Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

8 viewsIncome Statement

Income Statement

Uploaded by

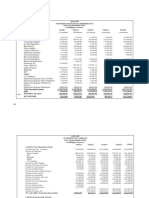

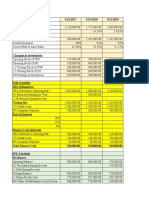

Chille Nchimunya BwalyaThe income statement shows the projected revenues and expenses over 5 years for a tyre pyrolysis project. In year 1, the project is expected to generate $38.7 million in revenue and $5.5 million in expenses, resulting in a $13.8 million profit before tax. Profits are projected to increase each year as production capacity expands from 50% in year 1 to 90% in year 5. The main revenue sources are oil, light oil, carbon black, and steel wire generated from tyre pyrolysis. Expenses include staff salaries, utilities, maintenance, depreciation, and taxes. By year 5, the project is expected to earn $18.1 million in annual profit after taxes.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Deutsche - DTC - PofDocument2 pagesDeutsche - DTC - PofChille Nchimunya Bwalya100% (2)

- Deutsche Bank-POF VerbiageDocument2 pagesDeutsche Bank-POF VerbiageChille Nchimunya Bwalya100% (2)

- Tumble Dry Project Financial ReportDocument3 pagesTumble Dry Project Financial ReportAkash SanganiNo ratings yet

- Leroy Merlin - Coastal Hire Price Guide 2019 - March 2019 PDFDocument2 pagesLeroy Merlin - Coastal Hire Price Guide 2019 - March 2019 PDFMphoNhlobaneMAK-g100% (1)

- Fall Protection Survey of RIG 40Document3 pagesFall Protection Survey of RIG 40Kevin Josh Bonales100% (1)

- Essay FIN202Document5 pagesEssay FIN202thaindnds180468No ratings yet

- Sales Operating Expense: LessDocument10 pagesSales Operating Expense: LessShiela Mae Azarcon TuvillaNo ratings yet

- Items Cost Cost ( N ) : Cleaners Food Technicians Security Guards Other Total Salary Labor Salary in NairaDocument4 pagesItems Cost Cost ( N ) : Cleaners Food Technicians Security Guards Other Total Salary Labor Salary in NairababatundeNo ratings yet

- Departmentalization Problem Key UeDocument2 pagesDepartmentalization Problem Key Ueedrianclyde100% (1)

- Cost Sheet - GenX - Team 4 .2Document7 pagesCost Sheet - GenX - Team 4 .2sanketmistry32No ratings yet

- Financial Projection For 5 Years-Revision4Document10 pagesFinancial Projection For 5 Years-Revision4Azmani AbdullahNo ratings yet

- SAVINGS BREAKDOWN 2023 For Update Any ObligationDocument25 pagesSAVINGS BREAKDOWN 2023 For Update Any ObligationLGU BinmaleyNo ratings yet

- Class 7 - Comprehensive CaseDocument4 pagesClass 7 - Comprehensive CasePurple BeastNo ratings yet

- Pangibitan, Geojanni R. - Activity 3 - A5Document4 pagesPangibitan, Geojanni R. - Activity 3 - A5Geojanni PangibitanNo ratings yet

- Dventure 1Document10 pagesDventure 1Jess Guiang CasamorinNo ratings yet

- Acquisition Cash FlowDocument3 pagesAcquisition Cash Flowkaeya alberichNo ratings yet

- German Laundry Franchisee Mother 31.05.2019 (1)Document74 pagesGerman Laundry Franchisee Mother 31.05.2019 (1)absolarsystems7No ratings yet

- Prolongation Cost RevisedDocument2 pagesProlongation Cost RevisedSvh KameshNo ratings yet

- Monthly Budget: Company NameDocument2 pagesMonthly Budget: Company NameMalleshNo ratings yet

- Budget 2021Document5 pagesBudget 2021Jobeth DaculaNo ratings yet

- SAAO As of February 28, 2011Document68 pagesSAAO As of February 28, 2011Budget Department - GenSan LGU100% (1)

- Corporate Valuation: Group - 2Document6 pagesCorporate Valuation: Group - 2RiturajPaulNo ratings yet

- Accomp and Cost Monitoring CCT Dimayuga Residence CSA 11.23.2022Document2 pagesAccomp and Cost Monitoring CCT Dimayuga Residence CSA 11.23.2022Julius Dean DumaguingNo ratings yet

- Q1Document31 pagesQ1Bhaskkar SinhaNo ratings yet

- ACCOUNTING FOR LABOR AND OH LectureDocument13 pagesACCOUNTING FOR LABOR AND OH LectureNah HamzaNo ratings yet

- 2022-26 2022 Total Unit Sales Total Revenue (Crore) Net Revenue (Crore) Total Expenses (Crore) Net Income (Crore) Crore in BDTDocument40 pages2022-26 2022 Total Unit Sales Total Revenue (Crore) Net Revenue (Crore) Total Expenses (Crore) Net Income (Crore) Crore in BDTAbdul MalakNo ratings yet

- Rafiki Net Cashflow Projections For 2024-2025Document7 pagesRafiki Net Cashflow Projections For 2024-2025marioNo ratings yet

- Financial Slide For ReportDocument6 pagesFinancial Slide For ReportTuan Noridham Tuan LahNo ratings yet

- AST LTCC ComputationDocument9 pagesAST LTCC ComputationeiraNo ratings yet

- Case Study CharlieDocument9 pagesCase Study CharlieHIMANSHU AGRAWALNo ratings yet

- Financial Model 1Document1 pageFinancial Model 1ahmedmostafaibrahim22No ratings yet

- Monthly Budget: Chicken StarDocument4 pagesMonthly Budget: Chicken StarFathy ManzanillaNo ratings yet

- Projected Broiler Farm (20,000)Document1 pageProjected Broiler Farm (20,000)Eean KicapNo ratings yet

- Mid Term BAV - 12 Oct 2017 - SolutionDocument2 pagesMid Term BAV - 12 Oct 2017 - SolutionMAYANK JAINNo ratings yet

- SL - No Name of Assst No Rate AmountDocument21 pagesSL - No Name of Assst No Rate Amountlegalsg75No ratings yet

- Capital BudgetingDocument20 pagesCapital BudgetingAngelo VilladoresNo ratings yet

- Salarios y PrestacionesDocument2 pagesSalarios y PrestacionesWalner Elias Asprilla MosqueraNo ratings yet

- Financial StatementDocument36 pagesFinancial StatementJigoku ShojuNo ratings yet

- Adjusting EntriesDocument18 pagesAdjusting EntriesTristan John MagrareNo ratings yet

- Capital Budgeting Techniques and Cash Flows Class ExerciseDocument6 pagesCapital Budgeting Techniques and Cash Flows Class ExerciseReynaldi DimasNo ratings yet

- Projection - FahadDocument4 pagesProjection - Fahadumerking2288No ratings yet

- Contoh Soal Flexibel Budget PDFDocument3 pagesContoh Soal Flexibel Budget PDFJaihut NainggolanNo ratings yet

- Advanced Corporate Finance Case 2Document3 pagesAdvanced Corporate Finance Case 2Adrien PortemontNo ratings yet

- Island Power (IPWR) Incremental Earning Forecast For The Project (Purchasing Machine Outright) From The Year 2017-2022Document4 pagesIsland Power (IPWR) Incremental Earning Forecast For The Project (Purchasing Machine Outright) From The Year 2017-2022Ruma RashydNo ratings yet

- Capital BudgetingDocument14 pagesCapital BudgetingbhaskkarNo ratings yet

- GRABICATION FS 10mosDocument37 pagesGRABICATION FS 10mosJbNo ratings yet

- Operating Performance: Air Philippines Employees' CooperativeDocument4 pagesOperating Performance: Air Philippines Employees' CooperativeChristian LlanteroNo ratings yet

- BSU Request266Document9 pagesBSU Request266RESHIEL MEDELNo ratings yet

- Projected Profit and Loss 2023Document6 pagesProjected Profit and Loss 2023Emmanuel LaysonNo ratings yet

- Monthely BudgetDocument4 pagesMonthely Budgetم سليمانNo ratings yet

- Profit & Loss PT TCP M Arif Rahman - 2005151018 - Akp-3aDocument1 pageProfit & Loss PT TCP M Arif Rahman - 2005151018 - Akp-3aM Arif RahmanNo ratings yet

- 2016 PPDocument13 pages2016 PPumeshNo ratings yet

- Basic Underlying Accounting PrinciplesDocument67 pagesBasic Underlying Accounting Principlesraymond guintibanoNo ratings yet

- Perhitungan Cash FlowDocument10 pagesPerhitungan Cash FlowhafizhNo ratings yet

- No 1Document3 pagesNo 1North KSDNo ratings yet

- Exhibit 2 Runcorn Chemicals DCF Analysis of Merseyside ProjectDocument1 pageExhibit 2 Runcorn Chemicals DCF Analysis of Merseyside ProjectBatool HamzaNo ratings yet

- Feasibility Chapter 3Document18 pagesFeasibility Chapter 3ROSE MARIE ROCONo ratings yet

- How To Compute Basic Income TaxDocument11 pagesHow To Compute Basic Income Taxkate trishaNo ratings yet

- Forever Young Campsite Projected Trading Profit & Loss Account For The Period Ended 31St DecemberDocument4 pagesForever Young Campsite Projected Trading Profit & Loss Account For The Period Ended 31St DecembermwauracoletNo ratings yet

- Three Statement Model 14-07-2021 (F3)Document16 pagesThree Statement Model 14-07-2021 (F3)Vaibhav BorateNo ratings yet

- Workings 23apr24Document4 pagesWorkings 23apr24Thomas DevaNo ratings yet

- Profit and Loss ProjectionDocument1 pageProfit and Loss ProjectionAbel GetachewNo ratings yet

- Private EquityDocument4 pagesPrivate EquityChille Nchimunya BwalyaNo ratings yet

- Reference Term Sheet For Non-Recourse Infrastructure Loans in Emerging MarketsDocument5 pagesReference Term Sheet For Non-Recourse Infrastructure Loans in Emerging MarketsChille Nchimunya BwalyaNo ratings yet

- Proposed Children'S Orphanage To Be Built at Kifaru Njia Panda-Moshi, KilimanjaroDocument4 pagesProposed Children'S Orphanage To Be Built at Kifaru Njia Panda-Moshi, KilimanjaroChille Nchimunya BwalyaNo ratings yet

- in Regards To The Offshore Registration and Please Know That A GBC 2 Conducts Business OutsideDocument6 pagesin Regards To The Offshore Registration and Please Know That A GBC 2 Conducts Business OutsideChille Nchimunya BwalyaNo ratings yet

- Hotel Development Term Sheet Hilton Garden Inn, City of Enid, OklahomaDocument12 pagesHotel Development Term Sheet Hilton Garden Inn, City of Enid, OklahomaChille Nchimunya BwalyaNo ratings yet

- Loan Equity Financing of PIODocument2 pagesLoan Equity Financing of PIOChille Nchimunya BwalyaNo ratings yet

- Tender 2Document72 pagesTender 2Chille Nchimunya BwalyaNo ratings yet

- Law Insider Quadra-Projects-Inc Finders-Fee-Agreement Filed 04-03-2009 ContractDocument7 pagesLaw Insider Quadra-Projects-Inc Finders-Fee-Agreement Filed 04-03-2009 ContractChille Nchimunya BwalyaNo ratings yet

- JBS Aberdeen Company Profile PPEDocument20 pagesJBS Aberdeen Company Profile PPEChille Nchimunya BwalyaNo ratings yet

- Sppe Profile 2015Document9 pagesSppe Profile 2015Chille Nchimunya BwalyaNo ratings yet

- Finder'S Fee Agreement: This Agreement Is Made This 5 Day of January 2009Document11 pagesFinder'S Fee Agreement: This Agreement Is Made This 5 Day of January 2009Chille Nchimunya BwalyaNo ratings yet

- Fault Codes: Address: Postal Address: Phone: Fax: E-Mail: HomepageDocument3 pagesFault Codes: Address: Postal Address: Phone: Fax: E-Mail: HomepageLudmila CroitoruNo ratings yet

- Thc120e3 Rt-Prc023-En - 05162012Document236 pagesThc120e3 Rt-Prc023-En - 05162012selvamejiaNo ratings yet

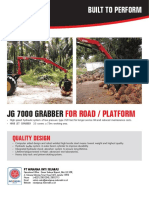

- Edit HIABDocument2 pagesEdit HIABRNo ratings yet

- Cooperative A UsDocument6 pagesCooperative A UscjethmalaniNo ratings yet

- 0625 w16 Ms 32Document10 pages0625 w16 Ms 32yuke kristinaNo ratings yet

- Inhibition of X80 Steel Corrosion in Oilfield Acidizing Environment PDFDocument9 pagesInhibition of X80 Steel Corrosion in Oilfield Acidizing Environment PDFLê CôngNo ratings yet

- My Recent Responsibilities Were Mainly ToDocument5 pagesMy Recent Responsibilities Were Mainly Tocherif yahyaouiNo ratings yet

- GX390 UT2 EnglishDocument42 pagesGX390 UT2 EnglishMike HadenNo ratings yet

- NC8 Patient Monitor: Intuitive Operation DesignDocument2 pagesNC8 Patient Monitor: Intuitive Operation DesignXinwen ChenNo ratings yet

- Laboratory em 4 Mercury PorosimetryDocument4 pagesLaboratory em 4 Mercury Porosimetrysaikat_cepNo ratings yet

- 2 - MPR-3 4 Series Register TableDocument14 pages2 - MPR-3 4 Series Register TableHabineza RemyNo ratings yet

- Challenges and Strategies of Rural Electrification Program For Electric Cooperatives in Central Luzon, PhilippinesDocument9 pagesChallenges and Strategies of Rural Electrification Program For Electric Cooperatives in Central Luzon, PhilippinesIOER International Multidisciplinary Research Journal ( IIMRJ)No ratings yet

- ISO 6743-10 - 1989 - Part. 10 - Family Y - MiscellaneousDocument8 pagesISO 6743-10 - 1989 - Part. 10 - Family Y - MiscellaneousMassimiliano VolaNo ratings yet

- Physics - Burglar AlarmDocument4 pagesPhysics - Burglar AlarmduderamNo ratings yet

- Chapter 08Document14 pagesChapter 08Gianne Karl AlmarinesNo ratings yet

- India and Sustainable Development Goals SDGsDocument2 pagesIndia and Sustainable Development Goals SDGsPritish MohanNo ratings yet

- Coordination CompdsDocument7 pagesCoordination CompdsAnil BahriNo ratings yet

- CDocument6 pagesCIhtisham Ul HaqNo ratings yet

- Universe Series Catalogu - TSURUMI PUMPDocument11 pagesUniverse Series Catalogu - TSURUMI PUMPpapathsheilaNo ratings yet

- Training Couses CatalogueDocument99 pagesTraining Couses CatalogueZ Babar KhanNo ratings yet

- Special Theory of ReletivityDocument41 pagesSpecial Theory of ReletivityRM FakharNo ratings yet

- Toothed CouplingsDocument47 pagesToothed CouplingsROUSSMATNo ratings yet

- 38-Hydraulic Design of Reservoir Outlet WorksDocument201 pages38-Hydraulic Design of Reservoir Outlet WorksAbdi RahimianNo ratings yet

- User Sessions - 8 - 25 - 2023 9 - 18 - 49 AMDocument8 pagesUser Sessions - 8 - 25 - 2023 9 - 18 - 49 AMElgene YoungNo ratings yet

- ERV Floating ProcedureDocument16 pagesERV Floating ProcedureDipti BhanjaNo ratings yet

- KIA KIA KIA: 1.descriptionDocument5 pagesKIA KIA KIA: 1.descriptionhugos31No ratings yet

- 793p 347351Document5 pages793p 347351BobdNo ratings yet

- Transportation Portfolio by Sapa Building System - ENDocument26 pagesTransportation Portfolio by Sapa Building System - ENSapa Building SystemNo ratings yet

Income Statement

Income Statement

Uploaded by

Chille Nchimunya Bwalya0 ratings0% found this document useful (0 votes)

8 views2 pagesThe income statement shows the projected revenues and expenses over 5 years for a tyre pyrolysis project. In year 1, the project is expected to generate $38.7 million in revenue and $5.5 million in expenses, resulting in a $13.8 million profit before tax. Profits are projected to increase each year as production capacity expands from 50% in year 1 to 90% in year 5. The main revenue sources are oil, light oil, carbon black, and steel wire generated from tyre pyrolysis. Expenses include staff salaries, utilities, maintenance, depreciation, and taxes. By year 5, the project is expected to earn $18.1 million in annual profit after taxes.

Original Description:

Income Statement

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe income statement shows the projected revenues and expenses over 5 years for a tyre pyrolysis project. In year 1, the project is expected to generate $38.7 million in revenue and $5.5 million in expenses, resulting in a $13.8 million profit before tax. Profits are projected to increase each year as production capacity expands from 50% in year 1 to 90% in year 5. The main revenue sources are oil, light oil, carbon black, and steel wire generated from tyre pyrolysis. Expenses include staff salaries, utilities, maintenance, depreciation, and taxes. By year 5, the project is expected to earn $18.1 million in annual profit after taxes.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

8 views2 pagesIncome Statement

Income Statement

Uploaded by

Chille Nchimunya BwalyaThe income statement shows the projected revenues and expenses over 5 years for a tyre pyrolysis project. In year 1, the project is expected to generate $38.7 million in revenue and $5.5 million in expenses, resulting in a $13.8 million profit before tax. Profits are projected to increase each year as production capacity expands from 50% in year 1 to 90% in year 5. The main revenue sources are oil, light oil, carbon black, and steel wire generated from tyre pyrolysis. Expenses include staff salaries, utilities, maintenance, depreciation, and taxes. By year 5, the project is expected to earn $18.1 million in annual profit after taxes.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

Income Statement (Values in US$)

Year 1 2 3 4 5

TYRE PYROLYSIS PROJECT 1 1 1 1 1

AT 100%

50% 60% 70% 80% 90%

PRODUCTION CAPACITY CAPACITY

PRODUCTS:

Oil Yield@$0.85 (40% - 50%) 45% = $26,775,000

31.5mKg 0.85 X 31,500,000

Light Oil@$0.85 (5% - 10%) 10% = 7mKg $5,950,000

0.85 X 7,000,000

Carbon Black@$196.1/ton (35% - 40%) 38% $5,216,260

= 26.6mKg 196.1 X 26,600

Steel Wire@$71.9/ton 15% = 10.5mKg 71.9 $754,950

X 10500

Syngas (3% - 5%) 5% = 3.5mKg. Not to be

sold, but to power equipment

Gross Revenue (USD) US$38,696,210.00 US$19,348,105.00 US$23,217,726.00 US$27,087,347 US$30,956,968.00 US$34,826,589.00

EXPENDITURES

Installation staff on site @120/day 32,400.00 - - - -

from Equipment Producers

Freight 126,000.00 - - - -

Customs Duties and Clearing costs 50,000.00 - - - -

Salaries 100,620.00 115,713.00 133,070 153,030 175,985

19,231.00 24,150 27,775 31,940 36,740

Travels and Training

Licensing Costs (DPR) 200,000.00 50,000 50,000 50,000 50,000

Licensing Costs: * a. NEPA b.

100,000.00 20,000 20,000 20,000 20,000

NESREA

Installation & Testing 80,000.00 - - - -

Utilities 10,000.00 11,500 13,225 15,210 17,500

Government Levies 10,000.00 11,500 13,225 15,210 17,500

Maintenance 75,000.00 86,250 99,200 114,100 131,215

10,000.00 11,500 13,225 15,210 17,500

Office Running Costs

Fueling for Vehicles 21,000 24,150 27,775 31,940 36,740

General Overhauling - - - - 1,500,000.00

Stock/ Raw Materials One Year 3,213,000.00 3,694,950 4,249,193 4,886, 572 5, 619,558

1,480,496.00 1,480,496.00 1,480,496.00 1,306,496.00

Depreciation 1,480,496.00

Total Expenses 5,527, 747 5, 530,209 6,127,184.00 6,813,708.00 8,929,234.00

Profit Before Tax 13, 820,358 17, 687,517 20,960,163 24,143,260 25,897,355

4,146,107.00 5,306, 255 7,242,978.00 7,769,207.00

Tax (30%) 6,288,049.00

Profit After Tax 9, 674,251 12,381,262.00 14,672,114.00 16,900,282.00 18,128,148.00

You might also like

- Deutsche - DTC - PofDocument2 pagesDeutsche - DTC - PofChille Nchimunya Bwalya100% (2)

- Deutsche Bank-POF VerbiageDocument2 pagesDeutsche Bank-POF VerbiageChille Nchimunya Bwalya100% (2)

- Tumble Dry Project Financial ReportDocument3 pagesTumble Dry Project Financial ReportAkash SanganiNo ratings yet

- Leroy Merlin - Coastal Hire Price Guide 2019 - March 2019 PDFDocument2 pagesLeroy Merlin - Coastal Hire Price Guide 2019 - March 2019 PDFMphoNhlobaneMAK-g100% (1)

- Fall Protection Survey of RIG 40Document3 pagesFall Protection Survey of RIG 40Kevin Josh Bonales100% (1)

- Essay FIN202Document5 pagesEssay FIN202thaindnds180468No ratings yet

- Sales Operating Expense: LessDocument10 pagesSales Operating Expense: LessShiela Mae Azarcon TuvillaNo ratings yet

- Items Cost Cost ( N ) : Cleaners Food Technicians Security Guards Other Total Salary Labor Salary in NairaDocument4 pagesItems Cost Cost ( N ) : Cleaners Food Technicians Security Guards Other Total Salary Labor Salary in NairababatundeNo ratings yet

- Departmentalization Problem Key UeDocument2 pagesDepartmentalization Problem Key Ueedrianclyde100% (1)

- Cost Sheet - GenX - Team 4 .2Document7 pagesCost Sheet - GenX - Team 4 .2sanketmistry32No ratings yet

- Financial Projection For 5 Years-Revision4Document10 pagesFinancial Projection For 5 Years-Revision4Azmani AbdullahNo ratings yet

- SAVINGS BREAKDOWN 2023 For Update Any ObligationDocument25 pagesSAVINGS BREAKDOWN 2023 For Update Any ObligationLGU BinmaleyNo ratings yet

- Class 7 - Comprehensive CaseDocument4 pagesClass 7 - Comprehensive CasePurple BeastNo ratings yet

- Pangibitan, Geojanni R. - Activity 3 - A5Document4 pagesPangibitan, Geojanni R. - Activity 3 - A5Geojanni PangibitanNo ratings yet

- Dventure 1Document10 pagesDventure 1Jess Guiang CasamorinNo ratings yet

- Acquisition Cash FlowDocument3 pagesAcquisition Cash Flowkaeya alberichNo ratings yet

- German Laundry Franchisee Mother 31.05.2019 (1)Document74 pagesGerman Laundry Franchisee Mother 31.05.2019 (1)absolarsystems7No ratings yet

- Prolongation Cost RevisedDocument2 pagesProlongation Cost RevisedSvh KameshNo ratings yet

- Monthly Budget: Company NameDocument2 pagesMonthly Budget: Company NameMalleshNo ratings yet

- Budget 2021Document5 pagesBudget 2021Jobeth DaculaNo ratings yet

- SAAO As of February 28, 2011Document68 pagesSAAO As of February 28, 2011Budget Department - GenSan LGU100% (1)

- Corporate Valuation: Group - 2Document6 pagesCorporate Valuation: Group - 2RiturajPaulNo ratings yet

- Accomp and Cost Monitoring CCT Dimayuga Residence CSA 11.23.2022Document2 pagesAccomp and Cost Monitoring CCT Dimayuga Residence CSA 11.23.2022Julius Dean DumaguingNo ratings yet

- Q1Document31 pagesQ1Bhaskkar SinhaNo ratings yet

- ACCOUNTING FOR LABOR AND OH LectureDocument13 pagesACCOUNTING FOR LABOR AND OH LectureNah HamzaNo ratings yet

- 2022-26 2022 Total Unit Sales Total Revenue (Crore) Net Revenue (Crore) Total Expenses (Crore) Net Income (Crore) Crore in BDTDocument40 pages2022-26 2022 Total Unit Sales Total Revenue (Crore) Net Revenue (Crore) Total Expenses (Crore) Net Income (Crore) Crore in BDTAbdul MalakNo ratings yet

- Rafiki Net Cashflow Projections For 2024-2025Document7 pagesRafiki Net Cashflow Projections For 2024-2025marioNo ratings yet

- Financial Slide For ReportDocument6 pagesFinancial Slide For ReportTuan Noridham Tuan LahNo ratings yet

- AST LTCC ComputationDocument9 pagesAST LTCC ComputationeiraNo ratings yet

- Case Study CharlieDocument9 pagesCase Study CharlieHIMANSHU AGRAWALNo ratings yet

- Financial Model 1Document1 pageFinancial Model 1ahmedmostafaibrahim22No ratings yet

- Monthly Budget: Chicken StarDocument4 pagesMonthly Budget: Chicken StarFathy ManzanillaNo ratings yet

- Projected Broiler Farm (20,000)Document1 pageProjected Broiler Farm (20,000)Eean KicapNo ratings yet

- Mid Term BAV - 12 Oct 2017 - SolutionDocument2 pagesMid Term BAV - 12 Oct 2017 - SolutionMAYANK JAINNo ratings yet

- SL - No Name of Assst No Rate AmountDocument21 pagesSL - No Name of Assst No Rate Amountlegalsg75No ratings yet

- Capital BudgetingDocument20 pagesCapital BudgetingAngelo VilladoresNo ratings yet

- Salarios y PrestacionesDocument2 pagesSalarios y PrestacionesWalner Elias Asprilla MosqueraNo ratings yet

- Financial StatementDocument36 pagesFinancial StatementJigoku ShojuNo ratings yet

- Adjusting EntriesDocument18 pagesAdjusting EntriesTristan John MagrareNo ratings yet

- Capital Budgeting Techniques and Cash Flows Class ExerciseDocument6 pagesCapital Budgeting Techniques and Cash Flows Class ExerciseReynaldi DimasNo ratings yet

- Projection - FahadDocument4 pagesProjection - Fahadumerking2288No ratings yet

- Contoh Soal Flexibel Budget PDFDocument3 pagesContoh Soal Flexibel Budget PDFJaihut NainggolanNo ratings yet

- Advanced Corporate Finance Case 2Document3 pagesAdvanced Corporate Finance Case 2Adrien PortemontNo ratings yet

- Island Power (IPWR) Incremental Earning Forecast For The Project (Purchasing Machine Outright) From The Year 2017-2022Document4 pagesIsland Power (IPWR) Incremental Earning Forecast For The Project (Purchasing Machine Outright) From The Year 2017-2022Ruma RashydNo ratings yet

- Capital BudgetingDocument14 pagesCapital BudgetingbhaskkarNo ratings yet

- GRABICATION FS 10mosDocument37 pagesGRABICATION FS 10mosJbNo ratings yet

- Operating Performance: Air Philippines Employees' CooperativeDocument4 pagesOperating Performance: Air Philippines Employees' CooperativeChristian LlanteroNo ratings yet

- BSU Request266Document9 pagesBSU Request266RESHIEL MEDELNo ratings yet

- Projected Profit and Loss 2023Document6 pagesProjected Profit and Loss 2023Emmanuel LaysonNo ratings yet

- Monthely BudgetDocument4 pagesMonthely Budgetم سليمانNo ratings yet

- Profit & Loss PT TCP M Arif Rahman - 2005151018 - Akp-3aDocument1 pageProfit & Loss PT TCP M Arif Rahman - 2005151018 - Akp-3aM Arif RahmanNo ratings yet

- 2016 PPDocument13 pages2016 PPumeshNo ratings yet

- Basic Underlying Accounting PrinciplesDocument67 pagesBasic Underlying Accounting Principlesraymond guintibanoNo ratings yet

- Perhitungan Cash FlowDocument10 pagesPerhitungan Cash FlowhafizhNo ratings yet

- No 1Document3 pagesNo 1North KSDNo ratings yet

- Exhibit 2 Runcorn Chemicals DCF Analysis of Merseyside ProjectDocument1 pageExhibit 2 Runcorn Chemicals DCF Analysis of Merseyside ProjectBatool HamzaNo ratings yet

- Feasibility Chapter 3Document18 pagesFeasibility Chapter 3ROSE MARIE ROCONo ratings yet

- How To Compute Basic Income TaxDocument11 pagesHow To Compute Basic Income Taxkate trishaNo ratings yet

- Forever Young Campsite Projected Trading Profit & Loss Account For The Period Ended 31St DecemberDocument4 pagesForever Young Campsite Projected Trading Profit & Loss Account For The Period Ended 31St DecembermwauracoletNo ratings yet

- Three Statement Model 14-07-2021 (F3)Document16 pagesThree Statement Model 14-07-2021 (F3)Vaibhav BorateNo ratings yet

- Workings 23apr24Document4 pagesWorkings 23apr24Thomas DevaNo ratings yet

- Profit and Loss ProjectionDocument1 pageProfit and Loss ProjectionAbel GetachewNo ratings yet

- Private EquityDocument4 pagesPrivate EquityChille Nchimunya BwalyaNo ratings yet

- Reference Term Sheet For Non-Recourse Infrastructure Loans in Emerging MarketsDocument5 pagesReference Term Sheet For Non-Recourse Infrastructure Loans in Emerging MarketsChille Nchimunya BwalyaNo ratings yet

- Proposed Children'S Orphanage To Be Built at Kifaru Njia Panda-Moshi, KilimanjaroDocument4 pagesProposed Children'S Orphanage To Be Built at Kifaru Njia Panda-Moshi, KilimanjaroChille Nchimunya BwalyaNo ratings yet

- in Regards To The Offshore Registration and Please Know That A GBC 2 Conducts Business OutsideDocument6 pagesin Regards To The Offshore Registration and Please Know That A GBC 2 Conducts Business OutsideChille Nchimunya BwalyaNo ratings yet

- Hotel Development Term Sheet Hilton Garden Inn, City of Enid, OklahomaDocument12 pagesHotel Development Term Sheet Hilton Garden Inn, City of Enid, OklahomaChille Nchimunya BwalyaNo ratings yet

- Loan Equity Financing of PIODocument2 pagesLoan Equity Financing of PIOChille Nchimunya BwalyaNo ratings yet

- Tender 2Document72 pagesTender 2Chille Nchimunya BwalyaNo ratings yet

- Law Insider Quadra-Projects-Inc Finders-Fee-Agreement Filed 04-03-2009 ContractDocument7 pagesLaw Insider Quadra-Projects-Inc Finders-Fee-Agreement Filed 04-03-2009 ContractChille Nchimunya BwalyaNo ratings yet

- JBS Aberdeen Company Profile PPEDocument20 pagesJBS Aberdeen Company Profile PPEChille Nchimunya BwalyaNo ratings yet

- Sppe Profile 2015Document9 pagesSppe Profile 2015Chille Nchimunya BwalyaNo ratings yet

- Finder'S Fee Agreement: This Agreement Is Made This 5 Day of January 2009Document11 pagesFinder'S Fee Agreement: This Agreement Is Made This 5 Day of January 2009Chille Nchimunya BwalyaNo ratings yet

- Fault Codes: Address: Postal Address: Phone: Fax: E-Mail: HomepageDocument3 pagesFault Codes: Address: Postal Address: Phone: Fax: E-Mail: HomepageLudmila CroitoruNo ratings yet

- Thc120e3 Rt-Prc023-En - 05162012Document236 pagesThc120e3 Rt-Prc023-En - 05162012selvamejiaNo ratings yet

- Edit HIABDocument2 pagesEdit HIABRNo ratings yet

- Cooperative A UsDocument6 pagesCooperative A UscjethmalaniNo ratings yet

- 0625 w16 Ms 32Document10 pages0625 w16 Ms 32yuke kristinaNo ratings yet

- Inhibition of X80 Steel Corrosion in Oilfield Acidizing Environment PDFDocument9 pagesInhibition of X80 Steel Corrosion in Oilfield Acidizing Environment PDFLê CôngNo ratings yet

- My Recent Responsibilities Were Mainly ToDocument5 pagesMy Recent Responsibilities Were Mainly Tocherif yahyaouiNo ratings yet

- GX390 UT2 EnglishDocument42 pagesGX390 UT2 EnglishMike HadenNo ratings yet

- NC8 Patient Monitor: Intuitive Operation DesignDocument2 pagesNC8 Patient Monitor: Intuitive Operation DesignXinwen ChenNo ratings yet

- Laboratory em 4 Mercury PorosimetryDocument4 pagesLaboratory em 4 Mercury Porosimetrysaikat_cepNo ratings yet

- 2 - MPR-3 4 Series Register TableDocument14 pages2 - MPR-3 4 Series Register TableHabineza RemyNo ratings yet

- Challenges and Strategies of Rural Electrification Program For Electric Cooperatives in Central Luzon, PhilippinesDocument9 pagesChallenges and Strategies of Rural Electrification Program For Electric Cooperatives in Central Luzon, PhilippinesIOER International Multidisciplinary Research Journal ( IIMRJ)No ratings yet

- ISO 6743-10 - 1989 - Part. 10 - Family Y - MiscellaneousDocument8 pagesISO 6743-10 - 1989 - Part. 10 - Family Y - MiscellaneousMassimiliano VolaNo ratings yet

- Physics - Burglar AlarmDocument4 pagesPhysics - Burglar AlarmduderamNo ratings yet

- Chapter 08Document14 pagesChapter 08Gianne Karl AlmarinesNo ratings yet

- India and Sustainable Development Goals SDGsDocument2 pagesIndia and Sustainable Development Goals SDGsPritish MohanNo ratings yet

- Coordination CompdsDocument7 pagesCoordination CompdsAnil BahriNo ratings yet

- CDocument6 pagesCIhtisham Ul HaqNo ratings yet

- Universe Series Catalogu - TSURUMI PUMPDocument11 pagesUniverse Series Catalogu - TSURUMI PUMPpapathsheilaNo ratings yet

- Training Couses CatalogueDocument99 pagesTraining Couses CatalogueZ Babar KhanNo ratings yet

- Special Theory of ReletivityDocument41 pagesSpecial Theory of ReletivityRM FakharNo ratings yet

- Toothed CouplingsDocument47 pagesToothed CouplingsROUSSMATNo ratings yet

- 38-Hydraulic Design of Reservoir Outlet WorksDocument201 pages38-Hydraulic Design of Reservoir Outlet WorksAbdi RahimianNo ratings yet

- User Sessions - 8 - 25 - 2023 9 - 18 - 49 AMDocument8 pagesUser Sessions - 8 - 25 - 2023 9 - 18 - 49 AMElgene YoungNo ratings yet

- ERV Floating ProcedureDocument16 pagesERV Floating ProcedureDipti BhanjaNo ratings yet

- KIA KIA KIA: 1.descriptionDocument5 pagesKIA KIA KIA: 1.descriptionhugos31No ratings yet

- 793p 347351Document5 pages793p 347351BobdNo ratings yet

- Transportation Portfolio by Sapa Building System - ENDocument26 pagesTransportation Portfolio by Sapa Building System - ENSapa Building SystemNo ratings yet