Professional Documents

Culture Documents

Revision Test Classs Xi

Revision Test Classs Xi

Uploaded by

JatinOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Revision Test Classs Xi

Revision Test Classs Xi

Uploaded by

JatinCopyright:

Available Formats

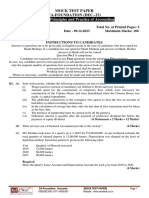

ST.

GEORGE’S SCHOOL, ALAKNANDA

ACCOUNTANCY REVISION TEST

1. Identify the accounting principle and assumption involved in the following: (2)

I. The life of an enterprise is divided into smaller parts so that the performance

can be measured at a regular interval.

II. Business shall continue for an infinite period of time and there is no intention

to close the business and scale down its operation significantly.

III. Anticipate all the future losses but not future profits.

IV. The transactions of the Business are recorded on the basis of the evidences

and source documents.

2. Pass journal entries in the books of Mona & Co. for the following transactions: (3)

i. 1/4/2022: Balances in the books carry forward from the previous year:

Machinery 2,0,000, Building 5,00,000, Furniture 1,00,000, Goods

50,000, Creditors 2,50,000

ii. 15/04/2022: Bought goods from Rajan & Sons, Kanpur of list price 40,000

at 20% Trade Discount and 5% cash discount. Paid 20% payment by cheque

immediately.

3. Open a T shape account of ‘Bank’ and Put the following transactions on the proper

side. Balance the same and state what closing balance indicates: (4)

i. Commence business with cash 1,00,000, Machiery 50,000 and

bank 1,20,000

ii. Purchase goods for 20,000 at terms 10% trade discount. Half of the

payment is made in cash and remaining through cheque

iii. 1/3 of the available goods were sold at a profit of 20% on Sales. 30%

of the payment was accepted by drawing a bill.

iv. Depreciation on Machinery @10% per annum

v. Cash deposited in to the bank 5,000.

4. Journalise the following transactions in the books of Ram enterprises: (6)

i. Out of the amount of 7,500 due from Mohan, an amount of 5,000 is

recovered immediately and balance will not be recovered.

ii. Received a cheque of 14,900 from Bhanu and allowed discount to him for

100. The cheque was deposited into the bank on the same day.

iii. Purchased machinery for 1,70,000 and payment made through cheque.

Installation expenses of 20,000 and freight of 10,000 was paid in cash.

iv. Goods worth 50,000 were destroyed by fire and insurance company paid a

claim of 45,000 after survey.

v. Purchased Goods for 25,000 and paid carriage on the same purchased goods

5,000

You might also like

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Republic Act No. 8424Document172 pagesRepublic Act No. 8424Yuwi100% (1)

- Case Analysis Hony, CIFA and Zoomlion (Creating Value and Strategic Choices in A Dynamic Market)Document5 pagesCase Analysis Hony, CIFA and Zoomlion (Creating Value and Strategic Choices in A Dynamic Market)abhinav100% (1)

- CA Foundation Accounts RTP Nov22Document29 pagesCA Foundation Accounts RTP Nov22adityatiwari122006No ratings yet

- Paper - 1: Principles & Practice of Accounting Questions True and FalseDocument29 pagesPaper - 1: Principles & Practice of Accounting Questions True and FalsePiyush GoyalNo ratings yet

- CBSE Class 11 Accountancy Worksheet - Question BankDocument17 pagesCBSE Class 11 Accountancy Worksheet - Question BankUmesh JaiswalNo ratings yet

- Delhi Pubic School, Nacharam Accountancy - Xi Question BankDocument9 pagesDelhi Pubic School, Nacharam Accountancy - Xi Question BanklasyaNo ratings yet

- Class 11 Accountancy Worksheet - 2023-24Document17 pagesClass 11 Accountancy Worksheet - 2023-24Yashi BhawsarNo ratings yet

- Form Three AssignmentDocument5 pagesForm Three AssignmentKennedy Odhiambo OchiengNo ratings yet

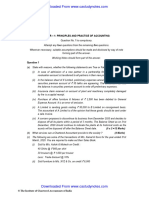

- Ca - Foundation: Principles and Practice AccountingDocument7 pagesCa - Foundation: Principles and Practice Accountingritikkumarsharmash9499No ratings yet

- 54103bos43406 p1Document31 pages54103bos43406 p1Aman GuptaNo ratings yet

- Term 1 QP XI - Subjective Paper 40 MarksDocument3 pagesTerm 1 QP XI - Subjective Paper 40 MarksAditiNo ratings yet

- Accounts RTP Foundation Nov 2020Document25 pagesAccounts RTP Foundation Nov 2020Jayasurya MuruganathanNo ratings yet

- Account Test 2Document5 pagesAccount Test 2klaw6048No ratings yet

- Must DoDocument27 pagesMust DoKuldeep SharmaNo ratings yet

- Cbse Class 11 Accountancy Sample Paper Sa1 2014Document3 pagesCbse Class 11 Accountancy Sample Paper Sa1 2014Ranjeet KumarNo ratings yet

- Mock TestDocument8 pagesMock TestDiksha DudejaNo ratings yet

- +1 Accountancy ONLINE Final Examination 2021Document5 pages+1 Accountancy ONLINE Final Examination 2021Rajwinder BansalNo ratings yet

- Accounting Equation and General JournalDocument3 pagesAccounting Equation and General JournalWaqar AhmadNo ratings yet

- CBSE Class 11 Accountancy Worksheet - Question BankDocument17 pagesCBSE Class 11 Accountancy Worksheet - Question Bankganesh pathakNo ratings yet

- Study Mat1 AccountsDocument23 pagesStudy Mat1 Accountsinnovative studiesNo ratings yet

- CA Foundation Accounts RTP May 2023Document32 pagesCA Foundation Accounts RTP May 2023PushkarNo ratings yet

- Journal Ledger Trial BalanceDocument8 pagesJournal Ledger Trial BalancejessNo ratings yet

- Business Acoounting (2020)Document4 pagesBusiness Acoounting (2020)harshdeepgarg5No ratings yet

- CA Foundation Paper 1 Principles and Practice of Accounting SADocument24 pagesCA Foundation Paper 1 Principles and Practice of Accounting SAavula Venkatrao100% (1)

- 73432bos59248 p1Document32 pages73432bos59248 p1sneha rajputNo ratings yet

- Accounting Round 1Document6 pagesAccounting Round 1Malhar ShahNo ratings yet

- Section "B" (Short-Answer Questions) (30 Marks) : Government Boys Degree College (M) Gulistan-E-Johar, KarachiDocument4 pagesSection "B" (Short-Answer Questions) (30 Marks) : Government Boys Degree College (M) Gulistan-E-Johar, KarachiArshad KhanNo ratings yet

- ACCT 1Document15 pagesACCT 1Joyce OcarizaNo ratings yet

- Qus. MTP Accounts - 09.12.23Document5 pagesQus. MTP Accounts - 09.12.23karann021003No ratings yet

- Paper - 1: Principles and Practice of Accounting: Question No. 1 Is CompulsoryDocument25 pagesPaper - 1: Principles and Practice of Accounting: Question No. 1 Is CompulsorySaurabh JainNo ratings yet

- Accounts Suggested Ans CAF Nov 20Document25 pagesAccounts Suggested Ans CAF Nov 20Anshu DasNo ratings yet

- Quiz BowlDocument2 pagesQuiz Bowlaccounting probNo ratings yet

- 73432bos59248 p1Document32 pages73432bos59248 p1A24 kore AakankshaNo ratings yet

- Paper - 1: Principles & Practice of Accounting Questions True and FalseDocument327 pagesPaper - 1: Principles & Practice of Accounting Questions True and Falseadityatiwari122006No ratings yet

- Paper - 1: Principles & Practice of Accounting Questions True and FalseDocument32 pagesPaper - 1: Principles & Practice of Accounting Questions True and FalseShaindra SinghNo ratings yet

- Class Xi SP 1Document17 pagesClass Xi SP 1Priya NasaNo ratings yet

- 4 MarksDocument4 pages4 MarksEswari GkNo ratings yet

- Model Paper, Accountancy, XIDocument13 pagesModel Paper, Accountancy, XIanyaNo ratings yet

- BUS 503 Advanced Accounting Exercise 1Document1 pageBUS 503 Advanced Accounting Exercise 1Alaa' Deen ManasraNo ratings yet

- Paper - 1: Principles & Practice of Accounting Questions True and FalseDocument25 pagesPaper - 1: Principles & Practice of Accounting Questions True and Falsegargee thakareNo ratings yet

- CA Foundation Accounts CHP 2 Test Series Question PaperDocument3 pagesCA Foundation Accounts CHP 2 Test Series Question PaperHimanshu RayNo ratings yet

- 20uafam01 BM01 20ubmam01 Principles of Financial AccountingDocument3 pages20uafam01 BM01 20ubmam01 Principles of Financial AccountingArshath KumaarNo ratings yet

- Financial Accounting NotesDocument25 pagesFinancial Accounting NotesNamish GuptaNo ratings yet

- 4.accounting Equation Self Assessment QnsDocument2 pages4.accounting Equation Self Assessment QnsYashashvi OmerNo ratings yet

- Foundation Accounts Suggested Nov20Document25 pagesFoundation Accounts Suggested Nov20dhanushd0613No ratings yet

- 22ODBBT103Document5 pages22ODBBT103Pallavi JaggiNo ratings yet

- Session Ending Examination 2019Document7 pagesSession Ending Examination 2019madhudevi06435No ratings yet

- ICAI MOCK TEST CA FOUNDATION DECEMBER 2022 Paper 1 Principles andDocument6 pagesICAI MOCK TEST CA FOUNDATION DECEMBER 2022 Paper 1 Principles andArpit GuptaNo ratings yet

- Model Question Paper Class 11 AccountsDocument97 pagesModel Question Paper Class 11 AccountsAbel Soby Joseph100% (3)

- Ch-2, Unit-6, Rectification of ErrorDocument6 pagesCh-2, Unit-6, Rectification of ErrorAFTAB KHANNo ratings yet

- Class 11 Accounts SP 1Document6 pagesClass 11 Accounts SP 1UdyamGNo ratings yet

- Foundation Accounts Suggested May19Document23 pagesFoundation Accounts Suggested May19Aman SinghNo ratings yet

- Class: XI Department: Commerce Worksheet No: Topic: Ledger & Trial BalanceDocument3 pagesClass: XI Department: Commerce Worksheet No: Topic: Ledger & Trial BalanceVansh SharmaNo ratings yet

- PAC All CAF Subjects Mocks With Solutions Regards Saboor AhmadDocument164 pagesPAC All CAF Subjects Mocks With Solutions Regards Saboor AhmadTajammal CheemaNo ratings yet

- Foundation Accounting TestDocument6 pagesFoundation Accounting Testalokkulkarni14No ratings yet

- 5664accountancy XIDocument9 pages5664accountancy XIAryan VishwakarmaNo ratings yet

- Receivable 1Document2 pagesReceivable 1Laura OliviaNo ratings yet

- Accountancy Set BDocument4 pagesAccountancy Set BPatanjal kumarNo ratings yet

- Test 4Document6 pagesTest 4Jayant MittalNo ratings yet

- Tutorial 05Document3 pagesTutorial 05Janidu KavishkaNo ratings yet

- Presentation Class X May Day 1st Paper MQDocument19 pagesPresentation Class X May Day 1st Paper MQMonzu IslamNo ratings yet

- Mof Company Shin YangDocument4 pagesMof Company Shin YangNicki Vine CapuchinoNo ratings yet

- Approval of Manufacturer Certificate: Ellwood Crankshaft and Machine CoDocument2 pagesApproval of Manufacturer Certificate: Ellwood Crankshaft and Machine CofrancisNo ratings yet

- Invoice Order Id 183986Document1 pageInvoice Order Id 183986Dendi Satria AgungNo ratings yet

- Cost Volume Profit AnalysisDocument8 pagesCost Volume Profit AnalysissachinremaNo ratings yet

- Operation in Service Industry: by Praveen SidolaDocument20 pagesOperation in Service Industry: by Praveen SidolaShashank SahuNo ratings yet

- Ndian Apital Arket: 25-1 Excel Books Business Environment Suresh BediDocument12 pagesNdian Apital Arket: 25-1 Excel Books Business Environment Suresh BediSebin ThomasNo ratings yet

- Pakistan State Oil CompanyDocument43 pagesPakistan State Oil CompanyfarkhundaNo ratings yet

- Microsoft Vs Motorola 11.04.09Document20 pagesMicrosoft Vs Motorola 11.04.09Florian MuellerNo ratings yet

- WBR Week 3Document2 pagesWBR Week 3akeyz08No ratings yet

- Process Matrix TemplateDocument2 pagesProcess Matrix TemplateJayant Kumar JhaNo ratings yet

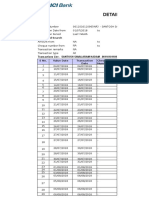

- Credit Appraisal Process at AXIS BankDocument137 pagesCredit Appraisal Process at AXIS BankIsha Srivastava100% (2)

- Invoice - MJ24 00186 - 2024 05 16Document2 pagesInvoice - MJ24 00186 - 2024 05 16pinkywawa88No ratings yet

- OpTransactionHistory19 06 2019Document18 pagesOpTransactionHistory19 06 2019Poonam KapadiaNo ratings yet

- Process Costing SWDocument2 pagesProcess Costing SWChristine AltamarinoNo ratings yet

- Concept of Business EnvironmentDocument4 pagesConcept of Business EnvironmentSandeep KumarNo ratings yet

- The Purpose Is Profit Mclaughlin en 26797Document5 pagesThe Purpose Is Profit Mclaughlin en 26797Tej ShahNo ratings yet

- Shoppers Stop ErpDocument4 pagesShoppers Stop Erpabhay_155841071No ratings yet

- RP3 Reflection Paper - Philosophy of BusinessDocument5 pagesRP3 Reflection Paper - Philosophy of BusinessjoeNo ratings yet

- Bill Date: Amount Due / !"#$%$& "' (: Rs.1848.44CRDocument2 pagesBill Date: Amount Due / !"#$%$& "' (: Rs.1848.44CRHitendra PatelNo ratings yet

- Interim Rules of Procedure On Corporate RehabilitationDocument11 pagesInterim Rules of Procedure On Corporate RehabilitationChrissy SabellaNo ratings yet

- Mohan Behera Resume PDFDocument2 pagesMohan Behera Resume PDFCody StumpoNo ratings yet

- Multiple Choice Questions Variable vs. Absorption CostingDocument106 pagesMultiple Choice Questions Variable vs. Absorption CostingNicole CapundanNo ratings yet

- Jennifer Fabi ResumeDocument2 pagesJennifer Fabi Resumeapi-290053864No ratings yet

- CA Assignment No. 5 Part 1 ABC and Joint CostingDocument15 pagesCA Assignment No. 5 Part 1 ABC and Joint CostingMethlyNo ratings yet

- Accounting ExercisesDocument2 pagesAccounting Exercisesapi-455338030No ratings yet

- A Project Report On Exide BatteryDocument72 pagesA Project Report On Exide BatterySourav Roy75% (4)

- Rating Action:: Moody's Upgrades Indonesia's Sovereign Rating To Baa3 Outlook StableDocument5 pagesRating Action:: Moody's Upgrades Indonesia's Sovereign Rating To Baa3 Outlook StableMelyastarda SiregarNo ratings yet