Professional Documents

Culture Documents

Mrunalini's Task-1

Mrunalini's Task-1

Uploaded by

Pampana Bala Sai Saroj RamCopyright:

Available Formats

You might also like

- Why Do Sponsors Use Project Finance?: 2. How Does Project Finance Create Value? Justify With An ExampleDocument3 pagesWhy Do Sponsors Use Project Finance?: 2. How Does Project Finance Create Value? Justify With An Examplekumsisa kajelchaNo ratings yet

- Public Relations ManagementDocument32 pagesPublic Relations ManagementHendra Manurung, S.IP, M.A100% (10)

- Associate CalassDocument151 pagesAssociate CalassMuhammad Naveed AnjumNo ratings yet

- Application Form For Business or Building PermitDocument1 pageApplication Form For Business or Building PermitJanice TangcalaganNo ratings yet

- The World of Money: Author: Mala Kumar Illustrator: Deepa BalsavarDocument41 pagesThe World of Money: Author: Mala Kumar Illustrator: Deepa BalsavarNeeha NM100% (1)

- Task 1Document6 pagesTask 1Ayushi GuptaNo ratings yet

- VCE Summer Internship Program 2021Document7 pagesVCE Summer Internship Program 2021Ruchira ParwandaNo ratings yet

- VCE Summer Internship Program 2020: Akshay - Ghadge20@ies - EduDocument7 pagesVCE Summer Internship Program 2020: Akshay - Ghadge20@ies - EduAKSHAY GHADGENo ratings yet

- Smart Task 1Document6 pagesSmart Task 1Krishnaja PrakashNo ratings yet

- VCE Summer Internship Program 2021: Smart Task Submission FormatDocument5 pagesVCE Summer Internship Program 2021: Smart Task Submission FormatKetan PandeyNo ratings yet

- VCE Summer Internship Program 2020: Name Email-ID Smart Task No. Project TopicDocument8 pagesVCE Summer Internship Program 2020: Name Email-ID Smart Task No. Project TopicYaShNo ratings yet

- VCE Summer Internship Program 2020: Smart Task Submission FormatDocument5 pagesVCE Summer Internship Program 2020: Smart Task Submission FormatAbhishek DongreNo ratings yet

- VCE Summer Internship Program 2021: Smart Task Submission FormatDocument7 pagesVCE Summer Internship Program 2021: Smart Task Submission FormatNiharika MathurNo ratings yet

- Project Finance - How It Works, Definition, and Types of LoansDocument7 pagesProject Finance - How It Works, Definition, and Types of LoansP H O E N I XNo ratings yet

- VCE Summer Internship Program 2020: Ruchit GuptaDocument5 pagesVCE Summer Internship Program 2020: Ruchit Guptaruchit guptaNo ratings yet

- Lecture 9 18042020 051242pm 29112020 123126pm 31052022 095838amDocument23 pagesLecture 9 18042020 051242pm 29112020 123126pm 31052022 095838amSyeda Maira Batool100% (1)

- Vanraj Samrt Task 1Document7 pagesVanraj Samrt Task 1Vanraj MakwanaNo ratings yet

- VCE InternshipsDocument6 pagesVCE Internshipsabhishek100% (1)

- Smart Task 01 - VCEDocument3 pagesSmart Task 01 - VCEHarshit AroraNo ratings yet

- Lecture 9 18042020 051242pm 29112020 123126pm 01012022 063406pm 1 18062022 052305pmDocument22 pagesLecture 9 18042020 051242pm 29112020 123126pm 01012022 063406pm 1 18062022 052305pmSyeda Maira BatoolNo ratings yet

- Vce Smart Task 1 (Project Finance)Document7 pagesVce Smart Task 1 (Project Finance)Ronak Jain100% (5)

- Project Finance Smart TaskDocument5 pagesProject Finance Smart TaskYASHASVI SHARMANo ratings yet

- Name Smart Task No. Project TopicDocument7 pagesName Smart Task No. Project TopicMd FarmanNo ratings yet

- Vardhan Consulting Finance Internship Task 1Document6 pagesVardhan Consulting Finance Internship Task 1Ravi KapoorNo ratings yet

- VCE Summer Internship Program 2021: Task Q1Document9 pagesVCE Summer Internship Program 2021: Task Q1Sona KumariNo ratings yet

- Question 1. What Is Finance? How Finance Is Different From Accounting? What Are Important BasicDocument4 pagesQuestion 1. What Is Finance? How Finance Is Different From Accounting? What Are Important BasicParmarth KhannaNo ratings yet

- Smart Task SubmissionDocument9 pagesSmart Task Submissionkishore kajaNo ratings yet

- Smart Task 1Document13 pagesSmart Task 1devesh bhattNo ratings yet

- Project Finance-Modelling and Analysis: A. Finance Is Defined As The Management of Money and Includes ActivitiesDocument3 pagesProject Finance-Modelling and Analysis: A. Finance Is Defined As The Management of Money and Includes ActivitiesDILIP KUMARNo ratings yet

- VCE Summer Internship Program 2021: Smart Task Submission FormatDocument5 pagesVCE Summer Internship Program 2021: Smart Task Submission FormatRohan SomaniNo ratings yet

- ch-5 4Document34 pagesch-5 4danielNo ratings yet

- Name Email-ID Smart Task No. Project Topic: Intern's DetailsDocument4 pagesName Email-ID Smart Task No. Project Topic: Intern's DetailsKinnu RajpuraNo ratings yet

- Electricity EconomicsDocument5 pagesElectricity Economicskennyajao08No ratings yet

- Module 1 Task 1 VceDocument10 pagesModule 1 Task 1 VcevedantNo ratings yet

- Smart Task 1 SubmissionDocument8 pagesSmart Task 1 SubmissionPrateek JoshiNo ratings yet

- Assignment - PM0012 - Project Finance and Budgeting - Set 2Document7 pagesAssignment - PM0012 - Project Finance and Budgeting - Set 2Bhupinder SinghNo ratings yet

- Project Finance-WPS OfficeDocument12 pagesProject Finance-WPS OfficeLAKHAN TRIVEDINo ratings yet

- Project FinanceDocument5 pagesProject FinanceRounak AgrawalNo ratings yet

- Modul 05 - Analisis Finansial ProyekDocument14 pagesModul 05 - Analisis Finansial Proyekyudi setio prabowoNo ratings yet

- Smart Task-1 (VCE)Document3 pagesSmart Task-1 (VCE)Pampana Bala Sai Saroj RamNo ratings yet

- Task 3Document5 pagesTask 3Pampana Bala Sai Saroj RamNo ratings yet

- Bpe 34603 - LN 5 25 March 2019Document28 pagesBpe 34603 - LN 5 25 March 2019Irfan AzmanNo ratings yet

- Financial and Economic EvaluationDocument40 pagesFinancial and Economic EvaluationBiruk BirhanuNo ratings yet

- Project Report - Project FinanceDocument10 pagesProject Report - Project Financeanon_266246835No ratings yet

- Revenue ModelDocument6 pagesRevenue ModelSayed Naved HaleemNo ratings yet

- Capital Raising Strategies: Tejshree KapoorDocument27 pagesCapital Raising Strategies: Tejshree KapoorVinod ReddyNo ratings yet

- VCE Summer Internship Program 2020: Smart Task Submission FormatDocument4 pagesVCE Summer Internship Program 2020: Smart Task Submission FormatRavi ParmarNo ratings yet

- Method of Financing: Infrastructure ProjectDocument20 pagesMethod of Financing: Infrastructure ProjectRAHUL KUMARNo ratings yet

- 6 Financial and Economic EvaluationDocument40 pages6 Financial and Economic EvaluationDaniel KetemawNo ratings yet

- Pratibha Singh - VCE Task1Document5 pagesPratibha Singh - VCE Task1Pratibha SinghNo ratings yet

- Last Chapter - Financial EvaluationDocument34 pagesLast Chapter - Financial EvaluationAmdu BergaNo ratings yet

- VCE Summer Internship Program 2021: Rishav Raj Gupta 1 Financial Modeling and AnalysisDocument6 pagesVCE Summer Internship Program 2021: Rishav Raj Gupta 1 Financial Modeling and AnalysisRISHAV RAJ GUPTANo ratings yet

- 1 Pre Read For Introductions To Project FinancingDocument4 pages1 Pre Read For Introductions To Project FinancingChanchal MisraNo ratings yet

- 403 All UnitsDocument73 pages403 All Units505 Akanksha TiwariNo ratings yet

- Financing of Constructed FacilitiesDocument41 pagesFinancing of Constructed FacilitiesUjang BOP EngineerNo ratings yet

- Project Financing-Lenders PerspectiveDocument26 pagesProject Financing-Lenders PerspectiveUsman Aziz Khan100% (1)

- Construction FinancingDocument33 pagesConstruction FinancingGeorgeNo ratings yet

- Is Security The Panacea For Default in Project Finance?: Ugochi Isobel NnadikaDocument23 pagesIs Security The Panacea For Default in Project Finance?: Ugochi Isobel NnadikaasfasdfasfNo ratings yet

- Project FinanceDocument37 pagesProject FinanceFarhana DibagelenNo ratings yet

- Financing of Constructed FacilitiesDocument24 pagesFinancing of Constructed FacilitiesLyka TanNo ratings yet

- Anastasia FAQDocument27 pagesAnastasia FAQAlbert MartinNo ratings yet

- Project FinancingDocument28 pagesProject Financingprateekratm1No ratings yet

- Tactical Objective: Strategic Maneuvers, Decoding the Art of Military PrecisionFrom EverandTactical Objective: Strategic Maneuvers, Decoding the Art of Military PrecisionNo ratings yet

- TSMC Revenue Breakdown - PNGDocument9 pagesTSMC Revenue Breakdown - PNGAra 1101No ratings yet

- 96 Kuli Maratha Surname List Download PDFDocument3 pages96 Kuli Maratha Surname List Download PDFsatyen Turki0% (1)

- TAR University College PlagiarismDocument12 pagesTAR University College PlagiarismPung Kang QinNo ratings yet

- Ôn Tập Tiếng Anh 6Document31 pagesÔn Tập Tiếng Anh 6DucNo ratings yet

- Industrial Training Project ReportDocument11 pagesIndustrial Training Project ReportmanishNo ratings yet

- PaymayaDocument1 pagePaymayaMitzie Caño0% (1)

- Dome Tank Eng PDFDocument2 pagesDome Tank Eng PDFDustin BooneNo ratings yet

- Arii 2018Document207 pagesArii 2018Bisa AcademyNo ratings yet

- Exhibition Brochure-Embalsamada-Con-Picante (Embalmed With Spice)Document6 pagesExhibition Brochure-Embalsamada-Con-Picante (Embalmed With Spice)Isa SonNo ratings yet

- Alonso y Glennie 2015Document5 pagesAlonso y Glennie 2015Sergio Fabian LizarazoNo ratings yet

- 308-329 - Ways and Means of Expressing Modality in English and UkrainianDocument17 pages308-329 - Ways and Means of Expressing Modality in English and UkrainianPetrea Nicoleta SimonaNo ratings yet

- HWSETA-Learner Employment Contract 2Document11 pagesHWSETA-Learner Employment Contract 2Rodgers Nsama KazembeNo ratings yet

- RG 1.47Document8 pagesRG 1.47hafizgNo ratings yet

- 40 2010 04 18 15 04 40 FacingAnUnequalWorld.v1Document329 pages40 2010 04 18 15 04 40 FacingAnUnequalWorld.v1xyzNo ratings yet

- The Rise of Hitler and The Nazi PartyDocument74 pagesThe Rise of Hitler and The Nazi Partyapi-267224618No ratings yet

- Cost II - CH - 2-Decision MakingDocument9 pagesCost II - CH - 2-Decision MakingYitera SisayNo ratings yet

- HRET Takes Up The Disqualification Case Against Mikey ArroyoDocument3 pagesHRET Takes Up The Disqualification Case Against Mikey ArroyoNational Citizens' Movement for Free Elections (NAMFREL)No ratings yet

- Assignment of Uloom Ul Quran For Ph-1Document11 pagesAssignment of Uloom Ul Quran For Ph-1Ibtisam Elahi Zaheer0% (3)

- Future of Voice: Telecoms Strategy Masterclass - Santa Clara & LondonDocument4 pagesFuture of Voice: Telecoms Strategy Masterclass - Santa Clara & LondonDean BubleyNo ratings yet

- PNP Patrol Plan Proficiency Evaluation Process GuidelinesDocument10 pagesPNP Patrol Plan Proficiency Evaluation Process GuidelinesCpsmu Santiago Cpo0% (1)

- Communion Songs For Advent SeasonDocument1 pageCommunion Songs For Advent Seasonbinatero nanetteNo ratings yet

- Oracle OOW19 Oracle WMS Cloud Update - Roadmap - Fastenal Case Study - 1569161499525001SPehDocument35 pagesOracle OOW19 Oracle WMS Cloud Update - Roadmap - Fastenal Case Study - 1569161499525001SPehNigel WhitmoreNo ratings yet

- Introduction and Preface To PFRS and Conceptual Framework: Theory of Accounts Preweek DiscussionDocument20 pagesIntroduction and Preface To PFRS and Conceptual Framework: Theory of Accounts Preweek DiscussionLeisleiRagoNo ratings yet

- Associated Gas Utilization Via MiniGTL Jan 2014 UpdateDocument37 pagesAssociated Gas Utilization Via MiniGTL Jan 2014 Updatekurtbk100% (1)

- Billie Eilish - TVDocument3 pagesBillie Eilish - TVhome maiaNo ratings yet

- Visiting Time - Vocabulary WorkDocument5 pagesVisiting Time - Vocabulary WorkHernan FilanninoNo ratings yet

Mrunalini's Task-1

Mrunalini's Task-1

Uploaded by

Pampana Bala Sai Saroj RamOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mrunalini's Task-1

Mrunalini's Task-1

Uploaded by

Pampana Bala Sai Saroj RamCopyright:

Available Formats

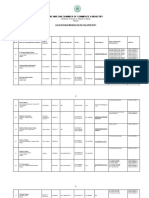

VCE Summer Internship Program 2021

Smart Task Submission Format

[ Download This Format in .DOCX format and then Edit it and SUBMIT]

Intern’s Details

Name Mrunalini Vanka

Email-ID 2201220@ipeindia.org

Smart Task No. 1

Project Topic Financial modelling and analysis

Smart Task (Solution)

Task Q1: What is Finance? How is Finance different from accounting? What are the important basic points

that should be learned to pursue a career in finance?

Task Q1 Solution:

Finance is the study of money, investments, and financial resources in diverse organisations such as firms,

individuals, and governments. It entails making decisions regarding obtaining, allocating, and utilising cash in

order to meet financial goals and maximise value.

Finance and accounting are two distinct but linked topics. While both are concerned with financial resource

management, they focus on distinct aspects:

Finance examines the big picture of managing money and assets. It entails examining an organization's

financial needs, making investment decisions, managing risks, and selecting the best sources of resources.

Finance specialists examine financial data, develop financial models, and offer recommendations to improve

financial performance.

Accounting is concerned with recording, summarising, and reporting financial transactions. It is concerned

with the systematic recording of financial data, the preparation of financial accounts, and the adherence to

accounting principles and regulations. Accountants provide precise and dependable financial information,

which is critical for decision-making, tax filing, and external reporting.

Learn to analyse and evaluate financial documents such as the balance sheet, income statement, and cash flow

statement. Learn how these statements provide information about a company's financial health and

performance.

Time Value of Money: Learn about the notion of time value of money, which recognises that a dollar today is

worth more than a dollar tomorrow due to opportunity cost and the possibility for return.

Risk and reward: Learn about the trade-offs between risk and reward. Understand the relationship between

risk and potential rewards in financial decisions, as well as how to properly analyse and manage risks.

Capital Budgeting: Learn how to evaluate investment possibilities and use capital budgeting strategies

including net present value (NPV), internal rate of return (IRR), and payback period.

ST Solution Page 1 https://techvardhan.com

VCE Summer Internship Program 2021

Smart Task Submission Format

500 Words (Max.)

Task Q2: What is Project Finance? How is project finance different from corporate finance? Why can't we

put project finance under corporate finance? Define 20 terminologies related to project finance.

Task Q2 Solution:

Project finance is a form of financing that is used for large-scale infrastructure, energy, and industrial

projects. It entails the establishment of a separate financial structure for a single project, with the cash flows

and assets of the project serving as the principal sources of repayment for the financing.

The following are the fundamental distinctions between Project Finance and Corporate Finance:

Purpose: Project Finance is used to fund specific projects, such as constructing a power plant or a toll road,

with the project's cash flows and assets serving as security. Corporate Finance, on the other hand, is

concerned with a company's overall financial management and continuing operations.

Risk Allocation: Risks are allocated among project stakeholders depending on their ability to bear and

manage them in Project Finance. For repayment, lenders and investors rely mostly on the project's assets and

cash flows. The risks in Corporate Finance are often shared by the corporation and its stockholders.

Cash Flow Dependency: Project finance is significantly reliant on the predicted cash flows of the project to

service the debt and produce returns for investors. Cash flows in Corporate Finance can come from a variety

of sources inside the company's activities and investments.

Asset Ring-Fencing: Ring-fencing the project's assets and cash flows from the broader corporate structure is a

common practise in project finance. This distinction shields the project's lenders and investors from the risks

connected with the company's other operations.

Limited resources: Project Finance often uses limited recourse finance, which means that lenders have limited

claims on the project's assets and cash flows. If the project fails, the lenders may not be able to recoup their

losses through the company's other assets.

terminologies:

SPV-Special Purpose Vehicle -It is a legal entity with limited liability created to fulfil narrow and

specific objectives.

Non-Recourse-Nonrecourse finance is a type of commercial lending that entitles the Lander to repay

only from the profits of the project the loan is funding and not from any other assets of the borrower.

Hedging counterparty – The financial institution providing interest or currency rate hedging to a

borrower.

ST Solution Page 2 https://techvardhan.com

VCE Summer Internship Program 2021

Smart Task Submission Format

Mezzanine lenders- it is a hybrid of debt and equity financing that gives the lender the right to convert

the debt into equity interest in the company in case of default.

Mini Perm Lending-A type of short-term real estate financing used to pay off income producing

construction or commercial properties.

DSCR- Debt Service Coverage Ratio is the cash flow available to pay current debt obligations.

Leverage-Funds borrowed funds to purchase an asset in the hopes that the income of capital gain

would surpass the cost of borrowing.

Project Report- it is a document that describes the projects, objectives challenges, and progress.

Contingency-A future event or circumstance which is possible but cannot be predicted with certainty.

Project Sponsor-An individual or a group that provides financial and other resources and support the

project.

Capital Intensive-It is the acquisition of physical assets by the company for the use of further its long-

term business goals and objectives.

500 Words (Max.)

Task Q3: What is non-recourse debt / loan? What is Mezzanine finance, explain with an example.

Task Q3 Solution:

Non-recourse debt, also known as non-recourse loan, is a type of financing in which the lender's claim is

limited to the collateral or specific assets of the project being financed. In the event of default, the lender's

recourse is restricted to the project's assets and cash flows, and they cannot pursue the borrower's other assets

or personal guarantees.

In non-recourse financing, the lender bears a higher level of risk compared to traditional recourse financing,

where the borrower is personally liable for repayment. Non-recourse debt is commonly used in project

finance, where the project's assets and cash flows serve as the primary source of repayment. This structure

helps protect the borrower or project sponsor from personal liability and limits their risk exposure.

Mezzanine finance, also known as mezzanine debt or mezzanine capital, is a hybrid form of financing that

combines elements of debt and equity. It sits between senior debt (traditional bank loans) and equity in the

capital structure of a company or project. Mezzanine finance is typically used to fill the funding gap between

the equity provided by the project sponsor and the senior debt provided by traditional lenders.

Here's an example to illustrate mezzanine finance:

Let's consider a company planning to build a large-scale infrastructure project, such as a toll road. The total

project cost is estimated to be $100 million. The project sponsor has managed to secure $70 million in equity

from investors but needs an additional $30 million to fully fund the project.

The project sponsor approaches a mezzanine financing provider, such as a private equity firm or specialized

mezzanine fund, for the remaining $30 million. The mezzanine lender offers a mezzanine loan, which has

characteristics of both debt and equity.

500 Words (Max.)

500 Words (Max.)

ST Solution Page 3 https://techvardhan.com

VCE Summer Internship Program 2021

Smart Task Submission Format

Task Q4: Explain in detail with reasons of what the sectors are or which type of projects are suitable for project

finance?

Task Q4 Solution:

Project financing is often used in large-scale infrastructure, energy, and industrial projects. These industries

have unique qualities that make them suited for project financing. Here are a few of the reasons why project

finance is frequently used in various industries:

High capital intensity: Projects in infrastructure (e.g., toll roads, airports, ports), energy (e.g., power plants,

renewable energy projects), and industrial (e.g., mining, manufacturing facilities) frequently demand

significant upfront investments. Project financing enables the mobilisation of large sums of funds to fund

these capital-intensive enterprises.

Extended Project Lifecycles: Projects in sectors such as infrastructure and energy can have extended

lifecycles that span many decades. Project finance fits perfectly with these long-term projects since it

provides financing that corresponds to the project's schedule, allowing for payback over time.

Certain industries, such as infrastructure and energy, generate very stable and predictable cash flows over the

course of a project's existence. Toll road projects, for example, produce cash from toll collections, whereas

power plants earn revenue via long-term power purchase agreements. These predictable income flows offer

lenders and investors with a dependable source of repayment, making project finance an appealing choice.

Tangible Assets: Projects financed through project financing frequently entail valuable tangible assets such as

buildings, plants, equipment, or infrastructure. These assets can be used as collateral for lending, providing

lenders with security in the event of a default.

Risk Ring-Fencing: Project finance provides for the isolation of project risks from the broader business

structure. This risk ring-fencing protects lenders and investors by restricting their exposure to the project and

its assets. It also clarifies the risk allocation among project parties.

Specific Revenue Streams: Many projects finance-eligible projects include dedicated revenue streams

connected to the project's production or services. Infrastructure projects, for example, may produce cash

through user fees, whereas energy projects may have long-term contracts for power sales. These distinct

revenue streams give lenders and investors with visibility and assurance about the project's potential to

produce cash flows for debt repayment.

Independent Project Entity: Project financing frequently entails the formation of a Special Purpose Vehicle

(SPV) or project firm that is completely dedicated to the project. This independent corporation assists in

isolating the project's financial performance, assets, and obligations from the balance sheet of the sponsor or

parent firm. This separation reduces risks linked with the sponsor's other operations while also providing

financial transparency for the project.

Political and regulatory risks: Projects in infrastructure and energy face political, regulatory, and

environmental hazards. By implementing risk allocation procedures, contracts, and government assistance

agreements, project finance can help alleviate these risks.

ST Solution Page 4 https://techvardhan.com

VCE Summer Internship Program 2021

Smart Task Submission Format

500 Words (Max.)

Please add / delete blocks if needed.

ST Solution Page 5 https://techvardhan.com

You might also like

- Why Do Sponsors Use Project Finance?: 2. How Does Project Finance Create Value? Justify With An ExampleDocument3 pagesWhy Do Sponsors Use Project Finance?: 2. How Does Project Finance Create Value? Justify With An Examplekumsisa kajelchaNo ratings yet

- Public Relations ManagementDocument32 pagesPublic Relations ManagementHendra Manurung, S.IP, M.A100% (10)

- Associate CalassDocument151 pagesAssociate CalassMuhammad Naveed AnjumNo ratings yet

- Application Form For Business or Building PermitDocument1 pageApplication Form For Business or Building PermitJanice TangcalaganNo ratings yet

- The World of Money: Author: Mala Kumar Illustrator: Deepa BalsavarDocument41 pagesThe World of Money: Author: Mala Kumar Illustrator: Deepa BalsavarNeeha NM100% (1)

- Task 1Document6 pagesTask 1Ayushi GuptaNo ratings yet

- VCE Summer Internship Program 2021Document7 pagesVCE Summer Internship Program 2021Ruchira ParwandaNo ratings yet

- VCE Summer Internship Program 2020: Akshay - Ghadge20@ies - EduDocument7 pagesVCE Summer Internship Program 2020: Akshay - Ghadge20@ies - EduAKSHAY GHADGENo ratings yet

- Smart Task 1Document6 pagesSmart Task 1Krishnaja PrakashNo ratings yet

- VCE Summer Internship Program 2021: Smart Task Submission FormatDocument5 pagesVCE Summer Internship Program 2021: Smart Task Submission FormatKetan PandeyNo ratings yet

- VCE Summer Internship Program 2020: Name Email-ID Smart Task No. Project TopicDocument8 pagesVCE Summer Internship Program 2020: Name Email-ID Smart Task No. Project TopicYaShNo ratings yet

- VCE Summer Internship Program 2020: Smart Task Submission FormatDocument5 pagesVCE Summer Internship Program 2020: Smart Task Submission FormatAbhishek DongreNo ratings yet

- VCE Summer Internship Program 2021: Smart Task Submission FormatDocument7 pagesVCE Summer Internship Program 2021: Smart Task Submission FormatNiharika MathurNo ratings yet

- Project Finance - How It Works, Definition, and Types of LoansDocument7 pagesProject Finance - How It Works, Definition, and Types of LoansP H O E N I XNo ratings yet

- VCE Summer Internship Program 2020: Ruchit GuptaDocument5 pagesVCE Summer Internship Program 2020: Ruchit Guptaruchit guptaNo ratings yet

- Lecture 9 18042020 051242pm 29112020 123126pm 31052022 095838amDocument23 pagesLecture 9 18042020 051242pm 29112020 123126pm 31052022 095838amSyeda Maira Batool100% (1)

- Vanraj Samrt Task 1Document7 pagesVanraj Samrt Task 1Vanraj MakwanaNo ratings yet

- VCE InternshipsDocument6 pagesVCE Internshipsabhishek100% (1)

- Smart Task 01 - VCEDocument3 pagesSmart Task 01 - VCEHarshit AroraNo ratings yet

- Lecture 9 18042020 051242pm 29112020 123126pm 01012022 063406pm 1 18062022 052305pmDocument22 pagesLecture 9 18042020 051242pm 29112020 123126pm 01012022 063406pm 1 18062022 052305pmSyeda Maira BatoolNo ratings yet

- Vce Smart Task 1 (Project Finance)Document7 pagesVce Smart Task 1 (Project Finance)Ronak Jain100% (5)

- Project Finance Smart TaskDocument5 pagesProject Finance Smart TaskYASHASVI SHARMANo ratings yet

- Name Smart Task No. Project TopicDocument7 pagesName Smart Task No. Project TopicMd FarmanNo ratings yet

- Vardhan Consulting Finance Internship Task 1Document6 pagesVardhan Consulting Finance Internship Task 1Ravi KapoorNo ratings yet

- VCE Summer Internship Program 2021: Task Q1Document9 pagesVCE Summer Internship Program 2021: Task Q1Sona KumariNo ratings yet

- Question 1. What Is Finance? How Finance Is Different From Accounting? What Are Important BasicDocument4 pagesQuestion 1. What Is Finance? How Finance Is Different From Accounting? What Are Important BasicParmarth KhannaNo ratings yet

- Smart Task SubmissionDocument9 pagesSmart Task Submissionkishore kajaNo ratings yet

- Smart Task 1Document13 pagesSmart Task 1devesh bhattNo ratings yet

- Project Finance-Modelling and Analysis: A. Finance Is Defined As The Management of Money and Includes ActivitiesDocument3 pagesProject Finance-Modelling and Analysis: A. Finance Is Defined As The Management of Money and Includes ActivitiesDILIP KUMARNo ratings yet

- VCE Summer Internship Program 2021: Smart Task Submission FormatDocument5 pagesVCE Summer Internship Program 2021: Smart Task Submission FormatRohan SomaniNo ratings yet

- ch-5 4Document34 pagesch-5 4danielNo ratings yet

- Name Email-ID Smart Task No. Project Topic: Intern's DetailsDocument4 pagesName Email-ID Smart Task No. Project Topic: Intern's DetailsKinnu RajpuraNo ratings yet

- Electricity EconomicsDocument5 pagesElectricity Economicskennyajao08No ratings yet

- Module 1 Task 1 VceDocument10 pagesModule 1 Task 1 VcevedantNo ratings yet

- Smart Task 1 SubmissionDocument8 pagesSmart Task 1 SubmissionPrateek JoshiNo ratings yet

- Assignment - PM0012 - Project Finance and Budgeting - Set 2Document7 pagesAssignment - PM0012 - Project Finance and Budgeting - Set 2Bhupinder SinghNo ratings yet

- Project Finance-WPS OfficeDocument12 pagesProject Finance-WPS OfficeLAKHAN TRIVEDINo ratings yet

- Project FinanceDocument5 pagesProject FinanceRounak AgrawalNo ratings yet

- Modul 05 - Analisis Finansial ProyekDocument14 pagesModul 05 - Analisis Finansial Proyekyudi setio prabowoNo ratings yet

- Smart Task-1 (VCE)Document3 pagesSmart Task-1 (VCE)Pampana Bala Sai Saroj RamNo ratings yet

- Task 3Document5 pagesTask 3Pampana Bala Sai Saroj RamNo ratings yet

- Bpe 34603 - LN 5 25 March 2019Document28 pagesBpe 34603 - LN 5 25 March 2019Irfan AzmanNo ratings yet

- Financial and Economic EvaluationDocument40 pagesFinancial and Economic EvaluationBiruk BirhanuNo ratings yet

- Project Report - Project FinanceDocument10 pagesProject Report - Project Financeanon_266246835No ratings yet

- Revenue ModelDocument6 pagesRevenue ModelSayed Naved HaleemNo ratings yet

- Capital Raising Strategies: Tejshree KapoorDocument27 pagesCapital Raising Strategies: Tejshree KapoorVinod ReddyNo ratings yet

- VCE Summer Internship Program 2020: Smart Task Submission FormatDocument4 pagesVCE Summer Internship Program 2020: Smart Task Submission FormatRavi ParmarNo ratings yet

- Method of Financing: Infrastructure ProjectDocument20 pagesMethod of Financing: Infrastructure ProjectRAHUL KUMARNo ratings yet

- 6 Financial and Economic EvaluationDocument40 pages6 Financial and Economic EvaluationDaniel KetemawNo ratings yet

- Pratibha Singh - VCE Task1Document5 pagesPratibha Singh - VCE Task1Pratibha SinghNo ratings yet

- Last Chapter - Financial EvaluationDocument34 pagesLast Chapter - Financial EvaluationAmdu BergaNo ratings yet

- VCE Summer Internship Program 2021: Rishav Raj Gupta 1 Financial Modeling and AnalysisDocument6 pagesVCE Summer Internship Program 2021: Rishav Raj Gupta 1 Financial Modeling and AnalysisRISHAV RAJ GUPTANo ratings yet

- 1 Pre Read For Introductions To Project FinancingDocument4 pages1 Pre Read For Introductions To Project FinancingChanchal MisraNo ratings yet

- 403 All UnitsDocument73 pages403 All Units505 Akanksha TiwariNo ratings yet

- Financing of Constructed FacilitiesDocument41 pagesFinancing of Constructed FacilitiesUjang BOP EngineerNo ratings yet

- Project Financing-Lenders PerspectiveDocument26 pagesProject Financing-Lenders PerspectiveUsman Aziz Khan100% (1)

- Construction FinancingDocument33 pagesConstruction FinancingGeorgeNo ratings yet

- Is Security The Panacea For Default in Project Finance?: Ugochi Isobel NnadikaDocument23 pagesIs Security The Panacea For Default in Project Finance?: Ugochi Isobel NnadikaasfasdfasfNo ratings yet

- Project FinanceDocument37 pagesProject FinanceFarhana DibagelenNo ratings yet

- Financing of Constructed FacilitiesDocument24 pagesFinancing of Constructed FacilitiesLyka TanNo ratings yet

- Anastasia FAQDocument27 pagesAnastasia FAQAlbert MartinNo ratings yet

- Project FinancingDocument28 pagesProject Financingprateekratm1No ratings yet

- Tactical Objective: Strategic Maneuvers, Decoding the Art of Military PrecisionFrom EverandTactical Objective: Strategic Maneuvers, Decoding the Art of Military PrecisionNo ratings yet

- TSMC Revenue Breakdown - PNGDocument9 pagesTSMC Revenue Breakdown - PNGAra 1101No ratings yet

- 96 Kuli Maratha Surname List Download PDFDocument3 pages96 Kuli Maratha Surname List Download PDFsatyen Turki0% (1)

- TAR University College PlagiarismDocument12 pagesTAR University College PlagiarismPung Kang QinNo ratings yet

- Ôn Tập Tiếng Anh 6Document31 pagesÔn Tập Tiếng Anh 6DucNo ratings yet

- Industrial Training Project ReportDocument11 pagesIndustrial Training Project ReportmanishNo ratings yet

- PaymayaDocument1 pagePaymayaMitzie Caño0% (1)

- Dome Tank Eng PDFDocument2 pagesDome Tank Eng PDFDustin BooneNo ratings yet

- Arii 2018Document207 pagesArii 2018Bisa AcademyNo ratings yet

- Exhibition Brochure-Embalsamada-Con-Picante (Embalmed With Spice)Document6 pagesExhibition Brochure-Embalsamada-Con-Picante (Embalmed With Spice)Isa SonNo ratings yet

- Alonso y Glennie 2015Document5 pagesAlonso y Glennie 2015Sergio Fabian LizarazoNo ratings yet

- 308-329 - Ways and Means of Expressing Modality in English and UkrainianDocument17 pages308-329 - Ways and Means of Expressing Modality in English and UkrainianPetrea Nicoleta SimonaNo ratings yet

- HWSETA-Learner Employment Contract 2Document11 pagesHWSETA-Learner Employment Contract 2Rodgers Nsama KazembeNo ratings yet

- RG 1.47Document8 pagesRG 1.47hafizgNo ratings yet

- 40 2010 04 18 15 04 40 FacingAnUnequalWorld.v1Document329 pages40 2010 04 18 15 04 40 FacingAnUnequalWorld.v1xyzNo ratings yet

- The Rise of Hitler and The Nazi PartyDocument74 pagesThe Rise of Hitler and The Nazi Partyapi-267224618No ratings yet

- Cost II - CH - 2-Decision MakingDocument9 pagesCost II - CH - 2-Decision MakingYitera SisayNo ratings yet

- HRET Takes Up The Disqualification Case Against Mikey ArroyoDocument3 pagesHRET Takes Up The Disqualification Case Against Mikey ArroyoNational Citizens' Movement for Free Elections (NAMFREL)No ratings yet

- Assignment of Uloom Ul Quran For Ph-1Document11 pagesAssignment of Uloom Ul Quran For Ph-1Ibtisam Elahi Zaheer0% (3)

- Future of Voice: Telecoms Strategy Masterclass - Santa Clara & LondonDocument4 pagesFuture of Voice: Telecoms Strategy Masterclass - Santa Clara & LondonDean BubleyNo ratings yet

- PNP Patrol Plan Proficiency Evaluation Process GuidelinesDocument10 pagesPNP Patrol Plan Proficiency Evaluation Process GuidelinesCpsmu Santiago Cpo0% (1)

- Communion Songs For Advent SeasonDocument1 pageCommunion Songs For Advent Seasonbinatero nanetteNo ratings yet

- Oracle OOW19 Oracle WMS Cloud Update - Roadmap - Fastenal Case Study - 1569161499525001SPehDocument35 pagesOracle OOW19 Oracle WMS Cloud Update - Roadmap - Fastenal Case Study - 1569161499525001SPehNigel WhitmoreNo ratings yet

- Introduction and Preface To PFRS and Conceptual Framework: Theory of Accounts Preweek DiscussionDocument20 pagesIntroduction and Preface To PFRS and Conceptual Framework: Theory of Accounts Preweek DiscussionLeisleiRagoNo ratings yet

- Associated Gas Utilization Via MiniGTL Jan 2014 UpdateDocument37 pagesAssociated Gas Utilization Via MiniGTL Jan 2014 Updatekurtbk100% (1)

- Billie Eilish - TVDocument3 pagesBillie Eilish - TVhome maiaNo ratings yet

- Visiting Time - Vocabulary WorkDocument5 pagesVisiting Time - Vocabulary WorkHernan FilanninoNo ratings yet