Professional Documents

Culture Documents

Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt Contributions

Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt Contributions

Uploaded by

Estephen EncenzoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt Contributions

Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt Contributions

Uploaded by

Estephen EncenzoCopyright:

Available Formats

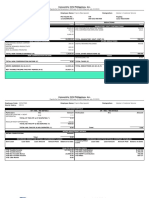

Concentrix CVG Philippines, Inc.

Payslip for the Period July 30 2023-August 12 2023 (Pay-out: August 18 2023)

Employee Code: 102027315 Employee Name: Estephen Encenzo Designation: Advisor I, Technical Support

Hourly Salary: 100.58

Tax Code: SSS No. Phil Health No. TIN Pagibig

09-4612204-2 16-025849395-5 382-583-790-000 1212-5318-1938

EARNINGS DEDUCTIONS

Description Hrs Total Description Total

TAXABLE EARNINGS MANDATORY GOVT CONTRIBUTIONS

BASIC PAY 48.00 4,827.83 SSS CONTRIBUTION EMPLOYEE SHARE 472.50

SERVICE INCENTIVE LEAVE 32.00 3,218.56

Total Night Differential 42.00 633.65

Total Overtime 1.00 125.73

COMPLEXITY ALLOWANCE -

689.66

PRORATED

TOTAL TAXABLE EARNINGS (A) 9,495.43 TOTAL MANDATORY GOVT CONT (D) 472.50

NON-TAXABLE EARNINGS OTHER DEDUCTIONS

RICE ALLOWANCE PRORATED 919.54

TOTAL NON-TAXABLE EARNINGS (B) 919.54 TOTAL OTHER DEDUCTIONS (E) 0.00

NON COMPENSATION INCOME TAXES

CONNECTIVITY REIMBURSEMENT 1,500.00

TOTAL NON COMPENSATION INCOME (C) 1,500.00 TOTAL TAXES (F) 0.00

GROSS EARNINGS (G) (A+B+C) 11,914.97 TOTAL DEDUCTIONS (H) (D+E+F) 472.50

NET TAXABLE INCOME THIS PAY PERIOD (A-D) 9,022.93

NET EARNINGS (G-H) 11,442.47

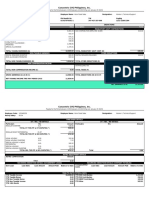

Concentrix CVG Philippines, Inc.

Payslip for the Period July 30 2023-August 12 2023 (Pay-out: August 18 2023)

Employee Code: 102027315 Employee Name: Estephen Encenzo Designation: Advisor I, Technical Support

Hourly Salary: 100.58

TIME BASED DETAILS

OT / HOL / ND DETAILS OT / HOL / ND DETAILS

Particulars Hrs Amount Particulars Hrs Amount

REGULAR OVERTIME 1.00 125.73

TOTAL OT THIS PP & OT DISPUTES (*) 125.73

REGULAR NIGHT DIFFERENTIAL 42.00 633.65

TOTAL ND THIS PP & ND DISPUTES (*) 633.65

TOTAL HOL THIS PP & HOL DISPUTES (*) 0.00 Total 0.00

RETRO ADJUSTMENT DETAILS

RETRO COMPUTATION Amount

Total 0.00

RECURRING DEDUCTION DETAILS (GOVERNMENT LOANS) RECURRING DEDUCTION DETAILS (COMPANY PAYABLES)

Company/Other

Govt Loan Loan Date Loan Amount Amount Paid Balance to Date Loan Date Loan Amount Amount Paid Balance to Date

Loans

YEAR-TO-DATE PAYROLL DATA

YTD Taxable Income 138,046.30 YTD SSS Contribution 8,617.50

YTD Taxable Bonus 0.00 YTD PHI Contribution 2,800.16

YTD Non Taxable Bonus 11,143.69 YTD HDMF Contribution 800.00

YTD Non Taxable Income 0.00 YTD Wtax 239.06

YTD 13th Month 0.00

You might also like

- Aryaduta JakartaDocument3 pagesAryaduta JakartaDeny Saputra0% (1)

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt Contributionszayn malikNo ratings yet

- Payslip: Employee Details Payment & Leave DetailsDocument2 pagesPayslip: Employee Details Payment & Leave DetailsKushal Malhotra100% (3)

- IndividualPayslip wOldPayout PDFDocument1 pageIndividualPayslip wOldPayout PDFFawaz SayedNo ratings yet

- S A 20190725Document4 pagesS A 20190725krishaNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsZeth Nathaniel TominesNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDj HandsomeNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt Contributionskeen yumangNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionspaacostanNo ratings yet

- CombinepdfDocument5 pagesCombinepdfKaye ApostolNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsVincent FerrerNo ratings yet

- CombinepdfDocument5 pagesCombinepdfKaye ApostolNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsKlevin LloydNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsVincent FerrerNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsVincent FerrerNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsVincent FerrerNo ratings yet

- Payslip July 7Document2 pagesPayslip July 7Clarke BlakeNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsMeleisa joy BeslyNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsKaye ApostolNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsVincent FerrerNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsAngela AradaNo ratings yet

- PayslipDocument2 pagesPayslipjzeb.gonzales18No ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt Contributionsxander fordNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsRICHYBOY SALACNo ratings yet

- Payslip YemplateDocument2 pagesPayslip YemplateCristine GonzalesNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsZarah BernabeNo ratings yet

- Encore Receivable Management, Inc. Philippine BranchDocument2 pagesEncore Receivable Management, Inc. Philippine BranchSamantha Joyce Valera TaezaNo ratings yet

- Concentrix Daksh Services Philippines CorporationDocument2 pagesConcentrix Daksh Services Philippines CorporationMike Gonzales JulianNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsVanessa SarraNo ratings yet

- Concentrix Daksh Services Philippines CorporationDocument2 pagesConcentrix Daksh Services Philippines CorporationThea HeterozygoesNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsArmina Aguilar BaisNo ratings yet

- Concentrix Daksh Services Philippines CorporationDocument2 pagesConcentrix Daksh Services Philippines CorporationThea HeterozygoesNo ratings yet

- Oct 15Document2 pagesOct 15Jane CruzNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsRICHYBOY SALACNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt Contributionsxander fordNo ratings yet

- 3483571f b300 4c77 b086 fb15ff8fccDocument2 pages3483571f b300 4c77 b086 fb15ff8fcckim JuabanNo ratings yet

- Concentrix Daksh Services Philippines CorporationDocument3 pagesConcentrix Daksh Services Philippines CorporationThea HeterozygoesNo ratings yet

- Combine PDFDocument3 pagesCombine PDFKaye ApostolNo ratings yet

- PAYSLIP Feb-2023Document1 pagePAYSLIP Feb-2023prasunaNo ratings yet

- Dem-Soho 2324 208 75508 100469Document2 pagesDem-Soho 2324 208 75508 100469Ayush ChouhanNo ratings yet

- PaySlip December2022 3Document1 pagePaySlip December2022 3pankaj kumarNo ratings yet

- Payslip JUN 2019Document2 pagesPayslip JUN 2019Tuneer SahaNo ratings yet

- Vision RX Lab Private Limited P-4, Kasba Industrial Estate, Phase - 1, Kolkata - 107Document1 pageVision RX Lab Private Limited P-4, Kasba Industrial Estate, Phase - 1, Kolkata - 107Pravin KhopadeNo ratings yet

- Atul Pandey (EEA1546)Document1 pageAtul Pandey (EEA1546)atulpandey15marchNo ratings yet

- Salary SlipDocument3 pagesSalary Slippankaj singhNo ratings yet

- Salary Slip Format For HCLDocument1 pageSalary Slip Format For HCLrajkannamdu100% (1)

- Earnings Taxable Non Taxable Hours Total: OvertimeDocument1 pageEarnings Taxable Non Taxable Hours Total: OvertimeIamRachaelNo ratings yet

- Mar 2024Document2 pagesMar 2024Tuneer SahaNo ratings yet

- Pay Slip For The Month of January 2018: Earnings Deductons ReimbursementsDocument1 pagePay Slip For The Month of January 2018: Earnings Deductons ReimbursementsBHAUSAHEB KOKANENo ratings yet

- Uber Philippines Centre of Excellence LLC: PayslipDocument1 pageUber Philippines Centre of Excellence LLC: PayslipKatey Yumul - OdiamanNo ratings yet

- Remuneration Statement: For The Month of October 2020Document1 pageRemuneration Statement: For The Month of October 2020AZIZ REHMANNo ratings yet

- PAYSLIP Jan-2023Document1 pagePAYSLIP Jan-2023prasunaNo ratings yet

- Payslip - 722 - 244572 - 30 - 2022Document2 pagesPayslip - 722 - 244572 - 30 - 2022kostadinkastefanova900No ratings yet

- 1.roshan Kumar-Payslip - May-2022Document1 page1.roshan Kumar-Payslip - May-2022Burning to ShineNo ratings yet

- Pay Is inDocument2 pagesPay Is inJo YelleNo ratings yet

- PAYSLIP FOR THE MONTH OF September, 2023: Toyota Kirloskar Motor PVT LTDDocument2 pagesPAYSLIP FOR THE MONTH OF September, 2023: Toyota Kirloskar Motor PVT LTDevilghostevilghost666No ratings yet

- Salary Slip - Quess)Document1 pageSalary Slip - Quess)gamersingh098123No ratings yet

- A - (EE & ER) - PDOC-Date Paid-2022-08-05Document1 pageA - (EE & ER) - PDOC-Date Paid-2022-08-05armanf2020zNo ratings yet

- Gannon Dunkerley & Co., LTD.: Civil Engineering Division, HyderabadDocument1 pageGannon Dunkerley & Co., LTD.: Civil Engineering Division, HyderabadNaga GeeNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Right to Work?: Assessing India's Employment Guarantee Scheme in BiharFrom EverandRight to Work?: Assessing India's Employment Guarantee Scheme in BiharNo ratings yet

- Business and Transfer Taxation Test BankDocument186 pagesBusiness and Transfer Taxation Test Bankprettyboiy19No ratings yet

- Introduction To Income TaxDocument7 pagesIntroduction To Income Taxsipabow760No ratings yet

- Flight TicketDocument1 pageFlight TicketnathisonsNo ratings yet

- 100 CR DeclarationDocument2 pages100 CR DeclarationOmkar VichareNo ratings yet

- Consultant Induction Program - Feedback Form: Questions Answer CommentsDocument1 pageConsultant Induction Program - Feedback Form: Questions Answer CommentsPrasad ReddNo ratings yet

- BankingDocument4 pagesBankingKurtis OconnorNo ratings yet

- Ken Age 31 and Amy Age 28 Booth Have Brought PDFDocument1 pageKen Age 31 and Amy Age 28 Booth Have Brought PDFhassan taimourNo ratings yet

- Bill of Exchange MCQDocument3 pagesBill of Exchange MCQsamegroup4100% (1)

- PT Cahaya - Kertas Kerja - JK, Bb. NSD, AjpDocument42 pagesPT Cahaya - Kertas Kerja - JK, Bb. NSD, Ajpmuhammadromihidayat23No ratings yet

- Donor's TaxDocument5 pagesDonor's TaxVernnNo ratings yet

- FA Assignment#4 Statement of Changes in Equity Company Name: Deepak NitriteDocument2 pagesFA Assignment#4 Statement of Changes in Equity Company Name: Deepak NitriteBhaktaNo ratings yet

- Electricity BillDocument1 pageElectricity Billkapurmohnish0% (2)

- GENMATHS Financial MathsDocument3 pagesGENMATHS Financial MathsAli HaidarNo ratings yet

- Addition To DPS P 102Document2 pagesAddition To DPS P 102roooyyNo ratings yet

- C B A A: Department of AccountancyDocument11 pagesC B A A: Department of AccountancyROMAR A. PIGANo ratings yet

- Accountancy Review Center (ARC) of The Philippines Inc.: Student HandoutsDocument8 pagesAccountancy Review Center (ARC) of The Philippines Inc.: Student HandoutsGoze, Cassandra JaneNo ratings yet

- January 31, 2021Document1 pageJanuary 31, 2021Юлия ПNo ratings yet

- Finance Policy Updated 01.03.16Document17 pagesFinance Policy Updated 01.03.16PartnersforinclusionNo ratings yet

- Economiccode PDFDocument35 pagesEconomiccode PDFRajib MahmudNo ratings yet

- Nach MandatesDocument11 pagesNach Mandatessrinivasa annamayya100% (2)

- Online Tax Payment PortalDocument1 pageOnline Tax Payment PortalNasim AktarNo ratings yet

- Vodafone Bill Nov MonthDocument14 pagesVodafone Bill Nov MonthTej PandyaNo ratings yet

- 71 Motijheel C/A Dhaka-1000 VAT Registration No: 001892527-0202 (VAT - 6.3)Document1 page71 Motijheel C/A Dhaka-1000 VAT Registration No: 001892527-0202 (VAT - 6.3)Md. Balayet Hossain ChowdhuryNo ratings yet

- Tax 2 - Midterm Quiz 1Document6 pagesTax 2 - Midterm Quiz 1Uy SamuelNo ratings yet

- Credit Note INY-NOTE-EHVL5XPKY08DJ4RMVR95MHNWWM 1634187510887Document1 pageCredit Note INY-NOTE-EHVL5XPKY08DJ4RMVR95MHNWWM 1634187510887AbhishekSinghPatelNo ratings yet

- Fwel2277 Payment CertificateDocument1 pageFwel2277 Payment CertificateArchie Joseph LlanaNo ratings yet

- Card SheetDocument21 pagesCard SheetJohn MillerNo ratings yet

- Booking Confirmation Letter and Payment Details-41Document2 pagesBooking Confirmation Letter and Payment Details-41RAMGOPAL GUPTANo ratings yet