Professional Documents

Culture Documents

CBIC Non Tariff Notification No. 072023-Customs (N.T) Dated 31.01.2023

CBIC Non Tariff Notification No. 072023-Customs (N.T) Dated 31.01.2023

Uploaded by

AltafOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CBIC Non Tariff Notification No. 072023-Customs (N.T) Dated 31.01.2023

CBIC Non Tariff Notification No. 072023-Customs (N.T) Dated 31.01.2023

Uploaded by

AltafCopyright:

Available Formats

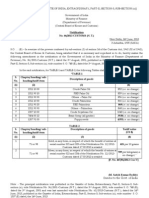

[TO BE PUBLISHED IN THE GAZETTE OF INDIA, EXTRAORDINARY, PART-II,

SECTION-3, SUB-SECTION (ii)]

Government of India

Ministry of Finance

Department of Revenue

Central Board of Indirect Taxes and Customs

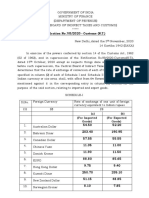

Notification No. 07/2023-CUSTOMS (N.T.)

New Delhi, 31st January, 2023

11 MAGHA, 1944 (SAKA)

S.O. … (E).– In exercise of the powers conferred by sub-section (2) of section 14 of the Customs

Act, 1962 (52 of 1962), the Central Board of Indirect Taxes & Customs, being satisfied that it is

necessary and expedient to do so, hereby makes the following amendments in the notification of

the Government of India in the Ministry of Finance (Department of Revenue), No. 36/2001-

Customs (N.T.), dated the 3rd August, 2001, published in the Gazette of India, Extraordinary,

Part-II, Section-3, Sub-section (ii), vide number S. O. 748 (E), dated the 3rd August, 2001,

namely:-

In the said notification, for TABLE-1, TABLE-2, and TABLE-3 the following Tables

shall be substituted, namely: -

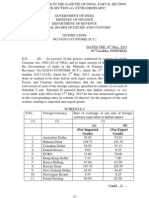

“TABLE-1

Chapter/ heading/ Tariff value

Sl. No. sub-heading/tariff Description of goods (US $Per Metric

item Tonne)

(1) (2) (3) (4)

1 1511 10 00 Crude Palm Oil 986

2 1511 90 10 RBD Palm Oil 992

3 1511 90 90 Others – Palm Oil 990

4 1511 10 00 Crude Palmolein 999

5 1511 90 20 RBD Palmolein 1002

6 1511 90 90 Others – Palmolein 1001

7 1507 10 00 Crude Soya bean Oil 1267

8 7404 00 22 Brass Scrap (all grades) 5324

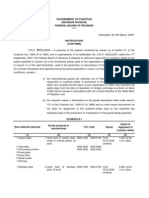

TABLE-2

Sl. Chapter/ heading/ Description of goods

No. sub-heading/tariff Tariff value

item (US $)

(1) (2) (3) (4)

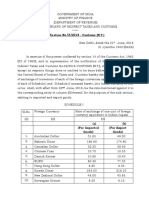

Gold, in any form, in respect of which the

benefit of entries at serial number 356 of

1. 71 or 98 620 per 10 grams

the Notification No. 50/2017-Customs

dated 30.06.2017 is availed

Silver, in any form, in respect of which the

benefit of entries at serial number 357 of

2. 71 or 98

the Notification No. 50/2017-Customs 768 per kilogram

dated 30.06.2017 is availed

(i) Silver, in any form, other than

medallions and silver coins having silver

content not below 99.9% or semi-

manufactured forms of silver falling under

sub-heading 7106 92;

(ii) Medallions and silver coins having

3. silver

content not below 99.9% or semi-

71 manufactured forms of silver falling under 768 per kilogram

sub-heading 7106 92, other than imports of

such goods through post, courier or

baggage.

Explanation. - For the purposes of this

entry, silver in any form shall not include

foreign

currency coins, jewellery made of silver or

articles made of silver.

(i) Gold bars, other than tola bars,

bearing manufacturer’s or refiner’s

engraved serial number and weight

expressed in metric units;

(ii) Gold coins having gold content not

4. below 99.5% and gold findings, other than

71 imports of such goods through post, 620 per 10 grams

courier or baggage.

Explanation. - For the purposes of this

entry, “gold findings” means a small

component such as hook, clasp, clamp, pin,

catch, screw back used to hold the whole or

a part of a piece of Jewellery in place.

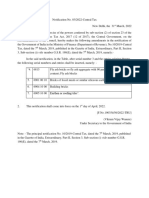

TABLE-3

Sl. Chapter/ heading/ Description of goods

No. sub-heading/tariff Tariff value

item (US $ Per Metric Tonne)

(1) (2) (3) (4)

1 080280 Areca nuts 9093 (i.e., no change)”

2. This notification shall come into force with effect from the 01st day of February, 2023.

[F. No. 467/01/2023-Cus.V]

(Harish Kumar)

Under Secretary to the Govt. of India

Note: - The principal notification was published in the Gazette of India, Extraordinary, Part-II,

Section-3, Sub-section (ii), vide Notification No. 36/2001–Customs (N.T.), dated the 3rd August,

2001, vide number S. O. 748 (E), dated the 3rd August, 2001 and was last amended vide

Notification No. 04/2023-Customs (N.T.), dated the 13th January, 2023, e-published in the

Gazette of India, Extraordinary, Part-II, Section-3, Sub-section (ii), vide number S.O. 259(E),

dated 13th January, 2023.

You might also like

- Uranian Master Lexicon 2.1Document409 pagesUranian Master Lexicon 2.1rmharris2018100% (4)

- Quotation For Repair Work at Ramp G PDFDocument2 pagesQuotation For Repair Work at Ramp G PDFSURIA ROAD TRADE SDN BHDNo ratings yet

- Pressure VesselsDocument9 pagesPressure VesselsSajal KulshresthaNo ratings yet

- AbsorptionDocument39 pagesAbsorptionAlexânder De Paula Rodrigues100% (2)

- csnt56 2023Document2 pagescsnt56 2023jade1993redNo ratings yet

- csnt66 2013Document1 pagecsnt66 2013stephin k jNo ratings yet

- csnt69 2013Document2 pagescsnt69 2013stephin k jNo ratings yet

- Https Chennaicustoms - Gov.in Wp-Content Uploads 2021 08 1434517275.htmDocument4 pagesHttps Chennaicustoms - Gov.in Wp-Content Uploads 2021 08 1434517275.htmBhuvanNo ratings yet

- csnt84 2023Document2 pagescsnt84 2023ketulraval2013No ratings yet

- CBIC-CUS TARIFF NOTFN NO.05 DT.22.01.2024-Seeks To Amend Notification No.11-2021 Dated 1st February 2021 To Impose AIDC On Entries Falling Under 7112 7113 and 7118Document1 pageCBIC-CUS TARIFF NOTFN NO.05 DT.22.01.2024-Seeks To Amend Notification No.11-2021 Dated 1st February 2021 To Impose AIDC On Entries Falling Under 7112 7113 and 7118srinivasan subbaiyanNo ratings yet

- csnt71 2013Document1 pagecsnt71 2013stephin k jNo ratings yet

- GST Rate Fs Bricks Tiles EnglishDocument5 pagesGST Rate Fs Bricks Tiles EnglishdhananjayNo ratings yet

- Customs Notification 36 - 2023Document2 pagesCustoms Notification 36 - 2023Raja SinghNo ratings yet

- Schedules Under Tamil Nadu Value Added Tax Act, 2006actDocument42 pagesSchedules Under Tamil Nadu Value Added Tax Act, 2006actvickyani1986yahoo.co.inNo ratings yet

- csnt54 2013Document2 pagescsnt54 2013stephin k jNo ratings yet

- 287 BoqDocument3 pages287 BoqbejayNo ratings yet

- Anti Dump CH 72.pdf JsessionidDocument97 pagesAnti Dump CH 72.pdf JsessionidprasadNo ratings yet

- 060-2010 Nsel ScamDocument3 pages060-2010 Nsel ScamNtvnews TeluguNo ratings yet

- Notification No. 90/2018 - Customs (N.T.)Document2 pagesNotification No. 90/2018 - Customs (N.T.)Tushit NathNo ratings yet

- This Notification Amends Notification No 62/94-Customs (NT), Dated The 21st November, 1994Document1 pageThis Notification Amends Notification No 62/94-Customs (NT), Dated The 21st November, 1994T Ankamma RaoNo ratings yet

- CSNT 05Document2 pagesCSNT 05sanjeev1910No ratings yet

- csnt57 2021Document3 pagescsnt57 2021Vikas AsthanaNo ratings yet

- cs11-2021 (AIDC)Document2 pagescs11-2021 (AIDC)Vogue LogisticsNo ratings yet

- Notification 11 2021Document2 pagesNotification 11 2021sudhagar palaniNo ratings yet

- 2009 Sro 211Document40 pages2009 Sro 211buttforoneNo ratings yet

- India Revised Sensitive List For LDCsDocument2 pagesIndia Revised Sensitive List For LDCsrithbaan basuNo ratings yet

- csnt15 2023Document2 pagescsnt15 2023Yash ChhabraNo ratings yet

- cs34 2023Document2 pagescs34 2023be21513dNo ratings yet

- Port de QC Grille Tarifaires Marchandises 2019 ENG FinalDocument12 pagesPort de QC Grille Tarifaires Marchandises 2019 ENG FinalBogdan NgrNo ratings yet

- 2-t Oil RuleDocument2 pages2-t Oil RuleDheeraj KumarNo ratings yet

- 7392 Tr15CMSP Tr5MMDR 2nd Attempt Upfront Amount Bid Security and Fixed Amount 16.11.2022Document3 pages7392 Tr15CMSP Tr5MMDR 2nd Attempt Upfront Amount Bid Security and Fixed Amount 16.11.2022Aayush DubeyNo ratings yet

- Notification No.67/2018 - Customs (N.T.) : Versa, Shall, With Effect From 3Document2 pagesNotification No.67/2018 - Customs (N.T.) : Versa, Shall, With Effect From 3Tushit NathNo ratings yet

- Budomari Sheet (11) New Second LotDocument12 pagesBudomari Sheet (11) New Second LotRT NafsanNo ratings yet

- Weekly Gold ETF MonitorDocument6 pagesWeekly Gold ETF MonitorRakesh VNo ratings yet

- 9 Central Excise Notifications 2009Document17 pages9 Central Excise Notifications 2009aveeramani@yahoo.comNo ratings yet

- Anti Dump ch-84Document36 pagesAnti Dump ch-84Tanwar KeshavNo ratings yet

- Bitre Fatalities Oct2023Document9 pagesBitre Fatalities Oct2023Darren mullanNo ratings yet

- Notification No. 93/2018 - Customs (N.T.)Document2 pagesNotification No. 93/2018 - Customs (N.T.)Tushit NathNo ratings yet

- Notification No. 09/2019 - Customs (N.T.)Document2 pagesNotification No. 09/2019 - Customs (N.T.)Zankar R ParikhNo ratings yet

- Public Notice On Cap Prices For Petroleum Products Effective Wednesday, 6 APRIL 2022Document10 pagesPublic Notice On Cap Prices For Petroleum Products Effective Wednesday, 6 APRIL 2022Fredy MasandikaNo ratings yet

- 66-G.O.ms - No.48-Cashew and Coconut GardensDocument6 pages66-G.O.ms - No.48-Cashew and Coconut GardenskvjraghunathNo ratings yet

- Notification No.54/2021 - Customs (N.T.) : Schedule-IDocument3 pagesNotification No.54/2021 - Customs (N.T.) : Schedule-Ianil nayakanahattiNo ratings yet

- 18 OctDocument2 pages18 OctTushit NathNo ratings yet

- csnt04 2024Document2 pagescsnt04 2024anandraothorveNo ratings yet

- Notification No.105/2020 - Customs (N.T.)Document2 pagesNotification No.105/2020 - Customs (N.T.)Sarvesh BansalNo ratings yet

- National Clutch Catalogue 2019Document156 pagesNational Clutch Catalogue 2019mm6088873No ratings yet

- csnt63 2013Document2 pagescsnt63 2013stephin k jNo ratings yet

- Presentation PPN EmasDocument10 pagesPresentation PPN EmasIndra YuNo ratings yet

- Commercial Invoice-DM 32-23Document1 pageCommercial Invoice-DM 32-23AbouNo ratings yet

- Notification No. 9/2013-Customs (ADD)Document3 pagesNotification No. 9/2013-Customs (ADD)stephin k jNo ratings yet

- CKJ GMBH Mr. Josef Stalter: Zum Ensheimer Geloesch 7 66386 St. IngbertDocument6 pagesCKJ GMBH Mr. Josef Stalter: Zum Ensheimer Geloesch 7 66386 St. Ingbertprathamesh malvankarNo ratings yet

- DX800 Rock DrillDocument35 pagesDX800 Rock Drilljakarohmat88No ratings yet

- Notification No.63/2018 - Customs (N.T.) : Versa, Shall, With Effect From 20Document2 pagesNotification No.63/2018 - Customs (N.T.) : Versa, Shall, With Effect From 20Tushit NathNo ratings yet

- E035 Rev. 01Document9 pagesE035 Rev. 01Ayoub ChebaaneNo ratings yet

- Factura de Compra No DubaiDocument1 pageFactura de Compra No DubaijosacuhamaNo ratings yet

- Inv PKLDocument4 pagesInv PKLbuiquy2kNo ratings yet

- Flour Mill Machinery Import SampleDocument14 pagesFlour Mill Machinery Import Samplealiroindia12No ratings yet

- 【PL】MEGAINDO Packinglist 323Document2 pages【PL】MEGAINDO Packinglist 323Wenny KamaruddinNo ratings yet

- 1796-Hvac LW Boq 25 MillionDocument26 pages1796-Hvac LW Boq 25 Millionmuzeek306No ratings yet

- Notification No.55/2018 - Customs (N.T.) : Versa, Shall, With Effect From 22Document2 pagesNotification No.55/2018 - Customs (N.T.) : Versa, Shall, With Effect From 22Tushit NathNo ratings yet

- Exchange 30 Dec 2013Document2 pagesExchange 30 Dec 2013ferro4uNo ratings yet

- Final Docs KM-DECDocument7 pagesFinal Docs KM-DECniralibrahmbhatt35No ratings yet

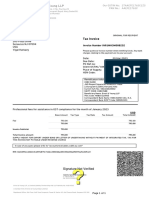

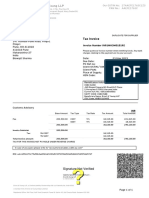

- EY Invoice - ORG - IN91MH3M008232Document1 pageEY Invoice - ORG - IN91MH3M008232AltafNo ratings yet

- PN222018Document3 pagesPN222018AltafNo ratings yet

- Circular No 12 2023Document3 pagesCircular No 12 2023AltafNo ratings yet

- Jhulaghat FinalDocument108 pagesJhulaghat FinalAltafNo ratings yet

- Ey Weekly Pricing BudgetingDocument4 pagesEy Weekly Pricing BudgetingAltafNo ratings yet

- EY Invoice - DUP - IN91MH3M015192Document1 pageEY Invoice - DUP - IN91MH3M015192AltafNo ratings yet

- Statement of Purpose For TU DElft-1updatedDocument5 pagesStatement of Purpose For TU DElft-1updatedDhriti NayyarNo ratings yet

- Phylum Aschelminthes (Nemathelminthes / Nematoda)Document15 pagesPhylum Aschelminthes (Nemathelminthes / Nematoda)Aditya KaleNo ratings yet

- 2018 Sigma Natural Ebook OPDocument55 pages2018 Sigma Natural Ebook OPRenan Norbiate de Melo100% (1)

- Extra NumericalsDocument2 pagesExtra NumericalsDeep KambleNo ratings yet

- HVAC - PM Permits AND TO Be Close PM Form SEND AT (8-11-2020)Document2 pagesHVAC - PM Permits AND TO Be Close PM Form SEND AT (8-11-2020)ali morisyNo ratings yet

- 'RAUP IOM-Aug06Document35 pages'RAUP IOM-Aug06Ngô Khắc ToảnNo ratings yet

- Metabolit SekunderDocument76 pagesMetabolit SekunderCempaka Kusuma DewiNo ratings yet

- ISCDL - Problem Statements For State Level HackthonDocument6 pagesISCDL - Problem Statements For State Level HackthonSarvesh DubeyNo ratings yet

- Kinoton FP30D Operating ManualDocument87 pagesKinoton FP30D Operating ManualTomekLecocqNo ratings yet

- Instrumentation Cables: Product CatalogueDocument44 pagesInstrumentation Cables: Product Cataloguexinying liuNo ratings yet

- Practice Question Ffor Module 7Document6 pagesPractice Question Ffor Module 7hemkumar DahalNo ratings yet

- Seal of History Our Inheritance in The Great Seal of USDocument207 pagesSeal of History Our Inheritance in The Great Seal of USAlfred E. NewmanNo ratings yet

- Special Section: Karst: - Fort Worth BasinDocument20 pagesSpecial Section: Karst: - Fort Worth Basincunin12No ratings yet

- مشروع بصمةDocument22 pagesمشروع بصمةMohammed alraeyNo ratings yet

- Egg Drop NotesDocument2 pagesEgg Drop Notesapi-365288705No ratings yet

- Allowable Stress Design of Concrete Masonry PilastersDocument7 pagesAllowable Stress Design of Concrete Masonry PilastersReinaldo Andrei SalazarNo ratings yet

- Peugeot 206 P Dag Owners ManualDocument119 pagesPeugeot 206 P Dag Owners ManualAlex Rojas AguilarNo ratings yet

- Solid State Physics JEST 2012-2019Document7 pagesSolid State Physics JEST 2012-2019Biswajit BhowmickNo ratings yet

- CYWGDocument19 pagesCYWGGerry EscañoNo ratings yet

- Westermo Ds Ddw-x42-Series 2204 en RevfDocument5 pagesWestermo Ds Ddw-x42-Series 2204 en RevfAnanthan GunasaharanNo ratings yet

- Addition of Green Tea Extract in Fructose Egg Yolk Milk Diluter On The Quality and Antioxidant ContenDocument9 pagesAddition of Green Tea Extract in Fructose Egg Yolk Milk Diluter On The Quality and Antioxidant Conten3129 NashihahNo ratings yet

- 2020 79th PNWIMC Annual Conference AnnouncementDocument2 pages2020 79th PNWIMC Annual Conference AnnouncementnwberryfoundationNo ratings yet

- The Polarization of Light: Experiment 3Document4 pagesThe Polarization of Light: Experiment 3Mujeeb UllahNo ratings yet

- Topic 6 Circular Motion Test P1Document11 pagesTopic 6 Circular Motion Test P1Sabrina_LGXNo ratings yet

- Technical Information: Dpbs 90 E MeDocument3 pagesTechnical Information: Dpbs 90 E MeЛулу ТраедNo ratings yet