Professional Documents

Culture Documents

SSRN Id3540140

SSRN Id3540140

Uploaded by

JakeCopyright:

Available Formats

You might also like

- Fintech ReportDocument24 pagesFintech ReportAnvesha Tyagi100% (1)

- Aztech MWR647 Easy Start GuideDocument20 pagesAztech MWR647 Easy Start GuideVincent 2020No ratings yet

- (QTTC) Future Trends and OpportunitiesDocument7 pages(QTTC) Future Trends and OpportunitiesHoa Ngọc HânNo ratings yet

- Draft - Artificial Intelligence in FinanceDocument9 pagesDraft - Artificial Intelligence in FinanceSandhya SharmaNo ratings yet

- Da 1 (1) MM21GF068Document9 pagesDa 1 (1) MM21GF068Kruthik BethapudiNo ratings yet

- Rishab GolaDocument7 pagesRishab GolaManan AswalNo ratings yet

- АІDocument7 pagesАІsavenkosofia685No ratings yet

- Artificial Intelligence: Its Impact On The Financial Services SectorDocument5 pagesArtificial Intelligence: Its Impact On The Financial Services SectorDilesh VeeramahNo ratings yet

- "Impact of Artificial Intelligence On Financial MarketDocument7 pages"Impact of Artificial Intelligence On Financial MarketDivya GoyalNo ratings yet

- Artificial Intelligence Project ReportDocument11 pagesArtificial Intelligence Project ReportShambhavi SharmaNo ratings yet

- AI in Banking (DARSHIT)Document4 pagesAI in Banking (DARSHIT)Darshit SharmaNo ratings yet

- Coombs Accepted VersionDocument7 pagesCoombs Accepted Versionrecojo3664No ratings yet

- A Comprehensive Study On Integration of Big Data and AI in Financial Industry and Its Effect On Present and Future OpportunitiesDocument11 pagesA Comprehensive Study On Integration of Big Data and AI in Financial Industry and Its Effect On Present and Future Opportunitiesandrew chiewNo ratings yet

- Political Economy of Science Essay 1Document11 pagesPolitical Economy of Science Essay 1vatsala tewaryNo ratings yet

- Artificial Intelligence in The Banking Sector With Special Reference To Pros and Cons, Need, Significance and RecommendationsDocument4 pagesArtificial Intelligence in The Banking Sector With Special Reference To Pros and Cons, Need, Significance and RecommendationsVikram Singh MeenaNo ratings yet

- Essay ManagementDocument3 pagesEssay ManagementMiftah FaridNo ratings yet

- Artificial Intelligence and Its Impacts On The Financial Services Sector.Document5 pagesArtificial Intelligence and Its Impacts On The Financial Services Sector.Dilesh VeeramahNo ratings yet

- AI Impacting Financial Services IndustryDocument3 pagesAI Impacting Financial Services IndustrysmritiNo ratings yet

- Exploring Current Opportunity and Threats of Artificial Intelligence On Small and Medium Enterprises Accounting Function Evidence From South West Part 1528 2635 25-2-693Document11 pagesExploring Current Opportunity and Threats of Artificial Intelligence On Small and Medium Enterprises Accounting Function Evidence From South West Part 1528 2635 25-2-693Kefi BelayNo ratings yet

- Arificial IntelligenceDocument6 pagesArificial Intelligenceamberamir152001No ratings yet

- Intelligence (AI) & SemanticsDocument55 pagesIntelligence (AI) & SemanticsRaja kamal ChNo ratings yet

- Idea For Eco ProjectDocument15 pagesIdea For Eco Projectcyan.07rNo ratings yet

- Artificial Intelligence in Finance - SigmoidalDocument7 pagesArtificial Intelligence in Finance - SigmoidalRanjeet MudholkarNo ratings yet

- Artificial Intelligence in Business and Finance : ReaditasitisDocument5 pagesArtificial Intelligence in Business and Finance : ReaditasitisNishant ShahNo ratings yet

- Bhavya Wani: Ai in FinanceDocument5 pagesBhavya Wani: Ai in FinanceScrappy CocoNo ratings yet

- Report 5Document6 pagesReport 5lakshaytomer12thaNo ratings yet

- Ai Finance 1Document10 pagesAi Finance 1Purnachandrarao SudaNo ratings yet

- Powering The Digital Economy PDFDocument16 pagesPowering The Digital Economy PDFYoussef EchNo ratings yet

- First DraftDocument9 pagesFirst Draftapi-744284834No ratings yet

- AIBA MODULE 1 Artificial Intelligence in BusinessDocument5 pagesAIBA MODULE 1 Artificial Intelligence in BusinessHik HjkkNo ratings yet

- AI in Banking - How Artificial Intelligence Is Used in BanksDocument12 pagesAI in Banking - How Artificial Intelligence Is Used in Bankschihebbaccar00No ratings yet

- Itfm RBLDocument13 pagesItfm RBLZany AlamNo ratings yet

- ปาฐกถา2 - ผศ พิเศษนพ พลวรรธน์AI-In-financialDocument19 pagesปาฐกถา2 - ผศ พิเศษนพ พลวรรธน์AI-In-financialUthen KaewwichianNo ratings yet

- Fintech Applications in BankingDocument12 pagesFintech Applications in BankingRadhika GoelNo ratings yet

- The Impact of Artificial Intelligence On Financial ServicesDocument2 pagesThe Impact of Artificial Intelligence On Financial Servicessuneel66229No ratings yet

- T10-R75-P2-artificial-intelligence-v5.1 - Study NotesDocument16 pagesT10-R75-P2-artificial-intelligence-v5.1 - Study Notespratik satputeNo ratings yet

- Artificial Intelligence in Financial Services - Need To Blend Automation With Human TouchDocument6 pagesArtificial Intelligence in Financial Services - Need To Blend Automation With Human TouchAnupamMehrotraNo ratings yet

- The Future: Artificial Intelligence's Profound Impact On Accounting and Society - Anticipating Job Market Dynamics and Evolving Skill Requirements For AccountantsDocument27 pagesThe Future: Artificial Intelligence's Profound Impact On Accounting and Society - Anticipating Job Market Dynamics and Evolving Skill Requirements For Accountantsindex PubNo ratings yet

- Strategies For Mitigating The Risks of Financial Fraud - 4464 Words - Proposal ExampleDocument7 pagesStrategies For Mitigating The Risks of Financial Fraud - 4464 Words - Proposal Examplemtahir777945No ratings yet

- ebook-the-ai-handbook-for-financial-services-leaders_ENDocument18 pagesebook-the-ai-handbook-for-financial-services-leaders_ENharshavmrgNo ratings yet

- AI OmanDocument9 pagesAI OmandijayNo ratings yet

- AI and Analytics in BFSI IndustryDocument17 pagesAI and Analytics in BFSI IndustryHarsh DedhiaNo ratings yet

- Artificial Intelligence and The Challenge of Creating Value: An Accounting Perspective Final Paper 2023Document7 pagesArtificial Intelligence and The Challenge of Creating Value: An Accounting Perspective Final Paper 2023Tamer A. ElNasharNo ratings yet

- Artificial Intelligence in Finance: April 2018Document3 pagesArtificial Intelligence in Finance: April 2018Johanna Veronica Alva ChaucaNo ratings yet

- Ai in BankingDocument6 pagesAi in BankingSHRADDHEY SHUKLA100% (1)

- AI _ ML_Article 3_20191125_V2Document5 pagesAI _ ML_Article 3_20191125_V2Ashish CharanNo ratings yet

- Onai Cop Gov PresentationDocument6 pagesOnai Cop Gov PresentationAshie ChifNo ratings yet

- Impact of Ai On Bank PerformanceDocument4 pagesImpact of Ai On Bank PerformanceHarman iNo ratings yet

- AI Gains Momentum in Core Financial Services Functions 1691763089Document9 pagesAI Gains Momentum in Core Financial Services Functions 1691763089Vinod GhorpadeNo ratings yet

- Synergy Between Fintech, Regtech, and Artificial Intelligence in Transforming The Financial EcosystemDocument8 pagesSynergy Between Fintech, Regtech, and Artificial Intelligence in Transforming The Financial EcosystemWijdan Saleem EdwanNo ratings yet

- Your Paragraph TextDocument15 pagesYour Paragraph Textbeekarma10No ratings yet

- Navigating AI Towards Better Future in CommerceDocument6 pagesNavigating AI Towards Better Future in Commerceaadal arasuNo ratings yet

- Ten Applications of AI To Fintech - by Corbin Hudson - Towards Data ScienceDocument9 pagesTen Applications of AI To Fintech - by Corbin Hudson - Towards Data Sciencemansura.habibaNo ratings yet

- Ai 1706769719Document44 pagesAi 1706769719waqar.asgharNo ratings yet

- Managing Machines The Governance of Artificial Intelligence Speech by James ProudmanDocument8 pagesManaging Machines The Governance of Artificial Intelligence Speech by James ProudmanHao WangNo ratings yet

- Impact of Technology in Banking Industry FINAL PAPERDocument8 pagesImpact of Technology in Banking Industry FINAL PAPERSam MumoNo ratings yet

- Literature ReviewDocument9 pagesLiterature Reviewevon khalilNo ratings yet

- Group 4 BVCR ReportDocument36 pagesGroup 4 BVCR ReportUtkarsh BansalNo ratings yet

- ESOC Rathiin BhartiDocument2 pagesESOC Rathiin Bhartiaditya g das niceballsNo ratings yet

- AI White Paper 102019Document14 pagesAI White Paper 102019Lim Siew LingNo ratings yet

- Ариозо Лизы Уж полночь близится из оперы Пиковая дамаDocument6 pagesАриозо Лизы Уж полночь близится из оперы Пиковая дамаJakeNo ratings yet

- ФОС Современные концепции финансового менеджментаDocument22 pagesФОС Современные концепции финансового менеджментаJakeNo ratings yet

- 185-192 Rrijm20230803022Document8 pages185-192 Rrijm20230803022JakeNo ratings yet

- T Bakixanov ElegiyaDocument7 pagesT Bakixanov ElegiyaJakeNo ratings yet

- General TO Matlab: 2005 Hakan Uraz - BM111 1Document20 pagesGeneral TO Matlab: 2005 Hakan Uraz - BM111 1Mehmet Fatih ÇakırNo ratings yet

- Difference Between Petrol and Diesel EngineDocument6 pagesDifference Between Petrol and Diesel EngineWaiming Tan100% (2)

- Akamai HTTP Content Delivery Customer Activation GuideDocument19 pagesAkamai HTTP Content Delivery Customer Activation GuideRodolfo RomeroNo ratings yet

- Sidewinder Missiles ReportDocument9 pagesSidewinder Missiles ReportAbhishek Singh0% (1)

- R8285A-G, J, K Control CentersDocument8 pagesR8285A-G, J, K Control Centersdougbert13731No ratings yet

- Mihaela Badescu Resume 2015Document2 pagesMihaela Badescu Resume 2015api-283341534No ratings yet

- Abner Doble PapersDocument13 pagesAbner Doble PapersAlvaro HiginoNo ratings yet

- Examples of Eportfolio PlatformsDocument3 pagesExamples of Eportfolio Platformsapi-387036492No ratings yet

- UR3 User Manual en E67ON GlobalDocument209 pagesUR3 User Manual en E67ON GlobalSergio Romano PadillaNo ratings yet

- Geh 6130Document132 pagesGeh 6130Sergio FurutaNo ratings yet

- Hyperledger Fabric Application Development: Unit 06Document28 pagesHyperledger Fabric Application Development: Unit 06bahrini ahmedNo ratings yet

- Compal La-A341p R1a 20130902a SchematicsDocument43 pagesCompal La-A341p R1a 20130902a Schematicspdg com100% (1)

- POS ProductsDocument5 pagesPOS ProductsEricNo ratings yet

- Honda FIT Brochure FA-LR-DigitalDocument9 pagesHonda FIT Brochure FA-LR-DigitalZNo ratings yet

- Hmi FatekDocument9 pagesHmi FatekDavid Mtz ZuritaNo ratings yet

- TSG Igbt Emd PDFDocument56 pagesTSG Igbt Emd PDFSudarshan DhumalNo ratings yet

- HEWM Standalone Watermark Inserter Deployment GuideDocument54 pagesHEWM Standalone Watermark Inserter Deployment GuidePartha Sarathi RoyNo ratings yet

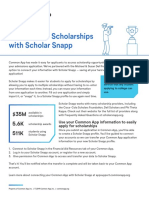

- Applying For Scholarships With Scholar SnappDocument1 pageApplying For Scholarships With Scholar Snappapi-504431434No ratings yet

- User ManualDocument240 pagesUser Manualangel4597No ratings yet

- Cables For Automation IndustryDocument40 pagesCables For Automation IndustryKalNo ratings yet

- Data Binding in .NET - C# Windows Forms - NDocument8 pagesData Binding in .NET - C# Windows Forms - NAdriana ChisNo ratings yet

- PLDT HOME FIBER and PLDT HOME DSL New Default WiFi Password HackDocument10 pagesPLDT HOME FIBER and PLDT HOME DSL New Default WiFi Password HackRene GilhangNo ratings yet

- A FSD Marine en - 17 108861Document2 pagesA FSD Marine en - 17 108861Mazhar SafdarNo ratings yet

- DSM Tuning Sheet v2.1 ModDocument15 pagesDSM Tuning Sheet v2.1 ModLuis Daniel Rodriguez VeraNo ratings yet

- Mc9s12hz128val Datasheetz PDFDocument28 pagesMc9s12hz128val Datasheetz PDFCarlos Geeket' El HalabiNo ratings yet

- OPM - Make To OrderDocument14 pagesOPM - Make To Orderkjganesh100% (1)

- Fact Sheet - IMPACT D Series - ENDocument12 pagesFact Sheet - IMPACT D Series - ENRodel AysonNo ratings yet

- Saep 1638Document10 pagesSaep 1638Branko_62No ratings yet

- The National Shipbuilding Research ProgramDocument54 pagesThe National Shipbuilding Research Programfirdaus_stNo ratings yet

SSRN Id3540140

SSRN Id3540140

Uploaded by

JakeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SSRN Id3540140

SSRN Id3540140

Uploaded by

JakeCopyright:

Available Formats

Applications of Artificial Intelligence in Financial Management Decisions:

A Mini-Review

Laila Al-Blooshi

Abu Dhabi University, Email: 1059690@students.adu.ac.ae

Haitham Nobanee

Abu Dhabi University, Email: haitham.nobanee@adu.ac.ae

Abstract

Artificial Intelligence (AI) has, during the past few years, made many signs of progress which

have enabled the creation of professional financing applications, which would, perhaps,

disrupt the finance industry. Thus, it is assumed that the AI could not only replace human

capital in full or in part but also enhance its performance beyond human benchmarks. For

companies around the world, there are a variety of programs.

A systemic content analysis methodology was used to evaluate related literature publications

in this study. A selection of papers, including posts, has been collected. This research focuses

on broad publications peer-reviewed, including Scopus and SSRN, which are listed in quality

and impact rankings. This selection of the highest-ranking papers not only guaranteed the

quality of papers that were most reviewed and validated but also provided the most up-to-date

research state during their publication periods. Some keywords are used to scan for artificial

intelligence papers, such as artificial intelligence and financial articles such as corporate

finance, artificial intelligence, digital finance, financial and artificial intelligence, etc.

AI has been found to be used by organizations around the world for the detection of

anomalies. It is used to establish optimal investment strategies. The other use of AI in

securities is algorithmic trading, programs that integrate information regarding changing

market dynamics and price levels by using proprietary algorithms to making automated

trading very rapidly.

However, given the financial consequences, companies should ensure a sufficient

understanding of the AI and other technology used in business by the senior management and

the board to ensure proper monitoring. This is particularly important in view of the growing

expectations of Board members to monitor substantive issues affecting the long-term value of

a company. The decision-making, deployment, and use of AI must be carried out within the

context of risk management, in order to capture market improvements. It will include four

main tasks, including risk recognition, risk assessment, prevention and risk control.

Electronic copy available at: https://ssrn.com/abstract=3540140

2

Introduction

In the field of finance, Artificial Intelligence is renovating the procedures for dealing with

finance. Artificial Intellect is assisting the fiscal diligence to modernize and enhance

progressions extending from credit decisions to a quantifiable transaction and commercial

risk administration. Traditional banking has been transformed within the financial services

over time due to great innovations and like the rest the way business functions, besides the

nature of professions (Bagheri, 2014). The financial services diligence has an antiquity of

expending computable approaches and a set of rules to support assessment making. These are

the basis of AI coordination, and the trade is consequently well-informed for AI

implementation, placing it at the lead of employing and promoting since AI knowledge (

Chan, Nayler, Raman, & Baker, 2019). AI can figure on hominoid intellect by identifying

outlines and variances in bulky aggregates of figures, which is significant in solicitations such

as anomaly recognition (instance; false dealings). AI may perhaps as well gauge and program

monotonous odd jobs in a further anticipated technique – together with multifaceted

computations, for illustration risk identifications associated with commercial transactions

(Bahrammirzaee, 2010).

Artificial Intelligence has captured the modern diffusion trends of perceived markets. The

idea of artificial intelligence is presently being practically used in diverse sectors. The

industry of financial organizations is dealing with artificial intelligence in real advanced

ways. The great invention of artificial intelligence is leading the industry of finance with a

fabulous tempest. In most of the daily aspects of the financial industry, AI is being applied to

acquire the advantages of time consumptions, cutting off cost and furthermore bringing in

added in values with faster assistance ( Eletter, Yaseen, & Elrefae, 2010). It is also reported

that the famous leading foremost International based corporate financial sectors are relying

on Artificial intelligence that has implemented within the opportunity of considered

technological progressions by the outcome the Artificial Intelligence with superior functional

assistance to the customers, enlightening performance and generating greater proceeds of

income sources (To & Lee, 2010).

Today the capitalists with their latest methods of dealing with business are apprehended with

enormous benefits of advanced digitalization on the International perspectives particularly in

the present era. The technology of Google, Twitter, Facebook, Microsoft and Apple has

shaped the daily official interactions and communications with one another in a monotonous

time period (Kraus & Palmer, 2018). Calculating, storage and investigating info is not merely

being at ease, but then again likewise further flexible and cost-effective such as I-cloud

Electronic copy available at: https://ssrn.com/abstract=3540140

3

assistances are ongoing to advance and the network of the internet is renovating in the

direction of the so entitled “Internet of Assets”. Through network sequence, the shift to the

“Internet of Ideals” has been started to activate. Starting from the Year 2020 the artificial

intelligence is anticipated to be applied in 90% of electronic engineering for new

merchandise enterprises and global dimensions of $1.2 billion of legitimate cryptocurrencies

will be transacted in the finance diligence. (Richter, 2017)

As the Artificial Intelligence wonder causes various inferences through speedy and

transformative change, it is significant for financiers and private enterprise investigators to be

alert of correlated consequences and influences and pinpoint emergent prospects on business.

The main features of dealing with commercial services of financial trade, applications of

Artificial Intelligence comprise algorithmic tradeoff, a configuration of trading portfolio and

leveraging, model authentication, recheck testing, robotic-instructing, simulated purchaser

subordinates, marketplace bearing exploration, supervisory agreement and pressure trial

assessment testing (Fethi & Pasiouras, 2009). The mode of Artificial Intelligence is bringing

about tremendous transformations in sectors of finance which are mainly detection of fraud

and regulations, chatbots and robot-instructor services and computations of insider trading

with algorithms.

Artificial Intellect (AI) is striking to be a break-even point for the finance industry. Through

frequent AI utilization in the long run, huge improvements might be comprehended over the

approaching period. The business is probable to with the exception of an additional $1 trillion

by the 2030 year-end with outdated monetary institutions cutting 23% from their budgets

(Kraus & Palmer, 2018).

Chatbots and simulated subordinates

Gravity is escalating on banks to accept a cardinal outlook. Banks requisite to familiarize to

developing prospects of customers, lessen expenses, avoid damages of trade to quicker

initiate-up challengers, and discover innovative means to propagate incomes. Banks' needs

are demanding to magnify aspects of obstacles in the practice of increasing buyer budgets

triggered by swift progress and wide creation outlines (Demyanyk, 2010). Banks often face

issues to handle with an expanding capacity of queries related to customer call-centers and

client correspondent electronic mail, and it is known that the Bank conventional customer-

service model has inadequate financial prudence of balance and adjusts unwell.

Consequently, banks are implementing chatbots or “hi-tech personality”. These could benefit

Electronic copy available at: https://ssrn.com/abstract=3540140

4

and provide on the stipulation, automatic assistance, such as allocating with repeatedly

enquired interrogations; accomplish financial services; and assist with fiscal applications

(Kraus & Palmer, 2018).

Scam recognition (Detecting fraud): With the emergence of E-commerce deception or

fraud online has greater than before and it is not so much possible to avoid. Recently the

United States has reported the detection of fraud 15 times of the concrete deception rate.

Artificial Intelligence comes in within reach nowadays. Through the support of investigating

statistical facts, the procedure of appliance practices can currently identify the false contract

deprived of some information to the humanoid specialists with the advancement of the

accurateness of actual period authorizations and reducing wrong failures ( Eletter, Yaseen, &

Elrefae, 2010). Multinational companies are currently exploring with Artificial Intelligence to

identify and crosscheck with unreliable prevention in financial sectors. One of the best use of

artificial intelligence applications we can observe is with the MasterCard. If the fraudsters are

trying to use some else’s MasterCard by stealing information and data the artificial Decision

Intelligence technology will analyze the actual data and send immediate notifications in the

genuine holders' email or smartphones and all related communicating mediums associated

with personalized wallets (Buchanan, 2019).

Protecting security: Many of the administrations are attempting to gadget the Artificial

Intellect in order to raise the safekeeping for operational dealings and associated services. It

is possible if there is processer access which can forecast the unlawful databases precisely

(Dirican, 2015).

Expenditure Configuration Forecast: Artificial Intelligence is beneficial for shopper

expenditure recognition used by numerous companies and financial service sectors. It will be

obliging when the cars are stolen or the account is hacked in order to avoid the deception or

shoplifting (Giudici, 2018).

Stock Dealer scheme: A computer system has been trained to predict when to buy or sell

shares in order to buy or sell shares in order to maximize the profits when to minimize the

losses during the uncertainties and meltdown. Client-side user validation: This can again

authenticate or recognize the user and permit the deal to come to pass (Fethi & Pasiouras,

2009).

Electronic copy available at: https://ssrn.com/abstract=3540140

5

Methodology

A systemic content analysis approach was used to analyze relevant literature publications.

The published literature contains papers which have been collected for this study. This

research focuses on the broad journal's database such as Scopus and SSRN, which have been

reviewed in terms of content and impact scores. The collection of the highest-ranking articles

not only guaranteed the consistency of the publications that were most checked and

confirmed but also made the current research condition the nearest to them during their

respective publishing times. There have been several keywords used to search papers on

artificial intelligence and finance, such as artificial intelligence, corporate finance, digital

finance technology, etc. (Smith, 2015).

Table 1: Journal and Publisher Distribution

Article Name Author(s) Journal Publisher Year Impact

Factor

1 A comparative Arash Neural Comput & Neural Comput & 2010 92

survey of artificial Bahrammirza Application Application

intelligence ee

applications in

finance: artificial

neural networks,

expert system and

hybrid intelligent

systems

2 Financial Time Bjoern European European 2010 100

Series Forecasting Krollner, symposium on symposium on

with Machine Bruce artificial neural artificial neural

Learning Vanstone, networks: networks:

Techniques: A Gavin Finnie Computational and Computational and

Survey machine learning machine learning

3 Fintech Risk Paolo Giudici Speciality Grand Speciality Grand 2018 83

Management: A Challenge Article Challenge Article

Research

Challenge for

Artificial

Intelligence in

Finance

4 Assessing Bank Meryem University of Bath University of Bath 2009 93

Performance with Duygun School of School of

Operational Fethi, Fotios Management Management

Research and Pasiouras

Artificial

Intelligence

Techniques: A

Survey

5 Zero Intelligence in Dan Ladley Leeds University Leeds University 2009 94

Economics and Business School Business School

Finance

6 Using a fuzzy G.T.S. Ho, Expert Systems with Expert Systems with 2012 95

association rule W.H. Ip, C.H. Applications Applications

mining approach to Wu, Y.K. Tse

identify the

Electronic copy available at: https://ssrn.com/abstract=3540140

6

financial data

association

7 Some Financial Larry D. Wall Federal Reserve Federal Reserve 2017 87

Regulatory Bank of Atlanta Bank of Atlanta

Implications of

Artificial

Intelligence

8 Natural Language Frank Z. Artificial Artificial 2018 94

Based Financial Xing · Erik Intelligence Review Intelligence Review

Forecasting: A Cambria ·

Survey. Roy E.

Welsch

9 Artificial Tom C.W. Fordham Law Fordham Law 2019 88

Intelligence, Lin Review Review

Finance, and the

Law

10 Artificial Bonnie G. The Alan Turing The Alan Turing 2019 91

Intelligence in Buchanan Institute Institute

Finance

11 Artificial Chi Chan, Asset Management, Asset Management, 2019 90

intelligence David Nayler, Banking and Banking and

applications in Jayant Insurance Insurance

financial services Raman,

Matthew

Baker

12 Neuro-Based Shorouq American Journal of American Journal of 2010 75

Artificial Fathi Eletter, Economics and Economics and

Intelligence Model Saad Ghaleb Business Business

for Loan Decisions Yaseen and Administration Administration

Ghaleb Awad

Elrefae

13 The Impacts of Cüneyt Social and Social and 2015 91

Robotics, Artificial Dirican Behavioral Sciences Behavioral Sciences

Intelligence On

Business and

Economics

14 Comparison of Ming-Chang International Journal International Journal 2010 80

Support Vector Lee and of Artificial of Artificial

Machine and Back Chang To Intelligence & Intelligence &

Propagation Neural Applications Applications

Network in

Evaluating the

Enterprise

Financial Distress

15 A Generic Philippe Universite des Universite des 2010 94

Architecture for Mathieu and Sciences et Sciences et

Realistic Olivier Technologies Technologies

Simulations of Brandouy

Complex Financial

Dynamics

16 Detection of Pediredla Decision Support Decision Support 2009 90

financial statement Ravisankar, Systems Systems

fraud and feature Vadlamani

selection using data Ravi,

mining techniques Gundumalla

Raghava Rao,

Indranil Bose

17 Deep learning for Manuel R. Universidade Universidade 2017 91

stock market Vargas, Federal do Rio de Federal do Rio de

prediction from Beatriz S. L. Janeiro Janeiro

Electronic copy available at: https://ssrn.com/abstract=3540140

7

financial news P. de Lima

articles and

Alexandre G.

Evsukoff

18 Artificial Alexandra Hanken School of Hanken School of 2017 91

Intelligence in Zavadskaya Economics Economics

Finance:

Forecasting Stock

Market Returns

using Artificial

Neural Networks

19 Evaluation of Gang Kou, Yi Information Information 2014 90

clustering Peng, Sciences Sciences

algorithms for Guoxun

financial risk Wang

analysis using

MCDM methods

20 Digital Sascha Kraus, International Journal International Journal 2018 81

entrepreneurship: Carolin of Entrepreneurial of Entrepreneurial

A research agenda Palmer Behavior & Behavior &

on new business Research Research

models

Table 2: Articles’ Category Based on the Subject

Article Name Objectives Findings Recommendations

1 A comparative Comparative research Results show that the The results show that in

survey of artificial has been done on the accuracy of such solving financial problems,

intelligence financial markets on artificial smart especially non-linear

applications in three popular methods in dealing patterns, the precision of such

finance: artificial technologies in with financial artificial smart methods is

neural networks, artificial intelligence, problems, particularly greater than conventional

expert system and including artificial nonlinear trends, is statistical methods.

hybrid intelligent neural networks, greater than traditional

systems expert systems and statistical methods.

synthetic intelligence

systems.

2 Financial Time Current machine There is agreement Researchers believe that

Series Forecasting learning and artificial among researchers that stock index forecasts are

with Machine intelligence research stock index significant. The core

Learning experiments used to forecasting is technology for computer

Techniques: A forecast stock market significant. The education is named Artificial

Survey activity. prevailing machine Neural Networks (ANN).

learning technology in

this field is known as

Artificial Neural

Networks (ANN).

3 Fintech Risk Targeting the new The study has found The goal can be

Management: A topic of finance that financial accomplished by

Research Challenge technologies by technology evolves implementing effective risk

for Artificial defining primary and expands, making management techniques, the

Intelligence in technical forces of it competitive, and enforcement pressure of

Finance transition such as Big raising potential which can be constrained by

Data Analytics, negative effects on the system itself.

Artificial Intelligence customers and

and Blockchain investors.

Electronic copy available at: https://ssrn.com/abstract=3540140

8

Technology.

4 Assessing Bank A comprehensive For DEA research Their viability and power

Performance with analysis of research banking and most efficiency have significantly

Operational utilizing Artificial experiments using a reduced and their results may

Research and Intelligence (A.I.) two-stage DEA, be skewed in the case of

Artificial and Operational feasibility and power DEA study banking and in

Intelligence Analysis (O.R) productivity have been most DEA studies.

Techniques: A methods for considerably reduced

Survey analyzing the and their findings may

efficiency of banks. be bias.

5 Zero Intelligence in Review the Zero Using the Zero Using the zero-intelligence

Economics and Intelligence Intelligence model in paradigm, academics, doctors

Finance methodology for conjunction with agent and computational analysts

investigating based computational were able to investigate

markets. economic techniques, issues that appeared to be

economists, extremely hard to analytically

physicians, and solve and provided

computer scientists interesting results for the

were able to economies and sciences in

investigate problems general.

that had proved very

difficult to penetrate

analytically and

generated interesting

results for the

economies and

sciences in general.

6 Using a fuzzy To identify the The case study The case study reveals that

association rule financial data indicates that the the new solution helps

mining approach to association use a approach suggested is creditors logically in actions

identify the financial fuzzy association rule a realistic way of without understanding the

data association mining approach supporting investors in underlying values of the

decisions who cannot Hang Seng index and other

recognize the secret economic indices.

principles between the

Hang Seng Index and

other economic

indexes.

7 Some Financial History of artificial The rapid The rapid development and

Regulatory intelligence with development and use use of AI technologies would

Implications of some big strengths of AI technologies will change the financial services

Artificial and weaknesses and change the financial sector and many real

Intelligence some aspects in services sector and economy sectors. If this

which AI influences many industries in the ability is understood, AI may

the future of the real economy. In the suffer significant

political and financial extent that this implications for financial

systems. potential is realized, conduct and prudential

the financial behavior supervisors.

and prudential

supervisors will have

significant

consequences for AI.

8 Natural Language Clarify the scope of The estimation of the

Based Financial NLFF analysis growth rate for each

Forecasting: A through the cycle creates an

Survey. organization and expectation of

arrangement of inflation, if the

related work methods valuation of an asset

and applications. The remains static.

survey will also Regardless of the

Electronic copy available at: https://ssrn.com/abstract=3540140

9

increase the changing market

knowledge of NLFF's pattern, the average

progress and growth rate is always

potential points and positive.

engage in discussions

in various disciplines.

9 Artificial An analysis of the The rise and growth in The rise and development in

Intelligence, threats and financial and other financial and other artificial

Finance, and the drawbacks such as artificial intelligence intelligence will undoubtedly

Law how technological would definitely be be one of the biggest legal,

knowledge and one of the most economic and social

uncertainty can affect important legal, advances of the coming

regulation, economy business and social years. The early advances

and culture and innovations of the gave insight into the

discourage it from years to come. The enormous potential and

being carried out. early developments ability of financial artificial

provided insights into intelligence.

the immense

capabilities of

financial artificial

intelligence and the

opportunity.

10 Artificial Search for current AI The financial services There is still artificial

Intelligence in literature on research, industry is still in the intelligence in the early

Finance practice and early stages of stages of financial services

regulation artificial intelligence. industry. AI is more

Throughout banking, omnipresent in banking and

AI has become more challenges, including

omnipresent and there financial, technological,

are more problems, economic and social hurdles,

including political, are that.

cultural, economic and

social hurdles.

11 Artificial In three areas of The use of AI in There are many drawbacks to

intelligence financial services: financial services has the use of AI in financial

applications in asset management, many advantages. It services. It can improve

financial services banking and can increase efficiency efficiency and output by

insurance, this paper and productivity by dynamically detecting

is a joint effort on the automating; minimize anomalies and/or long-term

benefits and cons of psychological or changes that can not be easily

AI applications. emotional errors; and identified through

improve the quality conventional tracking

and conciseness of methods, mitigating

management psychological or emotional

knowledge by mistakes. It can also improve

identifying patterns quality and conciseness of

and/or longer-term management information.

developments, which

cannot be easily

identified using

traditional monitoring

techniques.

12 Neuro-Based To create a proposed The results show that Artificial neural networks are

Artificial model which artificial neural a good tool for evaluating

Intelligence Model identifies an artificial networks are a good loan applications in Jordan

for Loan Decisions neural network as a tool to use in the commercial banks.

method to analyze Jordanian commercial

loan applications in banks ' loan

Jordan's commercial application evaluation.

banks to facilitate

Electronic copy available at: https://ssrn.com/abstract=3540140

10

loan decisions.

13 The Impacts of Analyze the impacts In the industrial age, Primitive mechanization of

Robotics, Artificial on industry and which humanity production processes took

Intelligence On environment of entered with steam place in the industrial age

Business and automation, artificial series long ago, that mankind joined with

Economics intelligence primitive production steam series long before.

process mechanization Mechatronic innovation,

took place. including advancements in

Developments in computer science,

internet and mobile nanotechnology,

devices are now advancement in medicine,

driving mechatronic health and wearable

research, including applications, now fuels

advancements in innovations in online and

computing, mobile devices.

nanotechnology,

advances in medicine,

safety and wireless

apps.

14 Comparison of For the assessment of BPN network is The BPN network is known

Support Vector financial distress in considered to be one as one of the most widely

Machine and Back companies, a model of the easiest and most employed neural network

Propagation Neural based on SVM with commonly used monitoring training methods.

Network in Gaussian kernel is methods for The comparable results show

Evaluating the proposed here. supervised neural that a median output gap:

Enterprise Financial network training. The higher precision and lower

Distress comparable results error rates are given by the

show that the output SVM.

difference is marginal;

the SVM provides

higher accuracy and

lower error rates.

15 A Generic Present a new highly The recent financial The recent financial crisis

Architecture for flexible financial crisis highlighted the demonstrated the need for

Realistic market agent model need for new research new tools to address the high

Simulations of in an API format tools capable of degree of complexity in the

Complex Financial addressing the field of the economy.

Dynamics economic world's high

degree of complexity.

16 Detection of To detect businesses Both strategies lacking All non-specifications

financial statement use deception on specification have methods have been

fraud and feature financial statements, been outperformed by implemented by PNN, while

selection using data using data mining PNN, although GP and the practicality and low

mining techniques methodology such as PNN have succeeded precision of GP and PNN

the Multilayer Feed others with practical surpassed some.

Forward Neural variety and limited

Network (MLFF), accuracy.

Support Vector

Machines (SVM), the

Genetic Program

(GP), Team Method

of Data Handles

(GMDH).

17 Deep learning for This article uses deep Deep learning Deep learning can identify

stock market learning approaches approaches can and analyze complex patterns

prediction from to forecast good and automatically detect and data connections in order

financial news weak index 500 and interpret complex to accelerate business

articles intraday directions patterns and data processes automatically.

with financial news associations to speed

titles and a variety of up the business

Electronic copy available at: https://ssrn.com/abstract=3540140

11

technical indicators. process.

18 Artificial This study examined ARMA models were The best approach for

Intelligence in different applications found to be the best minimizing prediction errors

Finance: Forecasting for artificial way to minimize was identified for ARMA

Stock Market intelligence in the prediction errors, models, while networks are

Returns using field of finance. whereas networks are often more accurate for

Artificial Neural often more reliable to predicting paths or symbols.

Networks predict path or

symbol.

19 Evaluation of Present a MCDM- The results show the The results show the efficacy

clustering based approach in the reliability of MCDM of MCDM approaches for

algorithms for financial risk approaches when clustering algorithm research

financial risk analysis, which analyzing clustering and suggest that repeated

analysis using classifies a range of algorithms and say clustering solutions lead to

MCDM methods common clustering that repetitive good 2-way clustering

algorithms. clustering solutions for solutions for selected

the chosen financial financial risk sets.

risk data sets leads to

good 2-way clustering

solutions.

20 Digital Gather cutting-edge Six sources of work on The study has identified and

entrepreneurship: A modern technology digital discusses six lines of analysis

research agenda on literature and provide entrepreneurship have on digital entrepreneurship,

new business an up-to-date been described and based on systematic review

models overview of key addressed, centered on of literature: digital business

themes and a systematic literature models; digital business

approaches explored review: digital processes; network strategies;

in the relevant business models; digital ecosystems; and

literature. digital business innovation in business

processes; network education and social

strategies; the digital technology.

ecosystem; corporate

education and social

technology enterprise.

Limitation of the study

This study as a whole has certain limitations and its methodology in particular. For instance,

creativity and intuition are limited. It can also neglect significant "brown literature," for

example studies. Throughout fact, it also restricts references to their transparency. In

comparison, the keywords used could have produced better performance. In comparison, this

study is based on the specific "keyword" index.

Results and Discussion

The use of computers and algorithms to enhance and simulate human intelligence consists of

artificial intelligence (AI). Using large amounts of data and current statistic techniques, AI

allows the predictive pattern recognition to provide the' best guess' solution to specific and

definitive problem sets. It's a machine to optimize essentially. The analysis relies not on

Electronic copy available at: https://ssrn.com/abstract=3540140

12

machine innate intelligence, but on data provided to a computer program ( Chan, Nayler,

Raman, & Baker, 2019).

Artificial intelligence (AI) is already a powerful tool widely used in financial services. If

companies use it with sufficient care, caution, and care, it will have an immense potential for

positive impact ( Eletter, Yaseen, & Elrefae, 2010). The study addresses a number of specific

technologies such as risk management, alpha generation, and asset management stewardship,

chatbots and automated helpers, underwriting, raise of the connection boss, identification of

fraud and banking algorithms ( Eletter, Yaseen, & Elrefae, 2010).

In recent years, Artificial Intelligence has made several advances that have allowed apps for

financial professionals to be developed, which could, or is likely to, disrupt the financial

sector. It is therefore believed that AI will substitute not only human capital in whole or in

part but also improve performance beyond the human level (Fethi & Pasiouras, 2009).

AI is used for the identification of phenomena. Pattern recognition facilitates the detection of

comportments that vary from normal patterns. For example, AI may be used to detect and

send warnings to money laundering, security threats, irregular financial arrangements, and

illegal transactions. It is used to build maximum investment strategies ( Chan, Nayler,

Raman, & Baker, 2019). There are now more and more robot consulting services that

automate portfolio management recommendations for individual investors. AI's other use is

in finance algorithmic commerce, systems that integrate information on changing market

conditions and price levels through the use of proprietary algorithms, allowing automatic

trades quite quickly. Trades are often conducted so fast that the word 'high-frequency trading'

has been taken up (Kraus & Palmer, 2018).

The use of AI in financial services has many advantages. It can increase efficiency and

productivity through automation; minimize mistakes induced by psychological or emotional

factors; and strengthen management information's accuracy or conciseness by detecting

patterns or longer-term developments that are not easily identified by existing monitoring

methods (Buchanan, 2019). Such requirements are particularly valid where legislation, like

the Financial Instrument Directive II for the European Union Markets (MiFID II), expands

senior management's obligations for analysis and takes greater data from the business into

account (Ho, Ip, Wu, & Tse, 2012).

Another primary use of AI is in the processing of text, news and semantic syntax. AI uses

automatically "interpreting" and evaluating texts such as papers, articles, social media and

material. It will be extremely important for the future development of financial systems,

because in a few seconds AI computers can absorb all relevant information and news while

Electronic copy available at: https://ssrn.com/abstract=3540140

13

people will take plenty of hours to handle all the details which can affect inventory

performance. Data mining facilitates estimation, predictive activity and price level analysis in

market data. Predictions and findings can also be included in legislative and structural

adjustments (Kraus & Palmer, 2018).

The use of AI technologies by the previous methodology, Text mining, is often viewed as a

sub-set in a market sentiment analysis. Market sentiment has recently grown with the

extensive development of social media platforms and the creation of large data sweatshops (

Eletter, Yaseen, & Elrefae, 2010). The growing pool of Big Data from the web and social

networking interactions provides fascinating new ways to study the conduct of market

participants. First of all, the comprehensive sentiment analysis of social media content has

been found to increase the predictability of future outcomes for a range of elections.

Likewise, several other studies linked the number of online searches for a specific topic to

early economic activity (Krollner, Vanstone, & Finnie , 2010).

The further successful application of AI could result from credit assessments such as credit

risk analysis, rating and score rates, bond rates. Various experiments have shown a greater

degree of accuracy of credit judgments and estimation of defaults in the use of artificial

neural networks (Zavadskaya, 2017). Established by the former CIO Douglas Merrill of

Google, ZestFinance has created a software system that enables better and more effective

engagement between borrowers and lenders. Conventional banking systems have not changed

in 50 years, despite fewer data points, less than 50 still being implemented and often biased

decisions taken. Through ZestFinance's ZAML, millions of new customers have been

identified using a number of Big Data Data points and the collateral search will be stopped.

Based on years of research, they argue that there is not a single breakthrough in the loan

analysis. Thus, by using thousands of data points ZAML can help better identify better

borrowers. It also helps to remove partialities. When an individual is late and takes longer,

the Founder indicates that he is not always a bad borrower, and he was surprised to find that

other things lay behind the probability of a human default. This is particularly relevant for

young people with little or no credit experience that mainstream companies usually try to

avoid. However, they suggest ZAML methods to crack the ' black box ' of machine learning,

which describes just how the tests are produced and offer candidates legal information in the

adverse event (Buchanan, 2019).

However, in AI applications, if organizations do not exercise sufficient care and prudence,

they face potential problems. These include prejudice in materials, procedures, and outcomes

for consumer identification and credit score, as well as due diligence in the supply chain. AI

Electronic copy available at: https://ssrn.com/abstract=3540140

14

analytics customers must be fully aware of the evidence used to prepare, check, retrain,

update and use their AI programs. This is relevant where third party analytics are offered or if

private analytics are based on data and services supported by third parties (Kou, Peng, &

Wang, 2014).

The suitability to use large data in consumer accounts and credit rating is also a cause for

concern. A UK insurer, for example, scrapped a program for assessment for the first time car

owners to drive safely in November 2016, utilizing social media posts to evaluate their

personality characteristics and determine the level of their insurance premiums. The social

media service provider in question stated that the initiative violated its privacy policy, which

states that data should not be used to make' eligibility decisions, including whether to agree to

or refuse an application or to charge for a loan the amount of interest (Buchanan, 2019).

In addition to carrying reputational risks, these concerns often have juridical and financial

consequences. As an example, the GDPR grants EU citizens the right to access information,

right to rectification, right to travel, right to oblivion, right to limit their data processing and

right to restrict profiling. However, it is unclear how easily people can opt-out for customer

profiling from sharing their data. There is also confusion as to if opting out will impact the

credit rating of people, which may influence the price and availability of insurance products

to apply for loans (Kou, Peng, & Wang, 2014).

Fines and legal cases relating to discrimination and the opacity of AI applications have

already been introduced. In October 2018, one of Britain's largest insurers charged £ 5.2

million over the inadequate management of a third-party provider by the Financial Conduct

Authority (FCA)–one of the highest penalties for an official partnership breach. FCA said

that the overreliance of the insurer on the software for voice analysis led to some claims that

were unfairly declined or not properly investigated ( Chan, Nayler, Raman, & Baker, 2019).

Separately, the first legislation against investment losses incurred by automated machines is

scheduled for May 2020. An activist made a complaint in conjunction with a supercomputer

intended to use Online Sources to gauge customer sentiments and to forecast a US market

future against a UK investment advisor (Lin T. C., 2019).

In the financial services industry, artificial intelligence persists in the early days. In banking,

AI is omnipresent and there are more obstacles, including legal, political, economic and

social barriers. The global financial ecosystem is also continuing to be subject to new

complexities (Giudici, 2018). With increasing availability of data and increasing computer

power, AI programs get more complicated. But AI, ML, DL, and previous developments are

so different that they can upgrade the financial laws. This question is raised in a compelling

Electronic copy available at: https://ssrn.com/abstract=3540140

15

2018 Financial Times article. Depreciation, for example, accounted for about one-third of

global business cash flows in 2017. But what happens when an AI computer becomes smarter

in the long run? The opposite of decay is machine learning by definition. So if an element is

used to become more expensive, it should be adversely affected. This would mean a

significant increase in income for certain technology companies ( Chan, Nayler, Raman, &

Baker, 2019).

In combination with artificial intelligence and the Internet of Things (IoT), physical things

will become more adaptive and responsive and will extend their useful lives. In addition to

big data, AI is viewed as a technique that can deliver enormous analytical power in the

financial services sector. Nonetheless, there are still many threats to be discussed. In financial

crisis scenarios many AI techniques remain untested (Buchanan, 2019).

Many situations have arisen in which financial firms ' computers appear to be working in an

unpredictable way, which has triggered failures and flash crashes, in particular, the Pound

flash crash in 2016 after the Brexit referendum. This needs more powerful technologies to be

built so that people can use these devices securely, efficiently and quickly. There is still a lot

to be done. Further research on AI learning and knowledge is urgently needed. Late Stephen

Hawking summed up: "The rise of strong AI will be the best or the worst thing ever for

mankind ( Xing, Cambria, & Welsch, 2018).

Conclusion

The use of machines and algorithms to improve and emulation of human intelligence is

Artificial Intelligence (AI). AI enables the identification of adaptive trends across large data

volumes and modern statistical methods to address a narrowly defined and permanent

problem set. It is basically an optimizer.

The analysis showed that Artificial Intelligence has made numerous advances in the last few

years, which have enabled applications for professionals in finance to be produced which

could or would, potentially, disrupted the finance sector. Therefore, it is believed that AI

could not only replace human resources fully or partially but also improve performance

beyond human standards. In companies around the world, there are a number of its

applications.

AI was found to be used for the identification of phenomena. It is used to build effective

investment strategies. The other application of AI in finance is algorithmic trading, systems

Electronic copy available at: https://ssrn.com/abstract=3540140

16

that incorporate knowledge about changing market conditions and price levels using

proprietary algorithms to make automated trades very rapid.

The syntax study of text processing, news and semantics is further significant use of AI. AI is

used for the intelligent reading and interpretation of data, including papers, articles, social

media and material. This is extremely significant if the AI system reads in a matter of

seconds when it requires several hours to do so and still cannot provide ALL details that

might influence the specific performance of the product. The development of investment

services in the future is important. The approach of data mining facilitates the study of market

data, the forecast behavior and price level. It can also provide for the forecasts and model

performance of legislative and structural development.

In the market feeling analysis, AI's use steams out of previous applications, text mining and is

often considered as its sub-set. Recent times have seen the extensive development of social

networking platforms and the processing of numerous data. The increasing array of "big data"

that results from individual internet experiences and various social networking creates

fascinating new ways of behavior research. For example, a quantitative analysis of the

content of social media has shown that the outcome of several elections in the forthcoming

elections is more predictable. Additionally, several additional studies related to the number of

online inquiries to a certain subject with a new business.

Further efficient AI deployment could be given by financial indicators such as credit risk

calculation, credit rating and efficiency, bond rating, etc. Some reports suggest that the use of

artificial neural networks increases the funding of businesses as the risk appraisal of ANN

and forecasts of bankruptcy are more reliable. Founded by former Google CIO Douglas

Merrill, ZestFinance is an advanced machine learning system that enables a better and more

efficient borrower-lender relationship.

Although not all companies are ready, in asset management, banking, insurance and other

areas artificial intelligence is a growing business priority in the financial services industry.

This sector generally recognizes the strategic nature of AI and players are already investing

heavily and channeling significant resources to the space to stay up to or be able to compete.

This paper has presented a multi-stakeholder perspective to help entrepreneurs navigate the

complexities of adopting AI and supervising priorities when using it. Although AI can be

used in several respects, the market has to explore what it actually entails.

Business leaders will challenge, evaluate their goals and determine the importance of their AI

projects outside technologies to differentiate between fact and exaggeration. AI use is

growing exponentially, with strong benefits and even unforeseeable hurdles. It impels leaders

Electronic copy available at: https://ssrn.com/abstract=3540140

17

to create a better understanding of technology and to establish a clear and accountable

direction in which AI can be incorporated effectively into their business models and wider

strategic goals.

In consideration of the financial consequences, businesses can provide a sufficient

understanding of AI and other technologies used in the industry by the senior management

and the board to provide effective control. This is particularly important because the board

members need to track significant issues that affect the long-term value of a company.

Throughout compliance with the Corporate Governance Code, the Board is' required to

determine the nature and scale of the major risks that it intends to take throughout order to

achieve its strategic objectives.'

Companies around the globe should maintain sound risk management and internal control

systems to ensure a sufficiently current risk framework is established, monitored and

communicated appropriately. AI decision making, execution, and use shall be conducted

within a framework of risk management that identifies business changes. It will include four

main activities: risk recognition, risk assessment, risk mitigation, and risk control–whether

the system is focused on the ISO, the funding organizations ' committee and another standard.

Early intervention, preparedness for accidents, crisis response strategies and preparation

should support this strategy.

Electronic copy available at: https://ssrn.com/abstract=3540140

18

Reference List

Lin, Tom, Artificial Intelligence, Finance, and the Law (November 04, 2019). Available at

SSRN: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3480607

Polson, Nick and Witte, Jan, Deep Learning for Finance: Deep Portfolios (September 05,

2016). Available at SSRN: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2838013

Zetzsche, Dirk and Buckley, Ross and Arner, Douglas and Nathan Barberis, Janos, From

FinTech to TechFin: The Regulatory Challenges of Data-Driven Finance (April 28, 2017).

Available at SSRN: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2959925

Lopez de Prado, Marcos, Advances in Financial Machine Learning (October 20, 2018).

Available at SSRN: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3270329

Filipe Ewald Wuerges, Artur and Alonso Borba, Jose, Artificial Intelligence Systems Applied

to Accounting, Auditing and Finance (August 26, 2009). Available at SSRN:

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1462453

Fathi Eletter, Shorouq and Ghaleb Yaseen, Saad and Awad Elrefae, Ghaleb, Neuro-Based

Artificial Intelligence Model for Loan Decisions (2010). Available at:

https://www.researchgate.net/profile/Saad_Yaseen/publication/290614456_Neuro-

Based_Artificial_Intelligence_Model_for_Loan_Decisions/links/56ec38b608aea35d5b981f2

b/Neuro-Based-Artificial-Intelligence-Model-for-Loan-Decisions.pdf

Lee, Ming-Chang and To, Chang, Comparison of Support Vector Machine and Back

Propagation Neural Network in Evaluating the Enterprise Financial Distress (July 2010).

Available at: https://arxiv.org/ftp/arxiv/papers/1007/1007.5133.pdf

Xing, Frank and Cambria, Erik and Welsch, Roy, Natural Language Based Financial

Forecasting: A Survey (April 07, 2017). Available at:

https://dspace.mit.edu/bitstream/handle/1721.1/116314/10462_2017_9588_ReferencePDF.pd

f?sequence=2&isAllowed=y

Bagheri, Ahmad and Mohammadi Peyhani, Hamed and Akbari, Mohsen, Financial

forecasting using ANFIS networks with quantum-behaved particle swarm optimization (April

03, 2014). Available at:

https://www.sciencedirect.com/science/article/pii/S0957417414001948

Bahrammirzaee, Arash, A comparative survey of artificial intelligence applications in

finance: artificial neural networks, expert system and hybrid intelligent systems (April 22,

2009). Available at:

https://www.researchgate.net/profile/Arash_Bahrammirzaee/publication/201829144_A_Com

parative_Survey_of_Artificial_Intelligence_Applications_in_Finance_Artificial_Neural_Net

works_Expert_System_and_Hybrid_Intelligent_Systems/links/5dc95bf8a6fdcc57503eda70/A

Electronic copy available at: https://ssrn.com/abstract=3540140

19

-Comparative-Survey-of-Artificial-Intelligence-Applications-in-Finance-Artificial-Neural-

Networks-Expert-System-and-Hybrid-Intelligent-Systems.pdf

Dirican, Cuneyt, The Impacts of Robotics, Artificial Intelligence On Business and Economics

(2015). Available at: https://cyberleninka.org/article/n/926024.pdf

Duygun-fethi, Meryem and Down, Claverton and Jackson, Gregory, Assessing Bank

Performance with Operational Research and Artificial Intelligence Techniques: A Survey

(2009). Available at: http://citeseerx.ist.psu.edu/viewdoc/summary?doi=10.1.1.473.4002

Giudici, Paolo, Fintech Risk Management: A Research Challenge for Artificial Intelligence

in Finance (November 27, 2018). Available at:

https://www.frontiersin.org/articles/10.3389/frai.2018.00001/full

Kou, Gang and Peng, Yi and Wang, Guoxun, Evaluation of clustering algorithms for

financial risk analysis using MCDM methods (2014). Available at:

https://www.researchgate.net/profile/Gang_Kou/publication/292137095_Information_Scienc

es-Kou-2014-4/links/56a9715808ae2df82165333a/Information-Sciences-Kou-2014-4.pdf

Kraus, Sascha and Palmer, Carolin and Kailier, Norbert and Lukas kallinger, Friedrich and

Spitzer, Jonathan, Digital entrepreneurship: A research agenda on new business models

(September 20, 2018). Available at:

https://www.emerald.com/insight/content/doi/10.1108/IJEBR-06-2018-0425/full/html

Krollner, Bjoern and Vanstone, Bruce and Finnie, Gavin, Financial Time Series Forecasting

with Machine Learning Techniques: A Survey (April 30, 2010). Available at:

https://s3.amazonaws.com/academia.edu.documents/59922561/Financial_Time_Series_Forec

asting_with_Machine_Learning20190703-28941-ae1b16.pdf?response-content-

disposition=inline%3B%20filename%3DFinancial_time_series_forecasting_with_m.pdf&X-

Amz-Algorithm=AWS4-HMAC-SHA256&X-Amz-

Credential=AKIAIWOWYYGZ2Y53UL3A%2F20200211%2Fus-east-

1%2Fs3%2Faws4_request&X-Amz-Date=20200211T133037Z&X-Amz-Expires=3600&X-

Amz-SignedHeaders=host&X-Amz-

Signature=7422c88a05209ecd2a6a119d0c6b3929477d094b1e0e5f1b2c97afe1ac91e24f

Mathieu, Philippe and Brandouy, Olivier, A Generic Architecture for Realistic Simulations of

Complex Financial Dynamics (January 2010). Available at:

https://www.researchgate.net/profile/Philippe_Mathieu/publication/220988433_A_Generic_

Architecture_for_Realistic_Simulations_of_Complex_Financial_Dynamics/links/0fcfd50806

bbd55308000000/A-Generic-Architecture-for-Realistic-Simulations-of-Complex-Financial-

Dynamics.pdf

Ravisankar, Pediredla and Ravi, Vadlamani and Raghava Rao, Gundumalla and Bose,

Indranil, Detection of financial statement fraud and feature selection using data mining

techniques (November 20, 2009). Available at:

https://pdfs.semanticscholar.org/15a9/b99aa207ea5b6615a245ced5f105738acf3a.pdf

Vargas, Manuel and Lima, Evsukoff, Alexandre, Deep learning for stock market prediction

from financial news articles (2017). Available at:

https://www.researchgate.net/profile/Manuel_Vargas13/publication/318798849_Deep_learni

Electronic copy available at: https://ssrn.com/abstract=3540140

20

ng_for_stock_market_prediction_from_financial_news_articles/links/5de6adb24585159aa45f

5e69/Deep-learning-for-stock-market-prediction-from-financial-news-articles.pdf

Wall, Larry, Some Financial Regulatory Implications of Artificial Intelligence (September

17, 2017). Available at: https://www.frbatlanta.org/-

/media/documents/news/conferences/2017/1102-financial-regulation-fit-for-the-

future/wall.pdf

Zavadskaya, AlexandrA, Artificial Intelligence in Finance: Forecasting Stock Market Returns

using Artificial Neural Networks (September 29, 2017). Available at:

https://helda.helsinki.fi/dhanken/bitstream/handle/123456789/170154/zavadskaya.pdf?sequen

ce=1

Zhou, Wei and Kapoor, Gaurav, Detecting evolutionary financial statement fraud (August 24,

2010). Available at:

https://pdfs.semanticscholar.org/f835/8221af35a63e96acc427d73fcb351433a18c.pdf

Additional Readings

Nobanee, H., Ellili, N. O. (2016). Corporate Sustainability Disclosure in Annual Reports:

Evidence from UAE Banks: Islamic versus Conventional. Renewable & Sustainable Energy

Reviews, 55, March, pp 1336-1341.

Alshehhi, A., Nobanee, H., Khare, N. (2018). The Impact of Sustainability Practices on

Corporate Financial Performance: Literature Trends and Future Research Potential.

Sustainability, 10 (2) pp 494-519.

Al Nuaimi, Aysha and Nobanee, Haitham, Corporate Sustainability Reporting and Corporate

Financial Growth (October 19, 2019). Available at SSRN: https://ssrn.com/abstract=3472418

Almansoori, Alia and Nobanee, Haitham, How Sustainability Contributes to Shared Value

Creation and Firms’ Value (October 19, 2019). Available at

SSRN: https://ssrn.com/abstract=3472411

Al Hammadi, Fatema and Nobanee, Haitham, Sustainability and Corporate Governance: A

Mini-Review (December 9, 2019). Available at

SSRN: https://ssrn.com/abstract=3500885 or http://dx.doi.org/10.2139/ssrn.3500885

Al Muhairi, Mariam and Nobanee, Haitham, Sustainable Financial Management (October 19,

2019). Available at SSRN: https://ssrn.com/abstract=3472417

Al Hammadi, Tahani and Nobanee, Haitham, FinTech and Sustainability: A Mini-Review

(December 9, 2019). Available at

SSRN: https://ssrn.com/abstract=3500873 or http://dx.doi.org/10.2139/ssrn.3500873

Alhadhrami, Ahmed and Nobanee, Haitham, Sustainability Practices and Sustainable

Financial Growth (October 19, 2019). Available at SSRN: https://ssrn.com/abstract=3472413

Electronic copy available at: https://ssrn.com/abstract=3540140

21

Al Breiki, Mariam and Nobanee, Haitham, The Role of Financial Management in Promoting

Sustainable Business Practices and Development (October 19, 2019). Available at

SSRN: https://ssrn.com/abstract=3472404

AlFalahi, Latifa and Nobanee, Haitham, Conceptual Building of Sustainable Economic

Growth and Corporate Bankruptcy (October 19, 2019). Available at

SSRN: https://ssrn.com/abstract=3472409

Al Ahbabi, Al Reem and Nobanee, Haitham, Conceptual Building of Sustainable Financial

Management & Sustainable Financial Growth (October 19, 2019). Available at

SSRN: https://ssrn.com/abstract=3472313

Alkaabi, Hamda and Nobanee, Haitham, A Study on Financial Management in Promoting

Sustainable Business Practices & Development (October 19, 2019). Available at

SSRN: https://ssrn.com/abstract=3472415

Electronic copy available at: https://ssrn.com/abstract=3540140

You might also like

- Fintech ReportDocument24 pagesFintech ReportAnvesha Tyagi100% (1)

- Aztech MWR647 Easy Start GuideDocument20 pagesAztech MWR647 Easy Start GuideVincent 2020No ratings yet

- (QTTC) Future Trends and OpportunitiesDocument7 pages(QTTC) Future Trends and OpportunitiesHoa Ngọc HânNo ratings yet

- Draft - Artificial Intelligence in FinanceDocument9 pagesDraft - Artificial Intelligence in FinanceSandhya SharmaNo ratings yet

- Da 1 (1) MM21GF068Document9 pagesDa 1 (1) MM21GF068Kruthik BethapudiNo ratings yet

- Rishab GolaDocument7 pagesRishab GolaManan AswalNo ratings yet

- АІDocument7 pagesАІsavenkosofia685No ratings yet

- Artificial Intelligence: Its Impact On The Financial Services SectorDocument5 pagesArtificial Intelligence: Its Impact On The Financial Services SectorDilesh VeeramahNo ratings yet

- "Impact of Artificial Intelligence On Financial MarketDocument7 pages"Impact of Artificial Intelligence On Financial MarketDivya GoyalNo ratings yet

- Artificial Intelligence Project ReportDocument11 pagesArtificial Intelligence Project ReportShambhavi SharmaNo ratings yet

- AI in Banking (DARSHIT)Document4 pagesAI in Banking (DARSHIT)Darshit SharmaNo ratings yet

- Coombs Accepted VersionDocument7 pagesCoombs Accepted Versionrecojo3664No ratings yet

- A Comprehensive Study On Integration of Big Data and AI in Financial Industry and Its Effect On Present and Future OpportunitiesDocument11 pagesA Comprehensive Study On Integration of Big Data and AI in Financial Industry and Its Effect On Present and Future Opportunitiesandrew chiewNo ratings yet

- Political Economy of Science Essay 1Document11 pagesPolitical Economy of Science Essay 1vatsala tewaryNo ratings yet

- Artificial Intelligence in The Banking Sector With Special Reference To Pros and Cons, Need, Significance and RecommendationsDocument4 pagesArtificial Intelligence in The Banking Sector With Special Reference To Pros and Cons, Need, Significance and RecommendationsVikram Singh MeenaNo ratings yet

- Essay ManagementDocument3 pagesEssay ManagementMiftah FaridNo ratings yet

- Artificial Intelligence and Its Impacts On The Financial Services Sector.Document5 pagesArtificial Intelligence and Its Impacts On The Financial Services Sector.Dilesh VeeramahNo ratings yet

- AI Impacting Financial Services IndustryDocument3 pagesAI Impacting Financial Services IndustrysmritiNo ratings yet

- Exploring Current Opportunity and Threats of Artificial Intelligence On Small and Medium Enterprises Accounting Function Evidence From South West Part 1528 2635 25-2-693Document11 pagesExploring Current Opportunity and Threats of Artificial Intelligence On Small and Medium Enterprises Accounting Function Evidence From South West Part 1528 2635 25-2-693Kefi BelayNo ratings yet

- Arificial IntelligenceDocument6 pagesArificial Intelligenceamberamir152001No ratings yet

- Intelligence (AI) & SemanticsDocument55 pagesIntelligence (AI) & SemanticsRaja kamal ChNo ratings yet

- Idea For Eco ProjectDocument15 pagesIdea For Eco Projectcyan.07rNo ratings yet

- Artificial Intelligence in Finance - SigmoidalDocument7 pagesArtificial Intelligence in Finance - SigmoidalRanjeet MudholkarNo ratings yet

- Artificial Intelligence in Business and Finance : ReaditasitisDocument5 pagesArtificial Intelligence in Business and Finance : ReaditasitisNishant ShahNo ratings yet

- Bhavya Wani: Ai in FinanceDocument5 pagesBhavya Wani: Ai in FinanceScrappy CocoNo ratings yet

- Report 5Document6 pagesReport 5lakshaytomer12thaNo ratings yet

- Ai Finance 1Document10 pagesAi Finance 1Purnachandrarao SudaNo ratings yet

- Powering The Digital Economy PDFDocument16 pagesPowering The Digital Economy PDFYoussef EchNo ratings yet

- First DraftDocument9 pagesFirst Draftapi-744284834No ratings yet

- AIBA MODULE 1 Artificial Intelligence in BusinessDocument5 pagesAIBA MODULE 1 Artificial Intelligence in BusinessHik HjkkNo ratings yet

- AI in Banking - How Artificial Intelligence Is Used in BanksDocument12 pagesAI in Banking - How Artificial Intelligence Is Used in Bankschihebbaccar00No ratings yet

- Itfm RBLDocument13 pagesItfm RBLZany AlamNo ratings yet

- ปาฐกถา2 - ผศ พิเศษนพ พลวรรธน์AI-In-financialDocument19 pagesปาฐกถา2 - ผศ พิเศษนพ พลวรรธน์AI-In-financialUthen KaewwichianNo ratings yet

- Fintech Applications in BankingDocument12 pagesFintech Applications in BankingRadhika GoelNo ratings yet

- The Impact of Artificial Intelligence On Financial ServicesDocument2 pagesThe Impact of Artificial Intelligence On Financial Servicessuneel66229No ratings yet

- T10-R75-P2-artificial-intelligence-v5.1 - Study NotesDocument16 pagesT10-R75-P2-artificial-intelligence-v5.1 - Study Notespratik satputeNo ratings yet

- Artificial Intelligence in Financial Services - Need To Blend Automation With Human TouchDocument6 pagesArtificial Intelligence in Financial Services - Need To Blend Automation With Human TouchAnupamMehrotraNo ratings yet

- The Future: Artificial Intelligence's Profound Impact On Accounting and Society - Anticipating Job Market Dynamics and Evolving Skill Requirements For AccountantsDocument27 pagesThe Future: Artificial Intelligence's Profound Impact On Accounting and Society - Anticipating Job Market Dynamics and Evolving Skill Requirements For Accountantsindex PubNo ratings yet

- Strategies For Mitigating The Risks of Financial Fraud - 4464 Words - Proposal ExampleDocument7 pagesStrategies For Mitigating The Risks of Financial Fraud - 4464 Words - Proposal Examplemtahir777945No ratings yet

- ebook-the-ai-handbook-for-financial-services-leaders_ENDocument18 pagesebook-the-ai-handbook-for-financial-services-leaders_ENharshavmrgNo ratings yet

- AI OmanDocument9 pagesAI OmandijayNo ratings yet

- AI and Analytics in BFSI IndustryDocument17 pagesAI and Analytics in BFSI IndustryHarsh DedhiaNo ratings yet

- Artificial Intelligence and The Challenge of Creating Value: An Accounting Perspective Final Paper 2023Document7 pagesArtificial Intelligence and The Challenge of Creating Value: An Accounting Perspective Final Paper 2023Tamer A. ElNasharNo ratings yet

- Artificial Intelligence in Finance: April 2018Document3 pagesArtificial Intelligence in Finance: April 2018Johanna Veronica Alva ChaucaNo ratings yet

- Ai in BankingDocument6 pagesAi in BankingSHRADDHEY SHUKLA100% (1)

- AI _ ML_Article 3_20191125_V2Document5 pagesAI _ ML_Article 3_20191125_V2Ashish CharanNo ratings yet

- Onai Cop Gov PresentationDocument6 pagesOnai Cop Gov PresentationAshie ChifNo ratings yet

- Impact of Ai On Bank PerformanceDocument4 pagesImpact of Ai On Bank PerformanceHarman iNo ratings yet

- AI Gains Momentum in Core Financial Services Functions 1691763089Document9 pagesAI Gains Momentum in Core Financial Services Functions 1691763089Vinod GhorpadeNo ratings yet

- Synergy Between Fintech, Regtech, and Artificial Intelligence in Transforming The Financial EcosystemDocument8 pagesSynergy Between Fintech, Regtech, and Artificial Intelligence in Transforming The Financial EcosystemWijdan Saleem EdwanNo ratings yet