Professional Documents

Culture Documents

SIDEBP

SIDEBP

Uploaded by

VahidCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SIDEBP

SIDEBP

Uploaded by

VahidCopyright:

Available Formats

Stocks & Commodities V.

2:3 (91-93): SIDEBAR: Programming Conventions for BASIC Technical Analysis subroutines:

Programming Conventions for BASIC Technical

Analysis subroutines:

NO Input/Output routine is provided, only a generic BASIC computational subroutine containing the

fundamental technical analysis is provided. This subroutine should, with only minor changes, work on

any computer using the BASIC language.

INPUT data {daily, weekly, monthly, etc.) must be provided by the user (i.e. YOU} in the following

matrix format: X(7,NUM) where

NUM= Number of days in the Matrix

X(0,NUM) = Date Optionally used to store the date

X(1 ,NUM) = Open Mean open trade price for the day

X(2,NUM) = High Highest trade price for the day

X(3,NUM) = Low Lowest trade price for the day

X(4,NUM) = Close Last trade or bid price for the day

X(5,NUM) = Volume Number of shares or contracts traded

X(6,NUM) = Open Interest Total contracts or optioned shares

X(7,NUM) = STUDY Last STUDY results stored here

B = Beginning First day of Matrix (usually = 1)

E = Ending Last day of Matrix (usually = NUM)

OUTPUT are usually in the STUDY column X(7,NUM) at the end of the subroutine. NO printing or

graphics is provided of the subroutine output.

1100 REM "MOMENTUM OSCILLATOR OF TRIPLE

EXPONENTIAL SMOOTHED DATA"

BY JACK K. HUTSON

COPYRIGHT (C) 1983, 1984

TECHNICAL ANALYSIS, INC.

1105 LET T$ = "TRIX":

REM STUDY TITLE

1110 LET P(6) = 1:

LET P(7) = 0:

REM DRAW A REFERENCE BASE LINE AT ZERO

1115 LET Y = 10000:

REM ARBITRARY OUTPUT SCALE FACTOR

1120 LET P$ = "1:0 2:H 3:L 4:C 5:V 6:0I 7:S :" :

GOSUB 1165:

ON NOT (N = 1 OR N = 2 OR N = 3

OR N = 4 OR N = 5 OR N = 6 OR N = 7) GOTO 1120:

REM ADJUST MATRIX COLUMN LENGTH TO TRUNCATE LEADING AND TRAILING

ZEROES

1125 FOR I = B TO E:

ON X(N,I) < > 0 GOTO 1135:

LET B = B + 1:

Article Text Copyright (c) Technical Analysis Inc. 1

Stocks & Commodities V. 2:3 (91-93): SIDEBAR: Programming Conventions for BASIC Technical Analysis subroutines:

NEXT

1135 FOR I = E TO B STEP - 1:

ON X(N,I) < > 0 GOTO 1145:

LET E = E - 1:

NEXT

1145 LET G = N:

LET T = LOG (X(G,B)):

LET U = T:

LET R = T:

LET Z = T:

REM SEED INITIAL ITERATION VARABLE S

1150 LET P$ = "1:ALPHA 2:FILTER 3:CUTOF F FREQ :" :

GOSUB 1165

1151 IF N = 1 THEN

LET P$ = ALPHA SMOOTHING CONS

TANT (0 TO 1) : " :

GOSUB 1165:

LET K = N:

GOTO 1160

1152 IF N = 2 THEN

LET P$ = " FILTER LENGTH IN DAYS : " :

GOSUB 1165:

GOTO 1155

1153 IF N = 3 THEN

LET P$ = CUTOFF FREQUENCY IN CYCLES/YEAR : " :

GOSUB 1165:

LET C = (1 - COS (N * 0.024166)) / 0.25992:

LET K = C * ( SQR (1 + 2 / C)- 1 ) :

GOTO 1160

1154 GOTO 1150:

REM BAD N VALUE

1155 LET K = 2 / (N + 1):

REM K = ALPHA APPROXIMATION ALGORITHM

1160 FOR I = B TO E:

LET R = ( LOG (X(G,I)) - R) *

K + R:

LET T = (R - T) * K + T:

LET U = (T - U) * K + U:

LET X(7,I) = (U - Z) * Y:

LET Z = U:

NEXT :

RETURN

1165 VTAB 2:

HTAB 1:

PRINT P$;:

INPUT " " ;N:

RETURN

PROGRAM LENGTH: 16 LINES / 1035 BYTES

Article Text Copyright (c) Technical Analysis Inc. 2

You might also like

- How Many Upgrades Do You Need TP Perform On A Three Unit StackDocument3 pagesHow Many Upgrades Do You Need TP Perform On A Three Unit StackAdi Gazap0% (7)

- Assignment: Peer Assessment: Module 1 Client/Brand Analysis: Task 1Document7 pagesAssignment: Peer Assessment: Module 1 Client/Brand Analysis: Task 1MihailNo ratings yet

- Quick Start Guide: Datapower Gateway Virtual EditionDocument2 pagesQuick Start Guide: Datapower Gateway Virtual EditionDARWIN LUQUENo ratings yet

- Lab Manual For Digital Signal Processing: Masters of Electrical EngineeringDocument31 pagesLab Manual For Digital Signal Processing: Masters of Electrical EngineeringVishalNo ratings yet

- Delete DP ManualDocument56 pagesDelete DP ManualDEVI PRASAD PATTNAIKNo ratings yet

- Experiment 13 Filter Designing On DSK TMS320C6713 ObjectivesDocument8 pagesExperiment 13 Filter Designing On DSK TMS320C6713 ObjectivesMohammad ArslaanNo ratings yet

- Solutions of MatlabDocument14 pagesSolutions of MatlabRaviKiranNo ratings yet

- To Design Different Filters On DSK TMS320C6713Document7 pagesTo Design Different Filters On DSK TMS320C6713Mohammad ArslaanNo ratings yet

- All All: CLC Clear Close LN 0:1:4 X (1 2 9 64 625) H (0 1 4 9 16) y Conv (X, H) Ly 0:length (Y) - 1Document32 pagesAll All: CLC Clear Close LN 0:1:4 X (1 2 9 64 625) H (0 1 4 9 16) y Conv (X, H) Ly 0:length (Y) - 1Mrityunjai SinghNo ratings yet

- Sem 5Document25 pagesSem 5koulickchakraborty5555No ratings yet

- Meet 09 - Algorithm ComplexityDocument27 pagesMeet 09 - Algorithm ComplexityJulianne ClaveNo ratings yet

- Output 2Document5 pagesOutput 2anilkoranga.pcNo ratings yet

- DSP Lab Manual Final Presidency UniversityDocument58 pagesDSP Lab Manual Final Presidency UniversitySUNIL KUMAR0% (1)

- Module of User Deined Function3Document30 pagesModule of User Deined Function3Vinayak SharmaNo ratings yet

- Time - Series - 1.ipynb - ColabDocument10 pagesTime - Series - 1.ipynb - Colabchltkdans159No ratings yet

- To Design Different Filters On DSK TMS320C6713Document12 pagesTo Design Different Filters On DSK TMS320C6713Mohammad ArslaanNo ratings yet

- DSP Final LabDocument30 pagesDSP Final Labdesi boyNo ratings yet

- DCC2006 SoundCardProgramming F6CTEDocument6 pagesDCC2006 SoundCardProgramming F6CTEProyec YectosNo ratings yet

- Lec9 EEE13 2s1617Document36 pagesLec9 EEE13 2s1617Nikko Angelo Dela RosaNo ratings yet

- DSP 72Document42 pagesDSP 72SakethNo ratings yet

- BharadwajDocument14 pagesBharadwajporas kajalaNo ratings yet

- Chhattisgarh Swami Vivekanand Technical University, Bhilai (C.G), IndiaDocument13 pagesChhattisgarh Swami Vivekanand Technical University, Bhilai (C.G), IndiayopNo ratings yet

- Implementatiion of Basic Signal Processing Functions in ScilabDocument13 pagesImplementatiion of Basic Signal Processing Functions in Scilabsreejithkrishna4No ratings yet

- Submitted By-Nishant Kumar Roll No-213ec5246: OutputDocument5 pagesSubmitted By-Nishant Kumar Roll No-213ec5246: OutputNishantKumarNo ratings yet

- Regression: 1 Implementación de Métodos de RegresiónDocument11 pagesRegression: 1 Implementación de Métodos de RegresiónÓscar Alfonso Gómez SepúlvedaNo ratings yet

- Third Year: Practical Work Book For The Course EE-393 Digital Signal ProcessingDocument44 pagesThird Year: Practical Work Book For The Course EE-393 Digital Signal ProcessingLakshmi KrishnaNo ratings yet

- EEE324 - Digital Signal ProcessingDocument6 pagesEEE324 - Digital Signal ProcessingSehrish AnsarNo ratings yet

- EE-493 Digital Signal Processing - 2013Document37 pagesEE-493 Digital Signal Processing - 2013Sana MahmoodNo ratings yet

- Lab Manual of Digital Signal Processing: Prepared By: Asst. Prof. J.N.ValaDocument38 pagesLab Manual of Digital Signal Processing: Prepared By: Asst. Prof. J.N.ValajaydeepjaydeepNo ratings yet

- Dspmanual MatlabDocument26 pagesDspmanual MatlabgsnaveenkumarNo ratings yet

- Experiment No.01: Object-Apparatus Required 1-For Addition - M-CodeDocument30 pagesExperiment No.01: Object-Apparatus Required 1-For Addition - M-CodeTeena SharmaNo ratings yet

- Lab 2Document5 pagesLab 2SRNo ratings yet

- DSP ManualDocument84 pagesDSP ManualBala913100% (1)

- SYSC 4405 Midterm2 Fall 2012Document2 pagesSYSC 4405 Midterm2 Fall 2012Aleksandra DiotteNo ratings yet

- Comp ProjectDocument30 pagesComp ProjectAnshu SinghNo ratings yet

- CS LAB Practical FileDocument17 pagesCS LAB Practical FileShiwank unknown gamer GuptaNo ratings yet

- DSP Lab01 HandoutDocument9 pagesDSP Lab01 HandoutHina ImtiazNo ratings yet

- DSP 2Document11 pagesDSP 2HARISABARISH J 21ECNo ratings yet

- REGNO:311119106029 Melodina Carnelian D Loyola - Icam College of Engineering and Technology (Licet)Document6 pagesREGNO:311119106029 Melodina Carnelian D Loyola - Icam College of Engineering and Technology (Licet)MELODINA CARNELIAN 19EC061No ratings yet

- Desain Rangkain KombinasionalDocument28 pagesDesain Rangkain KombinasionalAidi FinawanNo ratings yet

- 20011P0417 DSP Matlab AssignmentDocument12 pages20011P0417 DSP Matlab AssignmentNARENDRANo ratings yet

- Labsheet DSPDocument19 pagesLabsheet DSPhx477nNo ratings yet

- Part-A Experiments Using Matlab: DSP Lab ManualDocument40 pagesPart-A Experiments Using Matlab: DSP Lab ManualSharth KumarNo ratings yet

- Exp 1&2Document6 pagesExp 1&2ShahanasNo ratings yet

- Lab 4Document9 pagesLab 4shakaibNo ratings yet

- ADSP Lab ReportDocument45 pagesADSP Lab ReportsreenathNo ratings yet

- DSP New Manual1Document143 pagesDSP New Manual1Salai Kishwar JahanNo ratings yet

- Vidya Bhavan College For Engineering Technology, Rautapur, Chaubeypur, KanpurDocument22 pagesVidya Bhavan College For Engineering Technology, Rautapur, Chaubeypur, KanpurPrafful VermaNo ratings yet

- Expt 2FEEDBACKDocument16 pagesExpt 2FEEDBACKGnode GnodeNo ratings yet

- Cpe133 01Document9 pagesCpe133 01XDShadowkirbyNo ratings yet

- Projeto PassaBaixas FIRDocument12 pagesProjeto PassaBaixas FIRkevinkirstenlucasNo ratings yet

- Aman Thakur 22BCS16401 WS 1.1Document10 pagesAman Thakur 22BCS16401 WS 1.1heiwa8813No ratings yet

- Appendix A: Some Simple Facts Concerning Functions of Several VariablesDocument35 pagesAppendix A: Some Simple Facts Concerning Functions of Several VariablesazcodNo ratings yet

- Ritik Dubey - Ritik Dubey-1Document10 pagesRitik Dubey - Ritik Dubey-1Saurabh KumarNo ratings yet

- WCT Lab Assignment - 1Document5 pagesWCT Lab Assignment - 1Aayush SinghNo ratings yet

- Homework4 1Document10 pagesHomework4 1Yash SirowaNo ratings yet

- Plotting THE FREQUENCY RESPONSE IN MATLABDocument3 pagesPlotting THE FREQUENCY RESPONSE IN MATLABUbaid KhanNo ratings yet

- Wireless Communication Lab ETCS 463Document43 pagesWireless Communication Lab ETCS 463Mayank100% (1)

- Assignment 1 (B) : OutputDocument22 pagesAssignment 1 (B) : OutputArpit TyagiNo ratings yet

- Halstead Software ScienceDocument2 pagesHalstead Software Scienceyusra22100% (1)

- Simulation of Plane Sinusoidal Wave Propagation Through Lossy Dielectric Material Using Finite Difference Time Domain (FDTD) Modeling in PythonDocument8 pagesSimulation of Plane Sinusoidal Wave Propagation Through Lossy Dielectric Material Using Finite Difference Time Domain (FDTD) Modeling in PythonPalwinder Singh DhanjalNo ratings yet

- Adaptive Control Theory: Direct Self-Tuning Regulators and Internal ModelDocument27 pagesAdaptive Control Theory: Direct Self-Tuning Regulators and Internal ModelThanh NguyenNo ratings yet

- SIDEBPDocument1 pageSIDEBPVahidNo ratings yet

- FOURDocument16 pagesFOURVahidNo ratings yet

- LETTERDocument4 pagesLETTERVahidNo ratings yet

- (000063) PDFDocument268 pages(000063) PDFVahidNo ratings yet

- LETTERDocument2 pagesLETTERVahidNo ratings yet

- CORNDocument8 pagesCORNVahidNo ratings yet

- PRICDocument10 pagesPRICVahidNo ratings yet

- Understanding and Using The IEC 61850 A Case For Meta-ModellingDocument17 pagesUnderstanding and Using The IEC 61850 A Case For Meta-ModellingVahidNo ratings yet

- 000181Document50 pages000181VahidNo ratings yet

- Arabi MazaminDocument21 pagesArabi MazaminVahidNo ratings yet

- HVHF TransformerDocument10 pagesHVHF TransformerVahidNo ratings yet

- Practice Test #2 Problem Solving (197 Questions)Document45 pagesPractice Test #2 Problem Solving (197 Questions)Vahid0% (1)

- Book 2Document1,347 pagesBook 2VahidNo ratings yet

- Courtesy Prof Shahid Amin. Digitized by EgangotriDocument78 pagesCourtesy Prof Shahid Amin. Digitized by EgangotriVahidNo ratings yet

- Florence Famini: Module 4 Week 7&8 in Computer 9 (Web Designing Using HTML and CSS)Document7 pagesFlorence Famini: Module 4 Week 7&8 in Computer 9 (Web Designing Using HTML and CSS)Soliel RiegoNo ratings yet

- Christian Shematsi CV PDFDocument2 pagesChristian Shematsi CV PDFQasim JavedNo ratings yet

- PLC OpenDocument114 pagesPLC OpenŁukasz DziwuraNo ratings yet

- ECDL ICDL IT Security - Syllabus - V2.0 - Sample Part-Test - MSWIN7IE10 - V1 - 0Document9 pagesECDL ICDL IT Security - Syllabus - V2.0 - Sample Part-Test - MSWIN7IE10 - V1 - 0Del NoitNo ratings yet

- A Real-Time Flood Detection System Based On Machine Learning Algorithms With Emphasis OnDocument8 pagesA Real-Time Flood Detection System Based On Machine Learning Algorithms With Emphasis Onvyogi1414141414No ratings yet

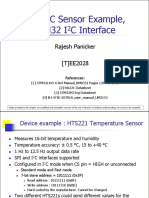

- (T) EE2028 Topic 8B I2C Sensor and STM32Document20 pages(T) EE2028 Topic 8B I2C Sensor and STM32Alex CarmonaNo ratings yet

- Philips Diagnostic X-Ray Upgrade and Benefit Program: Mobilediagnost WDR Rel 2.0/2.1Document3 pagesPhilips Diagnostic X-Ray Upgrade and Benefit Program: Mobilediagnost WDR Rel 2.0/2.1زكيعباديNo ratings yet

- Tx6A 10gig Utp Copper Cable With Advanced Matrix Technology: SpecificationsDocument2 pagesTx6A 10gig Utp Copper Cable With Advanced Matrix Technology: SpecificationsfguerreroaNo ratings yet

- HMITemplateSuiteV2 enDocument40 pagesHMITemplateSuiteV2 enSergNo ratings yet

- Test3 - Google SearchDocument2 pagesTest3 - Google SearchoglasifwdNo ratings yet

- Requirement SpecificationDocument18 pagesRequirement SpecificationMesele BerhanuNo ratings yet

- GeoVista Platform Logger7 - 4Document55 pagesGeoVista Platform Logger7 - 4عزالدينNo ratings yet

- MGW Installation GuideDocument23 pagesMGW Installation Guidemasoud.sharafi1970.09No ratings yet

- Manual Cordex 48-3.6KWDocument64 pagesManual Cordex 48-3.6KWPabloSanabriaNo ratings yet

- Configuration Management System (CMS)Document75 pagesConfiguration Management System (CMS)Preeti SinghNo ratings yet

- Computer EducationDocument4 pagesComputer Educationjonny talacayNo ratings yet

- Bourne Shell Scripting PDFDocument132 pagesBourne Shell Scripting PDFPieter VeendersNo ratings yet

- Basics of Contiki-OS PDFDocument32 pagesBasics of Contiki-OS PDFGhulam ShabbirNo ratings yet

- Consulting Specific ResumeDocument6 pagesConsulting Specific Resumeafjwduenevzdaa100% (2)

- Reporter 9.5.1.1 ReleaseNotesDocument12 pagesReporter 9.5.1.1 ReleaseNotesRoland HoNo ratings yet

- 8051 IntroductionDocument45 pages8051 IntroductionMohit MittalNo ratings yet

- All in One Seo Report - Manual: SL NoDocument9 pagesAll in One Seo Report - Manual: SL NoscribdmemNo ratings yet

- Mswipe WisePad API4.0.0 Integration Guide Android VersionDocument47 pagesMswipe WisePad API4.0.0 Integration Guide Android Versiondeepak.angrula506No ratings yet

- Eletrobisturi - BC Biomedical ESU 2400Document190 pagesEletrobisturi - BC Biomedical ESU 2400Victor HugoNo ratings yet

- Manual PacDrive C400Document8 pagesManual PacDrive C400Ulises PereiraNo ratings yet

- 2020 Samsung SMART Hospitality Displays: About Samsung Electronics Co., LTDDocument11 pages2020 Samsung SMART Hospitality Displays: About Samsung Electronics Co., LTDAchmad AminNo ratings yet

- WebInterface Configuration Manual BasicsDocument32 pagesWebInterface Configuration Manual BasicsprenticNo ratings yet