Professional Documents

Culture Documents

Befa Aat2 Plag

Befa Aat2 Plag

Uploaded by

Nehanth AdmirerOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Befa Aat2 Plag

Befa Aat2 Plag

Uploaded by

Nehanth AdmirerCopyright:

Available Formats

Case Study

Introduction:

This case study is to analyse the DEF company’s financial postion by calculating

the debt-to-equity ratio with the help of the given balance sheet.

Background:

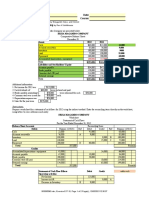

Balance Sheet

As of December 31st ,2022

Assets

Cash $50,000

Accounts Receivable $75,000

Inventory $100,000

Property, Plant, and Equipment $200,000

Total Assets $425,000

Liabilities

Accounts Payable $60,000

Notes Payable $75,000

Total Liabilities $135,000

Equity

Common Stock $100,000

Retained Earnings $190,000

Total Equity $290,000

Calculation:

Debt-to-Equity ratio = Total Liabilities / Total Equity

Debt-to-Equity ratio = $135,000 / $290,000

Debt-to-Equity ratio = 0.4655

Therefore, the Debt-to-Equity ratio as of December 31st,2022 is 0.4655.

Result:

I calculated the Debt-to-Equity ratio for the given balance sheet.

Conclusion:

The Debt-to-Equity ratio is helpful for estimating company’s financial position.

So, in the case of DEF company, I calculated the Debt-to-Equity ratio as of

December 31st,2022. That is 0.4655. So, it’s important that a company should

monitor and manage it’s debt.

Nehanth G

21951A6790

You might also like

- AssignmentDocument2 pagesAssignmentsunrise foods0% (1)

- Case 21Document14 pagesCase 21Gabriela LueiroNo ratings yet

- Exercise 1: On December 31, Bryniuk's Company, The Accounting Records Showed The Following InformationDocument10 pagesExercise 1: On December 31, Bryniuk's Company, The Accounting Records Showed The Following InformationJohn Kenneth Bohol50% (2)

- Assigment EFADocument3 pagesAssigment EFAResty Arum100% (1)

- 3-14 Free Cash Flow: Bailey Corporation's Financial Statements (Dollars and Shares Are in Millions) Are ProvidedDocument8 pages3-14 Free Cash Flow: Bailey Corporation's Financial Statements (Dollars and Shares Are in Millions) Are ProvidedCASTOR, Vincent Paul0% (1)

- Mid Term ExamDocument4 pagesMid Term ExamChris Rosbeck0% (1)

- Mid Term ExamDocument6 pagesMid Term ExamWaizin KyawNo ratings yet

- Horizontal&Vertical Analysis Sample ProblemDocument3 pagesHorizontal&Vertical Analysis Sample ProblemGenner RazNo ratings yet

- Annual Report: Balance SheetDocument2 pagesAnnual Report: Balance Sheetdummy GoodluckNo ratings yet

- Financial Statements and Cash Flow: Solutions To Questions and ProblemsDocument10 pagesFinancial Statements and Cash Flow: Solutions To Questions and ProblemsTing-An KuoNo ratings yet

- Liquidity Ratios - Practice QuestionsDocument14 pagesLiquidity Ratios - Practice QuestionsOsama SaleemNo ratings yet

- Kelompok 6 - UTS AKMDocument18 pagesKelompok 6 - UTS AKM21-010 Desi MailaniNo ratings yet

- Accounting Project - EMBA Cohort 43 Group33 - FinalSubmissionDocument4 pagesAccounting Project - EMBA Cohort 43 Group33 - FinalSubmissionodlivingstonNo ratings yet

- Annual Report Annual ReportDocument2 pagesAnnual Report Annual ReportsurvisureshNo ratings yet

- Exercise For Financial Statement Analysis and RatiosDocument15 pagesExercise For Financial Statement Analysis and RatiosViren JoshiNo ratings yet

- 3463afdcb438dc833d95f8d1814e4b36_8f5c0d43171d85063d48300fbb6274faDocument4 pages3463afdcb438dc833d95f8d1814e4b36_8f5c0d43171d85063d48300fbb6274faChelsea VisperasNo ratings yet

- Learning Activity 1 - Analysis of Financial StatementsDocument3 pagesLearning Activity 1 - Analysis of Financial StatementsAra Joyce PermalinoNo ratings yet

- Sadecki Corporation Balance Sheets Dec-31 Assets 2014 2013Document9 pagesSadecki Corporation Balance Sheets Dec-31 Assets 2014 2013mohitgaba19No ratings yet

- P23-7 (SCF-Direct and Indirect Methods From Comparative Financial Statements) ChapmanDocument4 pagesP23-7 (SCF-Direct and Indirect Methods From Comparative Financial Statements) Chapmanintan dwi cahaya100% (1)

- Practice Questions (CH 2)Document6 pagesPractice Questions (CH 2)enkeltvrelseNo ratings yet

- Comp XMDocument1 pageComp XMlogeshkounderNo ratings yet

- Chapter 2 - Financial AnalysisDocument66 pagesChapter 2 - Financial AnalysisRAHKAESH NAIR A L UTHAIYA NAIR100% (1)

- Chapter 2Document49 pagesChapter 2haiderasim1212No ratings yet

- ECU Topic 4Document8 pagesECU Topic 4Pinky RoseNo ratings yet

- Homework Assignment DoneDocument6 pagesHomework Assignment DoneLong Le KimNo ratings yet

- Business Financial AnalysisDocument14 pagesBusiness Financial Analysismc limNo ratings yet

- Est Time: 01-05 Financial Statements: Solutions To Chapter 3 Accounting and FinanceDocument16 pagesEst Time: 01-05 Financial Statements: Solutions To Chapter 3 Accounting and FinanceAEM EntertainmentNo ratings yet

- Finance ProblemsDocument50 pagesFinance ProblemsRandallroyce0% (1)

- CBSM100 Final Test F22Document10 pagesCBSM100 Final Test F22Kijab VenturesNo ratings yet

- Chapter 2 - Concept Questions and Exercises StudentDocument9 pagesChapter 2 - Concept Questions and Exercises StudentVõ Lê Khánh HuyềnNo ratings yet

- AHM13e Chapter - 01 - Solution To Problems and Key To CasesDocument19 pagesAHM13e Chapter - 01 - Solution To Problems and Key To CasesGaurav ManiyarNo ratings yet

- LATIHAN4 CFM Imam SartonoDocument10 pagesLATIHAN4 CFM Imam Sartonoims.mercubuanaNo ratings yet

- Financial Accounting Review (Week 1) : Income Statement and Balance Sheet Depreciation Gains and LossesDocument7 pagesFinancial Accounting Review (Week 1) : Income Statement and Balance Sheet Depreciation Gains and LossesAndy MoralesNo ratings yet

- 2011-02-09 035108 Finance 14Document4 pages2011-02-09 035108 Finance 14SamNo ratings yet

- Full Financial Accounting Course in One Video (10 Hours)Document24 pagesFull Financial Accounting Course in One Video (10 Hours)Zubair GhaznaviNo ratings yet

- Creating A Successful Financial Plan Chapter 11Document39 pagesCreating A Successful Financial Plan Chapter 11Taseen AhmeedNo ratings yet

- CH 13Document4 pagesCH 13Sri HimajaNo ratings yet

- Liquidity RatiosDocument3 pagesLiquidity RatiosMckenzie PalaganasNo ratings yet

- Common Size StatementsDocument2 pagesCommon Size StatementsvinnyedmundNo ratings yet

- Income Adam's Salary $ 45,000Document3 pagesIncome Adam's Salary $ 45,000SANDI ekstraNo ratings yet

- Name: Date: Instructor: Course: Accounting Principles Primer On Using Excel in AccountingDocument2 pagesName: Date: Instructor: Course: Accounting Principles Primer On Using Excel in AccountingHernando MaulanaNo ratings yet

- Deferred Income TaxesDocument3 pagesDeferred Income TaxesFEBRI IRAWANNo ratings yet

- Problems - FS TranslationDocument2 pagesProblems - FS TranslationMicah CarpioNo ratings yet

- Ratio Analysis Chapter 9Document5 pagesRatio Analysis Chapter 9natefir719No ratings yet

- Business Combi PrelimDocument4 pagesBusiness Combi PrelimmcespressoblendNo ratings yet

- Cash Flow Analysis: Mcgraw-Hill/Irwin © 2004 The Mcgraw-Hill Companies, Inc., All Rights ReservedDocument27 pagesCash Flow Analysis: Mcgraw-Hill/Irwin © 2004 The Mcgraw-Hill Companies, Inc., All Rights Reservedmabkhan_25No ratings yet

- Using The Following Financial Information Fill in The Table That FollowsDocument3 pagesUsing The Following Financial Information Fill in The Table That FollowsDevang ShetyeNo ratings yet

- UAS-AKL 1 - IntlDocument2 pagesUAS-AKL 1 - IntlSweda ArifahNo ratings yet

- CH 07 PPTsDocument30 pagesCH 07 PPTsAfifan Ahmad FaisalNo ratings yet

- 3.4 Final Accounts Balance Sheet (Statement of Financial Position)Document45 pages3.4 Final Accounts Balance Sheet (Statement of Financial Position)Magdalena NeuschitzerNo ratings yet

- SCF - OCF - FCF of JCB ChavezDocument2 pagesSCF - OCF - FCF of JCB ChavezRodel LemorinasNo ratings yet

- Assignment 2Document3 pagesAssignment 2leorezendNo ratings yet

- Topik 4 - Fin Planning & ForecastingDocument24 pagesTopik 4 - Fin Planning & ForecastingHaryadi WidodoNo ratings yet

- Balance Sheet ExerciseDocument5 pagesBalance Sheet ExercisekatnissNo ratings yet

- A. Calculate Watkins's Value of OperationsDocument20 pagesA. Calculate Watkins's Value of OperationsNarmeen Khan100% (1)

- MC Worksheet-3 (DICKY IRAWAN - C1I017051)Document5 pagesMC Worksheet-3 (DICKY IRAWAN - C1I017051)DICKY IRAWAN 1No ratings yet

- Accounting For Managerial Decisions: Assignment On Ratio AnalysisDocument7 pagesAccounting For Managerial Decisions: Assignment On Ratio Analysisarjunvashishta100% (1)

- Chapter 2 NotesDocument6 pagesChapter 2 NotesSurelis AcostaNo ratings yet

- 1 Courier C128574 R3 TCK0 ADocument2 pages1 Courier C128574 R3 TCK0 AAgz HrrfNo ratings yet

- Financial Accounting and Reporting Study Guide NotesFrom EverandFinancial Accounting and Reporting Study Guide NotesRating: 1 out of 5 stars1/5 (1)