Professional Documents

Culture Documents

Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt Contributions

Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt Contributions

Uploaded by

Zarah BernabeCopyright:

Available Formats

You might also like

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt Contributionszayn malikNo ratings yet

- Ias 20 QuestionsDocument6 pagesIas 20 QuestionsGonest Gone'stoëriaNo ratings yet

- Capital Markets and Investments INCOMPLETE - DastidarDocument32 pagesCapital Markets and Investments INCOMPLETE - Dastidarmidnight graphiteNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDj HandsomeNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsVincent FerrerNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsVincent FerrerNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsAngela AradaNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsVincent FerrerNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionspaacostanNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsZeth Nathaniel TominesNo ratings yet

- CombinepdfDocument5 pagesCombinepdfKaye ApostolNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsKaye ApostolNo ratings yet

- CombinepdfDocument5 pagesCombinepdfKaye ApostolNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsVincent FerrerNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsEstephen EncenzoNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt Contributionskeen yumangNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsKlevin LloydNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsRICHYBOY SALACNo ratings yet

- PayslipDocument2 pagesPayslipjzeb.gonzales18No ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsArmina Aguilar BaisNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt Contributionsxander fordNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsVanessa SarraNo ratings yet

- Payslip July 7Document2 pagesPayslip July 7Clarke BlakeNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsVincent FerrerNo ratings yet

- Oct 15Document2 pagesOct 15Jane CruzNo ratings yet

- Encore Receivable Management, Inc. Philippine BranchDocument2 pagesEncore Receivable Management, Inc. Philippine BranchSamantha Joyce Valera TaezaNo ratings yet

- Concentrix Daksh Services Philippines CorporationDocument2 pagesConcentrix Daksh Services Philippines CorporationMike Gonzales JulianNo ratings yet

- 3483571f b300 4c77 b086 fb15ff8fccDocument2 pages3483571f b300 4c77 b086 fb15ff8fcckim JuabanNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsMeleisa joy BeslyNo ratings yet

- Concentrix Daksh Services Philippines CorporationDocument2 pagesConcentrix Daksh Services Philippines CorporationThea HeterozygoesNo ratings yet

- Concentrix Daksh Services Philippines CorporationDocument2 pagesConcentrix Daksh Services Philippines CorporationThea HeterozygoesNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsRICHYBOY SALACNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt Contributionsxander fordNo ratings yet

- Payslip YemplateDocument2 pagesPayslip YemplateCristine GonzalesNo ratings yet

- Concentrix Daksh Services Philippines CorporationDocument3 pagesConcentrix Daksh Services Philippines CorporationThea HeterozygoesNo ratings yet

- Combine PDFDocument3 pagesCombine PDFKaye ApostolNo ratings yet

- Dem-Soho 2324 208 75508 100469Document2 pagesDem-Soho 2324 208 75508 100469Ayush ChouhanNo ratings yet

- Salary Slip Format For HCLDocument1 pageSalary Slip Format For HCLgamersingh098123No ratings yet

- Invitation LetterDocument32 pagesInvitation LetterPRASENJIT DENo ratings yet

- Salary Slip Format For HCLDocument1 pageSalary Slip Format For HCLrajkannamdu100% (1)

- 1.roshan Kumar-Payslip - May-2022Document1 page1.roshan Kumar-Payslip - May-2022Burning to ShineNo ratings yet

- PAYSLIP Feb-2023Document1 pagePAYSLIP Feb-2023prasunaNo ratings yet

- A - (EE & ER) - PDOC-Date Paid-2022-08-05Document1 pageA - (EE & ER) - PDOC-Date Paid-2022-08-05armanf2020zNo ratings yet

- Salary Slip - Quess)Document1 pageSalary Slip - Quess)gamersingh098123No ratings yet

- Salary Slip Format For HCLDocument1 pageSalary Slip Format For HCLgamersingh098123No ratings yet

- Remitence Report 4.21.23Document1 pageRemitence Report 4.21.23blackson knightsonNo ratings yet

- Mary Doe - (EE & ER) - PDOC-Date Paid-2022-02-25Document1 pageMary Doe - (EE & ER) - PDOC-Date Paid-2022-02-25rahul_ransureNo ratings yet

- Telecon Format - Project EngineerDocument1 pageTelecon Format - Project EngineerLily NguyenNo ratings yet

- C R Das (Income Comp) - 2021-2022Document1 pageC R Das (Income Comp) - 2021-2022vijayrobin.tiggaNo ratings yet

- Payslip - 722 - 244572 - 30 - 2022Document2 pagesPayslip - 722 - 244572 - 30 - 2022kostadinkastefanova900No ratings yet

- Earnings Taxable Non Taxable Hours Total: OvertimeDocument1 pageEarnings Taxable Non Taxable Hours Total: OvertimeIamRachaelNo ratings yet

- PaySlip December2022 3Document1 pagePaySlip December2022 3pankaj kumarNo ratings yet

- L00368bi 20231227 85232 0001094215Document1 pageL00368bi 20231227 85232 0001094215Vikas NimbranaNo ratings yet

- Payslip IR 129147 Suneel+Kumar MAY 2024Document1 pagePayslip IR 129147 Suneel+Kumar MAY 2024ayanbhargav3No ratings yet

- FormDocument1 pageFormKANHAIYA KUMARNo ratings yet

- September 15 Payslip PDFDocument1 pageSeptember 15 Payslip PDFjohn lerry loberioNo ratings yet

- Vision RX Lab Private Limited P-4, Kasba Industrial Estate, Phase - 1, Kolkata - 107Document1 pageVision RX Lab Private Limited P-4, Kasba Industrial Estate, Phase - 1, Kolkata - 107Pravin KhopadeNo ratings yet

- Nett Pay 4222.87Document1 pageNett Pay 4222.87sacNo ratings yet

- Remitence reportMMJ 4.21.23Document1 pageRemitence reportMMJ 4.21.23blackson knightsonNo ratings yet

- Remuneration Statement: For The Month of October 2020Document1 pageRemuneration Statement: For The Month of October 2020AZIZ REHMANNo ratings yet

- Right to Work?: Assessing India's Employment Guarantee Scheme in BiharFrom EverandRight to Work?: Assessing India's Employment Guarantee Scheme in BiharNo ratings yet

- PPT of Role of Rbi Policies Functions and ProhibitoryDocument17 pagesPPT of Role of Rbi Policies Functions and Prohibitoryr.vani75% (4)

- Madhu Chaudhary ReportDocument36 pagesMadhu Chaudhary ReportMadhu ChyNo ratings yet

- Principles of Business - Grade 11-Mock ExaminationDocument1 pagePrinciples of Business - Grade 11-Mock ExaminationShane MorrisNo ratings yet

- Nokia Financial Report 2022 Q4Document17 pagesNokia Financial Report 2022 Q4Ahmed HussainNo ratings yet

- Montecillo, Review QuestionsDocument7 pagesMontecillo, Review QuestionsIvory Mae MontecilloNo ratings yet

- Tugas AF 4Document9 pagesTugas AF 4Rival RmcNo ratings yet

- Statement 1672413844644Document11 pagesStatement 1672413844644Rachna GuptaNo ratings yet

- Promissory Note NotesDocument14 pagesPromissory Note NotesFreeman Lawyer91% (33)

- 10 Financial Analysis of NBPDocument32 pages10 Financial Analysis of NBPHafeez KhanNo ratings yet

- Homework Chap 9Document4 pagesHomework Chap 9aleuvoNo ratings yet

- Llpreg 1996Document809 pagesLlpreg 1996Priska MalvinNo ratings yet

- (15-00293 428-48) Expert Report - BainesDocument4 pages(15-00293 428-48) Expert Report - BainesJessie SmithNo ratings yet

- Circular No 4 2023Document2 pagesCircular No 4 2023NESL WebsiteNo ratings yet

- Financial Management Class Notes For BBADocument20 pagesFinancial Management Class Notes For BBASameel Rehman67% (3)

- Unclaimed Redemption/Dividend Withdrawal Form: Personal DetailsDocument2 pagesUnclaimed Redemption/Dividend Withdrawal Form: Personal Detailshardik ParikhNo ratings yet

- Exercises For Chapter 23 EFA2Document13 pagesExercises For Chapter 23 EFA2tuananh leNo ratings yet

- Banking System in MoldovaDocument3 pagesBanking System in MoldovaDiana PronozaNo ratings yet

- Sip ReportDocument52 pagesSip ReportRavi JoshiNo ratings yet

- Chapter 9 Market RiskDocument7 pagesChapter 9 Market RiskTu NgNo ratings yet

- Capital MarketDocument2 pagesCapital MarketromaNo ratings yet

- Car Loan FinalDocument21 pagesCar Loan Finalislamkilaniya66100% (1)

- DSK BankDocument2 pagesDSK BankNoel HCNo ratings yet

- Please Do Not Write On This Examination FormDocument8 pagesPlease Do Not Write On This Examination Formzaidashraf007No ratings yet

- 31 Excel Powerful FormulaDocument15 pages31 Excel Powerful FormulaGanesh Tiwari0% (1)

- LANDBANK Iaccess FAQsDocument16 pagesLANDBANK Iaccess FAQsAsh Campiao100% (1)

- Group 7 Case StudyDocument17 pagesGroup 7 Case StudyJAN RAY CUISON VISPERASNo ratings yet

- Inclusive Digital Financial Services A Reference Guide For RegulatorsDocument262 pagesInclusive Digital Financial Services A Reference Guide For Regulatorsunknown4080No ratings yet

- 1 - Introduction - Our Changing World and The Evolution of CSRDocument17 pages1 - Introduction - Our Changing World and The Evolution of CSRMariana CorreiaNo ratings yet

Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt Contributions

Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt Contributions

Uploaded by

Zarah BernabeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt Contributions

Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt Contributions

Uploaded by

Zarah BernabeCopyright:

Available Formats

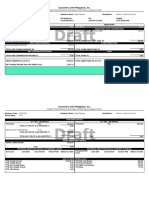

Concentrix CVG Philippines, Inc.

Payslip for the Period September 11 2022-September 24 2022 (Pay-out: September 30 2022)

Employee Code: 101733124 Employee Name: Zarah Bernabe Designation: Advisor II, Customer Service

Hourly Salary: 105.21

Tax Code: SSS No. Phil Health No. TIN Pagibig

34-8437486-7 02-027236272-7 000-388-061-790 1212-5064-9414

EARNINGS DEDUCTIONS

Description Hrs Total Description Total

TAXABLE EARNINGS MANDATORY GOVT CONTRIBUTIONS

BASIC PAY 53.58 5,637.51

SERVICE INCENTIVE LEAVE 24.00 2,525.04

Total Night Differential 45.37 715.95

Total Overtime 0.35 46.03

COMPLEXITY ALLOWANCE -

1,149.43

PRORATED

TOTAL TAXABLE EARNINGS (A) 10,073.96 TOTAL MANDATORY GOVT CONT (D) 0.00

NON-TAXABLE EARNINGS OTHER DEDUCTIONS

RICE ALLOWANCE PRORATED 919.54 HMO 2022 155.32

TOTAL NON-TAXABLE EARNINGS (B) 919.54 TOTAL OTHER DEDUCTIONS (E) 155.32

NON COMPENSATION INCOME TAXES

CONNECTIVITY REIMBURSEMENT 2,000.00 WITHHOLDING TAX 91.71

TOTAL NON COMPENSATION INCOME (C) 2,000.00 TOTAL TAXES (F) 91.71

GROSS EARNINGS (G) (A+B+C) 12,993.50 TOTAL DEDUCTIONS (H) (D+E+F) 247.03

NET TAXABLE INCOME THIS PAY PERIOD (A-D) 10,073.96

NET EARNINGS (G-H) 12,746.47

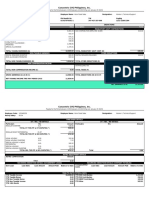

Concentrix CVG Philippines, Inc.

Payslip for the Period September 11 2022-September 24 2022 (Pay-out: September 30 2022)

Employee Code: 101733124 Employee Name: Zarah Bernabe Designation: Advisor II, Customer Service

Hourly Salary: 105.21

TIME BASED DETAILS

OT / HOL / ND DETAILS OT / HOL / ND DETAILS

Particulars Hrs Amount Particulars Hrs Amount

REGULAR OVERTIME 0.35 46.03

TOTAL OT THIS PP & OT DISPUTES (*) 46.03

REGULAR NIGHT DIFFERENTIAL 45.37 715.95

TOTAL ND THIS PP & ND DISPUTES (*) 715.95

TOTAL HOL THIS PP & HOL DISPUTES (*) 0.00 Total 0.00

RETRO ADJUSTMENT DETAILS

RETRO COMPUTATION Amount

Total 0.00

RECURRING DEDUCTION DETAILS (GOVERNMENT LOANS) RECURRING DEDUCTION DETAILS (COMPANY PAYABLES)

Company/Other

Govt Loan Loan Date Loan Amount Amount Paid Balance to Date Loan Date Loan Amount Amount Paid Balance to Date

Loans

YEAR-TO-DATE PAYROLL DATA

YTD Taxable Income 170,172.57 YTD SSS Contribution 9,990.00

YTD Taxable Bonus 0.00 YTD PHI Contribution 2,698.55

YTD Non Taxable Bonus 42,652.98 YTD HDMF Contribution 900.00

YTD Non Taxable Income 0.00 YTD Wtax 1,945.32

YTD 13th Month 0.00

You might also like

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt Contributionszayn malikNo ratings yet

- Ias 20 QuestionsDocument6 pagesIas 20 QuestionsGonest Gone'stoëriaNo ratings yet

- Capital Markets and Investments INCOMPLETE - DastidarDocument32 pagesCapital Markets and Investments INCOMPLETE - Dastidarmidnight graphiteNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDj HandsomeNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsVincent FerrerNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsVincent FerrerNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsAngela AradaNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsVincent FerrerNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionspaacostanNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsZeth Nathaniel TominesNo ratings yet

- CombinepdfDocument5 pagesCombinepdfKaye ApostolNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsKaye ApostolNo ratings yet

- CombinepdfDocument5 pagesCombinepdfKaye ApostolNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsVincent FerrerNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsEstephen EncenzoNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt Contributionskeen yumangNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsKlevin LloydNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsRICHYBOY SALACNo ratings yet

- PayslipDocument2 pagesPayslipjzeb.gonzales18No ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsArmina Aguilar BaisNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt Contributionsxander fordNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsVanessa SarraNo ratings yet

- Payslip July 7Document2 pagesPayslip July 7Clarke BlakeNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsVincent FerrerNo ratings yet

- Oct 15Document2 pagesOct 15Jane CruzNo ratings yet

- Encore Receivable Management, Inc. Philippine BranchDocument2 pagesEncore Receivable Management, Inc. Philippine BranchSamantha Joyce Valera TaezaNo ratings yet

- Concentrix Daksh Services Philippines CorporationDocument2 pagesConcentrix Daksh Services Philippines CorporationMike Gonzales JulianNo ratings yet

- 3483571f b300 4c77 b086 fb15ff8fccDocument2 pages3483571f b300 4c77 b086 fb15ff8fcckim JuabanNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsMeleisa joy BeslyNo ratings yet

- Concentrix Daksh Services Philippines CorporationDocument2 pagesConcentrix Daksh Services Philippines CorporationThea HeterozygoesNo ratings yet

- Concentrix Daksh Services Philippines CorporationDocument2 pagesConcentrix Daksh Services Philippines CorporationThea HeterozygoesNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsRICHYBOY SALACNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt Contributionsxander fordNo ratings yet

- Payslip YemplateDocument2 pagesPayslip YemplateCristine GonzalesNo ratings yet

- Concentrix Daksh Services Philippines CorporationDocument3 pagesConcentrix Daksh Services Philippines CorporationThea HeterozygoesNo ratings yet

- Combine PDFDocument3 pagesCombine PDFKaye ApostolNo ratings yet

- Dem-Soho 2324 208 75508 100469Document2 pagesDem-Soho 2324 208 75508 100469Ayush ChouhanNo ratings yet

- Salary Slip Format For HCLDocument1 pageSalary Slip Format For HCLgamersingh098123No ratings yet

- Invitation LetterDocument32 pagesInvitation LetterPRASENJIT DENo ratings yet

- Salary Slip Format For HCLDocument1 pageSalary Slip Format For HCLrajkannamdu100% (1)

- 1.roshan Kumar-Payslip - May-2022Document1 page1.roshan Kumar-Payslip - May-2022Burning to ShineNo ratings yet

- PAYSLIP Feb-2023Document1 pagePAYSLIP Feb-2023prasunaNo ratings yet

- A - (EE & ER) - PDOC-Date Paid-2022-08-05Document1 pageA - (EE & ER) - PDOC-Date Paid-2022-08-05armanf2020zNo ratings yet

- Salary Slip - Quess)Document1 pageSalary Slip - Quess)gamersingh098123No ratings yet

- Salary Slip Format For HCLDocument1 pageSalary Slip Format For HCLgamersingh098123No ratings yet

- Remitence Report 4.21.23Document1 pageRemitence Report 4.21.23blackson knightsonNo ratings yet

- Mary Doe - (EE & ER) - PDOC-Date Paid-2022-02-25Document1 pageMary Doe - (EE & ER) - PDOC-Date Paid-2022-02-25rahul_ransureNo ratings yet

- Telecon Format - Project EngineerDocument1 pageTelecon Format - Project EngineerLily NguyenNo ratings yet

- C R Das (Income Comp) - 2021-2022Document1 pageC R Das (Income Comp) - 2021-2022vijayrobin.tiggaNo ratings yet

- Payslip - 722 - 244572 - 30 - 2022Document2 pagesPayslip - 722 - 244572 - 30 - 2022kostadinkastefanova900No ratings yet

- Earnings Taxable Non Taxable Hours Total: OvertimeDocument1 pageEarnings Taxable Non Taxable Hours Total: OvertimeIamRachaelNo ratings yet

- PaySlip December2022 3Document1 pagePaySlip December2022 3pankaj kumarNo ratings yet

- L00368bi 20231227 85232 0001094215Document1 pageL00368bi 20231227 85232 0001094215Vikas NimbranaNo ratings yet

- Payslip IR 129147 Suneel+Kumar MAY 2024Document1 pagePayslip IR 129147 Suneel+Kumar MAY 2024ayanbhargav3No ratings yet

- FormDocument1 pageFormKANHAIYA KUMARNo ratings yet

- September 15 Payslip PDFDocument1 pageSeptember 15 Payslip PDFjohn lerry loberioNo ratings yet

- Vision RX Lab Private Limited P-4, Kasba Industrial Estate, Phase - 1, Kolkata - 107Document1 pageVision RX Lab Private Limited P-4, Kasba Industrial Estate, Phase - 1, Kolkata - 107Pravin KhopadeNo ratings yet

- Nett Pay 4222.87Document1 pageNett Pay 4222.87sacNo ratings yet

- Remitence reportMMJ 4.21.23Document1 pageRemitence reportMMJ 4.21.23blackson knightsonNo ratings yet

- Remuneration Statement: For The Month of October 2020Document1 pageRemuneration Statement: For The Month of October 2020AZIZ REHMANNo ratings yet

- Right to Work?: Assessing India's Employment Guarantee Scheme in BiharFrom EverandRight to Work?: Assessing India's Employment Guarantee Scheme in BiharNo ratings yet

- PPT of Role of Rbi Policies Functions and ProhibitoryDocument17 pagesPPT of Role of Rbi Policies Functions and Prohibitoryr.vani75% (4)

- Madhu Chaudhary ReportDocument36 pagesMadhu Chaudhary ReportMadhu ChyNo ratings yet

- Principles of Business - Grade 11-Mock ExaminationDocument1 pagePrinciples of Business - Grade 11-Mock ExaminationShane MorrisNo ratings yet

- Nokia Financial Report 2022 Q4Document17 pagesNokia Financial Report 2022 Q4Ahmed HussainNo ratings yet

- Montecillo, Review QuestionsDocument7 pagesMontecillo, Review QuestionsIvory Mae MontecilloNo ratings yet

- Tugas AF 4Document9 pagesTugas AF 4Rival RmcNo ratings yet

- Statement 1672413844644Document11 pagesStatement 1672413844644Rachna GuptaNo ratings yet

- Promissory Note NotesDocument14 pagesPromissory Note NotesFreeman Lawyer91% (33)

- 10 Financial Analysis of NBPDocument32 pages10 Financial Analysis of NBPHafeez KhanNo ratings yet

- Homework Chap 9Document4 pagesHomework Chap 9aleuvoNo ratings yet

- Llpreg 1996Document809 pagesLlpreg 1996Priska MalvinNo ratings yet

- (15-00293 428-48) Expert Report - BainesDocument4 pages(15-00293 428-48) Expert Report - BainesJessie SmithNo ratings yet

- Circular No 4 2023Document2 pagesCircular No 4 2023NESL WebsiteNo ratings yet

- Financial Management Class Notes For BBADocument20 pagesFinancial Management Class Notes For BBASameel Rehman67% (3)

- Unclaimed Redemption/Dividend Withdrawal Form: Personal DetailsDocument2 pagesUnclaimed Redemption/Dividend Withdrawal Form: Personal Detailshardik ParikhNo ratings yet

- Exercises For Chapter 23 EFA2Document13 pagesExercises For Chapter 23 EFA2tuananh leNo ratings yet

- Banking System in MoldovaDocument3 pagesBanking System in MoldovaDiana PronozaNo ratings yet

- Sip ReportDocument52 pagesSip ReportRavi JoshiNo ratings yet

- Chapter 9 Market RiskDocument7 pagesChapter 9 Market RiskTu NgNo ratings yet

- Capital MarketDocument2 pagesCapital MarketromaNo ratings yet

- Car Loan FinalDocument21 pagesCar Loan Finalislamkilaniya66100% (1)

- DSK BankDocument2 pagesDSK BankNoel HCNo ratings yet

- Please Do Not Write On This Examination FormDocument8 pagesPlease Do Not Write On This Examination Formzaidashraf007No ratings yet

- 31 Excel Powerful FormulaDocument15 pages31 Excel Powerful FormulaGanesh Tiwari0% (1)

- LANDBANK Iaccess FAQsDocument16 pagesLANDBANK Iaccess FAQsAsh Campiao100% (1)

- Group 7 Case StudyDocument17 pagesGroup 7 Case StudyJAN RAY CUISON VISPERASNo ratings yet

- Inclusive Digital Financial Services A Reference Guide For RegulatorsDocument262 pagesInclusive Digital Financial Services A Reference Guide For Regulatorsunknown4080No ratings yet

- 1 - Introduction - Our Changing World and The Evolution of CSRDocument17 pages1 - Introduction - Our Changing World and The Evolution of CSRMariana CorreiaNo ratings yet