Professional Documents

Culture Documents

Fundamental

Fundamental

Uploaded by

Wilfredo VillaflorOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fundamental

Fundamental

Uploaded by

Wilfredo VillaflorCopyright:

Available Formats

lOMoARcPSD|20937282

Fundamental Principles OF Taxation

BS Accountancy (Urdaneta City University)

Studocu is not sponsored or endorsed by any college or university

Downloaded by Wilfredo Villaflor (wilfredovillaflor01@gmail.com)

lOMoARcPSD|20937282

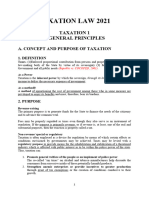

FUNDAMENTAL PRINCIPLES OF TAXATION

A. Definition of Taxation

Taxation is the process or means by which the sovereign (independent state), through its law-making

body (the legislature), imposes burdens upon subjects and objects within its jurisdiction for the purpose

of raising revenues to carry out the legitimate objects of government.

B. Nature or Characteristics Taxation

Under American Jurisprudence, the power to tax is considered inherent in a sovereign State because

it is a necessary attribute of sovereignty. Without this power, no sovereign State can exist or endure. The

power to tax proceeds upon the theory that the existence of a government is a necessity and this power

is an essential and inherent attribute of sovereignty, belonging as a matter of right to every independent

state or government. No sovereign state can continue to exist without the means to pay its expenses;

and that for those means, it has the right to compel all citizens and property within its limits to

contribute, hence, the emergence of the power to tax. (51 Am. Jur., Taxation 40).

NATURE OR CHARACTERISTICS OF TAXATION

a. Inherent Power

b. Legislative in Character

c. Subject to Inherent and Constitutional Limitations

NOTE: In the absence of inherent and constitutional limitations, the power to tax is comprehensive,

plenary, supreme and unlimited. It is so comprehensive that in the words of Justice Marshall, the power

to tax includes the power to destroy.

C. The Inherent Powers of the State

1. Police Power- it is the power to enact laws to promote the general welfare of the people.

2. Eminent Domain- it is the power to take private property for public use upon payment of just

compensation.

3. Power to Tax- it is the power to take property (generally money) for the support of the government

and for public purpose.

Downloaded by Wilfredo Villaflor (wilfredovillaflor01@gmail.com)

lOMoARcPSD|20937282

Similarities and Distinctions among the Inherent Powers of the State

Similarities

1. They are inherent in the State.

2. Underlie and exist independently of the constitution although the conditions for their exercise may be

prescribed by the Constitution.

3. Methods by which State interferes with private rights and property

4. Presuppose equivalent compensation

5. Exercised primarily by the legislature

D. PURPOSES OF TAXATION

Downloaded by Wilfredo Villaflor (wilfredovillaflor01@gmail.com)

lOMoARcPSD|20937282

1. Primary Purpose To raise revenue/funds to defray the necessary expenses of the government (also

called Revenue Purpose).

2. Secondary Purpose - As a tool for general, social and economic welfare (also called

Regulatory/Sumptuary/Compensatory Purpose).

1. Regulation

2. Promotion of General Welfare

3. Reduction of Social Inequality

4. Encourages Economic Growth

E. THEORY ON TAXATION

a) Necessity Theory - The existence of government is a necessity, it cannot continue without means to

pay its expenses, for this reason, it has the right to compel all its citizens and property to contribute.

b) The Benefits-Protection Theory- Taxes are what we pay for a civilized society. The government and the

people have a reciprocal and mutual duties of support and protection to one another (symbiotic

relationship between the government and the taxpayer).

c) Lifeblood Doctrine - Taxes are the lifeblood of the government without which it can neither exist nor

endure.

F. TAX DEFINED

Are enforced proportional contributions from persons and property, levied by the State by virtue of its

sovereignty for the support of the government and for all its public needs.

G. ESSENTIAL CHARACTERISTICS OF TAX

1. A tax is a forced charge, imposition or contribution;

2. It is a pecuniary burden payable in money;

3. It is imposed for public purpose;

4. It is imposed pursuant to a legislative authority;

5. It is levied within the territorial and legal jurisdiction of a state;

Downloaded by Wilfredo Villaflor (wilfredovillaflor01@gmail.com)

lOMoARcPSD|20937282

6. It is assessed in accordance with some reasonablerule of apportionment.

H. SCOPE OF THE LEGISLATIVE TAXING POWER

1. The person, property, or occupation to be taxed, excises or privileges, provided they are within the

taxing jurisdiction, are also included;

2. The amount or rate of the tax;

3. The purposes for which taxes shall be levied provided they are public purposes;

4. The kind of tax to be collected;

5. The apportionment of the tax, i.e., whether the tax shall be general or limited to a particular locality or

partly general and partly local;

6. The situs of taxation; and

7. The method of collection.

I. STAGES OR PROCESS OF TAXATION (LAP)

1. Levy or Imposition- This process involves the passage of tax laws or ordinances through the legislature.

2. Assessment and Collection- This process involves the act of administration and implementation of tax

laws by the executive through its administrative agencies such as the Bureau of Internal Revenue or

Bureau of Customs.

3. Payment of Tax- This process involves the act of compliance by the taxpayer in contributing his share

to pay the expenses of the government.

J. BASIC PRINCIPLES OF A SOUND TAX SYSTEM (FAT)

1. Fiscal Adequacy- The sources of government government revenue must be sufficient to meet

expenditures and other public needs.

2. Administrative Feasibility- Tax laws must be capable of convenient, just and effective administration-

free from confusion and uncertainty.

Downloaded by Wilfredo Villaflor (wilfredovillaflor01@gmail.com)

lOMoARcPSD|20937282

3. Theoretical Justice- A good tax system must be based on the taxpayer's ability to pay. This suggests

that taxation must be progressive conformably with the constitutional mandate that congress shall

evolve a progressive system of taxation.

K. LIMITATIONS ON THE TAXING POWER

1. Inherent Limitations- inherent limitations proceed from the very nature of the taxing power itself. The

taxing power has very distinct and positive limitations some of which inhere in its very nature and exist

whether declared or not declared in the written constitution.

(D-PINES)

1. Double taxation

Kinds of double taxation:

i. Direct Duplicate Taxation, this is objectionable and prohibited because it violates the

consitutional provision on uniformity and equality. It means:

- Taxing twice

- By the same taxing authority

- Within the same jurisdiction or taxing district

- For the same purpose

- In the same year or taxing period

- Same kind or character of tax

ii. Indirect Duplicate Taxation, is not legally objectionable. It extends to all cases in which there is a

burden of two or more pecuniary imposition but imposed by different taxing authorities.

ii. Public purpose

Proceeds from tax must be used for:

i. Support of the government.

ii. Some of the recognized objects of government.

iii. To promote the welfare of the community (not individuals).

Downloaded by Wilfredo Villaflor (wilfredovillaflor01@gmail.com)

lOMoARcPSD|20937282

iii.International comity or treaty - a State cannot tax another State based on the principle of Sovereign

Equality among States. E.g. tax law passed imposing taxes on foreign ambassadors is not a valid law.

iv.Non-delegability of the Taxing power - Power of taxation is purely legislative, hence the power cannot

be delegated either to the executive or judicial departments. The limitation arises from the doctrine of

separation of powers among the three branches of the government.

Exceptions to the rule against the delegation of the taxing power:

1. Delegation to the President, subject to some limitations and restrictions, to fix within specified

limits, tariff rates and tonnage or wharfage duties and other duties and imposts.

2. Delegation to local governments the power to create its own sources of revenue and to levy

taxes, subject to such limitations as may be provided by law.

3. Delegation to administrative agencies certain aspects of the taxing process that are not

legislative such as:

-the power to fix value of property for

- purposes of taxation pursuant to fixed rules the power to assess and collect taxes.

V. Exemption of the government

i. Agencies performing govemmental functions are tax exempt unless expressly taxed

ii. Agencies performing proprietary functions are subject to tax unless expressly exempted. GOCCS

performing proprietary functions are subject to tax, however the following are granted exemptions:

- Government Service Insurance System (GSIS)

- Social Security System (SSS)

- Philippine Health Insurance Corporation (PHIC)

- Local water districts (LWD's) Under CREATE Law: Home Development

- Mutual Fund (HDMF; also known as Pag ibig)

vi.Situs of taxation or territoriality - the taxing power of a country is limited to person and property

within and subject to its jurisdiction.

Place of taxation

Downloaded by Wilfredo Villaflor (wilfredovillaflor01@gmail.com)

lOMoARcPSD|20937282

i. The state where the subject to be taxed has a situs may rightfully levy and collect the tax. ii. The situs is

necessarily in the state which has jurisdiction or which exercises dominion over the subject in question.

Factors to consider in determining Situs of taxation

i. Subject matter (person, property, or activity)

ii. Nature of the tax

iii. Citizenship

iv. Residence of the taxpayer

Application of Situs of Taxation

Persons: Residence of the taxpayer

Real Property: Location

Tangible Personal Property: Location

Intangible Personal Property: Domicile of the owner

NOTE: Shares of stock in a domestic corporation of a nonresident alien are taxable in the Philippines

because said shares receive the protection and benefit of the Philippine laws

Income: Residence, or citizenship, or source of income

Business: Place of the business

NOTE:

Occupation: where the occupation is engaged in.

Transaction: where the transaction took place.

Gratuitous Transfer of Property: residence or citizenship of the taxpayer or location of the

property

2. Constitutional Limitations on the Taxing Power

-the following provisions may be said to be limitations prescribed in the Constitution on the

taxing power of the government.

a) Observance of due process of law

b) Equal protection of law

c) Uniformity in taxation

d) Progressive scheme of taxation

Downloaded by Wilfredo Villaflor (wilfredovillaflor01@gmail.com)

lOMoARcPSD|20937282

e) Non-imprisonment for non-payment of poll tax

f) Non-impairment of the obligations of contracts

g) Free-worship clause

h) Exemption of charitable institutions, churches, parsonages, or convents appurtenant

thereto, mosques, and non-profit cemeteries, and all lands, buildings and improvements

actually, directly and exclusively used for religious, charitable or 1educational purposes.

i) Exemption from taxes of the revenues and assets of non-profit, non-stock educational

institutions including grants, endowments, donations or contributions for educational

purposes.

j) Non-appropriation of public funds or property for the benefit of any church, sect or system

of religion, etc.

k) No money shall be paid out of the Treasury except in pursuance of an appropriation made by

law.

l) Concurrence of a majority of ALL members of Congress for the passage of a law granting tax

exemption

m) Non-diversification of tax collections

n) The President shall have the power to veto any particular item (s) in an appropriation,

revenue or tariff, but the veto shall not affect the item (s) to which no objection has been

made.

o) Non-impairment of the jurisdiction of the Supreme Court to review tax cases

p) Appropriations, revenue or tariff bills shall originate exclusively in the House of

Representatives but the Senate may propose or concur with amendments.

q) Each local government unit shall exercise the power to create its own sources of revenue

and shall have a just share in the national taxes.

L. TAX LAWS

NATURE OF INTERNAL REVENUE LAWS - Tax laws are civil and not penal in nature, although there

are penalties provided for their violation. The purpose of tax laws in imposing penalties for

delinquencies is to compel the timely payment of taxes or to punish evasion or neglect of duty in

respect thereof.

CONSTRUCTION OR INTERPRETATION OF TAX LAWS IN CASE OF DOUBT OR AMBIGUITY

1. Tax statutes are construed strictly against the government. Taxes, being burdens, are not to be

presumed beyond what the statute expressly and clearly declares.

2. Provisions granting tax exemptions are construed strictly against the taxpayer claiming tax

exemption.

APPLICATION OF TAX LAWS

General rule:

Tax laws are prospective in operation because the nature and amount of the tax could not be

foreseen and understood by the taxpayer at the time the transactions which the law seeks to tax

was completed.

Downloaded by Wilfredo Villaflor (wilfredovillaflor01@gmail.com)

lOMoARcPSD|20937282

Exception:

While it is not favored, a statute may nevertheless operate retroactively provided it is expressly

declared or is clearly the legislative intent. But a tax law should not be given retroactive

application when it would be harsh and oppressive.

M. SOURCES OF TAX LAWS

i. Constitution

ii. Tax Codes such as the National Internal Revenue Code, Tariff and Customs Code, and

portion of the Local Government Code

iii. Statutes like RA 1125 (an Act Creating the Court of Tax Appeals), RA 7716 (E-VAT Law),

RA 8424 (Tax Reform Act of 1997), RA 10963 (TRAIN law)

iv. Presidential Decrees

v. Executive Orders

vi. Court Decisions

vii. Revenue regulations promulgated by the Department of Finance

viii. Administrative issuances of the BIR like Revenue Memorandum Circulars, and those

of the Bureau of Customs like Customs Memorandum Orders

ix. BIR Rulings

x. Local Tax Ordinances

xi. Tax Treaties and Conventions with Foreign Countries

N. CLASSIFICATION OF TAXES

1. According to Subject Matter:

a) Personal, Poll or Capitation Tax – tax of a fixed amount imposed upon individual, whether

citizens or not, residing within a specified territory without regard to their property or the

occupation in which he may be engaged (e.g. basic community tax)

b) Property Tax – tax imposed on property, whether real or personal, in proportion either to its

value, or in accordance with some other reasonable method of apportionment (e.g. real estate

tax)

c) Excise Tax – any tax which does not fall within the classification of a poll tax or a property tax.

This is a tax on the exercise of certain rights and privileges (e.g. income tax, estate tax, donor’s

tax, VAT)

2. According to Who Bears the Burden:

a) Direct Tax – imposed on the person obliged to pay the same and this burden cannot be shifted

or passed on to another. (e.g. income tax, estate tax, donor’s tax)

b) Indirect Tax – the payment is demanded from a person who is allowed to transfer the burden

of taxation to another. (e.g. VAT)

Downloaded by Wilfredo Villaflor (wilfredovillaflor01@gmail.com)

lOMoARcPSD|20937282

3. According to Determination of Amount:

a) Specific Tax – this is a fixed amount based on volume, weight or quantity of goods as

measured by tools, instruments or standards. (e.g. excise tax on cigars and liquors)

b) Ad Valorem Tax – this imposition is based on the value of the property subject to tax. (e.g. VAT,

income tax, donor’s tax and estate tax)

4. According to Purpose:

1. Fiscal/General/Revenue Tax – levied without a specific or pre-determined purpose. (e.g.

income tax, donor’s tax and estate tax)

2. Regulatory/Special/Sumptuary Tax – those intended to achieve some social or economic

goals. (e.g. tariff and certain duties on imports)

5. According to Jurisdiction/Scope or Authority

a. National Tax – imposed by the National Government

NATIONAL INTERNAL REVENUE TAXES UNDER THE ADMINISTRATION OF THE BIR:

a) Income Tax

b) Estate and donor’s tax

c) Value-added tax

d) Other percentage taxes

e) Excise taxes

f) Documentary stamp taxes

b. Local Tax - imposed by municipal corporations (e.g. real estate tax)

6. According to Graduation or Rate

a. Proportional/Flat Rate Tax – unitary or single rate. (e.g. VAT)

b. Progressive/Graduated Tax – as the tax base grows, the tax rate increases. (e.g. income tax on

individuals)

c. Regressive Tax – the tax rate increases as the tax base decreases.

Downloaded by Wilfredo Villaflor (wilfredovillaflor01@gmail.com)

You might also like

- Final Tax PDFDocument34 pagesFinal Tax PDFMary Denize100% (4)

- Taxation Memaid (Beda)Document132 pagesTaxation Memaid (Beda)Maria Jennifer Yumul BorbonNo ratings yet

- Income TaxationDocument10 pagesIncome TaxationRocel Domingo100% (1)

- Management Accounting Decisions 1Document2 pagesManagement Accounting Decisions 1Angela Angeles0% (1)

- Module 1 Lecture TAXationDocument7 pagesModule 1 Lecture TAXationJagi KimNo ratings yet

- Taxation I ReviewDocument62 pagesTaxation I ReviewSK Tim RichardNo ratings yet

- TaxationDocument82 pagesTaxationCherry Ann LayuganNo ratings yet

- General Principles: Power of TaxationDocument21 pagesGeneral Principles: Power of TaxationCarl MurphyNo ratings yet

- Taxation Handout 1Document9 pagesTaxation Handout 1chancellxadeNo ratings yet

- General Principles of TaxationDocument12 pagesGeneral Principles of TaxationMatt Marqueses PanganibanNo ratings yet

- BBE Lawyers Notes Taxation LawDocument215 pagesBBE Lawyers Notes Taxation LawYoo PawNo ratings yet

- Income Taxation ReviewerDocument17 pagesIncome Taxation ReviewerRena Mae BalmesNo ratings yet

- Tax 1Document8 pagesTax 1Romeo ViernesNo ratings yet

- TAXATION p.1 3 of The SyllabusDocument61 pagesTAXATION p.1 3 of The SyllabusJanine Kae UrsulumNo ratings yet

- Prelim TaxationDocument8 pagesPrelim TaxationJocel Añasco LabiosNo ratings yet

- Principles of TaxationDocument29 pagesPrinciples of TaxationannyeongchinguNo ratings yet

- General Principles of Taxation General Principles of TaxationDocument14 pagesGeneral Principles of Taxation General Principles of TaxationAnne Rose EncinaNo ratings yet

- 2018 UDM Tax Law Review Part 1 - Lecture 1 Complete (July 02)Document20 pages2018 UDM Tax Law Review Part 1 - Lecture 1 Complete (July 02)Simeon SuanNo ratings yet

- TaxationDocument18 pagesTaxationMatthew MadriagaNo ratings yet

- Taxation Reviewer SAN BEDADocument129 pagesTaxation Reviewer SAN BEDARitch LibonNo ratings yet

- Taxation 1Document63 pagesTaxation 1Ella Joy MataNo ratings yet

- Shabu Batak TaxationDocument41 pagesShabu Batak TaxationJOSHUA M. ESCOTONo ratings yet

- Taxation: DifferenceDocument4 pagesTaxation: DifferenceZed AbantasNo ratings yet

- Reviewer in TaxationDocument19 pagesReviewer in TaxationMarco ComboyaNo ratings yet

- Principles of TaxationDocument13 pagesPrinciples of TaxationHazel OrtegaNo ratings yet

- General Principles of Taxation I. TaxationDocument14 pagesGeneral Principles of Taxation I. TaxationRegina BengadoNo ratings yet

- Taxation Reviewer SAN BEDADocument129 pagesTaxation Reviewer SAN BEDALiezl Oreilly VillanuevaNo ratings yet

- Tax ReviewerDocument12 pagesTax Reviewerashleykate.hapeNo ratings yet

- Taxation LawDocument127 pagesTaxation LawCarl MurphyNo ratings yet

- Taxation LawDocument127 pagesTaxation Lawtheia28No ratings yet

- Bukidnon State University Alubijid Satellite CampusDocument16 pagesBukidnon State University Alubijid Satellite CampusJames Bryle GalagnaraNo ratings yet

- Neral Principles of Taxation PDFDocument10 pagesNeral Principles of Taxation PDFKaren Joy MagsayoNo ratings yet

- Chapter 1 IntaxDocument7 pagesChapter 1 IntaxrarerawrolesNo ratings yet

- Principles of TaxationDocument32 pagesPrinciples of TaxationAndrea WaganNo ratings yet

- Lecture On General Principles of TaxationDocument75 pagesLecture On General Principles of TaxationJayen100% (1)

- Definition and Concept of TaxationDocument11 pagesDefinition and Concept of TaxationJackie Calayag100% (4)

- Legal Framework of TaxationDocument34 pagesLegal Framework of TaxationCamille HofilenaNo ratings yet

- Income Taxation (Principles of Taxation) : Fritz A. Perez, Cpa, CTT, Mritax, Mba (O.G)Document40 pagesIncome Taxation (Principles of Taxation) : Fritz A. Perez, Cpa, CTT, Mritax, Mba (O.G)JessaNo ratings yet

- Fundamental of Principle of TaxationDocument13 pagesFundamental of Principle of TaxationLilian FredelucesNo ratings yet

- Taxation NOTESDocument9 pagesTaxation NOTESVeronicaFranciscoNo ratings yet

- Documents - MX 132047518 Taxation Reviewer San Beda - PDFDocument128 pagesDocuments - MX 132047518 Taxation Reviewer San Beda - PDFAimee HallNo ratings yet

- Taxation LawDocument106 pagesTaxation Lawjohnanthony201No ratings yet

- Tax 311 Topic PDFDocument22 pagesTax 311 Topic PDFAnnie Mae YnotNo ratings yet

- General Principles of TaxationDocument33 pagesGeneral Principles of TaxationjoyNo ratings yet

- Local Media7305767987836246830Document20 pagesLocal Media7305767987836246830John RellonNo ratings yet

- Principles of Income TaxationDocument29 pagesPrinciples of Income TaxationAriane Grace Hiteroza MargajayNo ratings yet

- Taxation ReviewerDocument7 pagesTaxation Reviewermanresa4everNo ratings yet

- BAINCTAX Notes (REAL)Document2 pagesBAINCTAX Notes (REAL)Ashley BrevaNo ratings yet

- Local TaxationDocument17 pagesLocal TaxationabhiramNo ratings yet

- General Principles of TaxationDocument37 pagesGeneral Principles of TaxationWendy CassidyNo ratings yet

- Prelim Handouts What Is Taxation?Document18 pagesPrelim Handouts What Is Taxation?emielyn lafortezaNo ratings yet

- Chapter 1 - General Principles and Concepts of TaxationDocument13 pagesChapter 1 - General Principles and Concepts of Taxationchesca marie penarandaNo ratings yet

- Taxation 1 Lesson 1. Basic Concepts and Characteristics of TaxationDocument43 pagesTaxation 1 Lesson 1. Basic Concepts and Characteristics of Taxationjane quiambao100% (1)

- Principles of TaxationDocument32 pagesPrinciples of TaxationTyra Joyce Revadavia100% (1)

- Table of Contents IntroductionDocument25 pagesTable of Contents IntroductionRowena EspirituNo ratings yet

- Mike's Tax Law Reviewer (Compressed)Document23 pagesMike's Tax Law Reviewer (Compressed)Miguel Anas Jr.No ratings yet

- Basic PrinciplesDocument7 pagesBasic PrinciplesRodison de GuiaNo ratings yet

- The Economic Policies of Alexander Hamilton: Works & Speeches of the Founder of American Financial SystemFrom EverandThe Economic Policies of Alexander Hamilton: Works & Speeches of the Founder of American Financial SystemNo ratings yet

- Hamilton's Economic Policies: Works & Speeches of the Founder of American Financial SystemFrom EverandHamilton's Economic Policies: Works & Speeches of the Founder of American Financial SystemNo ratings yet

- Learning to Love Form 1040: Two Cheers for the Return-Based Mass Income TaxFrom EverandLearning to Love Form 1040: Two Cheers for the Return-Based Mass Income TaxNo ratings yet

- Chap7 9 RIT Exclusion and InclusionDocument62 pagesChap7 9 RIT Exclusion and InclusionCarmela Dawn DelfinNo ratings yet

- FIN-573 - Lecture 2 - Jan 28 2021Document33 pagesFIN-573 - Lecture 2 - Jan 28 2021Abdul BaigNo ratings yet

- Business Math Test QuestionsDocument6 pagesBusiness Math Test QuestionsJemimah CorporalNo ratings yet

- Project Appraisal - Investment Appraisal - 2023Document40 pagesProject Appraisal - Investment Appraisal - 2023ThaboNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruKaka JENo ratings yet

- Accountancy PPT 1Document22 pagesAccountancy PPT 1sakshamNo ratings yet

- 6.revised Galvanized Iron Sheet Product Producing PlantDocument23 pages6.revised Galvanized Iron Sheet Product Producing PlantaschalewNo ratings yet

- Panera Bread Financial Analysis Spring2015Document6 pagesPanera Bread Financial Analysis Spring2015Cinthia SantosNo ratings yet

- Abm Trial Balance ActivityDocument3 pagesAbm Trial Balance ActivityRoxanne RoldanNo ratings yet

- Departmental Interpretation and Practice Notes NO. 32 (Revised)Document51 pagesDepartmental Interpretation and Practice Notes NO. 32 (Revised)Difanny KooNo ratings yet

- Explanation.-The Provisions of This Paragraph Shall Not Apply in The Case of A Non-GovernmentDocument9 pagesExplanation.-The Provisions of This Paragraph Shall Not Apply in The Case of A Non-GovernmentAl Amin SarkarNo ratings yet

- ITR's and AssessmentDocument11 pagesITR's and Assessmentashutosh4iipmNo ratings yet

- FABM2 LESSON 3 Statement of Changes in EquityDocument4 pagesFABM2 LESSON 3 Statement of Changes in EquityArjay CorderoNo ratings yet

- M Form 2019Document4 pagesM Form 2019Kamille Ann RiveraNo ratings yet

- Nedai, Abbas (562-388-900) and Hosseini Ssayadnavard, MaryamDocument122 pagesNedai, Abbas (562-388-900) and Hosseini Ssayadnavard, Maryamirajiraj77No ratings yet

- Simplified Return of in Come For ManufacturersDocument4 pagesSimplified Return of in Come For ManufacturersSyed Faisal AhsanNo ratings yet

- Summary of Tax Rates On Individuals 2023Document1 pageSummary of Tax Rates On Individuals 2023elmashtoly.abdallahNo ratings yet

- BIR Application For Registration FORM (1901)Document2 pagesBIR Application For Registration FORM (1901)Francis Nico PeñaNo ratings yet

- Lecture On Taxation Law - 2020Document143 pagesLecture On Taxation Law - 2020Jay RamNo ratings yet

- Chapters 2 and 3 HandoutsDocument8 pagesChapters 2 and 3 HandoutsCarter LeeNo ratings yet

- The Institute of Chartered Accountants of IndiaDocument42 pagesThe Institute of Chartered Accountants of IndiaXpacNo ratings yet

- CA Sales - Results 2019 PDFDocument2 pagesCA Sales - Results 2019 PDFgarag muniNo ratings yet

- Acctg AssignmentDocument14 pagesAcctg AssignmentMargie ArañoNo ratings yet

- Saplan - Danilyn - Final OutputDocument16 pagesSaplan - Danilyn - Final OutputMarilyn Cercado FernandezNo ratings yet

- Taxmann - Budget Highlights 2022-2023Document42 pagesTaxmann - Budget Highlights 2022-2023Jinang JainNo ratings yet

- Revision (CA MCQ)Document2 pagesRevision (CA MCQ)Ee LynnNo ratings yet

- Capital Structure IIDocument31 pagesCapital Structure IIhatemNo ratings yet

- CH 05Document4 pagesCH 05flrnciairnNo ratings yet