Professional Documents

Culture Documents

Practice Exercise - Springbok - Solution

Practice Exercise - Springbok - Solution

Uploaded by

155- Salsabila Gading0 ratings0% found this document useful (0 votes)

10 views3 pagesOriginal Title

15. Practice Exercise - Springbok - Solution

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

10 views3 pagesPractice Exercise - Springbok - Solution

Practice Exercise - Springbok - Solution

Uploaded by

155- Salsabila GadingCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 3

Practice Exercise - Springbok - Solution Strictly Confidential

Table of Contents

Springbok Financial Statements

© 2015 to 2023 CFI Education Inc.

This Excel model is for educational purposes only and should not be used for any other reason. All content is Copyright material of CFI Education Inc.

All rights reserved. The contents of this publication, including but not limited to all written material, content layout, images, formulas, and code, are protected

under international copyright and trademark laws. No part of this publication may be modified, manipulated, reproduced, distributed, or transmitted in any

form by any means, including photocopying, recording, or other electronic or mechanical methods, without prior written permission of the publisher,

except in the case of certain noncommercial uses permitted by copyright law.

https://corporatefinanceinstitute.com/

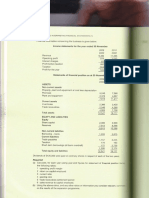

Construct the Cash Flow Statement for Springbok Inc.

1. Calculate the differences on the balance sheet

2. Calculate net CAPEX using the note below the cash flow statement

3. Complete the cash flow statement

4. The boxes to complete are in gray

Income Statement Balance Sheet Cash Flow Statement

ASSETS YEAR 1 YEAR 2 YEAR 2

YEAR 1

Current Assets Operating Cash Flow

Revenues 78,579 Cash 3,746 3,172 (574) Net income 2,584

Cost of Sales (48,719) Accounts Receivable 10,440 10,980 540 Depreciation 3,199

Gross Profit 29,860 Inventory 5,189 5,382 193 Unpaid Taxes (43)

Total Current Assets 19,375 19,534 Change in Accounts Receivable (540)

Other Operating Expenses (21,632) Change in Inventory (193)

EBITDA 8,228 Non-Current Assets Change in Accounts Payable 387

Property, Plant & Equipment 25,972 26,193 221 Cash From Operations 5,394

Depreciation (3,199) Total Non-Current Assets 25,972 26,193

Operating Profit (EBIT) 5,029 Investing Cash Flow

Total Assets 45,347 45,727 Property, Plant & Equipment (3,420)

Interest Expenses (Finance Cost) (1,278) Cash From Investing (3,420)

Profit Before Tax (EBT) 3,751

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY Financing Cash Flow

Tax Expense (1,167) Issuance (Repayment) of Short Term Debt (339)

Net Income (EAT) 2,584 Current Liabilities Issuance (Repayment) of Long Term Debt (812)

Accounts Payable 9,086 9,473 387 Issuance (Repayment) of Equity –

Dividends (1,397) Loans 3,124 2,785 (339) Payment of Dividends (1,397)

Retained Earnings 1,187 Unpaid Taxes 1,210 1,167 (43) Cash From Financing (2,548)

Total Current Liabilties 13,420 13,425

Net Increase (Decrease) in Cash (574)

Non-Current Liabilities Opening Cash Balance 3,746

Long-Term Debt 10,836 10,024 (812) Closing Cash Balance 3,172

Total Non-Current Liabilities 10,836 10,024

Matches balance sheet ok

Shareholders' Equity

Common Shares 9,202 9,202 – PPE Start of Year 25,972

Retained Earnings 11,889 13,076 1,187 Capex 3,420

Total Shareholders' Equity 21,091 22,278 Depreciation (3,199)

PPE End of Year 26,193

Total Liabilities & Equity 45,347 45,727

Total Assets 45,347 45,727

Total Liabilities & Equity 45,347 45,727

Difference – –

Practice Exercise - Springbok Page 3 of 3

You might also like

- 11.1. Practice Exercise - Cumberland Inc - BlankDocument5 pages11.1. Practice Exercise - Cumberland Inc - Blank155- Salsabila GadingNo ratings yet

- Cash Flow SolvedDocument3 pagesCash Flow SolvedRahul BindrooNo ratings yet

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Management Accounts For The Year 2022Document6 pagesManagement Accounts For The Year 2022Clyton MusipaNo ratings yet

- Espresso Software Financial Statements and Supplementary DataDocument38 pagesEspresso Software Financial Statements and Supplementary DataAnwar AshrafNo ratings yet

- For The Year Ended December 31, 2020: Rcs Consultancy CorporationDocument11 pagesFor The Year Ended December 31, 2020: Rcs Consultancy CorporationYzzabel Denise L. TolentinoNo ratings yet

- IFRS PGC-NIRF Dec. 70.2009 22 Dez - Chat of AccountsDocument30 pagesIFRS PGC-NIRF Dec. 70.2009 22 Dez - Chat of AccountsrpcoimbraNo ratings yet

- Practice Exercise - Springbok - BlankDocument3 pagesPractice Exercise - Springbok - Blank155- Salsabila GadingNo ratings yet

- CFI Accounting Fundementals Candor Cash Flow SolutionDocument2 pagesCFI Accounting Fundementals Candor Cash Flow SolutionsovalaxNo ratings yet

- Candor Cashflow ExerciseDocument2 pagesCandor Cashflow ExerciseHue PhamNo ratings yet

- Instructions:: Candor Cash Flow SolutionDocument1 pageInstructions:: Candor Cash Flow SolutionPirvuNo ratings yet

- Candor Cash Flow ExerciseDocument3 pagesCandor Cash Flow ExerciseMohammed100% (1)

- Nike, Inc. Consolidated Statements of Income Year Ended December 31 (In Millions) 2019 2018Document3 pagesNike, Inc. Consolidated Statements of Income Year Ended December 31 (In Millions) 2019 2018David Rolando García OpazoNo ratings yet

- A3 6Document3 pagesA3 6David Rolando García OpazoNo ratings yet

- The Boeing Company and Subsidiaries Consolidated Statements of Cash FlowsDocument1 pageThe Boeing Company and Subsidiaries Consolidated Statements of Cash Flowsdivineyang05No ratings yet

- Microsoft Corporation: (In Millions) Year Ended June 30, 2010 2009 2008Document1 pageMicrosoft Corporation: (In Millions) Year Ended June 30, 2010 2009 2008Dylan MakroNo ratings yet

- FM204Document8 pagesFM204Vinoth KumarNo ratings yet

- COMPANY 1 - SupaFood Financial Statements - 240102 - 143648Document5 pagesCOMPANY 1 - SupaFood Financial Statements - 240102 - 143648Marcel JonathanNo ratings yet

- TZero 2018 10-KDocument20 pagesTZero 2018 10-KgaryrweissNo ratings yet

- Solutions Worksheets - Chapt 3Document35 pagesSolutions Worksheets - Chapt 3Nam PhươngNo ratings yet

- Dell Financial Data Mid Course Quiz 1668627324062Document10 pagesDell Financial Data Mid Course Quiz 1668627324062rohit goyalNo ratings yet

- FIN448 DCFwWACC SolutionDocument9 pagesFIN448 DCFwWACC SolutionAndrewNo ratings yet

- Acct 401 Tutorial Set FiveDocument13 pagesAcct 401 Tutorial Set FiveStudy GirlNo ratings yet

- Module 4 - Analysis WorksheetDocument5 pagesModule 4 - Analysis WorksheetElizabethNo ratings yet

- Session 6Document4 pagesSession 6samuel tabotNo ratings yet

- Financial Analysis Hewlett Packard Corporation 2007Document24 pagesFinancial Analysis Hewlett Packard Corporation 2007SAMNo ratings yet

- Colgate 2020 AR Excel Financials For AR Web Site HSDocument6 pagesColgate 2020 AR Excel Financials For AR Web Site HSMohammad ameen Ur rahmanNo ratings yet

- Consolidated Statements of Operations - USD ($) Shares in Millions, $ in MillionsDocument20 pagesConsolidated Statements of Operations - USD ($) Shares in Millions, $ in MillionsLuka KhmaladzeNo ratings yet

- Chapter 7 Problem 7Document3 pagesChapter 7 Problem 7Pamela PerezNo ratings yet

- Fact-Sheet SyngeneDocument4 pagesFact-Sheet SyngeneRahul SharmaNo ratings yet

- Star ReportsDocument38 pagesStar ReportsAnnisa DewiNo ratings yet

- 2021 Full Year Cash Flow StatementDocument1 page2021 Full Year Cash Flow StatementROYAL ENFIELDNo ratings yet

- Berger Paints Bangladesh Limited Statement of Financial PositionDocument8 pagesBerger Paints Bangladesh Limited Statement of Financial PositionrrashadattNo ratings yet

- Consolidated Statement of Comprehensive Income: For The Year Ended 31 DecemberDocument5 pagesConsolidated Statement of Comprehensive Income: For The Year Ended 31 DecemberVajri Varun GuturuNo ratings yet

- Adani Ports & Special Economic Zone Ltd. (India) : SourceDocument9 pagesAdani Ports & Special Economic Zone Ltd. (India) : SourceDivyagarapatiNo ratings yet

- Consolidated Balance Sheet Metapower International, IncDocument12 pagesConsolidated Balance Sheet Metapower International, IncJha YaNo ratings yet

- HE 4 Questions - Updated-1Document13 pagesHE 4 Questions - Updated-1halelz69No ratings yet

- ABC Corporation Annual ReportDocument9 pagesABC Corporation Annual ReportCuong LyNo ratings yet

- CLWY Q1 2019 FinancialsDocument3 pagesCLWY Q1 2019 FinancialskdwcapitalNo ratings yet

- Chapter 3 108-117Document10 pagesChapter 3 108-117Leony SantikaNo ratings yet

- (In Millions) : Consolidated Statements of Cash FlowsDocument1 page(In Millions) : Consolidated Statements of Cash FlowsrocíoNo ratings yet

- Assets: PAYNET, Inc. Consolidated Balance SheetsDocument3 pagesAssets: PAYNET, Inc. Consolidated Balance Sheetschemicalchouhan9303No ratings yet

- Income Statements For The November: @Chapter7AnalyslngandlnterpretlngflnanclalstatementsDocument1 pageIncome Statements For The November: @Chapter7AnalyslngandlnterpretlngflnanclalstatementsAik Luen LimNo ratings yet

- Financial Analysis For NIKEDocument12 pagesFinancial Analysis For NIKEAnny Cloveries GabayanNo ratings yet

- Target FinancalDocument4 pagesTarget Financalnguyenchi1310No ratings yet

- Video 2.5-DogamerDocument18 pagesVideo 2.5-DogamerutamiNo ratings yet

- 3M - 2019 Annual Report ExcerptDocument7 pages3M - 2019 Annual Report ExcerptKumar AbhishekNo ratings yet

- Class Day Test BSC Finance Year 2Document5 pagesClass Day Test BSC Finance Year 2Revatee HurilNo ratings yet

- Consolidated Statements of Cash Flows (In Millions) : Year Ended December 31, 2014 2015 2016Document11 pagesConsolidated Statements of Cash Flows (In Millions) : Year Ended December 31, 2014 2015 2016Ritu SinghNo ratings yet

- American Airlines Group IncDocument5 pagesAmerican Airlines Group IncMyka Mabs MagbanuaNo ratings yet

- Supplementary Accounting Statement ECPLDocument15 pagesSupplementary Accounting Statement ECPLdeepNo ratings yet

- Analysis and Interpretation of Profitability: Operating ExpensesDocument2 pagesAnalysis and Interpretation of Profitability: Operating ExpensesDavid Rolando García OpazoNo ratings yet

- Reliance Industries Limited Cash Flow Statement For The Year 20 13-14Document2 pagesReliance Industries Limited Cash Flow Statement For The Year 20 13-14Vaidehi VihariNo ratings yet

- Consolidated Statements of Income: Dollars in Millions Except Per Share AmountsDocument6 pagesConsolidated Statements of Income: Dollars in Millions Except Per Share AmountsTran Van HaiNo ratings yet

- Choose The Best Answer Out of The Available Options For Each QuestionDocument2 pagesChoose The Best Answer Out of The Available Options For Each QuestionSambhav TripathiNo ratings yet

- Un-Audited Financial Statements For The Six Months Ended June 30, 2021Document1 pageUn-Audited Financial Statements For The Six Months Ended June 30, 2021Fuaad DodooNo ratings yet

- Financial Statement 2020Document3 pagesFinancial Statement 2020Fuaad DodooNo ratings yet

- Question 2Document3 pagesQuestion 2premsuwaatiiNo ratings yet

- Consolidated Balance Sheet: December 31, 2022 2021 (In Millions, Except Per Share Data)Document2 pagesConsolidated Balance Sheet: December 31, 2022 2021 (In Millions, Except Per Share Data)Maanvee JaiswalNo ratings yet

- Financial Statements and Supplementary Data: (In Millions, Except Per Share Amounts) Year Ended June 30, 2018 2017 2016Document5 pagesFinancial Statements and Supplementary Data: (In Millions, Except Per Share Amounts) Year Ended June 30, 2018 2017 2016SSDNo ratings yet

- 105 10 Amazon Financial StatementsDocument5 pages105 10 Amazon Financial StatementsCharles Vladimir SolvaskyNo ratings yet

- Consolidated Balance Sheet As at June 30, 2021: AssetsDocument2 pagesConsolidated Balance Sheet As at June 30, 2021: Assetsshannia dcostaNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- 1 SMDocument7 pages1 SM155- Salsabila GadingNo ratings yet

- WCM 1Document12 pagesWCM 1155- Salsabila GadingNo ratings yet

- We Are Intechopen, The World'S Leading Publisher of Open Access Books Built by Scientists, For ScientistsDocument13 pagesWe Are Intechopen, The World'S Leading Publisher of Open Access Books Built by Scientists, For Scientists155- Salsabila GadingNo ratings yet

- IFpaper 2020Document25 pagesIFpaper 2020155- Salsabila GadingNo ratings yet

- Practice Exercise - Cobble Hill Part 3 Cash Flow - BlankDocument4 pagesPractice Exercise - Cobble Hill Part 3 Cash Flow - Blank155- Salsabila GadingNo ratings yet

- 5th MEETING - RISK EVALUATIONDocument11 pages5th MEETING - RISK EVALUATION155- Salsabila GadingNo ratings yet

- Practice Exercise - Cobble Hill Part 3 Cash Flow - SolutionDocument4 pagesPractice Exercise - Cobble Hill Part 3 Cash Flow - Solution155- Salsabila GadingNo ratings yet

- Practice Exercise - Cobble Hill Part 3 Cash Flow - BlankDocument4 pagesPractice Exercise - Cobble Hill Part 3 Cash Flow - Blank155- Salsabila GadingNo ratings yet

- Practice Exercise - Ship Shape Retail - SolutionDocument4 pagesPractice Exercise - Ship Shape Retail - Solution155- Salsabila GadingNo ratings yet

- Practice Exercise - Ravensburger - BlankDocument3 pagesPractice Exercise - Ravensburger - Blank155- Salsabila GadingNo ratings yet

- Practice Exercise - Springbok - BlankDocument3 pagesPractice Exercise - Springbok - Blank155- Salsabila GadingNo ratings yet

- Working Capital Management andDocument15 pagesWorking Capital Management and155- Salsabila GadingNo ratings yet

- Literature Review of The ImpacDocument23 pagesLiterature Review of The Impac155- Salsabila GadingNo ratings yet

- Murataj, Marsida - 508493 - Senior Project ThesisDocument55 pagesMurataj, Marsida - 508493 - Senior Project Thesis155- Salsabila GadingNo ratings yet

- Pengaruh Motivasi Terhadap Kinerja Pegawai Badan Kepegawaian Dan Diklat Daerah Kabupaten Mamuju UtaraDocument12 pagesPengaruh Motivasi Terhadap Kinerja Pegawai Badan Kepegawaian Dan Diklat Daerah Kabupaten Mamuju Utara155- Salsabila GadingNo ratings yet

- Timber Flooring Financial Data Student Clean 11-2-2021Document67 pagesTimber Flooring Financial Data Student Clean 11-2-2021Aditya HonguntiNo ratings yet

- Cash Flow StatemementsDocument31 pagesCash Flow StatemementsTasim Ishraque100% (1)

- IPSAS Detil StandardDocument93 pagesIPSAS Detil StandardNur AsniNo ratings yet

- Accounting and Financial RecordDocument4 pagesAccounting and Financial RecordH mmNo ratings yet

- Accounting Standards Board (ASB) in 1977Document15 pagesAccounting Standards Board (ASB) in 1977Viswanathan SrkNo ratings yet

- Notes Cash FlowDocument16 pagesNotes Cash FlowsamundeswaryNo ratings yet

- Cash Flow StaementDocument14 pagesCash Flow StaementKhizar Hayat JiskaniNo ratings yet

- ISC AccountsDocument20 pagesISC AccountsKris BubnaNo ratings yet

- 1 CombinedDocument405 pages1 CombinedMansi aggarwal 171050No ratings yet

- Accounting For Business: Chapter 4: The Statement of Cash FlowsDocument40 pagesAccounting For Business: Chapter 4: The Statement of Cash FlowsegNo ratings yet

- CH 03Document51 pagesCH 03Lộc PhúcNo ratings yet

- Internship ProjectDocument40 pagesInternship ProjectAshutosh SinghNo ratings yet

- Individual Assignment 4 & 5 Financial Accounting & Analysis (Kmbn-103)Document2 pagesIndividual Assignment 4 & 5 Financial Accounting & Analysis (Kmbn-103)Peeush ShrivastavaNo ratings yet

- SEBI Grade A Complete GuideDocument20 pagesSEBI Grade A Complete GuideAtul AnandNo ratings yet

- Summer Training Project Report ON: "Financial Ratios"Document35 pagesSummer Training Project Report ON: "Financial Ratios"The Himalayas 360No ratings yet

- Cash Flow Statement New For YoutubeDocument48 pagesCash Flow Statement New For YoutubeTapan BarikNo ratings yet

- How To Prepare Cash Flow StatementDocument24 pagesHow To Prepare Cash Flow StatementKNOWLEDGE CREATORS100% (3)

- Consolidated Balance Sheet: As at 31st March, 2016Document15 pagesConsolidated Balance Sheet: As at 31st March, 2016Saswata ChoudhuryNo ratings yet

- GLO-BUS Decisions & Reports Year 6 (Practice)Document6 pagesGLO-BUS Decisions & Reports Year 6 (Practice)Ngọc ÁnhNo ratings yet

- Problem 2-14 & 2-15Document12 pagesProblem 2-14 & 2-15Qudsiya KalhoroNo ratings yet

- BPM Financial Modelling Fundamentals Practical Exercise SolutionsDocument19 pagesBPM Financial Modelling Fundamentals Practical Exercise SolutionsDaria YurovaNo ratings yet

- Potato and Banana Chips123Document39 pagesPotato and Banana Chips123andy100% (2)

- Assets: Aditional InformationDocument16 pagesAssets: Aditional Informationleeyaa aNo ratings yet

- Chapter 7 Financial Aspect ScheduleDocument13 pagesChapter 7 Financial Aspect ScheduleAleelNo ratings yet

- ACC2001 Aug 2011 Practice Exam QuestionsDocument4 pagesACC2001 Aug 2011 Practice Exam QuestionsShin TanNo ratings yet

- Bronson Corporation 2017 Income Statement (In Mllions)Document4 pagesBronson Corporation 2017 Income Statement (In Mllions)Dianne CastroNo ratings yet

- Financial Statements Analysis OF Companies (Non-Financial) Listed at Pakistan Stock ExchangeDocument463 pagesFinancial Statements Analysis OF Companies (Non-Financial) Listed at Pakistan Stock ExchangeMuhammad Asif YousafzaiNo ratings yet