ratings yet

- Accounting 101 Chapter 1Document39 pagesAccounting 101 Chapter 1Md. Riyad Mahmud 183-15-11991No ratings yet

- FoundationDocument14 pagesFoundationpramod singhNo ratings yet

- Zelalem: What Is The Accounting Equation?Document5 pagesZelalem: What Is The Accounting Equation?edosa. bedasaNo ratings yet

- Accounting AssignmentDocument6 pagesAccounting AssignmentSyed Sheraz Ahmed ShahNo ratings yet

- EntrepreneurshipHandout Week 5Document6 pagesEntrepreneurshipHandout Week 5Pio GuiretNo ratings yet

- Unit 1Document40 pagesUnit 1v9510491No ratings yet

- Basics of Financial AccountingDocument9 pagesBasics of Financial AccountingVinayKChaubeyNo ratings yet

- Assignment (Fundamentals of Book - Keeping & Accounting)Document25 pagesAssignment (Fundamentals of Book - Keeping & Accounting)api-370836989% (9)

- Acc1 Lesson Week10Document18 pagesAcc1 Lesson Week10KeiNo ratings yet

- Accounting - Group 2Document30 pagesAccounting - Group 2Angeline EsguerraNo ratings yet

- PrintyDocument6 pagesPrinty2023-1-95-018No ratings yet

- Introduction To Accounting: Accounting Is Basically About Storing Financial InformationDocument98 pagesIntroduction To Accounting: Accounting Is Basically About Storing Financial InformationAgs OliviaNo ratings yet

- Techno 101 FinalsDocument6 pagesTechno 101 FinalsGella myka SamsonNo ratings yet

- CHAPTER 3 The Accounting Cycle (I)Document33 pagesCHAPTER 3 The Accounting Cycle (I)Addisalem Mesfin0% (2)

- Module 02 - Financial AccountingDocument11 pagesModule 02 - Financial AccountingJohn Martin L. AilesNo ratings yet

- Basics of AccountingDocument11 pagesBasics of AccountinganbarasinghNo ratings yet

- Financial Accounting, 4eDocument49 pagesFinancial Accounting, 4eZulfiqarNo ratings yet

- Review of The Accounting ProcessDocument10 pagesReview of The Accounting ProcessFranz TagubaNo ratings yet

- Living in The Information AgeDocument45 pagesLiving in The Information AgeMahesh SindhaNo ratings yet

- Fra Notes JyotiDocument62 pagesFra Notes JyotiJyotirmayee NaikNo ratings yet

- Caie Igcse Accounting 0452 Theory v2Document24 pagesCaie Igcse Accounting 0452 Theory v2Haaris UsmanNo ratings yet

- Chapter 1: Financialapplications Fundamentals of AccountingDocument60 pagesChapter 1: Financialapplications Fundamentals of AccountingSTEVE WAYNE100% (1)

- Chart of Accounts (COA) Definition: Examples and How It WorksDocument1 pageChart of Accounts (COA) Definition: Examples and How It WorksThuraNo ratings yet

- Holy Ghost CatDocument2 pagesHoly Ghost CatThuraNo ratings yet

- SwahiliDocument4 pagesSwahiliThuraNo ratings yet

- Conversational PhrasesDocument2 pagesConversational PhrasesThuraNo ratings yet

- AB S1L5 080414 Sapod101Document5 pagesAB S1L5 080414 Sapod101ThuraNo ratings yet

- JESUS CAT True-God-ManDocument1 pageJESUS CAT True-God-ManThuraNo ratings yet

- AlphabetDocument2 pagesAlphabetThuraNo ratings yet

- Managerial Lesson 3 Slides UpdatedDocument75 pagesManagerial Lesson 3 Slides UpdatedThuraNo ratings yet

- Unit-2 EXTERNAL COMMUNICATIONDocument39 pagesUnit-2 EXTERNAL COMMUNICATIONThuraNo ratings yet

- CAT5Document3 pagesCAT5ThuraNo ratings yet

- Managerial Lesson 4 Slides UpdatedDocument32 pagesManagerial Lesson 4 Slides UpdatedThuraNo ratings yet

- Managerial Lesson 5 Slides UpdatedDocument27 pagesManagerial Lesson 5 Slides UpdatedThuraNo ratings yet

- CATHECHISM Worksheet QDocument2 pagesCATHECHISM Worksheet QThuraNo ratings yet

- CostingDocument3 pagesCostingThuraNo ratings yet

- CAT3Document1 pageCAT3ThuraNo ratings yet

- Lesson 5 SlidesDocument39 pagesLesson 5 SlidesThuraNo ratings yet

- Accrual Accounting vs. Cash Basis Accounting: What's The Difference?Document1 pageAccrual Accounting vs. Cash Basis Accounting: What's The Difference?ThuraNo ratings yet

- GAAP: Understanding It and The 10 Key Principles: U.S. Public Companies Must Follow GAAP For Their Financial StatementsDocument1 pageGAAP: Understanding It and The 10 Key Principles: U.S. Public Companies Must Follow GAAP For Their Financial StatementsThuraNo ratings yet

- What Is The Financial Accounting Standards Board (FASB) ?Document1 pageWhat Is The Financial Accounting Standards Board (FASB) ?ThuraNo ratings yet

- Costs of Production Exercise - GdocDocument7 pagesCosts of Production Exercise - GdocThuraNo ratings yet

- Marketing Environment Essay PlanDocument1 pageMarketing Environment Essay PlanThuraNo ratings yet

- Page 1 of 1574Document1,574 pagesPage 1 of 1574ThuraNo ratings yet

- Learn European Portuguese in 30 Day PlanDocument9 pagesLearn European Portuguese in 30 Day PlanThuraNo ratings yet

- Learn Xtra Exam Revision Accounting Part 1 - QDocument31 pagesLearn Xtra Exam Revision Accounting Part 1 - QThuraNo ratings yet

- EnglishDocument3 pagesEnglishThuraNo ratings yet

- 6BusinessAndIndustry (CBCS Aug-Sept 2021)Document2 pages6BusinessAndIndustry (CBCS Aug-Sept 2021)ThuraNo ratings yet

- An Introduction To InternshipsDocument4 pagesAn Introduction To InternshipsThuraNo ratings yet

- 7SoftCoreCommunicationSkills (CBCS Aug-Sept 2021)Document2 pages7SoftCoreCommunicationSkills (CBCS Aug-Sept 2021)ThuraNo ratings yet

- 1bs0 - 02 May 2019 Paper 1 Ms Edexcel Gcse BusinessDocument22 pages1bs0 - 02 May 2019 Paper 1 Ms Edexcel Gcse BusinessThuraNo ratings yet

- Information TechnologyDocument35 pagesInformation TechnologyThuraNo ratings yet

- Nan Mudhalvan Content Full PDFDocument15 pagesNan Mudhalvan Content Full PDFSwethaNo ratings yet

- Partnership OperationsDocument16 pagesPartnership OperationsobaldefrenchNo ratings yet

- EP60010 Funding New Venture PDFDocument2 pagesEP60010 Funding New Venture PDFRajat AgrawalNo ratings yet

- Hidalgo Kimberly Midterm HW1Document37 pagesHidalgo Kimberly Midterm HW1Eunie AquinoNo ratings yet

- Consolidated Balance Sheet: I. AssetsDocument7 pagesConsolidated Balance Sheet: I. AssetsSatishNo ratings yet

- Afs 2019 PDFDocument38 pagesAfs 2019 PDFArchie LlanoNo ratings yet

- Translation Exposure Part 1Document31 pagesTranslation Exposure Part 1Magzoub MohaNo ratings yet

- Sec. Cert. - CooperativeDocument2 pagesSec. Cert. - CooperativeMaribeth BlaquirNo ratings yet

- Chapter 3.auditing Concepts and ToolsDocument18 pagesChapter 3.auditing Concepts and ToolsHussen AbdulkadirNo ratings yet

- Auditor Switching: Management Turnover, Qualified Opinion, Audit Delay, Financial DistressDocument6 pagesAuditor Switching: Management Turnover, Qualified Opinion, Audit Delay, Financial DistressADELIA FILDZAH NADHILAHNo ratings yet

- Audit December 2017 EngDocument17 pagesAudit December 2017 EngNthabiseng ButsanaNo ratings yet

- WWW - Edutap.co - In: Forex Markets - Video 1Document51 pagesWWW - Edutap.co - In: Forex Markets - Video 1SaumyaNo ratings yet

- GSIS TEMPLATE Fire Insurance Application Form (TRAD)Document3 pagesGSIS TEMPLATE Fire Insurance Application Form (TRAD)Ronan MaquidatoNo ratings yet

- Indian Securities Market ReviewDocument221 pagesIndian Securities Market ReviewSunil Suppannavar100% (1)

- Memorandum of Understanding: N. LILAWATHI W/o: Late. NEMURI KUMAR GOUD, Age: 40 Yrs, OccDocument3 pagesMemorandum of Understanding: N. LILAWATHI W/o: Late. NEMURI KUMAR GOUD, Age: 40 Yrs, OccMarkandeya -The Fire100% (1)

- Issai 200Document41 pagesIssai 200ateam4984No ratings yet

- Policy Certificate 18205997585Document4 pagesPolicy Certificate 18205997585VISHESH JAISWALNo ratings yet

- Analysis of Financial Leverage On Profitability and RiskDocument90 pagesAnalysis of Financial Leverage On Profitability and RiskRajesh BathulaNo ratings yet

- Chapter 2 - FADocument23 pagesChapter 2 - FANouh Al-SayyedNo ratings yet

- Quiz 1 Answers KeyDocument3 pagesQuiz 1 Answers KeyDesiree100% (1)

- Audit Report - Plan Indonesia - HKNO - 020919Document6 pagesAudit Report - Plan Indonesia - HKNO - 020919Huwwa YakhsyaNo ratings yet

- BIRD Lucknow - Study-on-SHG-Federations - Summary PDFDocument14 pagesBIRD Lucknow - Study-on-SHG-Federations - Summary PDFgopalvNo ratings yet

- Transcript of Warren Buffett Interview With FCICDocument23 pagesTranscript of Warren Buffett Interview With FCICSantangel's ReviewNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument4 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceHarshavardhan A KNo ratings yet

- Term Insurance PlansDocument7 pagesTerm Insurance PlansPratiksha KambleNo ratings yet

- New Okhla Industrial Development Authority: GSTIN: 09AAALN0120A1ZV - New Bill Cum Challan For Water ChargesDocument1 pageNew Okhla Industrial Development Authority: GSTIN: 09AAALN0120A1ZV - New Bill Cum Challan For Water ChargesmahipkumarNo ratings yet

- Genral Project (Genaral Insurance and Its Impoact in IndiaDocument84 pagesGenral Project (Genaral Insurance and Its Impoact in Indiapooja pawarNo ratings yet

- Financial Reporting and Analysis 6Th Edition Full ChapterDocument41 pagesFinancial Reporting and Analysis 6Th Edition Full Chapterwilliam.decker273100% (23)

- Chapter Two-The Financial Environment: Markets, Institutions and Investment BanksDocument4 pagesChapter Two-The Financial Environment: Markets, Institutions and Investment Banksmaquesurat ferdousNo ratings yet

- AS 19 Leases: Bright LightsDocument7 pagesAS 19 Leases: Bright LightsRamNo ratings yet

Double Entry: What It Means in Accounting and How It's Used: 80% Touchless AP Processing

Double Entry: What It Means in Accounting and How It's Used: 80% Touchless AP Processing

Uploaded by

ThuraOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Double Entry: What It Means in Accounting and How It's Used: 80% Touchless AP Processing

Double Entry: What It Means in Accounting and How It's Used: 80% Touchless AP Processing

Uploaded by

ThuraCopyright:

Available Formats

EDUCATION NEWS SIMULATOR YOUR MONEY ADVISORS ACADEMY

CORPORATE FINANCE ACCOUNTING Advertisement

Double Entry: What It Means

in Accounting and How It's

Used

By ADAM HAYES Updated March 20, 2021

Reviewed by DAVID KINDNESS

Fact checked by AMANDA BELLUCCO-CHATHAM

Investopedia / Jessica Olah

What Is Double Entry?

Double entry, a fundamental concept underlying present-day bookkeeping and

accounting, states that every financial transaction has equal and opposite

effects in at least two different accounts. It is used to satisfy the accounting

equation:

Assets = Liabilities + Equity

With a double entry system, credits are offset by debits in a general ledger or T-

account.

Advertisement

80% touchless

AP processing.

No templates. No pre-

work.

CLICK

CLICK TO

TO PLAY

PLAY Make your Workday work

smarter for you with our AI-

powered Autonomous AP.

1:17

Double Entry appzen.com

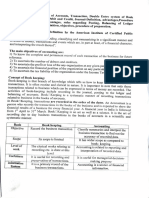

The Basics of Double Entry

In the double-entry system, transactions are recorded in terms

of debits and credits. Since a debit in one account offsets a credit in another, Learn More

the sum of all debits must equal the sum of all credits. The double-entry system

of bookkeeping standardizes the accounting process and improves the

accuracy of prepared financial statements, allowing for improved detection of

errors.

Types of Accounts

Bookkeeping and accounting are ways of measuring, recording, and

communicating a firm's financial information. A business transaction is an Advertisement

economic event that is recorded for accounting/bookkeeping purposes. In

general terms, it is a business interaction between economic entities, such as

customers and businesses or vendors and businesses.

Under the systematic process of accounting, these interactions are generally

classified into accounts. There are seven different types of accounts that all

business transactions can be classified:

Assets

Liabilities

Equities

Revenue

Expenses

Gains

Losses

Bookkeeping and accounting track changes in each account as a company

continues operations.

Debits and Credits

Debits and credits are essential to the double entry system. In accounting, a

debit refers to an entry on the left side of an account ledger, and credit refers to

an entry on the right side of an account ledger. To be in balance, the total of

debits and credits for a transaction must be equal. Debits do not always equate

to increases and credits do not always equate to decreases.

A debit may increase one account while decreasing another. For example, a

debit increases asset accounts but decreases liability and equity accounts,

which supports the general accounting equation of Assets = Liabilities +

Equity. On the income statement, debits increase the balances in expense and

loss accounts, while credits decrease their balances. Debits decrease revenue

and gains account balances, while credits increase their balances.

The Double-Entry Accounting System

Double-entry bookkeeping was developed in the mercantile period of Europe

to help rationalize commercial transactions and make trade more efficient. It

also helped merchants and bankers understand their costs and profits. Some

thinkers have argued that double-entry accounting was a key calculative

technology responsible for the birth of capitalism.

The accounting equation forms the foundation of the double-entry accounting

and is a concise representation of a concept that expands into the complex,

expanded and multi-item display of the balance sheet. The balance sheet is

based on the double-entry accounting system where total assets of a company

are equal to the total of liabilities and shareholder equity.

Essentially, the representation equates all uses of capital (assets) to all sources

of capital (where debt capital leads to liabilities and equity capital leads to

shareholders' equity). For a company keeping accurate accounts, every single

business transaction will be represented in at least of its two accounts.

For instance, if a business takes a loan from a financial entity like a bank, the

borrowed money will raise the company's assets and the loan liability will also

rise by an equivalent amount. If a business buys raw material by paying cash, it

will lead to an increase in the inventory (asset) while reducing cash capital

(another asset). Because there are two or more accounts affected by every

transaction carried out by a company, the accounting system is referred to as

double-entry accounting.

This practice ensures that the accounting equation always remains balanced –

that is, the left side value of the equation will always match with the right side

value.

KEY TAKEAWAYS

Double-entry refers to an accounting concept whereby assets =

liabilities + owners' equity.

In the double-entry system, transactions are recorded in terms of

debits and credits.

Double-entry bookkeeping was developed in the mercantile period of

Europe to help rationalize commercial transactions and make trade

more efficient.

The emergence of double-entry has been linked to the birth of

capitalism.

Real World Example of Double Entry

A bakery purchases a fleet of refrigerated delivery trucks on credit; the total

credit purchase was $250,000. The new set of trucks will be used in business

operations and will not be sold for at least 10 years—their estimated useful life.

To account for the credit purchase, entries must be made in their respective

accounting ledgers. Because the business has accumulated more assets, a debit

to the asset account for the cost of the purchase ($250,000) will be made. To

account for the credit purchase, a credit entry of $250,000 will be made to notes

payable. The debit entry increases the asset balance and the credit entry

increases the notes payable liability balance by the same amount.

Double entries can also occur within the same class. If the bakery's purchase

was made with cash, a credit would be made to cash and a debit to asset, still

resulting in a balance.

Compete Risk Free with $100,000 in Virtual

Cash

Put your trading skills to the test with our FREE Stock Simulator. Compete with

thousands of Investopedia traders and trade your way to the top! Submit trades

in a virtual environment before you start risking your own money. Practice

trading strategies so that when you're ready to enter the real market, you've

had the practice you need. Try our Stock Simulator today >>

PART OF

Guide to Accounting

CURRENTLY READING UP NEXT

Double Entry: What It Debit Definition: Credit Closing Entry

Means in Accounting Meaning and Its

and How It's Used Relationship to Credit

42 of 51 43 of 51 44 of 51 45 of 51

Related Terms

How a General Ledger Works With Double-Entry Accounting

Along With Examples

A general ledger is a record-keeping system for a company’s financial data, with debit and

credit account records validated by a trial balance. more

Debit Definition: Meaning and Its Relationship to Credit

A debit is an accounting entry that results in either an increase in assets or a decrease in

liabilities on a company’s balance sheet. more

What Is the Accounting Equation, and How Do You Calculate

Partner Links

It?

The accounting equation defines a company's total assets as the sum of its liabilities and Listen to the Investopedia Express podcast on

shareholders' equity. more Spotify

Learn to trade stocks by investing $100,000

Trial Balance: Definition, How It Works, Purpose, and virtual dollars...

Requirements

Get daily insights on what's moving the markets

A trial balance is a bookkeeping worksheet in which the balances of all ledgers are

and why it matters..

compiled into equal debit and credit account column totals. more

Sign up for our daily newsletters

Reconciliation in Account Definition, Purpose, and Types

Reconciliation is an accounting process that compares two sets of records to check that

figures are correct, and can be used for personal or business reconciliations. more

What Is Accrual Accounting, and How Does It Work?

Accrual accounting is where a business records revenue or expenses when a transaction

occurs using the double-entry accounting method. more

Related Articles

Accounting ACCOUNTING

The 8 Important Steps in the Accounting

Cycle

ACCOUNTING

What Is Double Entry Bookkeeping and

How's It Fit in General Ledger?

ACCOUNTING

Accrued Expenses vs. Accounts Payable:

What's the Difference?

ACCOUNTING

General Ledger vs. General Journal: What's

the Difference?

accountant ACCOUNTING

analyzing financial How to Calculate Credit and Debit

information

Balances in a General Ledger

Business ACCOUNTING

Planning Reporting Requirements of Contingent

Liabilities and GAAP Compliance

About Us Terms of Use Dictionary

Editorial Policy Advertise News

Privacy Policy Contact Us Careers

TRUSTe

California Privacy

Notice

# A B C D E F G H I J K L M N O P Q R S T U V W X Y Z

Investopedia is part of the Dotdash Meredith publishing family. We've updated our Privacy Policy, which will go in to effect on September 1, 2022. Review

our Privacy Policy

You might also like

- Double Entry BookkeepingDocument2 pagesDouble Entry BookkeepingGauravNo ratings yet

- What A Journal Is in Accounting, Investing, and TradingDocument1 pageWhat A Journal Is in Accounting, Investing, and TradingThuraNo ratings yet

- Module 4 - Double Entry Bookkeeping System and The Accounting EquationDocument9 pagesModule 4 - Double Entry Bookkeeping System and The Accounting EquationMark Christian BrlNo ratings yet

- Acc 7Document1 pageAcc 7Maxine FalcoNo ratings yet

- Unit 1 MADocument23 pagesUnit 1 MATheresa BrownNo ratings yet

- Module 2 - Double Entry Bookkeeping System and The Accounting EquationDocument9 pagesModule 2 - Double Entry Bookkeeping System and The Accounting EquationPrincess Joy CabreraNo ratings yet

- Basic Accounting Module 3Document72 pagesBasic Accounting Module 3Prince Varry LaureanoNo ratings yet

- 2double EntryDocument22 pages2double EntryJhoanNo ratings yet

- Module 2 - Double Entry Bookkeeping System and The Accounting EquationDocument9 pagesModule 2 - Double Entry Bookkeeping System and The Accounting EquationPrincess Joy CabreraNo ratings yet

- CHAPTER 3 Accounting Cycle (I)Document33 pagesCHAPTER 3 Accounting Cycle (I)Zemene HailuNo ratings yet

- ACFAR ReviewDocument39 pagesACFAR ReviewYza IgartaNo ratings yet

- Vaibhaw Iom AssingnDocument7 pagesVaibhaw Iom Assingnapi-3696990No ratings yet

- Reading Material AccountantDocument123 pagesReading Material Accountantsatyanweshi truthseeker100% (1)

- Basic Accounting For IT Part IIDocument4 pagesBasic Accounting For IT Part IImailbag6No ratings yet

- The Definitive and Comparative of Fundamentals of Accountancy, Business and ManagementDocument2 pagesThe Definitive and Comparative of Fundamentals of Accountancy, Business and ManagementEdlene Marielle ToribioNo ratings yet

- Debit and Credit RulesDocument4 pagesDebit and Credit RulesDanica VetuzNo ratings yet

- Ccounting Principles: Prepared by Christina SososutiksnoDocument47 pagesCcounting Principles: Prepared by Christina SososutiksnohattumercyNo ratings yet

- Acount BitDocument1 pageAcount BitOrbin SunnyNo ratings yet

- Q1 Week 3Document23 pagesQ1 Week 3Theresa Louiza PascualNo ratings yet

- Double Entry Book Keeping System Class 12 AccountDocument11 pagesDouble Entry Book Keeping System Class 12 AccountDixit PhuyalNo ratings yet

- Chapter 2 The Accounting CycleDocument63 pagesChapter 2 The Accounting CycleMULATNo ratings yet

- Basic Accounting ConceptsDocument2 pagesBasic Accounting ConceptsKhurram BaigNo ratings yet

- Accounting System (Compatibility Mode) PDFDocument10 pagesAccounting System (Compatibility Mode) PDFAftab AlamNo ratings yet

- Unit 1 PoaDocument12 pagesUnit 1 Poajigyasa.pNo ratings yet

- Simplified Notes Unit 1 and 2Document4 pagesSimplified Notes Unit 1 and 2John Paul Gaylan100% (1)

- Ita L3Document44 pagesIta L3kuloskiNo ratings yet

- Basic Accounting Concepts, Conventions, Bases & Policies, Concept of Balance SheetDocument44 pagesBasic Accounting Concepts, Conventions, Bases & Policies, Concept of Balance SheetVivan Menezes86% (7)

- Definition of AccountingDocument9 pagesDefinition of AccountingarvinapriskaNo ratings yet

- Accountacy Trial BalanceDocument5 pagesAccountacy Trial BalanceNihar patraNo ratings yet

- ACCTG 1 Week 4 - Recording Business TransactionsDocument17 pagesACCTG 1 Week 4 - Recording Business TransactionsReygie FabrigaNo ratings yet

- Double-Entry Book-KeepingDocument6 pagesDouble-Entry Book-KeepingFarman AfzalNo ratings yet

- Accounting ProcessDocument36 pagesAccounting ProcessYnnej GemNo ratings yet

- Basic AccountingDocument40 pagesBasic Accountingwajeeh100% (1)

- Accounting Essay - What Is Double Entry BookkkeepingDocument1 pageAccounting Essay - What Is Double Entry BookkkeepingyannaNo ratings yet

- Title /course Code Principles of AccountingDocument6 pagesTitle /course Code Principles of AccountingM Noaman AkbarNo ratings yet

- Introduction To Accounting and FinanceDocument39 pagesIntroduction To Accounting and FinanceEngr Muhammad RohanNo ratings yet

- Accounting 101 Chapter 1Document39 pagesAccounting 101 Chapter 1Md. Riyad Mahmud 183-15-11991No ratings yet

- FoundationDocument14 pagesFoundationpramod singhNo ratings yet

- Zelalem: What Is The Accounting Equation?Document5 pagesZelalem: What Is The Accounting Equation?edosa. bedasaNo ratings yet

- Accounting AssignmentDocument6 pagesAccounting AssignmentSyed Sheraz Ahmed ShahNo ratings yet

- EntrepreneurshipHandout Week 5Document6 pagesEntrepreneurshipHandout Week 5Pio GuiretNo ratings yet

- Unit 1Document40 pagesUnit 1v9510491No ratings yet

- Basics of Financial AccountingDocument9 pagesBasics of Financial AccountingVinayKChaubeyNo ratings yet

- Assignment (Fundamentals of Book - Keeping & Accounting)Document25 pagesAssignment (Fundamentals of Book - Keeping & Accounting)api-370836989% (9)

- Acc1 Lesson Week10Document18 pagesAcc1 Lesson Week10KeiNo ratings yet

- Accounting - Group 2Document30 pagesAccounting - Group 2Angeline EsguerraNo ratings yet

- PrintyDocument6 pagesPrinty2023-1-95-018No ratings yet

- Introduction To Accounting: Accounting Is Basically About Storing Financial InformationDocument98 pagesIntroduction To Accounting: Accounting Is Basically About Storing Financial InformationAgs OliviaNo ratings yet

- Techno 101 FinalsDocument6 pagesTechno 101 FinalsGella myka SamsonNo ratings yet

- CHAPTER 3 The Accounting Cycle (I)Document33 pagesCHAPTER 3 The Accounting Cycle (I)Addisalem Mesfin0% (2)

- Module 02 - Financial AccountingDocument11 pagesModule 02 - Financial AccountingJohn Martin L. AilesNo ratings yet

- Basics of AccountingDocument11 pagesBasics of AccountinganbarasinghNo ratings yet

- Financial Accounting, 4eDocument49 pagesFinancial Accounting, 4eZulfiqarNo ratings yet

- Review of The Accounting ProcessDocument10 pagesReview of The Accounting ProcessFranz TagubaNo ratings yet

- Living in The Information AgeDocument45 pagesLiving in The Information AgeMahesh SindhaNo ratings yet

- Fra Notes JyotiDocument62 pagesFra Notes JyotiJyotirmayee NaikNo ratings yet

- Caie Igcse Accounting 0452 Theory v2Document24 pagesCaie Igcse Accounting 0452 Theory v2Haaris UsmanNo ratings yet

- Chapter 1: Financialapplications Fundamentals of AccountingDocument60 pagesChapter 1: Financialapplications Fundamentals of AccountingSTEVE WAYNE100% (1)

- Chart of Accounts (COA) Definition: Examples and How It WorksDocument1 pageChart of Accounts (COA) Definition: Examples and How It WorksThuraNo ratings yet

- Holy Ghost CatDocument2 pagesHoly Ghost CatThuraNo ratings yet

- SwahiliDocument4 pagesSwahiliThuraNo ratings yet

- Conversational PhrasesDocument2 pagesConversational PhrasesThuraNo ratings yet

- AB S1L5 080414 Sapod101Document5 pagesAB S1L5 080414 Sapod101ThuraNo ratings yet

- JESUS CAT True-God-ManDocument1 pageJESUS CAT True-God-ManThuraNo ratings yet

- AlphabetDocument2 pagesAlphabetThuraNo ratings yet

- Managerial Lesson 3 Slides UpdatedDocument75 pagesManagerial Lesson 3 Slides UpdatedThuraNo ratings yet

- Unit-2 EXTERNAL COMMUNICATIONDocument39 pagesUnit-2 EXTERNAL COMMUNICATIONThuraNo ratings yet

- CAT5Document3 pagesCAT5ThuraNo ratings yet

- Managerial Lesson 4 Slides UpdatedDocument32 pagesManagerial Lesson 4 Slides UpdatedThuraNo ratings yet

- Managerial Lesson 5 Slides UpdatedDocument27 pagesManagerial Lesson 5 Slides UpdatedThuraNo ratings yet

- CATHECHISM Worksheet QDocument2 pagesCATHECHISM Worksheet QThuraNo ratings yet

- CostingDocument3 pagesCostingThuraNo ratings yet

- CAT3Document1 pageCAT3ThuraNo ratings yet

- Lesson 5 SlidesDocument39 pagesLesson 5 SlidesThuraNo ratings yet

- Accrual Accounting vs. Cash Basis Accounting: What's The Difference?Document1 pageAccrual Accounting vs. Cash Basis Accounting: What's The Difference?ThuraNo ratings yet

- GAAP: Understanding It and The 10 Key Principles: U.S. Public Companies Must Follow GAAP For Their Financial StatementsDocument1 pageGAAP: Understanding It and The 10 Key Principles: U.S. Public Companies Must Follow GAAP For Their Financial StatementsThuraNo ratings yet

- What Is The Financial Accounting Standards Board (FASB) ?Document1 pageWhat Is The Financial Accounting Standards Board (FASB) ?ThuraNo ratings yet

- Costs of Production Exercise - GdocDocument7 pagesCosts of Production Exercise - GdocThuraNo ratings yet

- Marketing Environment Essay PlanDocument1 pageMarketing Environment Essay PlanThuraNo ratings yet

- Page 1 of 1574Document1,574 pagesPage 1 of 1574ThuraNo ratings yet

- Learn European Portuguese in 30 Day PlanDocument9 pagesLearn European Portuguese in 30 Day PlanThuraNo ratings yet

- Learn Xtra Exam Revision Accounting Part 1 - QDocument31 pagesLearn Xtra Exam Revision Accounting Part 1 - QThuraNo ratings yet

- EnglishDocument3 pagesEnglishThuraNo ratings yet

- 6BusinessAndIndustry (CBCS Aug-Sept 2021)Document2 pages6BusinessAndIndustry (CBCS Aug-Sept 2021)ThuraNo ratings yet

- An Introduction To InternshipsDocument4 pagesAn Introduction To InternshipsThuraNo ratings yet

- 7SoftCoreCommunicationSkills (CBCS Aug-Sept 2021)Document2 pages7SoftCoreCommunicationSkills (CBCS Aug-Sept 2021)ThuraNo ratings yet

- 1bs0 - 02 May 2019 Paper 1 Ms Edexcel Gcse BusinessDocument22 pages1bs0 - 02 May 2019 Paper 1 Ms Edexcel Gcse BusinessThuraNo ratings yet

- Information TechnologyDocument35 pagesInformation TechnologyThuraNo ratings yet

- Nan Mudhalvan Content Full PDFDocument15 pagesNan Mudhalvan Content Full PDFSwethaNo ratings yet

- Partnership OperationsDocument16 pagesPartnership OperationsobaldefrenchNo ratings yet

- EP60010 Funding New Venture PDFDocument2 pagesEP60010 Funding New Venture PDFRajat AgrawalNo ratings yet

- Hidalgo Kimberly Midterm HW1Document37 pagesHidalgo Kimberly Midterm HW1Eunie AquinoNo ratings yet

- Consolidated Balance Sheet: I. AssetsDocument7 pagesConsolidated Balance Sheet: I. AssetsSatishNo ratings yet

- Afs 2019 PDFDocument38 pagesAfs 2019 PDFArchie LlanoNo ratings yet

- Translation Exposure Part 1Document31 pagesTranslation Exposure Part 1Magzoub MohaNo ratings yet

- Sec. Cert. - CooperativeDocument2 pagesSec. Cert. - CooperativeMaribeth BlaquirNo ratings yet

- Chapter 3.auditing Concepts and ToolsDocument18 pagesChapter 3.auditing Concepts and ToolsHussen AbdulkadirNo ratings yet

- Auditor Switching: Management Turnover, Qualified Opinion, Audit Delay, Financial DistressDocument6 pagesAuditor Switching: Management Turnover, Qualified Opinion, Audit Delay, Financial DistressADELIA FILDZAH NADHILAHNo ratings yet

- Audit December 2017 EngDocument17 pagesAudit December 2017 EngNthabiseng ButsanaNo ratings yet

- WWW - Edutap.co - In: Forex Markets - Video 1Document51 pagesWWW - Edutap.co - In: Forex Markets - Video 1SaumyaNo ratings yet

- GSIS TEMPLATE Fire Insurance Application Form (TRAD)Document3 pagesGSIS TEMPLATE Fire Insurance Application Form (TRAD)Ronan MaquidatoNo ratings yet

- Indian Securities Market ReviewDocument221 pagesIndian Securities Market ReviewSunil Suppannavar100% (1)

- Memorandum of Understanding: N. LILAWATHI W/o: Late. NEMURI KUMAR GOUD, Age: 40 Yrs, OccDocument3 pagesMemorandum of Understanding: N. LILAWATHI W/o: Late. NEMURI KUMAR GOUD, Age: 40 Yrs, OccMarkandeya -The Fire100% (1)

- Issai 200Document41 pagesIssai 200ateam4984No ratings yet

- Policy Certificate 18205997585Document4 pagesPolicy Certificate 18205997585VISHESH JAISWALNo ratings yet

- Analysis of Financial Leverage On Profitability and RiskDocument90 pagesAnalysis of Financial Leverage On Profitability and RiskRajesh BathulaNo ratings yet

- Chapter 2 - FADocument23 pagesChapter 2 - FANouh Al-SayyedNo ratings yet

- Quiz 1 Answers KeyDocument3 pagesQuiz 1 Answers KeyDesiree100% (1)

- Audit Report - Plan Indonesia - HKNO - 020919Document6 pagesAudit Report - Plan Indonesia - HKNO - 020919Huwwa YakhsyaNo ratings yet

- BIRD Lucknow - Study-on-SHG-Federations - Summary PDFDocument14 pagesBIRD Lucknow - Study-on-SHG-Federations - Summary PDFgopalvNo ratings yet

- Transcript of Warren Buffett Interview With FCICDocument23 pagesTranscript of Warren Buffett Interview With FCICSantangel's ReviewNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument4 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceHarshavardhan A KNo ratings yet

- Term Insurance PlansDocument7 pagesTerm Insurance PlansPratiksha KambleNo ratings yet

- New Okhla Industrial Development Authority: GSTIN: 09AAALN0120A1ZV - New Bill Cum Challan For Water ChargesDocument1 pageNew Okhla Industrial Development Authority: GSTIN: 09AAALN0120A1ZV - New Bill Cum Challan For Water ChargesmahipkumarNo ratings yet

- Genral Project (Genaral Insurance and Its Impoact in IndiaDocument84 pagesGenral Project (Genaral Insurance and Its Impoact in Indiapooja pawarNo ratings yet

- Financial Reporting and Analysis 6Th Edition Full ChapterDocument41 pagesFinancial Reporting and Analysis 6Th Edition Full Chapterwilliam.decker273100% (23)

- Chapter Two-The Financial Environment: Markets, Institutions and Investment BanksDocument4 pagesChapter Two-The Financial Environment: Markets, Institutions and Investment Banksmaquesurat ferdousNo ratings yet

- AS 19 Leases: Bright LightsDocument7 pagesAS 19 Leases: Bright LightsRamNo ratings yet