Professional Documents

Culture Documents

SS Trade Doc1

SS Trade Doc1

Uploaded by

Saransh SrivastavaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SS Trade Doc1

SS Trade Doc1

Uploaded by

Saransh SrivastavaCopyright:

Available Formats

Breakout

A breakout is a price movement of a stock or commodity beyond an iden fied level of resistance or

support . Resistance and support are levels where the price tends to stop or reverse . A breakout can signal a

1234 15

possible trading opportunity . A breakout to the upside means the price moves above a resistance level and

125

may indicate a long posi on . A breakout to the downside means the price moves below a support level and

1345

may indicate a short posi on . Breakouts are usually followed by increased volume and vola lity . Breakouts can

15 12

be subjec ve since not all traders use the same resistance and support levels . 5

Inves ng in Indian stocks can be a rewarding but risky endeavor. It's essen al to conduct thorough research and

consider your financial goals, risk tolerance, and investment horizon before making any investment decisions.

While I can't provide specific stock recommenda ons, I can offer you some general guidance on how to find

poten ally good stocks to invest in:

1. **Understand Your Investment Goals and Risk Tolerance:**

- Determine your investment objec ves, whether they are long-term growth, income, or a combina on of

both.

- Assess your risk tolerance to understand how much risk you are willing and able to take. Stocks can be

vola le, so be prepared for poten al fluctua ons in your por olio.

2. **Research the Stock Market:**

- Familiarize yourself with the Indian stock market (e.g., NSE and BSE) and its various indices (e.g., Ni y 50,

Sensex).

- Stay informed about economic and poli cal developments in India that can impact the stock market.

3. **Company Analysis:**

- Research individual companies by analyzing their financial statements, such as income statements, balance

sheets, and cash flow statements.

- Look for companies with strong fundamentals, including revenue growth, profitability, and a healthy balance

sheet.

- Consider the company's compe ve posi on in its industry and its growth prospects.

4. **Industry and Sector Analysis:**

- Evaluate the industry and sector trends in India. Some sectors may perform be er than others in different

economic environments.

- Diversify your investments across various sectors to reduce risk.

5. **Dividend Yield and Earnings Growth:**

- Consider stocks that pay dividends if you are looking for income. Look for companies with a history of

consistent dividend payments and the poten al for future dividend growth.

- For growth stocks, focus on companies with strong earnings growth poten al.

6. **Valua on Metrics:**

- Assess whether a stock is overvalued or undervalued by comparing key valua on metrics like Price-to-Earnings

(P/E) ra o, Price-to-Book (P/B) ra o, and Price-to-Sales (P/S) ra o to industry averages.

7. **Management Quality:**

- Research the company's management team. Effec ve and ethical leadership is crucial for long-term success.

- Look for companies with a transparent corporate governance structure.

8. **Market Research and Analysis Tools:**

- U lize financial news sources, stock market analysis pla orms, and investment research reports to gather

informa on and insights.

- You can use stock screeners, such as those provided by brokerage firms, to filter stocks based on your criteria.

9. **Diversifica on and Risk Management:**

- Diversify your investments across different stocks, sectors, and asset classes to spread risk.

- Consider consul ng with a financial advisor to help create a well-balanced por olio.

10. **Stay Informed and Be Pa ent:**

- Stay up-to-date with your investments and the broader market.

- Be pa ent and prepared for fluctua ons in the stock market. Inves ng is a long-term endeavor.

It's crucial to conduct your research and poten ally consult with a financial advisor who can provide

personalized guidance based on your financial situa on and goals. Addi onally, past performance of stocks is not

indica ve of future results, so exercise cau on and make informed decisions when inves ng in the stock market.

You might also like

- Investment AvenuesDocument17 pagesInvestment Avenuessaurav43% (7)

- Investing Made Simple - Warren Buffet Strategies To Building Wealth And Creating Passive IncomeFrom EverandInvesting Made Simple - Warren Buffet Strategies To Building Wealth And Creating Passive IncomeNo ratings yet

- Chapter 26 - Fundamentals of Corporate Finance 9th Edition - Test BankDocument23 pagesChapter 26 - Fundamentals of Corporate Finance 9th Edition - Test BankKellyGibbons100% (3)

- Basics of Stock MarketDocument9 pagesBasics of Stock MarketAkshay HarekarNo ratings yet

- Basics of Stock MarketDocument13 pagesBasics of Stock MarketRamcharan KadamNo ratings yet

- Introduction To Stock Market Investing For BeginnersDocument4 pagesIntroduction To Stock Market Investing For Beginnersshishirbhattarai120No ratings yet

- Research of EquitiesDocument14 pagesResearch of EquitiesDipti MahawarNo ratings yet

- Basics of Stock Market PDFDocument14 pagesBasics of Stock Market PDFNitesh YadavNo ratings yet

- Investment Is Putting Money Into Something With The Hope of Profit. More SpecificallyDocument20 pagesInvestment Is Putting Money Into Something With The Hope of Profit. More Specificallyzulfi12345No ratings yet

- Stock Market: Swarit Singh 18 Class Xii-A4Document7 pagesStock Market: Swarit Singh 18 Class Xii-A4Luvox AineNo ratings yet

- PortfolioDocument57 pagesPortfolioMitali VadgamaNo ratings yet

- ABS 420 AssignmentDocument20 pagesABS 420 AssignmentBenter JumaNo ratings yet

- Capital Market and Portfolio ManagementDocument10 pagesCapital Market and Portfolio ManagementFlora ChauhanNo ratings yet

- Lesson # 22 Common Stock: Analysis and Strategy The Passive StrategyDocument3 pagesLesson # 22 Common Stock: Analysis and Strategy The Passive StrategyRajesh KumarNo ratings yet

- How To Master Picking Stocks For Swing TradingDocument3 pagesHow To Master Picking Stocks For Swing TradingVenkataNo ratings yet

- Asset AllocationDocument8 pagesAsset AllocationAnonymous Hw6a6BYS3DNo ratings yet

- Black BookDocument83 pagesBlack Bookmahekpurohit1800No ratings yet

- TOPIC 7 & 8 - Portfolio MGTDocument15 pagesTOPIC 7 & 8 - Portfolio MGTDaniel DakaNo ratings yet

- INVESTMENTDocument3 pagesINVESTMENTCaroline B CodinoNo ratings yet

- StockDocument2 pagesStockMuskan NepalNo ratings yet

- Portfolio ConstructionDocument5 pagesPortfolio Constructionajayuseless100% (1)

- A Brief of How Mutual Funds WorkDocument12 pagesA Brief of How Mutual Funds WorkAitham Anil KumarNo ratings yet

- Sapm - Fifth (5) Sem BBIDocument156 pagesSapm - Fifth (5) Sem BBIRasesh ShahNo ratings yet

- Creating and Monitoring A Diversified Stock PortfolioDocument11 pagesCreating and Monitoring A Diversified Stock Portfolioసతీష్ మండవNo ratings yet

- Answers To Questions For SIP Final EvaluationDocument3 pagesAnswers To Questions For SIP Final EvaluationPRACHI DASNo ratings yet

- Finance Interview PreprationsDocument42 pagesFinance Interview PreprationsPiyush ChughNo ratings yet

- IPT Stocks 2012Document16 pagesIPT Stocks 2012reachernieNo ratings yet

- Unleashing The Power of InvestmentDocument2 pagesUnleashing The Power of InvestmentMoataz abd el fattahNo ratings yet

- Industry Profile Journey of Indian Stock MarketDocument16 pagesIndustry Profile Journey of Indian Stock MarketapurvwebworldNo ratings yet

- CapitalDocument4 pagesCapitalshikha singhNo ratings yet

- Sugumar PortfolioDocument8 pagesSugumar PortfoliosugumarNo ratings yet

- FinalDocument3 pagesFinalNeha RadiaNo ratings yet

- Ruminations On Investment PhilosophyDocument2 pagesRuminations On Investment PhilosophydhultstromNo ratings yet

- Concept and Practices of Investment PortfolioDocument6 pagesConcept and Practices of Investment PortfolioBinodNo ratings yet

- Unit 5 Iapm CapmDocument11 pagesUnit 5 Iapm Capmshubham JaiswalNo ratings yet

- Portfolio ManagementDocument9 pagesPortfolio ManagementAvinaw KumarNo ratings yet

- Portfolio RiskDocument9 pagesPortfolio RiskKeerthiNo ratings yet

- Portfolio and Investment Analysis - Students-1 2Document74 pagesPortfolio and Investment Analysis - Students-1 2Abdullahi AbdikadirNo ratings yet

- PWM Equity Investment PresentationDocument38 pagesPWM Equity Investment Presentationadisax3005No ratings yet

- Sapm - Mid TermsDocument3 pagesSapm - Mid Termssatyam skNo ratings yet

- Spam Unit 1-5Document84 pagesSpam Unit 1-5kaipulla1234567No ratings yet

- Becoming Warren BuffettDocument11 pagesBecoming Warren BuffettPhong ThầnNo ratings yet

- Mutual FundDocument23 pagesMutual FundPriyaNo ratings yet

- Steps of Portfolio Management Process /steps of Portfolio ManagementDocument8 pagesSteps of Portfolio Management Process /steps of Portfolio ManagementRuchi KapoorNo ratings yet

- Evaluating Portfolio and Making Investment DecisionsDocument19 pagesEvaluating Portfolio and Making Investment DecisionsIshan FactsNo ratings yet

- SM IndicesDocument25 pagesSM IndicesChun Qi TeohNo ratings yet

- Portfolio ConstructionDocument13 pagesPortfolio ConstructionRonak GosaliaNo ratings yet

- MF0010 - Sem 3 - Fall 2011Document7 pagesMF0010 - Sem 3 - Fall 2011Sonal PomalNo ratings yet

- Investing 101Document2 pagesInvesting 101Fikri SooudinNo ratings yet

- Part 2 - Investment ManagementDocument30 pagesPart 2 - Investment ManagementChethan BkNo ratings yet

- Investment ManagementDocument82 pagesInvestment ManagementSabita LalNo ratings yet

- Yasir Bhai ProjectDocument71 pagesYasir Bhai ProjectFaizan Sir's TutorialsNo ratings yet

- 4 Steps To Building A Profitable PortfolioDocument4 pages4 Steps To Building A Profitable PortfolioZaki KhateebNo ratings yet

- SekuritasDocument9 pagesSekuritasCindy permatasariNo ratings yet

- ChapterDocument90 pagesChapterRavi SharmaNo ratings yet

- The Equity PortfolioDocument6 pagesThe Equity PortfolioPete Thomas EbueNo ratings yet

- Presentation1 (Yasir Bhai)Document23 pagesPresentation1 (Yasir Bhai)Faizan Sir's TutorialsNo ratings yet

- Securities Analysis and Portfolio Management PDFDocument64 pagesSecurities Analysis and Portfolio Management PDFShreya s shetty100% (1)

- Mutual FundDocument23 pagesMutual FundDhruti BhatiaNo ratings yet

- INVESTING IN STOCKS: Building Wealth and Financial Freedom through Stock Market Investments (2023 Guide for Beginners)From EverandINVESTING IN STOCKS: Building Wealth and Financial Freedom through Stock Market Investments (2023 Guide for Beginners)No ratings yet

- Resume Albert H Manwaring VDocument1 pageResume Albert H Manwaring VKaarthik MandhulaNo ratings yet

- House Property - IllustrationDocument10 pagesHouse Property - IllustrationAnirban ThakurNo ratings yet

- Account Statement From 1 Jul 2019 To 31 Dec 2019: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument2 pagesAccount Statement From 1 Jul 2019 To 31 Dec 2019: TXN Date Value Date Description Ref No./Cheque No. Debit Credit Balancepratibha guptaNo ratings yet

- Irr and Incremental IrrDocument10 pagesIrr and Incremental IrrrashiNo ratings yet

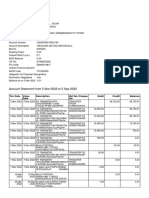

- Account Statement From 5 Mar 2022 To 5 Sep 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument5 pagesAccount Statement From 5 Mar 2022 To 5 Sep 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceMonirul IslamNo ratings yet

- Services of Askari BankDocument3 pagesServices of Askari BankAdeel KhanNo ratings yet

- Key Facts Statement PayDay LoanDocument2 pagesKey Facts Statement PayDay LoanSimon AdesolaNo ratings yet

- What Kills StartupsDocument12 pagesWhat Kills StartupsTimothy ChanNo ratings yet

- JPMorgan SmurfitKappaH1resultswrap-accelerationfromhereasboxpricescomethrough Jul 28 2021Document15 pagesJPMorgan SmurfitKappaH1resultswrap-accelerationfromhereasboxpricescomethrough Jul 28 2021Camila CalderonNo ratings yet

- Structured Trade Finance 8-1Document15 pagesStructured Trade Finance 8-1subash1111@gmail.comNo ratings yet

- Beginner Forex BookDocument39 pagesBeginner Forex BookRazvan RoscaNo ratings yet

- Us Postal CardsDocument6 pagesUs Postal Cardsapi-242424864No ratings yet

- Banking - Term Project: Running Head: Silk Bank - Final ReportDocument45 pagesBanking - Term Project: Running Head: Silk Bank - Final ReportAman Ahmad UrfiNo ratings yet

- Fees 2016 Francisco HomesDocument9 pagesFees 2016 Francisco HomesGolden SunriseNo ratings yet

- Chapter - 4: Risk and Return: An Overview of Capital Market TheoryDocument11 pagesChapter - 4: Risk and Return: An Overview of Capital Market TheoryAkash saxenaNo ratings yet

- Week 7 AUDIT PreTestDocument19 pagesWeek 7 AUDIT PreTestCale HenituseNo ratings yet

- O.M Scott and Sons Case SummaryDocument2 pagesO.M Scott and Sons Case SummarySUSHMITA SHUBHAMNo ratings yet

- Basel Norms For BankingDocument5 pagesBasel Norms For BankingAkshat PrakashNo ratings yet

- Assignment 4Document2 pagesAssignment 4businessdoctor23No ratings yet

- CUB - Account DetailsDocument1 pageCUB - Account DetailsAsim DasNo ratings yet

- Quiz Questionsbusfin Working Capital ManagementDocument6 pagesQuiz Questionsbusfin Working Capital ManagementAlma LopezNo ratings yet

- KMugri LUcaq 4 WStiDocument17 pagesKMugri LUcaq 4 WStiNikhil BisuiNo ratings yet

- Vanguard Long-Term Government Bond ETF 10+Document2 pagesVanguard Long-Term Government Bond ETF 10+Roberto PerezNo ratings yet

- Nism-Xii RGDocument5 pagesNism-Xii RGRishabh R. GuptaNo ratings yet

- SASS Prelims 2017 4E5N ADocument9 pagesSASS Prelims 2017 4E5N ADamien SeowNo ratings yet

- Chap 23Document12 pagesChap 23Sakshi GuptaNo ratings yet

- 2022 Annual Report Final - Dizon MinesDocument112 pages2022 Annual Report Final - Dizon MinesJun BelenNo ratings yet

- Trister Company FileDocument11 pagesTrister Company FilehljuristsinternationalNo ratings yet

- Cash Flows From Operating ActivitiesDocument5 pagesCash Flows From Operating Activitiesmarvi salmingoNo ratings yet