Professional Documents

Culture Documents

CO 3 - The Intelligent Audit - ISACA

CO 3 - The Intelligent Audit - ISACA

Uploaded by

BAGUS RADJAOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CO 3 - The Intelligent Audit - ISACA

CO 3 - The Intelligent Audit - ISACA

Uploaded by

BAGUS RADJACopyright:

Available Formats

FEATURE

The Intelligent Audit

“every aspect of learning or any other feature of

intelligence can be, in principle, so precisely

www.isaca.org/currentissue Do you have

described that a machine can be made to simulate

something

it.”1 Although AI has been studied for decades, only to say about this

Artificial intelligence (AI) is a key contributor to recently has the technology behind AI prospered article?

recent technological innovations, including into usable tools.

autopiloted cars. Although AI application is still Visit the Journal pages

under development for cars, it is already of the ISACA® website

The backbone of AI is training computers, with the

(www.isaca.org/journal),

implemented, operating and has room for use of large data sources, to recognize patterns and

find the article and click

expansion in financial audits. accomplish desired computational and relational on the Comments link to

tasks.2 The human aspect of AI is in this training; share your thoughts.

A financial audit requires time-consuming, labor- human inquiry, guidance and observation are

intensive research into an enterprise and its https://bit.ly/2ndp3Fx

needed for an AI system to operate successfully.

financial statements. The audit goal is to collect

evidence that allows the auditor to form an opinion Machine learning (ML) and natural language

on whether the financial statements properly processing (NLP) are types of AI. ML is “born from

represent the enterprise in all material respects. pattern recognition and the theory that computers

Using AI technologies in the audit process can learn without being programmed to perform

improves, but does not replace, the audit specific tasks.”3 ML is computers learning from

profession. AI enhances audits by increasing data. Given this technology, machines can infinitely

efficiency, effectiveness and accuracy. Accounting and independently adapt to produce consistent

and audit professionals should strive to research decisions and reliable results by identifying patterns

and become thought leaders on the future of their and make classifications or predictions based on

professions and relay that expert knowledge to these patterns. Common uses of ML in everyday life

senior leadership. These professionals have a role are recommendations for other purchases that

in ensuring that their organizations are innovators display during online shopping, social media

and adopters of AI to provide the best services showing not every post of friends but only those

possible to clients. that it determines are of interest to the account

holder, and self-driving cars.

Applying AI Technology to Tools

Computer scientist John McCarthy conceived the

term “artificial intelligence” in 1955. He believed

Pascal A. Bizarro, Ph.D., CISA

Is an associate professor of accounting in the accounting and management information systems department at Bowling Green

State University, Ohio (USA). He is the author of several published articles in leading journals, including The CPA Journal, ISACA®

Journal and Internal Auditing.

Emily Crum

Is a recent graduate of the Master of Accountancy program at Bowling Green State University, Ohio (USA). She joined the risk

advisor program at EY in Charlotte, North Carolina (USA), after her graduation.

Jake Nix, CISA, CPA

Founded RISC Point Advisory Group Ltd. to leverage a network of industry-leading subject matter experts and offer services in

managed compliance, business technology risk consulting, and transformation and strategy enablement. Previously, he worked for

EY and PricewaterhouseCoopers for several years. Nix served on the Ohio (USA) Certified Public Accountant (CPA) Foundation

board of trustees and has been published in the ISACA® Journal.

ISACA JOURNAL VOL 6 23

NLP is without the use of AI technologies. Although some

parts of the process can be automated, the process

...a branch of artificial intelligence that

still requires human involvement and judgment to

helps computers understand, interpret and

reach a conclusion.

manipulate human language…to fill the gap

between human communication and

Planning Phase—Auditor and AI Computer

computer understanding.4

Comparison

The audit begins with a planning phase, during

NLP improved tremendously over the past decade

which an auditor gains an understanding of the

and enables computers to read, hear and interpret

client’s industry and enterprise; performs a risk

speech extremely quickly, consistently and without

assessment; and determines the nature, extent and

bias, especially compared to humans. Predictive

timing of procedures based on their reliance on

and autocomplete typing via text or search engine;

internal controls. In a traditional audit, these tasks

spell check; virtual assistants such as Amazon

are accomplished by an auditor physically

Alexa, Apple Siri and Windows Cortana; voicemail

examining the industry and enterprise, holding

speech-to-text; and automatic translations are just

discussions with management and manually taking

some examples of NLP in daily life.

notes, reviewing minutes from board of director

(BoD) meetings, using judgment to evaluate risk of

ML and NLP can also be applied to accounting and

the environment and inherent risk that specific

financial auditing.

financial statement line items and significant

classes of transactions carry, and, ultimately,

AI’s Impact on Financial Audits determining how much reliance can be placed on

The financial audit process has been relatively internal controls.7 The traditional steps depend on

stagnant and has not seen many revolutionary the professional judgment and skepticism of the

developments since the implementation of the US auditor. AI can automate these procedures and

Sarbanes Oxley Act of 2002.5 The implementation remove a level of uncertainty.

of computer assistance vs. paper and pencil

changed the form in which work is completed, but

the historical nature remains the same. The AI NOT ONLY HAS THE

financial audit is in a mature stage and has become

sluggish and lacking in margins and innovation. POWER TO CHANGE AN

Through the power of technology, the audit can AUDIT, BUT ALSO HAS THE

develop far past the ticking and tying on which it is

focused today, and deeper into the world of analysis CAPABILITIES TO

and information processing.6 COMPLETELY TRANSFORM

The technologies that power AI to be effective, THE PROCESS.

efficient and applicable in the professional service

field are coming of age and are ready for

implementation. AI not only has the power to In an AI-assisted audit, the goals of the planning

change an audit, but also has the capabilities to phase are the same as those of a traditional audit.

completely transform the process, especially in the AI can collect and analyze client and industry data,

planning of the audit, evaluation of internal controls such as organizational structure (by analyzing

and performance of substantive procedures. organization charts or the details within a human

resources information system), operational

The steps and outcomes of an audit remain the methods, and accounting and financial systems,

same, whether it is a traditional or an AI-assisted from automatically gathered public data on the

audit. However, the way in which tasks are Internet, previous US Securities and Exchange

completed is where the true impact of AI can be Commission (SEC) filings, and client-provided

seen. Figure 1 compares audit procedures with and documents that feed into the AI system through

24 ISACA JOURNAL VOL 6

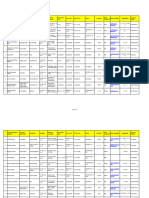

Figure 1—Audit Procedures Comparison With and Without AI Technologies

Impact of AI on

Accomplishing

Phase Procedures Without AI Procedures With AI Types of Technology Phase Tasks

Planning The auditor: The AI computer performs the • NLP Moderate impact

• Learns industry and business following tasks: • ML

environment through meetings with • Produces risk assessment based • Voice recognition

client management and review of on prior-year documents, business

BoD meeting minutes environment and industry trends for

• Examines client’s enterprise to auditor’s review

estimate a level of risk • Records, summarizes and produces

meeting minutes

Evaluation The auditor: The AI computer performs the • Voice recognition High impact

of internal • Reviews internal controls, policies following tasks: • NLP

controls and procedures • Prepares workpaper references, • ML

• Interviews process owners and including flowcharts and risk/

records details for workpapers control matrices, from recorded

• Performs operational test of interview information

controls by observing employees, • Analyzes screen captures of

reperforming processes and computer processes and flags

inspecting documents those that are questionable and

needing additional review

• Digitally inspects documents,

looking for adequate approvals

Substantive The auditor: The auditor leverages the following • NLP High impact

procedures • Manually observes inventory count technologies: • Voice recognition

• Sends and manages confirmation • Digital/mobile applications, barcodes • Drones

requests and QR codes, and drones assisting • ML

• Inspects supporting documents of in inventory counts • Encryption

sales orders and cash receipts • Encrypted online platform, • Internet of Things (IoT)

• Reviews select journal entries accessed by both auditors and

that fit circumstances that may customers, to manage confirmation

reflect fraud requests

• Analytically compares auditor’s

estimates and industry averages of The AI computer performs the

sales and other metrics to actual following tasks:

enterprise performance • Imports and automatically

reconciles cash receipts and

sales orders while comparing for

discrepancies

• Flags all transactions that are

potential fraud cases

• Creates estimation of

sales and other metrics based on

industry and competitor data

Closing The auditor: The AI computer performs the • NLP Low to moderate

procedures • Compiles audit findings following tasks: • ML impact

and issues • Formulates an audit score based on

• Uses professional judgment to client’s risk, audit findings and their

evaluate impact of findings effects to evaluate audit risk

• Forms categorical opinion • Forms opinion based on

• Writes audit report using the continuous-number grading scale

formatting provided by audit • Drafts audit report based on audit

standards score and formulated opinion

ISACA JOURNAL VOL 6 25

either connected sources or manual (human) client’s internal control system and evaluate the

collection and upload. AI can automatically produce implementation and operation of these controls to

a risk assessment report based on prior-year assess their reliability. In a traditional audit, this

workpapers and the business environment and process often includes reviewing internal control

industry trends for the auditor to evaluate. NLP, policies and procedures and interviewing those in

paired with voice recognition, can record, charge of major processes, such as sales

summarize and produce minutes of meetings held administration, accounting and finance, about sales

with the client. Using ML, an intelligent device can processes to gain an understanding of the internal

evaluate the business understanding, risk controls in place and the overall enterprise

assessment and prior audit information to propose processes.9 Details from these interviews are

a level of reliance that can be placed on internal manually recorded and posted to workpapers. After

controls.8 The AI machine outputs a level of reliance the interviews, the auditor conducts an operational

that is based on the data provided to the machine. test that typically includes observing employees

Data intended to be used by AI systems should be performing their duties, reperforming processes and

complete and accurate so that the output is reliable. inspecting documents. These processes are relatively

black and white—either the control performs as

intended or it does not—meaning that this is an area

that can be highly influenced by automation.

IN GENERAL, THE AI

TOOLS USED IN THE A primary consideration when evaluating the

effectiveness of internal controls over financial

PLANNING PHASE OF AN reporting is an accurate understanding of the

AUDIT HAVE A various business processes. AI can help reduce the

effort and improve the accuracy of business

MODERATE IMPACT ON process documentation. One of the AI tools that

THE WAY IN WHICH can help to improve and, in some cases, automate

this documentation is process mining.

TASKS OF THIS PHASE

Process mining offers objective, fact-based

ARE COMPLETED. insights, derived from actual event logs,

that help you audit, analyze, and improve

your existing business processes by

The auditor uses the proposed reliance level,

answering both compliance-related and

personal knowledge and judgment to set the control

performance-related questions.10

risk for the audit and plan the nature, extent and

timing of procedures. In general, the AI tools used in

Using the data that already reside in the system,

the planning phase of an audit have a moderate

process mining derives insights about business

impact on the way in which tasks of this phase are

processes and automates the creation of business

completed. Some tasks are automated, especially in

process documentation. Also, an auditor who is

the background research area, but the overall goals

evaluating the internal controls environment can

of this phase are rather judgment-based and cannot

use AI voice recognition and NLP to autogenerate

be highly impacted by the implementation of AI.

workpapers from interviews conducted. ML can be

This phase uses rather complex tools that are not

leveraged to inspect documents and determine if

yet fully perfected but are on their way. With an

the appropriate approvals have been received as

understanding of the business environment,

part of control testing. The AI tools that can be used

assessed level of control risk and audit plan

in this phase can have a large impact on the audit

complete, evaluation and testing can begin.

by automating many time-consuming, routine

processes.11 A more robust evaluation of internal

Evaluation of Internal Controls Phase—Auditor and

controls and a stronger understanding of business

AI Computer Comparison

processes lead to more efficient and effective

In the next audit phase, evaluating internal controls,

substantive testing and overall audit results.

the goal is to gain a deeper understanding of the

26 ISACA JOURNAL VOL 6

Substantive Procedures Phase—Auditor and AI

Computer Comparison

The third major phase of an audit is substantive

procedures, which test the details (classes of

transactions, account balances and disclosures)

and analytical procedures to detect material

misstatements. The amount of substantive

procedures performed is directly related to the

assessed level of audit risk, which is composed of

control risk, inherent risk and detection risk.

Traditional audits include many substantive

procedures, such as:

• Manually observing the reconciliation of a

sample of the warehouse physical inventory to

inventory that is recorded on the books

ML can identify the conditions under which journal

• Sending confirmation letters to the client’s

customers to confirm balances and investigate entries may be fictitious, such as abnormally large

discrepancies amounts, unused accounts and end-of-year

adjustments, and it can flag suspicious transactions

• Inspecting supporting documents of sales orders with unusual patterns. ML can also impact audit

and cash receipts analytical procedures by analyzing market trends

and competitor movements to estimate sales.

• Reviewing journal entries that fit circumstances

that could reflect fraud

The AI technologies related to substantive

• Analytically comparing the auditor’s estimates procedures are the most mature technologies in the

and industry averages for sales and other audit process. The ability of AI to continuously

metrics to actual enterprise performance analyze 100 percent of the data instead of samples

provides a much more accurate opinion.13 Use of AI

for analytics has been limited due to the complexity

of client environments. Many client enterprises use

THE AI TECHNOLOGIES more than one enterprise resource planning (ERP)

RELATED TO SUBSTANTIVE system, including legacy systems with disparate

database schemas. Depending on the situation, this

PROCEDURES ARE THE challenge can be addressed with automated tasks,

MOST MATURE such as process mining, or with a structured

approach, such as extract-transform-load (ETL), to

TECHNOLOGIES IN THE consolidate disparate data. “ETL is a type of data

AUDIT PROCESS. integration that refers to the three steps (extract,

transform, load) used to blend data from multiple

sources.”14 This approach can be used by audit

These procedures can be completely overhauled by professionals in a mixed-technology environment.

the implementation of AI, and this transformation By transforming the data into a common data

has already begun. Digital applications, bar codes model and utilizing a stand-alone database (note:

and drones assist with inventory observation and these can be owned by the client or audit firm

reconciliation. Online platforms manage depending on data privacy preferences), the auditor

confirmation requests between auditors and can use AI to perform functions otherwise

customers and use high levels of encryption unavailable in legacy systems. This makes it

technology.12 ML and NLP technologies are able to possible to gain the same level of insight across the

inspect documentation of sales orders and cash system, as in a ready-to-use ERP, such as SAP.

receipts and automatically reconcile discrepancies.

ISACA JOURNAL VOL 6 27

Closing Procedures—Auditor and AI Computer that specialize in AI, such as IBM Watson. Generally,

Comparison audit enterprises begin using AI tools for managing

After the tests of controls and details and the confirmations and requests, analyzing contracts,

analytical procedures, it is time to form an opinion simplifying the inventory process, and journal entry

on the client’s financial statements and issue an analysis.16 Although the larger audit enterprises

audit opinion. These closing procedures include have the capital to support AI development that

aggregating audit findings and issues, manually smaller enterprises may not have, vendors, such as

evaluating the potential impacts, and forming a Mindbridge AI, have developed affordable off-the-

categorical opinion (clean, qualified/modified, shelf software solutions that may be more viable for

adverse or disclaimer). With the assistance of AI, a audit enterprises that want to begin using AI, but do

score can be calculated based on the client’s risk of not have the means or desire to develop or fully

material misstatement, the number of errors found customize it.

and their effect, and automatically evaluate audit

risk.15 This could take an opinion from a category to

a continuous numerically graded range, therefore AI IS NOT A ONE-SIZE-

removing some of the ambiguity to which a

categorical opinion could lead. The overall audit FITS-ALL TYPE OF TOOL,

opinion is still based on professional judgment, but BUT, RATHER, A DIVERSE

with the help of AI, the opinion is much better

supported by facts and figures. TECHNOLOGY THAT CAN

BE ADAPTED TO UNIQUE

After an opinion is formed, the audit report is

compiled. Traditionally, this step is completed using ENVIRONMENTS.

the audit standard format. NLP can automatically

create a draft of the audit report from the known

final opinion, audit procedures, risk of material AI’s impact can also vary depending on the type of

misstatements and results. industry or enterprise. AI is not a one-size-fits-all

type of tool, but, rather, a diverse technology that

Audit enterprises need to carefully consider the AI can be adapted to unique environments. Industries

tools to use in their processes. Some AI tools require that are heavily automated and use AI such as

installation in the client environment; other AI tools manufacturing and healthcare are much more able

reside in the cloud and process and store sensitive to employ the full power of an intelligent audit.

data as described previously. These considerations Industries that lack automation cannot experience

can be addressed through a vendor management the same benefits from an intelligent audit due to

process, which ensures that the AI software meets the difficulty in transferring their manual processes

certain accepted standards, such as Service into workable data.

Organization Control (SOC) 2, which includes trust

services principles related to security, confidentiality Will AI Replace the Auditor?

and privacy. Additional attestations and certifications

are available, such as the International Organization After reading and analyzing how AI technologies

for Standardization’s (ISO) ISO 27001 certifications. can be used throughout the audit process, some

Like for any other tool an auditor chooses to use, due auditors may worry that they will be replaced by

care should be exercised to ensure that AI is not these technologies. Properly programmed AI tools

introducing any risk to the client’s system, security, can process massive quantities of data at lightning

confidentiality or privacy. speed and quickly identify anomalies—all with a

high rate of accuracy. However, AI is not yet capable

Many auditing enterprises, from the Big Four to of replacing “the judgment, skepticism or

regional and local, are implementing AI in their experience that humans bring to their work.”17 This

audits. These enterprises have either developed statement shows that, with all the power that AI

their own AI software or partnered with enterprises holds, it is still not enough to fully replace thinking

28 ISACA JOURNAL VOL 6

humans and the story they can tell about the data. 5 Congress.gov, “H.R. 3763 - Sarbanes-Oxley Act

of 2002,” USA, www.congress.gov/bill/ Enjoying

With AI assisting in analytics and testing, auditors 107th-congress/house-bill/3763

this article?

have more time available to investigate the reasons 6 Crosley, G.; A. Anderson; “The Audit of the

behind patterns and anomalies found by AI.18 AI can Future: Daring, Disruptive and Data-Driven But

• Read

perform many tedious tasks and free the auditor to Poised to Add Significant Value to Firms and

Understanding

act as more of an advisor and perform more review Clients,” Crosley Company, 6 March 2018,

Artificial

and judgment, thereby improving the overall quality www.crosleycompany.com/1747-2/

Intelligence.

and confidence in the audit while simultaneously 7 Issa, H.; T. Sun; M. A. Vasarhelyi; “Research

www.isaca.org/AI

reducing risk. To prepare for the deep Ideas for Artificial Intelligence in Auditing:

• Learn more

implementation of AI, auditors need to remain The Formalization of Audit and Workforce

about, discuss

relevant and competitive. An auditor “...will need to Supplementation,” Journal of Emerging

and collaborate

be tech-savvy, a strategic thinker and strong Technologies in Accounting, Fall 2016,

on emerging

communicator.”19 Even with AI, there will be a vol. 13, no. 2, p. 1-20, https://aaajournals.org/

technology in

continued need for deep knowledge and expertise doi/10.2308/jeta-10511

ISACA’s Online

in traditional audit areas, but auditors also need to 8 PricewaterhouseCoopers Japan; “Audit

Forums.

adapt to their changing environment. For students Transformation: How Will AI Change the Audit,”

https://engage.

hoping to enter this field, it is recommended that Research & Reports, March 2018, www.pwc.com/

isaca.org/

they add a focus in technology and analytics on top jp/en/knowledge/thoughtleadership.html

onlineforums

of their accounting foundation to become an ideal 9 Op cit Issa

candidate. For existing professionals, continuing 10 Celonis, “What Is Process Mining?”

education to gain comfort with and understanding https://www.celonis.com/process-mining/

of emerging technologies, while expanding critical what-is-process-mining/#

thinking and analytic skills will help them remain 11 Op cit PricewaterhouseCoopers Japan

competitive. The auditing field is rapidly changing 12 Ibid.

due to advancements in AI. Therefore, the 13 Brennan, B.; M. Baccala; M. Flynn; “Artificial

workforce needs to adapt to fit demands. Intelligence Comes to Financial Statement

Audits,” CFO, 2 February 2017, www.cfo.com/

Endnotes auditing/2017/02/artificial-intelligence-audits/

14 SAS, “ETL: What It Is and Why It Matters,”

1 Childs, M.; “John McCarthy: Computer Scientist SAS Institute Inc., www.sas.com/en_us/

Known as the Father of AI,” The Independent, insights/data-management/what-is-etl.html

1 November 2011, www.independent.co.uk/ 15 Op cit Issa

news/obituaries/john-mccarthy-computer- 16 Faggella, D.; “AI in the Accounting Big Four—

scientist-known-as-the-father-of-ai- Comparing Deloitte, PwC, KPMG, and EY,”

6255307.html Emerj, 17 May 2019, https://emerj.com/

2 SAS, “Artificial Intelligence: What It Is and ai-sector-overviews/ai-in-the-accounting-big-

Why It Matters,” SAS Institute Inc., 2019, four-comparing-deloitte-pwc-kpmg-and-ey/

www.sas.com/en_us/insights/analytics/ 17 Boillet, J.; “How AI Will Enable Us to Work

what-is-artificial-intelligence.html Smarter, Faster,” EY, 7 June 2017,

3 SAS, “Machine Learning: What It Is and www.ey.com/en_gl/assurance/how-ai-will-

Why It Matters,” SAS Institute Inc., 2019, enable-us-to-work-smarter-faster

www.sas.com/en_us/insights/analytics/ 18 Op cit Brennan

machine-learning.html 19 Guthrie, R.; “Preparing Tomorrow’s Auditors

4 SAS, “What Is Natural Language Processing?” For The Future Of Tech-Driven Accounting,”

SAS Institute Inc., 2019, www.sas.com/en_us/ Forbes, 30 August 2017, www.forbes.com/sites/

insights/analytics/what-is-natural-language- forbesfinancecouncil/2017/08/30/preparing-

processing-nlp.html tomorrows-auditors-for-the-future-of-tech-

driven-accounting/#1bbd8faa1c27

ISACA JOURNAL VOL 6 29

You might also like

- Feasibility Study For Flower ShopDocument72 pagesFeasibility Study For Flower ShopAileen Mifranum II100% (1)

- Statement of Auditing PracticeDocument8 pagesStatement of Auditing PracticeNestor Darío Duque MNo ratings yet

- What Skills and Attributes Does An Accounting Graduate Need? Evidence From Student Perceptions and Employer ExpectationsDocument65 pagesWhat Skills and Attributes Does An Accounting Graduate Need? Evidence From Student Perceptions and Employer ExpectationsZafour100% (7)

- Irzan Raditya - Artificial Intelligence 101Document47 pagesIrzan Raditya - Artificial Intelligence 101seonyeon caseNo ratings yet

- Case Study - Financial ServiceDocument5 pagesCase Study - Financial ServiceNia ニア Mulyaningsih0% (1)

- CAS 530 SamplingDocument14 pagesCAS 530 SamplingzelcomeiaukNo ratings yet

- Chapter 3 IT at WorkDocument19 pagesChapter 3 IT at WorkfarisNo ratings yet

- DDOS Attack Using KaliDocument10 pagesDDOS Attack Using KaliAJGMFAJNo ratings yet

- Aberlink 3D Mk4 User Manual (Iss 26-3)Document140 pagesAberlink 3D Mk4 User Manual (Iss 26-3)X800XL100% (1)

- Makalah Payroll and Personnel Kel 3 Ai 1Document29 pagesMakalah Payroll and Personnel Kel 3 Ai 1Nelly YulindaNo ratings yet

- Iaps 1002 - Practice NoteDocument4 pagesIaps 1002 - Practice NoteIvan Tamayo BasasNo ratings yet

- Autonomic Computing: A Seminar Report OnDocument43 pagesAutonomic Computing: A Seminar Report OnIyere GiftNo ratings yet

- Ks4ws Install Guide enDocument115 pagesKs4ws Install Guide enrubenNo ratings yet

- Bab 12. Pengaruh Teknologi Informasi Dalam Proses AuditDocument28 pagesBab 12. Pengaruh Teknologi Informasi Dalam Proses AuditErlanggaNo ratings yet

- Chapter 6 - Internal ControlDocument36 pagesChapter 6 - Internal Controlsiti fatimatuzzahraNo ratings yet

- Assignment PGD-2104: Computer Based AccountingDocument14 pagesAssignment PGD-2104: Computer Based AccountingGurpreet SinghNo ratings yet

- Environmental Cost Accounting and AuditingDocument7 pagesEnvironmental Cost Accounting and AuditingMohd HafizuddinNo ratings yet

- Running Head: Accounting Software Acquisition 1Document6 pagesRunning Head: Accounting Software Acquisition 1Erick Nyabuto100% (1)

- Process Narrative - SOX Project / IT Fixed Assets: PurposeDocument6 pagesProcess Narrative - SOX Project / IT Fixed Assets: PurposeZlatilNo ratings yet

- 02 Dasar Machine Learning 02 - Supervised Vs UnsupervisedDocument25 pages02 Dasar Machine Learning 02 - Supervised Vs UnsupervisedRin Kim100% (1)

- MVDAFT FinalDocument30 pagesMVDAFT FinalVaibhav BajpaiNo ratings yet

- Domain 2: Value Delivery From IT To The Business Is MOST Effectively Achieved byDocument6 pagesDomain 2: Value Delivery From IT To The Business Is MOST Effectively Achieved bysondos100% (1)

- Security Threats To E-Commerce - Electronic Payment System - E-Cash - Credit-Debit CardsDocument3 pagesSecurity Threats To E-Commerce - Electronic Payment System - E-Cash - Credit-Debit CardsDev SharmaNo ratings yet

- Auditing The Ultimate ShortDocument13 pagesAuditing The Ultimate ShortvishnuvermaNo ratings yet

- Contoh CV Mahasiswa IT - Data Analyst Intern - BIDocument3 pagesContoh CV Mahasiswa IT - Data Analyst Intern - BIabdulgafar sidik12No ratings yet

- Ais 2 AssignmentDocument18 pagesAis 2 AssignmentPui YanNo ratings yet

- Cloud-Based Accounting Technologies Preparing Future - Ready Professional AccountantsDocument11 pagesCloud-Based Accounting Technologies Preparing Future - Ready Professional AccountantsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- IEEE Srs TemplateDocument8 pagesIEEE Srs TemplateAriz LeañoNo ratings yet

- Internal Control WeaknessesDocument1 pageInternal Control WeaknessesKaryl Castillo0% (1)

- Kheri Arionadi Shobirin: PersonalDocument4 pagesKheri Arionadi Shobirin: PersonalDwi mulyana sodiqNo ratings yet

- Ananda Et Al (2015) PDFDocument9 pagesAnanda Et Al (2015) PDFrobbyNo ratings yet

- Case #2.3 - Worldcom - Professional Responsibility: I. Technical Audit GuidanceDocument8 pagesCase #2.3 - Worldcom - Professional Responsibility: I. Technical Audit GuidanceDaniel HunksNo ratings yet

- Accounting and Its BusinessDocument8 pagesAccounting and Its BusinessRaizza mae DuqueNo ratings yet

- RMK Audit 1 TM 6Document11 pagesRMK Audit 1 TM 6lailatulNo ratings yet

- Hertz Goes Wireless PG 252Document8 pagesHertz Goes Wireless PG 252Manisha PuriNo ratings yet

- Audit Sistem InformasiDocument13 pagesAudit Sistem Informasiraisa.kirana14No ratings yet

- IT Control and Audit - Chapter 09Document24 pagesIT Control and Audit - Chapter 09Hạ Phạm NhậtNo ratings yet

- Net Banking Mini ProjectDocument65 pagesNet Banking Mini ProjectTrupti SuryawanshiNo ratings yet

- BA RPA StudentWorkbookDocument35 pagesBA RPA StudentWorkbookAna Paula Ribas KrumNo ratings yet

- Budgeting and Budgetary Control As Tools For Accountability in Government ParastatalsDocument5 pagesBudgeting and Budgetary Control As Tools For Accountability in Government ParastatalsDineshNo ratings yet

- Chapter 3 - Behavior in OrganizationsDocument20 pagesChapter 3 - Behavior in OrganizationsRinjani PancanitiNo ratings yet

- Software Requirements Specification: Packet Sniffing Using WiresharkDocument8 pagesSoftware Requirements Specification: Packet Sniffing Using WiresharkVishal GuptaNo ratings yet

- The Trusted Tool For Data AnalysisDocument7 pagesThe Trusted Tool For Data Analysis02101989No ratings yet

- Treasury Review Audit ReportDocument118 pagesTreasury Review Audit ReportAstalapulos ListestosNo ratings yet

- RFID Attendance SystemDocument19 pagesRFID Attendance SystemSai VaishnaviNo ratings yet

- Case StudiesDocument8 pagesCase StudiesDhananjay PratapNo ratings yet

- Tech Application in FinanceDocument33 pagesTech Application in FinancePragathi SundarNo ratings yet

- Crime File AbstractDocument20 pagesCrime File AbstractPratik Patel0% (2)

- Project and Team Charter PDFDocument9 pagesProject and Team Charter PDFdas_ankita0111No ratings yet

- The Future of Accounting and Implications For Aspiring AccountantsDocument5 pagesThe Future of Accounting and Implications For Aspiring AccountantsIsaac Gabriel Kuruw100% (2)

- SAP Cost Details: SAP Business One Cost - Purchase As A 1 Time CostDocument4 pagesSAP Cost Details: SAP Business One Cost - Purchase As A 1 Time CostPILLINAGARAJUNo ratings yet

- GKB Data Analytics Mandate Part 1Document10 pagesGKB Data Analytics Mandate Part 1Vilma TejadaNo ratings yet

- Module 2 - Topic 3 - Lecture SlidesDocument27 pagesModule 2 - Topic 3 - Lecture SlidesJesta ZillaNo ratings yet

- Tugas GSLC 1Document5 pagesTugas GSLC 1JSKyung100% (1)

- Computer Fraud and Abuse TechniquesDocument12 pagesComputer Fraud and Abuse TechniquesSufrizal ChaniagoNo ratings yet

- Aplikasi Penjualan Di Toko Sribit Jaya Berbasis JavaDocument19 pagesAplikasi Penjualan Di Toko Sribit Jaya Berbasis JavaDynoco Poetra ArimbhiNo ratings yet

- Pengaruh Kualitas Pelayanan, Kewajiban Moral Dan Sanksi Perpajakan Terhadap Kepatuhan Wajib Pajak Hotel Dalam Membayar Pajak Hotel (Studi Kasuspada Wajib Pajak Hotel Di Kota Pekanbaru)Document14 pagesPengaruh Kualitas Pelayanan, Kewajiban Moral Dan Sanksi Perpajakan Terhadap Kepatuhan Wajib Pajak Hotel Dalam Membayar Pajak Hotel (Studi Kasuspada Wajib Pajak Hotel Di Kota Pekanbaru)Muhammad Rizal SurbaktiNo ratings yet

- Jurnal Skripsi - Edwin GunawanDocument11 pagesJurnal Skripsi - Edwin GunawanEdwin GunawanNo ratings yet

- SRS - Requirement Specification - AssignmentDocument8 pagesSRS - Requirement Specification - Assignmentjustin jazzNo ratings yet

- Visirule: An Overview of The Visirule Decision Logic Charting Tool From LpaDocument61 pagesVisirule: An Overview of The Visirule Decision Logic Charting Tool From LpaAyan KhareNo ratings yet

- AI Presentation v2Document30 pagesAI Presentation v2sagarsg13No ratings yet

- 情报分析的未来人工智能对情报分析影响的任务级观点 20201020 提交Document20 pages情报分析的未来人工智能对情报分析影响的任务级观点 20201020 提交chou youNo ratings yet

- Exam JN0-664 Topic 1 Question 3 Discussion - ExamTopicsDocument2 pagesExam JN0-664 Topic 1 Question 3 Discussion - ExamTopicsherbakNo ratings yet

- Nutridis Document FinalDocument76 pagesNutridis Document FinalNayana GowdaNo ratings yet

- Kitting TrolleyDocument31 pagesKitting TrolleyShubham Jain100% (1)

- 2 Uml For Ooad: 2.1 What Is UML? 2.2 Classes in UML 2.3 Relations in UML 2.4 Static and Dynamic Design With UMLDocument33 pages2 Uml For Ooad: 2.1 What Is UML? 2.2 Classes in UML 2.3 Relations in UML 2.4 Static and Dynamic Design With UMLthehtNo ratings yet

- Student Lab Manual For Experiment 3Document3 pagesStudent Lab Manual For Experiment 3MASUD RAIHAN LEEONNo ratings yet

- ANSI-A156-29-2001 Exit Locks Exit AlarmsDocument12 pagesANSI-A156-29-2001 Exit Locks Exit AlarmsAhmed AbidNo ratings yet

- 1MA1 3F Rms 20240111Document20 pages1MA1 3F Rms 20240111jorgeivan3458No ratings yet

- Java RecordDocument86 pagesJava RecordprabhanatarajanNo ratings yet

- First Year Second Year Third Year Fourth Year: Fall Winter Fall Winter Fall Winter Fall WinterDocument1 pageFirst Year Second Year Third Year Fourth Year: Fall Winter Fall Winter Fall Winter Fall Wintermraza17No ratings yet

- Week 7: Graph: Data Structures & Algorithm AnalysisDocument58 pagesWeek 7: Graph: Data Structures & Algorithm Analysisबानि तमिन्No ratings yet

- Vsx-6154-V2 / Vsx-6154-V2-Plus: DM&P Vortex86Sx 300Mhz Pc/104 Cpu ModuleDocument38 pagesVsx-6154-V2 / Vsx-6154-V2-Plus: DM&P Vortex86Sx 300Mhz Pc/104 Cpu ModuleCarlos JuniorNo ratings yet

- Computer Shop Business ThesisDocument5 pagesComputer Shop Business ThesisSara Alvarez100% (1)

- B0007 DTC GuideDocument1 pageB0007 DTC Guidemattmate89No ratings yet

- Grammar Practice 2Document1 pageGrammar Practice 2JudithSmileNo ratings yet

- Virtual Reality PresentationDocument20 pagesVirtual Reality PresentationHarshad Sawant 2433No ratings yet

- DataSunrise Database Security Suite User GuideDocument232 pagesDataSunrise Database Security Suite User Guidebcalderón_22No ratings yet

- FR - CQP.19 Erection Report of EquipmentDocument1 pageFR - CQP.19 Erection Report of EquipmentRamzi SaadaouiNo ratings yet

- CSC 102 Lecture Slides (1) Computer ScienceDocument153 pagesCSC 102 Lecture Slides (1) Computer ScienceFidelis OzuluNo ratings yet

- TCMI01-004: Triconex Communication Module Interface SpecificationDocument16 pagesTCMI01-004: Triconex Communication Module Interface SpecificationMohammed RedNo ratings yet

- MIKHMON Hotspot WifiDocument34 pagesMIKHMON Hotspot WifiToko Rahmat Mutiara LombokNo ratings yet

- Suppliers Registration-UpdatedDocument33 pagesSuppliers Registration-UpdateddaltonsrealtorNo ratings yet

- Google Pay Mb197748Document24 pagesGoogle Pay Mb197748Srivalli GuptaNo ratings yet

- CSM PSM CAM DifferenceDocument1 pageCSM PSM CAM DifferencesunsidNo ratings yet

- Chapter 4 SolutionsDocument63 pagesChapter 4 Solutionszhusen liangNo ratings yet

- General Mathematics NatDocument7 pagesGeneral Mathematics NatPearl Arianne Moncada MontealegreNo ratings yet

- Ug984 Vivado Microblaze RefDocument395 pagesUg984 Vivado Microblaze RefkedareswarraoNo ratings yet

- Kab. Pasuruan - Sertifikat Hut-48 PpniDocument6 pagesKab. Pasuruan - Sertifikat Hut-48 Ppniarvin anestNo ratings yet