Professional Documents

Culture Documents

Tink Payments Case - Recurring Payments

Tink Payments Case - Recurring Payments

Uploaded by

d rOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tink Payments Case - Recurring Payments

Tink Payments Case - Recurring Payments

Uploaded by

d rCopyright:

Available Formats

Tink case study interview

The Tink case study interview will be ~60 minutes and will include:

(i) Tell us about something interesting (5 minutes): You have the floor for 5 minutes - no slides, no notes - tell us

about something that excites you / teach us something new (this really could be anything!)

(ii) Case study Q&A (~45 minutes): see below

Case study

Presentation

● Prepare a presentation on the case, and present it (~45 minutes) to us. We’ll ask questions along the way,

and so can you!

● We recommend that you don’t spend more than 2 hours on the presentation.

● Please email the presentation to us at the latest end of day, the day before your case interview

● We are primarily interested in how you would solve the task and why you would solve them that way.

● Be creative in your thought-work, rather than what the slides look like (function before aesthetics).

Background

Today, Tink’s payments product is primarily used for invoice payment and account top-up use cases. Tink has long

term ambitions to expand to recurring payments based use-case within Open Banking.

You are a Product Manager at Tink. Through close dialogues with customers and conducting other research to

understand the Account to Account Payments space, you’ve identified that recurring payments is a potential

candidate for Tink's product offering. You’re now trying to figure out if it’s an important problem to solve or not. And if it

is; make a case to get the rest of the organization—and the team—excited about it!

Problem

Many end users today are initiating payments that are recurring, in other words initiating payments from their

accounts at regular intervals on an ongoing basis e.g. 20€/month on their savings account or to their music streaming

subscription. Yet the potential of recurring payments is not fully explored, Tink's current product offering mainly

supports one-time payments.

Task 1 - Value

Is this a problem worth solving? And if so, why/why not? What use-cases can it unlock?

1) For the individual; the end user?

2) For Tink customers, a merchant or a Payment Service Provider?

Task 2 - Plan to solve it

Describe the product (and it’s capabilities/behaviour) you’d suggest building to solve this problem. Which are the

most important aspects? How can that be potentially expanded in the different markets?

To this, describe the activities you’d implement if you’d do this properly, to test your hypothesis, and get it

implemented.

Task 3 - Measure success

Which KPI would you use to measure success?

Good luck!

You might also like

- Lean Solutions: How Companies and Customers Can Create Value and Wealth TogetherFrom EverandLean Solutions: How Companies and Customers Can Create Value and Wealth TogetherRating: 3.5 out of 5 stars3.5/5 (16)

- Bre-X ScamDocument14 pagesBre-X ScamAnonymous ilWXWxgNo ratings yet

- Fuqua CaseBook 2010-2011Document146 pagesFuqua CaseBook 2010-2011tinylittleworld100% (1)

- Business Studies Notes For IGCSEDocument118 pagesBusiness Studies Notes For IGCSESumolmal Srisukri100% (5)

- Interview Question Prep For PM InterviewsDocument9 pagesInterview Question Prep For PM InterviewsVarsha ShirsatNo ratings yet

- Diepenbrock BitcoinReport2011Document21 pagesDiepenbrock BitcoinReport2011tonydiepenbrockNo ratings yet

- Eman Abuolwan - Mock ExamDocument6 pagesEman Abuolwan - Mock ExamEman AbuolwanNo ratings yet

- Interview Case Real EstateDocument2 pagesInterview Case Real Estatebruno fernandesNo ratings yet

- Care The First Step in Tech Innovation For EntrepreneursDocument6 pagesCare The First Step in Tech Innovation For EntrepreneursHanako OnoNo ratings yet

- Chapter 4 - Maker To Entrepreneur - N.H.NguyenDocument60 pagesChapter 4 - Maker To Entrepreneur - N.H.NguyenTrần Quốc DuyNo ratings yet

- Investor Pitch Deck PointersDocument6 pagesInvestor Pitch Deck PointersTim ShipleNo ratings yet

- WBS FAQ v2Document17 pagesWBS FAQ v2Liliana StoicescuNo ratings yet

- Format of Business Plan For Incubation at TBI, IIT Patna: Ic IitpDocument14 pagesFormat of Business Plan For Incubation at TBI, IIT Patna: Ic IitpBhola yadavNo ratings yet

- E-Types SWOTDocument2 pagesE-Types SWOTRami KhaddajNo ratings yet

- Group 9 - PBM AssignmentDocument16 pagesGroup 9 - PBM AssignmentKunal AryaNo ratings yet

- StartupDocument13 pagesStartupZiongNo ratings yet

- Grade 10-illustration-Q1-W2Document15 pagesGrade 10-illustration-Q1-W2Lanie QuintuaNo ratings yet

- Abrar Kamal MunaDocument12 pagesAbrar Kamal MunaMahamodul Hasan ShohanNo ratings yet

- Full SummaryDocument44 pagesFull SummaryKhánh ĐanNo ratings yet

- Pain and PossibilitiesDocument34 pagesPain and PossibilitiesSarthak AnupamNo ratings yet

- Creative Thinking For BusinessDocument5 pagesCreative Thinking For BusinessShoobhàm ŽdtNo ratings yet

- PM School Deck CompilationDocument234 pagesPM School Deck CompilationKaransingh BishtNo ratings yet

- Fabm Week 1Document11 pagesFabm Week 1John Matthew De JesusNo ratings yet

- Important Tips For Interview For SAP SDDocument11 pagesImportant Tips For Interview For SAP SDvishal_sap84100% (1)

- The 4 Hour Work Week Book SummaryDocument5 pagesThe 4 Hour Work Week Book SummaryPratama Gita92% (13)

- Spin Selling QuestionsDocument8 pagesSpin Selling QuestionsTetty ManurungNo ratings yet

- Week 4: Product / Market FitDocument33 pagesWeek 4: Product / Market Fitkrishnan1159No ratings yet

- What Is A Business Plan?Document34 pagesWhat Is A Business Plan?Lukman78No ratings yet

- ENGG4900 Lecture NotesDocument5 pagesENGG4900 Lecture NotesElizabeth ChicalasNo ratings yet

- Duke Case PackDocument146 pagesDuke Case PackJiemi GaoNo ratings yet

- How To Get Funding in 4 Steps Tomas Pavlik 2019Document19 pagesHow To Get Funding in 4 Steps Tomas Pavlik 2019JohnNo ratings yet

- truyền thông kinh doanhDocument3 pagestruyền thông kinh doanhKarachi Sơn NguyễnNo ratings yet

- The Lean Startup (Review and Analysis of Ries' Book)From EverandThe Lean Startup (Review and Analysis of Ries' Book)Rating: 4.5 out of 5 stars4.5/5 (4)

- Entrepreneurship I Laying The Foundation Module 2Document115 pagesEntrepreneurship I Laying The Foundation Module 2tuyetvynguyen9402No ratings yet

- Business Plan & Pitching Workshop: Peter Farrell Cup Entrepreneurial ChallengeDocument53 pagesBusiness Plan & Pitching Workshop: Peter Farrell Cup Entrepreneurial ChallengealfinaNo ratings yet

- The Silicon Valley Way (Review and Analysis of Sherwin Jr.'s Book)From EverandThe Silicon Valley Way (Review and Analysis of Sherwin Jr.'s Book)No ratings yet

- Writing Concept Summaries For New VenturesDocument9 pagesWriting Concept Summaries For New Ventureshenry.leinardNo ratings yet

- Guidance - En001 Entrepreneuship 1: Assesment ActivityDocument21 pagesGuidance - En001 Entrepreneuship 1: Assesment Activitymariko1234No ratings yet

- PM School EbookDocument234 pagesPM School EbookAkshay Tyagi100% (1)

- Understanding The Case InterviewDocument10 pagesUnderstanding The Case InterviewShiva KalisettyNo ratings yet

- PJ Enterprises Outstanding Customer Service Workshop Facilitator's GuideDocument15 pagesPJ Enterprises Outstanding Customer Service Workshop Facilitator's Guideapi-309525535No ratings yet

- Assignment Cover Page: BUSM4535Document11 pagesAssignment Cover Page: BUSM4535Vu Anh QuangNo ratings yet

- Se PrintDocument7 pagesSe PrintMiguel GonzalezNo ratings yet

- Twinfunds: Marketplace For Invoices: Twinfunds Proprietary Document. Please Email For Any QueriesDocument1 pageTwinfunds: Marketplace For Invoices: Twinfunds Proprietary Document. Please Email For Any QueriesVarun JainNo ratings yet

- Generating Ideas For BusinessDocument28 pagesGenerating Ideas For BusinessAce MoonNo ratings yet

- Customer Service Skills - Student HandoutDocument34 pagesCustomer Service Skills - Student HandoutVinodh_Shankar_6121No ratings yet

- Lesson3 (Business Idea)Document11 pagesLesson3 (Business Idea)TipidDadayPasaylo100% (1)

- EF Asia Investor QuestionsDocument13 pagesEF Asia Investor Questionsvan.vn0912No ratings yet

- Chapter 2 The Business PlanDocument59 pagesChapter 2 The Business PlanRed ONo ratings yet

- Sample Client Project Scope ReportDocument4 pagesSample Client Project Scope ReportZhang GraceNo ratings yet

- Product Management CourseDocument20 pagesProduct Management CourseRohit ParhiNo ratings yet

- 15 What Is Business Models ECMT ReadyDocument32 pages15 What Is Business Models ECMT Readynitomac608No ratings yet

- Ninjacart - Associate Product Management - Case StudiesDocument5 pagesNinjacart - Associate Product Management - Case Studiessaumitra srivastavaNo ratings yet

- Chapter-Wise Summary of The Lean Startup by Eric Ries: Digital Assignment - 1Document13 pagesChapter-Wise Summary of The Lean Startup by Eric Ries: Digital Assignment - 1abcdNo ratings yet

- Enterprise Coursework IgcseDocument6 pagesEnterprise Coursework Igcseykzdmfajd100% (2)

- Summers - Interview TranscriptsDocument51 pagesSummers - Interview TranscriptsMarin JamesNo ratings yet

- I2 Framework TemplateDocument3 pagesI2 Framework Templatesiddharth21061992No ratings yet

- B-Plan - Workshop SummaryDocument9 pagesB-Plan - Workshop Summarykrishnakeerthana142081No ratings yet

- Final Test SP6-MyyhgDocument10 pagesFinal Test SP6-MyyhgNguyen Tran Phuong ThaoNo ratings yet

- Reading Lecture 07 - Investment CasesDocument14 pagesReading Lecture 07 - Investment CasesAlex TY LamNo ratings yet

- The Lean Product Playbook (Review and Analysis of Olsen's Book)From EverandThe Lean Product Playbook (Review and Analysis of Olsen's Book)No ratings yet

- SPCL Ncba and SBD CasesDocument115 pagesSPCL Ncba and SBD Casesjhen agustinNo ratings yet

- Green Banking Strategies Adopted by Various BankDocument102 pagesGreen Banking Strategies Adopted by Various BankSushma LawateNo ratings yet

- Leasing As A Form of DebtDocument24 pagesLeasing As A Form of DebtSheila Mae Guerta LaceronaNo ratings yet

- International Bank Draft ProceduresDocument1 pageInternational Bank Draft ProceduresBank GuaranteeNo ratings yet

- F 03 Clear GL Act UperformDocument10 pagesF 03 Clear GL Act Uperformmmathu7624No ratings yet

- Interim Results June 2008Document12 pagesInterim Results June 2008Huseyin BozkinaNo ratings yet

- Belisario Vs IACDocument2 pagesBelisario Vs IACJudy Miraflores DumdumaNo ratings yet

- Customer Relationship ManagementDocument4 pagesCustomer Relationship Managementrustyryan99rNo ratings yet

- Simple InterestDocument3 pagesSimple Interestjohn gabriel bondoyNo ratings yet

- MGT325 M3 CashManagementDocument6 pagesMGT325 M3 CashManagementfltdeckabNo ratings yet

- Dvs 3317Document8 pagesDvs 3317Zulu PowerNo ratings yet

- 2019 03 13 EEP Modern Monetary TheoryDocument2 pages2019 03 13 EEP Modern Monetary TheoryPevita PearceNo ratings yet

- What Are The Different Types of Interest and Why Do They MatterDocument6 pagesWhat Are The Different Types of Interest and Why Do They MatterRochelle Anne OpinaldoNo ratings yet

- Production-Script-Format DEPOSIT SLIPDocument3 pagesProduction-Script-Format DEPOSIT SLIPlynette sahulgaNo ratings yet

- Evidence Cases: PART 1. General ProvisionsDocument7 pagesEvidence Cases: PART 1. General ProvisionsAnne Laraga LuansingNo ratings yet

- MHA IB Security Asst. and ExecutiveDocument18 pagesMHA IB Security Asst. and ExecutiveTopRankersNo ratings yet

- Extras UnicreditDocument1 pageExtras Unicreditdamianjmk01No ratings yet

- MTN Operativa-Hsbc Holdings PLC CompletDocument23 pagesMTN Operativa-Hsbc Holdings PLC CompletfranviNo ratings yet

- Eros International PLC - Wells FargoDocument4 pagesEros International PLC - Wells FargoGuneet Singh SahniNo ratings yet

- Financial Awareness Paper IIIDocument8 pagesFinancial Awareness Paper IIIKartikeya YadavNo ratings yet

- Activity Based CostingDocument23 pagesActivity Based CostingLamhe Yasu0% (1)

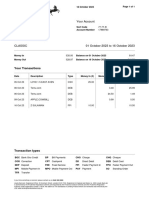

- Statement 2023 10Document1 pageStatement 2023 109jhdh8qthtNo ratings yet

- Chapter 4 - Time Value of MoneyDocument4 pagesChapter 4 - Time Value of MoneyTruc Khanh Pham NgocNo ratings yet

- Basic Accounting For Non-AccountantsDocument34 pagesBasic Accounting For Non-AccountantsJohn Rey Bantay RodriguezNo ratings yet

- Pothuluru Subba Reddy-DODocument3 pagesPothuluru Subba Reddy-DOShaik Chand BashaNo ratings yet

- Maoey & BankingDocument21 pagesMaoey & BankingSoyeb RaabbiNo ratings yet

- Financial Statement of Bank of IndiaDocument69 pagesFinancial Statement of Bank of IndiaAmandeep KaurNo ratings yet

- Annual ReportDocument192 pagesAnnual ReportMahender Kumar DacharlaNo ratings yet