Professional Documents

Culture Documents

2019 7-March Part-4 Memorandum

2019 7-March Part-4 Memorandum

Uploaded by

Lucky NetshamutavhaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2019 7-March Part-4 Memorandum

2019 7-March Part-4 Memorandum

Uploaded by

Lucky NetshamutavhaCopyright:

Available Formats

ADMISSION EXAMINATION I TOELATINGSEKSAMEN

LEGAL PRACTITIONERS' BOOKKEEPING I REGSPRAKTISYNSBOEKHOU

PART4/ DEEL4

7 MARCH I MAART 2019

ANSWERSIANTWOORDE

PLEASE NOTE THAT THE GUIDELINE ANSWERS TO PREVIOUS

PAPERS MAY NOT BE A CORRECT REFLECTION OF THE LAW

AND/OR PRACTICE AT THE MOMENT OF READING.

NOTE TO EXAMINER: This guideline records the views of the drafters. There may be

justifiable variations in practice which are brought out in the

answers. When this happens the examiner should apply his

discretion in marking the answer.

QUESTION 1 [151

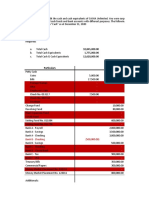

Business Cash Book for June 2018✓ 1

150 000✓ (1) Balance 300 000✓ (1)

Incorrect

Deposit error 180 000✓ (1) deposit 108 000✓ (1)

Bank

Balance 99 800✓ (1) Charges 5 600✓ (1)

Interest 16 200✓ (1)

429 800 429 800✓

Bank reconciliation statement as at 30 June

2018✓ (1)

Balance as per cash book 99 800(O/D)✓ (1)

Add: Bank error 105 000✓ (1)

Subtotal 204 800✓ (1)

Less: Outstanding eft 160 000✓ (1)

Balance as per

bank statement 44 800(O/D)✓ (2)

LAW SOCIETY OF SOUTH AFRICA

LEGAL EDUCATION AND DEVELOPMENT [L.E.A.DffM 1

QUESTION 2 [40]

2.1

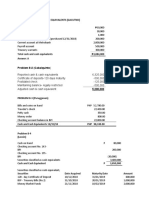

TRUST CASH BOOK

Nedbank - Sibusiso 1000 000 Nedbank 1 000 000

Nedbank 250 000 Counsel - Sibusiso 150 000

Gloria 2 500 000 Capitec (Gloria) 2 000 000

Various Clients 3 500 000 ABSA 3 000 000

Gloria - Costs 250 000 Sars 200 000

ABSA 2024 000 Fidelity Fund 24 000

Martin 500 000 Stock Broker 296 000

Stock Broker 348 000 Balance 3 702 000

10 372000 10 372 000

(15)

TRUST LEDGER

SIBUSISO

Cash

I

Counsel 150 000 1000 000

S 86(4) Sibusiso Nedbank

Cash

I

Cash 1000 000 250 000

GLORIA

SARS - Transfer Duty 200 000 Cash 2 500 000

Cash Costs 250 000

LAW SOCIETY OF SOUTH AFRICA

LEGAL EDUCATION AND DEVELOPMENT [L.E.A.D/rM 2

S 86(4} GLORIA- CAPITEC

Cash 2 000 000

VARIOUS CLIENTS

Cash

I

3 500 000

S 86(3) ASSA

Cash 3 000 ooo Cash 2 024 000

Fidelity Fund 24 000

MARTIN TRUST LEDGER

Cash (Shares) 296 000 Cash 500 000

Cash 348 000

(1 mark for each cash book and ledger entry) (33)

LIST OF TRUST CREDITORS

2.2 Sibusiso 850 000

Gloria 2 550 000

Sundry clients 3 500 000

Martin 552 000

Total Trust liabilities 7 452 000 (3)

LAW SOCIETY OF SOUTH AFRICA

LEGAL EDUCATION AND DEVELOPMENT [L.E.A.DJ™ 3

2.3 Trust Funds Available:

As Per Trust Cash Book 3 702 000

S86(4) Sibusiso 750 000

S86(4) Gloria 2 000 000

S86(3) 1 000 000

7 452 000 (4)

QUESTION 3 [301

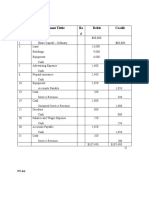

Trust Cash Book

Patricia 25000 Financial Adviser 3450

Transfer to Business 11500

Patricia 10050

2.fil)_QQ

Patricia Trust Account

Financial Adviser 3450 Deposit 25000

Transfer to Business 11500

Bank - Patricia 10050 --

2.fil)_QQ 2.fil)_QQ

I

Business Cash Book

Transfer ex Trust 11500

Patricia B

Fees and VAT 115.Q.Q Transfer ex Trust 115.Q.Q

I

Fees

Patricia 10000

Output VAT

1500

(1 mark for each cashbook and ledger entry) (13)

LAW SOCIETY OF SOUTH AFRICA

LEGAL EDUCATION AND DEVELOPMENT [L.E.A.D/™ 4

Fees Journal (30)

Patricia (B) 11500

Fees 10000

Output VAT 1500

Fees and VAT - Trust

(5)

Transfer Journal

Patricia (T) 11500

Patricia (B) 11500

Fees Transfer

(4)

Accounting Statement

Patricia

Deposit 25000

Paid Financial Adviser 3450

Fees 10000

VAT@15% 1500

Cheque herewith 10050

2.50.QQ 2.50.QQ

(8)

QUESTION 4 [151

4.1.1 At the conclusion of the matter; (1)

4.1.2 Yes (1)

4.1.3 All monies received, all disbursements made, the fee charged plus Vat. (3)

4.2.1 An attorney must open a Trust Banking Account (section 86( 2)), and record all

transactions in a Trust Cash Book, Journal and Ledger. The attorney must also

open a Business Banking Account and record all business transactions in a

Business Cash Book, Journal and Ledger. The accounting records must record

how ALL Trust monies are dealt with including disbursements, payments to third

parties, fee transfers and payments to client.

4.2.2 Section 87 states that the accounting records must contain detail of

(a) money received and paid on its own account;

(b) money received and paid on account of any person;

(c) money invested in terms of section 86;

(d) any interest on such investments.

4.2.3 Accounting records include those relating to

LAW SOCIETY OF SOUTH AFRICA

LEGAL EDUCATION AND DEVELOPMENT [L.E.A.DffM 5

(a ) money held in trust;

(b) money invested (section 86);

(c ) any estate of which practitioners (or administers on behalf of) is the executor,

trustee or curator;

(d) The affairs of the practice.

(10)

NOTE TO EXAMINER:

Since most candidates will not have seen the new manuals do not penalise references to

old sections:

78(1) instead of 86(2)

78(2)(a) instead of 86(3)

78 (2A) instead of 86(4)

TOTAL: (100]

LAW SOCIETY OF SOUTH AFRICA

LEGAL EDUCATION AND DEVELOPMENT [L.E.A.DffM 6

You might also like

- F7 (FR) Workbook (Mix)Document6 pagesF7 (FR) Workbook (Mix)Aye Myat ThawtarNo ratings yet

- Musharakah (Both Parties Incurred The Loss But According To The Capital Ratio)Document9 pagesMusharakah (Both Parties Incurred The Loss But According To The Capital Ratio)ASYHTAR BIN YAHIA -No ratings yet

- May 2013Document2 pagesMay 2013Mytreyi AtluriNo ratings yet

- GST TAx PDFDocument735 pagesGST TAx PDFRenugopalNo ratings yet

- 2015 19-August Part-4 MemorandumDocument6 pages2015 19-August Part-4 MemorandumLucky NetshamutavhaNo ratings yet

- 2018 16-October Part-4 MemorandumDocument6 pages2018 16-October Part-4 MemorandumLucky NetshamutavhaNo ratings yet

- 2018 7-February Part-4 MemorandumDocument6 pages2018 7-February Part-4 MemorandumLucky NetshamutavhaNo ratings yet

- 2017 23-August Part-4 MemorandumDocument7 pages2017 23-August Part-4 MemorandumLucky NetshamutavhaNo ratings yet

- CACell Intermediate Account Full Book-201-250Document50 pagesCACell Intermediate Account Full Book-201-250kalyanikamineniNo ratings yet

- Cash Flow StatementDocument3 pagesCash Flow StatementanupsuchakNo ratings yet

- Solution FileDocument3 pagesSolution FileDURGESH JHANo ratings yet

- Solutions Exercises Financial AccountingDocument11 pagesSolutions Exercises Financial Accountingddd huangNo ratings yet

- CNCS FY 2009 Financial Report (Loan Payment Trust Fund) Afr 2009 Full Report AddDocument13 pagesCNCS FY 2009 Financial Report (Loan Payment Trust Fund) Afr 2009 Full Report AddAccessible Journal Media: Peace Corps DocumentsNo ratings yet

- Null 33Document6 pagesNull 33ranganaitinotenda1No ratings yet

- CCP302Document13 pagesCCP302api-3849444No ratings yet

- Cafc Test Paper Acc 03Document9 pagesCafc Test Paper Acc 03Vandana GuptaNo ratings yet

- Audit of Cash ActivityDocument13 pagesAudit of Cash ActivityIris FenelleNo ratings yet

- Audit of Cash ActivityDocument13 pagesAudit of Cash ActivityIris FenelleNo ratings yet

- Group RepoprtingDocument3 pagesGroup RepoprtingPaulNo ratings yet

- SHT 031 AccountingDocument4 pagesSHT 031 Accountingnevil moraraNo ratings yet

- CPA 1 - Financial Acconting Sep 2022Document10 pagesCPA 1 - Financial Acconting Sep 2022Asaba GloriaNo ratings yet

- Final Accounts Without Adj Day 1 CW-1Document2 pagesFinal Accounts Without Adj Day 1 CW-1ROHIT PAREEKNo ratings yet

- Note Chapter 14 + 15 + CH A Mid-Term TestDocument4 pagesNote Chapter 14 + 15 + CH A Mid-Term TestGenoso OtakuNo ratings yet

- Pretest - Cash and ReceivablesDocument5 pagesPretest - Cash and ReceivablesMycah AliahNo ratings yet

- BT C1 - kttcqt1Document13 pagesBT C1 - kttcqt1Thảo NguyễnNo ratings yet

- Solution of Assignment Eco-04 Case: Mike (The Plumber) - A True StoryDocument5 pagesSolution of Assignment Eco-04 Case: Mike (The Plumber) - A True StoryYusuf HusseinNo ratings yet

- Ae 17 Midterms Assignment 1Document6 pagesAe 17 Midterms Assignment 1Ronald YNo ratings yet

- Cash and Cash EquivalentDocument22 pagesCash and Cash EquivalentDanielle Nicole MarquezNo ratings yet

- 313 314 Financing Cycle CORNEL-MannelleDocument3 pages313 314 Financing Cycle CORNEL-MannelleFaker MejiaNo ratings yet

- 2021 20-October Part-4 AnswersDocument6 pages2021 20-October Part-4 AnswersLucky NetshamutavhaNo ratings yet

- Tugas Sebelum UTS P. AK IIDocument12 pagesTugas Sebelum UTS P. AK IIMuhammad QolbiNo ratings yet

- Chapter 13 Corporations CACP - XLSX - Sheet1Document1 pageChapter 13 Corporations CACP - XLSX - Sheet1mhrzyn27No ratings yet

- Financial Accounting N 6 Test MG 2nd Semester 2017Document8 pagesFinancial Accounting N 6 Test MG 2nd Semester 2017professional accountantsNo ratings yet

- Test 2 SolutionDocument8 pagesTest 2 SolutionFelicia ChinNo ratings yet

- Problem 2: Income StatementDocument1 pageProblem 2: Income StatementazisridwansyahNo ratings yet

- Class Project - SolvedDocument8 pagesClass Project - SolvedMarcoNo ratings yet

- Cashflow TestDocument4 pagesCashflow Testbuddybest22No ratings yet

- Grade 10 Provincial Exam Accounting p1 AnswersDocument7 pagesGrade 10 Provincial Exam Accounting p1 AnswershobyanevisionNo ratings yet

- Tugas 4 Dasar AkuntansiDocument15 pagesTugas 4 Dasar AkuntansiSamuel PurbaNo ratings yet

- Midlands State University: Faculty of Commerce Department of AccountingDocument5 pagesMidlands State University: Faculty of Commerce Department of AccountingIsheanesu MutusvaNo ratings yet

- Activity No. 1 - Cash & Cash Equivalents (Salvador)Document9 pagesActivity No. 1 - Cash & Cash Equivalents (Salvador)Princess Aleia SalvadorNo ratings yet

- Audit ProblemsDocument2 pagesAudit ProblemsTicia TungpalanNo ratings yet

- SOLUTIONS To FAR FINAL PREDocument6 pagesSOLUTIONS To FAR FINAL PRELezyl UntalanNo ratings yet

- Final AccountsDocument39 pagesFinal Accountsaayushsurana1204No ratings yet

- Solution Ultimate Sample Paper 4Document5 pagesSolution Ultimate Sample Paper 4Karthick KarthickNo ratings yet

- Feelings To Pleasure by Jereliz Journal Entry 2014 Account TitleDocument20 pagesFeelings To Pleasure by Jereliz Journal Entry 2014 Account TitlejoanbltzrNo ratings yet

- Test Your Knowledge - 7Document2 pagesTest Your Knowledge - 7narangdiya602No ratings yet

- Grade 10 Provincial Exam Accounting (English) November 2017 Possible Answers - 050233Document11 pagesGrade 10 Provincial Exam Accounting (English) November 2017 Possible Answers - 050233hobyanevisionNo ratings yet

- Prorata ExerciceDocument3 pagesProrata ExerciceNjakanarivo Christian RajaonaNo ratings yet

- Accounting MBA Sem I 2018Document4 pagesAccounting MBA Sem I 2018yogeshgharpureNo ratings yet

- Izzy Trading Transaction Entries Special Journals SOLUTIONSDocument10 pagesIzzy Trading Transaction Entries Special Journals SOLUTIONSFranze Beatriz FLORESNo ratings yet

- Tutorial 5 Trial Balance and Errors.Document3 pagesTutorial 5 Trial Balance and Errors.annahkaupaNo ratings yet

- Adjusting FS ServiceDocument17 pagesAdjusting FS ServiceJasmine Acta100% (1)

- Jane Christine SolutionDocument7 pagesJane Christine Solutionckbeom0No ratings yet

- 6 Months Debtors Aging Reports: Date: 19/01/2022 Gan SDN BHD (Chor Kai En)Document3 pages6 Months Debtors Aging Reports: Date: 19/01/2022 Gan SDN BHD (Chor Kai En)karenNo ratings yet

- Case Study 1 - Blades Pty LTDDocument5 pagesCase Study 1 - Blades Pty LTDAli BasyaNo ratings yet

- Grade 10 Provincial Case Study MG 2023Document3 pagesGrade 10 Provincial Case Study MG 2023kwazy dlaminiNo ratings yet

- Win Ballada Parcor Chapter 4 ProblemDocument2 pagesWin Ballada Parcor Chapter 4 ProblemKrngyxNo ratings yet

- CIR V Deutsche Knowledge ServicesDocument3 pagesCIR V Deutsche Knowledge ServicesWilbert ChongNo ratings yet

- Petitioner Respondent: Second DivisionDocument19 pagesPetitioner Respondent: Second DivisionJeffrey JosolNo ratings yet

- Rmo 16-2007Document4 pagesRmo 16-2007Jaypee LegaspiNo ratings yet

- Certificate of Final Tax Withheld at Source: Kawanihan NG Rentas InternasDocument5 pagesCertificate of Final Tax Withheld at Source: Kawanihan NG Rentas InternasBrianSantiagoNo ratings yet

- The eBS R12 Tax Engine and The Australian GST: Jeannie DobneyDocument53 pagesThe eBS R12 Tax Engine and The Australian GST: Jeannie Dobneysridhar_eeNo ratings yet

- As-Is Report 1 Organization StructureDocument33 pagesAs-Is Report 1 Organization StructureBijay AgarwalNo ratings yet

- Final RFPDocument80 pagesFinal RFPAbhishek JhaNo ratings yet

- CGST CircularsDocument18 pagesCGST Circularsdinesh kasnNo ratings yet

- 08 - Chapter 1Document67 pages08 - Chapter 1Tun Lin WinNo ratings yet

- Agriculture Fruit Farm Business PlanDocument25 pagesAgriculture Fruit Farm Business PlanRakib_234No ratings yet

- Pilmico Vs CIRDocument9 pagesPilmico Vs CIRERNIL L BAWANo ratings yet

- Other Percentage TaxDocument7 pagesOther Percentage TaxJudeBragaisNo ratings yet

- Tender DocumentDocument29 pagesTender DocumentPrakash ArthurNo ratings yet

- IWCP: How To Apply For Qualifying by Alternative RouteDocument4 pagesIWCP: How To Apply For Qualifying by Alternative RoutearunkumarNo ratings yet

- Fort Bonifacio Development Corp v. CIR, G.R. No. 173425, 2013 Case DigestDocument4 pagesFort Bonifacio Development Corp v. CIR, G.R. No. 173425, 2013 Case Digestbeingme2No ratings yet

- Bag o Na ChipsDocument45 pagesBag o Na ChipsKrestyl Ann GabaldaNo ratings yet

- Atlas Consolidated Mining Development Corporation Vs CirDocument1 pageAtlas Consolidated Mining Development Corporation Vs CirKrystel Hypa MagallanesNo ratings yet

- Tax SyllabusDocument21 pagesTax Syllabusjb13_ruiz4200No ratings yet

- N.L.S I.U: Bangalore Ii Year MBL Supplementary Examination (Feb.) 2017 Investment LawsDocument8 pagesN.L.S I.U: Bangalore Ii Year MBL Supplementary Examination (Feb.) 2017 Investment LawsShrikant BudholiaNo ratings yet

- C. Sale of Professional Instruments and Implements Wearing Apparel, Domestic Animals and Personal Household Effects Under Certain ConditionsDocument150 pagesC. Sale of Professional Instruments and Implements Wearing Apparel, Domestic Animals and Personal Household Effects Under Certain ConditionsAngel TumamaoNo ratings yet

- Taganito V CIR Barcom Case DigestDocument2 pagesTaganito V CIR Barcom Case DigestBenjie RoqueNo ratings yet

- QuesDocument3 pagesQuesSiya GuptaNo ratings yet

- Bluedart Express (Bludar) : E-Com Momentum Fading B2B Remains CrucialDocument13 pagesBluedart Express (Bludar) : E-Com Momentum Fading B2B Remains CrucialDinesh ChoudharyNo ratings yet

- Mcdonald'S Philippines Realty Corporation Vs Cir Is MPRC'S Interest Income From Loans Subject To Vat?Document1 pageMcdonald'S Philippines Realty Corporation Vs Cir Is MPRC'S Interest Income From Loans Subject To Vat?Laika CorralNo ratings yet

- Lesson 1 Theories On Business Tax, Percentage Tax, and Excise TAXDocument2 pagesLesson 1 Theories On Business Tax, Percentage Tax, and Excise TAXRachelle Mae NagalesNo ratings yet

- Power Station Practice Assign 2Document4 pagesPower Station Practice Assign 2ford merfordNo ratings yet

- Ajit Bhawan Rate Contract 2022-23Document3 pagesAjit Bhawan Rate Contract 2022-23sweta suresh ganvirNo ratings yet

- Research Paper On Vat in EthiopiaDocument4 pagesResearch Paper On Vat in Ethiopiayhclzxwgf100% (1)