Professional Documents

Culture Documents

Debit Definition: Meaning and Its Relationship To Credit: Related Terms

Debit Definition: Meaning and Its Relationship To Credit: Related Terms

Uploaded by

ThuraOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Debit Definition: Meaning and Its Relationship To Credit: Related Terms

Debit Definition: Meaning and Its Relationship To Credit: Related Terms

Uploaded by

ThuraCopyright:

Available Formats

EDUCATION NEWS SIMULATOR YOUR MONEY ADVISORS ACADEMY

Advertisement

CORPORATE FINANCE ACCOUNTING Advertisement

Debit Definition: Meaning

and Its Relationship to Credit

By ADAM HAYES Updated July 22, 2022

Table of Contents

Reviewed by THOMAS BROCK

What Is the Difference

Fact checked by YARILET PEREZ

Between a Debit and a

Credit?

Normal Accounting

Balances

Debit Notes

Margin Debit

Contra Accounts

What is a debit?

What’s the difference

between a debit and a

credit?

Does debit always mean an

increase?

The Bottom Line

Investopedia / Madelyn Goodnight

A debit is an accounting entry that results in either an increase in assets or a

decrease in liabilities on a company’s balance sheet. In fundamental

accounting, debits are balanced by credits, which operate in the exact opposite

direction.

For instance, if a firm takes out a loan to purchase equipment, it would

simultaneously debit fixed assets and credit a liabilities account, depending on

the nature of the loan. The abbreviation for debit is sometimes “dr,” which is

short for “debtor.”

KEY TAKEAWAYS

A debit is an accounting entry that creates a decrease in liabilities or

an increase in assets.

Advertisement

In double-entry bookkeeping, all debits are made on the left side of

the ledger and must be offset with corresponding credits on the right

side of the ledger.

On a balance sheet, positive values for assets and expenses are

debited, and negative balances are credited.

Debit

What Is the Difference Between a Debit and a Credit?

A debit is a feature found in all double-entry accounting systems. Debits are the

opposite of credits. Debits represent money being paid out of a particular

account; credits represent money being paid in.

In a standard journal entry, all debits are placed as the top lines, while all

credits are listed on the line below debits. When using T-accounts, a debit is the

left side of the chart while a credit is the right side. Debits and credits are

utilized in the trial balance and adjusted trial balance to ensure that all entries

balance. The total dollar amount of all debits must equal the total dollar

amount of all credits. In other words, finances must balance.

A dangling debit is a debit balance with no offsetting credit balance that would

allow it to be written off. It occurs in financial accounting and reflects

discrepancies in a company’s balance sheet, as well as when a company

purchases goodwill or services to create a debit.

For example, if Barnes & Noble sold $20,000 worth of books, it would debit its

cash account $20,000 and credit its books or inventory account $20,000. This

double-entry system shows that the company now has $20,000 more in cash

and a corresponding $20,000 less in books.

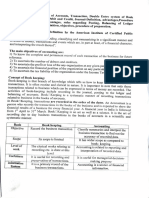

Normal Accounting Balances

Certain types of accounts have natural balances in financial accounting

systems. Assets and expenses have natural debit balances. This means that

positive values for assets and expenses are debited and negative balances are

credited.

For example, upon the receipt of $1,000 cash, a journal entry would include a

debit of $1,000 to the cash account in the balance sheet, because cash is

increasing. If another transaction involves payment of $500 in cash, the journal

entry would have a credit to the cash account of $500 because cash is being

reduced. In effect, a debit increases an expense account in the income

statement, and a credit decreases it.

Liabilities, revenues, and equity accounts have natural credit balances. If a

debit is applied to any of these accounts, the account balance has decreased.

For example, a debit to the accounts payable account in the balance sheet

indicates a reduction of a liability. The offsetting credit is most likely a credit to

cash because the reduction of a liability means that the debt is being paid and

cash is an outflow. For the revenue accounts in the income statement, debit

entries decrease the account, while a credit points to an increase to the

account.

Important: The concept of debits and offsetting credits are the

cornerstone of double-entry accounting.

Debit Notes

Debit notes are a form of proof that one business has created a legitimate debit

entry in the course of dealing with another business (B2B). This might occur

when a purchaser returns materials to a supplier and needs to validate the

reimbursed amount. In this case, the purchaser issues a debit note reflecting

the accounting transaction.

A business might issue a debit note in response to a received credit note.

Mistakes (often interest charges and fees) in a sales, purchase, or loan invoice

might prompt a firm to issue a debit note to help correct the error.

A debit note or debit receipt is very similar to an invoice. The main difference is

that invoices always show a sale, where debit notes and debit receipts reflect

adjustments or returns on transactions that have already taken place.

Margin Debit

When buying on margin, investors borrow funds from their brokerage and then

combine those funds with their own to purchase a greater number of shares

than they would have been able to purchase with their own funds. The debit

amount recorded by the brokerage in an investor’s account represents the cash

cost of the transaction to the investor.

The debit balance, in a margin account, is the amount of money owed by the

customer to the broker (or another lender) for funds advanced to purchase

securities. The debit balance is the amount of funds that the customer must

put into their margin account, following the successful execution of a security

purchase order, to properly settle the transaction.

The debit balance can be contrasted with the credit balance. While a long

margin position has a debit balance, a margin account with only short

positions will show a credit balance. The credit balance is the sum of the

proceeds from a short sale and the required margin amount under Regulation

T. [1] [2]

Sometimes, a trader’s margin account has both long and short margin

positions. Adjusted debit balance is the amount in a margin account that is

owed to the brokerage firm, minus profits on short sales and balances in a

special miscellaneous account (SMA).

Contra Accounts

Certain accounts are used for valuation purposes and are displayed on the

financial statements opposite the normal balances. These accounts are called

contra accounts. The debit entry to a contra account has the opposite effect as

it would to a normal account.

For example, an allowance for uncollectable accounts offsets the asset

accounts receivable. Because the allowance is a negative asset, a debit actually

decreases the allowance. A contra asset’s debit is the opposite of a normal

account’s debit, which increases the asset.

What is a debit?

A debit is an accounting entry that results in either an increase in assets or a

decrease in liabilities on a company’s balance sheet.

What’s the difference between a debit and a credit?

Debits are the opposite of credits. Debits represent money being paid out of a

particular account. Credits represent money being paid in.

Does debit always mean an increase?

It means an increase in assets. All accounts that normally contain a debit

balance will increase in amount when a debit (left column) is added to them

and reduced when a credit (right column) is added to them. The types of

accounts to which this rule applies are expenses, assets, and dividends.

The Bottom Line

A debit is an accounting entry that creates a decrease in liabilities or an

increase in assets. In double-entry bookkeeping, all debits are made on the left

side of the ledger and must be offset with corresponding credits on the right

side of the ledger. On a balance sheet, positive values for assets and expenses

are debited, and negative balances are credited.

Compete Risk Free with $100,000 in Virtual

Cash

Put your trading skills to the test with our FREE Stock Simulator. Compete with

thousands of Investopedia traders and trade your way to the top! Submit

trades in a virtual environment before you start risking your own money.

Practice trading strategies so that when you're ready to enter the real market,

you've had the practice you need. Try our Stock Simulator today >>

ARTICLE SOURCES

PART OF

Guide to Accounting

CURRENTLY READING UP NEXT

Debit Definition: Credit Closing Entry What Is an Invoice? It's

Meaning and Its Parts and Why They Are

Relationship to Credit Important

43 of 51 44 of 51 45 of 51 46 of 51

Related Terms

Drawing Account: What It Is and How It Works

A drawing account is maintained to track assets withdrawn from a business by its

owners. It is used primarily by sole proprietorships or partnerships. more

Contra Account Definition: Types and Example

A contra account is an account used in a general ledger to reduce the value of a related

account. A contra account's natural balance is the opposite of the associated account.

more

How a General Ledger Works With Double-Entry Accounting

Along With Examples Partner Links

A general ledger is a record-keeping system for a company’s financial data, with debit Sign up for our daily newsletters

and credit account records validated by a trial balance. more

Get daily insights on what's moving the markets

Trial Balance: Definition, How It Works, Purpose, and and why it matters..

Requirements Learn to trade stocks by investing $100,000

A trial balance is a bookkeeping worksheet in which the balances of all ledgers are virtual dollars...

compiled into equal debit and credit account column totals. more

Listen to the Investopedia Express podcast on

Spotify

Understanding Accounts Payable (AP) With Examples and

How to Record AP

"Accounts payable" (AP) refers to an account within the general ledger representing a

company's obligation to pay off a short-term obligations to its creditors or suppliers.

more

Reconciliation in Account Definition, Purpose, and Types

Reconciliation is an accounting process that compares two sets of records to check that

figures are correct, and can be used for personal or business reconciliations. more

Related Articles

accountant ACCOUNTING

analyzing financial How to Calculate Credit and Debit

information

Balances in a General Ledger

Accounting ACCOUNTING

The 8 Important Steps in the Accounting

Cycle

An accountant ACCOUNTING

sitting at the desk What Credit (CR) and Debit (DR) Mean on a

using the

Balance Sheet

calculator.

Paper with the ACCOUNTING

word "Accrual" and Accrued Expense vs. Accrued Interest:

a pen.

What's the Difference?

FINANCIAL STATEMENTS

Why Is Deferred Revenue Treated As a

Liability?

FINANCIAL STATEMENTS

How Do You Read a Balance Sheet?

About Us Terms of Use Dictionary

Editorial Policy Advertise News

Privacy Policy Contact Us Careers

TRUSTe

California Privacy

Notice

# A B C D E F G H I J K L M N O P Q R S T U V W X Y Z

Investopedia is part of the Dotdash Meredith publishing family. We've updated our Privacy Policy, which will go in to effect on September 1, 2022. Review

our Privacy Policy

You might also like

- Accountancy Class 11th T.S. Grewal Book PDF New Edition (Part 2) Pdf. by HELPING HAND ?? PDFDocument128 pagesAccountancy Class 11th T.S. Grewal Book PDF New Edition (Part 2) Pdf. by HELPING HAND ?? PDFGehna Jain80% (40)

- Tata Motors Dupont and Altman Z-Score AnalysisDocument4 pagesTata Motors Dupont and Altman Z-Score AnalysisLAKHAN TRIVEDINo ratings yet

- Book Keeping 101 by Tom Clendon 1688995453Document6 pagesBook Keeping 101 by Tom Clendon 1688995453amayarNo ratings yet

- Basis of Debit and CreditDocument17 pagesBasis of Debit and CreditBanaras KhanNo ratings yet

- Accounting101 ManualSampleDocument4 pagesAccounting101 ManualSampleAdam KobeNo ratings yet

- Acc. ch-6 Key Terms and Chapter Summary-6Document2 pagesAcc. ch-6 Key Terms and Chapter Summary-6AARYAN JESWANINo ratings yet

- Bookkeeping NCIII Lecture 3.1Document59 pagesBookkeeping NCIII Lecture 3.1jvtg994No ratings yet

- Acc1 Lesson Week10Document18 pagesAcc1 Lesson Week10KeiNo ratings yet

- Lesson 3 The Recording Process - MarabDocument39 pagesLesson 3 The Recording Process - Marabmasrurislam6No ratings yet

- Chapter 5Document19 pagesChapter 5Flordeliza HalogNo ratings yet

- Analyzing and Recording TransactionsDocument43 pagesAnalyzing and Recording TransactionsAndrea ValdezNo ratings yet

- Debit and Credit RulesDocument4 pagesDebit and Credit RulesDanica VetuzNo ratings yet

- Financial Accounting Module 2 SummaryDocument2 pagesFinancial Accounting Module 2 Summarymohita.gupta4No ratings yet

- The Recording Process: Weygandt - Kieso - KimmelDocument68 pagesThe Recording Process: Weygandt - Kieso - Kimmelatia fariaNo ratings yet

- Chapter 3 The Accounting Equation The Double Entry SystemDocument7 pagesChapter 3 The Accounting Equation The Double Entry System2023302256No ratings yet

- Double Entry and TB (Part 1)Document9 pagesDouble Entry and TB (Part 1)Aymen Asad KhanNo ratings yet

- Fundamentals of Accounting 3 1Document5 pagesFundamentals of Accounting 3 1Ale EalNo ratings yet

- Chapter Two - Fundamentals of AcctDocument14 pagesChapter Two - Fundamentals of AcctGedionNo ratings yet

- Analyzing and Recording TransactionDocument24 pagesAnalyzing and Recording TransactionĐàm Quang Thanh TúNo ratings yet

- The Expanded Ledger: Revenue, Expense, and DrawingsDocument37 pagesThe Expanded Ledger: Revenue, Expense, and DrawingsNavroopamNo ratings yet

- Teaching DemoDocument5 pagesTeaching DemoTenNo ratings yet

- Topic 2 Double Entry SystemDocument3 pagesTopic 2 Double Entry SystemRey ViloriaNo ratings yet

- 4.4 Bad and Doubtful DebtsDocument14 pages4.4 Bad and Doubtful Debtsnurainbello8No ratings yet

- 2 - The Recording ProcessDocument36 pages2 - The Recording Processimtiaz_uddin_2No ratings yet

- Accounting: An Information System Communicates Financial Information To The Users ThroughDocument37 pagesAccounting: An Information System Communicates Financial Information To The Users ThroughAmruth SaiNo ratings yet

- Accounting: Assets Liabilities + Equity A L + EDocument4 pagesAccounting: Assets Liabilities + Equity A L + EJohn LeeNo ratings yet

- Financial Accounting CH 2Document12 pagesFinancial Accounting CH 2Karim KhaledNo ratings yet

- TOPIC 4 Principle - Of.double - EntryDocument4 pagesTOPIC 4 Principle - Of.double - EntryNurul Ain Binti Abd RahimNo ratings yet

- LESSON 7 The Accounting EquationDocument3 pagesLESSON 7 The Accounting EquationUnamadable UnleomarableNo ratings yet

- Control AccountsDocument1 pageControl AccountsFalak MuscatiNo ratings yet

- The Golden Rules of AccountingDocument1 pageThe Golden Rules of AccountingRamesh ManiNo ratings yet

- Accounting - Group 2Document30 pagesAccounting - Group 2Angeline EsguerraNo ratings yet

- Principle of Double Entry & Trial Balance: Prepared By: Nurul Hassanah HamzahDocument35 pagesPrinciple of Double Entry & Trial Balance: Prepared By: Nurul Hassanah HamzahNur Amira NadiaNo ratings yet

- First SpetDocument30 pagesFirst Spetteem teerutNo ratings yet

- Basic Accounting and Reporting (Ballada, W., Et. Al) Chapter 3 - The Accounting Equation and The Double Entry System The AccountDocument5 pagesBasic Accounting and Reporting (Ballada, W., Et. Al) Chapter 3 - The Accounting Equation and The Double Entry System The AccountJohn Joseph100% (4)

- Debits and CreditsDocument4 pagesDebits and CreditsNebojša SavanovićNo ratings yet

- Accounting Journal EntriesDocument9 pagesAccounting Journal EntriesadnanNo ratings yet

- Basic AccountingDocument2 pagesBasic Accountingram sagarNo ratings yet

- The Recording Process: Learning ObjectivesDocument25 pagesThe Recording Process: Learning ObjectivesPhạm Thúy HằngNo ratings yet

- Chapter 4Document18 pagesChapter 42023661912No ratings yet

- ACC Plus - Ch.4 - Analysis of Transactions and The Rules of Debit and CreditDocument8 pagesACC Plus - Ch.4 - Analysis of Transactions and The Rules of Debit and CreditJeffrey Jazz BugashNo ratings yet

- Accounting: Assets Liabilities + Equity A L + EDocument4 pagesAccounting: Assets Liabilities + Equity A L + EjermaineNo ratings yet

- Double-Entry Book-KeepingDocument6 pagesDouble-Entry Book-KeepingFarman AfzalNo ratings yet

- The Recording ProcessDocument39 pagesThe Recording ProcessTasim IshraqueNo ratings yet

- The Recording Process: Pertemuan Ke-3Document39 pagesThe Recording Process: Pertemuan Ke-3Nadhiela AdaniNo ratings yet

- ACFC101 Chap 2 Double Entry System - 93410Document10 pagesACFC101 Chap 2 Double Entry System - 93410FUN & TECHNOLGYNo ratings yet

- 8 Debtors, Creditors, and Promisory NotesDocument30 pages8 Debtors, Creditors, and Promisory NotesERICK MLINGWANo ratings yet

- 8 Debtors, Creditors, and Promisory Notes UDDocument41 pages8 Debtors, Creditors, and Promisory Notes UDERICK MLINGWANo ratings yet

- Lec 5Document56 pagesLec 5Sara Abdelrahim MakkawiNo ratings yet

- Transaction 1: Company A Sold Its Products at $120 and Received The Full Amount in CashDocument24 pagesTransaction 1: Company A Sold Its Products at $120 and Received The Full Amount in CashPoonam RedkarNo ratings yet

- Accounting Basics - NotesDocument37 pagesAccounting Basics - NotesBeatrice RadulescuNo ratings yet

- AccounBM1 - Recording Business TransactionsDocument41 pagesAccounBM1 - Recording Business TransactionsKathlyn LabetaNo ratings yet

- H What Is ReconciliationDocument3 pagesH What Is ReconciliationDanica BalinasNo ratings yet

- Accountacy Trial BalanceDocument5 pagesAccountacy Trial BalanceNihar patraNo ratings yet

- Merchandise: Periodic Inventory MethodDocument11 pagesMerchandise: Periodic Inventory MethodLav Casal CorpuzNo ratings yet

- Chapter 2 - Recording ProcessDocument35 pagesChapter 2 - Recording ProcessMinetteGabrielNo ratings yet

- Financial Accounting, 4e: Weygandt, Kieso, & KimmelDocument67 pagesFinancial Accounting, 4e: Weygandt, Kieso, & KimmelBestboyshoyoNo ratings yet

- LESSON 4 Part II Without AnswerDocument3 pagesLESSON 4 Part II Without AnswerJulliene Sanchez DamianNo ratings yet

- Bookkeeping: Learning The Simple And Effective Methods of Effective Methods Of Bookkeeping (Easy Way To Master The Art Of Bookkeeping)From EverandBookkeeping: Learning The Simple And Effective Methods of Effective Methods Of Bookkeeping (Easy Way To Master The Art Of Bookkeeping)No ratings yet

- The Barrington Guide to Property Management Accounting: The Definitive Guide for Property Owners, Managers, Accountants, and Bookkeepers to ThriveFrom EverandThe Barrington Guide to Property Management Accounting: The Definitive Guide for Property Owners, Managers, Accountants, and Bookkeepers to ThriveNo ratings yet

- Teeter-Totter Accounting: Your Visual Guide to Understanding Debits and Credits!From EverandTeeter-Totter Accounting: Your Visual Guide to Understanding Debits and Credits!Rating: 2 out of 5 stars2/5 (1)

- Conversational PhrasesDocument2 pagesConversational PhrasesThuraNo ratings yet

- SwahiliDocument4 pagesSwahiliThuraNo ratings yet

- Managerial Lesson 4 Slides UpdatedDocument32 pagesManagerial Lesson 4 Slides UpdatedThuraNo ratings yet

- AlphabetDocument2 pagesAlphabetThuraNo ratings yet

- AB S1L5 080414 Sapod101Document5 pagesAB S1L5 080414 Sapod101ThuraNo ratings yet

- JESUS CAT True-God-ManDocument1 pageJESUS CAT True-God-ManThuraNo ratings yet

- Unit-2 EXTERNAL COMMUNICATIONDocument39 pagesUnit-2 EXTERNAL COMMUNICATIONThuraNo ratings yet

- What Is The Financial Accounting Standards Board (FASB) ?Document1 pageWhat Is The Financial Accounting Standards Board (FASB) ?ThuraNo ratings yet

- Managerial Lesson 3 Slides UpdatedDocument75 pagesManagerial Lesson 3 Slides UpdatedThuraNo ratings yet

- Holy Ghost CatDocument2 pagesHoly Ghost CatThuraNo ratings yet

- Managerial Lesson 5 Slides UpdatedDocument27 pagesManagerial Lesson 5 Slides UpdatedThuraNo ratings yet

- Double Entry: What It Means in Accounting and How It's Used: 80% Touchless AP ProcessingDocument1 pageDouble Entry: What It Means in Accounting and How It's Used: 80% Touchless AP ProcessingThuraNo ratings yet

- CAT5Document3 pagesCAT5ThuraNo ratings yet

- Chart of Accounts (COA) Definition: Examples and How It WorksDocument1 pageChart of Accounts (COA) Definition: Examples and How It WorksThuraNo ratings yet

- Lesson 5 SlidesDocument39 pagesLesson 5 SlidesThuraNo ratings yet

- Accrual Accounting vs. Cash Basis Accounting: What's The Difference?Document1 pageAccrual Accounting vs. Cash Basis Accounting: What's The Difference?ThuraNo ratings yet

- Learn European Portuguese in 30 Day PlanDocument9 pagesLearn European Portuguese in 30 Day PlanThuraNo ratings yet

- CATHECHISM Worksheet QDocument2 pagesCATHECHISM Worksheet QThuraNo ratings yet

- CAT3Document1 pageCAT3ThuraNo ratings yet

- GAAP: Understanding It and The 10 Key Principles: U.S. Public Companies Must Follow GAAP For Their Financial StatementsDocument1 pageGAAP: Understanding It and The 10 Key Principles: U.S. Public Companies Must Follow GAAP For Their Financial StatementsThuraNo ratings yet

- CostingDocument3 pagesCostingThuraNo ratings yet

- 7SoftCoreCommunicationSkills (CBCS Aug-Sept 2021)Document2 pages7SoftCoreCommunicationSkills (CBCS Aug-Sept 2021)ThuraNo ratings yet

- Marketing Environment Essay PlanDocument1 pageMarketing Environment Essay PlanThuraNo ratings yet

- 1bs0 - 02 May 2019 Paper 1 Ms Edexcel Gcse BusinessDocument22 pages1bs0 - 02 May 2019 Paper 1 Ms Edexcel Gcse BusinessThuraNo ratings yet

- Costs of Production Exercise - GdocDocument7 pagesCosts of Production Exercise - GdocThuraNo ratings yet

- 6BusinessAndIndustry (CBCS Aug-Sept 2021)Document2 pages6BusinessAndIndustry (CBCS Aug-Sept 2021)ThuraNo ratings yet

- Page 1 of 1574Document1,574 pagesPage 1 of 1574ThuraNo ratings yet

- An Introduction To InternshipsDocument4 pagesAn Introduction To InternshipsThuraNo ratings yet

- EnglishDocument3 pagesEnglishThuraNo ratings yet

- Information TechnologyDocument35 pagesInformation TechnologyThuraNo ratings yet

- Hindustan Petroleum Corporation (HPCL In) : Q4FY19 Result UpdateDocument6 pagesHindustan Petroleum Corporation (HPCL In) : Q4FY19 Result UpdatePraveen KumarNo ratings yet

- An Overview of IFRS 6 Exploration For and Evaluation of Mineral Resources PDFDocument22 pagesAn Overview of IFRS 6 Exploration For and Evaluation of Mineral Resources PDFJax TellerNo ratings yet

- MC4104 - Unit 1Document13 pagesMC4104 - Unit 1Senthil KumarNo ratings yet

- Accounting For OverheadDocument5 pagesAccounting For OverheadAdrian Paul BengilNo ratings yet

- Chapter 03 The Reporting Entity and Consolidated Financial Statements Answer KeyDocument21 pagesChapter 03 The Reporting Entity and Consolidated Financial Statements Answer Keyangel perezNo ratings yet

- Sample Construction Company Inc FinanciaDocument24 pagesSample Construction Company Inc FinanciaJamilene PandanNo ratings yet

- 12 Accountancy sp04Document45 pages12 Accountancy sp04Priyansh AryaNo ratings yet

- Sample Exam QuestionsDocument16 pagesSample Exam QuestionsMadina SuleimenovaNo ratings yet

- Chapter 05 Solution of Fundamental of Financial Accouting by EDMONDS (4th Edition)Document196 pagesChapter 05 Solution of Fundamental of Financial Accouting by EDMONDS (4th Edition)Awais Azeemi100% (3)

- Group Companies Chapter 3 Lecture9Document9 pagesGroup Companies Chapter 3 Lecture9Faint MokgokongNo ratings yet

- Accounting Lesson Plan Grade 8Document6 pagesAccounting Lesson Plan Grade 8Orphy ArifenNo ratings yet

- Current AssetsDocument3 pagesCurrent AssetsFelicity CabreraNo ratings yet

- Module 4 Exercises - JFCDocument10 pagesModule 4 Exercises - JFCJARED DARREN ONGNo ratings yet

- Prudential Public Limited Company (PUK)Document2 pagesPrudential Public Limited Company (PUK)Carlos FrancoNo ratings yet

- Spiceland 9e CH 09 SM Solutions ManualDocument83 pagesSpiceland 9e CH 09 SM Solutions ManualStephen Andrei VillanuevaNo ratings yet

- Statement of Changes in Equity - ExampleDocument3 pagesStatement of Changes in Equity - ExampleTami ChitandaNo ratings yet

- Chapter 18: Audit of Long-Term Liabilities: Review QuestionsDocument11 pagesChapter 18: Audit of Long-Term Liabilities: Review Questionstrixia nuylesNo ratings yet

- Chirkhwa Hydro Power Ltd.Document36 pagesChirkhwa Hydro Power Ltd.Manita KunwarNo ratings yet

- Class 5 Project Selection ExerciseDocument18 pagesClass 5 Project Selection ExerciseVinodshankar BhatNo ratings yet

- Mcq-Retirement DeathDocument3 pagesMcq-Retirement Deathrachit.ag04No ratings yet

- Chapter 3Document49 pagesChapter 3Laijanie Claire Gonzales AlvarezNo ratings yet

- Phillips PLL 6e Chap07Document58 pagesPhillips PLL 6e Chap07snsahaNo ratings yet

- Investment Corporation of BangladeshDocument220 pagesInvestment Corporation of BangladeshzamanasifNo ratings yet

- Duplichecker Plagiarism ReportDocument2 pagesDuplichecker Plagiarism ReportDeepak YadavNo ratings yet

- 8 Fair Value Measurement 6/12: 7.5 Capital DisclosuresDocument9 pages8 Fair Value Measurement 6/12: 7.5 Capital Disclosuresusman aliNo ratings yet

- Peru, BOP Analytic Presentation (Millions of U.S. Dollars)Document13 pagesPeru, BOP Analytic Presentation (Millions of U.S. Dollars)Oscar MontufarNo ratings yet

- Grier, Waymond A. - Credit Analysis of Financial Institutions-Euromoney Books (2012) - 151-300Document150 pagesGrier, Waymond A. - Credit Analysis of Financial Institutions-Euromoney Books (2012) - 151-300HILDA IDANo ratings yet

- Attachmentsresources90316 101442 Advance Accounting Nov. 2008 PDFDocument25 pagesAttachmentsresources90316 101442 Advance Accounting Nov. 2008 PDFDipen AdhikariNo ratings yet

- Quizes For FINALSDocument21 pagesQuizes For FINALSSaeym SegoviaNo ratings yet