Professional Documents

Culture Documents

Case Study 1

Case Study 1

Uploaded by

Bavleen Kaur ChawlaCopyright:

Available Formats

You might also like

- Negotiations Between Excalibur Engine Components Firm and Knight Engines IncDocument4 pagesNegotiations Between Excalibur Engine Components Firm and Knight Engines IncSiraj Ibrahim100% (1)

- Special Duties & Trade RemediesDocument21 pagesSpecial Duties & Trade RemediesAlyanna JoyceNo ratings yet

- Delight Dialysis CenterDocument23 pagesDelight Dialysis Center0shimaNo ratings yet

- Complete PMP Course Presentation 2016Document402 pagesComplete PMP Course Presentation 2016Aziz Aziz100% (3)

- Module Tariff6Document13 pagesModule Tariff6J- ArtizNo ratings yet

- Trade LawDocument9 pagesTrade Lawkunal mehtoNo ratings yet

- Objectives of DumpingDocument6 pagesObjectives of Dumpingmuhammad usamaNo ratings yet

- 2 - Governments Regulation of ImportsDocument34 pages2 - Governments Regulation of ImportsLinto SophieNo ratings yet

- The Dumping-Based Unfair Trade in World Trade Organization WTODocument19 pagesThe Dumping-Based Unfair Trade in World Trade Organization WTOBea LadaoNo ratings yet

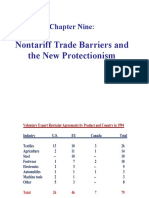

- Chapter Nine:: Nontariff Trade Barriers and The New ProtectionismDocument26 pagesChapter Nine:: Nontariff Trade Barriers and The New ProtectionismAhmad RonyNo ratings yet

- International Economics 15Th Edition Pugel Solutions Manual Full Chapter PDFDocument28 pagesInternational Economics 15Th Edition Pugel Solutions Manual Full Chapter PDFcemeteryliana.9afku100% (11)

- International Economics 15th Edition Pugel Solutions ManualDocument7 pagesInternational Economics 15th Edition Pugel Solutions Manualsaintcuc9jymi8100% (27)

- (Download PDF) International Economics 15th Edition Pugel Solutions Manual Full ChapterDocument30 pages(Download PDF) International Economics 15th Edition Pugel Solutions Manual Full Chapteranyelmaqkaj100% (4)

- Anti DumpingDocument52 pagesAnti DumpingSamuelNo ratings yet

- Tariff Commission FAQsDocument7 pagesTariff Commission FAQsFrancisJosefTomotorgoGoingoNo ratings yet

- Tax 2 Annotations (RAs)Document8 pagesTax 2 Annotations (RAs)Kevin HernandezNo ratings yet

- Actividad de Aprendizaje 11 Evidencia 7Document13 pagesActividad de Aprendizaje 11 Evidencia 7Maria Emilcen SanchezNo ratings yet

- Trade Barrier: Trade Barriers Are A General Term That Describes Any Government Policy or Regulation That RestrictsDocument3 pagesTrade Barrier: Trade Barriers Are A General Term That Describes Any Government Policy or Regulation That RestrictsAlex LeeNo ratings yet

- Internationl MarketingDocument17 pagesInternationl Marketingarchana yadavNo ratings yet

- International Trade Barrier:: Tariff BarriersDocument3 pagesInternational Trade Barrier:: Tariff BarriersMonir RaihanNo ratings yet

- Republic Act No 8752 Anti DumpingDocument13 pagesRepublic Act No 8752 Anti DumpingMalu Paras LacsonNo ratings yet

- International Business Law and Its Environment 8th Edition Schaffer Solutions ManualDocument8 pagesInternational Business Law and Its Environment 8th Edition Schaffer Solutions Manualsaintcuc9jymi8100% (25)

- IMT-18 Export Finance and Documentation: NotesDocument3 pagesIMT-18 Export Finance and Documentation: NotesPrasanta Kumar NandaNo ratings yet

- Law of Anti-DumpingDocument25 pagesLaw of Anti-DumpingShikhar GuptaNo ratings yet

- Anti-Dumping Act of 1999Document17 pagesAnti-Dumping Act of 1999jimNo ratings yet

- Activity No. 3 - Trade BarriersDocument5 pagesActivity No. 3 - Trade BarriersDeanne GuintoNo ratings yet

- Kuya GlenDocument10 pagesKuya GlenGlen AltasNo ratings yet

- NTI Umping Easures: HapterDocument34 pagesNTI Umping Easures: Haptermaanushi JainNo ratings yet

- International Trade LawDocument22 pagesInternational Trade LawHirak Mukherjee100% (2)

- Lecture 4Document26 pagesLecture 4exotic trendsNo ratings yet

- (Download PDF) International Business Law and Its Environment 8th Edition Schaffer Solutions Manual Full ChapterDocument30 pages(Download PDF) International Business Law and Its Environment 8th Edition Schaffer Solutions Manual Full Chapterabazidfullin100% (8)

- Countervailing DutyDocument30 pagesCountervailing DutySamuelNo ratings yet

- Special Examinations - June 2020Document17 pagesSpecial Examinations - June 2020Juan Simson KaulumaNo ratings yet

- International Business Law and Its Environment 8th Edition Schaffer Solutions Manual instant download all chapterDocument30 pagesInternational Business Law and Its Environment 8th Edition Schaffer Solutions Manual instant download all chapterdalgiclayao100% (1)

- Full International Business Law and Its Environment 8Th Edition Schaffer Solutions Manual Online PDF All ChapterDocument26 pagesFull International Business Law and Its Environment 8Th Edition Schaffer Solutions Manual Online PDF All Chapterbbrtibmacbdonia632100% (5)

- CBS Final Project (Waseem Jaffri, Hina, Sameer, Ahmed Ali Somroo, Jahanzaib)Document12 pagesCBS Final Project (Waseem Jaffri, Hina, Sameer, Ahmed Ali Somroo, Jahanzaib)Syed Waseem Abbas Shah JaffriNo ratings yet

- Tutorial Revision 3 A (Final) at 21-23 NovDocument4 pagesTutorial Revision 3 A (Final) at 21-23 NovSamihaSaanNo ratings yet

- Ra 8752 Gr1 OutlineDocument5 pagesRa 8752 Gr1 OutlineIELTSNo ratings yet

- TAX 2 Digests (Locgov)Document28 pagesTAX 2 Digests (Locgov)cmv mendoza100% (1)

- Kinh Tế Đối NgoạiDocument4 pagesKinh Tế Đối Ngoạiminhb2006353No ratings yet

- Primer RA8751 (CV)Document10 pagesPrimer RA8751 (CV)SamuelNo ratings yet

- AntidumpingDocument4 pagesAntidumpingShobanaNo ratings yet

- Allocation of Anti-Dumping Duty Under WTO Laws-Experience From US-offset ActDocument7 pagesAllocation of Anti-Dumping Duty Under WTO Laws-Experience From US-offset ActtranvangphuNo ratings yet

- Tariff, Derived From A French Word Meaning Rate, Price, or List of Charges, Is ADocument23 pagesTariff, Derived From A French Word Meaning Rate, Price, or List of Charges, Is ADilip YadavNo ratings yet

- Annex E: WT/DS108/RW Page E-1Document11 pagesAnnex E: WT/DS108/RW Page E-1Abhinav SinghNo ratings yet

- Anti Dumping Duty.Document17 pagesAnti Dumping Duty.mandiraNo ratings yet

- Evidencia 7 Compliance Foreign Laws...Document6 pagesEvidencia 7 Compliance Foreign Laws...Luis Carlos Viveros GarcésNo ratings yet

- ABE 154 GroupWork The Anti-Dumping ArgumentDocument5 pagesABE 154 GroupWork The Anti-Dumping ArgumentJessi Anne Nakol V. AligatoNo ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument8 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledBryan MagnayeNo ratings yet

- Reliance Industries LTD Anti Dumping FinalDocument10 pagesReliance Industries LTD Anti Dumping FinalSAURABH SUNNYNo ratings yet

- QUIZDocument9 pagesQUIZChâu GiangNo ratings yet

- Findings On Anti-DumpingDocument2 pagesFindings On Anti-DumpingdrbhattaNo ratings yet

- aNTI DUMPING LAWSDocument38 pagesaNTI DUMPING LAWSmica43826No ratings yet

- Procedure Section713 Rev2 28july 2020Document3 pagesProcedure Section713 Rev2 28july 2020aim zehcnasNo ratings yet

- Applied Economics Written ReportDocument4 pagesApplied Economics Written ReportTres KilluaNo ratings yet

- Anti-Dumping MeasuresDocument21 pagesAnti-Dumping MeasuresDrishti TiwariNo ratings yet

- H RPT 98-725Document94 pagesH RPT 98-725BibliohorseNo ratings yet

- Chapter 5 Anti-Dumping Measures: Verview of UlesDocument31 pagesChapter 5 Anti-Dumping Measures: Verview of UlesRAISALORENA CHAVEZGONZALEZNo ratings yet

- Trade RemediesDocument3 pagesTrade Remediesmalou_corderoNo ratings yet

- Tariff & Non-Tariff BarriersDocument29 pagesTariff & Non-Tariff BarriersSanjivSIngh0% (1)

- Tax 2. Q&A Compilation (R.A. 9135, 8751, 8752 & 8800)Document13 pagesTax 2. Q&A Compilation (R.A. 9135, 8751, 8752 & 8800)pa3ciaNo ratings yet

- Evidencia 7 Compliance With Foreign LawDocument11 pagesEvidencia 7 Compliance With Foreign LawJorge DeviaNo ratings yet

- AnsoffDocument18 pagesAnsoffVinay KumarNo ratings yet

- Welding of SteelDocument7 pagesWelding of SteelAlbert CostasNo ratings yet

- The Impact of Supply Chain Management Practices On Firm Performance: Evidence From 3PL IndustryDocument15 pagesThe Impact of Supply Chain Management Practices On Firm Performance: Evidence From 3PL IndustrySyed Monirul HossainNo ratings yet

- The Ultimate Guide To Trade Show Marketing by The Image ShoppeDocument35 pagesThe Ultimate Guide To Trade Show Marketing by The Image ShoppeRonald RosueiNo ratings yet

- Chief Information Officer in Portland Oregon Resume Jodie CreamerDocument3 pagesChief Information Officer in Portland Oregon Resume Jodie CreamerJodieCreamerNo ratings yet

- Tutorial Relevant Costs For StudentsDocument3 pagesTutorial Relevant Costs For StudentsJihan RafiqaNo ratings yet

- Bovonto Is A Popular Soft Drink Brand in IndiaDocument3 pagesBovonto Is A Popular Soft Drink Brand in IndiaAjay JNo ratings yet

- TransportationDocument4 pagesTransportationShrinidhi Priyankaa 1912985630No ratings yet

- Sales ManagementDocument2 pagesSales ManagementTomiris TulegenovaNo ratings yet

- MoroccoDocument5 pagesMoroccobennaniabadiyouNo ratings yet

- External EnvironmentDocument20 pagesExternal EnvironmentMelanie Cruz ConventoNo ratings yet

- Literature Review On Customer Perception About Online Shopping With Reference To Amazon in India.Document14 pagesLiterature Review On Customer Perception About Online Shopping With Reference To Amazon in India.Anushka GargNo ratings yet

- Shopify Dropshipping - Extreme CommerceDocument189 pagesShopify Dropshipping - Extreme Commercemaham farooqi100% (2)

- CHAPTER - 5 Marketing in Small BusinessDocument25 pagesCHAPTER - 5 Marketing in Small BusinesstemesgenNo ratings yet

- Original PDF Mr2 New Engaging Titles From 4ltr Press 2nd Edition PDFDocument41 pagesOriginal PDF Mr2 New Engaging Titles From 4ltr Press 2nd Edition PDFarlene.wax700100% (54)

- MEP Guidebook 2Document2 pagesMEP Guidebook 2Christopher LimNo ratings yet

- Cost Per Unit Rs. Rs. Rs. RS.: M. Azeem/Activity Based CostingDocument4 pagesCost Per Unit Rs. Rs. Rs. RS.: M. Azeem/Activity Based CostingKamran ArifNo ratings yet

- Crafting The Brand PositioningDocument23 pagesCrafting The Brand PositioningZainab GhaddarNo ratings yet

- Report On Human Resource Management in MFIs A State of PracticeDocument172 pagesReport On Human Resource Management in MFIs A State of Practice9415351296No ratings yet

- Marketing Plan, Target MarketDocument3 pagesMarketing Plan, Target Marketnadya bujangNo ratings yet

- IG 3rd Party Logistics 3PL and Ecommerce enDocument1 pageIG 3rd Party Logistics 3PL and Ecommerce enJoaquim AmericoNo ratings yet

- Manual de Calidad COELME (MQAS Rev. 1 ENGLISH)Document53 pagesManual de Calidad COELME (MQAS Rev. 1 ENGLISH)Rommel Augusto Arnica AguedoNo ratings yet

- GP 5 Supplier Quality ProcessesDocument187 pagesGP 5 Supplier Quality ProcessesNeumar Neumann0% (1)

- Chap014 - JIT and Lean OperationsDocument31 pagesChap014 - JIT and Lean Operationsspchheda4996100% (1)

- PegaDocument1 pagePegasunilchopseyNo ratings yet

- IBM Corporation A Case AnalysisDocument154 pagesIBM Corporation A Case AnalysisHaleel AlsayerNo ratings yet

- CPG Industry OverviewDocument12 pagesCPG Industry OverviewanupamsarkaarNo ratings yet

Case Study 1

Case Study 1

Uploaded by

Bavleen Kaur ChawlaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Case Study 1

Case Study 1

Uploaded by

Bavleen Kaur ChawlaCopyright:

Available Formats

Case Study 1

Global Trade Law-BUS8330, SEC3

Bavleen Kaur

8821387

Due Date – February 2,2023

Ans 1

Dumping is an act of selling the exported products by a company in the exporting country at a price

lower than the production cost. This act of international producers poses threats to the local producers,

who are selling their products at profitable selling price (Fasken, p. 111). The cost of producing the single

bulb by Syntax is $4.00, and they are selling at the price of $3.00 in their domestic market in Boga. On

the other hand they are selling the same product for $2.5 in Vietnam. Here, Syntax is not even

recovering 40% of its cost of production. However, since its business is being subsidized by the

government of Boga to improve the economy, selling at a lower price aids the company in attracting

more customers. But, the Vietnamese businesses obtains the bulb for $5.00 each, and they face tougher

competition from the international manufacturers, who were selling their substitutes at a very cheap

price. Thus, as Syntax Sells its goods at a lower price in comparison to its manufacturing costs, the

company is certainly performing the act of umping in Vietnamese market.

Ans 2

The Special Import Measures Act (SIMA) provides rules and procedures for scrutinizing the accusations

about dumped and subsidized imports that are endangering the domestic market of Canada, and the

levying the duties in response (Fasken, p. 111).

CBSA (Canada Border Services Agency) and CITT (Canada International Trade Tribunal) act has certain

roles under SIMA to address the dumping and subsidizing issues.

CBSA has the responsibility to ensure free trade of goods and services across Canadian Borders, that are

meeting the trade criteria’s. It ensures that Canadian Business and economy is benefitted by trade

legislation and agreements that meets Canada’s international obligations (Fasken, p. 111). If it founds

that any imported product is being dumped and subsidized, it raises concerns with CITT and demands

investigations under SIMA act. It has the power to levy provisional duties within 90 days of launching

investigation.

On the other hand, CITT measures the imports to Canada, and examines whether these are dumped or

subsidized having negative effects on domestic market through SIMA measures. It responds to the

economic or tariff concerns raised by government of Canada. It hears to the appeals and make decisions

on the act of CBSA on imposing tariffs on dumped goods (Fasken, p. 111). Overall, with SIMA, it

safeguards the integrity of Government of Canada process.

You might also like

- Negotiations Between Excalibur Engine Components Firm and Knight Engines IncDocument4 pagesNegotiations Between Excalibur Engine Components Firm and Knight Engines IncSiraj Ibrahim100% (1)

- Special Duties & Trade RemediesDocument21 pagesSpecial Duties & Trade RemediesAlyanna JoyceNo ratings yet

- Delight Dialysis CenterDocument23 pagesDelight Dialysis Center0shimaNo ratings yet

- Complete PMP Course Presentation 2016Document402 pagesComplete PMP Course Presentation 2016Aziz Aziz100% (3)

- Module Tariff6Document13 pagesModule Tariff6J- ArtizNo ratings yet

- Trade LawDocument9 pagesTrade Lawkunal mehtoNo ratings yet

- Objectives of DumpingDocument6 pagesObjectives of Dumpingmuhammad usamaNo ratings yet

- 2 - Governments Regulation of ImportsDocument34 pages2 - Governments Regulation of ImportsLinto SophieNo ratings yet

- The Dumping-Based Unfair Trade in World Trade Organization WTODocument19 pagesThe Dumping-Based Unfair Trade in World Trade Organization WTOBea LadaoNo ratings yet

- Chapter Nine:: Nontariff Trade Barriers and The New ProtectionismDocument26 pagesChapter Nine:: Nontariff Trade Barriers and The New ProtectionismAhmad RonyNo ratings yet

- International Economics 15Th Edition Pugel Solutions Manual Full Chapter PDFDocument28 pagesInternational Economics 15Th Edition Pugel Solutions Manual Full Chapter PDFcemeteryliana.9afku100% (11)

- International Economics 15th Edition Pugel Solutions ManualDocument7 pagesInternational Economics 15th Edition Pugel Solutions Manualsaintcuc9jymi8100% (27)

- (Download PDF) International Economics 15th Edition Pugel Solutions Manual Full ChapterDocument30 pages(Download PDF) International Economics 15th Edition Pugel Solutions Manual Full Chapteranyelmaqkaj100% (4)

- Anti DumpingDocument52 pagesAnti DumpingSamuelNo ratings yet

- Tariff Commission FAQsDocument7 pagesTariff Commission FAQsFrancisJosefTomotorgoGoingoNo ratings yet

- Tax 2 Annotations (RAs)Document8 pagesTax 2 Annotations (RAs)Kevin HernandezNo ratings yet

- Actividad de Aprendizaje 11 Evidencia 7Document13 pagesActividad de Aprendizaje 11 Evidencia 7Maria Emilcen SanchezNo ratings yet

- Trade Barrier: Trade Barriers Are A General Term That Describes Any Government Policy or Regulation That RestrictsDocument3 pagesTrade Barrier: Trade Barriers Are A General Term That Describes Any Government Policy or Regulation That RestrictsAlex LeeNo ratings yet

- Internationl MarketingDocument17 pagesInternationl Marketingarchana yadavNo ratings yet

- International Trade Barrier:: Tariff BarriersDocument3 pagesInternational Trade Barrier:: Tariff BarriersMonir RaihanNo ratings yet

- Republic Act No 8752 Anti DumpingDocument13 pagesRepublic Act No 8752 Anti DumpingMalu Paras LacsonNo ratings yet

- International Business Law and Its Environment 8th Edition Schaffer Solutions ManualDocument8 pagesInternational Business Law and Its Environment 8th Edition Schaffer Solutions Manualsaintcuc9jymi8100% (25)

- IMT-18 Export Finance and Documentation: NotesDocument3 pagesIMT-18 Export Finance and Documentation: NotesPrasanta Kumar NandaNo ratings yet

- Law of Anti-DumpingDocument25 pagesLaw of Anti-DumpingShikhar GuptaNo ratings yet

- Anti-Dumping Act of 1999Document17 pagesAnti-Dumping Act of 1999jimNo ratings yet

- Activity No. 3 - Trade BarriersDocument5 pagesActivity No. 3 - Trade BarriersDeanne GuintoNo ratings yet

- Kuya GlenDocument10 pagesKuya GlenGlen AltasNo ratings yet

- NTI Umping Easures: HapterDocument34 pagesNTI Umping Easures: Haptermaanushi JainNo ratings yet

- International Trade LawDocument22 pagesInternational Trade LawHirak Mukherjee100% (2)

- Lecture 4Document26 pagesLecture 4exotic trendsNo ratings yet

- (Download PDF) International Business Law and Its Environment 8th Edition Schaffer Solutions Manual Full ChapterDocument30 pages(Download PDF) International Business Law and Its Environment 8th Edition Schaffer Solutions Manual Full Chapterabazidfullin100% (8)

- Countervailing DutyDocument30 pagesCountervailing DutySamuelNo ratings yet

- Special Examinations - June 2020Document17 pagesSpecial Examinations - June 2020Juan Simson KaulumaNo ratings yet

- International Business Law and Its Environment 8th Edition Schaffer Solutions Manual instant download all chapterDocument30 pagesInternational Business Law and Its Environment 8th Edition Schaffer Solutions Manual instant download all chapterdalgiclayao100% (1)

- Full International Business Law and Its Environment 8Th Edition Schaffer Solutions Manual Online PDF All ChapterDocument26 pagesFull International Business Law and Its Environment 8Th Edition Schaffer Solutions Manual Online PDF All Chapterbbrtibmacbdonia632100% (5)

- CBS Final Project (Waseem Jaffri, Hina, Sameer, Ahmed Ali Somroo, Jahanzaib)Document12 pagesCBS Final Project (Waseem Jaffri, Hina, Sameer, Ahmed Ali Somroo, Jahanzaib)Syed Waseem Abbas Shah JaffriNo ratings yet

- Tutorial Revision 3 A (Final) at 21-23 NovDocument4 pagesTutorial Revision 3 A (Final) at 21-23 NovSamihaSaanNo ratings yet

- Ra 8752 Gr1 OutlineDocument5 pagesRa 8752 Gr1 OutlineIELTSNo ratings yet

- TAX 2 Digests (Locgov)Document28 pagesTAX 2 Digests (Locgov)cmv mendoza100% (1)

- Kinh Tế Đối NgoạiDocument4 pagesKinh Tế Đối Ngoạiminhb2006353No ratings yet

- Primer RA8751 (CV)Document10 pagesPrimer RA8751 (CV)SamuelNo ratings yet

- AntidumpingDocument4 pagesAntidumpingShobanaNo ratings yet

- Allocation of Anti-Dumping Duty Under WTO Laws-Experience From US-offset ActDocument7 pagesAllocation of Anti-Dumping Duty Under WTO Laws-Experience From US-offset ActtranvangphuNo ratings yet

- Tariff, Derived From A French Word Meaning Rate, Price, or List of Charges, Is ADocument23 pagesTariff, Derived From A French Word Meaning Rate, Price, or List of Charges, Is ADilip YadavNo ratings yet

- Annex E: WT/DS108/RW Page E-1Document11 pagesAnnex E: WT/DS108/RW Page E-1Abhinav SinghNo ratings yet

- Anti Dumping Duty.Document17 pagesAnti Dumping Duty.mandiraNo ratings yet

- Evidencia 7 Compliance Foreign Laws...Document6 pagesEvidencia 7 Compliance Foreign Laws...Luis Carlos Viveros GarcésNo ratings yet

- ABE 154 GroupWork The Anti-Dumping ArgumentDocument5 pagesABE 154 GroupWork The Anti-Dumping ArgumentJessi Anne Nakol V. AligatoNo ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument8 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledBryan MagnayeNo ratings yet

- Reliance Industries LTD Anti Dumping FinalDocument10 pagesReliance Industries LTD Anti Dumping FinalSAURABH SUNNYNo ratings yet

- QUIZDocument9 pagesQUIZChâu GiangNo ratings yet

- Findings On Anti-DumpingDocument2 pagesFindings On Anti-DumpingdrbhattaNo ratings yet

- aNTI DUMPING LAWSDocument38 pagesaNTI DUMPING LAWSmica43826No ratings yet

- Procedure Section713 Rev2 28july 2020Document3 pagesProcedure Section713 Rev2 28july 2020aim zehcnasNo ratings yet

- Applied Economics Written ReportDocument4 pagesApplied Economics Written ReportTres KilluaNo ratings yet

- Anti-Dumping MeasuresDocument21 pagesAnti-Dumping MeasuresDrishti TiwariNo ratings yet

- H RPT 98-725Document94 pagesH RPT 98-725BibliohorseNo ratings yet

- Chapter 5 Anti-Dumping Measures: Verview of UlesDocument31 pagesChapter 5 Anti-Dumping Measures: Verview of UlesRAISALORENA CHAVEZGONZALEZNo ratings yet

- Trade RemediesDocument3 pagesTrade Remediesmalou_corderoNo ratings yet

- Tariff & Non-Tariff BarriersDocument29 pagesTariff & Non-Tariff BarriersSanjivSIngh0% (1)

- Tax 2. Q&A Compilation (R.A. 9135, 8751, 8752 & 8800)Document13 pagesTax 2. Q&A Compilation (R.A. 9135, 8751, 8752 & 8800)pa3ciaNo ratings yet

- Evidencia 7 Compliance With Foreign LawDocument11 pagesEvidencia 7 Compliance With Foreign LawJorge DeviaNo ratings yet

- AnsoffDocument18 pagesAnsoffVinay KumarNo ratings yet

- Welding of SteelDocument7 pagesWelding of SteelAlbert CostasNo ratings yet

- The Impact of Supply Chain Management Practices On Firm Performance: Evidence From 3PL IndustryDocument15 pagesThe Impact of Supply Chain Management Practices On Firm Performance: Evidence From 3PL IndustrySyed Monirul HossainNo ratings yet

- The Ultimate Guide To Trade Show Marketing by The Image ShoppeDocument35 pagesThe Ultimate Guide To Trade Show Marketing by The Image ShoppeRonald RosueiNo ratings yet

- Chief Information Officer in Portland Oregon Resume Jodie CreamerDocument3 pagesChief Information Officer in Portland Oregon Resume Jodie CreamerJodieCreamerNo ratings yet

- Tutorial Relevant Costs For StudentsDocument3 pagesTutorial Relevant Costs For StudentsJihan RafiqaNo ratings yet

- Bovonto Is A Popular Soft Drink Brand in IndiaDocument3 pagesBovonto Is A Popular Soft Drink Brand in IndiaAjay JNo ratings yet

- TransportationDocument4 pagesTransportationShrinidhi Priyankaa 1912985630No ratings yet

- Sales ManagementDocument2 pagesSales ManagementTomiris TulegenovaNo ratings yet

- MoroccoDocument5 pagesMoroccobennaniabadiyouNo ratings yet

- External EnvironmentDocument20 pagesExternal EnvironmentMelanie Cruz ConventoNo ratings yet

- Literature Review On Customer Perception About Online Shopping With Reference To Amazon in India.Document14 pagesLiterature Review On Customer Perception About Online Shopping With Reference To Amazon in India.Anushka GargNo ratings yet

- Shopify Dropshipping - Extreme CommerceDocument189 pagesShopify Dropshipping - Extreme Commercemaham farooqi100% (2)

- CHAPTER - 5 Marketing in Small BusinessDocument25 pagesCHAPTER - 5 Marketing in Small BusinesstemesgenNo ratings yet

- Original PDF Mr2 New Engaging Titles From 4ltr Press 2nd Edition PDFDocument41 pagesOriginal PDF Mr2 New Engaging Titles From 4ltr Press 2nd Edition PDFarlene.wax700100% (54)

- MEP Guidebook 2Document2 pagesMEP Guidebook 2Christopher LimNo ratings yet

- Cost Per Unit Rs. Rs. Rs. RS.: M. Azeem/Activity Based CostingDocument4 pagesCost Per Unit Rs. Rs. Rs. RS.: M. Azeem/Activity Based CostingKamran ArifNo ratings yet

- Crafting The Brand PositioningDocument23 pagesCrafting The Brand PositioningZainab GhaddarNo ratings yet

- Report On Human Resource Management in MFIs A State of PracticeDocument172 pagesReport On Human Resource Management in MFIs A State of Practice9415351296No ratings yet

- Marketing Plan, Target MarketDocument3 pagesMarketing Plan, Target Marketnadya bujangNo ratings yet

- IG 3rd Party Logistics 3PL and Ecommerce enDocument1 pageIG 3rd Party Logistics 3PL and Ecommerce enJoaquim AmericoNo ratings yet

- Manual de Calidad COELME (MQAS Rev. 1 ENGLISH)Document53 pagesManual de Calidad COELME (MQAS Rev. 1 ENGLISH)Rommel Augusto Arnica AguedoNo ratings yet

- GP 5 Supplier Quality ProcessesDocument187 pagesGP 5 Supplier Quality ProcessesNeumar Neumann0% (1)

- Chap014 - JIT and Lean OperationsDocument31 pagesChap014 - JIT and Lean Operationsspchheda4996100% (1)

- PegaDocument1 pagePegasunilchopseyNo ratings yet

- IBM Corporation A Case AnalysisDocument154 pagesIBM Corporation A Case AnalysisHaleel AlsayerNo ratings yet

- CPG Industry OverviewDocument12 pagesCPG Industry OverviewanupamsarkaarNo ratings yet