Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

5 viewsTuski 10

Tuski 10

Uploaded by

syed shabbirThe document discusses the steps for processing payments in SAP, including calculating payment due dates, editing payment proposals, running the payment program to create documents, and defining print variants to print payment forms. It also describes how payment data is stored in tables and how house banks and bank accounts are set up with account IDs and GL accounts.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Sms 315 Test 2Document22 pagesSms 315 Test 2Yutaka KomatsuzakiNo ratings yet

- f6 Revision Kit AccaDocument362 pagesf6 Revision Kit Accamic julieNo ratings yet

- Invoicing Plan in Sap MMDocument16 pagesInvoicing Plan in Sap MMBadal Patra100% (1)

- Account T24Document1 pageAccount T24Luis Maria CepedaNo ratings yet

- Tuski 9Document1 pageTuski 9syed shabbirNo ratings yet

- 4 Account PayableDocument11 pages4 Account PayableChirag SolankiNo ratings yet

- Customizing Payment Program PDFDocument65 pagesCustomizing Payment Program PDFLeadership Club 12No ratings yet

- F110Document2 pagesF110pavan somarajuNo ratings yet

- Sap Bank AccountsDocument7 pagesSap Bank AccountsJose Luis GonzalezNo ratings yet

- RESUME SAP Financial Unit 3Document5 pagesRESUME SAP Financial Unit 3Novita WardaniNo ratings yet

- Unit - 1: Automatic Payments Lesson: Explaining The Automatic Payment RunDocument3 pagesUnit - 1: Automatic Payments Lesson: Explaining The Automatic Payment RunHaneesh DevarasettyNo ratings yet

- MG 10 - Fatimatus Zehroh - Summary SAP Unit 4Document15 pagesMG 10 - Fatimatus Zehroh - Summary SAP Unit 4Fatimatus ZehrohNo ratings yet

- Bill of Exchange PresentationDocument4 pagesBill of Exchange PresentationZORRONo ratings yet

- Customizing Data Setup Bank Account Management 20160510 PDFDocument68 pagesCustomizing Data Setup Bank Account Management 20160510 PDFDanny NinovaNo ratings yet

- Sap Financial StatementsDocument9 pagesSap Financial StatementsJose Luis GonzalezNo ratings yet

- Automatic Payment Program : AccountingDocument29 pagesAutomatic Payment Program : Accountingswetha devarakondaNo ratings yet

- APP SceneriesDocument29 pagesAPP SceneriesRaju BothraNo ratings yet

- Vendor Payments F-53Document2 pagesVendor Payments F-53Promoth JaidevNo ratings yet

- SAP Account ReceivablesDocument18 pagesSAP Account ReceivablesNavyaChNo ratings yet

- The Automatic Payment Program or APP Process in SAP FICO Enables You To Clear Open Items Between Customers and VendorsDocument6 pagesThe Automatic Payment Program or APP Process in SAP FICO Enables You To Clear Open Items Between Customers and Vendorsswati KulkarniNo ratings yet

- Cash ConcentrationDocument8 pagesCash Concentrationraviteja009No ratings yet

- SAP FI NotesDocument2 pagesSAP FI NotesvinodnagarajuNo ratings yet

- Lock BoxDocument4 pagesLock BoxAniruddha ChakrabortyNo ratings yet

- Fusion Ap NoteDocument16 pagesFusion Ap Notepraveen801No ratings yet

- Accounts PayableDocument27 pagesAccounts PayableSilvia MazuelaNo ratings yet

- What Are The Mandatory Setups For PayablesDocument13 pagesWhat Are The Mandatory Setups For Payablesdevender143No ratings yet

- SAP FICO Interview Questions and Answers: Learning IT Courses Has Never Been This EasyDocument20 pagesSAP FICO Interview Questions and Answers: Learning IT Courses Has Never Been This EasykhaledNo ratings yet

- Sap Implementation GuideDocument7 pagesSap Implementation Guidesiddharth.sbirje3571No ratings yet

- What You Need To Know About SAP Vendor Master Data MaintenanceDocument19 pagesWhat You Need To Know About SAP Vendor Master Data MaintenancejeetNo ratings yet

- Account PayableDocument48 pagesAccount PayableRavi Ravilala100% (1)

- AX2009 Advanced PaymentsDocument54 pagesAX2009 Advanced PaymentsKern Peters0% (1)

- Sap FiDocument12 pagesSap FiPankaj SharmaNo ratings yet

- Payment Process RequestDocument6 pagesPayment Process RequestVijay Tatoba NalawadeNo ratings yet

- Fica Dispute Case Creation ProcessDocument19 pagesFica Dispute Case Creation ProcessrinkushahNo ratings yet

- Account Payable System A Visual Studio Project ReportDocument15 pagesAccount Payable System A Visual Studio Project ReportNishant SainiNo ratings yet

- How Is Bank Reconciliation Handled in SAPDocument10 pagesHow Is Bank Reconciliation Handled in SAPajay_bplNo ratings yet

- 80219a 09Document48 pages80219a 09Indaia RufinoNo ratings yet

- 05 - Transactions in Office AccountsDocument18 pages05 - Transactions in Office AccountsSreepada k100% (1)

- SAP Accounts Payable AccountingDocument22 pagesSAP Accounts Payable AccountingSultan100% (1)

- Acct PayblesDocument60 pagesAcct PayblesRaddyNo ratings yet

- White Paper On Prepare and Record PaymentsDocument22 pagesWhite Paper On Prepare and Record PaymentsObaid Ul AleemNo ratings yet

- AP PrepareDocument51 pagesAP Preparebujjipandu7100% (1)

- Sap - RahulDocument7 pagesSap - RahulRahulSekharNo ratings yet

- FICA - Contract Accounts Receivable and PayableDocument21 pagesFICA - Contract Accounts Receivable and Payablekush2477100% (1)

- App Configuration NewDocument55 pagesApp Configuration NewRaksha RaniNo ratings yet

- Accounts PayableDocument27 pagesAccounts PayableManish ShankarNo ratings yet

- 21 Ef110a46c - Automatic Payment RunDocument9 pages21 Ef110a46c - Automatic Payment RunvittoriojayNo ratings yet

- Creating Payment Advice NotesDocument3 pagesCreating Payment Advice NotesEmilSNo ratings yet

- Banking System: in The Existing System The Transactions Are Done Only Manually But inDocument3 pagesBanking System: in The Existing System The Transactions Are Done Only Manually But inBhargav KondaNo ratings yet

- Basic Concepts AP - Part2Document11 pagesBasic Concepts AP - Part2ketans25No ratings yet

- NAVTTC SAP Fi Week - 6Document44 pagesNAVTTC SAP Fi Week - 6Anne RajputNo ratings yet

- MYOB Data Import ProcedureDocument3 pagesMYOB Data Import ProcedureAnonymous 7mJIoO1bh4No ratings yet

- ErpDocument2 pagesErpyoungpaulus0No ratings yet

- Bank Accounts OUs Ledgers Legal Entities RelationshipDocument7 pagesBank Accounts OUs Ledgers Legal Entities RelationshipSri RishiNo ratings yet

- ERP Application DocumentationDocument12 pagesERP Application DocumentationGopal RaiNo ratings yet

- Automatic Payment ProgramDocument21 pagesAutomatic Payment ProgramBala RanganathNo ratings yet

- What Is An Account Group and Where Is It UsedDocument5 pagesWhat Is An Account Group and Where Is It Usedragz22No ratings yet

- Sap Fi Ar DunningDocument18 pagesSap Fi Ar DunningAti Siti FathiahNo ratings yet

- The Controller's Function: The Work of the Managerial AccountantFrom EverandThe Controller's Function: The Work of the Managerial AccountantRating: 2 out of 5 stars2/5 (1)

- DocumentDocument2 pagesDocumentsyed shabbirNo ratings yet

- DocumentDocument2 pagesDocumentsyed shabbirNo ratings yet

- DocumentDocument2 pagesDocumentsyed shabbirNo ratings yet

- Document ffss5Document2 pagesDocument ffss5syed shabbirNo ratings yet

- DocumentDocument2 pagesDocumentsyed shabbirNo ratings yet

- Rizal Commercial Banking Corporation vs. Commissioner of Internal Revenue, 657 SCRA 70, September 07, 2011Document16 pagesRizal Commercial Banking Corporation vs. Commissioner of Internal Revenue, 657 SCRA 70, September 07, 2011j0d3No ratings yet

- Income Taxation - MODULE 1Document13 pagesIncome Taxation - MODULE 1Joe P PokaranNo ratings yet

- CIR vs. ALGUE INC. G.R. No. L 28896. February 17 1988 PDFDocument10 pagesCIR vs. ALGUE INC. G.R. No. L 28896. February 17 1988 PDFZenith EuropaNo ratings yet

- Ficustomisation FixedDocument134 pagesFicustomisation FixedSundarKrishnaNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Hamza SalihNo ratings yet

- MTN Operativa-Hsbc Holdings PLC CompletDocument23 pagesMTN Operativa-Hsbc Holdings PLC CompletfranviNo ratings yet

- The Current Status and The Prospect of E-Banking in BangladeshDocument42 pagesThe Current Status and The Prospect of E-Banking in BangladeshFayaza Rahman Eva85% (20)

- 2010 Sales Tax Seminar ManualDocument206 pages2010 Sales Tax Seminar ManualBarbara SalmeronNo ratings yet

- Online & Evening BankingDocument17 pagesOnline & Evening BankingAbrar AhmedNo ratings yet

- Hyundai Capital Auto Funding Iv Limited: Note Agency AgreementDocument32 pagesHyundai Capital Auto Funding Iv Limited: Note Agency Agreementpaths39No ratings yet

- Visa Direct General Funds Disbursement Sellsheet PDFDocument2 pagesVisa Direct General Funds Disbursement Sellsheet PDFPablo González de PazNo ratings yet

- Payment Methods For Students: Bank TransferDocument2 pagesPayment Methods For Students: Bank TransferJemal YayaNo ratings yet

- Chapter 3 Financial PlanningDocument25 pagesChapter 3 Financial PlanningChristopher Beltran CauanNo ratings yet

- MavrixDocument16 pagesMavrixRock MarkNo ratings yet

- Swift Standards Category 7 Version 11 September 2006Document245 pagesSwift Standards Category 7 Version 11 September 2006Ewoud Lietaert PeerbolteNo ratings yet

- Final AssigmentDocument27 pagesFinal AssigmentSHIVANG PATELNo ratings yet

- Sale DeedDocument9 pagesSale Deedsparsh9634No ratings yet

- Dnit - 4.5 MLD 25 - 01 - 2022 FinalDocument223 pagesDnit - 4.5 MLD 25 - 01 - 2022 Finalsiraj AhmedNo ratings yet

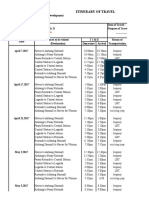

- Tev April-May 2017Document14 pagesTev April-May 2017Blay Cahatol EscausoNo ratings yet

- LamHoMing LaboratoryExcercise005Document8 pagesLamHoMing LaboratoryExcercise005Ho Ming LamNo ratings yet

- TankTerminals - KnowledgeDocument90 pagesTankTerminals - Knowledgesmartleo_waloNo ratings yet

- AccountStatement 28 JUN 2023 To 28 DEC 2023Document41 pagesAccountStatement 28 JUN 2023 To 28 DEC 2023wronglyrNo ratings yet

- PSP Buyer's Guide 2010 - Insights in The Worldwide Online PSP MarketDocument130 pagesPSP Buyer's Guide 2010 - Insights in The Worldwide Online PSP MarketNikhilesh PulugundlaNo ratings yet

- Bihar Finance Rules 2005Document60 pagesBihar Finance Rules 2005Mithilesh Kumar75% (4)

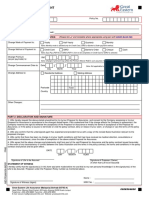

- GE Amendment FormDocument1 pageGE Amendment FormFelix GanNo ratings yet

- Electronic Payment Systems-FinalDocument105 pagesElectronic Payment Systems-Finaldileepvk1978No ratings yet

- Bartle Beyl, Inc - Kfc. 2306Document2 pagesBartle Beyl, Inc - Kfc. 2306clarikaNo ratings yet

- Simon Morris Deputy Chief Executive Complaint Case 1220093Document4 pagesSimon Morris Deputy Chief Executive Complaint Case 1220093CharonNo ratings yet

- Account Statement From 13 Jul 2022 To 13 Jan 2023Document8 pagesAccount Statement From 13 Jul 2022 To 13 Jan 2023ArulKing GiftsonNo ratings yet

Tuski 10

Tuski 10

Uploaded by

syed shabbir0 ratings0% found this document useful (0 votes)

5 views1 pageThe document discusses the steps for processing payments in SAP, including calculating payment due dates, editing payment proposals, running the payment program to create documents, and defining print variants to print payment forms. It also describes how payment data is stored in tables and how house banks and bank accounts are set up with account IDs and GL accounts.

Original Description:

Original Title

tuski10

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses the steps for processing payments in SAP, including calculating payment due dates, editing payment proposals, running the payment program to create documents, and defining print variants to print payment forms. It also describes how payment data is stored in tables and how house banks and bank accounts are set up with account IDs and GL accounts.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

5 views1 pageTuski 10

Tuski 10

Uploaded by

syed shabbirThe document discusses the steps for processing payments in SAP, including calculating payment due dates, editing payment proposals, running the payment program to create documents, and defining print variants to print payment forms. It also describes how payment data is stored in tables and how house banks and bank accounts are set up with account IDs and GL accounts.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

culates the cash discount period and due date for the net payment.

Grace periods are then added to

this due date, which special GL’s are to be included, blocking an item. The payment proposal can be

displayed for further processing, i.e., in log to see the system messages. 3)Edit proposal :You can be

able to edit the proposal, you can change house bank, payment method, and change payment due

date to restrict certain open items, block or unblock line items. 4) Payment Run: After Payment run

has been edited, you can run the payment program that creates the payment documents and

prepares the data for printing the forms. Before printing the forms, check the log once to make sure

the payment program run was successful. 5) Print run: You need to define the variants for print

programs, you need to run the print program at least one variant per print program per payment

method. The data created by Payment Program is stored in tables like: REGUH – Payee or payment

method data, REGUP – Individual open items data, REGUD – Bank data and payment amounts data.

House banks: FI12 Bank Directory – FI01 Heculates the cash discount period and due date for the net

payment. Grace periods are then added to this due date, which special GL’s are to be included,

blocking an item. The payment proposal can be displayed for further processing, i.e., in log to see the

system messages. 3)Edit proposal :You can be able to edit the proposal, you can change house bank,

payment method, and change payment due date to restrict certain open items, block or unblock line

items. 4) Payment Run: After Payment run has been edited, you can run the payment program that

creates the payment documents and prepares the data for printing the forms. Before printing the

forms, check the log once to make sure the payment program run was successful. 5) Print run: You

need to define the variants for print programs, you need to run the print program at least one variant

per print program per payment method. The data created by Payment Program is stored in tables

like: REGUH – Payee or payment method data, REGUP – Individual open items data, REGUD – Bank

data and payment amounts data. House banks: FI12 Bank Directory – FI01 Hecontact person,

telephone number. You can have N-number of house banks for your company code and for each

house bank there can be N-number of bank accounts, each bank account is identified by account ID.

This account ID is referenced in customer/vendor master record and is used by payment program by

the system. For account ID –you assign one bank account number and for each bank account number

defined in the house bank you need to create a GL account master record. calculates the cash

discount period and due date for the net payment. Grace periods are then added to this due date,

which special GL’s are to be included, blocking an item. The payment proposal can be displayed for

further processing, i.e., in log to see the system messages. 3)Edit proposal :You can be able to edit

the proposal, you can change house bank, payment method, and change payment due date to

restrict certain open items, block or unblock line items. 4) Payment Run: After Payment run has been

edited, you can run the payment program that creates the payment documents and prepares the

data for printing the forms. Before printing the forms, check the log once to make sure the payment

program run was successful. 5) Print run: You need to define

You might also like

- Sms 315 Test 2Document22 pagesSms 315 Test 2Yutaka KomatsuzakiNo ratings yet

- f6 Revision Kit AccaDocument362 pagesf6 Revision Kit Accamic julieNo ratings yet

- Invoicing Plan in Sap MMDocument16 pagesInvoicing Plan in Sap MMBadal Patra100% (1)

- Account T24Document1 pageAccount T24Luis Maria CepedaNo ratings yet

- Tuski 9Document1 pageTuski 9syed shabbirNo ratings yet

- 4 Account PayableDocument11 pages4 Account PayableChirag SolankiNo ratings yet

- Customizing Payment Program PDFDocument65 pagesCustomizing Payment Program PDFLeadership Club 12No ratings yet

- F110Document2 pagesF110pavan somarajuNo ratings yet

- Sap Bank AccountsDocument7 pagesSap Bank AccountsJose Luis GonzalezNo ratings yet

- RESUME SAP Financial Unit 3Document5 pagesRESUME SAP Financial Unit 3Novita WardaniNo ratings yet

- Unit - 1: Automatic Payments Lesson: Explaining The Automatic Payment RunDocument3 pagesUnit - 1: Automatic Payments Lesson: Explaining The Automatic Payment RunHaneesh DevarasettyNo ratings yet

- MG 10 - Fatimatus Zehroh - Summary SAP Unit 4Document15 pagesMG 10 - Fatimatus Zehroh - Summary SAP Unit 4Fatimatus ZehrohNo ratings yet

- Bill of Exchange PresentationDocument4 pagesBill of Exchange PresentationZORRONo ratings yet

- Customizing Data Setup Bank Account Management 20160510 PDFDocument68 pagesCustomizing Data Setup Bank Account Management 20160510 PDFDanny NinovaNo ratings yet

- Sap Financial StatementsDocument9 pagesSap Financial StatementsJose Luis GonzalezNo ratings yet

- Automatic Payment Program : AccountingDocument29 pagesAutomatic Payment Program : Accountingswetha devarakondaNo ratings yet

- APP SceneriesDocument29 pagesAPP SceneriesRaju BothraNo ratings yet

- Vendor Payments F-53Document2 pagesVendor Payments F-53Promoth JaidevNo ratings yet

- SAP Account ReceivablesDocument18 pagesSAP Account ReceivablesNavyaChNo ratings yet

- The Automatic Payment Program or APP Process in SAP FICO Enables You To Clear Open Items Between Customers and VendorsDocument6 pagesThe Automatic Payment Program or APP Process in SAP FICO Enables You To Clear Open Items Between Customers and Vendorsswati KulkarniNo ratings yet

- Cash ConcentrationDocument8 pagesCash Concentrationraviteja009No ratings yet

- SAP FI NotesDocument2 pagesSAP FI NotesvinodnagarajuNo ratings yet

- Lock BoxDocument4 pagesLock BoxAniruddha ChakrabortyNo ratings yet

- Fusion Ap NoteDocument16 pagesFusion Ap Notepraveen801No ratings yet

- Accounts PayableDocument27 pagesAccounts PayableSilvia MazuelaNo ratings yet

- What Are The Mandatory Setups For PayablesDocument13 pagesWhat Are The Mandatory Setups For Payablesdevender143No ratings yet

- SAP FICO Interview Questions and Answers: Learning IT Courses Has Never Been This EasyDocument20 pagesSAP FICO Interview Questions and Answers: Learning IT Courses Has Never Been This EasykhaledNo ratings yet

- Sap Implementation GuideDocument7 pagesSap Implementation Guidesiddharth.sbirje3571No ratings yet

- What You Need To Know About SAP Vendor Master Data MaintenanceDocument19 pagesWhat You Need To Know About SAP Vendor Master Data MaintenancejeetNo ratings yet

- Account PayableDocument48 pagesAccount PayableRavi Ravilala100% (1)

- AX2009 Advanced PaymentsDocument54 pagesAX2009 Advanced PaymentsKern Peters0% (1)

- Sap FiDocument12 pagesSap FiPankaj SharmaNo ratings yet

- Payment Process RequestDocument6 pagesPayment Process RequestVijay Tatoba NalawadeNo ratings yet

- Fica Dispute Case Creation ProcessDocument19 pagesFica Dispute Case Creation ProcessrinkushahNo ratings yet

- Account Payable System A Visual Studio Project ReportDocument15 pagesAccount Payable System A Visual Studio Project ReportNishant SainiNo ratings yet

- How Is Bank Reconciliation Handled in SAPDocument10 pagesHow Is Bank Reconciliation Handled in SAPajay_bplNo ratings yet

- 80219a 09Document48 pages80219a 09Indaia RufinoNo ratings yet

- 05 - Transactions in Office AccountsDocument18 pages05 - Transactions in Office AccountsSreepada k100% (1)

- SAP Accounts Payable AccountingDocument22 pagesSAP Accounts Payable AccountingSultan100% (1)

- Acct PayblesDocument60 pagesAcct PayblesRaddyNo ratings yet

- White Paper On Prepare and Record PaymentsDocument22 pagesWhite Paper On Prepare and Record PaymentsObaid Ul AleemNo ratings yet

- AP PrepareDocument51 pagesAP Preparebujjipandu7100% (1)

- Sap - RahulDocument7 pagesSap - RahulRahulSekharNo ratings yet

- FICA - Contract Accounts Receivable and PayableDocument21 pagesFICA - Contract Accounts Receivable and Payablekush2477100% (1)

- App Configuration NewDocument55 pagesApp Configuration NewRaksha RaniNo ratings yet

- Accounts PayableDocument27 pagesAccounts PayableManish ShankarNo ratings yet

- 21 Ef110a46c - Automatic Payment RunDocument9 pages21 Ef110a46c - Automatic Payment RunvittoriojayNo ratings yet

- Creating Payment Advice NotesDocument3 pagesCreating Payment Advice NotesEmilSNo ratings yet

- Banking System: in The Existing System The Transactions Are Done Only Manually But inDocument3 pagesBanking System: in The Existing System The Transactions Are Done Only Manually But inBhargav KondaNo ratings yet

- Basic Concepts AP - Part2Document11 pagesBasic Concepts AP - Part2ketans25No ratings yet

- NAVTTC SAP Fi Week - 6Document44 pagesNAVTTC SAP Fi Week - 6Anne RajputNo ratings yet

- MYOB Data Import ProcedureDocument3 pagesMYOB Data Import ProcedureAnonymous 7mJIoO1bh4No ratings yet

- ErpDocument2 pagesErpyoungpaulus0No ratings yet

- Bank Accounts OUs Ledgers Legal Entities RelationshipDocument7 pagesBank Accounts OUs Ledgers Legal Entities RelationshipSri RishiNo ratings yet

- ERP Application DocumentationDocument12 pagesERP Application DocumentationGopal RaiNo ratings yet

- Automatic Payment ProgramDocument21 pagesAutomatic Payment ProgramBala RanganathNo ratings yet

- What Is An Account Group and Where Is It UsedDocument5 pagesWhat Is An Account Group and Where Is It Usedragz22No ratings yet

- Sap Fi Ar DunningDocument18 pagesSap Fi Ar DunningAti Siti FathiahNo ratings yet

- The Controller's Function: The Work of the Managerial AccountantFrom EverandThe Controller's Function: The Work of the Managerial AccountantRating: 2 out of 5 stars2/5 (1)

- DocumentDocument2 pagesDocumentsyed shabbirNo ratings yet

- DocumentDocument2 pagesDocumentsyed shabbirNo ratings yet

- DocumentDocument2 pagesDocumentsyed shabbirNo ratings yet

- Document ffss5Document2 pagesDocument ffss5syed shabbirNo ratings yet

- DocumentDocument2 pagesDocumentsyed shabbirNo ratings yet

- Rizal Commercial Banking Corporation vs. Commissioner of Internal Revenue, 657 SCRA 70, September 07, 2011Document16 pagesRizal Commercial Banking Corporation vs. Commissioner of Internal Revenue, 657 SCRA 70, September 07, 2011j0d3No ratings yet

- Income Taxation - MODULE 1Document13 pagesIncome Taxation - MODULE 1Joe P PokaranNo ratings yet

- CIR vs. ALGUE INC. G.R. No. L 28896. February 17 1988 PDFDocument10 pagesCIR vs. ALGUE INC. G.R. No. L 28896. February 17 1988 PDFZenith EuropaNo ratings yet

- Ficustomisation FixedDocument134 pagesFicustomisation FixedSundarKrishnaNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Hamza SalihNo ratings yet

- MTN Operativa-Hsbc Holdings PLC CompletDocument23 pagesMTN Operativa-Hsbc Holdings PLC CompletfranviNo ratings yet

- The Current Status and The Prospect of E-Banking in BangladeshDocument42 pagesThe Current Status and The Prospect of E-Banking in BangladeshFayaza Rahman Eva85% (20)

- 2010 Sales Tax Seminar ManualDocument206 pages2010 Sales Tax Seminar ManualBarbara SalmeronNo ratings yet

- Online & Evening BankingDocument17 pagesOnline & Evening BankingAbrar AhmedNo ratings yet

- Hyundai Capital Auto Funding Iv Limited: Note Agency AgreementDocument32 pagesHyundai Capital Auto Funding Iv Limited: Note Agency Agreementpaths39No ratings yet

- Visa Direct General Funds Disbursement Sellsheet PDFDocument2 pagesVisa Direct General Funds Disbursement Sellsheet PDFPablo González de PazNo ratings yet

- Payment Methods For Students: Bank TransferDocument2 pagesPayment Methods For Students: Bank TransferJemal YayaNo ratings yet

- Chapter 3 Financial PlanningDocument25 pagesChapter 3 Financial PlanningChristopher Beltran CauanNo ratings yet

- MavrixDocument16 pagesMavrixRock MarkNo ratings yet

- Swift Standards Category 7 Version 11 September 2006Document245 pagesSwift Standards Category 7 Version 11 September 2006Ewoud Lietaert PeerbolteNo ratings yet

- Final AssigmentDocument27 pagesFinal AssigmentSHIVANG PATELNo ratings yet

- Sale DeedDocument9 pagesSale Deedsparsh9634No ratings yet

- Dnit - 4.5 MLD 25 - 01 - 2022 FinalDocument223 pagesDnit - 4.5 MLD 25 - 01 - 2022 Finalsiraj AhmedNo ratings yet

- Tev April-May 2017Document14 pagesTev April-May 2017Blay Cahatol EscausoNo ratings yet

- LamHoMing LaboratoryExcercise005Document8 pagesLamHoMing LaboratoryExcercise005Ho Ming LamNo ratings yet

- TankTerminals - KnowledgeDocument90 pagesTankTerminals - Knowledgesmartleo_waloNo ratings yet

- AccountStatement 28 JUN 2023 To 28 DEC 2023Document41 pagesAccountStatement 28 JUN 2023 To 28 DEC 2023wronglyrNo ratings yet

- PSP Buyer's Guide 2010 - Insights in The Worldwide Online PSP MarketDocument130 pagesPSP Buyer's Guide 2010 - Insights in The Worldwide Online PSP MarketNikhilesh PulugundlaNo ratings yet

- Bihar Finance Rules 2005Document60 pagesBihar Finance Rules 2005Mithilesh Kumar75% (4)

- GE Amendment FormDocument1 pageGE Amendment FormFelix GanNo ratings yet

- Electronic Payment Systems-FinalDocument105 pagesElectronic Payment Systems-Finaldileepvk1978No ratings yet

- Bartle Beyl, Inc - Kfc. 2306Document2 pagesBartle Beyl, Inc - Kfc. 2306clarikaNo ratings yet

- Simon Morris Deputy Chief Executive Complaint Case 1220093Document4 pagesSimon Morris Deputy Chief Executive Complaint Case 1220093CharonNo ratings yet

- Account Statement From 13 Jul 2022 To 13 Jan 2023Document8 pagesAccount Statement From 13 Jul 2022 To 13 Jan 2023ArulKing GiftsonNo ratings yet