Professional Documents

Culture Documents

Wolters Kluwer-OneSumX-Basel IV Vs Basel III Infographic

Wolters Kluwer-OneSumX-Basel IV Vs Basel III Infographic

Uploaded by

AlkOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Wolters Kluwer-OneSumX-Basel IV Vs Basel III Infographic

Wolters Kluwer-OneSumX-Basel IV Vs Basel III Infographic

Uploaded by

AlkCopyright:

Available Formats

Learn about end-to-end process From Data Integrity & Lineage to Finance & Risk Management, including credit

& market risk, operational,

Basel III vs Basel IV settlement, credit valuation adjustment, and counterparty credit risk. Not only can OneSumX for Basel IV's technology and expertise ensure

you comply with the Basel IV deadline and reporting obligations, but your teams can make timely, informed decisions to manage risk more

effectively, and optimize revenues.

11

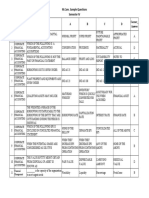

Due Diligence 1

Basel IV

Exposure to Corporates

Basel III

Basel IV : An Overview Not Present in Basel III Banks must take reasonable and adequate steps to assess the

operating and financial performance levels and trends through

Basel III Basel IV

Splitting Corporates in General Corporates & Specialized Lending

OneSumX for Basel IV

Claims on rated corporates including

10 internal credit analysis. insurance companies. Floor for identification of SME Corporates - Consolidated annual sales of

SCRA Grading

for Banks

Due diligence should, to the extent possible, be performed at Supervisors on national discretion can assign corporate counterparty <= €50 million

the solo entity level (with support of group or potential risk of RW more than 100% For jurisdictions that do not allow external ratings RW for “investment grade”

Basel III Basel IV group) to which there is a credit exposure. corporates is 65%, SME corporates is 85% and others is 100%

Not Present in Basel III SCRA Grade A - Grade A refers to exposures to banks, where the Exception -Due diligence does not apply to: Due Diligence requirements apply

counterparty bank has adequate capacity to meet their financial Sovereigns

commitments in a timely manner. Non-central government public sector entities (PSEs) 2

SCRA Grade B - Grade B refers to exposures to banks, where the counterparty

bank is subject to substantial credit risk, such as repayment capacities that are

Regulatory to Retail Exposure

dependent on stable or favorable economic or business conditions.

SCRA Grade C – Not Grade A and B. Grade C refers to higher credit risk exposures Basel III Basel IV

to banks, where the counterparty bank has material default risks and limited 75% RW for exposures qualifying as regulatory retail Splitting of regulatory retail into:

REGULATORY

margins of safety. Regulatory retail Qualification Criteria:

Orientation criteria – Exposure to person(s) or small

Regulatory retail (non-transactors) – Follow same

Regulatory retail Qualification Criteria as in Basel

Projections for business and ILAAP/

ICAAP

TIER 1 to 4

COMPLIANCE- business Regulatory retail (transactors) – facilities where balance is

Product criteria – Revolving credit, line of credit paid at each scheduled repayment date or no OD

CALCULATION +

REPORTING Basel Calculation And Regulatory Reporting 9 (e.g., credit cards, ODs), Personal loans & small

business facilities (excluding mortgages)

drawdowns for last 12 months

Other Retail – all, except, Regulatory retail (non-transactors)

Off Balance Sheet Granularity criteria – Aggregated exposure per & Regulatory retail (transactors)

100% Banks Need Each Of The Component Basel IV counterparty <0.2% of overall regulatory retail

Basel III

Off-Balance Sheet items converted to No maturity-based treatment for commitments. portfolio

Low Value Criteria – Maximum aggregated retail

Stress testing and projecting

credit exposures by using CCF. Specific Rules for calculation of credit equivalent amount of OTC

Specific Rules for calculation of credit derivates. exposure <= €1 million

liquidity (ILAAP)

equivalent amount of OTC derivates. A bank providing credit protection through a first-to-default or

second-to-default credit derivative is subject to capital

REG.

requirements on such instruments.

RWs for first to default credit derivates can be aggregated up to

3

Real Estate Exposure Class

COMPLIANCES +

PROJECTION

a maximum of 1250% multiplied by nominal amount.

Similar treatment for second or nth to default credit derivative Basel III Basel IV Saving time and cost by using

TIER 1 to 2

where asset with lowest risk weight can be excluded

(BUSINESS,STRESS

Support Business Scenarios + Integrated

Classifies real estate exposures as

Residential property & Commercial

Real Estate Classification

1. Regulatory real Estate

automation to speed up prudential

PLANNING)

Risk Stories property Regulatory residential real estate exposure not materially

risk reporting

8 ed Cred

diz

Residential property - Lending fully dependent on cash flows generated by the property.

Important For Risk Function + Larger Banks i

ar

secured by mortgages on residential Regulatory residential real estate exposure that are materially

Subordinated Debt property that is or will be occupied by the dependent on cash flows generated by the property.

tR

d

borrower, or that is rented Regulatory commercial real estate not materially dependent on

Stan

Basel III Basel IV

isk

RW for Residential property is 35% cash flows generated by the property.

Not a separate asset class, standard RW of

100% applies

RW of 150% to subordinated debt and capital

instruments threshold other than equities.

Commercial Real Estate Regulatory commercial real estate that are materially dependent Projections within the same solution

RW for Commercial Real Estate is 100% on cash flows generated by the property.

2. Other real Estate

3. Land acquisition development and construction (ADC) exposures.

V

Ba

lI

sel se

REG. 7 III v s B a Usage of exact regulatory metrics

COMPLIANCES Equity

+CONSOLIDATION

Basel III Basel IV

Regulatory Residential Real Estate – Not Materially dependent on (not proxies) in business projection

TIER 1 to 2

(PRUDENTIAL + cashflows from Property

Prudential Consolidation + Wide View Whole loan approach and Loan Splitting approach for RW 2. Other real Estate scenarios (stress, testing, forecasts,

FINANCE) Standard RW of 100% Standard RW of 100%

Loan Splitting Approach (Not Materially dependent on cashflows) Exposures to individuals – 75%

Important For Larger Banks + Finance RW of 400% to speculative unlisted equity exposures

Function

RW of 250% to all equity holdings except equity investments in funds;

Splitting tranche 1 - Risk weight of 20% is applied to the part of the

exposure up to 55% of the property value (based on Lien)

Exposures to SMEs 85%

RW of 150% for exposures materially dependent on cash flows

ILAAP, ICAAP) and for deal decision-

100% RW based on national discretion.

Equity investments in Funds:

Splitting tranche 2 – RW of counterparty to residual amount from

Splitting tranche 1

generated by property.

3. Land acquisition development and construction (ADC) exposures.

making

New approaches which include counterparty credit risk (CCR) as well Exposures to individuals – 75% Criteria 1 – RW of 100% based on Underwriting & Legal pre-sale

Look Through Approach (LTA) – most granular & risk sensitive – treats Exposures to SMEs 85% or pre-lease contracts

exposures as directly held by bank Regulatory Residential Real Estate – that are Materially dependent on Fallback RW 150% if criteria 1 does not met

Mandate based Approach (MBA)– uses information in equity fund’s cashflows from Property

mandate

Fall-back Approach – RW of 1250%

Partial use of these approaches are allowed based on certain qualifying

criteria 4

Leverage adjustment can be applied Exposure to Banks

Why Choose OneSumX for Leverage ratio – Total assets/Total Equity

Using LTA & MBA banks can use the formula

Capped at 1250%

Basel III

National supervisors to apply 1 approach

Basel IV

2 Approaches – ECRA (based on external ratings, similar to Option 2 in

Basel IV Brief

consistently for all banksa Basel 3) & SCRA (for unrated banks & jurisdictions that don’t allows

Finance, Risk and Regulatory 5

Risk weight one category less favorable

than that assigned to claims on the

external ratings)

SCRA Approach requires banks to classify bank exposures into one of

three risk-weight buckets (i.e. Grades A, B and C) and assign the

Basel IV is a regulatory framework that helps

6 sovereign of that country

banks meet goals beyond regulatory

Reporting ?

corresponding risk weights

Exposure Multilateral Development Exposure to Covered Bonds Exception - claims on banks in countries

'Base' Risk weight of Grade A is 40%, Grade B is 75% and Grade C is

with sovereigns rated BB+ to B- and on

Banks (MDS) Basel III Basel IV

Covered bonds are bonds issued by a bank or mortgage institution that are

banks in unrated countries RW will be

capped at 100%.

150%

Whereas the Risk weight for short term exposure of Grade A is 20%, compliance.

This asset class was not present in Basel 3

Long Successful Track Record in Basel Basel III Basel IV Treatment was similar to Banks exposure subject by law to special public supervision designed to protect bond holders.

Grade B is 50% and Grade C is 150%

To comply, banks are being called on to

class in Basel 3 Eligible Assets

and EU regulation support solutions 6 RW buckets, Based on option 2

applied for banks asset class

6 RW buckets

No use of short term RW allowed

Claims on, or guaranteed by, sovereigns, their central banks, public sector

entities or multilateral development banks examine risk in creative and demanding

0% RW for highly rated MDBs based on BCBS criteria

Unique single focus on Compliance for No use of short term RW allowed

0% RW for highly rated MDBs based on 50% RW for Banks incorporated in jurisdictions that do not allow

Claims secured by residential real estate that meet the specific criteria and LTV

<= 80% Option 2 – Based on external rating of the bank ways that forces them to rethink their

external ratings for regulatory purposes Claims secured by commercial real estate that meet the specific criteria and LTV Special treatment (except loans which already have

Finance, Risk and Reporting

BCBS criteria

<= 60%

Claims on, or guaranteed by banks that qualify for a 30% or lower risk weight.

150% RW)

Unrated long term – 50%

strategies and business models.

Integrated Finance, Risk & Reporting (capped at 15% of covered bond issuances)

Floors

Unrated short term (original maturity <=3 months) –

20% This ultimately allows them to enhance

Approach for Reconciliation by Design Nominal value of pool of assets by its issuer should not exceed nominal

outstanding by at least 10% growth, competitiveness and profitability - if

Minimum disclosure requirements

Solid organization, expertise and people they manage their organizations and their

to support your “Basel IV” journey data well.

You might also like

- Curriculum Map (Business Finance)Document6 pagesCurriculum Map (Business Finance)Juvilyn FelipeNo ratings yet

- Board of Survey Firearms: Regional Logistics and Research Development DivisionDocument17 pagesBoard of Survey Firearms: Regional Logistics and Research Development DivisionPSsg Abalos LouieNo ratings yet

- Chart of Accounts For Petroleum Exploration Company - Accounting-Financial-TDocument6 pagesChart of Accounts For Petroleum Exploration Company - Accounting-Financial-TJohnLAsia100% (1)

- Equity Research Methodology 031604Document1 pageEquity Research Methodology 031604vardashahid100% (1)

- MPS - IFRS 9 Financial Instruments V1)Document10 pagesMPS - IFRS 9 Financial Instruments V1)Fatima KhandwalaNo ratings yet

- Lecture 9 - Intangible AssetDocument9 pagesLecture 9 - Intangible AssetThảo HảiNo ratings yet

- Booklet Toolbox Basel4Document74 pagesBooklet Toolbox Basel4Rahajeng PramestiNo ratings yet

- Finance For Non-Financial ExecutivesDocument8 pagesFinance For Non-Financial ExecutivesImran ZahidNo ratings yet

- Sea Risk Basel III To Basel Iv2Document1 pageSea Risk Basel III To Basel Iv2abcNo ratings yet

- FORE School of Management Course Outline & Session PlanDocument4 pagesFORE School of Management Course Outline & Session PlanAru RanjanNo ratings yet

- Basel II Capital Accord SlidesDocument25 pagesBasel II Capital Accord SlidesAamir RazaNo ratings yet

- Essentials of Investments 8Th Edition by Bodie Full ChapterDocument41 pagesEssentials of Investments 8Th Edition by Bodie Full Chapteredward.wiggins427No ratings yet

- 100 TopicsDocument50 pages100 Topicsnikhils.ind18No ratings yet

- White Paper Solvency 2 Full Version 2012Document48 pagesWhite Paper Solvency 2 Full Version 2012UmbyisNo ratings yet

- PDFDocument347 pagesPDFkevin kimani chege100% (1)

- Unit 5: Business Finance: WWW - Carol.co - UkDocument3 pagesUnit 5: Business Finance: WWW - Carol.co - UkSylwia SdiriNo ratings yet

- Research Papers On Basel 2Document8 pagesResearch Papers On Basel 2c9r5wdf5100% (1)

- Financial Modelling 2016 PDFDocument25 pagesFinancial Modelling 2016 PDFĐỗ Đen Đổ Đỏ0% (1)

- Accounting Standards Full INCLUSING ANSWERSDocument235 pagesAccounting Standards Full INCLUSING ANSWERSAnsari Salman100% (1)

- Annual Report of IOCL 200Document1 pageAnnual Report of IOCL 200Nikunj ParmarNo ratings yet

- Bankability of ABB Solar Inverters 3AUA0000137644 EN RevB LowresDocument9 pagesBankability of ABB Solar Inverters 3AUA0000137644 EN RevB Lowresmiguelrobertosales337No ratings yet

- Pace BrochureDocument8 pagesPace BrochureHimanshuNo ratings yet

- Fundamentals of ABM 2 - MELCSDocument3 pagesFundamentals of ABM 2 - MELCSEngelie Pillado100% (5)

- PMR Form 2024.v2xlsDocument11 pagesPMR Form 2024.v2xlsleekwangtaoNo ratings yet

- Cost Analysis: Download Free Books atDocument36 pagesCost Analysis: Download Free Books atArun SharmaNo ratings yet

- Course Outline - Financial Accounting - FMG 27, IMG 12 & FM 1 - Prof. Vandana Gupta, Prof. Ambrish Gupta and Prof. HarshitaDocument3 pagesCourse Outline - Financial Accounting - FMG 27, IMG 12 & FM 1 - Prof. Vandana Gupta, Prof. Ambrish Gupta and Prof. HarshitaVineetNo ratings yet

- 11 01 03 Regulation Guide IntroductionDocument29 pages11 01 03 Regulation Guide IntroductionSiddharth JainNo ratings yet

- Full Download PDF of (Ebook PDF) Essentials of Investments 8th Edition by Bodie All ChapterDocument43 pagesFull Download PDF of (Ebook PDF) Essentials of Investments 8th Edition by Bodie All Chapterpalliskuswar100% (11)

- Ronak Somani CVDocument2 pagesRonak Somani CVS1626No ratings yet

- Accounts Intro 4Document1 pageAccounts Intro 4manishchd81No ratings yet

- Ebook PDF Financial Accounting For Mbas 6E by Easton Wild PDF Docx Full Chapter Chapter ScribdDocument41 pagesEbook PDF Financial Accounting For Mbas 6E by Easton Wild PDF Docx Full Chapter Chapter Scribdjeanette.rasmussen227100% (34)

- Corporate VentureDocument1 pageCorporate VentureRASHMI RASHMINo ratings yet

- Advanced Financial Modeling: Mergers and Acquisitions (M&A)Document38 pagesAdvanced Financial Modeling: Mergers and Acquisitions (M&A)Akshay SharmaNo ratings yet

- Corporate Accounting BCH: DSC-2.1Document2 pagesCorporate Accounting BCH: DSC-2.1PriyaNo ratings yet

- 3.4 Final Accounts TextbookDocument24 pages3.4 Final Accounts Textbookkayla1807115No ratings yet

- 2016 APAC Fit-Out Cost Guide - Occupier ProjectsDocument26 pages2016 APAC Fit-Out Cost Guide - Occupier ProjectsSkywardFire100% (1)

- Financial Reporting - SampleDocument42 pagesFinancial Reporting - Samplefchemtai4966No ratings yet

- Basel 2 - DeloitteDocument29 pagesBasel 2 - DeloitteSENTHIL KUMARNo ratings yet

- 6.operational Risk - Scenario Analysis Under Basel IIDocument18 pages6.operational Risk - Scenario Analysis Under Basel IIMirela Anca Schwartz GarlisteNo ratings yet

- Implementing Phase One of IFRS 9 Financial Instruments GL IFRSDocument24 pagesImplementing Phase One of IFRS 9 Financial Instruments GL IFRSAli Kreidieh100% (1)

- Financial Statement Analysis: Mcgraw-Hill/Irwin © The Mcgraw-Hill Companies, Inc., 2005Document50 pagesFinancial Statement Analysis: Mcgraw-Hill/Irwin © The Mcgraw-Hill Companies, Inc., 2005Kumail AbbasNo ratings yet

- BSBFIN601 Short Questions AnswersDocument13 pagesBSBFIN601 Short Questions AnswersMichael FelixNo ratings yet

- Qs - No A B C D Correct - Answer: Semester IVDocument5 pagesQs - No A B C D Correct - Answer: Semester IVSagar A BaverNo ratings yet

- Bank Limited: National Commercial Area DhakaDocument66 pagesBank Limited: National Commercial Area DhakaTasneef ChowdhuryNo ratings yet

- A B C D Private LimitedDocument22 pagesA B C D Private LimitedNIshithNo ratings yet

- BMCF5103 Aq Sept 2023Document7 pagesBMCF5103 Aq Sept 2023MohamedNo ratings yet

- Global Services Industry: Opportunities and ChallengesDocument4 pagesGlobal Services Industry: Opportunities and ChallengesEduardo ParraNo ratings yet

- AccountAbility Salary Survey 2010Document2 pagesAccountAbility Salary Survey 2010AccountAbility RecruitmentNo ratings yet

- S&P ERMethodologyDocument1 pageS&P ERMethodologyapi-3715003No ratings yet

- Financial Reporting WDocument345 pagesFinancial Reporting Wgordonomond2022No ratings yet

- Safety First Scenario AnalysisDocument18 pagesSafety First Scenario AnalysisAxo ZhangNo ratings yet

- Week AT Videos FAR Videos AP Videos Afar Videos MAS Videos TAX Videos RFBT VideosDocument2 pagesWeek AT Videos FAR Videos AP Videos Afar Videos MAS Videos TAX Videos RFBT VideosJeanette LampitocNo ratings yet

- M&A BundleDocument10 pagesM&A BundlegfraoterNo ratings yet

- P WC Final ReportDocument24 pagesP WC Final ReportHengky WijayantoNo ratings yet

- FMPR2 Module BookletDocument66 pagesFMPR2 Module BookletMarjorie Onggay MacheteNo ratings yet

- Accounting For Convertible Bonds Under IFRS 9: ArticlesDocument2 pagesAccounting For Convertible Bonds Under IFRS 9: Articleshur hussainNo ratings yet

- 00 BOMA RetailsDocument2 pages00 BOMA RetailsPercy SuarezNo ratings yet

- All F7 (FR) Technical Articles: (Association of Chartered Certified Accountants)Document160 pagesAll F7 (FR) Technical Articles: (Association of Chartered Certified Accountants)feysal shurieNo ratings yet

- Business Finance - Brainnest Lecture 3Document28 pagesBusiness Finance - Brainnest Lecture 3Amira Abdulshikur JemalNo ratings yet

- M5 Strategic ControlDocument38 pagesM5 Strategic ControlMetch ApphiaNo ratings yet

- Introduction and Roadmap of Ind As For 1st 2nd August Pune Branch Programme CA. Zaware SirDocument51 pagesIntroduction and Roadmap of Ind As For 1st 2nd August Pune Branch Programme CA. Zaware SirPratik100% (1)

- Nagasri Nelluri: Core Competencies Profile SummaryDocument4 pagesNagasri Nelluri: Core Competencies Profile SummaryNidhi VashisthNo ratings yet

- Profit and Loss Q.Document61 pagesProfit and Loss Q.rajshrichormare21No ratings yet

- The Age of Agility Building Learning Agile Leaders and Organizations Veronica Schmidt Harvey Full ChapterDocument67 pagesThe Age of Agility Building Learning Agile Leaders and Organizations Veronica Schmidt Harvey Full Chapterdean.hall763100% (9)

- Summer Dhamaka AprilDocument21 pagesSummer Dhamaka AprilPapia ChandaNo ratings yet

- Akl Ii TM 10Document5 pagesAkl Ii TM 10Amalia FillahNo ratings yet

- Contract of Sale - Cooperative Apartment 2001Document6 pagesContract of Sale - Cooperative Apartment 2001Annie Young-KohbergerNo ratings yet

- Project Report On Lakme PDFDocument66 pagesProject Report On Lakme PDFMithun Konjath30% (10)

- Chatgpt: FinanceDocument20 pagesChatgpt: FinanceGeorges AxelNo ratings yet

- Faysal Bank VoucherDocument1 pageFaysal Bank VoucherAliNo ratings yet

- Course 1: Global Financial Markets and AssetsDocument31 pagesCourse 1: Global Financial Markets and AssetsDhriti MalhotraNo ratings yet

- Cambridge IGCSE® Enterprise Coursebook (Houghton, Medi, Bryant, Matthew, Jain, Veenu) (Z-Library)Document159 pagesCambridge IGCSE® Enterprise Coursebook (Houghton, Medi, Bryant, Matthew, Jain, Veenu) (Z-Library)helenlxzNo ratings yet

- Er - Govind 09-07-2022Document2 pagesEr - Govind 09-07-2022MAHAA ONE RMC RAMASAMY MNo ratings yet

- Contract Manager Cover Letter SampleDocument8 pagesContract Manager Cover Letter Samplen1b0lit0wum3100% (1)

- NISM QuestionsDocument333 pagesNISM QuestionsAKshay100% (1)

- Post Covid Airlines PolicyDocument11 pagesPost Covid Airlines Policyruchiwaghmare10No ratings yet

- Instant Download Ebook PDF Accounting 26th Edition by Carl S Warren PDF ScribdDocument33 pagesInstant Download Ebook PDF Accounting 26th Edition by Carl S Warren PDF Scribdphyllis.rodriguez580100% (54)

- NT03 1222Document34 pagesNT03 1222Aadrit VatsNo ratings yet

- Your PacSun - Com Order ConfirmationDocument9 pagesYour PacSun - Com Order ConfirmationGuillermo RuizNo ratings yet

- TDS - Lucidene 361Document3 pagesTDS - Lucidene 361NO0% (1)

- Future of Trade 2021 - DMCC - 100621Document104 pagesFuture of Trade 2021 - DMCC - 100621kishore N100% (1)

- Sme Finance, Development and Trade in Botswana: A Gender PerspectiveDocument25 pagesSme Finance, Development and Trade in Botswana: A Gender PerspectiveAdethia ShafariantiNo ratings yet

- Taxation Law Case Doctrines (4DF1920)Document45 pagesTaxation Law Case Doctrines (4DF1920)roigtcNo ratings yet

- Where Are We HRM in MauritiusDocument9 pagesWhere Are We HRM in MauritiusJM TroNo ratings yet

- 18s ECO 341 Syllabus 9-1-17Document7 pages18s ECO 341 Syllabus 9-1-17Gabriel RoblesNo ratings yet

- Archiving Production Orders (PP-SFC)Document13 pagesArchiving Production Orders (PP-SFC)Mayte López AymerichNo ratings yet

- Entrepreneurship DevelopmentDocument3 pagesEntrepreneurship DevelopmentD06 suraj kumarNo ratings yet

- K and Ns Health and Happiness For PakistDocument6 pagesK and Ns Health and Happiness For PakistMuneeb AhmadNo ratings yet