Professional Documents

Culture Documents

Flood Certificate

Flood Certificate

Uploaded by

Estie FrankOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Flood Certificate

Flood Certificate

Uploaded by

Estie FrankCopyright:

Available Formats

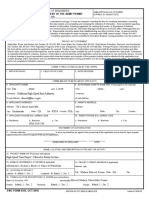

DEPARTMENT OF HOMELAND SECURITY

Federal Emergency Management Agency OMB Control No. 1660-0040

STANDARD FLOOD HAZARD DETERMINATION FORM (SFHDF) Expires: 09-30-2023

SECTION I - LOAN INFORMATION

1. LENDER/SERVICER NAME AND ADDRESS 2. COLLATERAL DESCRIPTION (Building/Mobile Home/Property) (See instructions for

more information.)

Customer Number Borrower:

1000260998 KIRSHENBAUM, AHARON

Address Determination Address:

THE FEDERAL SAVINGS BANK 74 WILLOW DR

4120 W DIVERSEY AVE STE C501 JACKSON, NJ 08527-3842

CHICAGO, IL 60639-2399 OCEAN COUNTY

APN/Tax ID: Lot: Block:

S/D: Phase:

Delivery Method: FDR-COM - WEB Section: Township: Range:

3. LENDER/SERVICER ID # 4. LOAN IDENTIFIER 5. AMOUNT OF FLOOD INSURANCE REQUIRED

10923080228

SECTION II

A. NATIONAL FLOOD INSURANCE PROGRAM (NFIP) COMMUNITY JURISDICTION

1. NFIP Community Name 2. County(ies) 3. State 4. NFIP Community Number

JACKSON, TOWNSHIP OF OCEAN COUNTY NJ 340375

B. NATIONAL FLOOD INSURANCE PROGRAM (NFIP) DATA AFFECTING BUILDING/MOBILE HOME

1. NFIP Map Number or Community-Panel Number 2. NFIP Map Panel Effective / 3. Is there a Letter of Map Change (LOMC)?

(Community name, if not the same as "A") Revised Date

34029C0160F September 29, 2006

• NO

(If yes, and LOMC date/no. is available,

4. Flood Zone 5. No NFIP Map YES

enter date and case no. below.)

X ☐ Date: Case No:

C. FEDERAL FLOOD INSURANCE AVAILABILITY (Check all that apply.)

1. Federal Flood Insurance is available (community participates in the NFIP). Regular Program Emergency Program of NFIP

2. Federal Flood Insurance is not available (community does not participate in the NFIP).

3. Building/Mobile Home is in a Coastal Barrier Resources Area (CBRA) or Otherwise Protected Area (OPA). Federal Flood Insurance

may not be available.

CBRA/OPA Designation Date:

D. DETERMINATION

IS BUILDING/MOBILE HOME IN SPECIAL FLOOD HAZARD AREA (ZONES CONTAINING THE LETTERS "A" OR "V")? YES NO

If yes, flood insurance is required by the Flood Disaster Protection Act of 1973.

If no, flood insurance is not required by the Flood Disaster Protection Act of 1973. Please note, the risk of flooding in this area is only reduced,

not removed.

This determination is based on examining the NFIP map, any Federal Emergency Management Agency revisions to it, and any other

information needed to locate the building /mobile home on the NFIP map.

E. COMMENTS (Optional) HMDA Information

State: 34

County: 029

MSA/MD: 35154

CT: 7171.02

34029717102

LIFE OF LOAN DETERMINATION

This flood determination is provided solely for the use and benefit of the entity named in Section 1, Box 1 in order to comply with the 1994

Reform Act and may not be used or relied upon by any other entity or individual for any purpose, including, but not limited to, deciding whether

to purchase a property or determining the value of a property.

F. PREPARER'S INFORMATION

NAME, ADDRESS, TELEPHONE NUMBER (If other than Lender) DATE OF DETERMINATION

ServiceLink National Flood September 05, 2023

500 E. Border St

Phone: 1.800.833.6347 ORDER NUMBER

Third Floor

Fax: 1.800.662.6347 1437818745

Arlington, TX 76010

FEMA FORM FF-206-FY-21-116 (formerly 086-0-32) (04/21) Page 1 of 1

Document created 09/05/2023 9:52:58 AM

Flood Order Number: 1437818745

Loan Number: 10923080228

Fee: $4.95

Document created 09/05/2023 9:52:58 AM

Notice of Special Flood Hazards and Availability of Federal Disaster Relief Assistance

Notice is Given By: THE FEDERAL SAVINGS BANK Loan Number: 10923080228

To: KIRSHENBAUM, AHARON Order Number: 1437818745

Property Location: 74 WILLOW DR Determination Date: 09/05/2023

JACKSON, NJ 08527-3842

Notice of Property IN Special Flood Hazard Area (SFHA)

The building or mobile home securing the loan for which you have applied is or will be located in an area with special flood hazards. The area has

been identified by the Administrator of the Federal Emergency Management Agency (FEMA) as a special flood hazard area using FEMA's Flood

Insurance Rate Map or the Flood Hazard Boundary Map for the following community:

JACKSON, TOWNSHIP OF - 34029C0160F

This area has a one percent (1%) chance of a flood equal to or exceeding the base flood elevation (a 100-year flood) in any given year. During

the life of a 30-year mortgage loan, the risk of a 100-year flood in a special flood hazard area is 26 percent (26%). Federal law allows a lender

and borrower jointly to request the Administrator of FEMA to review the determination of whether the property securing the loan is located in a

special flood hazard area. If you would like to make such a request, please contact us for further information.

Escrow Requirement for Residential Loans: Federal law may require a lender or its servicer to escrow all premiums and fees for flood insurance

that covers any residential building or mobile home securing a loan that is located in an area with special flood hazards. If your lender notifies

you that an escrow account is required for your loan, then you must pay your flood insurance premiums and fees to the lender or its servicer with

the same frequency as you make loan payments for the duration of your loan. These premiums and fees will be deposited in the escrow account,

which will be used to pay the flood insurance provider.

Notice of Property in a Participating Community

The community in which the property securing the loan is located participates in the National Flood Insurance Program (NFIP). Federal law

will not allow us to make you the loan that you have applied for if you do not purchase flood insurance. The flood insurance must be

maintained for the life of the loan. If you fail to purchase or renew flood insurance on the property, Federal law authorizes and requires us to

purchase the flood insurance for you at your expense.

• At a minimum, flood insurance purchased must cover the lesser of:

(1) the outstanding principal balance of the loan; or

(2) the maximum amount of coverage allowed for the type of property under the NFIP.

• Flood insurance coverage under the NFIP is limited to the building or mobile home and any personal property that secures your loan and

not the land itself.

• Federal disaster relief assistance (usually in the form of a low-interest loan) may be available for damages incurred in excess of your

flood insurance if your community's participation in the NFIP is in accordance with NFIP requirements.

• Although you may not be required to maintain flood insurance on all structures, you may still wish to do so, and your mortgage lender

may still require you to do so to protect the collateral securing the mortgage. If you choose not to maintain flood insurance on a

structure and it floods, you are responsible for all flood losses relating to that structure.

• Availability of Private Flood Insurance Coverage: Flood insurance coverage under the NFIP may be purchased through an insurance

agent who will obtain the policy either directly through the NFIP or through an insurance company that participates in the NFIP. Flood

insurance that provides the same level of coverage as a standard flood insurance policy under the NFIP may be available from private

insurers that do not participate in the NFIP. You should compare the flood insurance coverage, deductibles, exclusions, conditions and

premiums associated with flood insurance policies issued on behalf of the NFIP and policies issued on behalf of private insurance

companies and contact an insurance agent as to the availability, cost, and comparisons of flood insurance coverage.

Notice of Property in a Non-Participating Community

Flood insurance coverage under the NFIP is not available for the property securing the loan because the community in which the property is

located does not participate in the NFIP. In addition, if the non-participating community has been identified for at least one year as

containing a special flood hazard area, properties located in the community will not be eligible for Federal disaster relief assistance in the

event of a Federally declared flood disaster.

Notice of Property NOT IN Special Flood Hazard Area (SFHA)

The building or mobile home securing the loan for which you have applied is not currently located in an area designated by the Administrator of

FEMA as an SFHA. NFIP Flood insurance is not required, but may be available. If, during the term of this loan, the subject property is identified

as being in an SFHA, as designated by FEMA, you may be required to purchase and maintain flood insurance at your expense.

____________________________________________ ___________________________________________

Borrower’s Signature / Date Co-Borrower’s Signature / Date

THE FEDERAL SAVINGS BANK

____________________________________________ ___________________________________________

Lending Institution Lending Institution Authorized Signature / Date

Document created 09/05/2023 9:52:58 AM

You might also like

- Experian White Paper Fintech Led Digital LendingDocument37 pagesExperian White Paper Fintech Led Digital LendingSiddharth RoyNo ratings yet

- 4 Sem Bcom - Advanced Corporate AccountingDocument56 pages4 Sem Bcom - Advanced Corporate AccountingDipak Mahalik57% (7)

- Teschner Complaints RedactedDocument13 pagesTeschner Complaints RedactedAsbury Park PressNo ratings yet

- Affidavit of Redeem MortgageDocument4 pagesAffidavit of Redeem MortgageDan Just DumoNo ratings yet

- Jaildeath Quinn Lenoircounty InvestreportDocument3 pagesJaildeath Quinn Lenoircounty InvestreportDan KaneNo ratings yet

- Partnership Agency TrustDocument58 pagesPartnership Agency TrustThea Baltazar100% (7)

- ACC803 Advanced Financial Reporting: Week 2: Financial Statement Preparation and PresentationDocument17 pagesACC803 Advanced Financial Reporting: Week 2: Financial Statement Preparation and PresentationRavinesh PrasadNo ratings yet

- 2017 Exam With SolutionsDocument4 pages2017 Exam With SolutionsMathew YipNo ratings yet

- Trade Life CycleDocument98 pagesTrade Life Cyclepatcamp@blueyonder.co.uk100% (1)

- April 1, 2021: PRM's Response To The Town of Longboat KeyDocument29 pagesApril 1, 2021: PRM's Response To The Town of Longboat KeyMark BerginNo ratings yet

- DC School Fire Drill CitationsDocument130 pagesDC School Fire Drill CitationsABC7NewsNo ratings yet

- U.S. Army Corps of Engineers, Jacksonville District (Saj) : Violation Complaint FormDocument1 pageU.S. Army Corps of Engineers, Jacksonville District (Saj) : Violation Complaint FormCORALationsNo ratings yet

- Prelim - 3.2.21 - USF12058Document23 pagesPrelim - 3.2.21 - USF12058Andrea EspositoNo ratings yet

- Dec 08 06 2023Document4 pagesDec 08 06 2023jessicapsa22No ratings yet

- Anglers of The Au Sable's Letter To Michigan DNR Director Shannon Lott On Camp Grayling Memorandum.Document5 pagesAnglers of The Au Sable's Letter To Michigan DNR Director Shannon Lott On Camp Grayling Memorandum.Brandon ChewNo ratings yet

- Twic 2Document2 pagesTwic 2nooh.shammam09No ratings yet

- Public Service Commission: Devet RmentDocument12 pagesPublic Service Commission: Devet RmentGary DetmanNo ratings yet

- Application For Department of The Army PermitDocument3 pagesApplication For Department of The Army Permitjackson michaelNo ratings yet

- January: (Check The Appropriate Boxes and Complete As Necessary. If Additional Space Is Needed, Provide Attachments)Document9 pagesJanuary: (Check The Appropriate Boxes and Complete As Necessary. If Additional Space Is Needed, Provide Attachments)Nathan BlockNo ratings yet

- Gas Leak in Frederick On May 30Document2 pagesGas Leak in Frederick On May 30Chris PaulNo ratings yet

- Evergreen Terrace ApartmentsDocument21 pagesEvergreen Terrace ApartmentsRyan SloanNo ratings yet

- FF086033 ElevCert FormOnly RE 1mar2018Document8 pagesFF086033 ElevCert FormOnly RE 1mar2018tarunkumardongaNo ratings yet

- Reference Copy: Federal Communications CommissionDocument1 pageReference Copy: Federal Communications CommissionbeachvillageNo ratings yet

- Baby Brianna Lopez Briana Robert Walters JRDocument9 pagesBaby Brianna Lopez Briana Robert Walters JRBaby BriannaNo ratings yet

- ApplicationDocument5 pagesApplicationAmelia KaiNo ratings yet

- Grants Creek Crossing ApartmentsDocument21 pagesGrants Creek Crossing ApartmentsRyan SloanNo ratings yet

- Public Service Commission: State of FloridaDocument10 pagesPublic Service Commission: State of Floridathe next miamiNo ratings yet

- Fy2017 Liheap State PlanDocument47 pagesFy2017 Liheap State PlanJason HoffmanNo ratings yet

- Source 1Document54 pagesSource 1keshavarz.shirazu.ac.irNo ratings yet

- Print Preview - Preliminary Application: Project DescriptionDocument21 pagesPrint Preview - Preliminary Application: Project DescriptionRyan SloanNo ratings yet

- Vba 20 0996 AreDocument3 pagesVba 20 0996 AreJaster Da GreatNo ratings yet

- SUPBP-015: Superior Court of California, County of Los AngelesDocument2 pagesSUPBP-015: Superior Court of California, County of Los AngelesTom Eskwire0% (1)

- Orchard Creek ApartmentsDocument21 pagesOrchard Creek ApartmentsRyan SloanNo ratings yet

- Scottish Glen IIDocument21 pagesScottish Glen IIRyan SloanNo ratings yet

- Transit Noise and Vibration Impact Assessment Manual Fta Report No 0123 - 0 PDFDocument258 pagesTransit Noise and Vibration Impact Assessment Manual Fta Report No 0123 - 0 PDFKamrul HasanNo ratings yet

- SRTPV Solar Application FormDocument30 pagesSRTPV Solar Application FormramireddykonduriNo ratings yet

- Updated Transport Environmental Transport Permit Registration Form 2022 Updated (Blank Form)Document4 pagesUpdated Transport Environmental Transport Permit Registration Form 2022 Updated (Blank Form)Azylla TuranNo ratings yet

- Print Preview - Preliminary Application: Project DescriptionDocument25 pagesPrint Preview - Preliminary Application: Project DescriptionRyan SloanNo ratings yet

- 2008 Industrial Multi-Sector General PermitDocument3 pages2008 Industrial Multi-Sector General PermitAlb DocsNo ratings yet

- 02 FM SP Dilg 07 01 (CCSRF DBC)Document2 pages02 FM SP Dilg 07 01 (CCSRF DBC)Godece RosalNo ratings yet

- Instructions For Completing Application For Burial Benefits (UNDER 38 U.S.C., CHAPTER 23)Document4 pagesInstructions For Completing Application For Burial Benefits (UNDER 38 U.S.C., CHAPTER 23)artclevelandNo ratings yet

- Encroachment Permits Manual - Appendix - D - (Web)Document37 pagesEncroachment Permits Manual - Appendix - D - (Web)prowagNo ratings yet

- Tampa So WWTP FORM 2A 62-620.910 (2) SubmitDocument22 pagesTampa So WWTP FORM 2A 62-620.910 (2) SubmitgibfrogNo ratings yet

- ReferenceDocument3 pagesReferenceSkeevie SteveNo ratings yet

- Print Preview - Preliminary Application: Project DescriptionDocument21 pagesPrint Preview - Preliminary Application: Project DescriptionRyan SloanNo ratings yet

- PrelimCommitmentDocument21 pagesPrelimCommitmentAndrea EspositoNo ratings yet

- U.S. NRC Cover Letter and Notice of ViolationDocument7 pagesU.S. NRC Cover Letter and Notice of ViolationNewsChannel 9 StaffNo ratings yet

- Reference Copy: Federal Communications CommissionDocument8 pagesReference Copy: Federal Communications CommissionA. D.No ratings yet

- A 217252Document70 pagesA 217252agstrengNo ratings yet

- Print Preview - Preliminary Application: Project DescriptionDocument21 pagesPrint Preview - Preliminary Application: Project DescriptionRyan SloanNo ratings yet

- KonbDocument15 pagesKonbKylie Liana SteinNo ratings yet

- For Use of This Form, See NGR 37-111 The Proponent Agency Is NGB-ARH-SDocument4 pagesFor Use of This Form, See NGR 37-111 The Proponent Agency Is NGB-ARH-Sluis-pacheco-3313No ratings yet

- Print Preview - Preliminary Application: Project DescriptionDocument22 pagesPrint Preview - Preliminary Application: Project DescriptionRyan SloanNo ratings yet

- Reference Copy: Federal Communications CommissionDocument5 pagesReference Copy: Federal Communications CommissionA. D.No ratings yet

- Deal CAFRA Violation NoticeDocument3 pagesDeal CAFRA Violation NoticeAsbury Park PressNo ratings yet

- Baby Brianna Lopez Briana Patricia WaltersDocument10 pagesBaby Brianna Lopez Briana Patricia WaltersBaby Brianna67% (3)

- Print Preview - Preliminary Application: Project DescriptionDocument21 pagesPrint Preview - Preliminary Application: Project DescriptionRyan SloanNo ratings yet

- DD 2887Document1 pageDD 2887Jake JonesNo ratings yet

- Tricare Prime Enrollment, Disenrollment, and Primary Care Manager (PCM) Change FormDocument5 pagesTricare Prime Enrollment, Disenrollment, and Primary Care Manager (PCM) Change FormData hi DataNo ratings yet

- Insurance Identification Card Insurance Identification Card: Timothy Snyder 568 Highway 89 N Linn, MO 65051-3209Document2 pagesInsurance Identification Card Insurance Identification Card: Timothy Snyder 568 Highway 89 N Linn, MO 65051-3209Kelsey SnyderNo ratings yet

- CBP Form 434Document2 pagesCBP Form 434Heather SoraparuNo ratings yet

- InvoiceDocument1 pageInvoiceOnur BayramovNo ratings yet

- Form V - Borehole Registration FormDocument3 pagesForm V - Borehole Registration FormMasauso Lungu100% (1)

- Wakulla LNG Pipeline Water Quality Certificate ApplicationDocument32 pagesWakulla LNG Pipeline Water Quality Certificate ApplicationRyan E. Emanuel, Ph.D.No ratings yet

- How to Exercise Statutory Powers Properly: Cayman Islands Administrative LawFrom EverandHow to Exercise Statutory Powers Properly: Cayman Islands Administrative LawNo ratings yet

- Student's Worksheeet 3.2 & 4.2Document8 pagesStudent's Worksheeet 3.2 & 4.2Ayasha BeeNo ratings yet

- An Empirical Study of Financial Performance of Mahindra and Mahindra Co. - A Comparative AnalysisDocument7 pagesAn Empirical Study of Financial Performance of Mahindra and Mahindra Co. - A Comparative AnalysisVįňäý Ğøwđã VįñîNo ratings yet

- Appraoches To Valuation 1Document67 pagesAppraoches To Valuation 1tj00007No ratings yet

- Coca Cola India RatioDocument15 pagesCoca Cola India RatioKaran VermaNo ratings yet

- CPT Sample Question PaperDocument41 pagesCPT Sample Question PaperAshraf ValappilNo ratings yet

- 100 Pak Women Who MatterDocument16 pages100 Pak Women Who MattersanghamitrabNo ratings yet

- Aircraft Leasing and Financing-IssuesDocument3 pagesAircraft Leasing and Financing-IssuesshaiknazimahmedshafiNo ratings yet

- Suffolk Times Classifieds and Service Directory: Feb. 8, 2018Document11 pagesSuffolk Times Classifieds and Service Directory: Feb. 8, 2018TimesreviewNo ratings yet

- For Auto Bricks IndustryDocument7 pagesFor Auto Bricks IndustryRana MasudNo ratings yet

- Risk Management ProposalDocument13 pagesRisk Management ProposalromanNo ratings yet

- 138-Reyes-v-Secretary of JusticeDocument6 pages138-Reyes-v-Secretary of Justicecassandra leeNo ratings yet

- Arizona Pic Has Carried On Business For A Number ofDocument1 pageArizona Pic Has Carried On Business For A Number ofTaimour HassanNo ratings yet

- Position Review of Port Klang Free Zone Project and Port Klang Free Zone SDN BHDDocument51 pagesPosition Review of Port Klang Free Zone Project and Port Klang Free Zone SDN BHDKenny WongNo ratings yet

- Letter To Secretary of EducationDocument2 pagesLetter To Secretary of Educationapi-489800786No ratings yet

- Corporate Finance: Mergers and AcquisitionsDocument32 pagesCorporate Finance: Mergers and Acquisitionskkn35No ratings yet

- Act Past PaperDocument9 pagesAct Past PaperbanglauserNo ratings yet

- Gitman pmf13 ppt03Document68 pagesGitman pmf13 ppt03CARLOS ANDRESNo ratings yet

- IjarahDocument15 pagesIjarahArsalan Khan100% (1)

- Capital StructureDocument9 pagesCapital StructureManish XiiNo ratings yet

- Laws On Corporation 1Document6 pagesLaws On Corporation 1Abby AngNo ratings yet

- The Cost of Capital (Chapter 15) : Ovu-Advance Managerial Finance D.B. Hamm, Rev. Jan 2006Document20 pagesThe Cost of Capital (Chapter 15) : Ovu-Advance Managerial Finance D.B. Hamm, Rev. Jan 2006Arnel RemorinNo ratings yet

- New Central Bank Act NotesDocument14 pagesNew Central Bank Act NotesAleric Mondano75% (4)

- New Frontier Sugar DigestDocument1 pageNew Frontier Sugar DigestVon Lee De LunaNo ratings yet