Professional Documents

Culture Documents

Business Analytics Data Analysis and Decision Making 6th Edition Albright Solutions Manual

Business Analytics Data Analysis and Decision Making 6th Edition Albright Solutions Manual

Uploaded by

StephanieParkerexbfCopyright:

Available Formats

You might also like

- Solution Manual For Business Analytics Data Analysis and Decision Making 7th Edition AlbrightDocument3 pagesSolution Manual For Business Analytics Data Analysis and Decision Making 7th Edition AlbrightRobertMitchellmgea96% (45)

- Solution Manual For Experiencing The Worlds Religions 8th Edition Michael MolloyDocument9 pagesSolution Manual For Experiencing The Worlds Religions 8th Edition Michael MolloyMadelineShawstdf100% (49)

- Essentials of Business Statistics 2nd Edition Sanjiv Jaggia Alison KellyDocument32 pagesEssentials of Business Statistics 2nd Edition Sanjiv Jaggia Alison KellyLinda Mitchell100% (40)

- Test Bank For Small Business Management Launching and Growing Entrepreneurial Ventures 19th Edition Justin G Longenecker DownloadDocument19 pagesTest Bank For Small Business Management Launching and Growing Entrepreneurial Ventures 19th Edition Justin G Longenecker Downloaddesireemullinsgjzcsemwqx100% (25)

- Test Bank For Tappans Handbook of Massage Therapy 6th Edition by BenjaminDocument24 pagesTest Bank For Tappans Handbook of Massage Therapy 6th Edition by BenjaminKristinaChandlerrwdg100% (47)

- Business Law Principles For Todays Commercial Environment 5th Edition Twomey Solutions ManualDocument10 pagesBusiness Law Principles For Todays Commercial Environment 5th Edition Twomey Solutions ManualTammyJordanxqfe100% (45)

- Solution Manual For Effective Writing A Handbook For Accountants 11th Edition Claire B May Gordon S MayDocument8 pagesSolution Manual For Effective Writing A Handbook For Accountants 11th Edition Claire B May Gordon S MayPhillipMitchellpxog100% (42)

- Test Bank For Applied Statistics in Business and Economics 7th Edition David Doane Lori SewardDocument7 pagesTest Bank For Applied Statistics in Business and Economics 7th Edition David Doane Lori SewardAgnes Rhodes97% (37)

- Business Communication Today 13th Edition Bovee Solutions ManualDocument29 pagesBusiness Communication Today 13th Edition Bovee Solutions ManualStephanieParkerexbf100% (44)

- Contemporary Project Management 3rd Edition Timothy Kloppenborg Solutions ManualDocument14 pagesContemporary Project Management 3rd Edition Timothy Kloppenborg Solutions ManualCatherineJohnsonabpg100% (48)

- Solution Manual For Auditing Assurance Services A Systematic Approach 11th Edition William Messier JR Steven Glover Douglas PrawittDocument17 pagesSolution Manual For Auditing Assurance Services A Systematic Approach 11th Edition William Messier JR Steven Glover Douglas PrawittCalvinGreeneizfp100% (48)

- Solution Manual For Essentials of General Organic and Biochemistry 3rd Edition Denise GuinnDocument17 pagesSolution Manual For Essentials of General Organic and Biochemistry 3rd Edition Denise GuinnCameronHerreracapt100% (46)

- Business Communication Today 13th Edition Bovee Solutions ManualDocument29 pagesBusiness Communication Today 13th Edition Bovee Solutions ManualStephanieParkerexbf100% (44)

- Test Bank For Discovering Psychology The Science of Mind 1st Edition CacioppoDocument29 pagesTest Bank For Discovering Psychology The Science of Mind 1st Edition CacioppoPhillipRamirezezkyc100% (83)

- How Children Develop Canadian 5th Edition Siegler Test BankDocument12 pagesHow Children Develop Canadian 5th Edition Siegler Test BankRamon Roche100% (42)

- VZ-30 Service ManualDocument32 pagesVZ-30 Service ManualJimmy Mayta100% (1)

- Business Analysis and Valuation Using Financial Statements Text and Cases Palepu 5th Edition Solutions ManualDocument19 pagesBusiness Analysis and Valuation Using Financial Statements Text and Cases Palepu 5th Edition Solutions ManualStephanieParkerexbf100% (50)

- Business and Society Stakeholders Ethics Public Policy Lawrence 14th Edition Solutions ManualDocument10 pagesBusiness and Society Stakeholders Ethics Public Policy Lawrence 14th Edition Solutions ManualStephanieParkerexbf100% (46)

- Business in Action 7th Edition Bovee Solutions ManualDocument16 pagesBusiness in Action 7th Edition Bovee Solutions ManualStephanieParkerexbf100% (46)

- Behavioral Corporate Finance 2nd Edition Shefrin Solutions ManualDocument9 pagesBehavioral Corporate Finance 2nd Edition Shefrin Solutions ManualStephanieParkerexbf100% (51)

- Business Law Cheeseman 7th Edition Solutions ManualDocument14 pagesBusiness Law Cheeseman 7th Edition Solutions ManualStephanieParkerexbf100% (49)

- Business Law Text and Cases Clark Miller Cross 12th Edition Solutions ManualDocument9 pagesBusiness Law Text and Cases Clark Miller Cross 12th Edition Solutions ManualTammyJordanxqfe100% (49)

- Business Research Methods Cooper 12th Edition Solutions ManualDocument43 pagesBusiness Research Methods Cooper 12th Edition Solutions ManualTammyJordanxqfe100% (36)

- Business Law Today Comprehensive 11th Edition Miller Solutions ManualDocument25 pagesBusiness Law Today Comprehensive 11th Edition Miller Solutions ManualTammyJordanxqfe100% (46)

- Accounting Tools For Business Decision Making 6th Edition Kimmel Solutions ManualDocument24 pagesAccounting Tools For Business Decision Making 6th Edition Kimmel Solutions ManualBillyBishoptpyc100% (58)

- Auditing A Risk Based Approach To Conducting A Quality Audit Johnstone 10th Edition Solutions ManualDocument32 pagesAuditing A Risk Based Approach To Conducting A Quality Audit Johnstone 10th Edition Solutions ManualMariaDaviesqrbg100% (55)

- Business Law Text and Cases Clarkson 11th Edition Solutions ManualDocument25 pagesBusiness Law Text and Cases Clarkson 11th Edition Solutions ManualTammyJordanxqfe100% (45)

- College Algebra Blitzer 6th Edition Solutions ManualDocument58 pagesCollege Algebra Blitzer 6th Edition Solutions ManualKellyWagnermtbi100% (42)

- Campbell Biology Reece Urry Cain 9th Edition Solutions ManualDocument21 pagesCampbell Biology Reece Urry Cain 9th Edition Solutions ManualTammyJordanxqfe100% (40)

- College Algebra and Trigonometry 6th Edition Lial Solutions ManualDocument13 pagesCollege Algebra and Trigonometry 6th Edition Lial Solutions ManualKellyWagnermtbi100% (45)

- Contemporary Financial Management Moyer 12th Edition Solutions ManualDocument14 pagesContemporary Financial Management Moyer 12th Edition Solutions ManualCatherineJohnsonabpg100% (44)

- South-Western Federal Taxation 2017 Essentials of Taxation Individuals and Business Entities 20th Edition Raabe Solutions Manual 1Document23 pagesSouth-Western Federal Taxation 2017 Essentials of Taxation Individuals and Business Entities 20th Edition Raabe Solutions Manual 1donna100% (52)

- Fundamentals of Advanced Accounting Hoyle Doupnik 4th Edition Solutions ManualDocument48 pagesFundamentals of Advanced Accounting Hoyle Doupnik 4th Edition Solutions ManualSpencerMoorenbds100% (53)

- Engineering Problem Solving With C++ 4th Edition Etter Test Bank DownloadDocument5 pagesEngineering Problem Solving With C++ 4th Edition Etter Test Bank DownloadTrey Lorenz100% (24)

- College Accounting 14th Edition Price Solutions ManualDocument29 pagesCollege Accounting 14th Edition Price Solutions ManualTammyJordanxqfe100% (41)

- How Children Develop 5th Edition Siegler Test BankDocument29 pagesHow Children Develop 5th Edition Siegler Test Bankcharlesgriffinndygwczjme100% (35)

- Clinical Medical Assisting A Professional Field Smart Approach To The Workplace 2nd Edition Heller Solutions ManualDocument9 pagesClinical Medical Assisting A Professional Field Smart Approach To The Workplace 2nd Edition Heller Solutions ManualTammyJordanxqfe100% (50)

- Solution Manual For General Organic and Biological Chemistry 2 e 2nd Edition 0321802632Document14 pagesSolution Manual For General Organic and Biological Chemistry 2 e 2nd Edition 0321802632ErinGardnerbjdr100% (48)

- Illustrated Microsoft Office 365 and Office 2016 Projects Loose Leaf Version 1st Edition Cram Solutions Manual DownloadDocument10 pagesIllustrated Microsoft Office 365 and Office 2016 Projects Loose Leaf Version 1st Edition Cram Solutions Manual DownloadJan Neeley100% (22)

- Speech Craft 1st Edition Gunn Test Bank 1Document19 pagesSpeech Craft 1st Edition Gunn Test Bank 1thomas100% (56)

- Accounting Warren 23rd Edition Test BankDocument2 pagesAccounting Warren 23rd Edition Test BankBarbara Woodward100% (32)

- Solution Manual For Corporate Finance 4th Canadian Edition by BerkDocument12 pagesSolution Manual For Corporate Finance 4th Canadian Edition by BerkEdwin Muscara100% (39)

- Test Bank For Statistics For Business and Economics 8 e 0321937945Document24 pagesTest Bank For Statistics For Business and Economics 8 e 0321937945RayYoungtabfj100% (51)

- Psychology Perspectives and Connections 3rd Edition Feist Test Bank DownloadDocument77 pagesPsychology Perspectives and Connections 3rd Edition Feist Test Bank DownloadAlberta Vanleer100% (24)

- Elementary Statistics 9th Edition Weiss Test Bank DownloadDocument24 pagesElementary Statistics 9th Edition Weiss Test Bank DownloadLorenzo Goldberger100% (22)

- Basic College Mathematics 8th Edition Tobey Test Bank DownloadDocument46 pagesBasic College Mathematics 8th Edition Tobey Test Bank DownloadJudy Vasquez100% (18)

- To Download The Complete and Accurate Content Document, Go ToDocument15 pagesTo Download The Complete and Accurate Content Document, Go ToJesseBurnettkemz100% (47)

- Economics Principles Problems and Policies Mcconnell 20th Edition Solutions ManualDocument14 pagesEconomics Principles Problems and Policies Mcconnell 20th Edition Solutions ManualCatherineJohnsonabpg100% (49)

- Test Bank For The Developing Person Through The Life Span 8th Edition Kathleen BergerDocument10 pagesTest Bank For The Developing Person Through The Life Span 8th Edition Kathleen Bergerangelreidmjfczrakyt100% (34)

- Test Bank For Essentials of Business Communication 11th Edition Mary Ellen Guffey Dana LoewyDocument16 pagesTest Bank For Essentials of Business Communication 11th Edition Mary Ellen Guffey Dana LoewyNatalieMillersrjf100% (41)

- Accounting Volume 2 Canadian 9th Edition Horngren Solutions ManualDocument24 pagesAccounting Volume 2 Canadian 9th Edition Horngren Solutions ManualBillyBishoptpyc100% (51)

- Test Bank For Stationen 3rd EditionDocument14 pagesTest Bank For Stationen 3rd EditionRichardBellngsj100% (36)

- College Algebra 10th Edition Sullivan Solutions ManualDocument24 pagesCollege Algebra 10th Edition Sullivan Solutions ManualNancyGarciakprq100% (54)

- Test Bank For Information Technology Project Management 7th Edition SchwalbeDocument24 pagesTest Bank For Information Technology Project Management 7th Edition SchwalbeChristopherWigginsnbme100% (35)

- Accounting What The Numbers Mean Marshall 10th Edition Test BankDocument24 pagesAccounting What The Numbers Mean Marshall 10th Edition Test BankBillyBishoptpyc100% (45)

- Solution Manual For Employment Law For Human Resource Practice 5th Edition Full DownloadDocument22 pagesSolution Manual For Employment Law For Human Resource Practice 5th Edition Full Downloadtracyherrerabqgyjwormf100% (38)

- Solution Manual For Essential C For Engineers and Scientists 2 e 2nd Edition 0201741253Document40 pagesSolution Manual For Essential C For Engineers and Scientists 2 e 2nd Edition 0201741253CameronHerreracapt100% (39)

- Solution Manual For Foundations in Nursing Research 6 e 6th Edition 0132118572Document16 pagesSolution Manual For Foundations in Nursing Research 6 e 6th Edition 0132118572ScottMcguiretbfkj100% (47)

- Test Bank For Understanding Motivation and Emotion 6th Edition by ReeveDocument24 pagesTest Bank For Understanding Motivation and Emotion 6th Edition by ReevePeterMillermoakc100% (43)

- College Accounting Contemporary Approach 3rd Edition Haddock Solutions ManualDocument24 pagesCollege Accounting Contemporary Approach 3rd Edition Haddock Solutions ManualNancyGarciakprq100% (53)

- Thesis Using Linear RegressionDocument7 pagesThesis Using Linear Regressionpamelawrightvirginiabeach100% (1)

- Choosing VariablesDocument18 pagesChoosing VariableswuNo ratings yet

- Business Law Cheeseman 7th Edition Solutions ManualDocument14 pagesBusiness Law Cheeseman 7th Edition Solutions ManualStephanieParkerexbf100% (49)

- Business in Action 7th Edition Bovee Solutions ManualDocument16 pagesBusiness in Action 7th Edition Bovee Solutions ManualStephanieParkerexbf100% (46)

- Business and Society Stakeholders Ethics Public Policy Lawrence 14th Edition Solutions ManualDocument10 pagesBusiness and Society Stakeholders Ethics Public Policy Lawrence 14th Edition Solutions ManualStephanieParkerexbf100% (46)

- Business Analysis and Valuation Using Financial Statements Text and Cases Palepu 5th Edition Solutions ManualDocument19 pagesBusiness Analysis and Valuation Using Financial Statements Text and Cases Palepu 5th Edition Solutions ManualStephanieParkerexbf100% (50)

- Behavioral Corporate Finance 2nd Edition Shefrin Solutions ManualDocument9 pagesBehavioral Corporate Finance 2nd Edition Shefrin Solutions ManualStephanieParkerexbf100% (51)

- Navyfield Full ManualDocument11 pagesNavyfield Full Manualmarti1125100% (2)

- Iygb Gce: Core Mathematics C2 Advanced SubsidiaryDocument5 pagesIygb Gce: Core Mathematics C2 Advanced SubsidiaryssmithNo ratings yet

- Dhaka University Affiliated Colleges: Third Year Syllabus Department of MathematicsDocument8 pagesDhaka University Affiliated Colleges: Third Year Syllabus Department of MathematicsHasibul Hassan ShantoNo ratings yet

- FINAL EXAM 201820192 - Draf (270319)Document13 pagesFINAL EXAM 201820192 - Draf (270319)YuthishDheeranManiamNo ratings yet

- Police Visibility in The Prevention of Crime PreventionDocument4 pagesPolice Visibility in The Prevention of Crime PreventionDarcknyPusodNo ratings yet

- Ferroresonance StudiesDocument9 pagesFerroresonance StudiesSandeep GuptaNo ratings yet

- PEH Pre-Finals ReviewerDocument1 pagePEH Pre-Finals ReviewerMaribeth Alyssa GoNo ratings yet

- Rhonda's Creative Life - Sleeves On SaturdaysDocument15 pagesRhonda's Creative Life - Sleeves On SaturdaysDomingoPintoNo ratings yet

- Master Key To Imagination GuideDocument60 pagesMaster Key To Imagination GuideAnonymous ecgjAAD98% (45)

- Agent Application Form - NIADocument3 pagesAgent Application Form - NIASiva KumarrNo ratings yet

- MBA Interviews (Undergraduation Questions)Document14 pagesMBA Interviews (Undergraduation Questions)anshshah1310No ratings yet

- Fire Alarm System TypesDocument8 pagesFire Alarm System TypesSusan Macaraeg50% (4)

- Chapter 5 Steam and Gas TurbinesDocument64 pagesChapter 5 Steam and Gas TurbinesKeba Del Ray100% (2)

- Test Tasks For Reading: Presented by Lesley Nayeli Chávez Velázquez March 2020Document19 pagesTest Tasks For Reading: Presented by Lesley Nayeli Chávez Velázquez March 2020api-511296445No ratings yet

- Jurnal - Asmawati - E321192152 .Document11 pagesJurnal - Asmawati - E321192152 .Nurul fuadiNo ratings yet

- Saep 358Document17 pagesSaep 358Adel SulimanNo ratings yet

- Idose4 - Whitepaper - Technical - Low Res - PDF Nodeid 8432599&vernum - 2 PDFDocument40 pagesIdose4 - Whitepaper - Technical - Low Res - PDF Nodeid 8432599&vernum - 2 PDFOmarah AbdalqaderNo ratings yet

- Ngá Nghä©a Unit 4Document5 pagesNgá Nghä©a Unit 4Nguyen The TranNo ratings yet

- Exports Driven by Hallyu Increasing South Korea's Economic Growth - Cultural Diplomacy ApproachDocument17 pagesExports Driven by Hallyu Increasing South Korea's Economic Growth - Cultural Diplomacy ApproachAnastasya doriska MasliaNo ratings yet

- Standard Kessel Cat - Gral.Document40 pagesStandard Kessel Cat - Gral.Marcelo ResckNo ratings yet

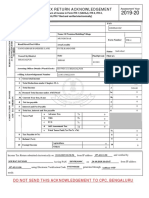

- Acknowledgement ItrDocument1 pageAcknowledgement ItrSourav KumarNo ratings yet

- Al Burj Al Thaki Warning & Control Devices TR: To: Federal Tax AuthorityDocument3 pagesAl Burj Al Thaki Warning & Control Devices TR: To: Federal Tax AuthorityAL BURJ AL THAKINo ratings yet

- Geotextile BookDocument63 pagesGeotextile BookIsparmoNo ratings yet

- Steel Body - Lever Hoists: A e B A e B A e BDocument1 pageSteel Body - Lever Hoists: A e B A e B A e BtylerlhsmithNo ratings yet

- Moore Stevens International DirectoryDocument296 pagesMoore Stevens International DirectoryShaun Neville50% (2)

- In A NutshellDocument3 pagesIn A NutshellJane TuazonNo ratings yet

- Httpsrvce Edu Insitesdefaultfiles7 20EC20III202620IV PDFDocument51 pagesHttpsrvce Edu Insitesdefaultfiles7 20EC20III202620IV PDFNANDITA SNo ratings yet

- Biochem Lab NotesDocument26 pagesBiochem Lab NotesRicky Justin NgoNo ratings yet

- Media Preparation and Uses in Medical MicrobiologyDocument20 pagesMedia Preparation and Uses in Medical MicrobiologyPrincewill SeiyefaNo ratings yet

Business Analytics Data Analysis and Decision Making 6th Edition Albright Solutions Manual

Business Analytics Data Analysis and Decision Making 6th Edition Albright Solutions Manual

Uploaded by

StephanieParkerexbfOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Business Analytics Data Analysis and Decision Making 6th Edition Albright Solutions Manual

Business Analytics Data Analysis and Decision Making 6th Edition Albright Solutions Manual

Uploaded by

StephanieParkerexbfCopyright:

Available Formats

Business Analytics Data Analysis and Decision

Making 6th Edition Albright Solutions Manual

To download the complete and accurate content document, go to:

https://testbankbell.com/download/business-analytics-data-analysis-and-decision-mak

ing-6th-edition-albright-solutions-manual/

Business Analytics Data Analysis and Decision Making 6th Edition Albright Solutions Manual

Business Analytics: Data Analysis and Decision Making, 6e

Chapter 10: Regression Analysis: Estimating Relationships

Answers to Conceptual Questions

Note to Instructors: Student answers will vary. The responses here are intended to provide

general guidance in terms of concepts that could be discussed.

C.1. This is a case where it is dangerous to infer causality from correlation. Yes, moderately

increased wine consumption could have some beneficial effect on preventing deaths

from heart disease, but there are undoubtedly other factors involved. In fact, it is very

conceivable that some other factor, possibly a cultural factor, drives both increased wine

consumption and fewer deaths from heart disease. At the very least, you shouldn’t infer

that drinking more wine is a magic bullet that will prevent death from heart disease!

C.2. Hopefully, the chapter drove the point home that this is usually a bad practice. You

should have a good reason for deleting outliers. You shouldn’t delete them just to make

an analysis come out better.

C.3. This flat scatter has a simple interpretation: Y is not related to X in the sense that your

prediction of Y will be the same (the height of the flat scatter) regardless of the value of X.

C.4. This high correlation between fitted values and residuals means that you have missed

something. That is, it means that the regression equation could be improved upon by

adding another term, transforming an existing term, or making some other modification. In

a “good” regression, the scatterplot of residuals versus fitted values should be a shapeless

swarm, with a very small correlation.

C.5. The key here is that the adjusted R-square has decreased as more terms have been

added. This implies that the extra terms are “not worth their weight” and should probably

be omitted. Based on parsimony, most analysts would consider Equation 1 the best.

However, keep in mind that such choices are “at the margin.” Probably all three

equations provide very similar predictions.

C.6. The answer to the first question is Yes, because it is a mathematical fact that R-square can

only increase when an extra variable is added to the equation. The answer to the second

question is also Yes, even though the reason is not at all intuitive. This is exactly what

happened in the Bendrix Overhead example. Without actually seeing this in a numerical

example, you would probably conclude, intuitively, that it couldn’t happen.

C.7. Causality can’t be seen from a regression output. Such an output only indicates whether

the variables are related. But for all you know, X could be driving Y, Y could be driving X,

or some other variable could be driving both X and Y, and the regression outputs would

be identical. For examples, look at macroeconomic variables. There are plenty of

relationships, but it’s not usually clear what is causing what.

C.8. You need to lag advertising by “pushing its column down” one or more rows. Then, for

example, Sales in May will be in the same row as Advertising in April, Advertising in March,

and maybe others. (You get to choose the number of lagged columns.) Then you can

regress the Sales variable against the lagged Advertising variables.

© 2015 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or

posted to a publicly accessible website, in whole or in part.

Visit TestBankBell.com to get complete for all chapters

Business Analytics Data Analysis and Decision Making 6th Edition Albright Solutions Manual

Chapter 10: Regression Analysis: Estimating Relationships 2

C.9. Creating the dummy variables is easy enough, either with StatTools or with simple IF

formulas. You can decide which category to use as the reference category (by ignoring

its dummy). However, the regression results will be equivalent, regardless of the category

chosen as the reference category. You just have to interpret each equation’s coefficients

relative to the chosen reference category.

C.10. As explained in Section 10-6c, the interpretation of regression results is simplified when

using log transformations as opposed to other nonlinear transformation. (Besides, they

often provide good fits.) The interpretation is always something like: If X increases by a

given (unit or percentage), Y will change by a given (unit or percentage), where the

correct words in parentheses depend on whether X, Y, or both are log-transformed.

C.11. You could try regressing Per Capita Income (Y) on Number of Cars Per 1000 People (X) for

countries where both are known. Assuming the fit is reasonably good, you could then use

this equation to predict Y from X for countries where X is known but Y isn’t.

© 2015 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or

posted to a publicly accessible website, in whole or in part.

Visit TestBankBell.com to get complete for all chapters

You might also like

- Solution Manual For Business Analytics Data Analysis and Decision Making 7th Edition AlbrightDocument3 pagesSolution Manual For Business Analytics Data Analysis and Decision Making 7th Edition AlbrightRobertMitchellmgea96% (45)

- Solution Manual For Experiencing The Worlds Religions 8th Edition Michael MolloyDocument9 pagesSolution Manual For Experiencing The Worlds Religions 8th Edition Michael MolloyMadelineShawstdf100% (49)

- Essentials of Business Statistics 2nd Edition Sanjiv Jaggia Alison KellyDocument32 pagesEssentials of Business Statistics 2nd Edition Sanjiv Jaggia Alison KellyLinda Mitchell100% (40)

- Test Bank For Small Business Management Launching and Growing Entrepreneurial Ventures 19th Edition Justin G Longenecker DownloadDocument19 pagesTest Bank For Small Business Management Launching and Growing Entrepreneurial Ventures 19th Edition Justin G Longenecker Downloaddesireemullinsgjzcsemwqx100% (25)

- Test Bank For Tappans Handbook of Massage Therapy 6th Edition by BenjaminDocument24 pagesTest Bank For Tappans Handbook of Massage Therapy 6th Edition by BenjaminKristinaChandlerrwdg100% (47)

- Business Law Principles For Todays Commercial Environment 5th Edition Twomey Solutions ManualDocument10 pagesBusiness Law Principles For Todays Commercial Environment 5th Edition Twomey Solutions ManualTammyJordanxqfe100% (45)

- Solution Manual For Effective Writing A Handbook For Accountants 11th Edition Claire B May Gordon S MayDocument8 pagesSolution Manual For Effective Writing A Handbook For Accountants 11th Edition Claire B May Gordon S MayPhillipMitchellpxog100% (42)

- Test Bank For Applied Statistics in Business and Economics 7th Edition David Doane Lori SewardDocument7 pagesTest Bank For Applied Statistics in Business and Economics 7th Edition David Doane Lori SewardAgnes Rhodes97% (37)

- Business Communication Today 13th Edition Bovee Solutions ManualDocument29 pagesBusiness Communication Today 13th Edition Bovee Solutions ManualStephanieParkerexbf100% (44)

- Contemporary Project Management 3rd Edition Timothy Kloppenborg Solutions ManualDocument14 pagesContemporary Project Management 3rd Edition Timothy Kloppenborg Solutions ManualCatherineJohnsonabpg100% (48)

- Solution Manual For Auditing Assurance Services A Systematic Approach 11th Edition William Messier JR Steven Glover Douglas PrawittDocument17 pagesSolution Manual For Auditing Assurance Services A Systematic Approach 11th Edition William Messier JR Steven Glover Douglas PrawittCalvinGreeneizfp100% (48)

- Solution Manual For Essentials of General Organic and Biochemistry 3rd Edition Denise GuinnDocument17 pagesSolution Manual For Essentials of General Organic and Biochemistry 3rd Edition Denise GuinnCameronHerreracapt100% (46)

- Business Communication Today 13th Edition Bovee Solutions ManualDocument29 pagesBusiness Communication Today 13th Edition Bovee Solutions ManualStephanieParkerexbf100% (44)

- Test Bank For Discovering Psychology The Science of Mind 1st Edition CacioppoDocument29 pagesTest Bank For Discovering Psychology The Science of Mind 1st Edition CacioppoPhillipRamirezezkyc100% (83)

- How Children Develop Canadian 5th Edition Siegler Test BankDocument12 pagesHow Children Develop Canadian 5th Edition Siegler Test BankRamon Roche100% (42)

- VZ-30 Service ManualDocument32 pagesVZ-30 Service ManualJimmy Mayta100% (1)

- Business Analysis and Valuation Using Financial Statements Text and Cases Palepu 5th Edition Solutions ManualDocument19 pagesBusiness Analysis and Valuation Using Financial Statements Text and Cases Palepu 5th Edition Solutions ManualStephanieParkerexbf100% (50)

- Business and Society Stakeholders Ethics Public Policy Lawrence 14th Edition Solutions ManualDocument10 pagesBusiness and Society Stakeholders Ethics Public Policy Lawrence 14th Edition Solutions ManualStephanieParkerexbf100% (46)

- Business in Action 7th Edition Bovee Solutions ManualDocument16 pagesBusiness in Action 7th Edition Bovee Solutions ManualStephanieParkerexbf100% (46)

- Behavioral Corporate Finance 2nd Edition Shefrin Solutions ManualDocument9 pagesBehavioral Corporate Finance 2nd Edition Shefrin Solutions ManualStephanieParkerexbf100% (51)

- Business Law Cheeseman 7th Edition Solutions ManualDocument14 pagesBusiness Law Cheeseman 7th Edition Solutions ManualStephanieParkerexbf100% (49)

- Business Law Text and Cases Clark Miller Cross 12th Edition Solutions ManualDocument9 pagesBusiness Law Text and Cases Clark Miller Cross 12th Edition Solutions ManualTammyJordanxqfe100% (49)

- Business Research Methods Cooper 12th Edition Solutions ManualDocument43 pagesBusiness Research Methods Cooper 12th Edition Solutions ManualTammyJordanxqfe100% (36)

- Business Law Today Comprehensive 11th Edition Miller Solutions ManualDocument25 pagesBusiness Law Today Comprehensive 11th Edition Miller Solutions ManualTammyJordanxqfe100% (46)

- Accounting Tools For Business Decision Making 6th Edition Kimmel Solutions ManualDocument24 pagesAccounting Tools For Business Decision Making 6th Edition Kimmel Solutions ManualBillyBishoptpyc100% (58)

- Auditing A Risk Based Approach To Conducting A Quality Audit Johnstone 10th Edition Solutions ManualDocument32 pagesAuditing A Risk Based Approach To Conducting A Quality Audit Johnstone 10th Edition Solutions ManualMariaDaviesqrbg100% (55)

- Business Law Text and Cases Clarkson 11th Edition Solutions ManualDocument25 pagesBusiness Law Text and Cases Clarkson 11th Edition Solutions ManualTammyJordanxqfe100% (45)

- College Algebra Blitzer 6th Edition Solutions ManualDocument58 pagesCollege Algebra Blitzer 6th Edition Solutions ManualKellyWagnermtbi100% (42)

- Campbell Biology Reece Urry Cain 9th Edition Solutions ManualDocument21 pagesCampbell Biology Reece Urry Cain 9th Edition Solutions ManualTammyJordanxqfe100% (40)

- College Algebra and Trigonometry 6th Edition Lial Solutions ManualDocument13 pagesCollege Algebra and Trigonometry 6th Edition Lial Solutions ManualKellyWagnermtbi100% (45)

- Contemporary Financial Management Moyer 12th Edition Solutions ManualDocument14 pagesContemporary Financial Management Moyer 12th Edition Solutions ManualCatherineJohnsonabpg100% (44)

- South-Western Federal Taxation 2017 Essentials of Taxation Individuals and Business Entities 20th Edition Raabe Solutions Manual 1Document23 pagesSouth-Western Federal Taxation 2017 Essentials of Taxation Individuals and Business Entities 20th Edition Raabe Solutions Manual 1donna100% (52)

- Fundamentals of Advanced Accounting Hoyle Doupnik 4th Edition Solutions ManualDocument48 pagesFundamentals of Advanced Accounting Hoyle Doupnik 4th Edition Solutions ManualSpencerMoorenbds100% (53)

- Engineering Problem Solving With C++ 4th Edition Etter Test Bank DownloadDocument5 pagesEngineering Problem Solving With C++ 4th Edition Etter Test Bank DownloadTrey Lorenz100% (24)

- College Accounting 14th Edition Price Solutions ManualDocument29 pagesCollege Accounting 14th Edition Price Solutions ManualTammyJordanxqfe100% (41)

- How Children Develop 5th Edition Siegler Test BankDocument29 pagesHow Children Develop 5th Edition Siegler Test Bankcharlesgriffinndygwczjme100% (35)

- Clinical Medical Assisting A Professional Field Smart Approach To The Workplace 2nd Edition Heller Solutions ManualDocument9 pagesClinical Medical Assisting A Professional Field Smart Approach To The Workplace 2nd Edition Heller Solutions ManualTammyJordanxqfe100% (50)

- Solution Manual For General Organic and Biological Chemistry 2 e 2nd Edition 0321802632Document14 pagesSolution Manual For General Organic and Biological Chemistry 2 e 2nd Edition 0321802632ErinGardnerbjdr100% (48)

- Illustrated Microsoft Office 365 and Office 2016 Projects Loose Leaf Version 1st Edition Cram Solutions Manual DownloadDocument10 pagesIllustrated Microsoft Office 365 and Office 2016 Projects Loose Leaf Version 1st Edition Cram Solutions Manual DownloadJan Neeley100% (22)

- Speech Craft 1st Edition Gunn Test Bank 1Document19 pagesSpeech Craft 1st Edition Gunn Test Bank 1thomas100% (56)

- Accounting Warren 23rd Edition Test BankDocument2 pagesAccounting Warren 23rd Edition Test BankBarbara Woodward100% (32)

- Solution Manual For Corporate Finance 4th Canadian Edition by BerkDocument12 pagesSolution Manual For Corporate Finance 4th Canadian Edition by BerkEdwin Muscara100% (39)

- Test Bank For Statistics For Business and Economics 8 e 0321937945Document24 pagesTest Bank For Statistics For Business and Economics 8 e 0321937945RayYoungtabfj100% (51)

- Psychology Perspectives and Connections 3rd Edition Feist Test Bank DownloadDocument77 pagesPsychology Perspectives and Connections 3rd Edition Feist Test Bank DownloadAlberta Vanleer100% (24)

- Elementary Statistics 9th Edition Weiss Test Bank DownloadDocument24 pagesElementary Statistics 9th Edition Weiss Test Bank DownloadLorenzo Goldberger100% (22)

- Basic College Mathematics 8th Edition Tobey Test Bank DownloadDocument46 pagesBasic College Mathematics 8th Edition Tobey Test Bank DownloadJudy Vasquez100% (18)

- To Download The Complete and Accurate Content Document, Go ToDocument15 pagesTo Download The Complete and Accurate Content Document, Go ToJesseBurnettkemz100% (47)

- Economics Principles Problems and Policies Mcconnell 20th Edition Solutions ManualDocument14 pagesEconomics Principles Problems and Policies Mcconnell 20th Edition Solutions ManualCatherineJohnsonabpg100% (49)

- Test Bank For The Developing Person Through The Life Span 8th Edition Kathleen BergerDocument10 pagesTest Bank For The Developing Person Through The Life Span 8th Edition Kathleen Bergerangelreidmjfczrakyt100% (34)

- Test Bank For Essentials of Business Communication 11th Edition Mary Ellen Guffey Dana LoewyDocument16 pagesTest Bank For Essentials of Business Communication 11th Edition Mary Ellen Guffey Dana LoewyNatalieMillersrjf100% (41)

- Accounting Volume 2 Canadian 9th Edition Horngren Solutions ManualDocument24 pagesAccounting Volume 2 Canadian 9th Edition Horngren Solutions ManualBillyBishoptpyc100% (51)

- Test Bank For Stationen 3rd EditionDocument14 pagesTest Bank For Stationen 3rd EditionRichardBellngsj100% (36)

- College Algebra 10th Edition Sullivan Solutions ManualDocument24 pagesCollege Algebra 10th Edition Sullivan Solutions ManualNancyGarciakprq100% (54)

- Test Bank For Information Technology Project Management 7th Edition SchwalbeDocument24 pagesTest Bank For Information Technology Project Management 7th Edition SchwalbeChristopherWigginsnbme100% (35)

- Accounting What The Numbers Mean Marshall 10th Edition Test BankDocument24 pagesAccounting What The Numbers Mean Marshall 10th Edition Test BankBillyBishoptpyc100% (45)

- Solution Manual For Employment Law For Human Resource Practice 5th Edition Full DownloadDocument22 pagesSolution Manual For Employment Law For Human Resource Practice 5th Edition Full Downloadtracyherrerabqgyjwormf100% (38)

- Solution Manual For Essential C For Engineers and Scientists 2 e 2nd Edition 0201741253Document40 pagesSolution Manual For Essential C For Engineers and Scientists 2 e 2nd Edition 0201741253CameronHerreracapt100% (39)

- Solution Manual For Foundations in Nursing Research 6 e 6th Edition 0132118572Document16 pagesSolution Manual For Foundations in Nursing Research 6 e 6th Edition 0132118572ScottMcguiretbfkj100% (47)

- Test Bank For Understanding Motivation and Emotion 6th Edition by ReeveDocument24 pagesTest Bank For Understanding Motivation and Emotion 6th Edition by ReevePeterMillermoakc100% (43)

- College Accounting Contemporary Approach 3rd Edition Haddock Solutions ManualDocument24 pagesCollege Accounting Contemporary Approach 3rd Edition Haddock Solutions ManualNancyGarciakprq100% (53)

- Thesis Using Linear RegressionDocument7 pagesThesis Using Linear Regressionpamelawrightvirginiabeach100% (1)

- Choosing VariablesDocument18 pagesChoosing VariableswuNo ratings yet

- Business Law Cheeseman 7th Edition Solutions ManualDocument14 pagesBusiness Law Cheeseman 7th Edition Solutions ManualStephanieParkerexbf100% (49)

- Business in Action 7th Edition Bovee Solutions ManualDocument16 pagesBusiness in Action 7th Edition Bovee Solutions ManualStephanieParkerexbf100% (46)

- Business and Society Stakeholders Ethics Public Policy Lawrence 14th Edition Solutions ManualDocument10 pagesBusiness and Society Stakeholders Ethics Public Policy Lawrence 14th Edition Solutions ManualStephanieParkerexbf100% (46)

- Business Analysis and Valuation Using Financial Statements Text and Cases Palepu 5th Edition Solutions ManualDocument19 pagesBusiness Analysis and Valuation Using Financial Statements Text and Cases Palepu 5th Edition Solutions ManualStephanieParkerexbf100% (50)

- Behavioral Corporate Finance 2nd Edition Shefrin Solutions ManualDocument9 pagesBehavioral Corporate Finance 2nd Edition Shefrin Solutions ManualStephanieParkerexbf100% (51)

- Navyfield Full ManualDocument11 pagesNavyfield Full Manualmarti1125100% (2)

- Iygb Gce: Core Mathematics C2 Advanced SubsidiaryDocument5 pagesIygb Gce: Core Mathematics C2 Advanced SubsidiaryssmithNo ratings yet

- Dhaka University Affiliated Colleges: Third Year Syllabus Department of MathematicsDocument8 pagesDhaka University Affiliated Colleges: Third Year Syllabus Department of MathematicsHasibul Hassan ShantoNo ratings yet

- FINAL EXAM 201820192 - Draf (270319)Document13 pagesFINAL EXAM 201820192 - Draf (270319)YuthishDheeranManiamNo ratings yet

- Police Visibility in The Prevention of Crime PreventionDocument4 pagesPolice Visibility in The Prevention of Crime PreventionDarcknyPusodNo ratings yet

- Ferroresonance StudiesDocument9 pagesFerroresonance StudiesSandeep GuptaNo ratings yet

- PEH Pre-Finals ReviewerDocument1 pagePEH Pre-Finals ReviewerMaribeth Alyssa GoNo ratings yet

- Rhonda's Creative Life - Sleeves On SaturdaysDocument15 pagesRhonda's Creative Life - Sleeves On SaturdaysDomingoPintoNo ratings yet

- Master Key To Imagination GuideDocument60 pagesMaster Key To Imagination GuideAnonymous ecgjAAD98% (45)

- Agent Application Form - NIADocument3 pagesAgent Application Form - NIASiva KumarrNo ratings yet

- MBA Interviews (Undergraduation Questions)Document14 pagesMBA Interviews (Undergraduation Questions)anshshah1310No ratings yet

- Fire Alarm System TypesDocument8 pagesFire Alarm System TypesSusan Macaraeg50% (4)

- Chapter 5 Steam and Gas TurbinesDocument64 pagesChapter 5 Steam and Gas TurbinesKeba Del Ray100% (2)

- Test Tasks For Reading: Presented by Lesley Nayeli Chávez Velázquez March 2020Document19 pagesTest Tasks For Reading: Presented by Lesley Nayeli Chávez Velázquez March 2020api-511296445No ratings yet

- Jurnal - Asmawati - E321192152 .Document11 pagesJurnal - Asmawati - E321192152 .Nurul fuadiNo ratings yet

- Saep 358Document17 pagesSaep 358Adel SulimanNo ratings yet

- Idose4 - Whitepaper - Technical - Low Res - PDF Nodeid 8432599&vernum - 2 PDFDocument40 pagesIdose4 - Whitepaper - Technical - Low Res - PDF Nodeid 8432599&vernum - 2 PDFOmarah AbdalqaderNo ratings yet

- Ngá Nghä©a Unit 4Document5 pagesNgá Nghä©a Unit 4Nguyen The TranNo ratings yet

- Exports Driven by Hallyu Increasing South Korea's Economic Growth - Cultural Diplomacy ApproachDocument17 pagesExports Driven by Hallyu Increasing South Korea's Economic Growth - Cultural Diplomacy ApproachAnastasya doriska MasliaNo ratings yet

- Standard Kessel Cat - Gral.Document40 pagesStandard Kessel Cat - Gral.Marcelo ResckNo ratings yet

- Acknowledgement ItrDocument1 pageAcknowledgement ItrSourav KumarNo ratings yet

- Al Burj Al Thaki Warning & Control Devices TR: To: Federal Tax AuthorityDocument3 pagesAl Burj Al Thaki Warning & Control Devices TR: To: Federal Tax AuthorityAL BURJ AL THAKINo ratings yet

- Geotextile BookDocument63 pagesGeotextile BookIsparmoNo ratings yet

- Steel Body - Lever Hoists: A e B A e B A e BDocument1 pageSteel Body - Lever Hoists: A e B A e B A e BtylerlhsmithNo ratings yet

- Moore Stevens International DirectoryDocument296 pagesMoore Stevens International DirectoryShaun Neville50% (2)

- In A NutshellDocument3 pagesIn A NutshellJane TuazonNo ratings yet

- Httpsrvce Edu Insitesdefaultfiles7 20EC20III202620IV PDFDocument51 pagesHttpsrvce Edu Insitesdefaultfiles7 20EC20III202620IV PDFNANDITA SNo ratings yet

- Biochem Lab NotesDocument26 pagesBiochem Lab NotesRicky Justin NgoNo ratings yet

- Media Preparation and Uses in Medical MicrobiologyDocument20 pagesMedia Preparation and Uses in Medical MicrobiologyPrincewill SeiyefaNo ratings yet