Professional Documents

Culture Documents

Chap 2 BST Revision

Chap 2 BST Revision

Uploaded by

Abhradeep GhoshOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chap 2 BST Revision

Chap 2 BST Revision

Uploaded by

Abhradeep GhoshCopyright:

Available Formats

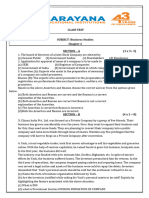

Question. X and Y are best friends. They decided to start a business.

Both of them contributed equal

amount in the business. Being good friends, they did not sign any agreement. After some time

conflicts rose between them. They start arguing with each other because of difference in opinions.

This affected their business adversely.

(a) Name and state the form of business they have started.

(b) What mistake they have done?

Question. Rohit operates a textile business. His family is joint and has a lot of ancestral property.

All the 15 family members are a part of this business. He is the eldest male member in the family so

he heads the business. He is liable to all the creditors of the business as he is the decision-maker.

Rohit’s grandson has just born a few days ago and he is also the member of the business.

(a) Which form of business is being undertaken by Rohit?

(b) Identify the features of this form of business highlighted in the above para.

Question. What is the minimum number of persons needed to form following forms of business

organisation:

(a) Sole proprietorship. (b) Joint Hindu Family Business.

(c) Private company. (d) Cooperative society.

(e) Partnership. (f) Public company.

Question. For which of the following types of business do you think a sole proprietorship form of

organisation would be more suitable, and why?

(a) Grocery store. (b) Medical store.

(c) Legal consultancy. (d) Craft centre.

(e) Internet cafe. (f) Chartered accountancy firm.

Question. Money Ltd. issues 1,00,000 shares of ₹ 10 each for public subscription. Application

(along with money) are received for 80,000 shares. Can the company allot these shares? Explain.

Question. Name the following:

(a) The most important or fundamental document of a company.

(b) The document containing the rules and regulations for the internal management of the affairs of

a company.

(c) The amount of money which must be raised before allotment of shares.

(d) The clause specifies the maximum capital which the company will be authorised to raise

through the issue of shares.

(e) The document called ‘Doctrine of Indoor Management’.

You might also like

- Practice Questions Without Sample Answers Business LawDocument7 pagesPractice Questions Without Sample Answers Business LawMendy HorowitzNo ratings yet

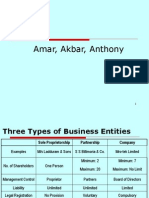

- Forms of Business EntityDocument20 pagesForms of Business EntityMain Daiictian HuNo ratings yet

- g11 SLW CH 2 Forms of Business OrgDocument5 pagesg11 SLW CH 2 Forms of Business OrgShreya KhannaNo ratings yet

- 11 BST CH-2 Forms of B.O.Document3 pages11 BST CH-2 Forms of B.O.Saurabh JainNo ratings yet

- Chapter 2 XI BST Assignment 1Document2 pagesChapter 2 XI BST Assignment 1nishant malikNo ratings yet

- Worksheet - Unit 2 - Forms of Business OrganizationsDocument3 pagesWorksheet - Unit 2 - Forms of Business Organizationsfredrick russelNo ratings yet

- Revision Sheet BST Final Term 2023-24Document3 pagesRevision Sheet BST Final Term 2023-24ARPIT AGRAWALNo ratings yet

- Class XL Business StudiesDocument2 pagesClass XL Business StudiesParv KukrejaNo ratings yet

- Worksheet-2 'Forms of Business Organisation'Document5 pagesWorksheet-2 'Forms of Business Organisation'harshNo ratings yet

- Grade 11 Business Practice PaperDocument16 pagesGrade 11 Business Practice PaperPurva JaniNo ratings yet

- Spanish Town High Entrepreneurship Unit 2Document4 pagesSpanish Town High Entrepreneurship Unit 2pat samNo ratings yet

- Chapter 2 Forms of Business OrganizationsDocument2 pagesChapter 2 Forms of Business OrganizationstmoNo ratings yet

- Revision QP 2Document4 pagesRevision QP 2NikithaNo ratings yet

- Class 11 Business Chapter 2Document14 pagesClass 11 Business Chapter 2Mahender RathorNo ratings yet

- Class 11 NCERT SOLUTIONS Business Chapter 2Document31 pagesClass 11 NCERT SOLUTIONS Business Chapter 2anshigoyal121No ratings yet

- Pocket Book On FinanceDocument131 pagesPocket Book On FinancerajasekharNo ratings yet

- UT-1 Business StudiesDocument6 pagesUT-1 Business Studieskarishma prabagaran100% (1)

- XI BS WS 2 Forms of Business OrganizationDocument3 pagesXI BS WS 2 Forms of Business Organizationsmithastanphen mesNo ratings yet

- BUSINESS STUDY Paper 2Document2 pagesBUSINESS STUDY Paper 2Manan BhattNo ratings yet

- Chapter - 2 Forms of Business Organisation: One Line QuestionsDocument2 pagesChapter - 2 Forms of Business Organisation: One Line QuestionstanishaNo ratings yet

- STAR LEGAL CONSULTANCY Intake FormDocument5 pagesSTAR LEGAL CONSULTANCY Intake Formstarlegalconsultancy4No ratings yet

- GR-11 Summer Break WSDocument4 pagesGR-11 Summer Break WSMay HarukaNo ratings yet

- Business Studies Case StudiesDocument4 pagesBusiness Studies Case StudiesShiv KumarNo ratings yet

- BST SQPDocument4 pagesBST SQPNidhi TanikellaNo ratings yet

- HTTP - Schools - Eklavyafocs.com - PDVLPSMAIN-2024 - WorkSheet - C14 - ELEVENTH - E - M5 - D18 - BUSINESS STUDIES 1Document2 pagesHTTP - Schools - Eklavyafocs.com - PDVLPSMAIN-2024 - WorkSheet - C14 - ELEVENTH - E - M5 - D18 - BUSINESS STUDIES 1Shubham SinghalNo ratings yet

- Legal Fundamentals For Canadian Business Canadian 4th Edition Yates Test BankDocument48 pagesLegal Fundamentals For Canadian Business Canadian 4th Edition Yates Test Bankgalvinegany3a72j100% (32)

- Blaw CA Notes Test QP With SolutionDocument56 pagesBlaw CA Notes Test QP With SolutionMuhammad WaseemNo ratings yet

- 10 Year GcseDocument2 pages10 Year GcseJumana AhmedNo ratings yet

- Partnership Public or Private Limited Company Sole Proprietorship How To Incorporate?Document15 pagesPartnership Public or Private Limited Company Sole Proprietorship How To Incorporate?kalidasdurgeNo ratings yet

- Asm1 2667Document3 pagesAsm1 2667Pushkar MittalNo ratings yet

- Law - T9 PartnershipDocument3 pagesLaw - T9 Partnership包子No ratings yet

- BS CTDocument6 pagesBS CTkartik deshwalNo ratings yet

- 11 Business Studies Notes Ch02 Forms of Business Organisation 2Document10 pages11 Business Studies Notes Ch02 Forms of Business Organisation 2Srishti SoniNo ratings yet

- CH 04Document16 pagesCH 04tahaalkibsi100% (1)

- AF205 ExamDocument5 pagesAF205 ExamShikha NandNo ratings yet

- 80G CertificateTax ExemptionDocument56 pages80G CertificateTax ExemptionskunwerNo ratings yet

- Pankajattri Law TermDocument14 pagesPankajattri Law TermPankaj AttriNo ratings yet

- Freer On Corporations BarbriDocument38 pagesFreer On Corporations BarbriJEL100% (1)

- PK Worksheet BS Class 11Document6 pagesPK Worksheet BS Class 11Krish PatidarNo ratings yet

- L2018027 Homework 1 I. Single Choice QuestionsDocument6 pagesL2018027 Homework 1 I. Single Choice QuestionsmohammedNo ratings yet

- Lec 3Document39 pagesLec 3MumtazAhmadNo ratings yet

- Unit - 1 Basic Concepts - Forms of Business Organization PDFDocument29 pagesUnit - 1 Basic Concepts - Forms of Business Organization PDFShreyash PardeshiNo ratings yet

- Business Law RQsDocument5 pagesBusiness Law RQsmpangaladickson2002No ratings yet

- BSTR Revision SheetDocument3 pagesBSTR Revision Sheetyifabec473No ratings yet

- Bus 1102 Discussion Forum Init 8Document1 pageBus 1102 Discussion Forum Init 8janice100% (1)

- Assignment 1573Document41 pagesAssignment 1573black horseNo ratings yet

- Class 11 Business Studies - Chapter 2Document9 pagesClass 11 Business Studies - Chapter 2Srk LegendNo ratings yet

- Chapter2 XI AssignmentDocument6 pagesChapter2 XI AssignmentSadhika MathurNo ratings yet

- BST WorksheetDocument6 pagesBST WorksheetKhusham AgrawalNo ratings yet

- AF5511 - Lecture 2 (Fundamentals of Company Law)Document47 pagesAF5511 - Lecture 2 (Fundamentals of Company Law)IvanKoNo ratings yet

- SBILLDocument5 pagesSBILLSrishti 2k22No ratings yet

- ORGANIZATION MANAGEMENT Module-15Document4 pagesORGANIZATION MANAGEMENT Module-15Mina CastorNo ratings yet

- Business Foundation ChecklistDocument7 pagesBusiness Foundation ChecklistWong AngelinaNo ratings yet

- CLP Class Activities For Week 3Document3 pagesCLP Class Activities For Week 3chinwe.dozok.blog79620No ratings yet

- Directory of Indian Law FirmsDocument37 pagesDirectory of Indian Law FirmsdeepahireNo ratings yet

- Types of Business Entities in IndiaDocument5 pagesTypes of Business Entities in IndiaAdeem AshrafiNo ratings yet

- Business Studies - Question Bank (2&7)Document4 pagesBusiness Studies - Question Bank (2&7)yeshvanth2007No ratings yet

- Win the Talent Game: A Guide to Lateral Hiring for Law Firms and LawyersFrom EverandWin the Talent Game: A Guide to Lateral Hiring for Law Firms and LawyersNo ratings yet

- From Sole Proprietor To LLC: A Beginners Guide To Forming A Limited Liability CompanyFrom EverandFrom Sole Proprietor To LLC: A Beginners Guide To Forming A Limited Liability CompanyNo ratings yet

- Practise PaperDocument2 pagesPractise PaperAbhradeep GhoshNo ratings yet

- 6098255-Theory Base of AccountingDocument3 pages6098255-Theory Base of AccountingAbhradeep GhoshNo ratings yet

- Limits and Derivatives Class 11 CbseDocument6 pagesLimits and Derivatives Class 11 CbseAbhradeep GhoshNo ratings yet

- Adult Observer ADHD QuestionnairesDocument8 pagesAdult Observer ADHD QuestionnairesAbhradeep GhoshNo ratings yet

- Ch5-Straight Lines-Class 11-Revision Notes With QuestionsDocument19 pagesCh5-Straight Lines-Class 11-Revision Notes With QuestionsAbhradeep GhoshNo ratings yet

- Mock Test 1 Class 11 AccountancyDocument2 pagesMock Test 1 Class 11 AccountancyAbhradeep GhoshNo ratings yet

- Correlation Class 11 Notes Statistics EconomicsDocument10 pagesCorrelation Class 11 Notes Statistics EconomicsAbhradeep GhoshNo ratings yet

- Accountancy Worksheet Grade XI Chapter 1 and Chapter 2Document2 pagesAccountancy Worksheet Grade XI Chapter 1 and Chapter 2Abhradeep Ghosh100% (3)

- Economics CH 3 Economics Census Methods NotesDocument40 pagesEconomics CH 3 Economics Census Methods NotesAbhradeep GhoshNo ratings yet