Professional Documents

Culture Documents

Dependants' Protection Scheme: Information Leaflet

Dependants' Protection Scheme: Information Leaflet

Uploaded by

Jedrek TeoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Dependants' Protection Scheme: Information Leaflet

Dependants' Protection Scheme: Information Leaflet

Uploaded by

Jedrek TeoCopyright:

Available Formats

DEPENDANTS’ PROTECTION SCHEME

INFORMATION LEAFLET

1. What is Dependants’ Protection Scheme (DPS)? 5. How do I pay the premium?

DPS is an affordable term life insurance that provides For your convenience, premium is automatically deducted

insured members and their families with some money to every year from your CPF savings.

get through the first few years should the insured members

pass away, suffer from Terminal Illness or Total Permanent If your CPF savings has insufficient funds to pay the

Disability. The scheme covers them for a sum assured of premium for full coverage, you can either be insured for a

$70,000 up to the end of the policy year during which they lower amount (the minimum sum assured is $5,000) or

turn 60 years old. From the policy anniversary in which they you can pay the difference in cash or other available

are 60 age last birthday up to the end of the policy year payment modes within 60 days from the policy renewal

during which they turn 65 years old, the sum assured is date to top up to the full sum assured. Your policy will

$55,000. lapse if no premium is paid after 60 days from policy

CPF members who are Singapore Citizens or Permanent renewal date.

Residents, between the age of 21 and 65, are

automatically extended with a DPS cover when they make

their first CPF working contribution. Those who are below 6. Will I be informed when my cover is renewed?

the age of 21, but 16 or above can apply for a DPS cover.

A notification will be sent to you 1 month before your

The scheme is optional and insured members can choose renewal date. If your CPF account does not have sufficient

to terminate their cover by completing the opt-out form. funds for full premium deduction, we will send a notification

to you.

2. I do not have a DPS cover. Do I have to declare my

health condition to be insured under DPS? You can also check your CPF transaction records online

anytime for your premium deductions, as well as view your

Yes, the eligibility for a DPS cover is subject to you being yearly CPF statement of account.

in good health at the point of policy commencement. You

must declare and fully disclose all information regarding You should report any changes in correspondence

your health, including, but not limited to: address, email and contact number to us for timely and

accurate updates to any changes in the status of your DPS

cover.

• All your past and current illnesses;

• Any surgery/treatment medical test that you had As part of our efforts to Go Green, we will progressively

previously undergone or will be undergoing; and move our servicing letters towards electronic documents

• Any physical or mental impairment. (eDocuments). You will be able to view your latest

eDocuments on eConnect. For more details or to opt for

Otherwise, it may affect the future claims and the hardcopy, you may refer to sg.gelife.co/eConnectFAQ.

insurance policy may not be valid.

7. What is the claim criteria?

3. My DPS is covered by NTUC Income prior to 1

April 2021. When my DPS cover is transferred DPS protects you and your family in the event of your

over to Great Eastern Life from 1 April 2021, do I death, or when you suffer from Terminal Illness or Total

need to declare my health? Permanent Disability during the term of your policy.

No, members who are already insured under DPS prior to Terminal Illness refers to an illness that a registered

1 April 2021 do not need to submit a new health medical practitioner under the Medical Registration Act

declaration form for illnesses that developed on or after certifies is expected to result in death within 12 months.

the commencement of their DPS covers under NTUC

Income. Great Eastern Life will continue to cover any Total Permanent Disability refers to the inability to take part

in any employment permanently or the total permanent

medical conditions that had developed on or after the

loss of physical function of both eyes, both limbs, or one

commencement of members’ DPS covers under NTUC

eye and one limb.

Income.

4. What is the premium I must pay?

Age Last Yearly Sum Assured

Birthday Premium

34 and below $18

35-39 $30

40-44 $50 $70,000

45-49 $93

50-54 $188

55-59 $298

60-64 $298 $55,000

8. What are the claim exclusions? (b) Terminal Illness/Total Permanent Disability

The documents required are:

You cannot claim the benefits under DPS if any of the (i) Total and Permanent Disability claim form

following events occur within the first policy year: (available on our website)

(a) you committed self-inflicted injury or suicide; (ii) Doctor’s Statement (available on our

(b) you committed a criminal offence punishable by website. This has to be completed by your

death; or medical practitioner before submitting to us)

(c) the claim arose out of your intentional criminal act. (iii) Receipt for the fee charged for completion of

the Doctor’s Statement (we will reimburse the

You also cannot claim the benefits under DPS if: fee to you after concluding the claim)

(d) you suffer from serious illness, Terminal Illness, or (iv) All available lab and test results

Total Permanent Disability before the

commencement of the policy; If any other document is required, we will inform you or

(e) you have provided false or misleading statement or the claimant accordingly.

information; or

10. Who will receive the approved claim benefits?

(f) your claim arose from wars or any warlike

operations or participation in any riot. Death claims will be paid to the nominee(s) in one

lumpsum according to the nomination. If no nomination is

Under (a) to (d), the policy will be cancelled and all the

made, the benefits will be paid to Proper Claimant(s) with

premiums you paid will be refunded with interest to your

reference to Section 61 of the Insurance Act (Chapter 142

CPF account.

of Singapore). A Proper Claimant can be the Executor of

Please refer to our website for the list of serious illnesses. the deceased’s estate or family member, e.g. spouse,

parent, child or sibling.

If your cover is subject to exclusions before 01/05/2016,

the same exclusions will apply to a claim under Total Terminal Illness or Total Permanent Disability claim

Permanent Disability. benefits will be paid to you. For insured members who lack

mental capacity, the claim will be paid to the deputy in

9. How do I apply for a claim? accordance to the Order of Court or donee of a valid

Lasting Power of Attorney.

(a) Death

The documents required are: 11. How do I make a nomination (revocable) for DPS?

(i) Death claim form (available on our website)

(ii) Certified true copy of the death certificate If you are at least 18 years old and wish to have the death

(iii) Letter from Immigration and Checkpoint claim benefits paid to your desired nominee(s), you may

Authority (ICA) for death occurring overseas make a nomination by submitting the DPS nomination form

(iv) Claimant’s identity card and proof of (available on our website) to us.

relationship with deceased

(v) Doctor’s Statement if the death occurred 12. What is a Lasting Power of Attorney?

overseas, to be completed by the last doctor

who attended to the deceased person. A Lasting Power of Attorney is a legal document that allows

(vi) Last Will of deceased (if deceased left a last a person who is 21 years of age or older (donor) and who

Will) has mental capacity, to voluntarily appoint one or more

(vii) Newspaper cutting and/or policy report for persons called donees to make decisions and act on

accidental death his/her behalf when he/she lacks mental capacity in the

future.

Medical report, post mortem report and/or

toxicology report may be required. If any other

document is required, we will inform the claimant

accordingly.

For more information on DPS, you can visit our website, call our hotline or email us:

Website : www.greateasternlife.com/DPS

Customer hotline : 6839 4565

Email : dps-sg@greateasternlife.com

您也可以浏览我們的网站 www.greateasternlife.com/dps-info-leaflet-apr2021 查阅上述信息的中文版本或致电我們的热

线电话 6839 4565 以了解更多详情。

Anda boleh juga melihat maklumat di atas dalam Bahasa Melayu menerusi lelaman kami di

www.greateasternlife.com/dps-info-leaflet-apr2021 atau hubungi kami di talian 6839 4565 untuk maklumat lanjut.

ஜ ୷இஜ ஂஅஜ ஶஜ ஜ ୷உஆ www.greateasternlife.com/dps-info-leaflet-apr2021 ୱஂஜ ୱஜ ୷இஐஜ

୭ஃஜஇஜொஅஜ ஶஜ ஜ ௯௩ஂஜ ஏஜ୷ஜ୷ஆஏஂஜ . ୫ஆஜ ஆௌ 6839 4565ୱஂஜ ୱஜ ୷இஐஜ

ூஜ ஏஆ உ௯ ୫ஈ୷ஜ୷ஆஏஂஜ .

You might also like

- Role of Torts in The Protection of The EnvironmentDocument5 pagesRole of Torts in The Protection of The EnvironmentShreyasree PaulNo ratings yet

- Sss Death Claim RequirementsDocument3 pagesSss Death Claim Requirementsmel7sumatra100% (7)

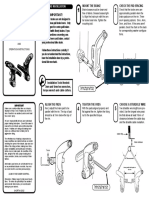

- Shorty 4 InstallDocument2 pagesShorty 4 Installoli garkiNo ratings yet

- A Beginner's Guide to Disability Insurance Claims in Canada: How to Apply for and Win Payment of Disability Insurance Benefits, Even After a Denial or Unsuccessful AppealFrom EverandA Beginner's Guide to Disability Insurance Claims in Canada: How to Apply for and Win Payment of Disability Insurance Benefits, Even After a Denial or Unsuccessful AppealNo ratings yet

- Community Tax Certificate PRINTDocument2 pagesCommunity Tax Certificate PRINTClarenz50% (2)

- Task 3 SITXGLC001Document2 pagesTask 3 SITXGLC001Pahn Panrutai0% (1)

- i-Care+OKU PDS+ (ENG)Document3 pagesi-Care+OKU PDS+ (ENG)hakimstars2003No ratings yet

- ICICI Pru Iprotect Smart Annexure V Option All in One 1-Sep-2017 To 1-Feb-2018Document6 pagesICICI Pru Iprotect Smart Annexure V Option All in One 1-Sep-2017 To 1-Feb-2018marketbus12No ratings yet

- Arceli M. Bolor-PNB-Eazy - health-PHP-09252020134415Document3 pagesArceli M. Bolor-PNB-Eazy - health-PHP-09252020134415Neil Mhartin NapolesNo ratings yet

- FNB Funeral Insurance Plan Terms and ConditionsDocument2 pagesFNB Funeral Insurance Plan Terms and Conditionsschweni64No ratings yet

- Ivhq Iahq Standard 2023-24 NewDocument17 pagesIvhq Iahq Standard 2023-24 Newsoumiabouaziz266No ratings yet

- FWD Critical Illness RiderDocument6 pagesFWD Critical Illness RiderZaini JamakNo ratings yet

- DescriptionOfCoverage StudyUSADocument26 pagesDescriptionOfCoverage StudyUSAHungNo ratings yet

- Arceli M. Bolor-PNB-Eazy - health-PHP-09292020091753Document3 pagesArceli M. Bolor-PNB-Eazy - health-PHP-09292020091753Neil Mhartin NapolesNo ratings yet

- Frequently Asked Questions: Claims and BenefitsDocument4 pagesFrequently Asked Questions: Claims and BenefitsjaimeelynpNo ratings yet

- ICICI Pru IProtect Smart Annexure V Option All in One 2-Feb-2018 To Till DateDocument8 pagesICICI Pru IProtect Smart Annexure V Option All in One 2-Feb-2018 To Till DatePankaj AdwaniNo ratings yet

- Voluntary SssDocument5 pagesVoluntary SssRaissa Anjela Carman-JardenicoNo ratings yet

- C Is Health Su Raksha Policy WordingDocument16 pagesC Is Health Su Raksha Policy Wordingsmith willNo ratings yet

- Health Suraksha Insurance Faqs Policy WordingDocument16 pagesHealth Suraksha Insurance Faqs Policy WordingSachinKumarNo ratings yet

- Policy Guidelines On Additional Death Benefit Due To Covid-19Document2 pagesPolicy Guidelines On Additional Death Benefit Due To Covid-19Jj DelloroNo ratings yet

- Murali ResiptDocument5 pagesMurali Resipt10ashvikaaNo ratings yet

- Annexure B - Frequently Asked Questions 2020-21 - TATA AIGDocument12 pagesAnnexure B - Frequently Asked Questions 2020-21 - TATA AIGrichards.prabhu1817No ratings yet

- SGPS - Travel Insurance BrochureDocument4 pagesSGPS - Travel Insurance Brochuremackenziebromstad1265No ratings yet

- MIFLetter10045975 29-8-2023 113620Document3 pagesMIFLetter10045975 29-8-2023 113620greenrootfinancialservicesNo ratings yet

- Odu BT BR and CF cc005728 BT 2022 23Document13 pagesOdu BT BR and CF cc005728 BT 2022 23sahapdeen haiderNo ratings yet

- Survivor ShipDocument31 pagesSurvivor Shipxxjulyxx87No ratings yet

- NTUC Claim FormDocument5 pagesNTUC Claim FormHihiNo ratings yet

- Policy BrochureDocument13 pagesPolicy BrochureAledo QueenNo ratings yet

- Life Insurance Policy WordingDocument3 pagesLife Insurance Policy WordingAkmal HelmiNo ratings yet

- FAQs-Top Up-2014-15Document4 pagesFAQs-Top Up-2014-15Naga Prasad PonnaNo ratings yet

- New Sme For MdselamaDocument3 pagesNew Sme For MdselamaHS INNOVATORNo ratings yet

- Employee State Insurance Act 1948: Presented by 1) Mayur KhatriDocument18 pagesEmployee State Insurance Act 1948: Presented by 1) Mayur KhatriJoginder GrewalNo ratings yet

- Employees' Compensation Commission (P.D. 626 As Amended)Document24 pagesEmployees' Compensation Commission (P.D. 626 As Amended)Angelica laroyaNo ratings yet

- 01 Disability Benefits For Wounded Warriors En-05-10030Document20 pages01 Disability Benefits For Wounded Warriors En-05-10030api-309082881No ratings yet

- LIC Health Protection Policy DetailsDocument13 pagesLIC Health Protection Policy DetailsSanchit TaksaliNo ratings yet

- Insurance PHILAMCARE Vs CA DigestDocument6 pagesInsurance PHILAMCARE Vs CA DigestPao MillanNo ratings yet

- Takaful MaybankDocument4 pagesTakaful MaybankSHANo ratings yet

- Accident Shield Online Policy WordingsDocument6 pagesAccident Shield Online Policy WordingssivakmahenNo ratings yet

- QLM Voda Terms and ConditionsDocument6 pagesQLM Voda Terms and ConditionsMuhammad Javed BhattiNo ratings yet

- Application For Cghs CardDocument3 pagesApplication For Cghs CardManpreetNo ratings yet

- Product Disclosure Sheet FLEXI PA TakafulDocument2 pagesProduct Disclosure Sheet FLEXI PA Takafulashyraf81No ratings yet

- Medical Report and ReceiptDocument5 pagesMedical Report and Receiptkumarsam087No ratings yet

- Out-of-Country Medical Coverage and Claims Guide: AIG Accident & HealthDocument2 pagesOut-of-Country Medical Coverage and Claims Guide: AIG Accident & HealthNomadic BeingNo ratings yet

- Etiqa+Critical+Care+Plus FAQDocument7 pagesEtiqa+Critical+Care+Plus FAQKeren Karunya SingamNo ratings yet

- Fi Life PDS Life CI 260922Document4 pagesFi Life PDS Life CI 260922Hafiz IqbalNo ratings yet

- Module 1 - Sickness BenefitDocument36 pagesModule 1 - Sickness BenefitBeltran ArielNo ratings yet

- Mindef Benefit SummaryDocument17 pagesMindef Benefit SummaryJedrek TeoNo ratings yet

- FAQs On MRCDocument9 pagesFAQs On MRCacctsnipccdNo ratings yet

- Manoj Kumar Airconditioner: Airconditioner Jw-Q18WuzaDocument2 pagesManoj Kumar Airconditioner: Airconditioner Jw-Q18WuzaManoj KumarNo ratings yet

- FAQ-Go Digit Voluntary Covid PlanDocument4 pagesFAQ-Go Digit Voluntary Covid PlanVenkatesh NarisettyNo ratings yet

- ESC H BAND FAQsDocument8 pagesESC H BAND FAQsRamesh DeshpandeNo ratings yet

- GT Mesra PA Free PA PL FinalEco Takaful Master PolicyDocument9 pagesGT Mesra PA Free PA PL FinalEco Takaful Master PolicyDen LabuNo ratings yet

- COVID-19 (Coronavirus) : DEASP Additional Customer InformationDocument10 pagesCOVID-19 (Coronavirus) : DEASP Additional Customer InformationCh TNo ratings yet

- Life Insurance Policy SampleDocument16 pagesLife Insurance Policy SampleSittie AinNo ratings yet

- Jeevan ArogyaDocument24 pagesJeevan Arogyassvelu5654No ratings yet

- Faq Covid 19Document2 pagesFaq Covid 19Prashanth NairNo ratings yet

- FAQs On InsuranceDocument10 pagesFAQs On InsuranceThe Genius WorldNo ratings yet

- BODI Policy Wording ENG - 08012016Document18 pagesBODI Policy Wording ENG - 08012016Khungar NyamdorjNo ratings yet

- ProHealth - Cash - Accordion - March2021 - V3 - V4Document8 pagesProHealth - Cash - Accordion - March2021 - V3 - V4hiteshmohakar15No ratings yet

- LIC Jeevan Arogya Brochure 2020Document21 pagesLIC Jeevan Arogya Brochure 2020Paul PrakashNo ratings yet

- Form No 03102014 ALIB Life Insurance BenefitsDocument2 pagesForm No 03102014 ALIB Life Insurance BenefitsAndres Kalikasan SaraNo ratings yet

- PDS - Credit Shield Premier Upgrade (Eng) - TMDocument5 pagesPDS - Credit Shield Premier Upgrade (Eng) - TMNasrul SalmanNo ratings yet

- TeleHealth PolicytermsDocument10 pagesTeleHealth PolicytermsChamara VidurangaNo ratings yet

- Solution Manual For Advanced Accounting 7th Edition Debra C Jeter Paul K ChaneyDocument29 pagesSolution Manual For Advanced Accounting 7th Edition Debra C Jeter Paul K Chaneybraidscanty8unib100% (45)

- Sturdivant V BACDocument38 pagesSturdivant V BACBrook BoondNo ratings yet

- Role of Icab and IcmabDocument12 pagesRole of Icab and IcmabEast West Technical InstituteNo ratings yet

- Enter The Body Makeover Challenge CompetitionDocument2 pagesEnter The Body Makeover Challenge CompetitionbmapiraNo ratings yet

- 2020 12 en PDFDocument116 pages2020 12 en PDFShubham SaindreNo ratings yet

- Constitutional Provisions On Labor and Book 1 - Pre-EmploymentDocument14 pagesConstitutional Provisions On Labor and Book 1 - Pre-EmploymentN4STYNo ratings yet

- MbfiDocument37 pagesMbfiFaustino LicudNo ratings yet

- Financial Reporting: © The Institute of Chartered Accountants of IndiaDocument5 pagesFinancial Reporting: © The Institute of Chartered Accountants of IndiaRITZ BROWNNo ratings yet

- Quiz 3 Ppe QuestionsDocument4 pagesQuiz 3 Ppe QuestionsJessica Marie MigrasoNo ratings yet

- Subhash Tyagi Vs - Sumit MalikDocument16 pagesSubhash Tyagi Vs - Sumit MalikJuris SourceNo ratings yet

- Petitioners Respondent: People of The Philippines, - Teresita Puig and Romeo PorrasDocument8 pagesPetitioners Respondent: People of The Philippines, - Teresita Puig and Romeo PorrasVianice BaroroNo ratings yet

- The Mirror of Shakespeare (Hamlet Commentary)Document9 pagesThe Mirror of Shakespeare (Hamlet Commentary)Kaylee HallNo ratings yet

- Anisha - Statutes Affecting Jurisdiction of Courts - Final DraftDocument6 pagesAnisha - Statutes Affecting Jurisdiction of Courts - Final DraftAnisha ReddyNo ratings yet

- Case Digest Recto VS, Hon TrocinoDocument2 pagesCase Digest Recto VS, Hon TrocinoNino Kim AyubanNo ratings yet

- Rejda rmiGE ppt01Document25 pagesRejda rmiGE ppt01Fadi OsamaNo ratings yet

- DESHABHIMANIDocument6 pagesDESHABHIMANIfebinpaulk4uNo ratings yet

- Violence As (De) Civilizing Process in Fight ClubDocument13 pagesViolence As (De) Civilizing Process in Fight ClubAnastasija OrlovaNo ratings yet

- PLDT Vs NTCDocument2 pagesPLDT Vs NTCJayNo ratings yet

- 11 Building BlocksDocument23 pages11 Building Blocksphoebe apayyo100% (2)

- National Highways Excellence Awards - Winners2019Document2 pagesNational Highways Excellence Awards - Winners2019Amit Kumar ChandaNo ratings yet

- Sharma 01Document1 pageSharma 01Surajmal TansukhraiNo ratings yet

- Affordable CebuDocument19 pagesAffordable CebuNicko TanteNo ratings yet

- G.R. No. 220400, March 20, 2019 Annie Tan, Petitioner, V. Great Harvest Enterprises, Inc., Respondent. Decision Leonen, J.Document31 pagesG.R. No. 220400, March 20, 2019 Annie Tan, Petitioner, V. Great Harvest Enterprises, Inc., Respondent. Decision Leonen, J.Jay TelanNo ratings yet

- National Service Training Program: NSTP Mentors Led by NSTP Head, Oscar G. PulidoDocument38 pagesNational Service Training Program: NSTP Mentors Led by NSTP Head, Oscar G. PulidoJean AlvaradoNo ratings yet

- RPD Daily Incident Report 1/1/22Document7 pagesRPD Daily Incident Report 1/1/22inforumdocsNo ratings yet

- Rbi 2012-13 493Document3 pagesRbi 2012-13 493ambarishramanuj8771No ratings yet