Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

2 viewsCASE 80 - PNB v. Bagamaspad, 89 Phil. 365 (1951)

CASE 80 - PNB v. Bagamaspad, 89 Phil. 365 (1951)

Uploaded by

Jemuel LadabanThis document summarizes a Philippine Supreme Court case from 1951 regarding two bank employees who improperly granted crop loans without proper authorization or oversight. The bank sued the employees to recover the amount of the unauthorized loans. The court found the employees were negligent in their duties and violated bank policies, making them liable to repay the full amount of the improper loans under relevant civil codes. While some borrowers did repay parts of the loans, this did not constitute ratification of the employees' unauthorized acts by the bank.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Riano - 2019Document385 pagesRiano - 2019Jemuel Ladaban93% (14)

- 02 CVP Analysis For PrintingDocument8 pages02 CVP Analysis For Printingkristine claire50% (2)

- 5th 57. PNB Vs BagamaspadDocument1 page5th 57. PNB Vs BagamaspadXing Keet LuNo ratings yet

- Danao vs. CADocument5 pagesDanao vs. CAvanessa_3No ratings yet

- Viray and Viola Viray For Petitioner. First Assistant Solicitor General Roberto A. Gianzon and Solicitor Manuel Tomacruz For RespondentDocument13 pagesViray and Viola Viray For Petitioner. First Assistant Solicitor General Roberto A. Gianzon and Solicitor Manuel Tomacruz For RespondentCarren Paulet Villar CuyosNo ratings yet

- Nego Fulltext (Rigor - BPI)Document46 pagesNego Fulltext (Rigor - BPI)Roche DaleNo ratings yet

- Ii. Loan (C. Simple Loan or Mutuum)Document195 pagesIi. Loan (C. Simple Loan or Mutuum)ErikaAlidioNo ratings yet

- Obligations and ContractsDocument220 pagesObligations and ContractsDeon marianoNo ratings yet

- 4) BPI Family Bank vs. FrancoDocument10 pages4) BPI Family Bank vs. FrancoNathalie YapNo ratings yet

- G.R. No. L-24837Document2 pagesG.R. No. L-24837Hanifa D. Al-ObinayNo ratings yet

- Plaintiff-Appellee vs. vs. Defendant-Appellant Solicitor General Isabelo P. SamsonDocument6 pagesPlaintiff-Appellee vs. vs. Defendant-Appellant Solicitor General Isabelo P. SamsonJia Chu ChuaNo ratings yet

- Plaintiffs Appellees Defendants Defendant AppellantDocument16 pagesPlaintiffs Appellees Defendants Defendant AppellantEarl YoungNo ratings yet

- G.R. No. 144887 November 17, 2004 ALFREDO RIGOR, Petitioner, People of The Philippines, Respondent. Azcuna, J.Document5 pagesG.R. No. 144887 November 17, 2004 ALFREDO RIGOR, Petitioner, People of The Philippines, Respondent. Azcuna, J.teepeeNo ratings yet

- Reaction Paper On SeminarDocument5 pagesReaction Paper On SeminarJC TuqueroNo ratings yet

- PNB v. BagamaspadDocument2 pagesPNB v. BagamaspadJP Murao IIINo ratings yet

- Serrano vs. Central BankDocument4 pagesSerrano vs. Central BankVilpa VillabasNo ratings yet

- Petitioner vs. vs. Respondent: Second DivisionDocument7 pagesPetitioner vs. vs. Respondent: Second DivisionVener MargalloNo ratings yet

- Republic of The Philippines: Factual AntecedentsDocument7 pagesRepublic of The Philippines: Factual AntecedentsRobert QuiambaoNo ratings yet

- 142558-1968-Singson - v. - Bank - of - The - Philippine - Islands20210424-12-1hrqm8gDocument3 pages142558-1968-Singson - v. - Bank - of - The - Philippine - Islands20210424-12-1hrqm8gNicorobin RobinNo ratings yet

- 137684-1980-Serrano v. Central Bank of The Philippines20190125-5466-19jls49Document5 pages137684-1980-Serrano v. Central Bank of The Philippines20190125-5466-19jls49ShairaCamilleGarciaNo ratings yet

- Soriano V PeopleDocument21 pagesSoriano V PeopleptbattungNo ratings yet

- BDO UNIBANK v. FRANCISCO PUADocument11 pagesBDO UNIBANK v. FRANCISCO PUAsejinmaNo ratings yet

- Mejia vs. Reyes, 4 SCRA 648Document3 pagesMejia vs. Reyes, 4 SCRA 648Doo RaNo ratings yet

- Credit Transactions - Atty. Julian Rodrigo A. Dela CruzDocument7 pagesCredit Transactions - Atty. Julian Rodrigo A. Dela CruzAndrei Da JoseNo ratings yet

- Case 8 - ART. 1953Document4 pagesCase 8 - ART. 1953krizzledelapenaNo ratings yet

- Digests Muttum PDFDocument16 pagesDigests Muttum PDFdennis buclanNo ratings yet

- 00 Nego Combined All Cases Assignment #1 (Full Text)Document244 pages00 Nego Combined All Cases Assignment #1 (Full Text)Ainah BaratamanNo ratings yet

- 14 National Bank Vs Maza PDFDocument4 pages14 National Bank Vs Maza PDFYollaine GaliasNo ratings yet

- BPI V Franco GR123498Document11 pagesBPI V Franco GR123498Jesus Angelo DiosanaNo ratings yet

- Nego 1Document22 pagesNego 1I.F.S. VillanuevaNo ratings yet

- G.R. No. 148163 - Banco Filipino Savings and Mortgage Bank v. YbañezDocument6 pagesG.R. No. 148163 - Banco Filipino Savings and Mortgage Bank v. YbañezlckdsclNo ratings yet

- 013 Florentino v. PNB, 28 April 1956Document4 pages013 Florentino v. PNB, 28 April 1956Alvin Dela LunaNo ratings yet

- Canon 15 CasesDocument8 pagesCanon 15 CasesGe LatoNo ratings yet

- Soriano V PeopleDocument15 pagesSoriano V PeopleanailabucaNo ratings yet

- F10 PNB Vs BagamaspadDocument1 pageF10 PNB Vs Bagamaspadlucky javellanaNo ratings yet

- Florentino v. PNB, G.R. No. L-8782Document4 pagesFlorentino v. PNB, G.R. No. L-8782Eszle Ann L. ChuaNo ratings yet

- PNB V Luzon SuretyDocument7 pagesPNB V Luzon SuretyChristiane Marie BajadaNo ratings yet

- Week 4 Case Digest - MANLUCOB, Lyra Kaye B.Document6 pagesWeek 4 Case Digest - MANLUCOB, Lyra Kaye B.LYRA KAYE MANLUCOBNo ratings yet

- 1 - Philippine Education Company Vs SorianoDocument4 pages1 - Philippine Education Company Vs SorianoKeej DalonosNo ratings yet

- G.R. No. L-26833Document3 pagesG.R. No. L-26833Julian DubaNo ratings yet

- Digest FinalDocument27 pagesDigest FinalLee YouNo ratings yet

- CASES (Til Degree of Dili)Document296 pagesCASES (Til Degree of Dili)redbutterfly_766No ratings yet

- Case Canon 15Document22 pagesCase Canon 15lynne tahilNo ratings yet

- Bpi vs. Iac L-66826, Aug. 19, 1988Document5 pagesBpi vs. Iac L-66826, Aug. 19, 1988rosario orda-caiseNo ratings yet

- Assignment AdminDocument17 pagesAssignment AdminAngel SosaNo ratings yet

- G.R. No. 144887 November 17, 2004 ALFREDO RIGOR, Petitioner, People of The Philippines, RespondentDocument8 pagesG.R. No. 144887 November 17, 2004 ALFREDO RIGOR, Petitioner, People of The Philippines, RespondentBea BaloyoNo ratings yet

- BPI v. CA, Bonnevie v. CA, Republic v. Bagtas, Republic v. Grualdo, Producers Bank v. CADocument11 pagesBPI v. CA, Bonnevie v. CA, Republic v. Bagtas, Republic v. Grualdo, Producers Bank v. CAMarlon SevillaNo ratings yet

- Petitioner vs. vs. Respondents Agapito S. Fajardo Marino E. Eslao Leovillo C. AgustinDocument6 pagesPetitioner vs. vs. Respondents Agapito S. Fajardo Marino E. Eslao Leovillo C. AgustinKarina GarciaNo ratings yet

- People Vs ConcepcionDocument3 pagesPeople Vs ConcepcionTenten Belita PatricioNo ratings yet

- G.R. No. L-22405, June 30, 1971Document4 pagesG.R. No. L-22405, June 30, 1971Jaymie ValisnoNo ratings yet

- PPL vs. ConcepcionDocument1 pagePPL vs. ConcepcionnvmndNo ratings yet

- Arieta Vs Naric - GR L15645Document12 pagesArieta Vs Naric - GR L15645jovelyn davoNo ratings yet

- Oblicon DigestsDocument6 pagesOblicon Digestscharmae casilNo ratings yet

- Banco Filipino Savings and Mortgage Bank v. YbanezDocument14 pagesBanco Filipino Savings and Mortgage Bank v. YbanezArnold BagalanteNo ratings yet

- Arrieta vs. NARIC, G.R. No. 15645, 31 January 1964Document5 pagesArrieta vs. NARIC, G.R. No. 15645, 31 January 1964Sandra DomingoNo ratings yet

- 1st Set Credit TransactionDocument113 pages1st Set Credit TransactionLiz Matarong BayanoNo ratings yet

- Marcelino B Florentino Vs Philippine National Bank098 Phil 959Document3 pagesMarcelino B Florentino Vs Philippine National Bank098 Phil 959Kathleen Ebilane PulangcoNo ratings yet

- 04 A.C. No. 378 March 30, 1962 JOSE G. MEJIA and EMILIA N. ABRERA vs. FRANCISCO S. REYESDocument2 pages04 A.C. No. 378 March 30, 1962 JOSE G. MEJIA and EMILIA N. ABRERA vs. FRANCISCO S. REYESHechelle S. DE LA CRUZNo ratings yet

- Rigor vs. People G.R. No. 144887Document7 pagesRigor vs. People G.R. No. 144887Gendale Am-isNo ratings yet

- BPI vs. IntermeDocument5 pagesBPI vs. IntermenbragasNo ratings yet

- The Fireside Chats of Franklin Delano Roosevelt Radio Addresses to the American People Broadcast Between 1933 and 1944From EverandThe Fireside Chats of Franklin Delano Roosevelt Radio Addresses to the American People Broadcast Between 1933 and 1944No ratings yet

- Santos Vs RasalanDocument5 pagesSantos Vs RasalanJemuel LadabanNo ratings yet

- Pepsi-Cola Bottling Company of The Philippines, Inc. v. City of ButuanDocument6 pagesPepsi-Cola Bottling Company of The Philippines, Inc. v. City of ButuanJemuel LadabanNo ratings yet

- Case 35 - Zobel Inc. vs. Court of Appeals, G.R. No. 113931 (1998)Document7 pagesCase 35 - Zobel Inc. vs. Court of Appeals, G.R. No. 113931 (1998)Jemuel LadabanNo ratings yet

- Case 28 - Banco Filipino vs. CA (2000)Document13 pagesCase 28 - Banco Filipino vs. CA (2000)Jemuel LadabanNo ratings yet

- Case 1 - Berboso v. CabralDocument10 pagesCase 1 - Berboso v. CabralJemuel LadabanNo ratings yet

- GSIS v. DaymielDocument9 pagesGSIS v. DaymielJemuel LadabanNo ratings yet

- ASTEC v. ERCDocument31 pagesASTEC v. ERCJemuel LadabanNo ratings yet

- Case 5 - Philippine Hawk Corporation v. LeeDocument12 pagesCase 5 - Philippine Hawk Corporation v. LeeJemuel LadabanNo ratings yet

- Case 75 - PHILTRANCO v. PWU-AGLO, G.R. No. 180962, February 26, 2014Document11 pagesCase 75 - PHILTRANCO v. PWU-AGLO, G.R. No. 180962, February 26, 2014Jemuel LadabanNo ratings yet

- Board of Trustees v. VelascoDocument11 pagesBoard of Trustees v. VelascoJemuel LadabanNo ratings yet

- Case 83 - Union of Filipro Employees v. Nestle Philippines, March 3, 2008Document14 pagesCase 83 - Union of Filipro Employees v. Nestle Philippines, March 3, 2008Jemuel LadabanNo ratings yet

- Civil Codal PDFDocument125 pagesCivil Codal PDFAbbieBallesterosNo ratings yet

- CASE 151 - Maynard v. HillDocument6 pagesCASE 151 - Maynard v. HillJemuel LadabanNo ratings yet

- Case 68 - Unilever v. Rivera, G.R. No. 201701, June 3, 2013Document10 pagesCase 68 - Unilever v. Rivera, G.R. No. 201701, June 3, 2013Jemuel LadabanNo ratings yet

- Villamaria v. CA (G.R. No. 165881, April 19, 2006)Document18 pagesVillamaria v. CA (G.R. No. 165881, April 19, 2006)Jemuel LadabanNo ratings yet

- Case 76 - Jordan v. Grandeur Security, G.R. No. 206716, June 18, 2014Document13 pagesCase 76 - Jordan v. Grandeur Security, G.R. No. 206716, June 18, 2014Jemuel LadabanNo ratings yet

- Case 86 - Diolosa v. CADocument2 pagesCase 86 - Diolosa v. CAJemuel LadabanNo ratings yet

- CASE 154 - Capin-Cadiz v. Brent HospitalDocument20 pagesCASE 154 - Capin-Cadiz v. Brent HospitalJemuel LadabanNo ratings yet

- 7 - Kala Manter (Imran Series)Document257 pages7 - Kala Manter (Imran Series)Saim YounisNo ratings yet

- Ch2b Accounting TransactionDocument58 pagesCh2b Accounting TransactionLizette Janiya SumantingNo ratings yet

- Income Tax Planning: A Study of Tax Saving Instruments: PreprintDocument11 pagesIncome Tax Planning: A Study of Tax Saving Instruments: PreprintPallavi PalluNo ratings yet

- A Comparison of The Finance Companies in BangladeshDocument27 pagesA Comparison of The Finance Companies in BangladeshAnik MuidNo ratings yet

- ERP Software - Financial Accounting Module ProposalDocument19 pagesERP Software - Financial Accounting Module Proposalrohit@turtlerepublic.com0% (1)

- Junior Philippine Institute of AccountantsDocument6 pagesJunior Philippine Institute of AccountantsA BNo ratings yet

- Tutorial FIN221 Chapter 3 - Part 1 (Q&A)Document17 pagesTutorial FIN221 Chapter 3 - Part 1 (Q&A)jojojoNo ratings yet

- JFK Vs The Fed - Fractional BankingDocument8 pagesJFK Vs The Fed - Fractional BankingAprajita SinghNo ratings yet

- Answer Far270 Feb2021Document8 pagesAnswer Far270 Feb2021Nur Fatin AmirahNo ratings yet

- Joy and Jolly Day Care CentreDocument20 pagesJoy and Jolly Day Care CentreSsemakula FrankNo ratings yet

- Invoice: Excelcargo LogisticsDocument1 pageInvoice: Excelcargo LogisticsJohn MaxwellNo ratings yet

- Assessing The Risk of Material Misstatement: Audit I Class Unsoed 22 May 2021Document37 pagesAssessing The Risk of Material Misstatement: Audit I Class Unsoed 22 May 2021julietNo ratings yet

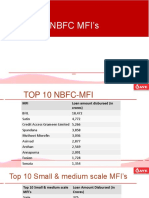

- NBFC Mfi AnalysisDocument10 pagesNBFC Mfi AnalysisNeeraj KumarNo ratings yet

- Chapter 22 Contract CostingDocument18 pagesChapter 22 Contract CostingPavan Kalyan JennyNo ratings yet

- APC 403 PFRS For SMEsDocument10 pagesAPC 403 PFRS For SMEsHazel Seguerra BicadaNo ratings yet

- Multiple Choice - DerivativesDocument3 pagesMultiple Choice - DerivativesLouiseNo ratings yet

- ACC 308 Final Management AnalysisDocument6 pagesACC 308 Final Management AnalysisBREANNA JOHNSONNo ratings yet

- Cashless Society: Presented By: Arsalan ArifDocument24 pagesCashless Society: Presented By: Arsalan ArifArsalan ArifNo ratings yet

- Assumptions: Dec-YE Unit 2018A 2019A 2020A 2021E 2022E 2023E 2024E 2025EDocument3 pagesAssumptions: Dec-YE Unit 2018A 2019A 2020A 2021E 2022E 2023E 2024E 2025ENouf ANo ratings yet

- The FBI Estimates That 80 Percent of All Mortgage Fraud Involves Collaboration or Collusion by Industry InsidersDocument31 pagesThe FBI Estimates That 80 Percent of All Mortgage Fraud Involves Collaboration or Collusion by Industry Insiders83jjmack50% (2)

- Trigonometry and Investments QuizDocument6 pagesTrigonometry and Investments QuizTimNo ratings yet

- 2019 - 1 POP Final Timetable - 0Document30 pages2019 - 1 POP Final Timetable - 0Anonymous IjhB0kuFNo ratings yet

- Ud Wirastri Siklus AkuntansiDocument39 pagesUd Wirastri Siklus AkuntansiPutri EkawatiNo ratings yet

- Chapter 09: Long-Lived Assets Land 5,000 Additional 15K CASH 100,000 MACHINE 30 or 52 Debt X 100,000Document14 pagesChapter 09: Long-Lived Assets Land 5,000 Additional 15K CASH 100,000 MACHINE 30 or 52 Debt X 100,000mostakNo ratings yet

- Day 1 ECCA TrainingDocument78 pagesDay 1 ECCA Trainingadinsmaradhana100% (1)

- Saregamappd 20211102210939-1Document415 pagesSaregamappd 20211102210939-1dilip kumarNo ratings yet

- Using The MACD EffectivelyDocument21 pagesUsing The MACD Effectivelypderby1No ratings yet

- ACCA Audit & Assurance Complete Notes PwC's AcademyDocument187 pagesACCA Audit & Assurance Complete Notes PwC's AcademyZainab SyedaNo ratings yet

- Introduction To Price Action TradingDocument19 pagesIntroduction To Price Action TradingGio GameloNo ratings yet

CASE 80 - PNB v. Bagamaspad, 89 Phil. 365 (1951)

CASE 80 - PNB v. Bagamaspad, 89 Phil. 365 (1951)

Uploaded by

Jemuel Ladaban0 ratings0% found this document useful (0 votes)

2 views12 pagesThis document summarizes a Philippine Supreme Court case from 1951 regarding two bank employees who improperly granted crop loans without proper authorization or oversight. The bank sued the employees to recover the amount of the unauthorized loans. The court found the employees were negligent in their duties and violated bank policies, making them liable to repay the full amount of the improper loans under relevant civil codes. While some borrowers did repay parts of the loans, this did not constitute ratification of the employees' unauthorized acts by the bank.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document summarizes a Philippine Supreme Court case from 1951 regarding two bank employees who improperly granted crop loans without proper authorization or oversight. The bank sued the employees to recover the amount of the unauthorized loans. The court found the employees were negligent in their duties and violated bank policies, making them liable to repay the full amount of the improper loans under relevant civil codes. While some borrowers did repay parts of the loans, this did not constitute ratification of the employees' unauthorized acts by the bank.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

2 views12 pagesCASE 80 - PNB v. Bagamaspad, 89 Phil. 365 (1951)

CASE 80 - PNB v. Bagamaspad, 89 Phil. 365 (1951)

Uploaded by

Jemuel LadabanThis document summarizes a Philippine Supreme Court case from 1951 regarding two bank employees who improperly granted crop loans without proper authorization or oversight. The bank sued the employees to recover the amount of the unauthorized loans. The court found the employees were negligent in their duties and violated bank policies, making them liable to repay the full amount of the improper loans under relevant civil codes. While some borrowers did repay parts of the loans, this did not constitute ratification of the employees' unauthorized acts by the bank.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 12

FIRST DIVISION

[G.R. No. L-3407. June 29, 1951.]

PHILIPPINE NATIONAL BANK, plaintiff-appellee, vs. BERNARDO

BAGAMASPAD and BIENVENIDO M. FERRER, defendants-

appellants.

Jose G. Flores, for appellants.

Nemesio P. Labunao for appellee.

SYLLABUS

1. PRINCIPAL AND AGENT; CROP LOANS; UNAUTHORIZED AND

CARELESS GRANTS OF LOANS TO FICTITIOUS OR INSOLVENT BORROWERS.

— The acts of laxity, negligence and carelessness of the defendants are

amply established by the evidence. The evidence also shows that in violation

of instructions and regulations of the bank, the defendants released large

crop loans aggregating P348,768 to about 103 borrowers who were neither

landowners nor tenants but only public land sales applicants. Held: The

defendants are civilly liable, under articles 1718, 1719 and 1902 of the Civil

Code and under article 259 of the Code of Commerce.

2. ID.; ID.; ID.; ALLEGED RATIFICATION BY PHILIPPINE NATIONAL

BANK. — Although the Philippine National Bank filed suits against said

borrowers, resulting in the payment of part of said loans thereby reducing

the original claim of the bank from P704,903 to P699,803, such filing of suits

is not a ratification of the acts of the defendants, as there was no intention

on the part of the bank to ratify those unauthorized acts. The plaintiff was

merely trying to diminish as much as possible the loss to itself and decrease

the defendants' financial liability.

3. ID.; ID.; ID.; NECESSITY OF GOING FIRST AGAINST THE

BORROWERS. — It is not necessary for plaintiff bank to go against the

individual borrowers first, exhaust all remedies against them, and then hold

the defendants liable only for the balance which cannot be collected. The

Bank's cause of action accrued, and the injury to it was complete, on the

very day that the amounts of the unauthorized loans were released by the

erring officials. (Corsicana National Bank vs. Johnson, 64 L. ed., 141.)

DECISION

MONTEMAYOR, J : p

CD Technologies Asia, Inc. © 2023 cdasiaonline.com

On May 25, 1948, the plaintiff Philippine National Bank, a banking

corporation organized and operating under the laws of the Philippines, with

main office in the City of Manila and agencies in different provinces like the

province of Cotabato, initiated this suit in the Court of First Instance of

Cotabato for the purpose of collecting from the defendants Bernardo

Bagamaspad and Bienvenido M. Ferrer who, in the years 1946 and 1947,

were its Agent and Assistant Agent, respectively, in its Cotabato Agency, the

sum of P704,903.18, said to have been disbursed and released by them as

special crop loans, without authority and in a careless manner to manifestly

insolvent, unqualified or fictitious borrowers, all contrary to the rules and

regulations of the plaintiff Bank. In the course of the trial, upon petition of

plaintiff's counsel, the amount of the claim was reduced to P699,803.57, due

to payments made by some of the borrowers. On March 31, 1949, the trial

court rendered judgment in favor of the plaintiff, ordering both defendants to

pay jointly and severally to it the sum of P699,803.57, representing the

uncollected balance of the special crop loans improperly released by said

defendants, with legal interest thereon from the date of the filing of the

complaint, plus costs. The two defendants appealed from that decision. The

appeal was first taken to the Court of Appeals but in view of the amount

involved it was certified to this Tribunal by the said Court of Appeals.

The uncontroverted facts in the present case may be briefly stated as

follows. Because of the Pacific War and by reason of the destruction and loss

of animals of labor, farm implements, and damage to or abandonment of

farm lands, after liberation there was acute shortage of foodstuffs. President

Roxas in order to foment and encourage food production, instructed the

plaintiff Philippine National Bank to extend special facilities to farmers in the

form of crop loans in order to enable them to rehabilitate their farms. In

pursuance of said instructions and to cooperate with the Administration, the

plaintiff Bank passed the corresponding resolution (Exhibit B) authorizing the

granting of ten-month special crop loans to bona fide food producers, land-

owners or their tenants, under certain conditions. Delfin Buencamino, one of

the Vice-Presidents of the Bank and head of the Branches and Agencies

Department of said institution, was entrusted with the supervision of the

granting of these loans. Juan Tueres, one of the Assistant Managers of said

Department drafted the corresponding rules and regulations regarding the

granting of said special crop loans. After approval by Buencamino, these

rules and regulations were embodied in a circular letter (Exhibit C), a copy of

which was personally delivered to defendant Ferrer. These rules and

regulations were later amplified by another circular letter (Exhibit D).

Besides circularizing its branches and agencies with these rules and

regulations, on June 14, 1946, the Bank held in Manila a conference of all its

Managers and Agents. Defendant Ferrer, Assistant Agent of the Cotabato

Agency attended the conference in representation of said Agency. He

arrived late but Tueres explained to him what had been discussed during the

conference, emphasizing to him the necessity of exercising diligence and

care in the granting of the crop loans to see to it that they are granted only

to bona fide planters, land-owners or tenants, as well as repeating to him the

advice of Vicente Carmona, President of the bank, that the Managers and

CD Technologies Asia, Inc. © 2023 cdasiaonline.com

Agents of the Bank should not allow themselves to be fooled.

The Cotabato Agency under the management of the two defendants

began granting these special crop loans in July, 1946, and by March of the

following year, 1947, said Agency had granted to over 5,000 borrowers,

loans in the total amount of a little over eight and a half million pesos.

The theory on which the Bank's claim and complaint are based is that

the two defendants Bagamaspad and Ferrer acting as Agent and Assistant

Agent of the Cotabato Agency, in granting new crop loans after November

13, 1946, violated the instructions of the Bank, and that furthermore, in

granting said crop loans, they acted negligently and did not exercise the

care and precaution required of them in order to prevent the release of crop

loans to persons who were neither qualified borrowers nor entitled to the

assistance being rendered by the Government and the Bank, all contrary to

the rules and regulations issued by the Bank.

Because of the heavy disbursements made by the Cotabato Agency in

the form of crop loans and because of exhaustion of its funds, said agency

sent a telegram, Exhibit 11, dated November 11, 1946, requesting authority

from the central office to secure cash from the Zamboanga Agency. Replying

to this telegram, Delfin Buencamino sent a letter, Exhibit E, dated November

13, 1946; addressed to the Cotabato Agency stating among other things that

the purpose of these funds (to be obtained from the Zamboanga Agency)

was to meet the releases of the second installment crop loans being granted

which according to the telegram aggregated P60,000 daily. The letter

reminded the Agency that the central office had not yet received the

Agency's monthly reports on special crop loans granted, as required by the

regulations, and it emphasized the necessity of performing inspection of the

field to verify whether the amount released as first installment was actually

used for the purpose for which it was granted, before releasing the second

installment. In relation with said letter, Exhibit E, defendant Bagamaspad

wrote a letter, Exhibit F, dated November 18, 1946, to the central office

making reference to said Exhibit E, reiterating the Agency's heavy

disbursements on second installments for crop loans and stating that Ferrer

had been instructed to proceed to Zamboanga to secure the needed cash,

and that Ferrer was able to secure P300,000 from the Zamboanga Agency.

Then making reference to and quoting a portion of the letter of Buencamino,

Exhibit E, Bagamaspad in his letter said:

"In connection with the following portion:

'In this connection, we would like to state that the purpose of

these funds is to meet the release of the second installment of crop

loans being granted by that agency, which, according to your said

telegram, will run to P600,000 daily.'

of your above mentioned letter, may we know if we could still entertain

new applicants on Special Crop Loans? We are constrained to request

for this matter because there are now on file no less than 1,000 new

applicants which we could not entertain because of your above quoted

statement. Yesterday they held a demonstration and copy of the

picture is hereto attached. In addition, there are about 5,000 settlers in

Koronadal Valley who, according to your indorsement of Oct. 31, 1946

CD Technologies Asia, Inc. © 2023 cdasiaonline.com

to the Technical Assistant to the President of the Philippines, could be

given crop loans. If we could not therefore disburse from the funds

taken from Zamboanga Agency against first installment of applicants

on crop loans, we shall appreciate if you could give us definite course

of action towards the clarification of our stand to the public.

"We are again sending Asst. Agent B. M. Ferrer to Zamboanga to

despatch this letter without delay and wait there for whatever

instruction that you may give with reference to our desire to secure

more cash from our Zamboanga Agency, say P1,000,000 and whether

we shall continue granting special crop loans or not.

"With reference to the cash that we desire to secure more, we

could tell you with assurance that the same shall arrive there safely

under guard on a chartered plane which will cost not more than P300

only."

From this letter of Bagamaspad of which his co-defendant Ferrer must

have been aware, because he himself prepared it upon order of Bagamaspad

(pp. 340-344, t. s. n.), particularly the portion above- quoted, it will be seen

that without waiting for authority to secure funds from the Zamboanga

Agency, Ferrer obtained P300,000 from said Agency, and that Bagamaspad

again had sent Ferrer to Zamboanga to await instruction from the central

office regarding their desire and intention to secure in additional P1,000,000

for the Cotabato Agency. As a matter of fact, however, once in Zamboanga,

and without waiting for instructions, Ferrer again secured P500,000 from the

Zamboanga Agency. It was while Ferrer already carrying the P500,000 was

about to board the plane that was to take him to Cotabato, that he received

the answer from the central office, Exhibit G, authorizing him to obtain only

P300,000 from the Zamboanga Agency, with the statement that as soon as

the said amount was exhausted, the Cotabato Agency may again request for

replenishment. This letter of the Central Office again emphasized the

necessity of strict compliance with the rules and regulations regarding the

required field inspection before releasing the second installment. The said

letter, Exhibit G, ended with the following:

"Concerning the new special crop loan applications numbering

about 1,000, we would like to be informed whether the farms of the

said applicants have already been actually planted, considering that at

this advanced period planting season in low-land palay region is now

over. As the purpose for which special crop loans are being granted by

the Bank is to provide the farmers with funds to meet the expenses of

their farms and if said farms have already been planted, we believe

that the farmers may not need said credit facilities unless it has been

found out by actual investigation and verification that said loans are

needed by them.

"Please, therefore, let us hear from you regarding this matter."

(Italics ours)

In answer to this letter, Exhibit G, defendants sent a telegram, Exhibit

H, dated November 25, 1946, to the central office in Manila, stating that for

Cotabato, the planting season for second crops ended December. In answer

to Exhibit H, the central office sent a telegram, Exhibit I, dated November

CD Technologies Asia, Inc. © 2023 cdasiaonline.com

28, 1946, expressly instructing the Cotabato Agency to discontinue granting

new crop loans. The defendants claim that this telegram, Exhibit I, was

received by them by mail on December 7, 1946.

In their brief the appellants contend that the trial court erred in finding

and holding that in extending new special crop loans after November 26,

1946, amounting to P726,680, they as Agent and Assistant Agent,

respectively, of the Cotabato Agency, did so at their own risk and in violation

of the instructions received from the Manila office; also that the court erred

in holding that they (appellants) acted with extreme laxity, negligence and

carelessness in granting said new special crop loans. On the first assigned

error appellants maintain that outside of the telegram, Exhibit I, which they

claim to have received only on December 7, 1946, there was no instruction

by the central office stopping the granting of new special crop loans.

It may be that there was no such express instruction couched in so

many words directly ordering the defendants to stop granting new special

crop loans, but that said idea of the central office could be gathered from its

letter, Exhibit E, and that it was understood and clearly, by the defendants,

is evident. If defendants did not so understand it, namely, that they were no

longer authorized to grant new special crop loans, how else may we interpret

the contents of the letter of Bagamaspad, Exhibit F, particularly that portion

wherein after quoting a portion of the central office letter Exhibit E, he asks

if they (defendants) could still entertain new applications for special crop

loans? At least, they then doubted their authority to grant new special crop

loans and until that doubt was cleared up and determined by new

instructions from their superiors, it was their bounden duty to stop granting

new loans. Appellant Ferrer himself, in response to questions asked by the

trial court during the hearing, said that in case of doubt as to whether or not

to disburse funds of the bank, he should consult and await instructions.

Appellants asked for instructions as to whether or not they should grant new

special crop loans. This request for instructions is contained clearly in

Bagamaspad's letter, Exhibit F, where in one paragraph he asks: "May we

know if we could still entertain new applications on special crop loans?" And,

in another paragraph he says: "We are again sending Asst. Agent B. M.

Ferrer to Zamboanga . . . and wait there for further instructions that you

may give . . . and whether we shall continue granting special crops loans or

not." The trouble is that without waiting for said requested instructions,

appellants proceeded to grant new special crop loans from November 26,

1946 to January 4, 1947.

Appellants not only granted new special crop loans after they were

given to understand by the central office that they should no longer grant

said new loans and before appellants received instructions as to what they

should do in that regard, but they also violated the express instructions of

the Bank to the effect that funds received from the Zamboanga Agency

should be utilized only to pay second installments on special crop loans. Of

course, defendants contend that the total of P800,000 secured from the

Zamboanga Agency were all used in paying second installments, but the

contrary is amply established by Exhibit T, a statement prepared by

CD Technologies Asia, Inc. © 2023 cdasiaonline.com

Felicisimo Lopez, Chief Examiner of the Bank showing that out of the

P500,000 secured from the Zamboanga Agency on or about November 18,

1946, the amount of P232,931.58 was paid on account of new special crop

loans or first installments. The plaintiff-appellee Bank in its brief explains in

details this use of part of the Zamboanga funds in paying first installments

on new crop loans.

As to the alleged error committed by the trial court in finding and

holding that the appellants were extremely lax, negligent and careless in

granting new special crop loans, we quote with approval a portion of the well

considered decision of the trial Judge, Hon. Arsenio Solidum, on this point:

"From the evidence of record, one cannot help but be amazed at

the extreme laxity, negligence and carelessness on the part of the

defendants in the granting of the special crop loans. It seems that all

precautions to protect the interest of the Philippine National Bank as

the principal of the defendants were thrown overboard. From all

appearances, the door of the Cotabato Agency was left wide open by

the defendants as an invitation for all persons to come in and secure

from them special crop loans regardless of whether or not under the

rules prescribed therefor they were rightfully entitled thereto. . . ." (p.

165, Record on Appeal)

xxx xxx xxx

"What really happened was that in those days of crop loan boom,

the borrowers made a holiday of the funds of the Cotabato Agency of

the Philippine National Bank with the indulgence and tolerance of the

defendants as the managing officials of the Agency. And the saddest

part of it all was that the money did not go to the farmers who needed

it the most but to unscrupulous persons, who, taking undue advantage

of the laxity and looseness of the defendants in doling out these loans,

secured special crop loan funds without the least idea of investing

them in food production campaign for which they were primarily

intended. Part of the booty went to the pockets of those who acted as

intermediaries in the procurement of the loans under the very noses of

the defendants fully knowing that such practice was prohibited by the

rules and regulations of the Philippine National Bank governing the

operation of provincial agencies (Exhibits 'W', 'T', 'T-1', to 'T-11', 'U', 'U-

1' to 'U-2') . . ." (pp. 176-177, Record on Appeal)

The lower court as may be seen, severely criticised and condemned

the acts of laxity, negligence and carelessness of the appellants. But the

severity of this criticism and condemnation would appear to be amply

warranted by the evidence. Out of the numerous acts of laxity, negligence

and carelessness established by the record, a few cases may be cited.

Exhibits C and D which contain instructions and rules and regulations

governing the granting of special crop loans, provide that before a crop loan

is granted the Agent or Sub-Agent of the Bank must be satisfied that the

applicant is either a landowner well known to be possessing the particular

property on which the crop is to be produced, or if the applicant be a tenant

he must be recommended by the landowner concerned or in the absence of

said landowner must be properly identified that he is the bona fide tenant

actually tilling the land from which the crop to be mortgaged would be

CD Technologies Asia, Inc. © 2023 cdasiaonline.com

harvested.

The evidence shows that in violation of these instructions and

regulations, the defendants released large loans aggregating P348,768.22 to

about 103 borrowers who were neither landowners or tenants but only public

land sales applicants, that is to say, persons who have merely filed

applications to buy public lands. It is a well known fact that when a person

desires to apply for the purchase of public lands usually containing trees,

underbrush, cogon or other wild vegetation, and never previously cultivated,

he merely goes over the land, stakes it out and then files his application with

the Public Land Office. Subsequently and in due time the Bureau of Lands

examines the application, tries to determine the location of the land, its

identity, proceeds to classify it to see if it is open to sale and if so, perhaps

makes a rough survey of it to establish its exact location and fix boundaries

with respect to the entire area of the public domain. The application

naturally carries no implication of occupancy, possession, much less

cultivation and dominion. And yet, in spite of all this, the appellants had

been granting loans to these public lands sale applicants who were neither

landowners or tenants.

The record further shows that Mr. Villamarzo, District Land Officer for

Cotabato with whom these sale applications had been filed, came to know

that the certificates that he had been issuing to the applicants, which were

nothing but acknowledgments of the filing of the applications, had been used

by said applicants to secure special crop loans, and so he went to see the

appellants as early as the middle of August of 1946 and advised them that

those certificates were issued merely to show that the applications had been

filed with him but that it did not mean that said applications had already

been investigated, much less that the lands covered by them had been

surveyed. Then about the end of the same month Villamarzo accompanied

by Almonte, a Division Land Inspector of the Bureau of Lands, again went to

the defendants and repeated the advice and warning. Despite all these, as

already stated, appellants granted new special crop loans to 103 of these

public land sales applicants, knowing as they must have known that the

borrowers were neither landowners nor tenants. Furthermore, it should be

remembered that these special crop loans according to regulations were

payable in ten (10) months, and were to be secured by chattel mortgages on

the crops to be produced. A virgin land, especially if covered with trees or

underbrush, needs to be cleared and placed in condition for cultivation

before crops may be produced. That work of clearing would take some time.

A public land sale applicant, even assuming that he immediately began to

clear the land applied for even before favorable action on his application is

taken, is hardly in a position to meet the requirements of the regulations

governing the granting of special crop loans, namely, to mortgage the crop

he is going to produce, and pay the loan within ten months.

Appellants in their over-enthusiasm and seemingly inordinate desire to

grant as many loans as possible and in amounts disproportionate to the

needs of the borrowers, admitted and passed upon more loan applications

CD Technologies Asia, Inc. © 2023 cdasiaonline.com

than they could properly handle. From July, 1946 to March, 1947 the total

amount of about eight and a half (8 1/2) million pesos was released in the

form of special crop loans to about 5,105 borrowers and this, in a relatively

sparsely populated province like Cotabato. As a consequence of this big

volume of business the bookkeeper of the Agency could not keep up with the

posting of the daily transactions in his books and ledgers and he was several

months behind. There were so many applications acted upon and accepted

that they could not all be carefully examined and many of them do not even

bear the initials or signatures of the appellants as required by regulations.

Some of the chattel mortgages given to secure the payments of the loans,

contrary to regulations, do not show the number of cavans of palay to be

produced on the land and to be mortgaged in favor of the Bank.

Contrary to the Bank's rules and regulations regarding the granting of

special crop loans, the defendants allowed intermediaries to intervene in the

granting of special crop loans. Many lawyers, business agents and other

persons intervened in the granting of the loans. We may have an idea of the

part played by these intermediaries by referring to a portion of the report,

Exhibit V, prepared by Mr. Lagdameo, one of the Assistant Managers of the

Agencies and Branches Department of the plaintiff Bank, sent to Cotabato to

investigate the crop loan anomalies in the Cotabato Agency, which portion

we quote below:

"On top of this, were the heavy expenses incurred by the

borrowers to secure crop loans. The rush was so unprecedented that

applicants had to stay for weeks in hotels in Cotabato to lobby for the

approval of their applications. They even went to the extent of

engaging intermediaries who in the words of some borrowers were the

best ones to fix things with the agency for the approval and immediate

release of the loan. These intermediaries are government employees

and business agents and particularly practicing attorneys who charged

fees up to 5 per cent of the total loans approved. Instances have been

shown that the Agency itself collected the attorney's fees and delivered

them to the parties concerned. In other cases, the intermediaries

themselves were the ones who received the proceeds of the loans and

distributed them to the borrowers. It has also been found that loan

papers including the preparation of promissory notes, debit tickets,

etc., were prepared by said intermediaries and submitted to the

Agency already executed. . . .."

There is evidence to the effect that sometimes the fees of these

intermediaries were collected by the Agency itself and were later turned over

to appellant Ferrer, perhaps to be later given by him to said intermediaries.

One of the provisions of the rules and regulations concerning the

granting of loans is to the effect that loans to be released by a Provincial

Agency like that of the appellants' should be approved by a Loan Board to be

composed of the Agent, like defendant Bagamaspad; the Assistant Agent,

like Ferrer or the Inspector if there is no Assistant Agent; and the Municipal

Treasurer where the borrower resides. The evidence, however, shows that

many of the special crop loans released by the appellants have not been

approved by this Board and others have not even been approved by anyone

of them.

CD Technologies Asia, Inc. © 2023 cdasiaonline.com

It will be remembered that in the letter of Vice President Buencamino,

Exhibit G, dated November 19, 1946, speaking of the new special crop loan

applications numbering about 1,000 mentioned by appellant Bagamaspad in

his letter, Exhibit F, the plaintiff Bank wanted to know whether on that date,

November 19th, the farmers in Cotabato had already planted their farms in

which case there was no need for their obtaining crop loans to meet the

expenses of planting. Answering this query, the Cotabato Agency under the

appellants, sent a telegram (Exhibit H) dated November 25, 1946, to the

plaintiff Bank saying that the planting season for Cotabato for second crops

ends in December. This was evidently intended to justify the granting of

special crop loans even at the end of the year. The evidence however, belies

the correctness of this statement and information. Mr. Aniceto Padilla,

Assistant Provincial Agricultural Supervisor, a graduate of the College of

Agriculture of the University of the Philippines, told the court that his office,

which is the Provincial Agricultural Station in Cotabato, has determined the

proper period for planting crops raised in that province, and that for upland

palay, the planting season is during the months of March, April up to May;

that for lowland palay is June and July; and that second crops may be planted

in September even as late as October. From this, one may conclude that it is

not true as the appellants informed the Bank that the planting season for

palay (second crop) in Cotabato ends in December. Whether this incorrect

information was given deliberately or thru negligence and carelessness, we

deem it unnecessary to determine.

To give a further idea of the confusion, lack of care and method with

which the Cotabato Agency was managed by the appellants, the record

shows that in January, 1947, Mr. Simeon Intal, Traveling Auditor of the

Philippine National Bank, was sent to Cotabato with instructions to make an

audit of the accounts of the Cotabato Agency and to see for himself the

reported irregularities being committed in said Agency with respect to the

granting of special crop loans. According to Mr. Intal he found the Cotabato

Agency like a market place full of people. He saw crop loan papers like

promissory notes, loan applications and chattel mortgages scattered all over

the office of the Agency, some on the desks of employees, on open shelves

or on top of filing cabinets, and others on the floor. He found that

transactions which had taken place five months before were not yet posted

in the books of the Agency. In February, 1947, Mr. Amado Lagdameo, then

one of the Assistant Managers of the Branches and Agencies Department of

the Bank, was also sent to Cotabato and there he found the same conditions

found and reported by Intal. In order to make thorough investigation of the

anomalies reportedly obtaining in the Cotabato Agency, Felicisimo Lopez, a

certified public accountant and Chief Examiner of the plaintiff Bank, was sent

to Cotabato in June, 1947. He checked up the findings of Intal about the

deplorable condition of the books and records of the Agency and he agreed

with said findings. Lopez and Intal assisted by Benjamin de Guzman, Branch

Auditor of the Bank at the Davao Branch, Mr. Macuja (who later succeeded

Benjamin de Guzman), Mr. Juan B. Sanchez, now Branch Auditor in Legaspi,

Mr. Antonio Cruz of the Head Office, Mr. Danao from Oriental Misamis, Mr.

Fernandez from Zamboanga and Mr. Romena of the Davao Branch, went to

CD Technologies Asia, Inc. © 2023 cdasiaonline.com

work on the books and records of the Cotabato Agency and it took them

almost four months to straighten out the special crop loan accounts and

bring the books up-to-date, after which, they found that as of June 10, 1947,

the Cotabato Agency had released special crop loans in the aggregate sum

of P8,688,864.

To us who have always had the impression and the idea that the

business of a Bank is conducted in an orderly, methodical and businesslike

manner, that its papers, especially those relating to loans with their

corresponding securities, are properly filed, well- kept and in a safe place, its

books kept up-to-date, and that its funds are not given out in loans without

careful and scrupulous scrutiny of the responsibility and solvency of the

borrowers and the sufficiency of the security given by them, the conditions

obtaining in the Cotabato Agency due to the apparent indifference,

carelessness or negligence of the appellants, is indeed shocking. And it is

because of these shortcomings of the appellants, their disregard of the

elementary rules and practice of banking and their violation of instructions of

their superiors, that these anomalies resulting in financial losses to the Bank

were made possible.

The trial court based the civil liability of the appellants herein on the

provisions of Arts. 1718 and 1719 of the Civil Code, defining and

enumerating the duties and obligations of an agent and his liability for

failure to comply with such duties, and Art. 259 of the Code of Commerce

which provides that an agent must observe the provisions of law and

regulations with respect to business transactions entrusted to him otherwise

he shall be responsible for the consequences resulting from their breach or

omissions; and also Art. 1902 of the Civil Code which provides for the liability

of one for his tortious act, that is to say, any act or omission which causes

damage to another by his fault or negligence. Appellants while agreeing with

the meaning and scope of the legal provisions cited, nevertheless insist that

those provisions are not applicable to them inasmuch as they are not guilty

of any violation of instructions or regulations of the plaintiff Bank; and that

neither are they guilty of negligence of carelessness as found by the trial

court. A careful study and consideration of the record, however, convinces

us and we agree with the trial court that the defendants-appellants have not

only violated instructions of the plaintiff Bank, including things which said

Bank wanted done or not done, all of which were fully understood by them,

but they (appellants) also violated standing regulations regarding the

granting of loans; and, what is more, thru their carelessness, laxity and

negligence, they allowed loans to be granted to persons who were not

entitled to receive loans.

It is the contention of the appellants that the act of plaintiff Bank in

filing suits against the borrowers to whom appellants were said to have

granted loans without authority, which suits resulted in the payment of part

of said loans resulting in the reduction of the original claim of the plaintiff

Bank from P704,903.18 to P699,803.57, should be interpreted and

considered as a ratification of the acts of the appellants. What is more, it is

contended that it would be iniquitous for the plaintiff to go against the

CD Technologies Asia, Inc. © 2023 cdasiaonline.com

defendants for whatever amounts may have been loaned by the latter and at

the same time go against the individual borrowers for collection of the

respective sums borrowed by them. That would be enriching the plaintiff at

the expense of the defendants." We cannot subscribe to this theory. As

pointed out by Counsel for appellee, ordinarily, a principal who collects

either judicially or extrajudicially a loan made by an agent without authority,

thereby ratifies the said act of the agent. In the present case, however, in

filing suits against some of the borrowers to collect at least part of the

unauthorized loans, there was no intention on the part of the plaintiff Bank

to ratify the acts of appellants. Neither did the plaintiff receive any

substantial benefit by its act of filing these suits if we consider the fact that

the collections so far made, form a small or insignificant portion of the entire

principal and interest. And, we fail to see any iniquity in this act of the

plaintiff in suing some of the borrowers to collect what it could at the same

time holding the appellants liable for the balance, because the plaintiff Bank

is not trying to enrich itself at the expense of the defendants but is merely

trying to diminish as much as possible the loss to itself and automatically

decrease the financial liability of appellants. Considering the large amount

for which appellants are found liable, it is a matter of serious doubt if they

are in a position to pay it. Moreover, whatever amount is collected by the

plaintiff Bank from borrowers, serves to diminish the financial liability of the

appellants, in the same way that the original claim of P704,903.18, at the

very instance of plaintiff was reduced to P699,803.57. In other words, the act

of the plaintiff Bank in this matter, far from being iniquitous, is really

beneficial to the appellants.

Appellants further contend that the present action is rather premature

for the reason that there is no showing that the borrowers to whom they

allegedly gave loans without authority, are manifestly insolvent or

unqualified, and that the loans granted to them are uncollectible and have

been written off the books of the Bank as "bad debts". We find this

contention untenable. It is not necessary for the plaintiff Bank to first go

against the individual borrowers, exhaust all remedies against them and

then hold the defendants liable only for the balance which cannot be

collected. The case of Corsicana National Bank vs. Johnson, 64 L. ed. 141,

cited by the trial court and by the plaintiff Bank is in point. The issue in that

case whether or not a bank could proceed against one of its officials for

losses which it had sustained in consequence of the unauthorized loans

released by said official, or whether it should first pursue its remedies

against the borrowers or await the liquidation of their estates. The Supreme

Court of the United States in said case held that the cause of action of the

Bank accrued and the injury to it was complete on the very day that the

amounts of the unauthorized loans were released by the erring official. We

quote a part of that decision:

"Assuming the Fleming and Templeton notes were found to

represent an excessive loan, knowingly participated in or assented to

by defendant as a director of the Bank, in our opinion the cause of

action against him accrued on or about June 10, 1907, when the Bank,

through his act, parted with the money loaned, receiving in return only

CD Technologies Asia, Inc. © 2023 cdasiaonline.com

negotiable paper that it could not lawfully accept because the

transaction was prohibited by section 5200, Rev. Stat. (Comp. Stat.

section 9761, 6 Fed. Stat. Anno. 2d ed., p. 761). The damage as well as

the injury was complete at that time, and the Bank was not obliged to

await the maturity of the notes, because immediately it became the

duty of the officers or directors who knowingly participated in making

the excessive loan to undo the wrong done by taking the notes off the

hands of the Bank and restoring to it the money that had been loaned.

Of course, whatever of value the Bank recovered from the borrowers

on account of the loan would go in diminution of the damages; but the

responsible officials would have no right to require the Bank to pursue

its remedies against the borrowers or await the liquidation of their

estates. The liability imposed by the statute upon the director is a

direct liability, not contingent or collateral."

In view of all the foregoing, and finding no reversible error in the

decision appealed from, the same is hereby affirmed with costs against the

appellants. So ordered.

Paras, C. J., Feria, Pablo, Bengzon, Tuason, Jugo and Bautista Angelo,

JJ., concur.

CD Technologies Asia, Inc. © 2023 cdasiaonline.com

You might also like

- Riano - 2019Document385 pagesRiano - 2019Jemuel Ladaban93% (14)

- 02 CVP Analysis For PrintingDocument8 pages02 CVP Analysis For Printingkristine claire50% (2)

- 5th 57. PNB Vs BagamaspadDocument1 page5th 57. PNB Vs BagamaspadXing Keet LuNo ratings yet

- Danao vs. CADocument5 pagesDanao vs. CAvanessa_3No ratings yet

- Viray and Viola Viray For Petitioner. First Assistant Solicitor General Roberto A. Gianzon and Solicitor Manuel Tomacruz For RespondentDocument13 pagesViray and Viola Viray For Petitioner. First Assistant Solicitor General Roberto A. Gianzon and Solicitor Manuel Tomacruz For RespondentCarren Paulet Villar CuyosNo ratings yet

- Nego Fulltext (Rigor - BPI)Document46 pagesNego Fulltext (Rigor - BPI)Roche DaleNo ratings yet

- Ii. Loan (C. Simple Loan or Mutuum)Document195 pagesIi. Loan (C. Simple Loan or Mutuum)ErikaAlidioNo ratings yet

- Obligations and ContractsDocument220 pagesObligations and ContractsDeon marianoNo ratings yet

- 4) BPI Family Bank vs. FrancoDocument10 pages4) BPI Family Bank vs. FrancoNathalie YapNo ratings yet

- G.R. No. L-24837Document2 pagesG.R. No. L-24837Hanifa D. Al-ObinayNo ratings yet

- Plaintiff-Appellee vs. vs. Defendant-Appellant Solicitor General Isabelo P. SamsonDocument6 pagesPlaintiff-Appellee vs. vs. Defendant-Appellant Solicitor General Isabelo P. SamsonJia Chu ChuaNo ratings yet

- Plaintiffs Appellees Defendants Defendant AppellantDocument16 pagesPlaintiffs Appellees Defendants Defendant AppellantEarl YoungNo ratings yet

- G.R. No. 144887 November 17, 2004 ALFREDO RIGOR, Petitioner, People of The Philippines, Respondent. Azcuna, J.Document5 pagesG.R. No. 144887 November 17, 2004 ALFREDO RIGOR, Petitioner, People of The Philippines, Respondent. Azcuna, J.teepeeNo ratings yet

- Reaction Paper On SeminarDocument5 pagesReaction Paper On SeminarJC TuqueroNo ratings yet

- PNB v. BagamaspadDocument2 pagesPNB v. BagamaspadJP Murao IIINo ratings yet

- Serrano vs. Central BankDocument4 pagesSerrano vs. Central BankVilpa VillabasNo ratings yet

- Petitioner vs. vs. Respondent: Second DivisionDocument7 pagesPetitioner vs. vs. Respondent: Second DivisionVener MargalloNo ratings yet

- Republic of The Philippines: Factual AntecedentsDocument7 pagesRepublic of The Philippines: Factual AntecedentsRobert QuiambaoNo ratings yet

- 142558-1968-Singson - v. - Bank - of - The - Philippine - Islands20210424-12-1hrqm8gDocument3 pages142558-1968-Singson - v. - Bank - of - The - Philippine - Islands20210424-12-1hrqm8gNicorobin RobinNo ratings yet

- 137684-1980-Serrano v. Central Bank of The Philippines20190125-5466-19jls49Document5 pages137684-1980-Serrano v. Central Bank of The Philippines20190125-5466-19jls49ShairaCamilleGarciaNo ratings yet

- Soriano V PeopleDocument21 pagesSoriano V PeopleptbattungNo ratings yet

- BDO UNIBANK v. FRANCISCO PUADocument11 pagesBDO UNIBANK v. FRANCISCO PUAsejinmaNo ratings yet

- Mejia vs. Reyes, 4 SCRA 648Document3 pagesMejia vs. Reyes, 4 SCRA 648Doo RaNo ratings yet

- Credit Transactions - Atty. Julian Rodrigo A. Dela CruzDocument7 pagesCredit Transactions - Atty. Julian Rodrigo A. Dela CruzAndrei Da JoseNo ratings yet

- Case 8 - ART. 1953Document4 pagesCase 8 - ART. 1953krizzledelapenaNo ratings yet

- Digests Muttum PDFDocument16 pagesDigests Muttum PDFdennis buclanNo ratings yet

- 00 Nego Combined All Cases Assignment #1 (Full Text)Document244 pages00 Nego Combined All Cases Assignment #1 (Full Text)Ainah BaratamanNo ratings yet

- 14 National Bank Vs Maza PDFDocument4 pages14 National Bank Vs Maza PDFYollaine GaliasNo ratings yet

- BPI V Franco GR123498Document11 pagesBPI V Franco GR123498Jesus Angelo DiosanaNo ratings yet

- Nego 1Document22 pagesNego 1I.F.S. VillanuevaNo ratings yet

- G.R. No. 148163 - Banco Filipino Savings and Mortgage Bank v. YbañezDocument6 pagesG.R. No. 148163 - Banco Filipino Savings and Mortgage Bank v. YbañezlckdsclNo ratings yet

- 013 Florentino v. PNB, 28 April 1956Document4 pages013 Florentino v. PNB, 28 April 1956Alvin Dela LunaNo ratings yet

- Canon 15 CasesDocument8 pagesCanon 15 CasesGe LatoNo ratings yet

- Soriano V PeopleDocument15 pagesSoriano V PeopleanailabucaNo ratings yet

- F10 PNB Vs BagamaspadDocument1 pageF10 PNB Vs Bagamaspadlucky javellanaNo ratings yet

- Florentino v. PNB, G.R. No. L-8782Document4 pagesFlorentino v. PNB, G.R. No. L-8782Eszle Ann L. ChuaNo ratings yet

- PNB V Luzon SuretyDocument7 pagesPNB V Luzon SuretyChristiane Marie BajadaNo ratings yet

- Week 4 Case Digest - MANLUCOB, Lyra Kaye B.Document6 pagesWeek 4 Case Digest - MANLUCOB, Lyra Kaye B.LYRA KAYE MANLUCOBNo ratings yet

- 1 - Philippine Education Company Vs SorianoDocument4 pages1 - Philippine Education Company Vs SorianoKeej DalonosNo ratings yet

- G.R. No. L-26833Document3 pagesG.R. No. L-26833Julian DubaNo ratings yet

- Digest FinalDocument27 pagesDigest FinalLee YouNo ratings yet

- CASES (Til Degree of Dili)Document296 pagesCASES (Til Degree of Dili)redbutterfly_766No ratings yet

- Case Canon 15Document22 pagesCase Canon 15lynne tahilNo ratings yet

- Bpi vs. Iac L-66826, Aug. 19, 1988Document5 pagesBpi vs. Iac L-66826, Aug. 19, 1988rosario orda-caiseNo ratings yet

- Assignment AdminDocument17 pagesAssignment AdminAngel SosaNo ratings yet

- G.R. No. 144887 November 17, 2004 ALFREDO RIGOR, Petitioner, People of The Philippines, RespondentDocument8 pagesG.R. No. 144887 November 17, 2004 ALFREDO RIGOR, Petitioner, People of The Philippines, RespondentBea BaloyoNo ratings yet

- BPI v. CA, Bonnevie v. CA, Republic v. Bagtas, Republic v. Grualdo, Producers Bank v. CADocument11 pagesBPI v. CA, Bonnevie v. CA, Republic v. Bagtas, Republic v. Grualdo, Producers Bank v. CAMarlon SevillaNo ratings yet

- Petitioner vs. vs. Respondents Agapito S. Fajardo Marino E. Eslao Leovillo C. AgustinDocument6 pagesPetitioner vs. vs. Respondents Agapito S. Fajardo Marino E. Eslao Leovillo C. AgustinKarina GarciaNo ratings yet

- People Vs ConcepcionDocument3 pagesPeople Vs ConcepcionTenten Belita PatricioNo ratings yet

- G.R. No. L-22405, June 30, 1971Document4 pagesG.R. No. L-22405, June 30, 1971Jaymie ValisnoNo ratings yet

- PPL vs. ConcepcionDocument1 pagePPL vs. ConcepcionnvmndNo ratings yet

- Arieta Vs Naric - GR L15645Document12 pagesArieta Vs Naric - GR L15645jovelyn davoNo ratings yet

- Oblicon DigestsDocument6 pagesOblicon Digestscharmae casilNo ratings yet

- Banco Filipino Savings and Mortgage Bank v. YbanezDocument14 pagesBanco Filipino Savings and Mortgage Bank v. YbanezArnold BagalanteNo ratings yet

- Arrieta vs. NARIC, G.R. No. 15645, 31 January 1964Document5 pagesArrieta vs. NARIC, G.R. No. 15645, 31 January 1964Sandra DomingoNo ratings yet

- 1st Set Credit TransactionDocument113 pages1st Set Credit TransactionLiz Matarong BayanoNo ratings yet

- Marcelino B Florentino Vs Philippine National Bank098 Phil 959Document3 pagesMarcelino B Florentino Vs Philippine National Bank098 Phil 959Kathleen Ebilane PulangcoNo ratings yet

- 04 A.C. No. 378 March 30, 1962 JOSE G. MEJIA and EMILIA N. ABRERA vs. FRANCISCO S. REYESDocument2 pages04 A.C. No. 378 March 30, 1962 JOSE G. MEJIA and EMILIA N. ABRERA vs. FRANCISCO S. REYESHechelle S. DE LA CRUZNo ratings yet

- Rigor vs. People G.R. No. 144887Document7 pagesRigor vs. People G.R. No. 144887Gendale Am-isNo ratings yet

- BPI vs. IntermeDocument5 pagesBPI vs. IntermenbragasNo ratings yet

- The Fireside Chats of Franklin Delano Roosevelt Radio Addresses to the American People Broadcast Between 1933 and 1944From EverandThe Fireside Chats of Franklin Delano Roosevelt Radio Addresses to the American People Broadcast Between 1933 and 1944No ratings yet

- Santos Vs RasalanDocument5 pagesSantos Vs RasalanJemuel LadabanNo ratings yet

- Pepsi-Cola Bottling Company of The Philippines, Inc. v. City of ButuanDocument6 pagesPepsi-Cola Bottling Company of The Philippines, Inc. v. City of ButuanJemuel LadabanNo ratings yet

- Case 35 - Zobel Inc. vs. Court of Appeals, G.R. No. 113931 (1998)Document7 pagesCase 35 - Zobel Inc. vs. Court of Appeals, G.R. No. 113931 (1998)Jemuel LadabanNo ratings yet

- Case 28 - Banco Filipino vs. CA (2000)Document13 pagesCase 28 - Banco Filipino vs. CA (2000)Jemuel LadabanNo ratings yet

- Case 1 - Berboso v. CabralDocument10 pagesCase 1 - Berboso v. CabralJemuel LadabanNo ratings yet

- GSIS v. DaymielDocument9 pagesGSIS v. DaymielJemuel LadabanNo ratings yet

- ASTEC v. ERCDocument31 pagesASTEC v. ERCJemuel LadabanNo ratings yet

- Case 5 - Philippine Hawk Corporation v. LeeDocument12 pagesCase 5 - Philippine Hawk Corporation v. LeeJemuel LadabanNo ratings yet

- Case 75 - PHILTRANCO v. PWU-AGLO, G.R. No. 180962, February 26, 2014Document11 pagesCase 75 - PHILTRANCO v. PWU-AGLO, G.R. No. 180962, February 26, 2014Jemuel LadabanNo ratings yet

- Board of Trustees v. VelascoDocument11 pagesBoard of Trustees v. VelascoJemuel LadabanNo ratings yet

- Case 83 - Union of Filipro Employees v. Nestle Philippines, March 3, 2008Document14 pagesCase 83 - Union of Filipro Employees v. Nestle Philippines, March 3, 2008Jemuel LadabanNo ratings yet

- Civil Codal PDFDocument125 pagesCivil Codal PDFAbbieBallesterosNo ratings yet

- CASE 151 - Maynard v. HillDocument6 pagesCASE 151 - Maynard v. HillJemuel LadabanNo ratings yet

- Case 68 - Unilever v. Rivera, G.R. No. 201701, June 3, 2013Document10 pagesCase 68 - Unilever v. Rivera, G.R. No. 201701, June 3, 2013Jemuel LadabanNo ratings yet

- Villamaria v. CA (G.R. No. 165881, April 19, 2006)Document18 pagesVillamaria v. CA (G.R. No. 165881, April 19, 2006)Jemuel LadabanNo ratings yet

- Case 76 - Jordan v. Grandeur Security, G.R. No. 206716, June 18, 2014Document13 pagesCase 76 - Jordan v. Grandeur Security, G.R. No. 206716, June 18, 2014Jemuel LadabanNo ratings yet

- Case 86 - Diolosa v. CADocument2 pagesCase 86 - Diolosa v. CAJemuel LadabanNo ratings yet

- CASE 154 - Capin-Cadiz v. Brent HospitalDocument20 pagesCASE 154 - Capin-Cadiz v. Brent HospitalJemuel LadabanNo ratings yet

- 7 - Kala Manter (Imran Series)Document257 pages7 - Kala Manter (Imran Series)Saim YounisNo ratings yet

- Ch2b Accounting TransactionDocument58 pagesCh2b Accounting TransactionLizette Janiya SumantingNo ratings yet

- Income Tax Planning: A Study of Tax Saving Instruments: PreprintDocument11 pagesIncome Tax Planning: A Study of Tax Saving Instruments: PreprintPallavi PalluNo ratings yet

- A Comparison of The Finance Companies in BangladeshDocument27 pagesA Comparison of The Finance Companies in BangladeshAnik MuidNo ratings yet

- ERP Software - Financial Accounting Module ProposalDocument19 pagesERP Software - Financial Accounting Module Proposalrohit@turtlerepublic.com0% (1)

- Junior Philippine Institute of AccountantsDocument6 pagesJunior Philippine Institute of AccountantsA BNo ratings yet

- Tutorial FIN221 Chapter 3 - Part 1 (Q&A)Document17 pagesTutorial FIN221 Chapter 3 - Part 1 (Q&A)jojojoNo ratings yet

- JFK Vs The Fed - Fractional BankingDocument8 pagesJFK Vs The Fed - Fractional BankingAprajita SinghNo ratings yet

- Answer Far270 Feb2021Document8 pagesAnswer Far270 Feb2021Nur Fatin AmirahNo ratings yet

- Joy and Jolly Day Care CentreDocument20 pagesJoy and Jolly Day Care CentreSsemakula FrankNo ratings yet

- Invoice: Excelcargo LogisticsDocument1 pageInvoice: Excelcargo LogisticsJohn MaxwellNo ratings yet

- Assessing The Risk of Material Misstatement: Audit I Class Unsoed 22 May 2021Document37 pagesAssessing The Risk of Material Misstatement: Audit I Class Unsoed 22 May 2021julietNo ratings yet

- NBFC Mfi AnalysisDocument10 pagesNBFC Mfi AnalysisNeeraj KumarNo ratings yet

- Chapter 22 Contract CostingDocument18 pagesChapter 22 Contract CostingPavan Kalyan JennyNo ratings yet

- APC 403 PFRS For SMEsDocument10 pagesAPC 403 PFRS For SMEsHazel Seguerra BicadaNo ratings yet

- Multiple Choice - DerivativesDocument3 pagesMultiple Choice - DerivativesLouiseNo ratings yet

- ACC 308 Final Management AnalysisDocument6 pagesACC 308 Final Management AnalysisBREANNA JOHNSONNo ratings yet

- Cashless Society: Presented By: Arsalan ArifDocument24 pagesCashless Society: Presented By: Arsalan ArifArsalan ArifNo ratings yet

- Assumptions: Dec-YE Unit 2018A 2019A 2020A 2021E 2022E 2023E 2024E 2025EDocument3 pagesAssumptions: Dec-YE Unit 2018A 2019A 2020A 2021E 2022E 2023E 2024E 2025ENouf ANo ratings yet

- The FBI Estimates That 80 Percent of All Mortgage Fraud Involves Collaboration or Collusion by Industry InsidersDocument31 pagesThe FBI Estimates That 80 Percent of All Mortgage Fraud Involves Collaboration or Collusion by Industry Insiders83jjmack50% (2)

- Trigonometry and Investments QuizDocument6 pagesTrigonometry and Investments QuizTimNo ratings yet

- 2019 - 1 POP Final Timetable - 0Document30 pages2019 - 1 POP Final Timetable - 0Anonymous IjhB0kuFNo ratings yet

- Ud Wirastri Siklus AkuntansiDocument39 pagesUd Wirastri Siklus AkuntansiPutri EkawatiNo ratings yet

- Chapter 09: Long-Lived Assets Land 5,000 Additional 15K CASH 100,000 MACHINE 30 or 52 Debt X 100,000Document14 pagesChapter 09: Long-Lived Assets Land 5,000 Additional 15K CASH 100,000 MACHINE 30 or 52 Debt X 100,000mostakNo ratings yet

- Day 1 ECCA TrainingDocument78 pagesDay 1 ECCA Trainingadinsmaradhana100% (1)

- Saregamappd 20211102210939-1Document415 pagesSaregamappd 20211102210939-1dilip kumarNo ratings yet

- Using The MACD EffectivelyDocument21 pagesUsing The MACD Effectivelypderby1No ratings yet

- ACCA Audit & Assurance Complete Notes PwC's AcademyDocument187 pagesACCA Audit & Assurance Complete Notes PwC's AcademyZainab SyedaNo ratings yet

- Introduction To Price Action TradingDocument19 pagesIntroduction To Price Action TradingGio GameloNo ratings yet