Professional Documents

Culture Documents

80G Receit

80G Receit

Uploaded by

acmeOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

80G Receit

80G Receit

Uploaded by

acmeCopyright:

Available Formats

1

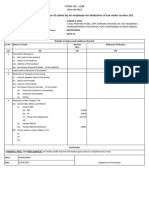

[FORM No. 10BE

(See rule 18AB)

Certificate of donation under clause (ix) of sub-section (5) of section 80G and under clause (ii) of sub-section (1A) of section 35 of

the Income-tax Act, 1961

Acknowledgement Number A B C D 0 2 2 2 0 0 0 0 0 0 1

1 PAN of the reporting person A B C D E 1 2 3 4 F

Donee

2 Name of the reporting person

3 Address of the reporting person

4 Unique Registration Number (URN)

5 Date of Issue of Unique Registration Number

6 Unique Identification Number PAN A B C D E 1 2 3 4 F

Aadhaar

Other

Donor and donations

7 Name of Donor

8 Address of Donor

9 Amount of donation received

10 Financial year in which such donation was received

11 Type of donation Corpus Specific grants Others

12 Section under which donation is eligible for deduction Section Section Section Section

80G(5)(vi) 35(1)(ii) 35(1)(iia) 35(1)(iii)

VERIFICATION

I, son/ daughter of solemnly declare that to the best of my knowledge and belief, the information given in the

certificate is correct and complete and is in accordance with the provisions of the Income-tax Act, 1961. I further

declare that I am making this certificate in my capacity as and I am also competent to issue this

certificate. I am holding permanent account number .

Date:

Signature:.................................................

]

1. Substituted by the Income-tax (Fourteenth Amendment) Rules, 2022, w.e.f. .

You might also like

- The Role of The Social Worker in The 21st CenturyDocument12 pagesThe Role of The Social Worker in The 21st CenturySyed Hadi100% (1)

- (Form No. 10be (See Rule 18AB) Certificate of Donation Under Clause (Ix) of Sub-Section (5) of Section 80G and Under Clause (Ii) To Sub-Section (1A) of Section 35 of The Income-Tax Act, 1961Document1 page(Form No. 10be (See Rule 18AB) Certificate of Donation Under Clause (Ix) of Sub-Section (5) of Section 80G and Under Clause (Ii) To Sub-Section (1A) of Section 35 of The Income-Tax Act, 1961Priya Vijay kumaarNo ratings yet

- Ishwar Charitable Trust Certificate BookDocument2 pagesIshwar Charitable Trust Certificate BookManisha PatelNo ratings yet

- (FORM No. 10BD (See Rule 18AB) (E-Form) : Details of The Donors and DonationsDocument2 pages(FORM No. 10BD (See Rule 18AB) (E-Form) : Details of The Donors and DonationsSneha SharmaNo ratings yet

- BKHPD5320C 10BECertificateDocument1 pageBKHPD5320C 10BECertificatedeepaksinghchaudhary1988No ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document2 pagesStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192mayurNo ratings yet

- Itrform 12 BBDocument3 pagesItrform 12 BBDedyTo'tedongNo ratings yet

- Itrform 12 BBDocument3 pagesItrform 12 BBPrAbHaS DarLiNgNo ratings yet

- Itrform 12 BBDocument3 pagesItrform 12 BBAnonymous DbmKEDxNo ratings yet

- Itrform 12 BBDocument3 pagesItrform 12 BBAnonymous DbmKEDxNo ratings yet

- Itrform 12 BBDocument3 pagesItrform 12 BBWater SpecNo ratings yet

- Fabdd PDFDocument3 pagesFabdd PDFSahil KumarNo ratings yet

- Itrform12bb PDFDocument3 pagesItrform12bb PDFRudolph Antony ThomasNo ratings yet

- Itrform12bb PDFDocument3 pagesItrform12bb PDFMuhammed RiyazNo ratings yet

- Itrform12bb PDFDocument3 pagesItrform12bb PDFSahil KumarNo ratings yet

- Itrform12bb PDFDocument3 pagesItrform12bb PDFMeghana JoshiNo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document2 pagesStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Chandra ShekarNo ratings yet

- Form 12 BB MsirDocument1 pageForm 12 BB MsirrajeshNo ratings yet

- New Form 12BBDocument2 pagesNew Form 12BBramanNo ratings yet

- Income Tax Rules, 1962: Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document5 pagesIncome Tax Rules, 1962: Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Santosh Aditya Sharma ManthaNo ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument1 pageForm No.12Bb: Details of Claims and Evidence ThereofBSNL RBLNo ratings yet

- Form-12BB FY 2021-22Document2 pagesForm-12BB FY 2021-22Vinay JadhavNo ratings yet

- Tax DeclarationDocument2 pagesTax DeclarationVISHAKHA SHARMANo ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument2 pagesForm No.12Bb: Details of Claims and Evidence ThereofsujupsNo ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument2 pagesForm No.12Bb: Details of Claims and Evidence ThereofSathish NakeerthaNo ratings yet

- Form 12BB in Excel FormatDocument2 pagesForm 12BB in Excel FormatJTO NIBNo ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument2 pagesForm No.12Bb: Details of Claims and Evidence ThereofSathish NakeerthaNo ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument2 pagesForm No.12Bb: Details of Claims and Evidence ThereofVighneshwarBhatNo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document2 pagesStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Chandra ShekarNo ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument2 pagesForm No.12Bb: Details of Claims and Evidence Thereofvijay sharmaNo ratings yet

- Tax Investment Form FY 2023-24Document3 pagesTax Investment Form FY 2023-24rishabh.vermaNo ratings yet

- Form 12BB PDFDocument1 pageForm 12BB PDFbala_thegameNo ratings yet

- Form 12Document2 pagesForm 12sarathNo ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument4 pagesForm No.12Bb: Details of Claims and Evidence ThereofParmar NileshNo ratings yet

- 1.4 FORM NO 12 BB FinalDocument2 pages1.4 FORM NO 12 BB FinalVinit KayarkarNo ratings yet

- File 20042020153269734Document1 pageFile 20042020153269734Skill IndiaNo ratings yet

- Form 12BBDocument2 pagesForm 12BBPintu pajaiNo ratings yet

- 12BB FY 2021 22 Form pdf6010Document3 pages12BB FY 2021 22 Form pdf6010Subhahan BashaNo ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument1 pageForm No.12Bb: Details of Claims and Evidence ThereofmaddymatNo ratings yet

- Form12BB-258 (HARDIK K - PATEL)Document1 pageForm12BB-258 (HARDIK K - PATEL)Automobile EngineeringNo ratings yet

- Form 20231218064720293198Document2 pagesForm 20231218064720293198siddharthbackupfilesNo ratings yet

- (See Rule 26C of Income Tax Rules, 1962) : Form No. 12BbDocument1 page(See Rule 26C of Income Tax Rules, 1962) : Form No. 12BbSaad YusufNo ratings yet

- Form12bb 246 (Yagnesh V Anavadiya)Document1 pageForm12bb 246 (Yagnesh V Anavadiya)chanduNo ratings yet

- Form 12BB in Excel FormatDocument4 pagesForm 12BB in Excel Formatkumar45caNo ratings yet

- Form12BB 22 23Document3 pagesForm12BB 22 23Vipin KumarNo ratings yet

- Form 12BB in Word FormatDocument2 pagesForm 12BB in Word FormatAlka Joshi0% (1)

- Form No.12Bb: Details of Claims and Evidence ThereofDocument4 pagesForm No.12Bb: Details of Claims and Evidence ThereofsivaNo ratings yet

- Income Tax Declaration Form - FORM-NO. 12BBDocument10 pagesIncome Tax Declaration Form - FORM-NO. 12BBPrince MittalNo ratings yet

- Form 12BB in Excel FormatDocument9 pagesForm 12BB in Excel FormatAnonymous gG31dZ9ONo ratings yet

- Form. 12BBDocument6 pagesForm. 12BBaruyl001No ratings yet

- Form 12BBDocument1 pageForm 12BBGopala KrishnanNo ratings yet

- BP040 Current Process ModelDocument1 pageBP040 Current Process Modelsastrylanka1980No ratings yet

- It Form 12BBDocument4 pagesIt Form 12BBBunty JeeNo ratings yet

- Form No. 15CB: B 1. Country To Which Remittance Is MadeDocument3 pagesForm No. 15CB: B 1. Country To Which Remittance Is MadeDaman GillNo ratings yet

- Form-12BB 2019-20Document1 pageForm-12BB 2019-20sabir aliNo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document1 pageStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Guru RajNo ratings yet

- Income Tax Savings Declaration Form EngDocument2 pagesIncome Tax Savings Declaration Form EngDedyTo'tedongNo ratings yet

- 1679046399297-Income Tax - 12BB Form and Annexure FormDocument2 pages1679046399297-Income Tax - 12BB Form and Annexure FormsiddharthbackupfilesNo ratings yet

- Form 12BBDocument3 pagesForm 12BBAndroid TricksNo ratings yet

- Mercer Consulting (India) Private Limited Form No. 12Bb (See Rule 26C) Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document1 pageMercer Consulting (India) Private Limited Form No. 12Bb (See Rule 26C) Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Shubham ShrivastavaNo ratings yet

- To Build Overall Muscle Mass EffectivelyDocument2 pagesTo Build Overall Muscle Mass EffectivelyacmeNo ratings yet

- Diets For Fat Loss Can Vary Based On Individual NeedsDocument1 pageDiets For Fat Loss Can Vary Based On Individual NeedsacmeNo ratings yet

- Introduction To Nomenclature of Organic Chemical Systems With Particular Reference To Heterocyclic Compounds Containing Up To Three RingsDocument5 pagesIntroduction To Nomenclature of Organic Chemical Systems With Particular Reference To Heterocyclic Compounds Containing Up To Three RingsacmeNo ratings yet

- Acme HR BrochureDocument10 pagesAcme HR BrochureacmeNo ratings yet

- Request Letter For Health CampDocument1 pageRequest Letter For Health Campacme0% (3)

- List of Secretary Union Councils District Sialkot No. & Name of Union Council Name of Secretary UC Cell NumbersDocument8 pagesList of Secretary Union Councils District Sialkot No. & Name of Union Council Name of Secretary UC Cell NumbersAhmed MaherNo ratings yet

- Schengen Visa Application FormDocument8 pagesSchengen Visa Application FormYasser Hammad MohamedNo ratings yet

- Oklahoma Publishing v. WallingDocument2 pagesOklahoma Publishing v. WallingMindy BautistaNo ratings yet

- Nicaragua V HondurasDocument29 pagesNicaragua V HondurasJefferson DiosesNo ratings yet

- Singapore Bangladesh Relations FinalDocument14 pagesSingapore Bangladesh Relations FinalShakib AhmedNo ratings yet

- Finding AidDocument4 pagesFinding Aidapi-197141714No ratings yet

- 2023 Form 3 History Test JuneDocument4 pages2023 Form 3 History Test JuneKaylah MatshedisoNo ratings yet

- VolksempfängerDocument4 pagesVolksempfängerJoao EliasNo ratings yet

- Yusof Ishak Secondary School Humanities Study Tour Ho Chi Minh City, VietnamDocument19 pagesYusof Ishak Secondary School Humanities Study Tour Ho Chi Minh City, Vietnamadamant751No ratings yet

- Hidden Gulag in North KoreaDocument243 pagesHidden Gulag in North Koreathedawnstrider100% (1)

- Beed 1013Document3 pagesBeed 1013Jin Hui TanNo ratings yet

- Yukichi FukuzawaDocument33 pagesYukichi FukuzawaInês VieiraNo ratings yet

- Klein Cain ConstitutionDocument7 pagesKlein Cain Constitutionapi-371617736No ratings yet

- Islamic Aspects of The New Constitution of Pakistan: Manzooruddin AhmedDocument38 pagesIslamic Aspects of The New Constitution of Pakistan: Manzooruddin AhmedKiranHayatNo ratings yet

- Aswat v. GalidoDocument2 pagesAswat v. GalidoRando TorregosaNo ratings yet

- Reading Buchi Emecheta: Contests For Women's Experience in Women's StudiesDocument7 pagesReading Buchi Emecheta: Contests For Women's Experience in Women's StudiesCinthia MarquesNo ratings yet

- Moppets Worker ApplicationDocument3 pagesMoppets Worker Applicationapi-89463374No ratings yet

- Multicultural and Social Justice Counseling CompetDocument22 pagesMulticultural and Social Justice Counseling Competkafi naNo ratings yet

- Korean WarDocument9 pagesKorean War819-Sagar kumarNo ratings yet

- Mcintosh Reserve Webquest WorksheetDocument8 pagesMcintosh Reserve Webquest Worksheetapi-621525562No ratings yet

- School Based Child Protection PoliciesDocument4 pagesSchool Based Child Protection PoliciesGem Lam SenNo ratings yet

- DNC Fraud Lawsuit/ Wilding V. DNCDocument31 pagesDNC Fraud Lawsuit/ Wilding V. DNCLaw&CrimeNo ratings yet

- Amin - 1973 - Underdevelopment and Dependence in Black Africa Their Historical Origins and Contemporary FormsDocument21 pagesAmin - 1973 - Underdevelopment and Dependence in Black Africa Their Historical Origins and Contemporary Formsxenlogic100% (1)

- Komunikasyon at PananaliksikDocument73 pagesKomunikasyon at PananaliksikANGELU RANE BAGARES INTOL100% (2)

- Upset Since 2019, ex-MP Muddahanumegowda To Quit Congress - Deccan HeraldDocument6 pagesUpset Since 2019, ex-MP Muddahanumegowda To Quit Congress - Deccan HeraldAkash guptaNo ratings yet

- Iloilo City Regulation Ordinance 2017-053Document5 pagesIloilo City Regulation Ordinance 2017-053Iloilo City CouncilNo ratings yet

- SGTM 5 B Attitudes & Behaviour " Cultural Awareness"Document29 pagesSGTM 5 B Attitudes & Behaviour " Cultural Awareness"Maggi BoldNo ratings yet

- Corruption Perceptions Index 2010Document12 pagesCorruption Perceptions Index 2010NDTVNo ratings yet

- HSE353E W10 (July Crisis)Document41 pagesHSE353E W10 (July Crisis)Ngan Ping Ping0% (1)