Professional Documents

Culture Documents

Predictive Analysis of Major Copper and Gold Mining Projects in Papua New Guinea

Predictive Analysis of Major Copper and Gold Mining Projects in Papua New Guinea

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Predictive Analysis of Major Copper and Gold Mining Projects in Papua New Guinea

Predictive Analysis of Major Copper and Gold Mining Projects in Papua New Guinea

Copyright:

Available Formats

Volume 8, Issue 9, September 2023 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

Predictive Analysis of Major Copper and Gold

Mining Projects in Papua New Guinea

Kaepae Ken Ail

Lecturer at the Mining Engineering Department

Papua New Guinea University of Technology

Private Mail Bag, Lae, Morobe Province

Abstract:- The article provides some perspectives on the major minerals produced in PNG have been consistently at

undeveloped Wafi copper-gold project, the option to re- high percentile levels. The future market outlooks were likely

open the troublesome Porgera gold mine and extension of to be attractive with demands triggered by post-conflict

Ok Tedi copper-gold mine. The existing Ok Tedi and the reconstruction, and the shift to industrial minerals (e.g.,

proposed Wafi have been megaprojects that could make lithium and nickel/cobalt) as nations collaborate on

substantial economic impacts on the economy of Papua mitigating climate change (Edition 2021). It could be a high

New Guinea (PNG). The importance of prioritising these time for PNG to grasp the opportunity by increasing

projects was that their total net ground values could be extraction during the high mineral prices and slow down

about 80 billion US dollars; and generate some 30 billion during low prices. However, it has slowed down at a wrong

dollars in taxes, royalty and dividends in the next 20 time with very few grass-roots exploration expenditure and

years. The benefit distributions estimated comprised of delayed or abandoned some advanced exploration projects. It

direct revenue only and the method used did not capture would be essential for PNG to timely develop these projects

the indirect benefits (employment and contracts). As to stimulate the economic and social growth. Thus, the

such, predicting the value chain distribution could assist purpose of the study was to entice the GoPNG to fast-track

the government to timely make informed policy choices the targeted mining projects in the near future.

based on merits of individual mining projects under

consideration as PNG continues to face unprecedented II. METHODOLOGY

economic and social challenges.

The economic and financial benefits were estimated

Keywords:- Megaprojects, timely, resource revenue, direct using the Marketable Asset Pricing and Input Output

and indirect benefits, value chain distribution, economic and (MAPIO) model. The MAPIO model template was

social benefits. collaboratively constructed by a team of World Bank (WB)

consultants in 2021 for restructuring the value chain

I. INTRODUCTION distribution of the extractive sector in PNG. It was

constructed in excel with fixed resource inputs, cost and

PNG has been a mineral producer since 1972 where its market variables and taxation, including equity interests of

production frontier increased significantly ever since copper the state, Provincial Governments (PG) and landowners.

and gold were first produced from the former Panguna copper Various MAPIO models were constructed for each of the

mine on the Bougainville Island (Kellow and Simms 2021). mining projects assessed in this article. The summaries of the

Presently, PNG produces copper, gold, silver, nickel and results are given in Appendices A and B.

hydrocarbon products (oil and gas) that constitute 80% of

total exports, 28% of gross national product (GNP) and 8% A. Wafi/Golfu copper-gold project

of direct revenue, excluding the indirect benefits. The The Wafi project has been an undeveloped copper-gold

extractive sector has induced multiplier effects and created deposit, which has advanced towards licensing and

vertical linkages with the non-mineral sectors that encourage permitting and social contract stages. The proposed US$7.4

diversify into manufacturing, hospitality and billion (K25 billion) (capital cost) was tipped to be a

telecommunication sectors. However, the industry has fallen megaproject that could change the face of Morobe Province

far behind the global scene due to political and social and the economy of PNG. It could produce 4.54 million

disturbances that disorientated the decision-making processes metric tonnes copper and 7.5 million ounces of gold over the

(Harden and Sugden 2019). The quest for rent-seeking has 28-year mine life. The whole of life ground value was

become a futile ground for political meddling, while the estimated to be US$34.6 billion at prices fixed at US$6000

industry productivity has declined and social unrests continue per tonne metric copper and US$1200 per an ounce of gold

to disrupt smooth operation of resource projects. These issues (Roche, Brueckner et al. 2021). The Harmony-Newcrest Joint

have led to wasteful extraction and efficiency losses that, in, Venture having 50% stake would operate the mine with stake

turn diminished the resource revenue. ownership structure that may include the state owning 30%,

the Morobe Provincial Government (MPG) and landholder

The situation suggests PNG could miss out on entities have 20%. The local entities may realise a net value

benefiting from the high copper, gold and nickel prices if it of US$19 billion derived from direct and indirect tax revenue.

fails to timely develop the advanced mining projects and The economic results were derived from the MAPIO model

extend the lives of existing mines. Currently, the prices of of the Wafi project (Table 1).

IJISRT23SEP128 www.ijisrt.com 373

Volume 8, Issue 9, September 2023 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

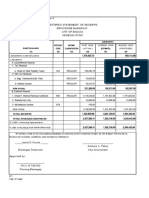

Table 1: Cash flow statement of the proposed Wafi copper project

NPV IRR (%) DPBP Capital

Economic Variables Capex (US$M)

(US$M) (Year) Efficiency

Wafi Project 7,377** 5,173 18 5+8* 0.72

External partner (50%) 3,582 4,660 20 5+8* 1.3

State (30%) 2,149 1,552 15 5+8* 0.72

MPG & Landowners (20% 1,433 1,035 13 5+8* 0.72

Benefits (direct & indirect) Amount

(Nominal $)

Net Project Cash Flow After Financing 25,653

Royalties, Levies & import duty 1,320

Corporate income tax 6,175

Additional profit tax (APT) 1,341

Dividend withholding tax 1,109

Foreign contractor withholding tax 1,141

Total benefits (direct & indirect taxes only) 11,086

KMHL Share of Net Cash Flow 7,462

Carry Interest Paid (8 years) -843

Principal Paid -2,149

KMHL Net CF After Carry Debt Service 4,470

MPG & LOs share of Net Cash Flow 5,092

Carry interest paid (8 years debt period) -562

Principal paid -1433

MPG & LOs Net CF After Debt Service 3,097

Total Benefits Retained (excl. Payee tax) 18,653

*Proposed construction period of 5 years plus the computed payback period

** Working capital, exploration and inflation added to the initial capital cost

The first part of Table 1 shows the Wafi project was intention to negotiate to own about 20% interest in the

financially viable with an NPV of US$5.173 billion, 18% project. Within this arrangement, their upfront capital cost

IRR, and 8-year payback period with a construction period of contribution could be in excess of US$1.4 billion. The NPV

5 years. The capital employed could add 72 cents to every for the MPG and landowner equity interests was estimated to

dollar invested. The investor could contribute 50% of the be $1 billion, 13% IRR and identical payback period and 70

capital cost to realise an NPV of US$4.7 billion, 20% IRR, cents added to the equity capital invested. The significance of

and similar payback period with 1.3 dollar being added to the these results was that despite the risks involved in securing

investment. The state, through its nominee, Kumul Minerals the equity capital, the benefits could be realised if the present

Holding Limited (KMHL) may contribute 30% of the capital market conditions persist. This could place the state and

cost, which was estimated to be US$2.2 billion. It could landowners in strategic positions to benefit from the

realise an NPV of $1.6 billion, 15% IRR and an 8-year megaproject as graphically represented in Figure 1.

payback period. The MPG and the landowners indicated the

Capital cost

Economic profit 13%

34% Operating cost

20%

1% 25%

MPG & LO

5% Profit taxes, royalty &

State dividends APT

2%

Indirect benefits (10% of Opex)

Fig. 1: Value chain distribution from the Wafi-Golfu project

IJISRT23SEP128 www.ijisrt.com 374

Volume 8, Issue 9, September 2023 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

Figure 1 show the value chain distribution where a net 2019 (at the time of writing this article). The Porgera

value of US$19 billion (i.e., US$680 million per year) could landowners, Enga Provincial Government (EPG) and the

flow to PNG over the 28-year mine life. The cash flow society at large staged overwhelming opposition in form of

configuration comprised of economic profit (34%), which public protests against BNL’s application to renew the initial

exceeded the capital and the operating costs (33%) and 33% SML. It was blamed for human right abuses, negligence of

of the net revenue could flow to local stakeholders. These environmental impacts and inequitable benefit sharing

comprised of taxes and royalties and equity dividend (Connell 2001, Albin-Lackey 2011). Resoundingly, a

turnovers from the KMHL and the MPG and landowner sympathetic government decided to cancel the initial Porgera

equity interests. The profit taxes, APT and royalty proceeds SML. This was followed by passing of the Mining Act

tend to exceed the dividends from direct equity participation (Amendment 2020) that was devised to legitimise the legality

(25% >7%). This reflected that equity ownership could be of State’s decision to cancel the SML. The BNL threatened

highly risky compared to raising revenue using taxes and to take the case to an international arbitration. However, it

royalties. Besides these, the indirect benefits comprised of restrained itself from any harsh actions that may expose PNG

inputs to production and fixed costs, including local contracts to sovereign risks. The BNL has been considerate and flexible

and employment during the construction stage. Conceptually, to negotiate with the GoPNG that resulted in the Porgera

the costs, profits and fiscal revenue could be distributed Framework Agreement (PFA). The PFA attempted to win-

equitably amongst the participating stakeholders. However, back the social and political loyalty by increasing the local

this may not be the case since the conceptual analysis omitted stake ownership to 51% while the BNL (including Zijin

the revenue leakages that may arise from unethical behaviour Mining Group Co Ltd) retained a balance of 49% interest in

of mine operator and efficiency losses. the mine.

The Wafi mining project could be the largest economic The former owners deceptively operated the mine under

activity in the region as it being within PNG’s industrial city an unincorporated entity, which was formerly the

of Lae, and vast agricultural region of the host Morobe unincorporated Porgera joint venture (PJV). Indeed, there

Province. It may support the lagging non - minerals sector were no legitimate joint venture (JV) partners involved. The

that could boost labour productivity in all sectors of the former owner Placer Dome and the BNL had 100%

economy. This could occur if all layers of governments ownership with a 5% interest owned by Mineral Resource

diversify the benefits to develop Morobe region’s arable land Enga (MRE) in the first 20 years of the mine life. As a result

to increase agriculture and livestock production to supply the of this, the Porgera mine did not generate revenue relative to

local market and for export. This would trigger an increase in the tax base. The PJV was not transparent in financial

value added growth of manufacturing and services sectors. disclosure and it secluded into consolidated financial

Thus, the Wafi copper deposit may transform PNG’s statements. The lessons learnt suggest an incorporated JV

economy and increase the productivity of the non-minerals could assist in measuring the tax liabilities; disclosure of

sector. project-specific financial statements; and share information

and managerial obligations. The New Porgera Limited (NPL)

B. The Old Porgera Gold mine was incorporated as a JV entity to manage the defunct mine,

The Porgera gold mine was commissioned in 1990. which was under preparation for the much-awaited re-

Within three years, the mine attained normal rate of return opening at the time of writing this article. The NPL being an

(ROR) on the initial capital invested. It was developed with a incorporated entity exists as a genuine JV entity with

low capital cost of US$647 million. The low-cost mine had substantial local stake ownership that could retain some 53%

easy access to high-grade deposits in both surface and of the value chain of the Porgera gold mine.

underground mines at early stages of the mine life. As a

result, the mine was one of the richest gold mines outside C. The New Porgera Gold mine

South Africa (Burton and Banks 2020). The twin operation The existing mineral resource was about 4.79 million

(surface and underground mines) raised the pre-tax and post- tonnes, which contained about 2 to 4 million ounces of gold

tax IRRs to 28% and 38 % over the 30 years of operation (silver inclusive) according to the 2019 Financial Report.

since commissioning in 1990. However, the corporate income This in-situ reserve could lead to a mine life of less than 10

tax (CIT) performance was unusually lower than expected years. This could constitute the project to be a medium scale

despite it had high-quality deposits and a low-cost operation mine. The maintenance and preparation were expected to take

with an average production rate of 500,000 ounces of gold per place in 2023 and commence production in 2024 at an

year (Ail 2018). For instance, the Internal Revenue operating cost of US$800/ounce of gold. These data were

Commission (IRC) had a tax compliance dispute with the used to model the remaining resource by incorporating

mine operator, Barrick Niugini Limited (BNL). The issue was PNG’s taxation regime and the 51%/49% share split between

resolved to make way for fast-tracking the mine re-opening. the participating stakeholders as shown in Table 2. A 20-year

However, these irregularities could be common in the gold mine life model was constructed using the MAPIO model

mining sector in PNG (Gillies 2019). with an assumption of US$3 billion capital cost of re-opening

the mine. As such, there were many uncertainties associated

The initial special mining lease (SML) expired in 2018 with the troublesome Porgera gold mine in terms of

and the BNL applied to renew the lease. Not surprisingly, it generating the economic and financial and indirect benefits

attracted political and social opposition that led to temporary as estimated in Table 2.

closure where the mine remained under maintenance since

IJISRT23SEP128 www.ijisrt.com 375

Volume 8, Issue 9, September 2023 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

Table 2: Financial cash flows and fiscal revenue of Porgera gold mine (20 years)

ROJECT CASH FLOW Amount (Nominal US$

Total Net Revenue 16,938

Exploration -

Total Capex 6,050

Total Opex 8,400

Capitalised Net Revenue (Pre-Start) -

Pre-Tax Cash Flow 2,488

Royalties, Levies & Tax 1,727

Additional Profits Tax (APT) -

After-Tax Cash Flow 2,162

Project Finance Debt Drawdown -

Project Finance Debt Principal Repaid -

Net Project Cash Flow After Financing 2,162

Net present value (NPV) 149

Internal Rate of Return (%) 7

Discounted payback period (DPBP) (years) 17

Kumul Share of Net Cash Flow 1,068

Carry Interest Paid 497

Principal Paid 459

KMHL Net CF After Carry Debt Service 112

Payback period (10 years) 17

EPG & LO Participation - Cost Before Operation

EPG & LOs Cost of Operations Funding Source

State Transfer -

Partner or Other Finance [if applicable] 311

EPG & LOs Share of Net Cash Flow 748

Carry interest paid 348

Principal paid 321

EPG & LO Net CF After Carry Debt Service 78

Table 2 shows the results of the Porgera model using a grade would be predictably low. It may require strategic

production rate of 462,672 ounces of gold), which assumed planning to increase the value-chain distribution from

the mine life would be extended to 20 years. The model extracting the remaining resource (Ail, Campus et al.). Since

marginally improved the project economics to an NPV of the existing production plants and equipment were in

$149 million and an IRR of 9%. The Porgera gold mine may serviceable condition, the mine could re-open at a reduced

generate a net value of $16.9 billion and a post-tax profit of capital cost and start with a medium scale operation and

$2.2 billion over the 20-year mine life. The total revenue from progressively expand by adding reserves and allow the mine

taxes, royalty and levy could be $1.7 billion. Additionally, the itself to raise the capital required for expansion. This could

KMHL may receive $112 million in dividends. Likewise, ease the financial burden of raising the equity capital on the

some $78 million (dividend) could flow to the EPG and the part of the State, the EPG and the Porgera landowners’ equity

Porgera landowners from owning the 5% and 15% interests participation.

respectively. Over the past 30 years, the Porgera mine did not

consistently generate dividends for the EPG and the The BNL may take a social approach to resolve the

landowners having the 5% interest (Ail 2018). Moreover, the outstanding liabilities (e.g., compensation and resettlement of

results strongly suggest a mine life less than 10 years could SML communities) before commencing the mine. These

be uneconomical. The financial analysts may question the costs should be recognised on carried-on sunk costs accrued

economic viability of the mine since reserve base was from the past operation. Another option could be a contractor

unknown at the time of re-opening the mine. operating the mine on behalf of the State and Barrick. It may

ease the long-term tensions amongst the local stakeholders

The model results showed that Porgera could be a and transparently disclose production, revenue, costs,

medium scale mine that may gradually expand production project-based financial statements and tax liability. This may

over time with the geological information and data gathered resolve the outstanding issues such as resettlement of

through greenfield exploration. Over the past 30 years of communities within the SML, compensation for environment

mining, the high-grade epithermal resource has been impacts and human right abuses (Albin-Lackey 2011).

depleted. The underground resource has declined to a low- Further, the troublesome Porgera gold mine may not affect

grade mesothermal deposit, which overlies the porphyritic Barrick’s net assets since it represented only 2% of its global

intrusion at a considerable depth (current depth was 1.9 km position as a leading gold producer. While knowing the

RL). At this depth, the operating cost could be high and the reserves had depleted, if the main partner illegitimately sells

IJISRT23SEP128 www.ijisrt.com 376

Volume 8, Issue 9, September 2023 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

its interests in the near future, the social cost and closure challenges associated with environmental impacts and high

liabilities could be shifted to another entity. This action could production costs prolonged the payback period for 10 years.

ignite a cycle of social and political unrest if the present In 2001, the World Bank recommended the operator to close

arrangements were prematurely disrupted within the 10 years the mine due to pollution of the Fly River. Eventually, the

without resolving the outstanding social and environmental former mine operator, Broken Hill Propriety (BHP), now

issues. BHP Billiton exited the mine in 2002. However, the GoPNG

sought to continue to operate the mine through an alternative

D. The Existing Ok Tedi Mine (1982–2020) arrangement known as Community Mine Continuation

The Ok Tedi copper-gold mine was constructed at a real Agreement (CMCA). Under the CMCA, the mine was

capital cost of US$878.8 million in 1984. It was timely operated by PNG Sustainable Development (PNGSD) on

commissioned to replenish the premature cessation of copper behalf of the affected region and the GoPNG (Carr and Filer

production at the former Panguna copper mine (Armstrong, 2012). Later, the GoPNG took over the mine in 2014 to have

Baillie et al. 2014). The Ok Tedi mine has been the major direct control with a 67/33% ownership split between the

driver of PNG’s economy and forward linkages in the host KMHL (state) and the WP Government and the landowners.

region and the Western Province (WP). However, cost The past value chain distributions are given in Figure 2.

TCS & SSG

0.5%

Foreign

spending

7%

Operating cost

Local 30%

spending

19%

Compensation

6%

Mineral rent (profit)

Royalty… Taxes & 24%

dividends

13%

Fig. 2: Historical value chain distribution of the Ok Tedi mine (1984-2022)

Figure 2 shows the Ok Tedi copper mine generated a The manufacturing, construction and trade sectors had

gross value of K37 billion between 1984 and 2022. The strong direct links with the Ok Tedi mine compared to the

economic profit after tax was about K10 billion (24%) and agriculture and service sectors and utilities. The mine created

20% of the net revenue (K9 billion) flowed to PNG in taxes, substantial multiplier effects in the region. The 17% local

royalty, levy, dividends and compensation payments. The Ok spending consisted of large national contractors. It

Tedi mine’s benefit distributions (including profit or represented the intensity of direct procurements from region’s

economic rent) between 1982 and 2021 exceeded that of other agriculture sector and other household productive sectors,

mines that existed within that period. The direct and indirect including local employment (Bainton and Jackson 2020). The

taxes captured 86% of the revenue from the Ok Tedi mine. local procurements mostly comprised of small contractors,

The local spending and contracts exceeded the foreign catering, wholesale, and retail activities within the Tabubil

spending (19%>7%). These results indicate that there were Mining Town (TMT) and other centres, especially Kiunga

substantial inflows of indirect benefits into the regional and and Daru. The low productive capacity of the region entices

the national economy (Togolo 2021). The Ok Tedi’s the Ok Tedi Mining Limited (OTML) to import agricultural

outstanding performance showed such results that could be products from other regions in PNG and abroad. There was

possible if there were high level of transparency at the high intensity of direct linkages associated with the local

corporate management level. However, the performance did economy in the 1982-2020 periods despite there has been

not reflect the fiscal landscape of PNG’s mining taxation mixed blessings from the extractive sector (Analytica 2019).

regime, nor the results encourage nationalisation through

expropriation of the existing mines (Pumuye, Farrar et al. The Ok Tedi mine represented a major advantage in

2022). which a large component of the accessible revenue, including

indirect benefits, could be retained within PNG. As often the

case, the extension of any operating mine would be

financially cheaper and technically efficient than re-opening

IJISRT23SEP128 www.ijisrt.com 377

Volume 8, Issue 9, September 2023 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

a closed mine (e.g., Porgera) and/or developing a new mine were 0.51% copper and 0.61g/Oz gold and 230% of ounces

(e.g., Wafi copper-gold deposit). The Ok Tedi could be a of silver produced. The remaining resource contains 5.09

bonanza mine for PNG in the next 20 to 30 years if the copper million metric tonnes of copper, 15.6 million ounces of gold

and gold prices were sustained at the present levels. Also, the and 35.8 million ounces of silver. Based on this data, and

likelihood of increasing the copper reserve in the region using Taylor’s formula, the remaining mine life was

would be an advantage for the region and PNG. The historical estimated to be 21 years and could produce 23 million tonnes

analysis suggests the GoPNG should endorse the extension of per year till 2043. The metal contents were computed based

the Ok Tedi mine life. on 88% and 95% mill and refinery recovery rates

respectively. The model applied the basic income tax,

E. The Ok Tedi Mine life extension (2023-2043) withholding, royalty and levy rates, including the 67%/33%

The OTML’s 2021 Financial Report showed the deposit interest split amongst the state and the WPG and the

resource increased to 489 Mt, whose copper and gold grades landowners (Table 3).

Table 3: Model results of the Ok Tedi mine extension (2023-2043)

PROJECT CASH FLOW Amount (Nominal US$)

Total Net Revenue 14,055

Exploration -

Total Capex 3,285

Total Opex 2,426

Capitalised Net Revenue (635)

Project Finance interest paid -

Pre-Tax Cash Flow 8,979

Royalties, Levies & Tax 2,873

Additional Profits Tax (APT) -

After-Tax Cash Flow 6,106

Project Finance Debt Drawdown -

Project Finance Debt Principal Repaid -

Net Project Cash Flow After Financing 6,106

Net Present Value (NPV) 1,876

Internal Rate of Return (IRR) 31

Discounted payback period 5

STATE PARTICIPATION

KMHL share of Net Cash Flow 3,666

Carry Interest Paid -

Principal Paid -

KMHL Net CF After Carry Debt Service 3,666

PROVINCIAL GOVERNMENT & LO PARTICIPATION

WPG & LOs share of Net Cash Flow 1,806

Carry Interest Paid -

Principal Paid -

WPG & LOs Net CF After Debt Service 1,806

Table 3 shows the Ok Tedi mine could generate net 31% IRR since Ok Tedi was an operating mine whose

revenue of $14.1 billion over the next 20-year mine life. The sustaining capital cost comprised of 30% to 40% of the fixed

free cash flow (post-tax profit) was estimated to be US$6.1 costs. Because it has been an ageing mine, any increase in

billion. The revenue collected using taxes, royalty and levy price could be offset by cost increases and declining resource

could be $2.9 billion, while the KMHL may benefit from a grade as expected. This, in, turn could cause the post-tax

dividend of $3.66 billion. The WPG and Ok Tedi landowners profits, the tax revenue and dividends to decrease. Further,

may realise a free carried dividend of $1.81 billion. the value chain distributions were estimated at conservative

Moreover, the NPV and IRR were high and that could suggest prices and the resource was assumed to decline starting 2033.

the mine life extension seemed a viable option given the The mine was likely to generate substantial direct and indirect

present high copper and gold prices. This coincided with a benefits (Fig. 3).

IJISRT23SEP128 www.ijisrt.com 378

Volume 8, Issue 9, September 2023 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

WPG & LO

dividend

Economic profit

10%

26%

State dividend

19%

17%

15%

Capital cost

Tax, royalty &

levy 13%

Operating

Fig. 3: Value chain distribution of the Ok Tedi mine (2023-2043)

The value chain distribution shown in Figure 3 reflect article were predicted to generate direct revenue and indirect

the capital and production costs take up 30% of the gross benefits to support the economy to fulfil the goals of the

value of US$14 billion over the 20 years of production. Since Strategic Plan 2027. However, some overarching

taxes, royalty and levies were part of the costs, the operating impediments if not addressed could adversely affect these

costs could account for 57% of the NSR value, which may projects. PNG has been very low in industry competitiveness

narrow the profit margin to 26%. Further, the 15% revenue and ranked a high-risk jurisdiction, which could have

captured using taxes, royalty and levy could be in excess of impeded attracting the capital required to timely develop the

$2.9 billion. The state (KMHL) and the WPG and Wafi-Golfu project. Finally, the time could be running out for

landowner’s equity dividends could be in access of $3.66 fast-tracking these megaprojects during the high mineral

billion (19%) and $1.81 billion (10%) respectively. However, prices. Otherwise, PNG may miss out its luck in benefiting

it has been an ageing mine and any increase in price could be from the opportunities brought about by the mining boom

offset by cost increases and experience a progressive decline globally.

in the resource grade (Pollard 2014). This, in, turn would

induce post-tax profits, revenue and dividends to eventually ACKNOWLEDGEMENTS

decrease. The importance of the results was the mine life

extension tends to reassure that there could be positive Appreciation is extended to the WB team for assisting

economic impacts on the livelihoods of host communities, with the MAPIO model designed to support the GoPNG to

Western Province and PNG as a whole. develop a national development strategy for the extractive

sector. Also, gratitude is extended to Mining Engineering

III. CONCLUSION Department staff and colleagues for supporting research at

the University.

This article has sought to investigate the importance of

developing these megaprojects that could rescue PNG from REFERENCES

the present economic and the social challenges. The Ok Tedi

being an existing mine offers far greater socio-economic [1.] Ail, K. K. (2018). Techniques for analysing and

benefits than the option to re-open the estranged Porgera gold reconciling the progressive mineral taxation regime of

mine. The Porgera gold mine has been facing a problem of Papua New Guinea, Curtin University.

fading loyalty of older generation who signed the initial [2.] Ail, K. K., et al. "Employing Strategic Planning to

MoAs. The younger generation intensified a strong challenge Achieve Sustainable Livelihoods in a Post-Mine

against all the odds to balance the socio-economic benefits Period: A Case Study of The Porgera Gold Mine in

and address the adverse environment impacts. The lesson Papua New Guinea."

learnt suggest that long-life mines need to build the skill [3.] Albin-Lackey, C. (2011). Gold's costly dividend:

capacity of the young generation to sustain them in the long- Human rights impacts of Papua New Guinea's Porgera

run, which could be a recipe for establishing sound gold mine, desLibris.

relationship between the community and the investor. [4.] Analytica, O. (2019). "Papua New Guinea's economy

Further, the proposed Wafi copper-gold project would add is set to weaken." Emerald Expert Briefings(oxan-db).

value to PNG’s economy and increase the multiplier effects [5.] Armstrong, R., et al. (2014). The Ok Tedi Mine in

of the regional economy. The megaprojects identified in this Papua New Guinea. Mining and Communities:

IJISRT23SEP128 www.ijisrt.com 379

Volume 8, Issue 9, September 2023 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

Understanding the Context of Engineering Practice,

Springer: 15-44.

[6.] Bainton, N. and R. T. Jackson (2020). "Adding and

sustaining benefits: Large-scale mining and landowner

business development in Papua New Guinea." The

Extractive Industries and Society 7(2): 366-375.

[7.] Burton, J. and G. Banks (2020). "The Porgera mine in

PNG: Some background."

[8.] Carr, P. and C. Filer (2012). "Plans to Close the Ok

Tedi Mine in Papua New Guinea."

[9.] Connell, J. (2001). "Dilemmas of development: The

social and economic impact of the porgera gold mine

1989-1994.(Book reviews)." The Australian Journal of

Anthropology 12(3): 388-389.

[10.] Edition, P. S. (2021). "World Exploration Trends

2021."

[11.] Gillies, A. (2019). The EITI’s Role in Addressing

Corruption. Extractive Industries Transparency

Initiative Discussion Paper.

[12.] Harden, R. and C. Sugden (2019). "An update of recent

events: the Papua New Guinea economy."

[13.] Kellow, A. and M. Simms (2021). Mining Industry

Association at Multiple Levels of Governance:

Drilling Down, Cambridge Scholars Publishing.

[14.] Pollard, P. J. (2014). "Grade distribution of the giant

Ok Tedi Cu-Au deposit, Papua New Guinea—a

discussion." Economic Geology 109(5): 1489-1492.

[15.] Pumuye, G. M., et al. (2022). Governance of State-

Owned Enterprises in the Mining and Petroleum

Sectors of Papua New Guinea, Bond University.

[16.] Roche, C., et al. (2021). "Understanding why impact

assessment fails; a case study of theory and practice

from Wafi-Golpu, Papua New Guinea."

Environmental Impact Assessment Review 89:

106582.

[17.] Togolo, A. I. (2021). The Sustainability of Local

Business Development Around the Ok Tedi Mine,

Papua New Guinea, The Australian National

University (Australia).

[18.] https://oktedi.com/ok-tedi-declares-2021-interim-

dividend-and-extends-mine-life/

[19.] https://www.annualreports.com/HostedData/AnnualR

eportArchive/b/TSX_ABX_2019.pdf

IJISRT23SEP128 www.ijisrt.com 380

Volume 8, Issue 9, September 2023 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

TABLES OF APPENDICES

APPENDIX A-I: WAFI COPPER-GOLD PROJECT MODEL RESULTS

PROJECT FINANCE

Project Finance? TRUE/FALSE TRUE

CapEx US$m 7,085

Debt Share % 70.00%

Financial Close year 2023

Debt Share of CapEx US$m 2,129

Upfront Fees % 1.50%

Upfront Fees US$m 32

Interest During Construction % 5.60%

Interest During Construction US$m 119

Capitalized Financing Costs US$m 151

Debt Drawdown US$m 2,280

71%

Post-Completion Interest % 6.00%

Post-Completion Interest % 6.00%

Post-Completion Interest Paid US$m 1,241

Project Finance Payback Period years 15

Opening Balance US$m 26,242

Debt Drawdown US$m 2,280

Debt Repayment on Principal US$m 2,280

Closing Balance US$m 26,242

PROJECT CASH FLOW nom

Total Net Revenue US$m 55,200

Exploration US$m 770

Total CapEx US$m 7,377

Total OpEx US$m 11,606

Capitalised Net Revenue (Pre Commercial Start) US$m (292)

Project Finance Post- Completion Interest Paid US$m 1,241

Pre-Tax Cash Flow US$m 34,497

Royalties, Levies & Tax US$m 11,581

Additional Profits Tax (APT) US$m 3,321

After-Tax Cash Flow US$m 19,595

Project Finance Debt Drawdown US$m 2,280

Project Finance Debt Principal Repaid US$m 2,280

Net Project Cash Flow After Financing US$m 19,595

Present Value

Cummulative Present Value (6,906)

Net Present Value (NPV) 1,959

Internal Rate of Return (IRR) 18%

Undiscounted Payback Period (DPBP) (years) 7

IJISRT23SEP128 www.ijisrt.com 381

Volume 8, Issue 9, September 2023 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

APPENDIX A-II: WAFI COPPER-GOLD PROJECT MODEL RESULTS

STATE EQUITY PARTICIPATION

A. STATE PARTICIPATION nom

Project Past Cost US$m 770

Project Cost Before Operati ons US$m 754

State Back-i n Year (=Project Fi nanci al Cl ose) year 2023

Total State Parti ci pati on % 19.28%

Kumul Parti ci pati on % 16.50%

PG & MRDC Parti ci pati on % 2.78%

Fi nance Terms [Must i nput i n "Mi ni ng_Scenari oManager" tab i f PartnerFi nance or OtherFi nance i s sel ected

Past Cost Fi nance Terms

Past Cost Interest Rate % 7.00%

Past Cost Maturi ty years 4

Costs Before Operati on Fi nance Terms

Costs Before Operati on Interest Rate % 7.00%

Costs Before Operati on Maturi ty years 16

B. KUMUL PARTICIPATION

A-I. Kumul Participation - Past Cost Funding

Kumul Past Cost Fundi ng Source PartnerFi nance

State Transfer [i f appl i cabl e] US$m -

Partner or Other Fi nance [i f appl i cabl e] US$m 127

PartnerFi nance and OtherFi nance onl y:

Past Cost Pri nci pal [Pri ori ty 4 for repayment]

Maturi ty years 4

Openi ng Bal ance US$m 995

Carry Borrowi ng US$m 167

Pri nci pal Due US$m 167

Pri nci pal Pai d US$m 167

Unpai d Pri nci pal US$m -

Cl osi ng Bal ance US$m

Past Cost Interest [Pri ori ty 2]

Interest % 7.00%

Interest Due US$m 70

Interest Pai d US$m 30

Unpai d Interest US$m -

*Interest accrued before project start is capitalized

A-I. KMHL Participation - Cost Before Operations Funding

KMHL Cash Cal l s Fundi ng Source PartnerFi nance

State Transfer [i f appl i cabl e] US$m -

Partner or Other Fi nance [i f appl i cabl e] US$m 124

PartnerFi nance and OtherFi nance onl y:

Costs Before Operati ons Pri nci pal [Pri ori ty 3]

Maturi ty years 16

Openi ng Bal ance US$m 1,520

Carry Borrowi ng US$m 136

Pri nci pal Due US$m 136

Pri nci pal Pai d US$m 136

Unpai d Pri nci pal US$m -

Cl osi ng Bal ance US$m

Costs Before Operati ons Interest [Pri ori ty 1]

Interest % 7.00%

Interest Due US$m 106

Interest Pai d US$m 95

Unpai d Interest US$m -

*Interest accrued before project start is capitalized

(1,380.00)

KMHL Share of Net Cash Fl ow 3,485

Carry Interest Pai d 125

Pri nci pal Pai d 303

KMHL Net Cash Flow After Carry Debt Service 3,057

IJISRT23SEP128 www.ijisrt.com 382

Volume 8, Issue 9, September 2023 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

APPENDIX A-III: WAFI COPPER-GOLD PROJECT MODEL RESULTS

MOROBE PROVINCIAL GOVERNMENT AND LANDOWNERS

A-II MOROBE PROVINCIAL GOVERNMENT & LANDOWNER PARTICIPATION

A-II. MPG & LO Participation - Past Cost Funding

MPG & LO Past Cost Funding Source PartnerFinance

State Transfer [if applicable] US$m -

Partner or Other Finance [if applicable] US$m 21

PartnerFinance and OtherFinance only:

Past Cost Principal [Priority 4 for repayment]

Maturity years 4

Opening Balance US$m 168

Carry Borrowing US$m 28

Principal Due US$m 28

Principal Paid US$m 28

Unpaid Principal US$m -

Closing Balance US$m

Past Cost Interest [Priority 2]

Interest % 7.00%

Interest Due US$m 12

Interest Paid US$m 5

Unpaid Interest US$m -

*Interest accrued before project start is capitalized

A-III. MPG & LO Participation - Cost Before Operations Funding

MPG & LO Cost bf Operations Funding Source PartnerFinance

State Transfer [if applicable] US$m -

Partner or Other Finance [if applicable] US$m 21

PartnerFinance and OtherFinance only:

Costs Before Operations Principal [Priority 3]

Maturity years 16

Opening Balance US$m 256

Carry Borrowing US$m 23

Principal Due US$m 23

Principal Paid US$m 23

Unpaid Principal US$m -

Closing Balance US$m

Costs Before Operations Interest [Priority 1]

Interest % 7.00%

Interest Due US$m 18

Interest Paid US$m 16

Unpaid Interest US$m -

*Interest accrued before project start is capitalized

MPG & LOShare of Net Cash Flow 587

Carry Interest Paid 21

Principal Paid 51

Kumul Net Cash Flow After Carry Debt Service 515

IJISRT23SEP128 www.ijisrt.com 383

Volume 8, Issue 9, September 2023 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

APPENDIX B-I: PORGERA GOLD MINE RE-OPENING MODEL RESULTS

PROJECT MODEL – 20-YEAR MINE LIFE

PROJECT CASH FLOW nom

Total Net Revenue US$m 16,938

Exploration US$m -

Total CapEx US$m 6,050

Total OpEx US$m 8,400

Capitalised Net Revenue (Pre Commercial Start) US$m -

Project Finance Post- Completion Interest Paid US$m -

Pre-Tax Cash Flow US$m 2,488

Royalties, Levies & Tax US$m 1,727

Additional Profits Tax (APT) US$m -

After-Tax Cash Flow US$m 2,162

Project Finance Debt Drawdown US$m -

Project Finance Debt Principal Repaid US$m -

Net Project Cash Flow After Financing US$m 2,162

A. STATE PARTICIPATION nom

Project Past Cost US$m -

Project Cost Before Operations US$m 1,481

State Back-in Year (=Project Financial Close) year 0

Total State Participation % 51.00%

KMHL Participation % 30.00%

PG & MRDC Participation % 21.00%

Finance Terms [Must input in "Mining_ScenarioManager" tab if PartnerFinance or OtherFinance is selec

Past Cost Finance Terms

Past Cost Interest Rate % 7.00%

Past Cost Maturity years 4

Costs Before Operation Finance Terms

Costs Before Operation Interest Rate % 7.00%

Costs Before Operation Maturity years 1

IJISRT23SEP128 www.ijisrt.com 384

Volume 8, Issue 9, September 2023 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

APPENDIX B-II: PORGERA GOLD MINE RE-OPENING MODEL RESULTS

KMHL PARTICIPATION

A-I. KMHL PARTICIPATION

A-I. KMHL Participation - Past Cost Funding

KMHL Past Cost Funding Source PartnerFinance

State Transfer [if applicable] US$m -

Partner or Other Finance [if applicable] US$m -

PartnerFinance and OtherFinance only:

Past Cost Principal [Priority 4 for repayment]

Maturity years 4

Opening Balance US$m -

Carry Borrowing US$m -

Principal Due US$m -

Principal Paid US$m -

Unpaid Principal US$m -

Closing Balance US$m

Past Cost Interest [Priority 2]

Interest % 7.00%

Interest Due US$m -

Interest Paid US$m -

Unpaid Interest US$m -

*Interest accrued before project start is capitalized

A-II. KMHL Participation - Cost Before Operations Funding

KMHL Cash Calls Funding Source PartnerFinance

State Transfer [if applicable] US$m -

Partner or Other Finance [if applicable] US$m 444

PartnerFinance and OtherFinance only:

Costs Before Operations Principal [Priority 3]

Maturity years 1

Opening Balance US$m 7,509

Carry Borrowing US$m 459

Principal Due US$m 7,324

Principal Paid US$m 459

Unpaid Principal US$m 6,865

Closing Balance US$m

Costs Before Operations Interest [Priority 1]

Interest % 7.00%

Interest Due US$m 782

Interest Paid US$m 497

Unpaid Interest US$m 239

*Interest accrued before project start is capitalized

KMHL Share of Net Cash Flow 1,068

Carry Interest Paid 497

Principal Paid 459

Kumul Net Cash Flow After Carry Debt Service 112

IJISRT23SEP128 www.ijisrt.com 385

Volume 8, Issue 9, September 2023 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

APPENDIX B-III: PORGERA GOLD MINE RE-OPENING MODEL RESULTS

EPG AND PORGERA LANDOWNER EQUITY PARTICIPATION

B. EPG & PORGERA LO PARTICIPATION

B-I. PG & MRDC Participation - Past Cost Funding

EPG & LO Past Cost Funding Source PartnerFinance

State Transfer [if applicable] US$m -

Partner or Other Finance [if applicable] US$m -

PartnerFinance and OtherFinance only:

Past Cost Principal [Priority 4 for repayment]

Maturity years 4

Opening Balance US$m -

Carry Borrowing US$m -

Principal Due US$m -

Principal Paid US$m -

Unpaid Principal US$m -

Closing Balance US$m

Past Cost Interest [Priority 2]

Interest % 7.00%

Interest Due US$m -

Interest Paid US$m -

Unpaid Interest US$m -

*Interest accrued before project start is capitalized

B-II. EPG & LO Participation - Cost Before Operations Funding

PG & MRDC Cost bf Operations Funding Source PartnerFinance

State Transfer [if applicable] US$m -

Partner or Other Finance [if applicable] US$m 311

PartnerFinance and OtherFinance only:

Costs Before Operations Principal [Priority 3]

Maturity years 1

Opening Balance US$m 5,257

Carry Borrowing US$m 321

Principal Due US$m 5,127

Principal Paid US$m 321

Unpaid Principal US$m 4,805

Closing Balance US$m

Costs Before Operations Interest [Priority 1]

Interest % 7.00%

Interest Due US$m 547

Interest Paid US$m 348

Unpaid Interest US$m 168

*Interest accrued before project start is capitalized

EPG & LO Share of Net Cash Flow 748

Carry Interest Paid 348

Principal Paid 321

EPG & LO Net Cash Flow After Carry Debt Service 78

IJISRT23SEP128 www.ijisrt.com 386

Volume 8, Issue 9, September 2023 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

APPENDIX C-I: OK TEDI COPPER-GOLD MINE EXTENSION MODEL RESULTS

PROJECT CASH FLOW nom

Total Net Revenue US$m 14,055

Exploration US$m -

Total CapEx US$m 3,285

Total OpEx US$m 2,426

Capitalised Net Revenue (Pre Commercial Start) US$m (635)

Project Finance Post- Completion Interest Paid US$m -

Pre-Tax Cash Flow US$m 8,979

Royalties, Levies & Tax US$m 2,873

Additional Profits Tax (APT) US$m -

After-Tax Cash Flow US$m 6,106

Project Finance Debt Drawdown US$m -

Project Finance Debt Principal Repaid US$m -

Net Project Cash Flow After Financing US$m 6,106

A STATE PARTICIPATION nom

Project Past Cost US$m -

Project Cost Before Operations US$m -

State Back-in Year (=Project Financial Close) year 0

Total State Participation % 100.00%

KMHL Participation % 67.00%

PG & MRDC Participation % 33.00%

Finance Terms [Must input in "Mining_ScenarioManager" tab if PartnerFinance or OtherFinance is selec

Past Cost Finance Terms

Past Cost Interest Rate % 0.00%

Past Cost Maturity years 0

Costs Before Operation Finance Terms

Costs Before Operation Interest Rate % 0.00%

Costs Before Operation Maturity years 0

IJISRT23SEP128 www.ijisrt.com 387

Volume 8, Issue 9, September 2023 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

APPENDIX C-II: OK TEDI COPPER-GOLD MINE EXTENSION MODEL RESULTS

KMHL PARTICIPATION

A-I: KUMUL PARTICIPATION

A-I. KMHL Participation - Past Cost Funding

KMHL Past Cost Funding Source FALSE

State Transfer [if applicable] US$m -

Partner or Other Finance [if applicable] US$m -

PartnerFinance and OtherFinance only:

Past Cost Principal [Priority 4 for repayment]

Maturity years 0

Opening Balance US$m -

Carry Borrowing US$m -

Principal Due US$m -

Principal Paid US$m -

Unpaid Principal US$m -

Closing Balance US$m

Past Cost Interest [Priority 2]

Interest % 0.00%

Interest Due US$m -

Interest Paid US$m -

Unpaid Interest US$m -

*Interest accrued before project start is capitalized

A-II. KMHL Participation - Cost Before Operations Funding

KMHL Cash Calls Funding Source FALSE

State Transfer [if applicable] US$m -

Partner or Other Finance [if applicable] US$m -

PartnerFinance and OtherFinance only:

Costs Before Operations Principal [Priority 3]

Maturity years 0

Opening Balance US$m -

Carry Borrowing US$m -

Principal Due US$m -

Principal Paid US$m -

Unpaid Principal US$m -

Closing Balance US$m

Costs Before Operations Interest [Priority 1]

Interest % 0.00%

Interest Due US$m -

Interest Paid US$m -

Unpaid Interest US$m -

*Interest accrued before project start is capitalized

KMHL Share of Net Cash Flow 3,666

Carry Interest Paid -

Principal Paid -

KMHL Net Cash Flow After Carry Debt Service 3,666

IJISRT23SEP128 www.ijisrt.com 388

Volume 8, Issue 9, September 2023 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

APPENDIX C-III: OK TEDI COPPER-GOLD MINE EXTENSION MODEL RESULTS

WESTERN PROVINCIAL GOVERNMENT AND LANDOWNER PARTICIPATION

B. WESTERN PROVINCIAL GOVERNMENT & LO PARTICIPATION

B-I. WPG & LO Participation - Past Cost Funding

WPG & LOs Past Cost Funding Source FALSE

State Transfer [if applicable] US$m -

Partner or Other Finance [if applicable] US$m -

PartnerFinance and OtherFinance only:

Past Cost Principal [Priority 4 for repayment]

Maturity years 0

Opening Balance US$m -

Carry Borrowing US$m -

Principal Due US$m -

Principal Paid US$m -

Unpaid Principal US$m -

Closing Balance US$m

Past Cost Interest [Priority 2]

Interest % 0.00%

Interest Due US$m -

Interest Paid US$m -

Unpaid Interest US$m -

*Interest accrued before project start is capitalized

B-II. WPG & LO Participation - Cost Before Operations Funding

WPG & LO Cost bf Operations Funding Source FALSE

State Transfer [if applicable] US$m -

Partner or Other Finance [if applicable] US$m -

PartnerFinance and OtherFinance only:

Costs Before Operations Principal [Priority 3]

Maturity years 0

Opening Balance US$m -

Carry Borrowing US$m -

Principal Due US$m -

Principal Paid US$m -

Unpaid Principal US$m -

Closing Balance US$m

Costs Before Operations Interest [Priority 1]

Interest % 0.00%

Interest Due US$m -

Interest Paid US$m -

Unpaid Interest US$m -

*Interest accrued before project start is capitalized

WPG & LO Share of Net Cash Flow 1,806

Carry Interest Paid -

Principal Paid -

WPG & LO Net Cash Flow After Carry Debt Service 1,806

IJISRT23SEP128 www.ijisrt.com 389

You might also like

- Net Meds BillDocument1 pageNet Meds Billhimanshu5513No ratings yet

- The Saudi Arabia Construction Projects MarketDocument16 pagesThe Saudi Arabia Construction Projects MarketAnupam Asthana67% (3)

- Group 4 - GeoPacific FINALDocument19 pagesGroup 4 - GeoPacific FINALNigel BullNo ratings yet

- Australian Securities Exchange Notice: Half Year Results To 30 June 2020Document4 pagesAustralian Securities Exchange Notice: Half Year Results To 30 June 2020TimBarrowsNo ratings yet

- Nr05 - Strategic Resources Pellet Conversion ProjectDocument6 pagesNr05 - Strategic Resources Pellet Conversion ProjectJared JoubertNo ratings yet

- Exceptional Pre-Feasibility Study Results For The Vares Silver Project Including Us$1,040 Million Post-Tax NPV AND 113% IRRDocument52 pagesExceptional Pre-Feasibility Study Results For The Vares Silver Project Including Us$1,040 Million Post-Tax NPV AND 113% IRRUtibe basseyNo ratings yet

- Lycopodium Completes Direct OFS For Arcadia Project: HighlightsDocument93 pagesLycopodium Completes Direct OFS For Arcadia Project: HighlightsE-25 Siddhesh BNo ratings yet

- Studi Kebutuhan Investasi Energi Di IndonesiaDocument84 pagesStudi Kebutuhan Investasi Energi Di IndonesiaArchibald Nagel100% (1)

- Southern Cable Group BHDDocument12 pagesSouthern Cable Group BHDlkt_pestechNo ratings yet

- Kefi Bank Loan Based Proposal Selected 2dec19Document4 pagesKefi Bank Loan Based Proposal Selected 2dec19hussein alkadirNo ratings yet

- Port of Newcastle - Hydrogen PlansDocument6 pagesPort of Newcastle - Hydrogen PlansMatthew KellyNo ratings yet

- BW6 Bidders Conference Consolidated - RENEWABLE ENERGYDocument58 pagesBW6 Bidders Conference Consolidated - RENEWABLE ENERGYLutherOldaNo ratings yet

- Nighthawk FlashDocument1 pageNighthawk FlashpapatopapatoNo ratings yet

- Novelis Q1FY22 Earnings PresentationDocument21 pagesNovelis Q1FY22 Earnings PresentationLourdu XavierNo ratings yet

- Newmont MiningDocument38 pagesNewmont MiningHenry JenkinsNo ratings yet

- Aug-2010-Citi Indonesia ConferenceDocument67 pagesAug-2010-Citi Indonesia ConferenceFatchul WachidNo ratings yet

- Giga Metals Corporate Presentation August 18 - 2023Document33 pagesGiga Metals Corporate Presentation August 18 - 2023Yomi1990No ratings yet

- Pan African Resources: Exceeding Expectations (As Usual)Document11 pagesPan African Resources: Exceeding Expectations (As Usual)Owm Close CorporationNo ratings yet

- Results FY2022Document27 pagesResults FY2022Sofia GuedesNo ratings yet

- PC - Hindalco Q4FY21 Update - May 2021 20210522002841 PDFDocument6 pagesPC - Hindalco Q4FY21 Update - May 2021 20210522002841 PDFAniket DhanukaNo ratings yet

- Investor Digest: Equity Research - 20 March 2024Document5 pagesInvestor Digest: Equity Research - 20 March 2024brian butarNo ratings yet

- Sime Darby 2021Document32 pagesSime Darby 2021Che Muhd. HanifNo ratings yet

- Kpil 9 2 24 PLDocument8 pagesKpil 9 2 24 PLrmishraNo ratings yet

- A C ' O P - P B P: April 2020 TSX-V:BRZ Otcqb:BlilfDocument17 pagesA C ' O P - P B P: April 2020 TSX-V:BRZ Otcqb:BlilfEzequiel Guillermo Trejo NavasNo ratings yet

- 1303南亞 1091210 NomuraDocument9 pages1303南亞 1091210 NomuraDeron LaiNo ratings yet

- Nepal Rastra Bank: Current Macroeconomic and Financial Situation of NepalDocument13 pagesNepal Rastra Bank: Current Macroeconomic and Financial Situation of NepalSuniel ChhetriNo ratings yet

- Sustainably Sourcing Magnet and Heavy Rare Earths To Meet Net Zero Carbon AmbitionsDocument47 pagesSustainably Sourcing Magnet and Heavy Rare Earths To Meet Net Zero Carbon Ambitions10evenwoodcloseNo ratings yet

- Bauxite ProjectDocument20 pagesBauxite Projectzainul fitri100% (1)

- Construction Sector: Limited Impact of Second COVID Wave On ExecutionDocument3 pagesConstruction Sector: Limited Impact of Second COVID Wave On ExecutionLavanya SubramaniamNo ratings yet

- Forum Project Presentation Guidelines EnglishDocument10 pagesForum Project Presentation Guidelines EnglishMarton CavaniNo ratings yet

- WB - Vietnam Energy Sector Assessment 2018 PDFDocument81 pagesWB - Vietnam Energy Sector Assessment 2018 PDFViet Linh VuNo ratings yet

- Intelligence Weekly - Vol 11 No33Document12 pagesIntelligence Weekly - Vol 11 No33Haruna RafiuNo ratings yet

- Tellurian Inc.: Corporate PresentationDocument36 pagesTellurian Inc.: Corporate PresentationGag PafNo ratings yet

- Sustainable Development On Mining, Processing, and EnvironmentDocument36 pagesSustainable Development On Mining, Processing, and Environmentjohan tampubolonNo ratings yet

- RCJ&Y - Jubail Industrial City 2: Phase 3 and 4 Sea Water Cooling StationDocument5 pagesRCJ&Y - Jubail Industrial City 2: Phase 3 and 4 Sea Water Cooling Stationsalman KhanNo ratings yet

- Ar Webcast Q2 2022 Final PDFDocument19 pagesAr Webcast Q2 2022 Final PDFJuan GurrolaNo ratings yet

- PT Telekomunikasi Indonesia, TBK: Fairly Steady 1Q20 ResultsDocument9 pagesPT Telekomunikasi Indonesia, TBK: Fairly Steady 1Q20 ResultsSugeng YuliantoNo ratings yet

- OGDCL Full Year (FY 2021) Results Presentation - 0Document11 pagesOGDCL Full Year (FY 2021) Results Presentation - 0Elishba MustafaNo ratings yet

- Investors Presentation: The Cobalt CompanyDocument27 pagesInvestors Presentation: The Cobalt Companyaeid101No ratings yet

- Press Release MBMA Announces FY2023 ResultsDocument6 pagesPress Release MBMA Announces FY2023 Resultsakhmad ashariNo ratings yet

- Arcelor Mittal Fact Book 2022Document100 pagesArcelor Mittal Fact Book 2022Hossin ZianiNo ratings yet

- PPPPPTDocument41 pagesPPPPPTbikash ranaNo ratings yet

- Barrick 2017 Operations and Technical Update 2Document219 pagesBarrick 2017 Operations and Technical Update 2Rudy Dwi PrasetyoNo ratings yet

- Abdulrahman Al Ghabban Presentation PDFDocument60 pagesAbdulrahman Al Ghabban Presentation PDFThameem AnsariNo ratings yet

- PFS-15 11 2019-1Document82 pagesPFS-15 11 2019-1Energiebleu ProjectsNo ratings yet

- 05january2024 India DailyDocument155 pages05january2024 India Dailypradeep kumarNo ratings yet

- Lucara q3 2022 Investor Call Presentation FinalDocument19 pagesLucara q3 2022 Investor Call Presentation FinalMiguel Couto RamosNo ratings yet

- HiveDocument41 pagesHiveclara.nicolasNo ratings yet

- Invest in Economic ZonesDocument45 pagesInvest in Economic ZonesParvez Syed RafiNo ratings yet

- IIFL - Capital Goods - Union Budget 2022 - 20220202Document10 pagesIIFL - Capital Goods - Union Budget 2022 - 20220202Bharat NarrativesNo ratings yet

- Seplat Energy Fy 21 Results - Final - 28022022Document180 pagesSeplat Energy Fy 21 Results - Final - 28022022ZAINAB OLADIPONo ratings yet

- Kahoot!Document6 pagesKahoot!Federico NiciferoNo ratings yet

- Dilip Buildcon: Strong ComebackDocument11 pagesDilip Buildcon: Strong ComebackPawan AsraniNo ratings yet

- Vatech Q2fy23 Jbwa 281122Document7 pagesVatech Q2fy23 Jbwa 281122Manish BNo ratings yet

- R&D in Mining Industry - Knowledge RidgeDocument10 pagesR&D in Mining Industry - Knowledge RidgeВладимир ШалагинNo ratings yet

- Report by Light House LTD 2024Document7 pagesReport by Light House LTD 2024nilayshah123No ratings yet

- What Is Project FinanceDocument28 pagesWhat Is Project FinanceUkas KgNo ratings yet

- Plaquette - PRECASEM - CIMEC 2019 English VersionDocument18 pagesPlaquette - PRECASEM - CIMEC 2019 English VersionFranck BertrandNo ratings yet

- EG - Helwan South Power ProjectDocument13 pagesEG - Helwan South Power ProjectAhmed AbdelhamidNo ratings yet

- Nigerian Mining Progress But Still A Long Way To Go1Document30 pagesNigerian Mining Progress But Still A Long Way To Go1Olusola OgunyemiNo ratings yet

- AI Robots in Various SectorDocument3 pagesAI Robots in Various SectorInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- MSMEs and Rural Prosperity: A Study of their Influence in Indonesian Agriculture and Rural EconomyDocument6 pagesMSMEs and Rural Prosperity: A Study of their Influence in Indonesian Agriculture and Rural EconomyInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Prevalence of Microorganisms in UTI and Antibiotic Sensitivity Pattern among Gram Negative Isolates: A Cohort StudyDocument4 pagesPrevalence of Microorganisms in UTI and Antibiotic Sensitivity Pattern among Gram Negative Isolates: A Cohort StudyInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- An Explanatory Sequential Study of Public Elementary School Teachers on Deped Computerization Program (DCP)Document7 pagesAn Explanatory Sequential Study of Public Elementary School Teachers on Deped Computerization Program (DCP)International Journal of Innovative Science and Research TechnologyNo ratings yet

- Geotechnical Assessment of Selected Lateritic Soils in Southwest Nigeria for Road Construction and Development of Artificial Neural Network Mathematical Based Model for Prediction of the California Bearing RatioDocument10 pagesGeotechnical Assessment of Selected Lateritic Soils in Southwest Nigeria for Road Construction and Development of Artificial Neural Network Mathematical Based Model for Prediction of the California Bearing RatioInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Occupational Injuries among Health Care Workers in Selected Hospitals in Ogbomosho, Oyo StateDocument6 pagesOccupational Injuries among Health Care Workers in Selected Hospitals in Ogbomosho, Oyo StateInternational Journal of Innovative Science and Research Technology100% (1)

- Intrusion Detection and Prevention Systems for Ad-Hoc NetworksDocument8 pagesIntrusion Detection and Prevention Systems for Ad-Hoc NetworksInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Nurturing Corporate Employee Emotional Wellbeing, Time Management and the Influence on FamilyDocument8 pagesNurturing Corporate Employee Emotional Wellbeing, Time Management and the Influence on FamilyInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Innovative Mathematical Insights through Artificial Intelligence (AI): Analysing Ramanujan Series and the Relationship between e and π\piDocument8 pagesInnovative Mathematical Insights through Artificial Intelligence (AI): Analysing Ramanujan Series and the Relationship between e and π\piInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Fuzzy based Tie-Line and LFC of a Two-Area Interconnected SystemDocument6 pagesFuzzy based Tie-Line and LFC of a Two-Area Interconnected SystemInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Importance of Early Intervention of Traumatic Cataract in ChildrenDocument5 pagesImportance of Early Intervention of Traumatic Cataract in ChildrenInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Dynamic Analysis of High-Rise Buildings for Various Irregularities with and without Floating ColumnDocument3 pagesDynamic Analysis of High-Rise Buildings for Various Irregularities with and without Floating ColumnInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Integration of Information Communication Technology, Strategic Leadership and Academic Performance in Universities in North Kivu, Democratic Republic of CongoDocument7 pagesIntegration of Information Communication Technology, Strategic Leadership and Academic Performance in Universities in North Kivu, Democratic Republic of CongoInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- The Effects of Liquid Density and Impeller Size with Volute Clearance on the Performance of Radial Blade Centrifugal Pumps: An Experimental ApproachDocument16 pagesThe Effects of Liquid Density and Impeller Size with Volute Clearance on the Performance of Radial Blade Centrifugal Pumps: An Experimental ApproachInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Comparison of JavaScript Frontend Frameworks - Angular, React, and VueDocument8 pagesComparison of JavaScript Frontend Frameworks - Angular, React, and VueInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Diode Laser Therapy for Drug Induced Gingival Enlaregement: A CaseReportDocument4 pagesDiode Laser Therapy for Drug Induced Gingival Enlaregement: A CaseReportInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Analysis of Factors Obstacling Construction Work in The Tojo Una-Una Islands RegionDocument9 pagesAnalysis of Factors Obstacling Construction Work in The Tojo Una-Una Islands RegionInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Breaking Down Barriers To Inclusion: Stories of Grade Four Teachers in Maintream ClassroomsDocument14 pagesBreaking Down Barriers To Inclusion: Stories of Grade Four Teachers in Maintream ClassroomsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Occupational Safety: PPE Use and Hazard Experiences Among Welders in Valencia City, BukidnonDocument11 pagesOccupational Safety: PPE Use and Hazard Experiences Among Welders in Valencia City, BukidnonInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- A Novel Approach to Template Filling with Automatic Speech Recognition for Healthcare ProfessionalsDocument6 pagesA Novel Approach to Template Filling with Automatic Speech Recognition for Healthcare ProfessionalsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Total Cost of Ownership of Electric Car and Internal Combustion Engine Car With Performance NormalizationDocument11 pagesTotal Cost of Ownership of Electric Car and Internal Combustion Engine Car With Performance NormalizationInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Organizational Factors That Influence Information Security in Smes: A Case Study of Mogadishu, SomaliaDocument10 pagesOrganizational Factors That Influence Information Security in Smes: A Case Study of Mogadishu, SomaliaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- The Influence of Artificial Intelligence On Employment Trends in The United States (US)Document5 pagesThe Influence of Artificial Intelligence On Employment Trends in The United States (US)International Journal of Innovative Science and Research TechnologyNo ratings yet

- Pecha Kucha Presentation in The University English Classes: Advantages and DisadvantagesDocument4 pagesPecha Kucha Presentation in The University English Classes: Advantages and DisadvantagesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Classifying Crop Leaf Diseases Using Different Deep Learning Models With Transfer LearningDocument8 pagesClassifying Crop Leaf Diseases Using Different Deep Learning Models With Transfer LearningInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Disseminating The Real-World Importance of Conjunct Studies of Acculturation, Transculturation, and Deculturation Processes: Why This Can Be A Useful Technique To Analyze Real-World ObservationsDocument15 pagesDisseminating The Real-World Importance of Conjunct Studies of Acculturation, Transculturation, and Deculturation Processes: Why This Can Be A Useful Technique To Analyze Real-World ObservationsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Gender-Based Violence: Engaging Children in The SolutionDocument10 pagesGender-Based Violence: Engaging Children in The SolutionInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Mediating Effect of Encouraging Attitude of School Principals On Personal Well-Being and Career Ethics of TeachersDocument10 pagesMediating Effect of Encouraging Attitude of School Principals On Personal Well-Being and Career Ethics of TeachersInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- The Relationship of Total Quality Management Practices and Project Performance With Risk Management As Mediator: A Study of East Coast Rail Link Project in MalaysiaDocument19 pagesThe Relationship of Total Quality Management Practices and Project Performance With Risk Management As Mediator: A Study of East Coast Rail Link Project in MalaysiaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Integrating Multimodal Deep Learning For Enhanced News Sentiment Analysis and Market Movement ForecastingDocument8 pagesIntegrating Multimodal Deep Learning For Enhanced News Sentiment Analysis and Market Movement ForecastingInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Conventional Versus Non Conventional Cash4079Document10 pagesConventional Versus Non Conventional Cash4079Amna SaeedNo ratings yet

- Analysis of Firms' Share Repurchases Causation: A Case Study of StarbucksDocument10 pagesAnalysis of Firms' Share Repurchases Causation: A Case Study of StarbucksJovelyn Delos ReyesNo ratings yet

- Gloe Co. Aloe Vera Gel PatchDocument50 pagesGloe Co. Aloe Vera Gel PatchLiana BaluyotNo ratings yet

- Secial Terms and Conditions of RFQ 1.0 CommunicationDocument14 pagesSecial Terms and Conditions of RFQ 1.0 CommunicationKarandeep SinghNo ratings yet

- WHT-Card - (TY 2024)Document1 pageWHT-Card - (TY 2024)yahya zafarNo ratings yet

- IGCSE-OL - Bus - CH - 23 - Answers To CB ActivitiesDocument4 pagesIGCSE-OL - Bus - CH - 23 - Answers To CB ActivitiesOscar WilliamsNo ratings yet

- Julie Clarke Thesis PDFDocument723 pagesJulie Clarke Thesis PDFAlina BalasaNo ratings yet

- GovAcc HO No. 4 - Revenue and Other ReceiptsDocument13 pagesGovAcc HO No. 4 - Revenue and Other Receiptsbobo kaNo ratings yet

- Reservation AgreementDocument1 pageReservation Agreementsherryann100% (1)

- 1 RGDGNDocument13 pages1 RGDGNRuth TenajerosNo ratings yet

- Income Taxes: Basic ConceptsDocument7 pagesIncome Taxes: Basic ConceptsTrisha Mae Mendoza MacalinoNo ratings yet

- Chapter Three: International Taxation IssuesDocument39 pagesChapter Three: International Taxation Issuesembiale ayaluNo ratings yet

- Plan807 Charu 15Document3 pagesPlan807 Charu 15Sambhaji KoliNo ratings yet

- Intermediate Macroeconomics SummaryDocument22 pagesIntermediate Macroeconomics SummaryJildert OppedijkNo ratings yet

- CHAPTER 3 - Transfer and Business TaxDocument6 pagesCHAPTER 3 - Transfer and Business TaxKatKat Olarte0% (1)

- Holiday and Wage Record SpreadsheetDocument2 pagesHoliday and Wage Record SpreadsheetpasangbhpNo ratings yet

- Past Year Current Year Budget Year (Actual) (Proposed)Document16 pagesPast Year Current Year Budget Year (Actual) (Proposed)Saphire DonsolNo ratings yet

- What Train LawDocument1 pageWhat Train LawJanlie GautaneNo ratings yet

- A Study On Effective Marketing Strategies of Max Life Insurance With Reference To Bilaspur DistrictDocument5 pagesA Study On Effective Marketing Strategies of Max Life Insurance With Reference To Bilaspur DistrictSunita SharmaNo ratings yet

- Myanmar Business Today - Vol 2, Issue 18Document32 pagesMyanmar Business Today - Vol 2, Issue 18Myanmar Business TodayNo ratings yet

- Customs Procedure CodesDocument9 pagesCustoms Procedure CodesTSEDEKENo ratings yet

- VI Sem Rescheduled UG PVT Reg. TT 2021 PDFDocument4 pagesVI Sem Rescheduled UG PVT Reg. TT 2021 PDFAlkesh AntonyNo ratings yet

- Amulya A TY Hyb RevisedDocument2 pagesAmulya A TY Hyb RevisedNirmala NirmalaNo ratings yet

- Annual Enterprise Survey 2021 Financial Year Provisional 1Document3 pagesAnnual Enterprise Survey 2021 Financial Year Provisional 1Harden CraterNo ratings yet

- How To Calculate Your Taxable Profits: Helpsheet 222Document14 pagesHow To Calculate Your Taxable Profits: Helpsheet 222subtle69No ratings yet

- Villarin Vs MunasqueDocument14 pagesVillarin Vs MunasqueIvan Montealegre ConchasNo ratings yet

- TAX 2 Case DigestDocument6 pagesTAX 2 Case DigestGatan CawilanNo ratings yet

- GIS Handbook For MunicipalitiesDocument40 pagesGIS Handbook For MunicipalitiesKurainashe MugwagwaNo ratings yet

- Taxation of Individuals QuizzerDocument37 pagesTaxation of Individuals QuizzerJc QuismundoNo ratings yet