Professional Documents

Culture Documents

BofA CoreChecking en ADA

BofA CoreChecking en ADA

Uploaded by

Frank TilemanCopyright:

Available Formats

You might also like

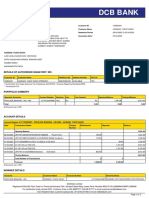

- DCB Bank: Statement of AccountDocument2 pagesDCB Bank: Statement of AccounthasnainNo ratings yet

- Bac Core Checking EnusDocument2 pagesBac Core Checking Enusapi-285070305No ratings yet

- Asterisk-Free Checking Account: 1 Everyday TransactionsDocument3 pagesAsterisk-Free Checking Account: 1 Everyday TransactionsMarcells Danyel JordanNo ratings yet

- Understanding Bank of America Interest Checking: An Overview of Key Policies and FeesDocument2 pagesUnderstanding Bank of America Interest Checking: An Overview of Key Policies and FeesGheorghiu GheorgheNo ratings yet

- 3584 CS MyAccess ALL 8 2013Document2 pages3584 CS MyAccess ALL 8 2013rasheed-aliNo ratings yet

- Overview of Regular Savings Key Policies and Fees: Bank of America Clarity StatementDocument2 pagesOverview of Regular Savings Key Policies and Fees: Bank of America Clarity StatementJacob DaleNo ratings yet

- Netspend All-Access Account: Monthly UsageDocument2 pagesNetspend All-Access Account: Monthly UsageSam BojanglesNo ratings yet

- Easy Checking SnapshotDocument2 pagesEasy Checking SnapshotsupportNo ratings yet

- BoA - Deposit Form 05731Document2 pagesBoA - Deposit Form 05731Coy IngramNo ratings yet

- Attain Checking Product DisclosureDocument2 pagesAttain Checking Product DisclosureieatpinktacozNo ratings yet

- Screenshot 2023-11-26 at 12.01.23 AMDocument73 pagesScreenshot 2023-11-26 at 12.01.23 AMqt5tggw8k8No ratings yet

- Rapid Meta Visa Fixed 2 - 194007202 - CHA Online Bundle - 05935-30-900Document12 pagesRapid Meta Visa Fixed 2 - 194007202 - CHA Online Bundle - 05935-30-900Valeria M.SNo ratings yet

- Deposit Checking Account GuideDocument2 pagesDeposit Checking Account GuideMarilena HapcaNo ratings yet

- 730462222Document20 pages730462222Tank ZillaNo ratings yet

- PT CAP BasicBankingDocument3 pagesPT CAP BasicBankingRayan PaulNo ratings yet

- Nfcu Secured Credit Card Application - 800nDocument2 pagesNfcu Secured Credit Card Application - 800nKako The 66th ChannelNo ratings yet

- Yield Pledge Checking: Account Opening & UsageDocument2 pagesYield Pledge Checking: Account Opening & Usageshenzo_No ratings yet

- Metabank Terms and ConditionsDocument17 pagesMetabank Terms and ConditionsMoses MillerNo ratings yet

- Business Bonus Account v79.0Document3 pagesBusiness Bonus Account v79.0prabeshmanNo ratings yet

- A Guide To Your Common Checking Account Fees: How Deposits and Withdrawals Are ProcessedDocument4 pagesA Guide To Your Common Checking Account Fees: How Deposits and Withdrawals Are ProcessedBradley KirtsNo ratings yet

- ATM and Debit Card Overdraft Coverage Confirmation NoDocument2 pagesATM and Debit Card Overdraft Coverage Confirmation NoSucreNo ratings yet

- SFLF 720320418 enDocument1 pageSFLF 720320418 enMelinda R. FranciscoNo ratings yet

- Elite Gold NCDocument2 pagesElite Gold NCAakash AgarwalNo ratings yet

- PaychekPLUS 8148384 Disclosures - 2022 UPDATED 8 - 2 - 2022Document8 pagesPaychekPLUS 8148384 Disclosures - 2022 UPDATED 8 - 2 - 2022Jeshua CaballeroNo ratings yet

- Cont'dDocument24 pagesCont'dAurora Ma'atNo ratings yet

- Chase Sample GuideDocument3 pagesChase Sample Guideapi-310599226No ratings yet

- Overdraft BrochureDocument6 pagesOverdraft BrochureStone pobeeNo ratings yet

- 1650318373.8033838 Paychekplus-67426349-Disclosures Client6Document4 pages1650318373.8033838 Paychekplus-67426349-Disclosures Client6Jonathan GameroNo ratings yet

- All Fees Amount Details: Fee ScheduleDocument17 pagesAll Fees Amount Details: Fee ScheduleLuke EvansNo ratings yet

- Overdraft NoticeDocument1 pageOverdraft Noticeleinbergerwife1No ratings yet

- List of All Fees For The Green Dot Special Edition Prepaid Mastercard or Visa CardDocument7 pagesList of All Fees For The Green Dot Special Edition Prepaid Mastercard or Visa CardJamie AuslanderNo ratings yet

- Summary of Rates and FeesDocument2 pagesSummary of Rates and Fees7fr8cr5wt2No ratings yet

- Interest Rates and Interest Charges: Capital One Account TermsDocument4 pagesInterest Rates and Interest Charges: Capital One Account Termsfrank montanoNo ratings yet

- Smart Advantage C Reg DDDocument4 pagesSmart Advantage C Reg DDekinediepreyeNo ratings yet

- Chase FeeDocument5 pagesChase FeePeter Ruliang YanNo ratings yet

- Prepaid Disclosures: We Charge 8 Other Types of Fees. Here Are Some of ThemDocument3 pagesPrepaid Disclosures: We Charge 8 Other Types of Fees. Here Are Some of ThemKrista PressleyNo ratings yet

- Interest Rates and Interest ChargesDocument5 pagesInterest Rates and Interest ChargesGadriel GargardNo ratings yet

- BrightWay Acquistion Terms AMF89 35.99 NDocument6 pagesBrightWay Acquistion Terms AMF89 35.99 Njlp036046gmail.comNo ratings yet

- This Is A Summary Only. Please See Below This Box For Full DetailsDocument10 pagesThis Is A Summary Only. Please See Below This Box For Full DetailsSequencersNo ratings yet

- Boa CardDocument5 pagesBoa Cardapi-285069637100% (1)

- SFLF 730372319 en PDFDocument1 pageSFLF 730372319 en PDFHenri BlankNo ratings yet

- Disclosure.3433.en USDocument4 pagesDisclosure.3433.en USRakibNo ratings yet

- OverraftDocs 1234Document8 pagesOverraftDocs 1234KimberlyNo ratings yet

- SFLF 730449321 enDocument1 pageSFLF 730449321 enkatyaNo ratings yet

- Credit CardsDocument5 pagesCredit CardsCemitoXNo ratings yet

- Netspend All-Access AccountDocument35 pagesNetspend All-Access Accountchristopherhowell269100% (1)

- Chase Disclosure AgreementDocument3 pagesChase Disclosure Agreementbstinson829No ratings yet

- Interest Rates and Interest ChargesDocument5 pagesInterest Rates and Interest ChargesAlex LagunesNo ratings yet

- Standard Checking Summary PDFDocument2 pagesStandard Checking Summary PDFBobby BakerNo ratings yet

- Deposit ProductsDocument14 pagesDeposit ProductssupportNo ratings yet

- Easy SavingsDocument2 pagesEasy SavingsPepper JackNo ratings yet

- PNC - Consumer Schedule of Service Charges and FeesDocument4 pagesPNC - Consumer Schedule of Service Charges and FeesblarghhhhNo ratings yet

- Cardholder Agreement Edv01odcashDocument54 pagesCardholder Agreement Edv01odcashTruLuv FaithNo ratings yet

- Go2Bank Deposit Account AgreementDocument40 pagesGo2Bank Deposit Account AgreementHank MacsNo ratings yet

- Overdraft Payment Service DisclosureDocument2 pagesOverdraft Payment Service DisclosureMaltro ChooNo ratings yet

- Secured Personal Terms enDocument8 pagesSecured Personal Terms enluiscelis01No ratings yet

- Salem Five Direct Consumer Banking Fee ScheduleDocument2 pagesSalem Five Direct Consumer Banking Fee ScheduleshoppingonlyNo ratings yet

- In Case of Errors or Questions About Your Electronic Funds TransfersDocument2 pagesIn Case of Errors or Questions About Your Electronic Funds TransfersMuhammad AdeelNo ratings yet

- Disclosure 26339 en-USDocument5 pagesDisclosure 26339 en-USjeremyallan6969No ratings yet

- You’Re a Business Owner, Not a Dummy!: Understand Your Merchant AccountFrom EverandYou’Re a Business Owner, Not a Dummy!: Understand Your Merchant AccountRating: 2 out of 5 stars2/5 (1)

- Finance Rbi AffairsmindDocument326 pagesFinance Rbi Affairsmindanshuman kumarNo ratings yet

- The New Math of Reverse Mortgages For Retirees - WSJ (June 2022)Document5 pagesThe New Math of Reverse Mortgages For Retirees - WSJ (June 2022)ejbejbejbNo ratings yet

- E-Stamp: Government of RajasthanDocument11 pagesE-Stamp: Government of RajasthanAnil kumarNo ratings yet

- EastWest Consumer LendingDocument4 pagesEastWest Consumer LendingCrestNo ratings yet

- Challan KPCET3AL079E810085 14022023 182210Document1 pageChallan KPCET3AL079E810085 14022023 182210PavanNo ratings yet

- Statement Tombi - qbthr1 20220607202731Document2 pagesStatement Tombi - qbthr1 20220607202731abdoulayea2001No ratings yet

- Interest RateDocument1 pageInterest RateAmin 16No ratings yet

- BGE Presentation 20231024Document56 pagesBGE Presentation 20231024amarikaivagyNo ratings yet

- Dhani Finance PDF-2Document4 pagesDhani Finance PDF-2shaileshkumar443155No ratings yet

- Raising FinanceDocument26 pagesRaising FinanceChris WallaceNo ratings yet

- Texas Bank MayDocument8 pagesTexas Bank May76xzv4kk5vNo ratings yet

- Billing - Mahadiscom.in Processpayment - PHPDocument1 pageBilling - Mahadiscom.in Processpayment - PHPnavinNo ratings yet

- Credit Card StatementDocument4 pagesCredit Card StatementGurpreet SinghNo ratings yet

- Unit Number/ Heading: Intermediate Accounting Ii (Ae 16) Learning Material: Postemployment BenefitDocument3 pagesUnit Number/ Heading: Intermediate Accounting Ii (Ae 16) Learning Material: Postemployment BenefitSitti Ayesha HasimanNo ratings yet

- Annuity QuestionsDocument6 pagesAnnuity Questionssecret studentNo ratings yet

- New MESALA Application Form - EditableDocument1 pageNew MESALA Application Form - EditableJR0% (1)

- Cross Border Insolvency in IndiaDocument11 pagesCross Border Insolvency in IndiaSYAMALA YASHWANTH REDDYNo ratings yet

- AA015 Chap 2 LectureDocument5 pagesAA015 Chap 2 Lecturenorismah isaNo ratings yet

- Semanur BankDocument1 pageSemanur Banksemanurcaliskan541No ratings yet

- Source DocumentsDocument3 pagesSource DocumentsNurudeen JiomhNo ratings yet

- CHR Report - 10 September 2023Document37 pagesCHR Report - 10 September 2023RR PatelNo ratings yet

- e-StatementBRImo 709601019320532 Nov2023 20231115 181629Document1 pagee-StatementBRImo 709601019320532 Nov2023 20231115 181629Dhika LNo ratings yet

- Section - 54B Income-Tax Act 1961 - FA 2022 Capital Gain On Transfer of Land Used For Agricultural Purposes Not To Be Charged in Certain CasesDocument2 pagesSection - 54B Income-Tax Act 1961 - FA 2022 Capital Gain On Transfer of Land Used For Agricultural Purposes Not To Be Charged in Certain CasesSolution PointNo ratings yet

- Banks Vietnam Risks From Real 16jan2023 PBC - 1349912Document9 pagesBanks Vietnam Risks From Real 16jan2023 PBC - 1349912Kim Yen NguyenNo ratings yet

- Concern Worldwide: Salary SlipDocument1 pageConcern Worldwide: Salary SlipwubyiebasazinNo ratings yet

- DST-CTA-gr 221655 2021Document5 pagesDST-CTA-gr 221655 2021Teresita TibayanNo ratings yet

- Flowchart Bankruptcy Proceedings Up To The Stage A Debtor Is Adjudged A BankruptDocument2 pagesFlowchart Bankruptcy Proceedings Up To The Stage A Debtor Is Adjudged A BankruptAudrey LimNo ratings yet

- BG Application FormDocument2 pagesBG Application Formnivaldo helmeisterNo ratings yet

BofA CoreChecking en ADA

BofA CoreChecking en ADA

Uploaded by

Frank TilemanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BofA CoreChecking en ADA

BofA CoreChecking en ADA

Uploaded by

Frank TilemanCopyright:

Available Formats

Sort_Audit: CC:00-53-5421NSB

Bank of America Advantage Plus Banking®

Clarity Statement® — Overview of key policies and fees

Account information

Opening Deposit $100 or more

Monthly $12.00 each month. You can avoid the Monthly Maintenance Fee when you do ONE of the following each

Maintenance statement cycle:

Fee • Make at least one qualifying Direct Deposit of $250 or more, OR

• Maintain a minimum daily balance of $1,500 or more, OR

• Enroll in the Preferred Rewards program. Learn more at bankofamerica.com/preferred-rewards.

ATM fees

Bank of America ATMs No ATM fee For deposits, withdrawals, transfers or balance inquiries

Non-Bank of America ATMs $2.50 In the U.S., plus any fee charged by the ATM's operator

$5.00 Outside the U.S., plus any fee charged by the ATM's operator

Overdraft policy

• To help you avoid fees, we won't authorize ATM withdrawals or everyday debit card purchases when you don't have enough money

in your account at the time of the transaction.

• When we determine you don't have enough money in your account to cover other items such as checks or scheduled payments, we'll either

authorize and pay the item and overdraw your account (an overdraft item),1 or decline or return the item unpaid (a returned item). When

this happens, you may be charged a fee. See details below.

• We offer two overdraft setting options for how you want us to process your other transactions.

Overdraft settings and fees

Option 1: Standard - This setting will be automatically applied to your account.

• Your checks and scheduled payments may be paid, causing an overdraft.

• You may be charged an Overdraft Item Fee if you overdraw your account.

• If we return an item unpaid, we won't charge a fee, but the payee may.

Overdraft Item Fee $10.00 We won’t charge this fee:

(We won't charge you more per item • If your account is overdrawn by $1 or less OR

than 2 of these fees per day.) • For items that are $1 or less OR

• On ACH resubmissions labeled by the merchant as “RETRY PYMT” or “REDEPCHECK”

Option 2: Decline All - You can choose this setting if you would like to have your transactions declined or returned unpaid

when you don’t have enough money. With this setting you can avoid Overdraft Item Fees.

• Checks or scheduled payments will be returned unpaid if you don’t have enough money in your account.

• If your account becomes overdrawn for any reason, we won’t charge you an Overdraft Item Fee.

• When we decline or return a transaction, we won’t charge a fee, but the payee may.

Keep in mind, regardless of your overdraft setting, if you set up Balance ConnectTM for overdraft protection,2 we’ll automatically

transfer available funds from one or more of your linked backup accounts if you’re about to overdraw your account.

Please see the Personal Schedule of Fees and Deposit Agreement and Disclosures for your account terms.

1. Our overdraft fee of $10 may apply for overdrafts created by check, recurring debit card transactions, or other electronic means. If your account is overdrawn, you must

immediately bring your account to a positive balance. We pay overdrafts at our discretion and we reserve the right not to pay. For example, we typically do not pay overdrafts if

your account is not in good standing.

2. Balance ConnectTM for overdraft protection is also available from your Bank of America credit card. Overdraft protection transfers from your credit card are Bank Cash Advances and

will accrue interest at the Bank Cash Advance APR. Please refer to your Credit Card Agreement for additional details. Overdraft protection transfers from a linked savings account

count towards the six transactions you're allowed each month from your savings account and may lead to a Withdrawal Limit Fee.

Information is current as of 08/2022 and is subject to change. See reverse

Additional fees

Statement copies $5.00 For each paper copy that you request from us

No fee Printable statements are available in Online Banking.

Check images $3.00 For each monthly statement that includes a printed check image

No fee Printable check images from the last 18 months are available online

Ordering checks Varies Depending on the style you choose

Card replacement $5.00 To replace an ATM or debit card when your card hasn't expired; additional $15

for rush delivery

Stop payment $30.00 For each request

Cashier's checks $15.00 For each check

Domestic wire $15.00 For each incoming wire transfer

transfers

$30.00 For each outgoing wire transfer

International wire $16.00 For each incoming wire transfer

transfers

No fee For each outgoing wire transfer sent in foreign currency

$45.00 For each outgoing wire transfer sent in U.S. Dollars

Other fees may also apply, including those charged by the recipient’s financial institution, foreign taxes, and other fees that are part of the wire transfer process. Markups

associated with the currency conversion are included in the Bank of America exchange rate. When deciding between sending in foreign currency or U.S. Dollars, you should

consider factors that impact the total cost to send or the amount available after transfer such as exchange rates and other fees.

Non-Bank of America Per transaction, greater of $5.00 OR 3% of the amount (maximum $10.00) when you use your ATM

Teller Withdrawal or debit card, or card number, to make a withdrawal, transfer or payment at another bank and it is

processed as a cash disbursement.

When your deposits are available

• Cash, direct deposits, wire transfers: On the day we receive them.

• Checks: Usually the next business day, if deposited before the financial center or ATM cutoff time.

• Mobile Check Deposit: Usually the next business day if deposited by applicable cutoff times. Please refer to Deposit Checks, then

Help in the Mobile Banking app for additional details and terms and conditions.

• If we place a hold on your deposit, we'll let you know the hold reason and when your funds will be available. This is typically

provided at the time of deposit but may also be mailed later. Deposits greater than $5,525 and checks deposited within the first 30

days of account opening may be held longer.

How we post transactions

The way we post transactions impacts your account balance. If there's not enough available money in your account to cover all of

your transactions, the posting order can impact the number of overdraft fees you incur. At the end of each business day, we'll group

transactions received that day into categories before posting them. Below are the most common categories, and common

transaction types in each, in the order that they generally post to your account. Keep in mind that transactions that are still

processing may lower your available balance.

• Deposits: Added from highest to lowest dollar amount.

• Many debit transactions: Subtracted based on the date and time you made them (if the system knows the date and time of the

transaction). These include one-time and recurring debit card transactions, one-time transfers, ATM withdrawals, and checks cashed

with our tellers.*

• Other checks you wrote: Subtracted in check number order.*

• Most other electronic payments and preauthorized transfers: Subtracted from highest to lowest dollar amount. These include

scheduled transfers, online bill payments and preauthorized payments that use your account number.

• Most fees: Subtracted from highest to lowest dollar amounts.

* If our system doesn't receive date and time information, or can't detect the check number, remaining transactions in these categories

are posted from highest to lowest dollar amount.

Get the most out of your account

Review all the features and For questions, schedule an appointment

benefits of your new account at to visit a financial center at Call us at

bankofamerica.com/quickstart bankofamerica.com/appointments 800.432.1000

Additional fee waivers may be available to Bank of America Private Bank and qualified Merrill Lynch Wealth Management® clients. Please contact your advisor to learn more.

Merrill Lynch, Pierce, Fenner & Smith Incorporated (also referred to as “MLPF&S” or “Merrill”) makes available certain investment products sponsored, managed, distributed or provided by companies

that are affiliates of Bank of America Corporation (“BofA Corp.”). MLPF&S is a registered broker-dealer, registered investment adviser, Member SIPC and a wholly owned subsidiary of BofA Corp.

Banking products are provided by Bank of America, N.A. and affiliated banks, Members FDIC and wholly owned subsidiaries of Bank of America Corporation.

© 2022 Bank of America Corporation. 4370841 | 00-14-9315 | ALL STATES

00-53-5421NSB

You might also like

- DCB Bank: Statement of AccountDocument2 pagesDCB Bank: Statement of AccounthasnainNo ratings yet

- Bac Core Checking EnusDocument2 pagesBac Core Checking Enusapi-285070305No ratings yet

- Asterisk-Free Checking Account: 1 Everyday TransactionsDocument3 pagesAsterisk-Free Checking Account: 1 Everyday TransactionsMarcells Danyel JordanNo ratings yet

- Understanding Bank of America Interest Checking: An Overview of Key Policies and FeesDocument2 pagesUnderstanding Bank of America Interest Checking: An Overview of Key Policies and FeesGheorghiu GheorgheNo ratings yet

- 3584 CS MyAccess ALL 8 2013Document2 pages3584 CS MyAccess ALL 8 2013rasheed-aliNo ratings yet

- Overview of Regular Savings Key Policies and Fees: Bank of America Clarity StatementDocument2 pagesOverview of Regular Savings Key Policies and Fees: Bank of America Clarity StatementJacob DaleNo ratings yet

- Netspend All-Access Account: Monthly UsageDocument2 pagesNetspend All-Access Account: Monthly UsageSam BojanglesNo ratings yet

- Easy Checking SnapshotDocument2 pagesEasy Checking SnapshotsupportNo ratings yet

- BoA - Deposit Form 05731Document2 pagesBoA - Deposit Form 05731Coy IngramNo ratings yet

- Attain Checking Product DisclosureDocument2 pagesAttain Checking Product DisclosureieatpinktacozNo ratings yet

- Screenshot 2023-11-26 at 12.01.23 AMDocument73 pagesScreenshot 2023-11-26 at 12.01.23 AMqt5tggw8k8No ratings yet

- Rapid Meta Visa Fixed 2 - 194007202 - CHA Online Bundle - 05935-30-900Document12 pagesRapid Meta Visa Fixed 2 - 194007202 - CHA Online Bundle - 05935-30-900Valeria M.SNo ratings yet

- Deposit Checking Account GuideDocument2 pagesDeposit Checking Account GuideMarilena HapcaNo ratings yet

- 730462222Document20 pages730462222Tank ZillaNo ratings yet

- PT CAP BasicBankingDocument3 pagesPT CAP BasicBankingRayan PaulNo ratings yet

- Nfcu Secured Credit Card Application - 800nDocument2 pagesNfcu Secured Credit Card Application - 800nKako The 66th ChannelNo ratings yet

- Yield Pledge Checking: Account Opening & UsageDocument2 pagesYield Pledge Checking: Account Opening & Usageshenzo_No ratings yet

- Metabank Terms and ConditionsDocument17 pagesMetabank Terms and ConditionsMoses MillerNo ratings yet

- Business Bonus Account v79.0Document3 pagesBusiness Bonus Account v79.0prabeshmanNo ratings yet

- A Guide To Your Common Checking Account Fees: How Deposits and Withdrawals Are ProcessedDocument4 pagesA Guide To Your Common Checking Account Fees: How Deposits and Withdrawals Are ProcessedBradley KirtsNo ratings yet

- ATM and Debit Card Overdraft Coverage Confirmation NoDocument2 pagesATM and Debit Card Overdraft Coverage Confirmation NoSucreNo ratings yet

- SFLF 720320418 enDocument1 pageSFLF 720320418 enMelinda R. FranciscoNo ratings yet

- Elite Gold NCDocument2 pagesElite Gold NCAakash AgarwalNo ratings yet

- PaychekPLUS 8148384 Disclosures - 2022 UPDATED 8 - 2 - 2022Document8 pagesPaychekPLUS 8148384 Disclosures - 2022 UPDATED 8 - 2 - 2022Jeshua CaballeroNo ratings yet

- Cont'dDocument24 pagesCont'dAurora Ma'atNo ratings yet

- Chase Sample GuideDocument3 pagesChase Sample Guideapi-310599226No ratings yet

- Overdraft BrochureDocument6 pagesOverdraft BrochureStone pobeeNo ratings yet

- 1650318373.8033838 Paychekplus-67426349-Disclosures Client6Document4 pages1650318373.8033838 Paychekplus-67426349-Disclosures Client6Jonathan GameroNo ratings yet

- All Fees Amount Details: Fee ScheduleDocument17 pagesAll Fees Amount Details: Fee ScheduleLuke EvansNo ratings yet

- Overdraft NoticeDocument1 pageOverdraft Noticeleinbergerwife1No ratings yet

- List of All Fees For The Green Dot Special Edition Prepaid Mastercard or Visa CardDocument7 pagesList of All Fees For The Green Dot Special Edition Prepaid Mastercard or Visa CardJamie AuslanderNo ratings yet

- Summary of Rates and FeesDocument2 pagesSummary of Rates and Fees7fr8cr5wt2No ratings yet

- Interest Rates and Interest Charges: Capital One Account TermsDocument4 pagesInterest Rates and Interest Charges: Capital One Account Termsfrank montanoNo ratings yet

- Smart Advantage C Reg DDDocument4 pagesSmart Advantage C Reg DDekinediepreyeNo ratings yet

- Chase FeeDocument5 pagesChase FeePeter Ruliang YanNo ratings yet

- Prepaid Disclosures: We Charge 8 Other Types of Fees. Here Are Some of ThemDocument3 pagesPrepaid Disclosures: We Charge 8 Other Types of Fees. Here Are Some of ThemKrista PressleyNo ratings yet

- Interest Rates and Interest ChargesDocument5 pagesInterest Rates and Interest ChargesGadriel GargardNo ratings yet

- BrightWay Acquistion Terms AMF89 35.99 NDocument6 pagesBrightWay Acquistion Terms AMF89 35.99 Njlp036046gmail.comNo ratings yet

- This Is A Summary Only. Please See Below This Box For Full DetailsDocument10 pagesThis Is A Summary Only. Please See Below This Box For Full DetailsSequencersNo ratings yet

- Boa CardDocument5 pagesBoa Cardapi-285069637100% (1)

- SFLF 730372319 en PDFDocument1 pageSFLF 730372319 en PDFHenri BlankNo ratings yet

- Disclosure.3433.en USDocument4 pagesDisclosure.3433.en USRakibNo ratings yet

- OverraftDocs 1234Document8 pagesOverraftDocs 1234KimberlyNo ratings yet

- SFLF 730449321 enDocument1 pageSFLF 730449321 enkatyaNo ratings yet

- Credit CardsDocument5 pagesCredit CardsCemitoXNo ratings yet

- Netspend All-Access AccountDocument35 pagesNetspend All-Access Accountchristopherhowell269100% (1)

- Chase Disclosure AgreementDocument3 pagesChase Disclosure Agreementbstinson829No ratings yet

- Interest Rates and Interest ChargesDocument5 pagesInterest Rates and Interest ChargesAlex LagunesNo ratings yet

- Standard Checking Summary PDFDocument2 pagesStandard Checking Summary PDFBobby BakerNo ratings yet

- Deposit ProductsDocument14 pagesDeposit ProductssupportNo ratings yet

- Easy SavingsDocument2 pagesEasy SavingsPepper JackNo ratings yet

- PNC - Consumer Schedule of Service Charges and FeesDocument4 pagesPNC - Consumer Schedule of Service Charges and FeesblarghhhhNo ratings yet

- Cardholder Agreement Edv01odcashDocument54 pagesCardholder Agreement Edv01odcashTruLuv FaithNo ratings yet

- Go2Bank Deposit Account AgreementDocument40 pagesGo2Bank Deposit Account AgreementHank MacsNo ratings yet

- Overdraft Payment Service DisclosureDocument2 pagesOverdraft Payment Service DisclosureMaltro ChooNo ratings yet

- Secured Personal Terms enDocument8 pagesSecured Personal Terms enluiscelis01No ratings yet

- Salem Five Direct Consumer Banking Fee ScheduleDocument2 pagesSalem Five Direct Consumer Banking Fee ScheduleshoppingonlyNo ratings yet

- In Case of Errors or Questions About Your Electronic Funds TransfersDocument2 pagesIn Case of Errors or Questions About Your Electronic Funds TransfersMuhammad AdeelNo ratings yet

- Disclosure 26339 en-USDocument5 pagesDisclosure 26339 en-USjeremyallan6969No ratings yet

- You’Re a Business Owner, Not a Dummy!: Understand Your Merchant AccountFrom EverandYou’Re a Business Owner, Not a Dummy!: Understand Your Merchant AccountRating: 2 out of 5 stars2/5 (1)

- Finance Rbi AffairsmindDocument326 pagesFinance Rbi Affairsmindanshuman kumarNo ratings yet

- The New Math of Reverse Mortgages For Retirees - WSJ (June 2022)Document5 pagesThe New Math of Reverse Mortgages For Retirees - WSJ (June 2022)ejbejbejbNo ratings yet

- E-Stamp: Government of RajasthanDocument11 pagesE-Stamp: Government of RajasthanAnil kumarNo ratings yet

- EastWest Consumer LendingDocument4 pagesEastWest Consumer LendingCrestNo ratings yet

- Challan KPCET3AL079E810085 14022023 182210Document1 pageChallan KPCET3AL079E810085 14022023 182210PavanNo ratings yet

- Statement Tombi - qbthr1 20220607202731Document2 pagesStatement Tombi - qbthr1 20220607202731abdoulayea2001No ratings yet

- Interest RateDocument1 pageInterest RateAmin 16No ratings yet

- BGE Presentation 20231024Document56 pagesBGE Presentation 20231024amarikaivagyNo ratings yet

- Dhani Finance PDF-2Document4 pagesDhani Finance PDF-2shaileshkumar443155No ratings yet

- Raising FinanceDocument26 pagesRaising FinanceChris WallaceNo ratings yet

- Texas Bank MayDocument8 pagesTexas Bank May76xzv4kk5vNo ratings yet

- Billing - Mahadiscom.in Processpayment - PHPDocument1 pageBilling - Mahadiscom.in Processpayment - PHPnavinNo ratings yet

- Credit Card StatementDocument4 pagesCredit Card StatementGurpreet SinghNo ratings yet

- Unit Number/ Heading: Intermediate Accounting Ii (Ae 16) Learning Material: Postemployment BenefitDocument3 pagesUnit Number/ Heading: Intermediate Accounting Ii (Ae 16) Learning Material: Postemployment BenefitSitti Ayesha HasimanNo ratings yet

- Annuity QuestionsDocument6 pagesAnnuity Questionssecret studentNo ratings yet

- New MESALA Application Form - EditableDocument1 pageNew MESALA Application Form - EditableJR0% (1)

- Cross Border Insolvency in IndiaDocument11 pagesCross Border Insolvency in IndiaSYAMALA YASHWANTH REDDYNo ratings yet

- AA015 Chap 2 LectureDocument5 pagesAA015 Chap 2 Lecturenorismah isaNo ratings yet

- Semanur BankDocument1 pageSemanur Banksemanurcaliskan541No ratings yet

- Source DocumentsDocument3 pagesSource DocumentsNurudeen JiomhNo ratings yet

- CHR Report - 10 September 2023Document37 pagesCHR Report - 10 September 2023RR PatelNo ratings yet

- e-StatementBRImo 709601019320532 Nov2023 20231115 181629Document1 pagee-StatementBRImo 709601019320532 Nov2023 20231115 181629Dhika LNo ratings yet

- Section - 54B Income-Tax Act 1961 - FA 2022 Capital Gain On Transfer of Land Used For Agricultural Purposes Not To Be Charged in Certain CasesDocument2 pagesSection - 54B Income-Tax Act 1961 - FA 2022 Capital Gain On Transfer of Land Used For Agricultural Purposes Not To Be Charged in Certain CasesSolution PointNo ratings yet

- Banks Vietnam Risks From Real 16jan2023 PBC - 1349912Document9 pagesBanks Vietnam Risks From Real 16jan2023 PBC - 1349912Kim Yen NguyenNo ratings yet

- Concern Worldwide: Salary SlipDocument1 pageConcern Worldwide: Salary SlipwubyiebasazinNo ratings yet

- DST-CTA-gr 221655 2021Document5 pagesDST-CTA-gr 221655 2021Teresita TibayanNo ratings yet

- Flowchart Bankruptcy Proceedings Up To The Stage A Debtor Is Adjudged A BankruptDocument2 pagesFlowchart Bankruptcy Proceedings Up To The Stage A Debtor Is Adjudged A BankruptAudrey LimNo ratings yet

- BG Application FormDocument2 pagesBG Application Formnivaldo helmeisterNo ratings yet